The global organic rice flour market is likely to expand from USD 373.3 million in 2025 to USD 631.6 million by 2035, reflecting a robust compound annual growth rate (CAGR) of 5.4%. The growth is being driven by rising demand for clean-label, gluten-free, and minimally processed ingredients across multiple food categories, including bakery products, baby food, sauces, cereals, and ready-to-eat meals.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 373.3 million |

| Market Size (2035) | USD 631.6 million |

| CAGR (2025 to 2035) | 5.4% |

As awareness about food sensitivities, digestive health, and dietary transparency grows, consumers are increasingly turning to organic, plant-based alternatives like rice flour that are allergen-free and environmentally sustainable. Its application in gluten-free and vegan recipes has surged, particularly among health-conscious and ethically driven consumer groups.

The global organic rice flour market is projected to reach USD 373.3 million in 2025. In the organic flours market, it holds an estimated 5-6% share, driven by its use in clean-label and allergen-free formulations. It contributes around 4-6% to the gluten-free ingredients market, supported by rising demand for celiac-safe options. In the organic food ingredients segment, organic rice flour accounts for approximately 1-2%, used across snacks, cereals, and processed meals.

Within the bakery ingredients market, it makes up about 2-3%, particularly in gluten-free bread, pastries, and cookies. It also holds a 1-2% share in the plant-based ingredients market, as food manufacturers adopt it in vegan and dairy-free recipes for texture and bulk.

Organic white rice flour will dominate with a 65.4% market share in 2025. Baby food applications are expected to lead with a 32.7% share due to rising infant health awareness. India will be the fastest-growing country, with an 8.3% CAGR through 2030, while the USA will retain the largest market value at USD 104.2 million. Key players like Bob’s Red Mill and Aryan International are expanding production capacity and upgrading milling technologies.

The global rise of plant-based diets and wellness-oriented lifestyles has significantly boosted demand for alternative flours, with organic rice flour gaining popularity for its light texture and neutral taste. It is increasingly used in gluten-free baking, pancake mixes, breakfast cereals, and infant nutrition, where purity and digestibility are prioritized. Food processors embrace organic rice flour to align with clean-label product development and meet consumer demand for recognizable, natural ingredients.

In June 2024, Doves Farm, a leading UK organic flour brand, introduced a 100% Organic White Rice Flour aimed at gluten-free baking. The launch, featuring sustainably sourced rice and improved milling processes, attracted attention in trade publications such as Bakery & Snacks, where the company highlighted consumer demand for high-quality, clean-label flours in baked goods.

The next table encapsulates the different assessments of CAGR over six months for the base year (2024) and the present year (2025) of the global organic rice flour sector. This study puts the spotlight on the performance trends and revenue patterns and assists the parties concerned in steering through the changing market course. H1 is for January to June and refers to the first half of a year, whereas H2 represents July to December, the second half of the year.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.9% |

| H2 (2024 to 2034) | 5.4% |

| H1 (2025 to 2035) | 5.1% |

| H2 (2025 to 2035) | 5.6% |

In the first half (H1) of the decade from 2024 to 2034, the market is expected to expand at a 4.9% CAGR, followed by a higher growth rate of 5.4% in the second half (H2). Entering the period from 2025 to 2035, the CAGR is projected to rise to 5.1% in H1 and stabilize at 5.6% in H2. In H1, the industry recorded an increase of 20 BPS, whereas in H2, the growth rate increased slightly by 20 BPS.

The organic rice flour market is witnessing substantial growth, driven by increasing consumer demand for gluten-free, organic food products. Organic white rice flour leads the market with a 65.4% share in 2025, while baby food applications dominate the end-use sector, holding 32.7% market share.

Organic white rice flour is expected to dominate the market with a 65.4% share by 2025.

The baby food segment is poised to dominate the organic rice flour market, accounting for 32.7% in 2025.

Supermarkets and hypermarkets are expected to capture 35% of the market share in the organic rice flour segment by 2025.

The global organic rice flour market has a diverse competition with foreign-based firms, regional manufacturers, and the presence of a major Chinese supplier. Although multinational companies have a dominant share of the pie, largely due to the availability of broad distribution networks and brand recognition, regional players are getting strong with sales of good-quality organic rice flour that is specifically designed to meet local preferences.

Regional brands are the main actors accelerating the development of the market by using locally sourced organic rice and catering to specific consumer needs. In North America and Europe, regional brands respond to consumer demands by offering premium, gluten-free, and allergen-free organic rice flour mixes. In the case of Southeast Asia, local companies are the primary players with the advantages of good suppliers of rice and organic products.

Chinese makers have solidly set the pace in the market, which results in a large share of the global production. China’s rice processing sector is highly advanced, with a priority on cost-effective manufacturing and export-oriented strategies.

Numerous Chinese businesses offer organic rice flour supplies to food processors and bakery manufacturing companies that are based all over the world. They are reaping the benefits from sophisticated milling technology as well as government backing for organic agriculture.

Regional brands are the ones to improve their positions on the market via investments in quality control, organic certificates, and the direct-to-consumer e-commerce model. That, in its turn, allows them to compete with MNCs, predominantly in such specific segments as baby food and gluten-free baking. Given the continuous growth in demand, regional and Chinese players will enhance their production capacities, which will, in fact, further fuel the competition in the global organic rice flour market.

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Country | United States |

|---|---|

| Estimated Market Size in 2025 (USD Million) | 104.2 |

| CAGR (2025 to 2030) | 6.7% |

| Country | China |

|---|---|

| Estimated Market Size in 2025 (USD Million) | 70.6 |

| CAGR (2025 to 2030) | 6.0% |

| Country | India |

|---|---|

| Estimated Market Size in 2025 (USD Million) | 27.3 |

| CAGR (2025 to 2030) | 8.3% |

| Country | Japan |

|---|---|

| Estimated Market Size in 2025 (USD Million) | 30.5 |

| CAGR (2025 to 2030) | 5.0% |

| Country | Germany |

|---|---|

| Estimated Market Size in 2025 (USD Million) | 56 |

| CAGR (2025 to 2030) | 3.2% |

In 2025, the United States will be the leader in the global organic rice flour market. The market size is expected to increase to approximately USD 104.2 million, gaining extra advantage in terms of satisfying picky consumers who are more game to eat healthy, thus increasing gluten-free and organic options. The USA highly developed food processing industry and the widespread availability of organic products in retail chains are other factors that promote this market.

Manufacturers are innovating and expanding their supply chains to respond to the rising consumer demand. Additionally, the provision of favourable government policies and the certifications for organic farming lead to consumer trust and spill overs to market growth.

China's organic rice flour market is shaping up with growth, as the sector is predicted to expand at a CAGR of 3.4% by the year 2035. The market size is expected to increase to approximately USD 70.6 million. One of the most notable factors for this growth is the increasing awareness level of the health benefits of organic products today among most Chinese consumers. The demographic transition and a rise in per capita income have contributed to this shift towards healthier diet choices.

Therefore, cooking methods with organic rice flour are also being discovered. Local companies are spending on organic farming and getting certified. Notwithstanding, they may encounter challenges like production cost inflation and quality assurance breaks leading to hindrance in the market growth.

India's organic rice flour market is projected to expand rapidly, posting a remarkable CAGR of 5.9% from 2025 to 2035. The market size is expected to increase to approximately USD million. This is due mainly to the increased health awareness of consumers along with the increase of gluten intolerance, which results in higher demand for gluten-free substitutes like organic rice flour.

The traditional rice cultivation in the country has a very deep historical background, and due to this reason, the strong base for the eco-friendly rice flour production exists. Manufacturers are taking advantage of this situation by endorsing organic farming practices and getting relevant certifications to be attractive to health-conscious consumers. The expansion of organized retail and e-commerce platforms in India also facilitates easier access to organic products, further propelling market growth.

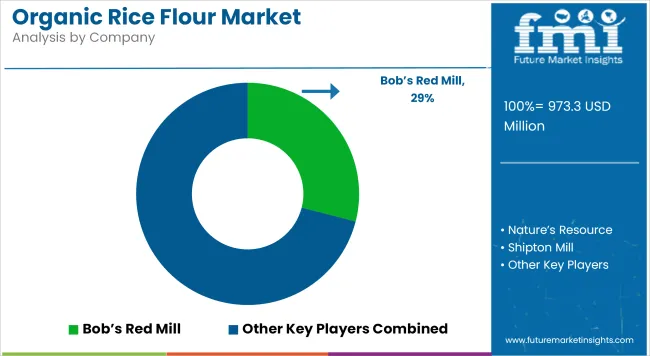

The organic rice flour market is moderately fragmented, with a blend of established companies and emerging brands driving growth through innovation and sustainability. Key players such as Bob’s Red Mill Natural Foods, BENEO GmbH, and Hain Celestial Group dominate through established distribution networks, extensive R&D, and strong brand equity.

For example, Bob’s Red Mill focuses on expanding its gluten-free baking range, while BENEO integrates functional benefits into its rice flour line to appeal to health-conscious consumers. Newer entrants like Nutriseed and Aryan International are leveraging e-commerce and clean-label positioning to penetrate niche markets, particularly in Europe and Asia.

Strategic initiatives include product innovation, clean-label certification, and investment in eco-friendly milling technologies. In 2024, Firebird Mills and Shipton Mill introduced improved organic flour blends for artisanal and commercial bakers. Despite rising demand, entry barriers remain high due to strict organic certification standards and capital requirements. However, rising consumer interest in allergen-free and natural ingredients continues to attract new players.

Recent Developments in the Organic Rice Flour Industry

Organic rice flour market is segmented into organic white rice flour and organic brown rice flour.

Organic rice flour market is categorized into bakery, sauces and dressings, baby food, snacks, meat-based products, processed food, food service industry, household, and others.

Organic rice flour market is divided into supermarket/hypermarket, convenience stores, departmental stores, specialty stores, and online retail.

Organic rice flour market is segmented across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

The global organic rice flour market is expected to expand at a CAGR of 5.4% from 2025 to 2035.

The global organic rice flour market is projected to reach USD 631.6 million by 2035.

Organic white rice flour is expected to be the fastest-growing segment due to its high adoption in gluten-free bakery and baby food applications.

Increasing demand for gluten-free and clean-label products, rising health awareness, growth in organic farming practices, and expanding application in bakery and baby food industries are major growth drivers.

Some of the dominant players include SunOpta Inc., Western Foods, Ingredion Incorporated, The Scoular Company, Doves Farm Foods Ltd, and Bob’s Red Mill.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Organic Fruit Powder Market Size, Growth, and Forecast for 2025 to 2035

Organic Condiments Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA