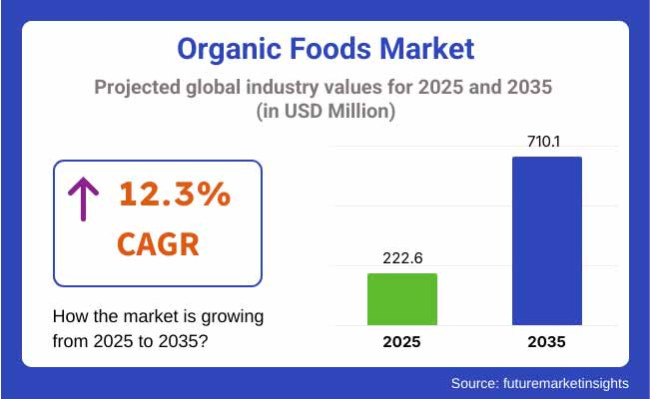

The organic foods market is estimated to be worth USD 222.6 million in 2025 and is projected to reach a value of USD 710.1 million by 2035, expanding at a CAGR of 12.3% over the assessment period of 2025 to 2035.

The industry is currently rising significantly thanks to the significant increase in consumer awareness and concern regarding health, sustainability, and the environment. Organic foods, which do not contain synthetic pesticides, genetically modified organisms (GMOs), or artificial additives, are becoming more popular with consumers across different categories including fresh produce, dairy, meat, beverages, and packaged foods. The expansion of the industry is also influenced by consumers' growing fondness for clean-label and minimally processed food products.

The increasing progress of the industry is strongly associated with the fact that consumers are opting for healthy dietary choices. The trendiest food products that consumers are looking for are the ones that are nutrient-rich, chemical-free, and ethically sourced, which consequently triggers the demand for fruits, vegetables, grains, and protein sources produced organically.

Moreover, the image of organic food as a means of getting better digestion, fewer allergic reactions, and a generally improved quality of life is also having an impact on what people decide to buy.

The increased retail and e-commerce facilities are also playing a part in industry development. Supermarkets, specialty organic stores, and online platforms are authenticating organic products and are successfully reaching out to wider consumer bases. Besides, direct-to-consumer organic brands and subscription-based grocery delivery services have also entered the picture and are working on the enhancement of the industry.

The scientific developments in organic agriculture along with the precision farming model, soil enrichment processes, and organic pest control have substantially increased the quality and quantity of the crops. In addition, the implementation of blockchain and traceability processes will not only increase the level of transparency in the sourcing of organic foods but also enhance, in turn, the trust of the consumers in organic products that have a certification.

However, there are also bright sides, as a lot of opportunities present themselves for the expansion of the industry. The demand for organic snacks, plant-based protein alternatives, and functional organic foods is opening new channels for growth.

Also, the backing of the government to development, organic farming, and sustainable initiatives is predicted to foster more progress in the whole area. The industry is expected to flourish for the long term as consumers adjust their purchasing preferences away from traditional foods toward health-friendly and environmentally sustainable ones.

The industry continues to see strong growth fueled by growing consumer understanding of health attributes, sustainability, and clean label. Retail consumers are most concerned with fresh organic fruits and vegetables, dairy products, and grains, with demand highest for non-GMO, pesticide-free, and ethically produced products.

The foodservice sector, ranging from organic restaurants to catering establishments, incorporates organic ingredients to meet consumer demand for natural and environmentally friendly dining. The processed industry, encompassing snacks, beverages, and convenient ready-to-eat meals, is growing based on hectic lifestyles and consumers' desire for convenient and healthy food.

The segment of baby food is one of the drivers, as parents look for nutrient-dense, chemical-free, and minimally processed food for infant nutrition. The challenges involve increased costs, supply chain limitations, and regulatory complexities, necessitating the brands to invest in transparent sourcing, affordability initiatives, and innovative formulations in order to stay competitively positioned.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year (H1) spans from January to June, while the second half (H2) includes the months from July to December.

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 6.0%, followed by a higher growth rate of 6.3% in the second half (H2) of the same decade. Moving into the subsequent period from 2025 to 2035, the CAGR is projected to increase to 6.1% in the first half (H1) and remain considerably high at 6.2% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| 2024 to 2034 (H1) | 4.9% |

| 2024 to 2034 (H2) | 5.5% |

| 2025 to 2035 (H1) | 5.1% |

| 2025 to 2035 (H2) | 5.6% |

The industry during the period 2020 to 2024 experienced robust growth with the growing health awareness among consumers and their shift toward chemical-free, non-GMO, and pesticide-free food products. Rising sustainability and organic awareness resulted in skyrocketing demand for organic food, particularly in Europe and North America.

Direct-to-consumer and online retailing picked up pace, with stores highlighting robust transparency and fair sourcing. Organic food and organic plant-based options functional food broke ground to fuel new product development, while blockchain infused transparency into the supply chain. However, organic food remained a luxury food, due to high production cost, and price was still the biggest deterrent to higher consumption.

AI-powered precision farming, lab-grown organic foods, and autonomous organic food delivery systems will transform the organic food industry in 2025 to 2035. We will see a movement towards hyper-local, regenerative and carbon-zero organic food with ever-increasingly regulatory regimes demanding more stringent environmental footprint criteria.

It will become more mainstream accepted, while the sustainability push will be net-zero carbon organic agriculture emissions will be demandedAI powered personalized nutrition and bioengineered organic superfood Urbanization and government incentives will push the Asian-Pacific and Middle Eastern organic industries to expand further, along with blockchain-supported decentralized food traceability that will change the landscape of supply chain transparency.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing consumer health and wellness awareness | Enhanced regulatory frameworks and AI-driven organic certification procedures |

| Demand for pesticide-free, non-GMO, and chemical-free organic food products | Hyper-local, regenerative, and carbon-neutral organic food preferences |

| Use of blockchain technology for supply chain traceability | AI-powered precision farming and in-lab synthesis of organic food |

| Growth of e-commerce and direct-to-consumer organic food sales | Growing adoption of automated organic food delivery and smart retailing concepts |

| Prioritize sustainable packaging and reduced food waste | Net-zero carbon emissions in organic agriculture and circular economy alignment |

| Tight labeling and certification standards for organics | Organic global standardization and stricter environmental footprint regulations |

The industry is at the crossroads of witnessing the threat of the supply chain due to its heavy reliance on climate-sensitive agriculture. The oscillating weather conditions, the deteriorating of soil quality, and the consequences of pest infestations lead to under-performance of crops which, in turn, causes price fluctuations and supply shortfalls.

An organic certification that cuts through a tangle of red tape across different countries is another hurdle to jump over. The need for compliance with strict labeling, pesticide-free regulations, and renewable certificates increases production costs and adds burdens to the administrative process. Companies must be acquainted with the regulatory landscape, devise pathways to ease certification, and be clear with the customers in order to meet those expectations and sidestep legal pitfalls.

The high prices of organic foods are a double-edged sword in economic crises. Inflation, as well as consumers changing their habits, can bring about a decrease in the demand that will be directed towards conventional alternatives, thus, causing the slow growth of the industry. The best way to deal with this issue is to focus on the value-driven communication, private-label organic products, and the expansion of affordability through the strategic implementation of prices and promotions.

Fake and misleading organic claims are a reputational risk, as the people lose trust when they hear about the deceptive rumors. The supply chain enhanced with product traceability, adoption of blockchain-based verification and cooperation with third parties as a certifier can increase the credibility and prove that the customers can have confidence in the organic products.

Concerns regarding sustainability also play a role in the industry as organic farming is more land and resource demanding than conventional methods. In the long run, regenerative agriculture, decreased carbon footprint, and water conservation measures will address environmental challenges and provide keys for the industry to succeed.

Organic Milk Leading the Dairy Category

| Segment | Value Share (2025) |

|---|---|

| Organic Milk (By Category) | 34% |

The industry continues to expand as customers are interested in health, sustainability, and clean-label products. Up to 2025, the industry is segmented by category, and the leader is dairy, with a 34% industry share, followed by processed and frozen, at 18.5%.

Organic dairy foods, including milk, yogurt, cheese, and butter, dominate the industry due to expanding consumer demand for hormone-free, antibiotic-free, and pasture-raised dairy. Key players such as Danone (Horizon Organic), Organic Valley, and Arla Foods are leading the way in this segment. Organic Valley, for example, has expanded its line of grass-fed dairy foods in response to increased demand for sustainably raised dairy. Furthermore, the EU Organic Action Plan and other government support for organic farming keep driving the industry growth.

Due to the trend toward busy lifestyles and the demand for easy, preservative-free meals, the organic processed and frozen foods category is hitting its stride. Amy's Kitchen, Earth's Best (Hain Celestial), and Good Food Made Simple are building their portfolios with organic frozen entrees, pizzas, and snacks.

Amy's Kitchen, for instance, has USDA-certified organic frozen meals that address the increasing number of vegan and gluten-free consumers.The addition of plant-based ingredients and functional ingredients like probiotics and omega-3s is picking up steam. Consumers increasingly want organic foods that provide health benefits beyond basic nutrition, fueling the development of fortified and nutrient-dense foods.

Online sales of organic foods are experiencing significant expansion, with major retailers like Whole Foods (Amazon), Thrive Market, and Walmart increasing their organic product offerings. The direct-to-consumer (DTC) platforms, subscription-based services, and digital grocery shopping that consumers now enjoy are driving the trend toward an industry shift to online retail channels.

Organic Whole Grains Gaining Market Share in Cereals & Grains

| Segment | Value Share (2025) |

|---|---|

| Organic Whole Grains (By Product Type) | 29% |

Consumer demand for clean-label, sustainably sourced, and chemically free food products has been enabling prominent growth within the industry. On the basis of type, organic whole grains will hold the largest percentage of the market, 29% by 2025, followed by organic meat at 18.0%.

Organic whole grains are the largest segment of the industry as consumers look for healthier, high-fiber replacements to conventional grains (quinoa, oats, brown rice, and whole wheat). The plant-based and functional nutrition trends have increased demand for organic grains used in cereals, bread, pasta and snack foods. Big brands, including Bob's Red Mill, Nature's Path and Arrowhead Mills, are adding lines of organic grains. For example, Nature's Path launched regenerative organic certified (ROC) whole grains to attract consumers interested in agriculture sustainability.

Organic meat, such as beef, poultry and pork, is starting to gain traction as consumers gravitate toward antibiotic-free, grass-fed and humanely raised animals. The schemes such as USDA Organic and EU Organic Certification also remain stringent in their compliance, increasing consumer confidence.

Leaders in the industry, such as Applegate Farms (Hormel Foods), Perdue's Harvestland Organic, and Eversfield Organic, have certified organic meat products. Expanded use of ethical sources and regenerative farming practices, such as rotational grazing, also strengthens this category.

Organic foods with fortification, such as omega-enriched grains and organic high-protein meat, are gaining industry share. Shoppers are searching more actively for nutrient-rich foods that provide other health benefits, driving innovation in the industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 12.0% |

| UK | 11.2% |

| France | 10.8% |

| Germany | 11.5% |

| Italy | 10.3% |

| South Korea | 13.5% |

| Japan | 10.5% |

| China | 13.0% |

| Australia | 12.2% |

| New Zealand | 11.8% |

The USA industry continues to dominate, supported by growing consumer demand for organic and sustainable goods. The nation's advanced infrastructure promotes organic farming and effective distribution networks. Organic food finds its way into big-box stores and online platforms, leveraging high incomes and a population that prioritizes health even more.

Highly controlled networks ensure product authenticity, stimulating industry growth. Greater organic brand global reach as well as food plant alternative innovation are transforming industry dynamics. Greater development of direct-to-consumer business models and sustainable packaging trends are also fueling the expansion of the organic food industry.

UK’s demand for organic food is fueled by growing environmental consciousness and government-backed sustainability policies. Locally and ethically sourced organic food is in increasing demand, leading retailers to expand their organic product lines. Urban agriculture and community-supported agriculture (CSA) schemes are becoming popular and appealing to the green consumer.

Subscription boxes delivering organic food online, stimulated by e-commerce growth, are also gaining momentum. Post-Brexit trade policy has also focused attention on domestic organic production, lessening reliance on organic imports as well as stockpiling local supply chains.

France is Europe's biggest industry for organic food, driven by a cultural tradition of exquisite food and sustainable farming. Organic producers are subsidized by the government and held to rigorous certification processes that give consumers confidence. Supermarkets and special food stores sell organic food in specialty sections, with fresh produce, fruits, milk as well as bread being the top sellers.

Farm-to-table restaurants are gaining popularity, with restaurants and hotel groups buying directly from organic farms more and more. Organic wine production is a flagship segment that benefits from France's international brand recognition in the wine industry.

Germany has a well-developed industry with a high level of consumer sensitivity to sustainability. Government incentives for organic farming and strict labeling regulations have led to dense industry penetration. Organic convenience foods and plant-based protein foods are gaining traction, mirroring changing eating habits.

Discount stores as well as supermarkets are making organic fruits and vegetables accessible, and specialty organic food stores are still popular. Agro-tech and vertical farm investments are revolutionizing the domestic organic supply chain, providing year-round availability.

A rich agricultural heritage drives organic food in Italy with an emphasis on high-quality, locally produced foods. Organic pasta, olive oil, and dairy are increasing, and high exports are driving them. The government is incentivizing small-scale organic producers in the form of incentives to ensure product authenticity.

Agritourism is facilitating growth in marketing through organic farm holidays and local food tourism, which is gaining popularity. The traditional Italian Mediterranean diet culture also assists the organic food industry since it is aligned with the trends of health-conscious consumers.

The South Korean organic food industry is expanding at a very rapid rate, with growing food safety concerns and strong demand for high-end health products. Organic baby food and food supplements are among the most rapidly growing categories. Urbanization has also led to rising online demand for organics, with the big supermarket chains investing in direct-to-consumer supply chain models. Functional foods with organic foods incorporated within them are gaining popularity, particularly in the wellness and beauty-conscious segments.

The Japanese industry is moving steadily ahead on the heels of Japan's rapidly aging population looking for a healthier food trend. The industry is seeing a high demand for organic rice, tea, and fermented food, which is in line with traditional food habits. Government policies promoting sustainable agriculture and reduced pesticide usage are boosting the industry.

However, Japan's high dependence on imports of organic products is a concern. Store retailers are becoming more interested in traceability and the application of blockchain technology in providing proof of authenticity of their items. Organics convenience foods are entering new markets and selling to busy, urban consumers.

The industry in China is one of the world's fastest-evolving markets, driven by increasing consumer demand for food safety. Increased growth of the middle class and growing disposable incomes fuel demand for improved-quality organic products. Government organic certification is strict, adhering to international standards.

Distribution is online, and leading websites carry a variety of organic products. European and Australian organics are in demand. Domestic investment in sustainable and organic farm programs is to increase the growth of the industry further.

Australia's organic food industry is driven by a strong agriculture sector and growing consumer demand for chemical-free foods. Organic meat and dairy products are increasing steadily in the nation, supported by exports to the Asian continent. Quality organic standards come from industry-controlled certifications as well as state promotion.

Retailers continue to add more organic offerings, with supermarkets and health food stores at the forefront. Organic-friendly agricultural practices such as regenerative agriculture become more prominent. The expansion of organic meal companies is changing urban consumption habits to make organic food available to more people.

New Zealand's organic food industry is shaped by its virgin environment and strong agriculture sector. It is a significant exporter of organic fresh produce, dairy products, and meat to Asia. Organic home consumption is growing, with consumers seeking natural food that is locally produced.

Organic certification schemes have been enhanced to international standards. Global and domestic markets offer a growing industry for natural health foods and organic honey. Investing in sustainable agriculture practices and eco-friendly packaging is reaping long-term industry sustainability.

The organic foods sector is a high and ever-increasingly competitive industry where consumers demand clean-label, non-GMO, and sustainably sourced products. Nestlé, Danone, and General Mills, among others, operate as global food giants that are strategically acquiring and building their brands to challenge long-term traditional organic specialists.

The limited availability of organic farmland and strict certification present major barriers to entry; therefore, the supply chain management and sourcing strategy from existing producers will be vital competitive factors.

Another differentiating factor for the industry lies with digital transparency, whereby brands create consumer confidence through blockchain traceability, fair trade certification, or using eco-friendly production processes. DTC brands and small regional organic cooperatives are successfully promoting real farm-to-table experiences and vigorous sustainability narratives that engage an ethical consumer.

Therefore, regenerative agriculture and climate-smart food production are fast-tracking the industry, with carbon sequestration, biodiversity, as well as healthy soils now in vogue. While environmental consciousness has taken precedence in purchasing decisions, marrying sustainability to transparency as well as innovation are advanced competencies that will be the hallmark of the next growth phase in organic foods.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Danone S.A. | 18-22% |

| Nestlé S.A. | 15-19% |

| General Mills, Inc. | 12-16% |

| Hain Celestial Group | 10-14% |

| Organic Valley | 8-12% |

| Other Companies (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Danone S.A. | A leading organic dairy as well as plant-based food manufacturer, making investments in regenerative agriculture and sustainable packaging. |

| Nestlé S.A. | Growing its organic food business through acquisitions, targeting infant nutrition, dairy, and plant-based offerings. |

| General Mills, Inc. | Owner of Annie's and Cascadian Farm, with a focus on organic cereals, snacks, as well as regenerative farm initiatives. |

| Hain Celestial Group | Experts in organic packaged food, teas, and baby food, with robust distribution across North America and Europe. |

| Organic Valley | A cooperative-owned leader in organic dairy and grass-fed offerings with a focus on ethical sourcing and fair trade practices. |

Key Company Insights

Danone S.A. (18-22%)

Danone has established itself as a leader in organic dairy as well as plant food by investing in soil health and carbon-neutral farming. It has expanded through brands like Horizon Organic and Silk.

Nestlé S.A. (15-19%)

Nestlé has been aggressively pursuing organic baby food and dairy, as well as building its plant-based product lines through the acquisition of brands like Gerber Organic and investments in sustainable cocoa sourcing for its organic chocolate products.

General Mills, Inc. (12-16%)

General Mills fortified its organic range with Annie's, Cascadian Farm, and Muir Glen, emphasizing pesticide-free farming practices as well as regenerative agriculture.

Hain Celestial Group (10-14%)

Hain Celestial leads in the organic packaged food category through brands such as Earth's Best, Celestial Seasonings, and The Greek Gods, which appeal to health-conscious consumers.

Organic Valley (8-12%)

Organic Valley is a cooperative owned by farmers that specializes in organic dairy and pasture-raised meat. Its special focus is on animal welfare and sustainable agriculture.

Other Key Players (25-35% Combined)

By category, the industry is segmented into dairy, frozen & processed foods, fruits & vegetables, cereals & grains, meat, fish & poultry, and others.

By product type, it classifies the industry into unprocessed and processed organic food products.

By distribution channel, the industry is distributed through online retail stores, supermarkets/hypermarkets, convenience stores, specialty stores, and other retail formats worldwide.

By region, the industry is divided into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

The industry is expected to reach USD 222.6 million in 2025.

The industry is projected to grow to USD 710.1 million by 2035.

The industry is expected to grow at a CAGR of approximately 12.1% from 2025 to 2035.

China is expected to experience the highest growth, with a CAGR of 13% during the forecast period.

The organic milk segment is one of the most widely consumed categories in the industry.

Leading companies include Hero Group, B&G Foods, Wilkin & Sons Ltd, F. Duerr & Sons Ltd, Murphy Orchards, Trailblazer Foods, Kissan, Bonne Maman, and St. Dalfour.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Asia Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Asia Pacific Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Asia Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Asia Pacific Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: MEA Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Application, 2023 to 2033

Figure 143: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Organic Fruit Powder Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA