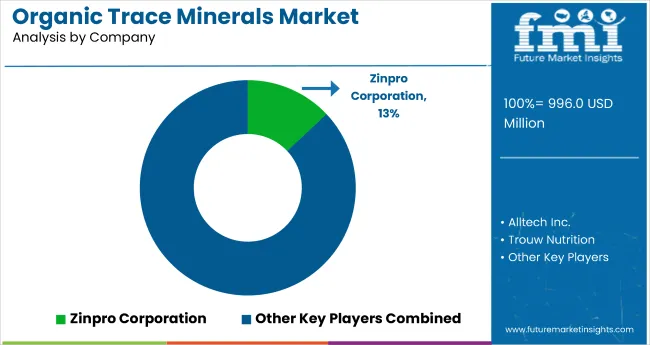

The global organic trace minerals market is projected to grow from USD 996 million in 2025 to USD 1,880 million by 2035, registering a CAGR of 6.5% over the forecast period. The market growth is primarily driven by increasing awareness of micronutrient bioavailability, stringent feed regulations banning antibiotic growth promoters, and the growing trend of sustainable livestock farming.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 996 million |

| Projected Market Value (2035F) | USD 1,880 million |

| Value-based CAGR (2025 to 2035) | 6.5% |

These minerals, including zinc, copper, selenium, and manganese, are crucial for animal health and human nutrition, as they enhance immunity, reproductive function, and nutrient absorption. Advances in chelation technology and rising demand for personalized nutrition solutions are accelerating adoption across both feed and human supplement sectors.

The market holds an estimated 100% share in the chelated minerals market, reflecting its dominant position in this niche. Within the animal feed additives market, organic trace minerals account for 4.2%, emphasizing their increasing relevance in sustainable nutrition. They contribute around 2.8% to the nutritional supplements market, driven by their enhanced absorption and health benefits in human applications.

In the animal health market, they command a 1.6% share due to their proven benefits in livestock immunity and productivity. However, in the much larger global food and beverage ingredients market, their share remains limited to under 0.05%, indicating significant room for growth through innovation and awareness.

Government and industry regulations across key markets like the USA, the European Union, and India are strengthening demand for organic trace mineral inclusion in feed formulations. In the USA, the FDA’s Animal Feed Safety System (AFSS) mandates strict safety standards, while the EU’s ban on antibiotic growth promoters since 2006 has led to widespread use of mineral chelates as natural alternatives.

In India, rising demand for high-quality animal products is prompting increased use of bioavailable minerals in poultry and dairy sectors. These frameworks are shaping a more resilient and health-driven animal nutrition ecosystem globally.

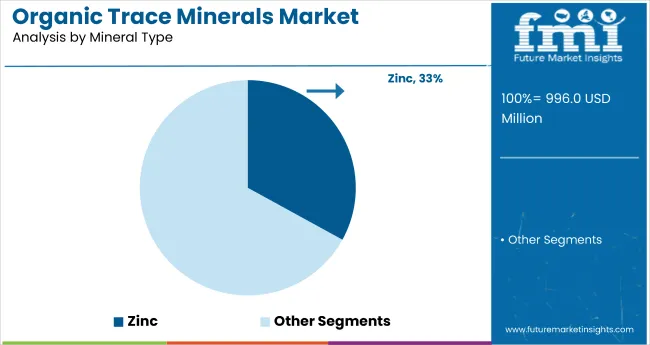

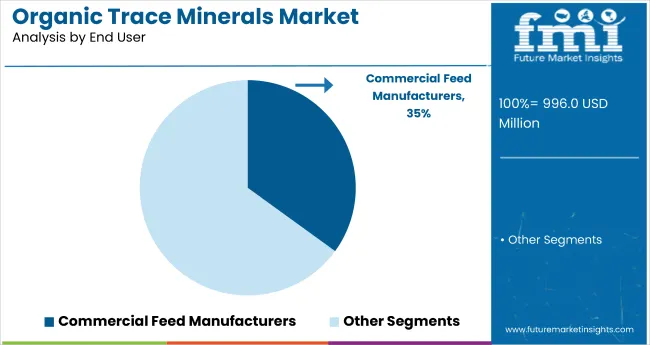

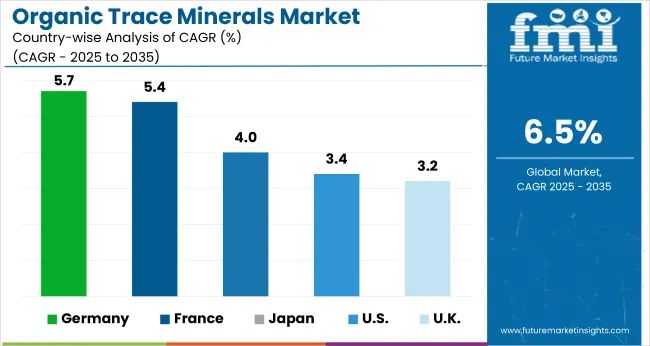

Germany is projected to be the fastest-growing market globally, expected to expand at a CAGR of 5.7% from 2025 to 2035. Commercial feed manufacturers will lead the end user segment with a 35% share, while zinc will dominate the mineral type segment with a 33% share in 2025. The USA and Japan markets are also expected to grow steadily, registering CAGRs of 3.4% and 4%, respectively,

The global market is segmented by mineral type, application type, form, end user, and region. By mineral type, the market is divided into zinc, copper, manganese, iron, selenium, chromium, and others (cobalt, iodine, boron, molybdenum). In terms of application type, the market is categorized into animal feed (ruminants, swine, poultry, aquaculture, equine, pets, others) and human nutrition.

By form, the market is segmented into powder, liquid, premixes, granules, and bolus. By end user, the market includes commercial feed manufacturers, individual farmers & ranchers, veterinary use, animal supplements producers, and dietary supplements & fortified food manufacturers.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Zinc is projected to lead the mineral type segment with a 33% market share by 2025, owing to its vital role in immune support and growth across animal and human applications. The advancement in chelation technologies has significantly improved zinc’s bioavailability and absorption efficiency.

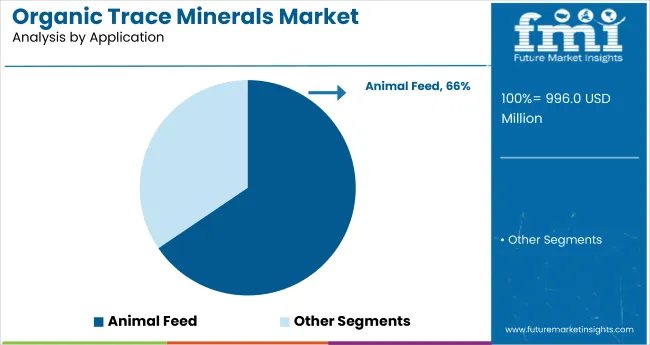

Animal feed is expected to dominate the application segment, accounting for 65.5% of the total market share by 2025, supported by increasing global demand for meat and eggs. As antibiotic restrictions rise, organic trace minerals serve as key alternatives for maintaining poultry health.

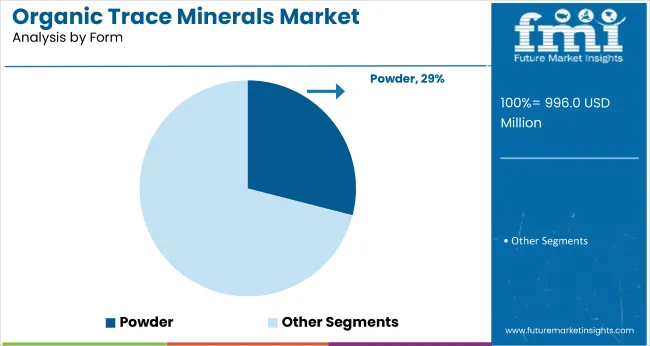

Powder is projected to capture 29% of the market by 2025, favored for its long shelf life, lower cost, and easy integration into feed and supplement mixes. Their stable composition supports consistent dosing across livestock and human applications.

Commercial feed manufacturers are forecasted to hold a 35% market share by 2025, making them the leading end-user segment. Their focus on performance-optimized feed has driven strong adoption of trace minerals that meet both quality and compliance standards.

The global organic trace minerals market is witnessing steady expansion, driven by rising awareness of animal nutrition, the demand for bioavailable supplements, and the need for sustainable agricultural practices. Organic trace minerals play a vital role in improving feed efficiency, animal health, and regulatory compliance in livestock production and human wellness.

Recent Trends in the Organic Trace Minerals Market

Challenges in the Organic Trace Minerals Market

Germany leads organic trace minerals growth among top OECD countries with a 5.7% CAGR, driven by EU feed regulations and chelation adoption. France follows closely at 5.4%, supported by food safety standards and natural supplement preference.

Japan’s market grows at 4% CAGR, boosted by AI-driven personalized nutrition and aging population needs. The USA shows moderate expansion at 3.4%, underpinned by encapsulation in large-scale livestock systems. The UK records the slowest growth at 3.2%, reflecting post-Brexit regulatory caution and limited innovation.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA organic trace minerals revenue is projected to grow at a CAGR of 3.4% from 2025 to 2035. Growth is driven by adoption of mineral encapsulation, strict feed safety standards, and demand from a large-scale livestock and poultry industry.

The sales of organic trace minerals in Germany are expected to expand at 5.7% CAGR during the forecast period, supported by EU antibiotic bans and traceability standards. Animal feed producers are integrating zinc and manganese chelates to improve immunity and productivity naturally.

The French organic trace minerals market is projected to grow at a 5.4% CAGR during the forecast period. National food safety standards and sustainable livestock programs support the market, particularly in dairy, poultry, and specialty livestock sectors.

The Japan organic trace minerals market is projected to grow at 4% CAGR from 2025 to 2035. This growth is supported by AI-led wellness programs, customized nutrition, and increased focus on elderly and animal health.

The UK organic trace minerals revenue is projected to grow at a CAGR of 3.2% from 2025 to 2035, representing the slowest growth among the top OECD nations, at 0.49 times the global pace. Uptake is led by feed compliance post-Brexit and mid-scale applications across ruminants and poultry.

The market is moderately consolidated, with major players such as Zinpro Corporation, Alltech Inc., Trouw Nutrition, Kemin Industries, and Novus International, Inc. dominating the industry. These companies offer high-quality, bioavailable trace minerals used in animal feed and human nutrition. Zinpro Corporation specializes in performance trace mineral solutions for livestock productivity, while Alltech Inc. focuses on sustainable animal health and feed innovation.

Trouw Nutrition delivers precision nutrition products with advanced chelation technology. Kemin Industries provides mineral-based additives supporting immune function and growth. Novus International, Inc. is recognized for its expertise in chelated mineral solutions across poultry and swine applications. Other key players like DSM Nutritional Products, BASF SE, Phibro Animal Health Corporation, and ADM Animal Nutrition offer specialized blends and encapsulated formulations that enhance nutrient absorption and animal performance.

Human nutrition-focused brands such as Solgar, NOW Foods, Garden of Life, Nature’s Bounty, and Pure Encapsulations also play a vital role in delivering mineral supplements tailored to personalized health and wellness trends. Companies like Balchem Corporation, Nutreco N.V., Pancosma S.A., and Bluestar Adisseo Company further contribute with targeted solutions for both fortified food and feed applications.

Recent Organic Trace Minerals Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 996 million |

| Projected Market Size (2035) | USD 1,880 million |

| CAGR (2025 to 2035) | 6.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value/volume in units |

| Mineral Type Analyzed | Zinc, Copper, Manganese, Iron, Selenium, Chromium, and Others (Cobalt, Iodine, Boron, Molybdenum) |

| Application Type Analyzed | Animal Feed (Ruminants, Swine, Poultry, Aquaculture, Equine, Pets, Other) and Human Nutrition |

| Form Analyzed | Powder, Liquid, Premixes, Granules, and Bolus |

| End User Analyzed | Commercial Feed Manufacturers, Individual Farmers & Ranchers, Veterinary Use, Animal Supplements Producers, and Dietary Supplements & Fortified Food Manufacturers |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Zinpro Corporation, Alltech Inc., Trouw Nutrition, Kemin Industries, Novus International Inc., Balchem Corporation, DSM Nutritional Products, Phibro Animal Health Corporation, ADM Animal Nutrition, BASF SE, Vitamins China, Bluestar Adisseo Company, Nutreco N.V., Pancosma S.A., Solgar Inc., NOW Foods, Garden of Life, Thorne Research, Pure Encapsulations, Metagenics, Bluebonnet Nutrition, MegaFood, and Nature’s Bounty |

| Additional Attributes | Dollar sales by mineral type, share by form, regional demand growth, regulatory influence, sustainability trends, competitive benchmarking |

As per mineral type, the market has been categorized into zinc, copper, manganese, iron, selenium, chromium, and others.

As per application type, the market has been categorized into animal feed (ruminants, swine, poultry, aquaculture, equine, pets, others), and human nutrition.

This segment is further categorized into powder, liquid, premixes, granules, and bolus.

As per application, the market has been categorized into commercial feed manufacturers, individual farmers & ranchers, veterinary use, animal supplements producers, and dietary supplements & fortified food manufacturers.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market is valued at USD 996 million in 2025.

The market is forecasted to reach USD 1,880 million by 2035, reflecting a CAGR of 6.5%.

Zinc will lead the mineral type segment, accounting for 33% of the global market share in 2025.

Commercial feed manufacturers will dominate the end user segment with a 35% share in 2025.

Germany is projected to grow at the fastest rate, with a CAGR of 5.7% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA