The organic dyes market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.4 billion by 2035, registering a compound annual growth rate (CAGR) of 2.0% over the forecast period.

This modest growth trajectory points toward a mature industry with steady but limited expansion opportunities. In the period between 2025 and 2030, demand will be supported by textile applications, leather finishing, and printing inks, where organic dyes maintain relevance due to their coloring intensity and versatility. However, growth will remain constrained by competition from synthetic alternatives and regulatory scrutiny over environmental impact.

Between 2030 and 2035, the market is expected to inch upward, reaching USD 1.4 billion, with gains driven by niche applications in food coloring, cosmetics, and specialty coatings where natural or bio-based formulations hold consumer appeal. The incremental growth of USD 0.3 billion over the ten years reflects restrained expansion, requiring producers to focus on innovation, compliance with eco-label standards, and performance differentiation.

Textile manufacturing operations experience application challenges as organic dyes require coordination between dye house operations and fabric finishing departments to achieve consistent color reproduction across different fiber types and processing conditions. Dye technicians coordinate with quality control teams to establish standardized dyeing procedures while managing variables including water quality, temperature profiles, and auxiliary chemical interactions that affect both color development and fabric performance characteristics.

Supply chain operations encounter sourcing complexity as organic dye production requires coordination between agricultural raw material suppliers and chemical processing facilities that may operate on different seasonal cycles. Procurement teams work with supplier qualification departments to establish traceability systems for natural precursor materials while managing inventory considerations for raw materials that may have seasonal availability and quality variations affecting final product consistency.

Cross-functional coordination between regulatory affairs and product development teams creates ongoing dialogue about compliance requirements as organic dyes face increasing scrutiny regarding environmental impact and worker safety considerations. Regulatory specialists work with formulation chemists to evaluate alternative synthesis routes and purification methods while managing documentation requirements for various international markets with differing approval processes and testing standards.

Food and cosmetic application teams encounter operational challenges as organic dyes intended for consumer products require additional purification steps and testing protocols compared to textile applications. Quality assurance departments coordinate with customer technical services to establish specifications for heavy metal content, microbiological purity, and allergen testing while managing segregated production lines that prevent cross-contamination between industrial and consumer-grade products.

| Metric | Value |

|---|---|

| Organic Dyes Market Estimated Value in (2025 E) | USD 1.1 billion |

| Organic Dyes Market Forecast Value in (2035 F) | USD 1.4 billion |

| Forecast CAGR (2025 to 2035) | 2.0% |

The organic dyes market is experiencing steady momentum as industries shift toward eco-friendly and biodegradable colorants that comply with evolving environmental and regulatory standards. The integration of organic dyes in textile manufacturing, food processing, cosmetics, and printing applications has been increasing due to their vibrant color properties, high solubility, and minimal ecological impact.

The growing awareness regarding synthetic dye pollutants and the pressure to reduce industrial wastewater toxicity have further prompted industries to adopt organic dye alternatives. In addition, the rise of digital textile printing, personalized fashion, and low-energy dyeing processes are enhancing the relevance of organic dye formulations that offer precise tone reproduction and improved compatibility with advanced printing technologies.

Collaborative innovations among chemical producers and textile OEMs are driving scalability of novel organic dye variants with improved thermal and lightfastness properties Over the coming years, the market is expected to benefit from increased investments in bio-based dye development and closed-loop production technologies that align with circular economy principles.

The organic dyes market is segmented by type, application, function, source, product form, and geographic regions. By type, the organic dyes market is divided into Synthetic Organic Dyes, Natural Organic Dyes, and Modified Organic Dyes. In terms of application, the organic dyes market is classified into Textiles, Leather, Paper, Food, and Cosmetics. Based on function, the organic dyes market is segmented into Colorants, Mordants, Brighteners, and Dye Adjuvants. By source, the organic dyes market is segmented into Plants, Animals, Coal Tar, and Petroleum.

By product form, the organic dyes market is segmented into Powders, Liquids, Pastes, and Granules. Regionally, the organic dyes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Synthetic organic dyes are projected to hold 47.9% of the total revenue share in the organic dyes market in 2025, establishing themselves as the dominant type category. Their widespread adoption is being driven by their chemical versatility, broad color range, and strong bonding affinity with various substrates. The ability to fine-tune chromophores for desired optical properties has positioned synthetic organic dyes as the preferred choice for high-volume applications in textile, paper, and leather processing.

These dyes exhibit high solubility, reproducibility, and stability under industrial-scale conditions, which makes them particularly suitable for batch and continuous dyeing operations. Cost-efficiency and superior performance characteristics in terms of lightfastness and wash resistance have further contributed to their adoption across both conventional and digitally printed fabrics.

Continuous innovation in azo, anthraquinone, and phthalocyanine dye classes has enabled compliance with global safety regulations, further cementing their dominance. The compatibility of these dyes with automated systems and sustainable auxiliary chemicals is reinforcing their commercial success.

The textiles application segment is expected to account for 36.5% of the organic dyes market revenue in 2025, driven by the sector’s increasing shift toward sustainable dyeing solutions. The segment's growth is being fueled by strong consumer preference for eco-conscious garments and pressure on manufacturers to eliminate harmful chemicals from supply chains.

The integration of organic dyes into textile production processes has been supported by advancements in low-water and low-energy dyeing methods that align with global environmental standards. The ability of organic dyes to deliver rich, vibrant, and long-lasting hues on both natural and synthetic fibers is contributing to their demand across apparel, home furnishings, and technical textiles.

Regulatory pressures in major textile-producing regions are encouraging the transition from conventional dyeing to cleaner, safer alternatives. Additionally, the rise in demand for natural fibers such as organic cotton and hemp has reinforced the preference for compatible dye chemistries, solidifying the textiles segment’s leading position.

The colorants function segment is anticipated to represent 45.2% of the organic dyes market’s total revenue share in 2025, reflecting its foundational role across a wide spectrum of end-use industries. This segment's leadership is being influenced by the growing integration of organic dyes as primary color-imparting agents in sectors such as printing inks, plastics, coatings, and personal care.

Their use as colorants is supported by high purity, uniform particle distribution, and superior transparency, making them suitable for applications that demand aesthetic precision and performance. The increasing requirement for non-toxic, biodegradable, and non-mutagenic colorants has positioned organic dye-based solutions as the go-to choice in food-grade and pharma-grade formulations.

Enhanced compatibility with solvents and polymers, along with resistance to chemical degradation, has contributed to their expanding utility. The shift toward sustainable packaging and product labeling is also accelerating demand for safe and vibrant colorants, consolidating this segment’s role in driving functional innovation in coloration science.

The organic dyes market is driven by regulations, eco-friendly demand, and growth in textiles and food. However, challenges such as higher costs and limited availability impact the market’s expansion poten

The organic dyes market is strongly influenced by government regulations aimed at reducing harmful chemicals in manufacturing processes. These regulations push industries such as textiles, food, and cosmetics to seek safer, more environmentally friendly alternatives. Governments worldwide are increasingly enforcing stricter standards on chemical usage, pushing companies to adopt organic dyes that are less harmful to human health and the environment. This trend is particularly visible in the textile industry, where demand for safer dyes is growing due to consumer awareness of chemical exposure. In regions like Europe and North America, regulatory pressure is leading to a shift toward greener dyeing practices.

As consumer awareness regarding the environmental impact of synthetic dyes rises, the demand for organic dyes continues to grow. Organic dyes are viewed as a more eco-friendly alternative, offering a less harmful option for various applications, including textiles, cosmetics, and food coloring. The textile sector, in particular, is seeing increased adoption of organic dyes due to their reduced toxicity and biodegradability. As manufacturers seek to align with consumer preferences and regulatory demands for greener production processes, the market for organic dyes is expanding, especially in industries where safety and environmental impact are key considerations.

The textile industry remains one of the largest contributors to the demand for organic dyes, with a significant share of the market. The shift toward organic dyes is being driven by increasing consumer demand for natural, organic products. In the food industry, the use of organic dyes in natural food coloring is also gaining momentum, as consumers increasingly opt for products with fewer artificial additives. The growing emphasis on organic and natural products in both sectors is pushing manufacturers to adopt organic dyes, contributing to market growth. This trend is further supported by ongoing research into the development of new, vibrant organic colors for these industries.

Despite their advantages, organic dyes face challenges such as higher production costs and limited availability compared to synthetic alternatives. Organic dyes often require more complex processing methods and raw materials, which can increase their cost, making them less competitive in price-sensitive industries. The availability of high-quality organic dyes can be limited, especially in the demand for specific colors. These factors may restrain market growth in certain regions and industries, where cost is a major factor in decision-making. However, as the organic dye industry scales and demand increases, production costs may decrease, improving their competitiveness in the market.

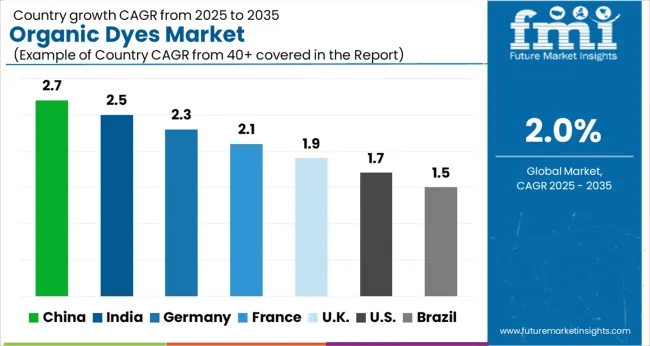

| Countries | CAGR |

|---|---|

| China | 2.7% |

| India | 2.5% |

| Germany | 2.3% |

| France | 2.1% |

| UK | 1.9% |

| USA | 1.7% |

| Brazil | 1.5% |

The organic dyes market is projected to grow globally at a CAGR of 2.0% from 2025 to 2035, fueled by the increasing demand for eco-friendly alternatives to synthetic dyes across various sectors. China leads the market with a CAGR of 2.7%, supported by its large-scale textile manufacturing sector and government initiatives encouraging the use of safer, environmentally friendly products. India follows with a CAGR of 2.5%, driven by expanding textile and food industries, where demand for organic dyes is increasing. France records a growth of 2.1%, supported by the growing adoption of natural dyes in textiles and food production. The UK shows a 1.9% growth, driven by demand in the textile and cosmetics industries. The USA posts a CAGR of 1.7%, with increasing awareness among consumers and regulatory push for sustainable products across sectors like cosmetics, textiles, and food. This analysis covers over 40 countries, with these key markets serving as benchmarks for sustainable production practices, regulatory developments, and innovation in the organic dyes industry.

The organic dyes market in the UK is projected to achieve a CAGR of 1.9% during 2025–2035, slightly below the global average of 2.0%. The market grew at a CAGR of 1.6% during 2020–2024, driven by increasing awareness of environmental impacts and the rising demand for sustainable products. The growth rate for the 2025–2035 period is expected to rise due to increasing consumer demand for eco-friendly alternatives in the textile, cosmetics, and food industries. The adoption of organic dyes in these sectors is fueled by stricter regulations on the use of synthetic dyes and growing consumer preference for natural, biodegradable products. The rising emphasis on sustainability and innovation in dyeing technologies will also contribute to the growth of the organic dyes market in the UK

China is projected to grow at a CAGR of 2.7% during 2025–2035, surpassing the global average of 2.0%. Between 2020 and 2024, the market grew at 2.3%, driven by its massive textile industry, which is increasingly adopting organic dyes to meet both regulatory standards and consumer demand for safer, more sustainable products. The higher growth for the 2025–2035 period is expected from the continued industrial shift toward sustainability and eco-friendly solutions. China’s large-scale textile production, coupled with its government’s commitment to reducing pollution and enhancing environmental standards, will drive the adoption of organic dyes. Manufacturers will focus on meeting the rising demand for organic dyes in fashion, food, and cosmetics sectors as part of China’s green transition.

India is expected to post a CAGR of 2.5% during 2025–2035, above the global average. During 2020–2024, the market grew at a CAGR of 2.1%, supported by the growing textile and agricultural sectors, where organic dyes are increasingly used due to regulatory pressure and consumer preference for natural products. The higher growth rate for 2025–2035 is expected to result from greater government incentives for sustainable manufacturing processes, alongside rising awareness in industries such as food, cosmetics, and textiles. India’s significant shift toward eco-friendly production methods and increased investment in renewable materials will further boost the organic dyes market, particularly in industries focusing on cleaner production practices.

The organic dyes market in France is projected to grow at a CAGR of 2.1% during 2025–2035, slightly below the global average. Between 2020 and 2024, the market grew at a rate of 1.8%, driven by the demand for eco-friendly and biodegradable dyes in the fashion, food, and cosmetic industries. France’s strong regulatory framework regarding environmental standards is accelerating the use of organic dyes, particularly in textiles and food coloring. The higher growth forecast for the 2025–2035 period is driven by further advancements in eco-friendly dyeing technologies and consumer shifts toward sustainable products. As sustainability becomes a higher priority in both industrial practices and consumer choices, organic dyes are expected to see increased adoption across various sectors in France.

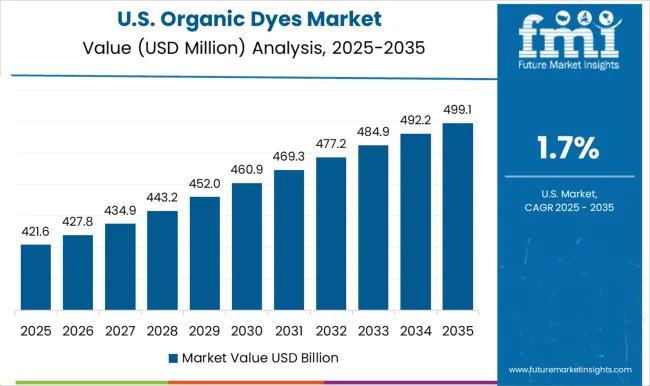

The Organic Dyes market in the USA is projected to grow at a CAGR of 1.7% during 2025–2035, below the global average of 2.0%. During the 2020–2024 period, the market grew at a CAGR of 1.5%, driven by increasing awareness of environmental issues and the growing demand for sustainable solutions across industries such as textiles, food, and cosmetics. The higher growth forecast for 2025–2035 is expected to be propelled by stricter government regulations on synthetic dyes, along with a rising shift toward green technologies in manufacturing. The demand for organic dyes will increase as USA industries continue to prioritize eco-friendly and biodegradable options to meet sustainability standards. Consumers are also becoming more conscious of the environmental impact of the products they purchase, pushing manufacturers in sectors like fashion and food to adopt organic dyes to meet these changing preferences. Advances in organic dye formulations, improving cost-effectiveness and performance, will drive future market growth.

The organic dyes market is highly competitive, driven by the increasing adoption of eco-friendly colorants across the textile, food, cosmetics, and industrial sectors. Gharda Chemicals Ltd. is recognized for its strong portfolio of environmentally sustainable organic dyes and intermediates, emphasizing green chemistry and compliance with international environmental standards. Lanxess AG remains a key global player, offering a broad spectrum of high-performance organic dyes and pigments designed for industrial coatings, textiles, and plastics applications, with a focus on sustainable and energy-efficient dyeing processes. Archroma Management GmbH specializes in textile colorants and functional chemicals, delivering a comprehensive range of low-impact, eco-certified organic dyes to meet growing demand for sustainable textile coloration.

DyStar Group continues to lead in textile dye innovation, offering reactive, disperse, and vat dyes with an emphasis on sustainability, color fastness, and water-efficient dyeing technologies. Sandoz AG, while now focused primarily on pharmaceuticals, maintains expertise in high-purity organic intermediates applicable to specialty dye formulations for medical and industrial uses. China National Bluestar (Group) Co., Ltd. (part of Sinochem Holdings) supplies cost-effective organic dye solutions for textile and specialty chemical markets across Asia, leveraging large-scale production and an integrated supply chain. DIC Corporation, a global leader in printing inks, pigments, and organic colorants, delivers high-stability, environmentally responsible dyes used in coatings, packaging, and digital printing applications.

Crompton Greaves Consumer Electricals Ltd. integrates organic dye-based pigments into paints, coatings, and lighting solutions for residential and commercial use, emphasizing durability and energy efficiency. BASF SE dominates the market with its extensive organic pigment and dye portfolio, supporting industries such as textiles, automotive coatings, and plastics, and maintaining a strong focus on regulatory compliance and circular production processes. Kiri Industries Ltd. is a significant producer of reactive and acid dyes, prioritizing cost efficiency, export competitiveness, and sustainable manufacturing practices aligned with international environmental norms. Sahyadri Industries Ltd., though primarily engaged in building materials, is diversifying into biodegradable colorant solutions, particularly for textile and food-grade applications.

Clariant AG stands out for its innovative organic dye technologies that offer high color strength, uniformity, and reduced water usage, supporting sustainable textile and industrial dyeing processes. Atul Ltd. contributes to the market with high-performance organic dyes and intermediates used in textile, leather, and paper applications, emphasizing product reliability and consistency. Huntsman Corporation, through its legacy Textile Effects business (now part of Archroma since 2023), provides advanced, high-performance organic dye systems designed for sustainability, performance efficiency, and global regulatory alignment.

Competitive strategies across the organic dyes market center on innovation in eco-friendly dye formulations, production efficiency, and regulatory compliance. Key players are expanding their product portfolios and manufacturing capacities, enhancing dye durability, recyclability, and bio-based sourcing, and collaborating with downstream industries to develop application-specific colorant solutions. As sustainability and environmental stewardship become central to market differentiation, the integration of low-impact processes and bio-derived dye technologies continues to define the competitive landscape of the global organic dyes market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Type | Synthetic Organic Dyes, Natural Organic Dyes, and Modified Organic Dyes |

| Application | Textiles, Leather, Paper, Food, and Cosmetics |

| Function | Colorants, Mordants, Brighteners, and Dye Adjuvants |

| Source | Plants, Animals, Coal Tar, and Petroleum |

| Product Form | Powders, Liquids, Pastes, and Granules |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Gharda Chemicals Ltd.; Lanxess AG; Archroma Management GmbH; DyStar Group; Sandoz AG; China National Bluestar (Group) Co., Ltd. (Sinochem Holdings); DIC Corporation; Crompton Greaves Consumer Electricals Ltd.; BASF SE; Kiri Industries Ltd.; Sahyadri Industries Ltd.; Clariant AG; Atul Ltd.; Huntsman Corporation (Textile Effects now part of Archroma). |

| Additional Attributes | Dollar sales, projected growth rates, and market share of leading players. Insights on regional demand distribution, consumer trends toward eco-friendly products, and regulatory impacts are crucial. |

The global organic dyes market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the organic dyes market is projected to reach USD 1.4 billion by 2035.

The organic dyes market is expected to grow at a 2.0% CAGR between 2025 and 2035.

The key product types in organic dyes market are synthetic organic dyes, natural organic dyes and modified organic dyes.

In terms of application, textiles segment to command 36.5% share in the organic dyes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Organic Fruit Powder Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA