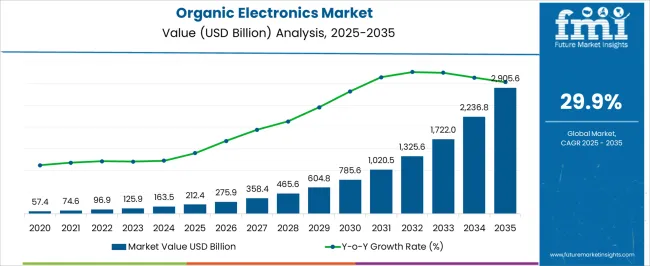

The Organic Electronics Market is estimated to be valued at USD 212.4 billion in 2025 and is projected to reach USD 2905.6 billion by 2035, registering a compound annual growth rate (CAGR) of 29.9% over the forecast period.

| Metric | Value |

|---|---|

| Organic Electronics Market Estimated Value in (2025 E) | USD 212.4 billion |

| Organic Electronics Market Forecast Value in (2035 F) | USD 2905.6 billion |

| Forecast CAGR (2025 to 2035) | 29.9% |

The organic electronics market is witnessing steady growth, supported by the rising demand for lightweight, flexible, and energy-efficient electronic components across multiple industries. The adoption of organic materials is being driven by their ability to provide design flexibility, reduced production costs, and compatibility with large-area manufacturing processes. Growing investment in sustainable technologies is further encouraging the use of organic electronics, particularly in applications where lower environmental impact and reduced energy consumption are prioritized.

Advancements in material science, such as improved stability and higher charge carrier mobility of organic compounds, are expanding their scope of use in next-generation consumer and industrial devices. Regulatory support for environmentally responsible materials, alongside increasing corporate initiatives toward green manufacturing, is further strengthening market opportunities.

The ability of organic electronics to integrate seamlessly with flexible substrates is enabling their deployment in areas such as wearable technology, smart displays, and medical devices As the demand for innovative and energy-efficient solutions continues to rise, the market is expected to achieve long-term growth supported by continuous research, commercialization, and industrial collaborations.

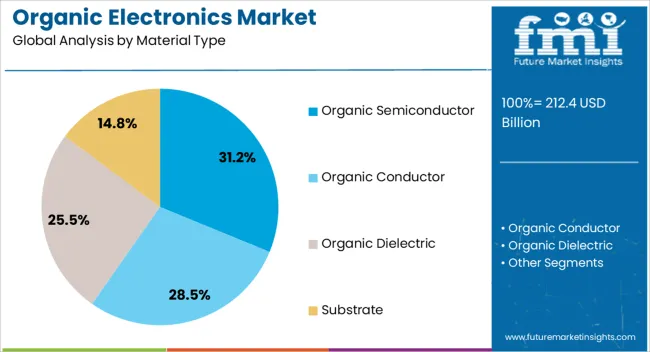

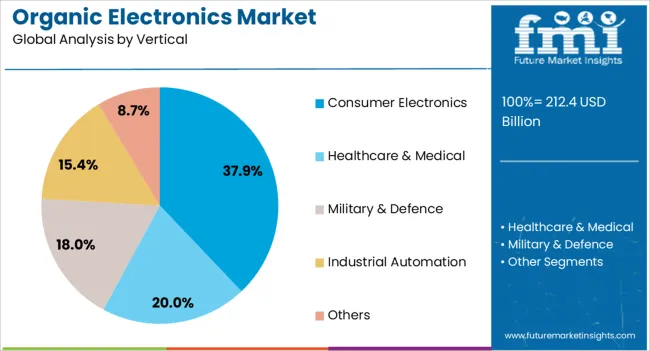

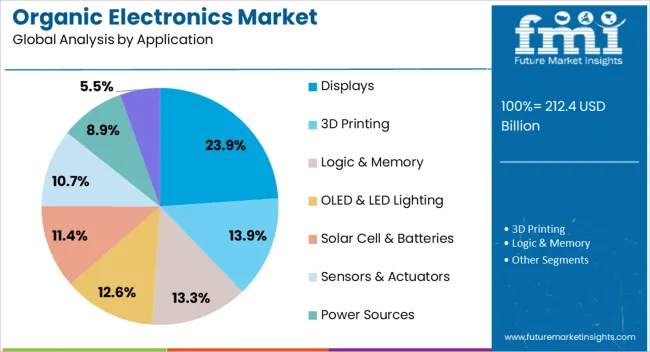

The organic electronics market is segmented by material type, vertical, application, and geographic regions. By material type, organic electronics market is divided into Organic Semiconductor, Organic Conductor, Organic Dielectric, and Substrate. In terms of vertical, organic electronics market is classified into Consumer Electronics, Healthcare & Medical, Military & Defence, Industrial Automation, and Others. Based on application, organic electronics market is segmented into Displays, 3D Printing, Logic & Memory, OLED & LED Lighting, Solar Cell & Batteries, Sensors & Actuators, Power Sources, and Others (Transistors, RFID etc.). Regionally, the organic electronics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The organic semiconductor segment is projected to hold 31.2% of the organic electronics market revenue share in 2025, making it the leading material type. Its dominance is being supported by the ability of organic semiconductors to deliver lightweight, flexible, and cost-efficient alternatives to traditional inorganic materials. Improved charge transport properties, enhanced tunability, and compatibility with solution processing techniques have reinforced their role in high-performance applications.

The segment is also being driven by their suitability for large-area electronic devices, where scalability and lower material costs are important. The increasing use of organic semiconductors in thin-film transistors, sensors, and photovoltaic systems is strengthening their market presence. Their potential to be processed at lower temperatures enables integration with flexible substrates, expanding their adoption in emerging applications such as wearable devices and smart packaging.

Continuous advancements in molecular engineering and stability improvements are ensuring higher reliability and performance, which supports long-term adoption As industries prioritize sustainable and adaptable electronic materials, organic semiconductors are positioned to maintain their leadership within the market.

The consumer electronics vertical is anticipated to account for 37.9% of the organic electronics market revenue share in 2025, making it the dominant end-use vertical. Growth in this segment is being supported by the widespread demand for flexible, energy-efficient, and lightweight components in devices such as smartphones, laptops, tablets, and wearable technology. Organic materials are being increasingly integrated into display panels, sensors, and power sources, where they enable thinner designs and enhanced portability.

The segment’s expansion is also linked to the rising preference for eco-friendly and recyclable materials, aligning with consumer and regulatory trends toward sustainable electronics. The ability of organic electronics to support large-scale, cost-efficient production is further enhancing their adoption in consumer applications.

Technological advancements that improve durability, resolution, and energy efficiency are strengthening the competitiveness of these materials against traditional electronic components As consumer expectations shift toward devices with enhanced performance and sustainable features, the consumer electronics vertical is expected to remain the largest contributor to revenue within the organic electronics market.

The displays application segment is expected to hold 23.9% of the organic electronics market revenue share in 2025, establishing it as the leading application area. This leadership is being reinforced by the rapid adoption of organic light-emitting diodes and flexible display technologies in consumer and commercial products. The superior brightness, contrast, and viewing angles offered by organic materials are driving their use in high-performance displays across smartphones, televisions, automotive panels, and signage systems.

The ability to design thinner and lighter displays without compromising visual quality is contributing to their widespread adoption. Cost reduction in manufacturing processes, combined with the flexibility of roll-to-roll printing techniques, is enabling large-scale commercialization of organic display technologies. The segment is also benefiting from strong consumer demand for enhanced visual experiences and the growing trend toward foldable and wearable devices.

Continuous innovations in material stability and lifetime performance are ensuring greater reliability, which is essential for mass-market adoption As demand for advanced display technologies continues to expand, the displays segment is expected to remain central to revenue growth in the organic electronics market.

Organic electronics is the application of organic molecules and certain types of polymers, which have the ability to conduct electricity, to develop semiconductors, electricity-conducting circuits, and electronic devices.

The organic electronics market is estimated to grow at a CAGR of 29.9% for the forecast period of 2025 to 2035.

Development in organic chemistry and polymer technology is helping in the growth of the organic electronic market. The market is relatively nascent and will need time to improve, but as it finds applications in consumer electronics and healthcare, the market is bound to grow.

The rate of acceptance and development of environmentally friendly technologies has increased throughout time. The market demand for organic electronics is growing due to the utilisation of sustainable energy sources like organic batteries and biodegradable materials in technological advancements like OLEDs. Because organic devices are simpler to dispose of in the environment, governments all over the world support them. Additionally, organic electronics use less energy to operate, resulting in energy-saving solutions.

In 2025, North America had the largest market share of 35.2%, and South Asia and the Pacific are estimated to have the fastest growth rate of CAGR at 32.7%.

Several organic companies which are developing organic electronic components are in North America, and this will fuel the growth of organic electronics. North America also has a large healthcare and medicine industry and manufacturing industry, which will allow the market to grow.

South Asia and the Pacific are witnessing a growth in the manufacturing and implementation of solar cells and batteries for providing electricity for country-wide purposes. The consumer electronics market in this region is also huge. For this reason, South Asia and the Pacific is the fastest growing region.

The United States is technologically advanced, having adopted advanced technologies such as AI, machine learning, and IoT in the past, making a positive contribution to its growth. Additionally, the United States is adopting digital signage and other advanced display technologies in consumer electronics, which is evidently driving the growth of the market.

Due to the technological advancements and investments which are made for research and development in this country, USA is estimated to be a large market for organic electronics.

India has a large population due to which it can act as a big marketplace for consumer electronics, boosting the growth of organic electronic components. The increasing income of the middle class in the country is another factor allowing greater expenditures on consumer electronics.

Germany has a large chemical industry, which could drive the development of organic electronics and a manufacturing industry that requires electronic components. Companies and consumers are developing an interest in organic electronic technology and its applications since it is eco-friendly and low-cost.

Semiconductors are the most widely used electronic components in consumer and industrial sectors. As there are developments in organic electronic components, their applications can be used in developing semiconductors for various purposes.

Organic electronics also cost less than inorganic semiconductor materials. For this reason, the market share for organic semiconductors is estimated to increase at a CAGR of 34.4%.

Organic Semiconductors have a wide range of applications in various electronic components. LEDs, printed circuit boards, inkjet printers, and so on.

If the application of organic electronics can extend to the mobile phone and communication industries and the automotive industry, the demand for organic electronics can sky rocket.

For this reason, the consumer electronics segment is estimated to have the largest market share for the forecast period. For the year 2025, the market share was 32.1%.

Solar cells are at the forefront of renewable energy, and several countries are moving toward the implementation of environmentally friendly means of generating energy. Solar cells have applications in consumer electronic devices as well.

For this reason, solar cells and batteries are estimated to witness a CAGR growth of 36.1%.

Companies currently developing organic electronics are chemical companies that develop organic materials like polymers and polycarbonates, which could be developed into creating organic electronic components.

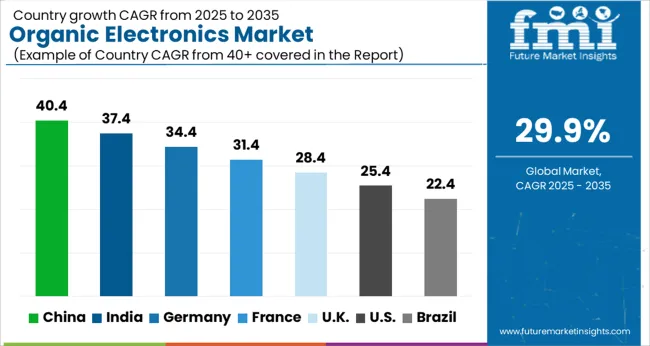

| Country | CAGR |

|---|---|

| China | 40.4% |

| India | 37.4% |

| Germany | 34.4% |

| France | 31.4% |

| UK | 28.4% |

| USA | 25.4% |

| Brazil | 22.4% |

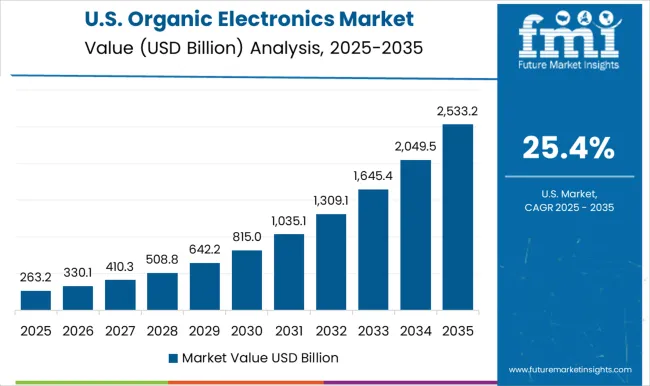

The Organic Electronics Market is expected to register a CAGR of 29.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 40.4%, followed by India at 37.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 22.4%, yet still underscores a broadly positive trajectory for the global Organic Electronics Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 34.4%. The USA Organic Electronics Market is estimated to be valued at USD 80.4 billion in 2025 and is anticipated to reach a valuation of USD 773.5 billion by 2035. Sales are projected to rise at a CAGR of 25.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 9.9 billion and USD 6.7 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 212.4 Billion |

| Material Type | Organic Semiconductor, Organic Conductor, Organic Dielectric, and Substrate |

| Vertical | Consumer Electronics, Healthcare & Medical, Military & Defence, Industrial Automation, and Others |

| Application | Displays, 3D Printing, Logic & Memory, OLED & LED Lighting, Solar Cell & Batteries, Sensors & Actuators, Power Sources, and Others (Transistors, RFID etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Merck Group, Sumitomo Corporation, BASF SE, AGC INC, Evonik Industries AG, Heliatek GmbH, Novaled GmbH, COVESTRO AG, H.C Starck Inc., and POLYIC GMBH & CO. KG |

The global organic electronics market is estimated to be valued at USD 212.4 billion in 2025.

The market size for the organic electronics market is projected to reach USD 2,905.6 billion by 2035.

The organic electronics market is expected to grow at a 29.9% CAGR between 2025 and 2035.

The key product types in organic electronics market are organic semiconductor, organic conductor, organic dielectric and substrate.

In terms of vertical, consumer electronics segment to command 37.9% share in the organic electronics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Organic Fruit Powder Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA