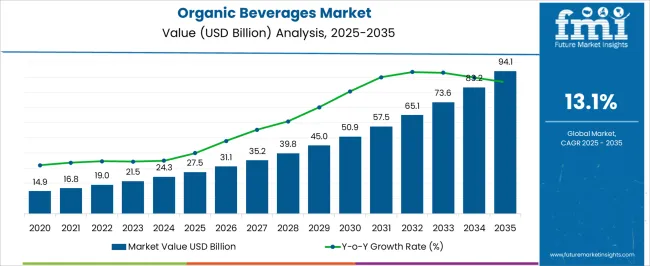

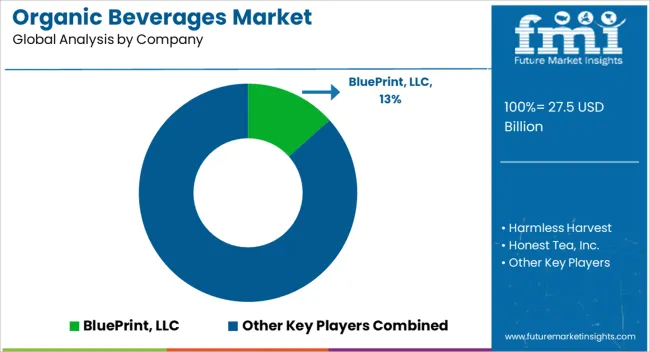

The organic beverages market is expected to grow from USD 27.5 billion in 2025 to USD 94.1 billion by 2035, registering a 13.1% CAGR and generating an absolute dollar opportunity of USD 66.6 billion. Growth is driven by rising consumer preference for health-conscious and natural products, increased awareness of wellness and nutrition, and expanding availability of organic drinks, including juices, teas, functional beverages, and plant-based alternatives. Retail expansion, e-commerce penetration, and product innovation also contribute to market growth globally.

Analyzing the contribution of volume versus price growth provides insight into the drivers of revenue expansion. In the early phase from 2025 to 2028, growth is predominantly volume-driven, as adoption increases in North America, Europe, and the Asia Pacific due to higher consumption frequency, wider distribution networks, and growing consumer awareness. Between 2029 and 2032, both volume and price contribute to market expansion, as premiumization trends emerge, and consumers are willing to pay higher prices for organic, sustainably sourced, or fortified beverages.

From 2033 to 2035, price growth will increasingly influence revenue, particularly in mature markets where market penetration is high, and incremental revenue will come from premium offerings, limited editions, and functional beverages with added health benefits. Overall, the USD 66.6 billion opportunity reflects a combination of increased consumption volumes and strategic pricing, illustrating how consumer demand and value-based product positioning drive sustained growth in the organic beverages market between 2025 and 2035.

| Metric | Value |

|---|---|

| Organic Beverages Market Estimated Value in (2025 E) | USD 27.5 billion |

| Organic Beverages Market Forecast Value in (2035 F) | USD 94.1 billion |

| Forecast CAGR (2025 to 2035) | 13.1% |

The organic beverages market is driven by five primary parent markets with specific shares. Functional and health drinks lead with 35%, as consumers seek products with natural ingredients, vitamins, and antioxidants. Fruit and vegetable juices contribute 25%, emphasizing organic sourcing and nutritional quality. Dairy-based beverages account for 20%, including organic milk, yogurt drinks, and smoothies. Tea and coffee represent 10%, where organic and fair-trade certifications appeal to health- and eco-conscious consumers. Sports and energy drinks hold 10%, incorporating natural ingredients and organic formulations. These sectors collectively define global demand and shape product innovation in organic beverages.

Recent developments in the organic beverages market focus on clean-label formulations, sustainability, and product diversification. Manufacturers are introducing beverages with natural sweeteners, plant-based ingredients, and functional additives, including probiotics, adaptogens, and vitamins. Sustainable sourcing, eco-friendly packaging, and transparent labeling are becoming key differentiators in the market. The rise of e-commerce and direct-to-consumer sales is expanding market reach and accessibility. Regional flavor innovations and hybrid beverage formats are attracting a diverse range of consumer segments.

The organic beverages market is experiencing sustained growth, driven by rising consumer awareness around health, environmental sustainability, and clean-label products. Increasing preference for chemical-free and naturally sourced beverages has positioned organic options as a popular alternative across multiple age groups and regions.

Regulatory support for organic certification and the expansion of organic farming practices have further enhanced the credibility and availability of these products. Manufacturers are investing in innovative formulations and eco-friendly packaging to align with evolving consumer expectations.

As demand rises in both developed and emerging markets, product diversification and strategic placement in mainstream retail channels are boosting visibility and access. The market is expected to maintain its upward trajectory as wellness trends, lifestyle-driven choices, and ethical consumption continue to influence purchasing behavior across the global food and beverage industry.

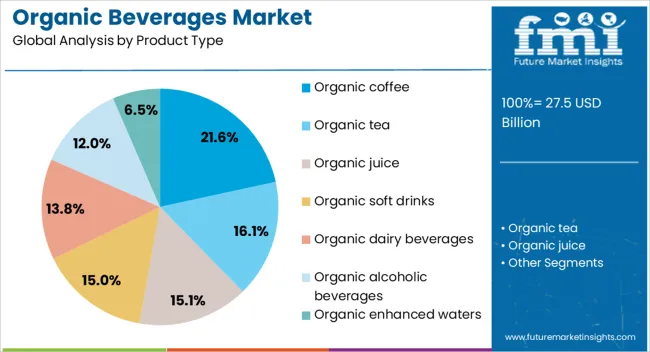

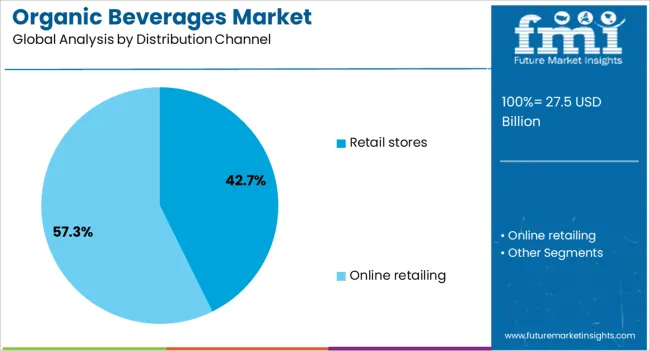

The organic beverages market is segmented by product type, distribution channel, and geographic regions. By product type, organic beverages market is divided into Organic coffee, Organic tea, Organic juice, Organic soft drinks, Organic dairy beverages, Organic alcoholic beverages, and Organic enhanced waters. In terms of distribution channel, organic beverages market is classified into Retail stores and Online retailing. Regionally, the organic beverages industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The organic coffee segment accounts for 22% of the product type category, highlighting its strong foothold within the organic beverages market. This segment’s growth is largely attributed to increasing demand for premium, ethically sourced coffee with no synthetic additives or pesticides.

Consumers are drawn to organic coffee for its perceived health benefits and its alignment with fair-trade and sustainability values. Specialty coffee shops, health food retailers, and online platforms have accelerated the reach of organic coffee, especially among millennials and health-conscious urban populations.

Product innovation, including cold brews, ready-to-drink formats, and compostable packaging, has further enhanced its market appeal. As consumers continue to prioritize transparency and origin traceability, the organic coffee segment is expected to expand steadily through targeted branding and continued improvements in quality and sourcing practices.

Retail stores lead the distribution channel category with a 43% share, reaffirming their significance in making organic beverages widely accessible to mainstream consumers. Supermarkets, hypermarkets, and health-focused retail chains have played a vital role in expanding shelf presence and encouraging trial among new buyers.

The convenience of in-person selection, coupled with trust in certified organic labeling, supports strong consumer engagement within this channel. Retailers have responded by dedicating more shelf space to organic beverage lines and featuring in-store promotions to attract health-conscious shoppers.

Private label offerings and regional organic brands are also gaining traction through retail networks, contributing to segment growth. As demand for functional and clean-label beverages increases, retail stores are expected to maintain a central role in driving volume sales and introducing consumers to a wider array of organic drink options.

The global organic beverages market is expanding due to increasing consumer preference for health-conscious and chemical-free drinks. Asia Pacific accounts for over 40% of global consumption, led by China and India, while North America and Europe focus on high-value organic juices, dairy drinks, and plant-based beverages. Rising awareness of nutritional benefits, immunity enhancement, and clean-label products drives adoption. Innovations in cold-pressed juices, organic teas, functional drinks, and natural sweeteners are accelerating market growth. E-commerce expansion and retail penetration further support accessibility and consumer adoption globally.

The primary driver of the organic beverages market is rising consumer health consciousness and demand for clean-label, chemical-free products. Organic fruit and vegetable juices, functional beverages, and plant-based drinks are experiencing 7–9% annual growth due to perceived health benefits. North America and Europe emphasize certification and traceability to ensure product authenticity, boosting consumer confidence. Asia Pacific shows growth in organic teas, juices, and dairy beverages due to rising disposable incomes and urbanization. Increasing preference for immunity-boosting ingredients such as ginger, turmeric, and probiotics supports market expansion. Retail chains, supermarkets, and online channels are facilitating wider distribution, enhancing accessibility and consumption.

Opportunities in the organic beverages market are driven by product innovation and digital retail channels. Cold-pressed juices, functional drinks with antioxidants, and fortified plant-based beverages are gaining consumer preference globally. E-commerce platforms, subscription models, and home delivery services enable convenient access, increasing sales by 10–15% in key regions. Asia Pacific presents strong opportunities due to expanding middle-class populations and urban lifestyles. Manufacturers investing in sustainable packaging, novel flavors, and natural sweeteners can capture health-conscious consumer segments. Expansion in the ready-to-drink functional beverage sector, including probiotic and energy drinks, offers measurable growth potential across North America, Europe, and emerging markets.

Key trends in the organic beverages market include the use of functional ingredients, sustainable sourcing, and eco-friendly packaging. Ingredients such as plant proteins, probiotics, antioxidants, and natural extracts enhance health benefits, driving consumer preference. Cold-pressed and minimally processed beverages are trending due to improved nutrient retention. Asia Pacific adoption is increasing rapidly due to awareness campaigns and lifestyle changes, while North America and Europe emphasize certifications such as USDA Organic and EU Organic. Manufacturers are incorporating biodegradable bottles, recyclable cartons, and low-carbon production processes to appeal to eco-conscious consumers. Personalization, subscription models, and digital marketing are shaping modern consumption patterns, driving consistent market growth.

Despite growth, the organic beverages market faces restraints due to high product costs and supply chain limitations. Organic raw materials, such as fruits, vegetables, and plant extracts, cost 20–40% more than their conventional alternatives, which limits their affordability for price-sensitive consumers. Seasonal fluctuations affect availability, which in turn impacts production continuity. Certification and compliance requirements for organic labeling increase operational expenses and lead times. Cold-chain logistics for fresh and functional beverages add complexity and cost.

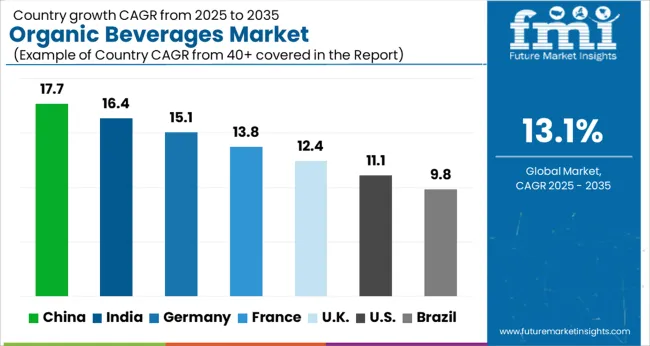

| Country | CAGR |

|---|---|

| China | 17.7% |

| India | 16.4% |

| Germany | 15.1% |

| France | 13.8% |

| UK | 12.4% |

| USA | 11.1% |

| Brazil | 9.8% |

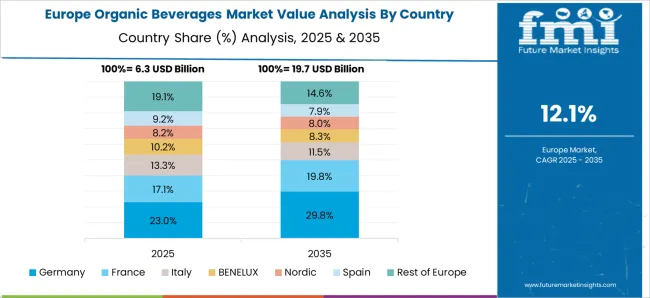

The organic beverages market is projected to grow at a global CAGR of 13.1% through 2035, driven by rising consumer preference for health-conscious drinks, natural ingredients, and functional beverages. China leads at 17.7%, a 1.35× multiple over the global benchmark, supported by BRICS-driven growth in urban consumption, retail expansion, and production of organic beverages. India follows at 16.4%, a 1.25× multiple, reflecting increasing domestic demand, adoption of healthy lifestyles, and expansion of organic beverage manufacturing. Germany records 15.1%, a 1.15× multiple, shaped by OECD-backed innovation in functional and natural beverages, sustainability practices, and quality standards. France posts 13.8%, slightly above the global rate, with adoption focused on premium organic products and specialty beverages. The United Kingdom shows 12.4%, 0.95× the global CAGR, driven by consumer awareness and retail penetration.

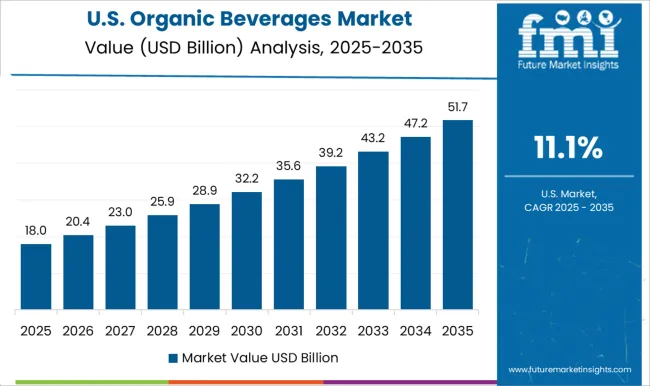

The United States stands at 11.1%, 0.85× the benchmark, with steady uptake in health-focused and organic beverage consumption. BRICS nations contribute the largest market volume, OECD countries emphasize innovation and quality, while ASEAN markets support growth through increasing demand for natural and functional drinks. This report includes insights on 40+ countries; the top markets are shown here for reference.

The organic beverages market in China is projected to grow at a CAGR of 17.7%, driven by increasing consumer awareness of health, wellness, and natural ingredients. Leading manufacturers such as Yili Group, COFCO, and local organic beverage producers are offering juices, teas, and functional drinks with natural, additive-free formulations. Adoption is concentrated in urban centers, modern retail, and e-commerce channels. Technological trends include cold-pressed juices, fortified beverages, and innovative packaging for extended shelf life. Government initiatives supporting food safety, quality standards, and organic certification reinforce market growth. Rising consumer preference for healthier, natural drinks accelerates adoption in China.

The organic beverages market in India is expected to expand at a CAGR of 16.4%, supported by rising health consciousness, increasing disposable incomes, and growing e-commerce penetration. Key suppliers such as Dabur, Organic India, and Patanjali offer juices, herbal drinks, and fortified beverages with natural ingredients. Adoption is concentrated in urban households, modern retail, and online marketplaces. Technological developments include cold-pressed juices, functional blends, and innovative packaging for freshness retention. Government policies promoting organic agriculture, food safety, and quality standards reinforce market growth. Increasing consumer demand for healthy and natural drinks accelerates adoption across India.

The organic beverages market in Germany is projected to grow at a CAGR of 15.1%, driven by consumer preference for natural, additive-free drinks, functional beverages, and organic juices. Leading companies such as Rauch, Alnatura, and Voelkel supply organic juices, herbal drinks, and functional beverages with certified organic ingredients. Adoption is concentrated in supermarkets, health stores, and e-commerce platforms. Technological trends include cold-pressed juices, fortified beverages, and eco-friendly packaging. Government initiatives supporting organic certification, sustainable production, and food quality standards reinforce market growth. Rising demand for healthier, premium organic drinks accelerates adoption in Germany.

The organic beverages market in the United Kingdom is projected to grow at a CAGR of 12.4%, supported by consumer interest in natural ingredients, health benefits, and functional beverages. Key suppliers such as Innocent Drinks, Alpro, and Rude Health provide juices, herbal drinks, and plant-based beverages with certified organic ingredients. Adoption is concentrated in supermarkets, specialty stores, and online channels. Technological trends focus on fortified beverages, cold-pressed juices, and sustainable packaging. Government policies supporting organic certification, food safety, and healthy diets reinforce market growth. Rising demand for natural and functional drinks accelerates adoption in the United Kingdom.

The organic beverages market in the United States is expected to grow at a CAGR of 11.1%, supported by increasing health awareness, functional beverage consumption, and organic certification adoption. Leading companies such as Honest Tea, BluePrint, and Suja provide juices, herbal drinks, and fortified beverages with certified natural ingredients. Adoption is concentrated in supermarkets, e-commerce, and specialty health stores. Technological trends emphasize cold-pressed juice production, functional blends, and eco-friendly packaging. Government initiatives supporting organic labeling, food safety, and healthy diets reinforce market adoption. Rising consumer preference for natural, additive-free beverages drives steady growth in the United States.

Competition in the organic beverages sector is being driven by demand for natural, additive-free products, with companies focusing on flavor innovation, quality consistency, and distribution reach. BluePrint, LLC and Harmless Harvest are being advanced with cold-pressed juices and coconut-based beverages that highlight purity, nutrient retention, and eco-friendly packaging. Honest Tea, Inc. and Inko's LLC are being positioned with a variety of organic teas and fruit-infused drinks that target health-conscious consumers seeking clean-label options. KeVita, Inc. and Kombucha Wonder Drink LLC are being showcased with probiotic-rich beverages that support digestive health while offering unique flavor profiles, catering to the growing functional drinks segment.

Lifeway Foods, Inc. and Nature's Best, Inc. are being applied with fermented and plant-based drinks that combine taste with nutritional benefits, while New Age Beverages Corporation and Oregon Chai, Inc. are being highlighted with organic blends tailored for both retail and foodservice channels. Remedy Drinks and R.W. Knudsen Family, Inc. are being positioned with organic juice and tea products emphasizing natural ingredients, cold-pressed processing, and transparent sourcing.

| Item | Value |

|---|---|

| Quantitative Units | USD 27.5 Billion |

| Product Type | Organic coffee, Organic tea, Organic juice, Organic soft drinks, Organic dairy beverages, Organic alcoholic beverages, and Organic enhanced waters |

| Distribution Channel | Retail stores and Online retailing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BluePrint, LLC, Harmless Harvest, Honest Tea, Inc., Inko's LLC, KeVita, Inc., Kombucha Wonder Drink LLC, Lifeway Foods, Inc., Nature's Best, Inc., New Age Beverages Corporation, Oregon Chai, Inc., Remedy Drinks, and R.W. Knudsen Family, Inc. |

| Additional Attributes | Dollar sales by beverage type and end use, demand dynamics across retail, foodservice, and online channels, regional trends in organic consumption and health awareness, innovation in flavors, functional ingredients, and packaging, environmental impact of sourcing and production, and emerging use cases in plant-based, functional, and ready-to-drink beverages. |

The global organic beverages market is estimated to be valued at USD 27.5 billion in 2025.

The market size for the organic beverages market is projected to reach USD 94.1 billion by 2035.

The organic beverages market is expected to grow at a 13.1% CAGR between 2025 and 2035.

The key product types in organic beverages market are organic coffee, organic tea, organic juice, organic soft drinks, organic dairy beverages, organic alcoholic beverages and organic enhanced waters.

In terms of distribution channel, retail stores segment to command 42.7% share in the organic beverages market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Organic Fruit Powder Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA