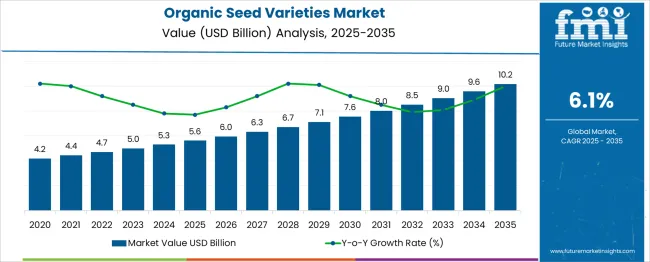

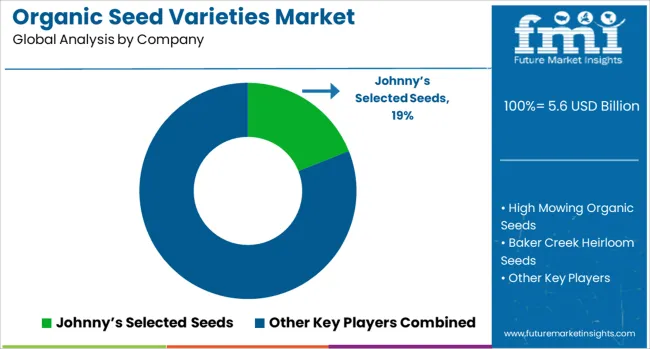

The Organic Seed Varieties Market is estimated to be valued at USD 5.6 billion in 2025 and is projected to reach USD 10.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. The market’s elasticity with respect to macroeconomic indicators is projected to remain limited in early years, as adoption is driven more by certification mandates and policy-linked farming transitions than by direct consumer demand or commodity price shifts. Input cost fluctuations, including fertilizer and synthetic pesticide pricing, are expected to have minimal short-term impact on organic seed volumes, as farmers committed to certified cultivation are unlikely to switch back.

Stronger sensitivity is expected in relation to rural financing, credit availability, and farm-level income trends, particularly in Asia and South America. These indicators influence seed renewal rates and the selection of higher-performing, pest-resistant organic seed lines. Government support through subsidies or procurement programs is also likely to affect replacement cycles and varietal diversity. The elasticity is expected to remain uneven across regions, with stable demand in North America and Europe, and more variable growth patterns tied to macroeconomic cycles in emerging markets. Overall, the market’s response to macro shifts is projected to follow a lagged but upward-moving trend, shaped by agricultural policy and land-use priorities.

| Metric | Value |

|---|---|

| Organic Seed Varieties Market Estimated Value in (2025 E) | USD 5.6 billion |

| Organic Seed Varieties Market Forecast Value in (2035 F) | USD 10.2 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

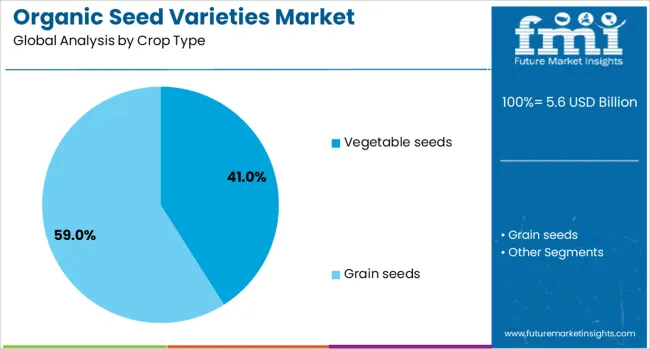

The organic seed varieties market holds specific positions across related parent segments. It accounts for around 39 % of the global organic seeds product segment, largely driven by vegetable seeds such as lettuce, root veggies, and gourds. In the organic field crop seed sector, it represents close to 42 %, reflecting dominance in grains like wheat, oats, and barley. Within the organic herb and flower seed market, its share is about 8–10 %, catering to home gardeners and niche growers.

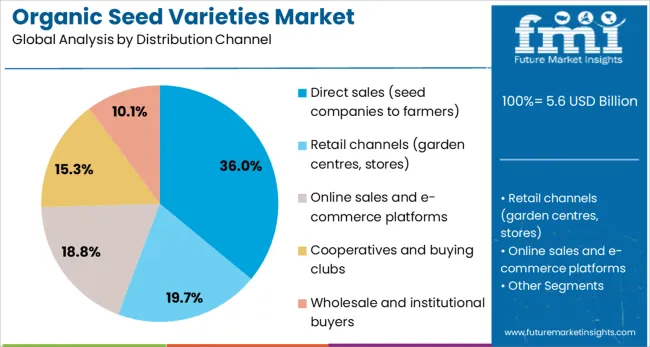

The oilseed and alternative grain seed segment captures roughly 5–7%, including items like flaxseed and amaranth. Distribution-wise, through wholesalers, organic seed varieties constitute over 65% of the channel share, while retail and cooperative channels cover about 8–10% combined, with online platforms contributing less than 3% overall. Demand is intensifying for high-yield, disease-resistant organic varieties developed using non-GMO breeding methods, addressing environmental resilience and performance.

Expansion of digital tools enhances germination rates and stress tolerance. Certification programs are gaining importance, supporting product transparency and consumer trust. Strategic partnerships among seed producers, research institutions, and cooperatives are accelerating regional adaptation of seed varieties, especially in developing markets like India and China. While wholesalers dominate supply chains, online and cooperative distribution channels are expanding, supporting direct outreach to small-scale growers and urban gardeners. These trends signal a maturing sector focused on sustainable yields, genetic diversity, and scalable market access.

The Organic Seed Varieties market is undergoing steady expansion, supported by increasing consumer preference for chemical-free food and sustainable agricultural practices. Rising awareness about the environmental and health impacts of conventional farming has encouraged the adoption of organic cultivation, thereby increasing demand for certified organic seeds.

Governments and international bodies have also promoted organic farming through incentives and regulatory frameworks, which has enhanced farmer participation globally. Continuous innovation in organic seed breeding and the emergence of resilient crop varieties have improved yield stability, further strengthening the commercial viability of organic farming.

Seed producers are investing in localized seed varieties and improving their supply chain transparency, which is positively impacting both the trust and adoption rates among farmers. As the organic food market continues to grow worldwide, the organic seed industry is expected to witness sustained demand, with opportunities emerging across diverse crop types and distribution platforms..

The organic seed varieties market is segmented by crop type and distribution channel and geographic regions. By crop type of the organic seed varieties market is divided into Vegetable seeds, Grain seeds, Fruit seeds, Herb and flower seeds, and Oilseed and alternative grains. In terms of distribution channel of the organic seed varieties market is classified into Direct sales (seed companies to farmers), Retail channels (garden centres, stores), Online sales and e-commerce platforms, Cooperatives and buying clubs, and Wholesale and institutional buyers. Regionally, the organic seed varieties industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vegetable seeds segment is anticipated to account for 41% of the Organic Seed Varieties market revenue share in 2025, making it the leading crop type. Growth in this segment has been primarily influenced by the increasing global demand for fresh, organically grown vegetables in both retail and food service sectors. Farmers have shown preference for organic vegetable seeds due to the relatively shorter crop cycles, higher profitability, and adaptability to diverse agro-climatic conditions.

Seed developers have responded by introducing varieties with improved disease resistance and consistent yields, which has enhanced the appeal of this subsegment. Additionally, government support for urban and peri-urban organic farming initiatives has further expanded the scope for vegetable seed adoption.

The segment’s dominance has also been reinforced by consumer trends favoring healthier diets, leading to increased cultivation of organic vegetables. This has prompted seed companies to focus on innovation and accessibility, ensuring the vegetable seeds subsegment continues to outperform other crop types in the organic seed sector..

The direct sales segment, comprising direct transactions between seed companies and farmers, is expected to hold 36% of the Organic Seed Varieties market revenue share in 2025, establishing it as the leading distribution channel. This segment’s strength has been driven by the demand for transparent and traceable seed sourcing, especially among organic growers who prioritize quality assurance and certified inputs.

Seed companies have increasingly adopted direct engagement models to provide farmers with technical guidance, product education, and customized recommendations, which has improved trust and brand loyalty. The elimination of intermediaries has allowed for more efficient communication and better pricing strategies, benefiting both producers and end users.

Furthermore, the ability to deliver specialized seed varieties directly to farms has proven advantageous in meeting localized agricultural needs. As organic farming practices become more widespread, direct sales are expected to remain the preferred channel, supported by digital platforms, farmer outreach programs, and sustained partnerships between producers and growers..

The organic seed varieties market has expanded rapidly as sustainable agriculture practices gain traction globally. Demand is being supported by increasing farm-level adoption of certified organic crops and regulatory frameworks favoring non-GMO seeds. Crop diversity, including cereals, vegetables, and legumes, has widened in certified seed portfolios. Breeding innovations such as heirloom preservation, disease-resistant lines, and heritage cultivars are gaining prominence. Farmers in emerging nations are integrating organic seed programs to meet both local food security and export standards.

Innovation in organic seed breeding has driven improvements in germination rates, disease resistance, and yield stability under low-input conditions. Specialized breeding programs have introduced cropping lines that thrive in organic soil regimes and resist fungal pathogens common in no-synthetic-fertilizer systems. Crop-specific centers have released heritage and farmer-led varieties that align with regional agroecological zones. Seed certification protocols now ensure traceability and genetic purity, bolstering grower confidence and market access. Hybrid heirloom varieties are gaining traction in premium specialty markets. Development of crop-specific seed libraries and on‑farm seed saver networks has expanded cultivar variety. This innovation surge is supporting diversified crop rotations, enhancing soil health, and meeting rising organic produce demand with consistent seed quality and adaptability.

Organic seed adoption has been influenced by policy support and strict certification protocols. Agricultural regulations in many countries mandate sourcing certified organic seed varieties for crop systems labeled as organic, thereby ensuring traceability and authenticity. Certification agencies now require yearly seed testing, purity algorithms, and non-GMO declarations before labeling. Public‑private partnerships often provide subsidized access to certified seed for smallholder farms. Organic seed cooperatives and seed banks have been established to manage genetic diversity and regional suitability. Import-export standards for organic crops frequently include seed provenance criteria, influencing procurement for export-oriented farms. These regulated structures have stimulated demand across certified acreage while supporting farmer training programs focused on seed selection, stewardship, and regenerative practices.

While certified organic seeds deliver benefits in long-term farm ecology and premium price points, upfront costs remain higher than conventional seeds. Seed pricing can be 20–40% higher due to stringent breeding protocols, certification overhead, and limited production scale. For many smallholders, lack of access to distribution channels poses a barrier. Organic seed supply chains typically involve smaller-output cooperatives rather than global seed giants, limiting availability in remote rural areas. Bulk purchase programs and community seed fairs have addressed this, though logistical gaps persist. Additionally, seed sovereignty regulations and local varietal approval timelines may delay access. Limited on-farm storage and germination consistency issues further affect repeat use. Investment in localized seed multiplication training and decentralized distribution models is needed to bridge affordability and availability.

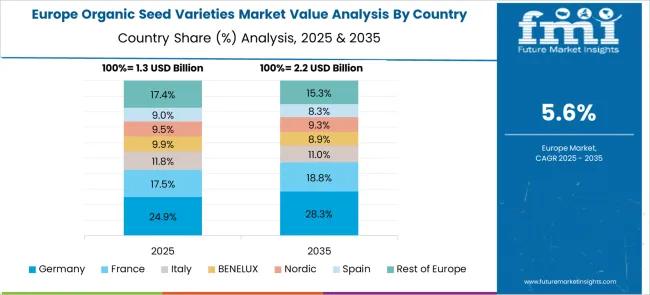

Market dynamics vary by region with strong performance in Europe and North America where certified organic acreage and premium produce markets are well established. In these zones, heritage and specialty varieties such as ancient grains and heirloom vegetables account for rising organic acreage. Emerging economies in Asia-Pacific and Latin America are witnessing accelerating adoption, particularly among smallholder networks adopting diversified cropping systems for domestic consumption and export. Local demand for climate-adapted varieties and drought‑tolerant cultivars has created niche opportunities. Seed exchange initiatives and farmer-led breeding in agro-climatic zones are expanding. Institutional procurement for school feeding programs and urban food cooperatives is growing interest. This regional diversity underscores opportunities in tailoring varietal portfolios to local agroecological conditions and consumer trends.

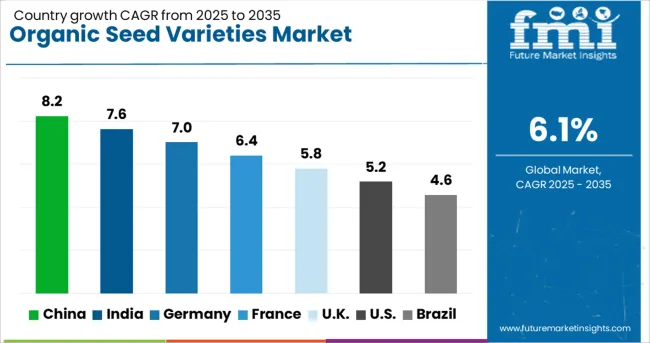

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

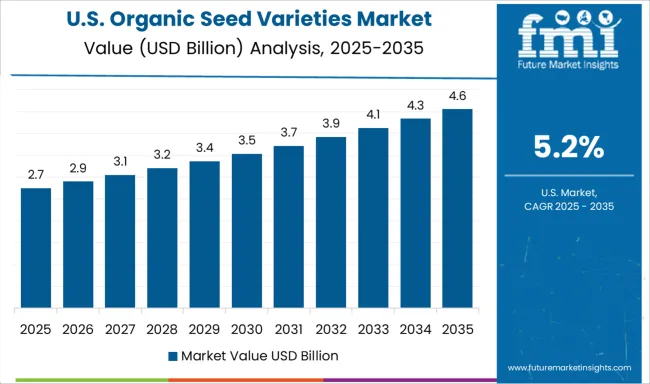

| USA | 5.2% |

| Brazil | 4.6% |

Global demand for organic seed varieties is projected to rise at a CAGR of 6.1% between 2025 and 2035. China, at 8.2%, leads among the 40+ countries analyzed, followed by India at 7.6% and Germany at 7.0%. These countries exceed the global growth average by +35%, +25%, and +15% respectively. The United Kingdom aligns closely with the global trend at 5.8%, while the United States trails at 5.2%, reflecting a –15% deviation from the global rate. Adoption is influenced by policy incentives, export orientation, regional agronomic preferences, and commercial farming scale. These five countries illustrate varying production, regulatory, and market readiness dynamics, with over 40 countries analyzed in detail within the report.

China is projected to register a CAGR of 8.2% in the organic seed varieties market from 2025 to 2035, driven by central government mandates for chemical-free farming inputs. Companies such as Origin Agritech and Winall Hi-tech Seed have developed seed lines tailored to regional pest pressures and soil health programs. Large-scale cooperatives in Inner Mongolia and Yunnan provinces have been early adopters, supported by incentives for organic exports. The segment is benefiting from targeted funding for R&D on drought-resistant and pest-tolerant organic seeds. Domestic seed validation frameworks continue to influence commercialization speed.

India is forecast to grow at a CAGR of 7.6% in the organic seed varieties market between 2025 and 2035. The market is supported by policies promoting natural farming and cluster-based organic production. Companies such as Namdhari Seeds and Kaveri Seed Company have scaled certified organic vegetable and cereal seed offerings. Regions like Sikkim, Maharashtra, and Karnataka have introduced localized seed banks to support indigenous crop adaptation. Export demand for organic pulses and spices is influencing breeder investment in disease-resistant open-pollinated varieties. Certification costs and yield consistency remain key adoption barriers.

Germany is expected to grow at a CAGR of 7.0% in the organic seed varieties market through 2035. Regulatory mandates for seed purity and regional seed traceability have advanced the sector’s institutional credibility. Saatgut Dillmann and Bingenheimer Saatgut AG have expanded organic seed breeding programs focused on biodiversity and disease resilience. Uptake is being observed in biodynamic farms and ecological cooperatives. Farm-to-fork certification mechanisms and ecological public procurement targets are reshaping procurement of certified organic varieties. Farmer cooperatives are also partnering with retail chains to commercialize heritage seed lines.

The United Kingdom is projected to grow at a CAGR of 5.8% in the organic seed varieties market through 2035. Demand is shaped by voluntary labeling schemes and institutional push from the Soil Association and Organic Farmers and Growers. Companies such as Stormy Hall Seeds and Organic Seed Producers Ltd are working with farms on adaptive breeding strategies for the UK climate. Supply gaps persist due to reliance on imported seed stocks. New breeding networks funded by DEFRA are supporting the domestication of niche crops for organic rotations. Crop resilience and shorter maturity cycles are critical breeding goals.

The United States is expected to grow at a CAGR of 5.2% in the organic seed varieties market from 2025 to 2035. The market remains supply-constrained due to limited certified organic breeding capacity. Companies like Johnny’s Selected Seeds and High Mowing Organic Seeds are expanding portfolios for niche crops like leafy greens and cover crops. Demand is stronger in California, Oregon, and the Northeast, where certified organic acreage continues to expand. Constraints include high compliance costs, fragmented certification, and absence of dedicated organic-only breeding programs at the federal level.

Johnny’s Selected Seeds offers a broad selection of certified organic seeds tailored for both home growers and small-scale farms. Its approach focuses on variety trials, region-specific adaptability, and in-house breeding to ensure consistent performance under organic cultivation. The company has prioritized high-germination rates and resistance traits in popular crops such as lettuce, carrots, and peppers. High Mowing Organic Seeds provides a combination of open-pollinated and hybrid varieties, backed by dedicated research facilities that support development of pest-resistant and high-yielding strains without synthetic inputs. Baker Creek Heirloom Seeds specializes in rare and heirloom organic seeds, serving niche growers, market gardeners, and collectors.

Its catalog includes hundreds of unique vegetable varieties sourced globally, with a strong focus on genetic preservation. Vitalis Organic Seeds, a division of Enza Zaden, caters primarily to commercial producers by offering certified organic hybrids suited for large-scale cultivation. Key crops include tomatoes, cucumbers, and leafy greens, all selected for uniformity and disease tolerance. Seed Savers Exchange functions as a nonprofit seed preservation organization distributing organic heirloom seeds through a large grower network. Its efforts ensure seed diversity, protect genetic heritage, and promote long-term resilience within the organic farming ecosystem.

A large-scale organic seed facility with an A+++ energy rating and solar integration was launched to enhance clean processing. Seed producers introduced microplastic-free coatings and biological treatments to meet regulatory and ecological standards.

AI-assisted breeding improved yield consistency and stress tolerance in vegetable and grain crops. Over 100 new USDA-certified organic seed varieties were added across commercial catalogs, supporting diversified organic farming systems globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.6 Billion |

| Crop Type | Vegetable seeds, Grain seeds, Fruit seeds, Herb and flower seeds, and Oilseed and alternative grains |

| Distribution Channel | Direct sales (seed companies to farmers), Retail channels (garden centres, stores), Online sales and e-commerce platforms, Cooperatives and buying clubs, and Wholesale and institutional buyers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Johnny’s Selected Seeds, High Mowing Organic Seeds, Baker Creek Heirloom Seeds, Vitalis Organic Seeds, and Seed Savers Exchange |

The global organic seed varieties market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the organic seed varieties market is projected to reach USD 10.2 billion by 2035.

The organic seed varieties market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in organic seed varieties market are vegetable seeds, _lettuce, _tomato, _spinach, _carrot, _cucumber, _bell pepper, grain seeds, _wheat, _corn, _rice, _barley, _oats, _millet, _quinoa, fruit seeds, _melon, _watermelon, _strawberry, _berry varieties, herb and flower seeds, _basil, _cilantro, _parsley, _sunflower, _zinnia, _marigold, oilseed and alternative grains, _soybean, _flax, _buckwheat, _amaranth and _sesame.

In terms of distribution channel, direct sales (seed companies to farmers) segment to command 36.0% share in the organic seed varieties market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Organic Fruit Powder Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA