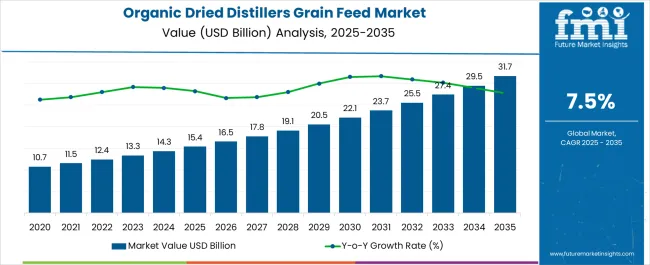

The organic dried distillers grain feed market, valued at USD 15.4 billion in 2025 and projected to reach USD 31.7 billion by 2035, is expanding at a CAGR of 7.5%. From 2020 to 2024, the market advanced from USD 10.7 billion to USD 14.3 billion, reflecting a strong early adoption phase supported by the rising demand for organic livestock feed and the global shift toward chemical-free meat, dairy, and poultry production.

Annual increments such as USD 11.5 billion in 2021, USD 12.4 billion in 2022, USD 13.3 billion in 2023, and USD 14.3 billion in 2024 highlight a consistent upward trajectory, driven by the increasing number of certified organic farms and greater consumer preference for naturally raised animal products. Between 2025 and 2030, the market progresses from USD 15.4 billion to USD 22.1 billion, accounting for nearly 42% of the total projected increase. This stage is supported by expanded adoption across poultry, swine, and ruminant feed segments, alongside advancements in drying technologies and improvements in supply chain efficiency.

From 2031 to 2035, the market advances further from USD 23.7 billion to USD 31.7 billion, contributing about 37% of overall growth. This later phase is fueled by stronger regulations supporting organic certification, global expansion of organic retail channels, and rising disposable incomes driving demand for premium animal-derived food products. Overall, the organic dried distillers grain feed market demonstrates a robust and steady growth path through 2035, driven by consumer health trends, regulatory support, and the continued expansion of organic farming practices worldwide.

| Metric | Value |

|---|---|

| Organic Dried Distillers Grain Feed Market Estimated Value in (2025 E) | USD 15.4 billion |

| Organic Dried Distillers Grain Feed Market Forecast Value in (2035 F) | USD 31.7 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The organic dried distillers grain feed market holds an essential role within the global livestock and animal nutrition industry, representing approximately 16–18% of the broader organic feed ingredients segment due to its high protein, fiber, and energy profile. Within the global dried distillers grain (DDG) sector, the organic variant contributes close to 12–14%, reflecting growing demand for clean-label and GMO-free feed options in dairy, poultry, and swine production.

In the broader sustainable livestock nutrition category, it commands around 10–12%, fueled by the rising shift toward organic-certified meat, milk, and egg production catering to premium consumer markets. The aquaculture feed segment accounts for nearly 7–9%, where organic DDG is being increasingly integrated as a cost-effective plant-based protein alternative to fishmeal. Growth is supported by the expansion of organic livestock farming practices, regulatory encouragement for natural feed inputs, and rising consumer preference for traceable and antibiotic-free animal products.

Feed manufacturers are investing in optimized blending processes, ensuring better digestibility and nutrient retention, which enhances animal health and productivity. Despite challenges such as higher production costs, limited raw material availability, and certification complexities, the market continues to expand, driven by international trade in organic feed inputs, strong demand from Europe and North America, and rising adoption across Asia-Pacific. With innovations in fermentation, drying technology, and supply chain certification, organic dried distillers grain feed is steadily reinforcing its position as a strategic component of the premium organic livestock and aquaculture feed ecosystem.

Increased awareness of organic feed benefits, particularly in enhancing animal health and product quality, has contributed to its expanding adoption across various animal husbandry sectors. The market is benefiting from growing consumer preference for organic meat, dairy, and poultry products, encouraging farmers to transition to organic feed sources.

The use of dried distillers grain as a protein-rich, fiber-dense feed ingredient is being favored for its cost-effectiveness and nutritional value. Expansion of organic farming practices, along with government support for sustainable agriculture, is further strengthening market demand.

Technological advancements in feed processing are improving the nutrient retention and digestibility of these products, making them more appealing to both large-scale commercial operations and smaller organic farms. As the global focus on sustainable food production intensifies, the market is expected to maintain a positive growth trajectory.

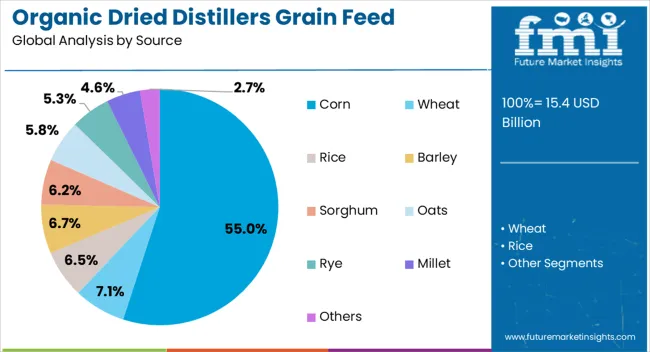

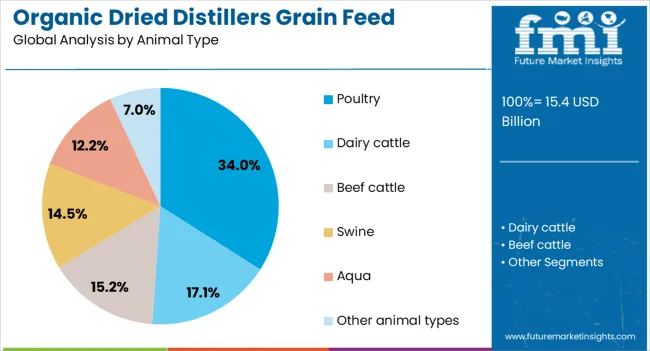

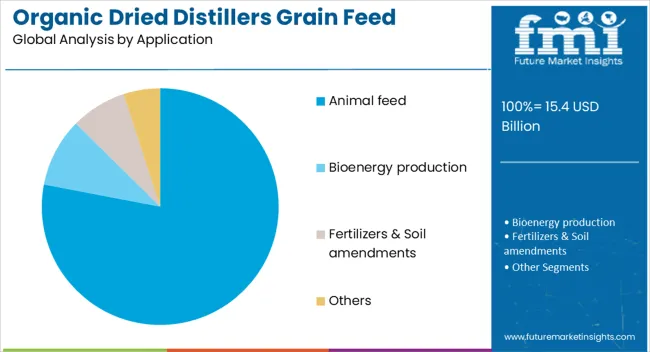

The organic dried distillers grain feed market is segmented by source, animal type, application, distribution channel, and geographic regions. By source, organic dried distillers grain feed market is divided into corn, wheat, rice, barley, sorghum, oats, rye, millet, and others. In terms of animal type, organic dried distillers grain feed market is classified into poultry, dairy cattle, beef cattle, swine, aqua, and other animal types. Based on application, organic dried distillers grain feed market is segmented into animal feed, bioenergy production, fertilizers & soil amendments, and others. By distribution channel, organic dried distillers grain feed market is segmented into offline and online. Regionally, the organic dried distillers grain feed industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The corn source segment is projected to hold 55% of the organic dried distillers grain feed market revenue share in 2025, establishing itself as the leading source type. This dominance has been driven by the abundant availability of corn as a raw material and its superior nutritional profile, which supports balanced diets for various livestock. Corn-based distillers grain offers a rich source of protein, fiber, and essential amino acids, making it suitable for multiple feed formulations.

The segment's growth has been reinforced by the efficiency of corn in the distillation process, yielding consistent quality and higher volumes of dried distillers grain. Widespread cultivation of organic corn in major producing regions has ensured stable supply chains, reducing market volatility. Furthermore, its compatibility with advanced feed processing techniques has enhanced digestibility and nutrient absorption, leading to improved animal performance. These attributes have positioned corn as the preferred choice among feed producers seeking to meet both economic and nutritional requirements in organic livestock production.

The poultry animal type segment is expected to account for 34% of the organic dried distillers grain feed market revenue share in 2025, making it the leading animal type segment. This growth has been supported by the rising global demand for organic poultry products and the efficiency of poultry production systems in converting feed into high-value protein.

Organic dried distillers grain has been increasingly incorporated into poultry diets due to its balanced nutrient content, particularly its protein and energy density, which support healthy growth and egg production. Feed formulations incorporating distillers grain have been shown to enhance feed conversion ratios while maintaining compliance with organic production standards.

The expansion of organic-certified poultry farming operations, combined with consumer willingness to pay premium prices for organic meat and eggs, has reinforced the demand for high-quality feed inputs. Additionally, advancements in feed blending technologies have allowed producers to optimize poultry-specific formulations, driving sustained growth in this segment.

The animal feed application segment is anticipated to capture 78% of the organic dried distillers grain feed market revenue share in 2025, establishing it as the dominant application area. This prominence has been attributed to the central role of dried distillers grain as a cost-effective and nutritionally rich feed ingredient across multiple livestock categories.

The high protein, energy, and fiber content of organic distillers grain makes it an ideal component for balanced feed formulations that meet organic certification requirements. The segment has benefited from its versatility in being included in rations for poultry, cattle, swine, and aquaculture, enabling feed manufacturers to cater to diverse farming needs. As the demand for organic animal products rises globally, feed producers are prioritizing high-quality organic inputs to maintain product integrity and consumer trust. Continued innovation in processing methods to improve nutrient availability and shelf stability is further strengthening the position of animal feed as the leading application in this market.

The organic dried distillers grain feed market is expanding rapidly due to its role in livestock nutrition, aquaculture applications, certification-driven growth, and supply chain improvements. Rising consumer preference for organic-certified animal products ensures steady momentum.

The organic dried distillers grain feed market is gaining prominence as livestock producers integrate it into daily feeding programs for poultry, dairy, and swine. Its high fiber and protein content make it a reliable supplement to reduce reliance on conventional feed grains. Farmers are adopting it for its ability to improve feed efficiency, enhance weight gain, and support organic certification requirements. In dairy production, it has shown positive results in boosting milk yield and quality, while poultry farms value it for its amino acid profile. Broader acceptance is also influenced by rising consumer demand for organic-certified animal products, making organic DDG a competitive feed alternative in premium farming systems.

Aquaculture producers are turning toward organic dried distillers grain feed as a sustainable alternative to expensive fishmeal and soy-based proteins. Its digestibility and nutrient retention are attracting attention for use in organic fish farming, especially in salmon and tilapia production. By providing a cost-effective protein source, organic DDG helps aquaculture operators maintain profitability while meeting organic certification standards. Its lower environmental footprint compared to conventional fishmeal also enhances its value in regulated aquaculture markets. Regional governments promoting organic seafood exports are supporting adoption, further expanding market penetration. This trend strengthens the case for organic DDG as a viable protein replacement in aquafeed formulations.

Certification frameworks play a critical role in shaping demand for organic dried distillers grain feed. Producers and feed mills are increasingly investing in compliance with USDA Organic, EU Organic, and other international certification standards to expand their market presence. These certifications improve product credibility and enable access to premium markets in North America, Europe, and emerging Asia-Pacific regions. By aligning with these global standards, suppliers are securing long-term contracts with livestock and aquaculture operators. The premium price advantage attached to certified organic feed ingredients ensures that demand continues to rise, strengthening confidence in organic DDG as a critical input for certified farming systems.

Despite its potential, the organic dried distillers grain feed market faces supply chain complexities due to limited organic corn and grain availability. Higher production costs associated with certified organic raw materials result in premium pricing, which can limit adoption in cost-sensitive markets. Seasonal variations in grain production also create challenges in consistent availability. Logistics and storage requirements for maintaining organic integrity add further complexity to distribution networks. However, larger players are adopting strategies such as vertical integration, direct farmer sourcing, and investment in regional processing plants to overcome these constraints.

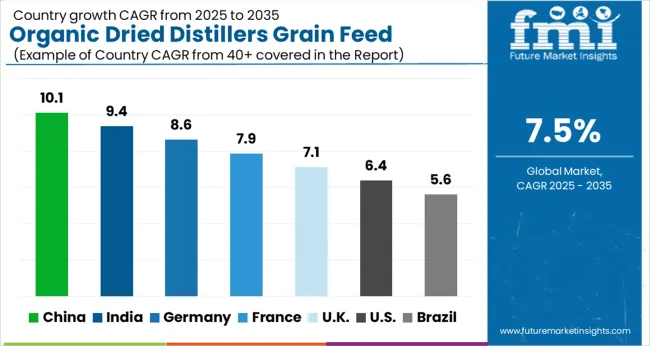

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

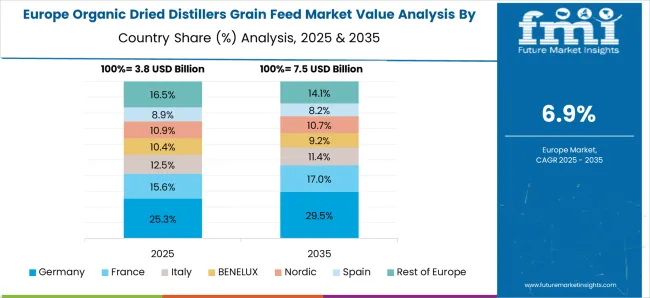

The organic dried distillers grain feed market is projected to expand globally at a CAGR of 7.5% from 2025 to 2035, supported by increasing livestock nutrition demand, higher adoption of organic feed, and strong investments in sustainable animal farming. China leads with a CAGR of 10.1%, fueled by rising meat production, growing dairy sector investments, and government-backed programs encouraging organic feed adoption. India follows at 9.4%, driven by poultry and aquaculture expansion, alongside increasing consumer preference for organically sourced meat and dairy products. France grows at 7.9%, shaped by its strong dairy and ruminant feed sector, where organic formulations are gaining market share. The United Kingdom achieves 7.1%, driven by demand in poultry and sheep farming, while the United States records 6.4%, reflecting steady yet moderate growth, supported by niche organic meat and dairy segments. This performance highlights Asia as the fastest-growing hub, Europe as a regulatory-driven region, and North America as a consistent but mature market for organic dried distillers grain feed.

China’s CAGR for the organic dried distillers grain feed market stood at 8.5% between 2020–2024 and advanced to 10.1% during 2025–2035, showing faster expansion. Early progress was driven by growing livestock demand and gradual acceptance of organic feed in dairy and poultry farms. The significant increase in the next decade reflects government initiatives to promote feed efficiency, investments in organic farming systems, and stronger consumer demand for organic dairy and meat. Expansion of aquaculture also contributed to higher adoption of DDG feed in specialized diets. With China’s rising protein demand, the country remains the global leader in this segment.

India’s CAGR for the organic dried distillers grain feed market was around 7.8% during 2020–2024 and climbed to 9.4% between 2025–2035, highlighting stronger growth momentum. The earlier phase experienced moderate adoption due to cost sensitivity and lack of awareness among smallholder farmers. In the next phase, growth was driven by increasing poultry production, aquaculture expansion, and rising organic dairy initiatives. Government support for organic farming and certification standards also played a role in boosting adoption. Broader participation from cooperatives and private feed companies has further ensured accessibility. India is emerging as a dynamic growth hub for organic DDG feed adoption.

France’s CAGR in the organic dried distillers grain feed market was estimated at 6.4% between 2020–2024 and rose to 7.9% during 2025–2035, showing a steady rise. Earlier progress was moderate as adoption remained limited to dairy farms and certain meat producers. The next few years saw stronger performance due to growing consumer demand for organic food, reinforced EU regulatory standards, and expansion of premium feed products in the market. French dairy cooperatives played a key role in mainstreaming organic DDG feed as part of broader sustainable farming practices. Partnerships between feed manufacturers and regional producers expanded its penetration further.

The CAGR for the UK organic dried distillers grain feed market was 6.0% during 2020–2024 and improved to 7.1% between 2025–2035, reflecting an upward trend. Early progress was modest due to smaller-scale organic livestock production and limited feed integration. The next phase gained momentum as consumer demand for organic beef, dairy, and poultry rose sharply. Investments by feed companies in region-specific blends and wider distribution through cooperatives boosted growth. Stronger policy backing for organic agriculture and farmer training programs also influenced adoption. This shift demonstrates the UK’s consistent move toward premium livestock feed solutions.

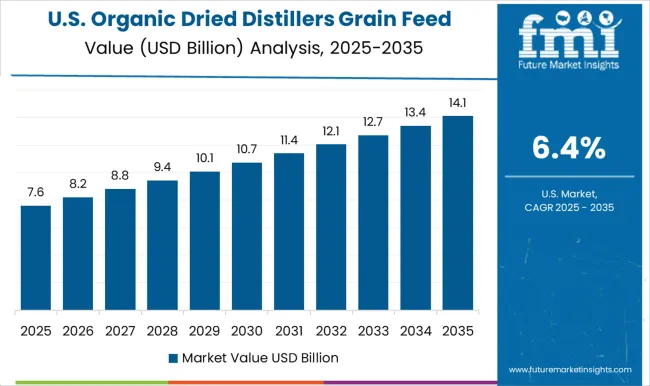

The USA organic dried distillers grain feed market posted a CAGR of 5.5% during 2020–2024 and advanced to 6.4% between 2025–2035, reflecting steady progress. The earlier phase saw restrained growth due to high reliance on conventional DDG feed and slower adoption in mainstream livestock production. The following decade improved as organic dairy and meat demand strengthened, alongside farmer investments in higher-value livestock products. Expansion of certification programs and regional branding supported premium feed adoption. While growth is slower compared to Asia and Europe, the USA retains importance as a stable organic feed market with consistent consumption.

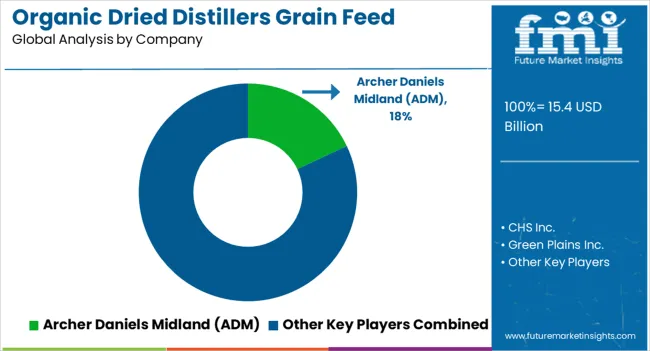

The organic dried distillers grain feed market is highly competitive, shaped by large-scale ethanol producers and agribusiness firms that integrate feed byproducts into diversified operations. Archer Daniels Midland (ADM) remains a key leader, leveraging its vast ethanol production capacity and global feed distribution networks to supply consistent volumes of organic DDG. CHS Inc. emphasizes farmer-owned cooperative strength, channeling DDG feed into livestock markets with strong regional penetration in North America. Green Plains Inc. focuses on efficiency-driven ethanol operations while promoting DDG as a value-added product, increasingly targeting organic livestock producers. CropEnergies AG, as one of Europe’s leading ethanol firms, capitalizes on regulatory frameworks encouraging renewable feed solutions, giving it an edge in EU markets.

Flint Hills Resources, part of Koch Industries, integrates ethanol production with renewable fuel initiatives, reinforcing steady availability of DDG feed to large-scale buyers. Valero Energy Corporation maintains strong ethanol production capacity, distributing DDG feed through its established energy and agribusiness channels. POET and other ethanol producers collectively form a significant supply base, driving competitive intensity by expanding production efficiency and meeting rising organic feed demand. Differentiation in this market is centered on production scale, supply reliability, and regional reach, while strategic moves include co-product innovation, stronger collaborations with feed distributors, and expansion of certification for organic-compliant DDG feed.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.4 Billion |

| Source | Corn, Wheat, Rice, Barley, Sorghum, Oats, Rye, Millet, and Others |

| Animal Type | Poultry, Dairy cattle, Beef cattle, Swine, Aqua, and Other animal types |

| Application | Animal feed, Bioenergy production, Fertilizers & Soil amendments, and Others |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Archer Daniels Midland (ADM), CHS Inc., Green Plains Inc., CropEnergies AG, Flint Hills Resources / Koch related, Valero Energy Corporation, and POET / other ethanol producers |

| Additional Attributes | Dollar sales, share by livestock type, regional demand trends, supply chain costs, export-import flows, certification impacts, competitor strategies, and distribution networks. |

The global organic dried distillers grain feed market is estimated to be valued at USD 15.4 billion in 2025.

The market size for the organic dried distillers grain feed market is projected to reach USD 31.7 billion by 2035.

The organic dried distillers grain feed market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in organic dried distillers grain feed market are corn, wheat, rice, barley, sorghum, oats, rye, millet and others.

In terms of animal type, poultry segment to command 34.0% share in the organic dried distillers grain feed market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Organic Fruit Powder Market Size, Growth, and Forecast for 2025 to 2035

Organic Condiments Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA