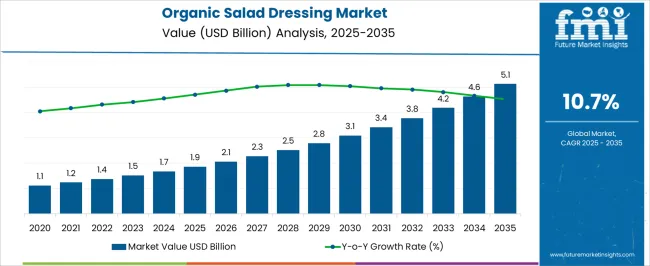

The Organic Salad Dressing Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 5.1 billion by 2035, registering a compound annual growth rate (CAGR) of 10.7% over the forecast period.

The organic salad dressing market is expanding steadily due to rising consumer preference for clean-label, chemical-free, and naturally sourced food products. Demand growth is being driven by increasing awareness of health and wellness, coupled with shifting dietary patterns favoring organic and plant-based ingredients. Market participants are emphasizing product innovation, improved packaging, and sustainable sourcing to strengthen their brand positioning.

The growing penetration of e-commerce and the expansion of organized retail networks are enhancing accessibility to organic food products globally. Regulatory support for organic certification and labeling standards is fostering consumer trust and market transparency.

The future outlook indicates sustained growth as consumers continue to associate organic products with better nutrition, safety, and environmental sustainability Continuous product diversification and flavor innovation are expected to enhance category appeal and support the market’s trajectory toward premiumization, ensuring long-term profitability and competitive differentiation across key distribution channels.

| Metric | Value |

|---|---|

| Organic Salad Dressing Market Estimated Value in (2025 E) | USD 1.9 billion |

| Organic Salad Dressing Market Forecast Value in (2035 F) | USD 5.1 billion |

| Forecast CAGR (2025 to 2035) | 10.7% |

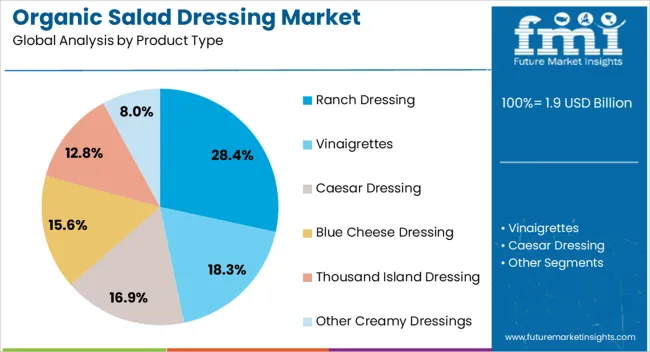

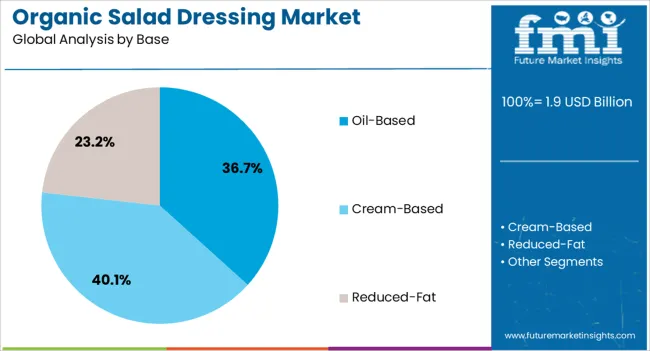

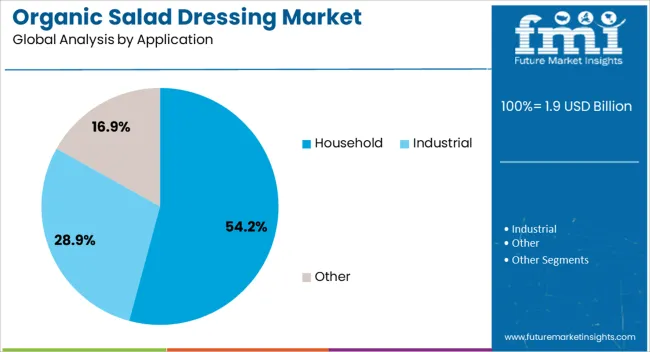

The market is segmented by Product Type, Base, Application, and Distribution Channel and region. By Product Type, the market is divided into Ranch Dressing, Vinaigrettes, Caesar Dressing, Blue Cheese Dressing, Thousand Island Dressing, and Other Creamy Dressings. In terms of Base, the market is classified into Oil-Based, Cream-Based, and Reduced-Fat. Based on Application, the market is segmented into Household, Industrial, and Other. By Distribution Channel, the market is divided into Hypermarkets & Supermarkets, Convenience Stores, Specialty Retailers, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ranch dressing segment, accounting for 28.40% of the product type category, has emerged as the leading product due to its versatility, creamy texture, and widespread appeal across different cuisines. Its organic variants are gaining strong traction among health-conscious consumers seeking indulgent yet natural flavor options.

Manufacturers are focusing on developing formulations free from artificial stabilizers and preservatives while maintaining authentic taste and consistency. Retail visibility and marketing campaigns highlighting organic certifications are reinforcing brand loyalty.

The segment’s leadership is supported by continued innovation in flavor customization and the introduction of low-fat and dairy-free alternatives As consumer awareness regarding ingredient transparency increases, ranch dressing’s adaptability and consistent demand in both retail and foodservice channels are expected to sustain its leading market position.

The oil-based segment, holding 36.70% of the base category, has maintained dominance due to its clean-label profile, extended shelf life, and compatibility with diverse flavor blends. It is preferred by manufacturers for its stability and natural emulsifying properties that align with organic standards.

Consumer preference for lighter dressings made with olive, avocado, or sunflower oils is reinforcing market demand. Technological advancements in cold-press extraction and organic oil refining have improved product quality and consistency.

The segment benefits from consumer perception of oil-based dressings as healthier options compared to creamy counterparts Continued innovation in infused oils and herb-based formulations is expected to sustain market leadership and broaden adoption across both retail and foodservice channels.

The household segment, representing 54.20% of the application category, is leading the market due to growing adoption of home-based healthy eating habits and increasing consumption of fresh salads and organic meals. Convenience, affordability, and availability through supermarkets and online retail platforms are enhancing household adoption rates.

Manufacturers are targeting family-oriented product lines with multi-serving pack sizes and eco-friendly packaging. Consumer preference for natural ingredients and transparency in labeling is reinforcing trust in certified organic salad dressing brands.

Promotional activities and recipe-based marketing have further driven product usage in daily meal preparations With ongoing lifestyle shifts toward health-conscious home cooking, the household segment is expected to remain the dominant consumer base, contributing significantly to sustained market expansion.

Market Penetration of Organic Salad Dressing in Retail and Foodservice Sectors

Healthy eating out has become a notable trend among the younger generation. Even out at parties or social gatherings, fitness enthusiasts are still giving precedence to their diets. Thus, salads are becoming more prominent on the menus of restaurants and other food service businesses.

The determination of eateries to make salads more appealing and tasty is also raising the profile of salads on menus. Even people who are not that entrenched in fitness culture are being enticed by salads. Thus, the organic salad dressing market is also benefitting.

Analysis of Flavor Innovations in the Organic Salad Dressing Market

The dynamic nature of the industry necessitates innovation in flavoring. To get ahead of competitors, manufacturers of salad dressing are experimenting with new flavors to give a different taste to the product.

Certain innovative flavors that have come the way of consumers recently include sun-dried tomatoes, black pepper, balsamic, and more. These innovations in flavor keep the wheels of the industry grinding.

Regional Variations in Demand for Organic Salad Dressing based on Culinary Preferences

Methods of salad preparations vary from region to region. As such, the dressing used for salads changes on a geographical basis too. For example, regions near the seas, such as the Mediterranean, prefer organic ingredients grown around the region that get plenty of sun.

Meanwhile, places like India and China heavily favor local ingredients, with fruit-based salad dressings widely popular. Thus, stakeholders are adopting different strategies in different areas of the world.

The market size of organic salad dressing in 2020 was tipped to be USD 1.1 million. The organic salad dressing market advanced at a CAGR of 11.1% between 2020 and 2025, reaching USD 1,511 million in 2025.

The need for healthy eating was highlighted during the pandemic. As a result, salads became the go-to option for a significant number of the global population. The unavailability of certain ingredients during the period also saw consumers turn towards the simplicity of diets. Thus, the salad dressing sector grew along with the changed consumer perception of salads.

The sector is slated to advance at a slightly slower rate in the forecast period as compared to the historical period. However, the opportunities for suppliers are still set to be immense over the coming decade.

Demand for organic salad dressing in the food industry is one of the primary factors for the sector’s predicted growth over the coming years. An increase in the number of restaurants, cafes, and other eating places is set to benefit the industry. Online ordering is another phenomenon that is helping the sector to prosper.

Stakeholders are making efforts to solidify in the minds of consumers the benefits of salad dressing that is organic. However, the industry still faces competition from conventional salad dressings, which eats into the demand for the product.

Salads have traditionally been seen as a dish of the Western world. However, with the Westernization of Asian countries like India and Japan, salads are penetrating further into previously untapped regions of the world. The healthy trends in Europe are benefiting the organic salad dressing market in the region.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 4.8% |

| United Kingdom | 10.4% |

| China | 5.9% |

| India | 9.8% |

| Germany | 11.5% |

In the United States, the organic salad dressing market is anticipated to rise at a CAGR of 4.8%. Demand for the dressing is rising as a result of accelerating gym and fitness culture.

With problems like obesity and chronic diseases on the rise in the country, there is a pronounced need for healthy food. Thus, salads are becoming more common in the country, which is, in turn, benefitting the demand for organic salad dressing in the United States.

The United Kingdom organic salad dressing market is predicted to register a CAGR of 10.4% over the next ten years. In the United Kingdom, consumers are desirous of more variety in their food. Trying out new cuisines has become a notable trend among the population.

Salads are also getting varied in the nation to a greater degree. Healthy ingredients from all over the world are making their way to kitchens in the nation and making refreshing salads. This openness to varied salad ingredients is also reflected in salad dressing in the United Kingdom.

Germany’s organic salad dressing market is expected to rise at a CAGR of 11.5% over the estimated period. In Germany, premium restaurants are cropping up at a rapid pace. The already rich culinary history of the country is being enriched by the flowering of luxurious eating places.

The pricey nature of these places is becoming less of a deterrent as disposable income increases among the younger generation. These places often provide food sourced from all over the world. For salads, these places ensure only top-quality dressing is provided. Thus, premium organic dressings are getting a boost in the region.

The section below sheds some light on key segments. Vinaigrettes are the top product types in the industry. The dressings are mainly distributed through supermarkets.

| Segment | Vinaigrettes (Product Type) |

|---|---|

| Value Share (2025) | 34% |

The production process of vinaigrettes is simple. Thus, it has earned admirers from consumers as well as organic salad dressing producers. Homemade vinaigrettes are quite common as a result.

The ability of vinaigrettes to complement not only salads but other delicacies is also appreciated. Pasta is just one dish where the use of vinaigrettes is flourishing. Thus, the multi-functionality of the product is helping it make waves.

| Segment | Supermarkets and Hypermarkets (Distribution Channel) |

|---|---|

| Value Share (2025) | 31% |

Supermarkets and hypermarkets allow end users to buy all the ingredients for a salad in one place. Thus, the convenience of these stores is cherished by consumers. The variety on the shelves of super and hypermarkets also endears this distribution channel to consumers.

A rising distribution channel, however, is the online one. Online channels not only increase the convenience of consumers but also the variety on display is even broader. Thus, online play has become a prominent part of industry players’ strategies.

Players in the organic salad dressing market are looking to integrate new ingredients to freshen up their products and stand out from the competition. Stakeholders are also trying out appealing packaging to increase the scope of the sector.

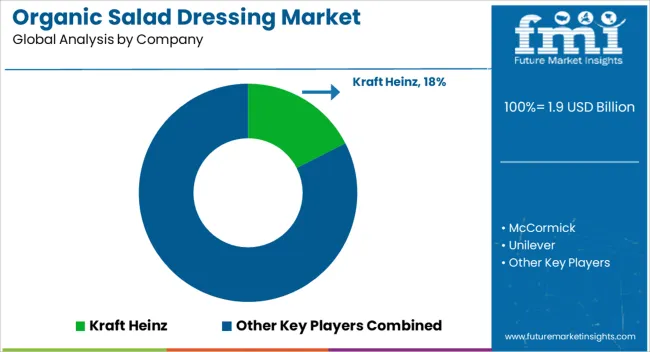

One of the prominent companies in the industry, Kraft Heinz, is adopting acquisition strategies to boost the scope of the ingredients they get to play with. McCormick, on the other hand, aims to increase its industry share by offering their renowned Italian dressings.

Several players are focusing on using functional ingredients like prebiotics and antioxidants in their salad dressings to make them attractive to consumers. Players are also looking to adopt sustainable sourcing practices to woo eco-conscious customers and reduce environmental impact.

Companies are also using online platforms to reach potential customers globally. Similarly, strategies like collaborations, mergers, facility expansions, and alliances are becoming prevalent as players look to expand their footprint.

Industry Updates

Based on the product type, the sector is divided into ranch dressing, vinaigrettes, caesar dressing, blue cheese dressing, thousand island dressing, and other creamy dressings.

Based on the base, the organic salad dressing market is divided into cream-based, oil-based, and reduced-fat.

Based on the application, the industry is divided into household, industrial, and other.

Based on the distribution channel, the organic salad dressing market is divided into hypermarkets & supermarkets, convenience stores, specialty retailers, and others.

Industry analysis has been carried out in key nations of North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

The global organic salad dressing market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the organic salad dressing market is projected to reach USD 5.1 billion by 2035.

The organic salad dressing market is expected to grow at a 10.7% CAGR between 2025 and 2035.

The key product types in organic salad dressing market are ranch dressing, vinaigrettes, caesar dressing, blue cheese dressing, thousand island dressing and other creamy dressings.

In terms of base, oil-based segment to command 36.7% share in the organic salad dressing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Organic Fruit Powder Market Size, Growth, and Forecast for 2025 to 2035

Organic Condiments Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA