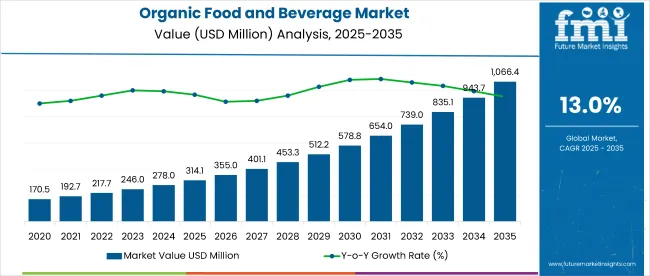

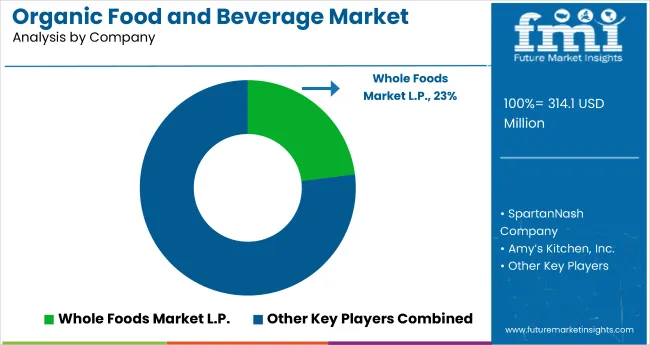

The global organic food and beverage market is projected to grow from USD 314.1 million in 2025 to USD 1,066.4 million by 2035, registering a CAGR of 13%. The market expansion is being driven by rising health awareness, clean-label trends, and growing concerns over synthetic additives in food.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 314.1 million |

| Projected Market Value (2035F) | USD 1,066.4 million |

| Value-based CAGR (2025 to 2035) | 13% |

Consumers are increasingly shifting toward chemical-free, non-GMO, and sustainably produced food and beverage options. Innovations in organic product formulations, eco-friendly packaging, and enhanced e-commerce access across urban and semi-urban regions further accelerate the demand.

The market holds a 100% share within the certified organic products segment, forming its core. It contributes 28% to the natural and clean-label products market, reflecting consumer preference for transparency and health. Within the broader functional food and beverage market, it accounts for nearly 9%, supported by rising demand for nutrient-rich, additive-free items.

In the health and wellness market, organic products contribute around 4%, driven by lifestyle shifts. However, in the expansive global food and beverage market, the organic segment holds a modest share of less than 0.2%, highlighting strong growth potential ahead.

Government regulations impacting the market focus on organic certification, food safety, and sustainable agriculture. Standards such as the National Programme for Organic Production (NPOP), USDA Organic Certification, and EU Organic Regulations set strict guidelines for production, processing, labeling, and distribution of organic food.

In India, bodies like APEDA oversee organic certification, ensuring chemical-free practices and traceability. These regulatory frameworks drive market credibility, reinforce consumer trust, and promote broader adoption of organic food and beverages.

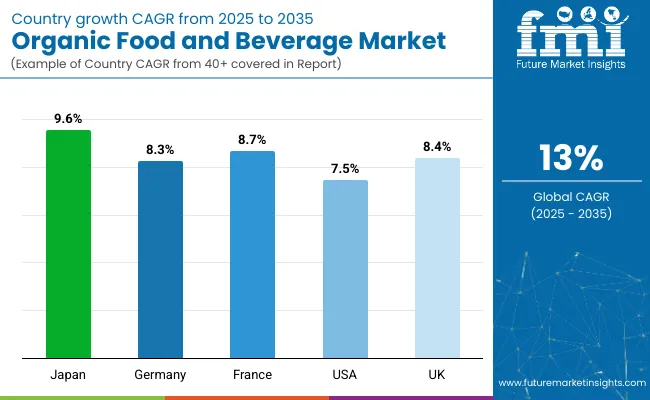

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 9.6% from 2025 to 2035. Unprocessed will lead the process segment with a 58% share, while fruits and vegetables will dominate the product type segment with a 43.6% share. The USA and Germany markets are expected to grow steadily at CAGRs of 7.5% and 8.3%, respectively. The UK and France will also show solid growth with CAGRs of 8.4% and 8.7%, respectively.

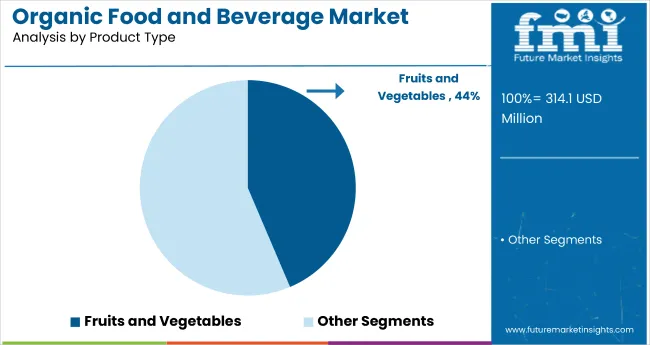

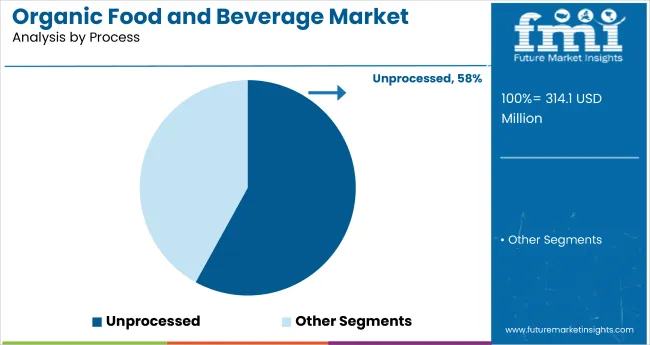

The market is segmented by product type, process, distribution channel, and region. By product type, the market includes fruits and vegetables, meat, fish, & poultry, dairy products, frozen & processed foods, non-dairy beverages, coffee & tea, beer & wine, and other organic food and beverages. Based on process, the market is bifurcated into processed and unprocessed.

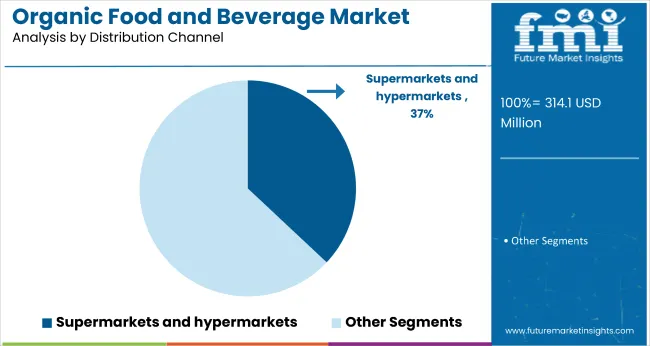

By distribution channel, the market is segmented into supermarket/hypermarket, specialty stores, convenience stores, online sales channel, and others (farmers’ markets, cooperative stores, health food cafes, direct-to-consumer subscriptions). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

Fruits and vegetables are projected to dominate the product type segment, capturing 43.6% of the market share by 2025. These products are widely preferred due to their freshness, nutritional value, and absence of chemical residues.

Unprocessed is projected to capture 58% of the market share in 2025, driven by growing consumer preference for natural, minimally altered products that retain their nutritional value and freshness.

Supermarkets/hypermarkets are expected to lead the distribution channel segment in 2025, capturing 37.4% of the global market share due to wide product availability, consumer trust, and convenient one-stop shopping experiences.

The global organic food and beverage market is experiencing robust growth, fueled by rising consumer awareness regarding health, sustainability, and food safety. Organic products are increasingly favored for being free from synthetic chemicals, GMOs, and artificial additives.

Recent Trends in the Organic Food and Beverage Market

Challenges in the Organic Food and Beverage Market

Japan momentum is driven by high-tech organic farming, government-certified labeling, and integration of smart agriculture for traceability and food purity. Germany and France maintain consistent demand driven by EU organic farming policies and sustainability subsidies under the Farm to Fork strategy. In contrast, developed economies such as the USA (7.5% CAGR), UK (8.4%), and Japan (9.6%) are expected to expand at a steady 0.58-0.74x of the global growth rate.

Japan shows the strongest growth in the market, driven by its aging population, demand for traceable clean-label products, and advancements in sustainable agriculture. France follows with robust demand across dairy, bakery, and wine, supported by national health campaigns and farm-to-table models.

The UK is expanding steadily, with increasing preference for organic ready meals, baby food, and convenience products. Germany’s market is shaped by policy-driven shifts, strong retail infrastructure, and private label penetration. The United States, while growing more slowly, remains a high-value market with strong demand for plant-based, gluten-free, and USDA-certified organic offerings.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan organic food and beverage market is growing at a CAGR of 9.6% from 2025 to 2035. The market expansion is fueled by an aging population, rising demand for food purity, and innovations in sustainable agriculture.

The Germany organic food and beverage revenue is growing at a CAGR of 8.3% during the forecast period, led by policy-backed consumer shifts and strong retail infrastructure. EU funding for organic agriculture, strict food safety laws, and demand for environmentally friendly diets are major growth factors.

The French organic food and beverage market is projected to grow at an 8.7% CAGR, driven by government-backed health campaigns and consumer preference for local organic products. Demand is concentrated in dairy, bakery, and wine categories.

The organic food and beverage market in USA is projected to grow at a CAGR of 7.5% from 2025 to 2035, 0.58x of the global growth rate. Demand is driven by health-conscious millennials, USDA organic programs, and retail expansion via both supermarkets and online platforms.

The UK organic food and beverage revenue is projected to grow at a CAGR of 8.4% from 2025 to 2035, reaching 0.65x the global pace. Growth is supported by post-pandemic wellness trends, growing demand for organic baby food, and environmental advocacy.

The global market is moderately consolidated, with prominent players such as Whole Foods Market L.P., SpartanNash Company, Amy’s Kitchen, Inc., Organic Valley, and Conagra Brands, Inc. shaping the global landscape. These companies offer a wide range of certified organic products, focusing on sustainability, transparency, and nutritional value. Whole Foods Market L.P. leads in retail distribution, while Amy’s Kitchen, Inc. is recognized for its organic ready-to-eat meals.

Organic Valley specializes in dairy products sourced from cooperative farms, and Conagra Brands, Inc. emphasizes clean-label innovation. Nestlé and General Mills Inc. contribute through extensive portfolios and global reach, while Eden Foods, Dole Food Company, Inc., and Dairy Farmers of America, Inc. focus on specialized segments such as produce, dairy, and snacks. SunOpta drives growth with its expertise in plant-based beverages and ingredients.

Recent Organic Food and Beverage Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 314.1 million |

| Projected Market Size (2035) | USD 1,066.4 million |

| CAGR (2025 to 2035) | 13% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value/Volume in metric tons |

| Product Types Analyzed | Fruits & Vegetables, Meat, Fish, & Poultry, Dairy Products, Frozen & Processed Foods, Non-Dairy Beverages, Coffee & Tea, Beer & Wine, and Other Organic Food and Beverages |

| Process Types Analyzed | Processed and Unprocessed |

| Distribution Channels Analyzed | Supermarket/Hypermarket, Specialty Stores, Convenience Stores, Online Sales Channel, and Others (Farmers’ Markets, Cooperative Stores, Health Food Cafes, Direct-to-Consumer Subscriptions) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Whole Foods Market L.P., SpartanNash Company, Amy’s Kitchen, Inc., Organic Valley, Conagra Brands, Inc., Nestlé, Eden Foods, SunOpta, Dole Food Company, Inc., Dairy Farmers of America, Inc., and General Mills Inc. |

| Additional Attributes | Share by product type and channel, regional growth trends, policy impact, clean-label influence, certification frameworks, competitive benchmarking |

The market is valued at USD 314.1 million in 2025.

The market is forecasted to reach USD 1,066.4 million by 2035, reflecting a CAGR of 13%.

Unprocessed will lead the process segment, accounting for 58% of the global market share in 2025.

Fruits and vegetables will dominate the product type segment with a 43.6% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 9.6% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Organic Fruit Powder Market Size, Growth, and Forecast for 2025 to 2035

Organic Condiments Market Size, Growth, and Forecast for 2025 to 2035

Organic Tea Market - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA