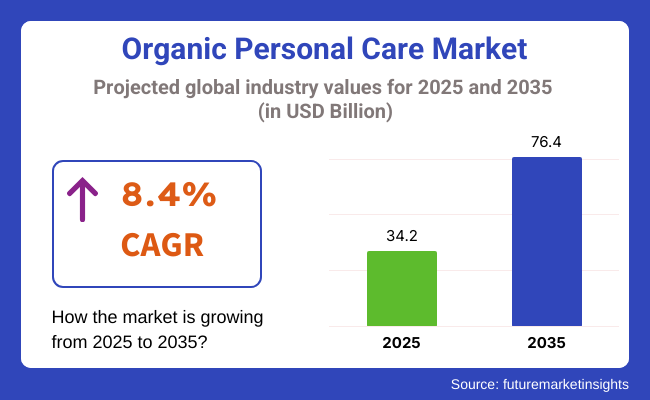

The organic personal care market size was USD 34.2 billion in 2025 and was expected to grow at a CAGR of 8.4% over the 2025 to 2035 forecast period. The global valuation of the industry is expected to reach USD 76.4 billion by 2035.

A key driver of growth is growing consumer demand for chemical-free, plant-based, and green beauty and hygiene products, which are in line with overall sustainability trends.

The market is in transition as consumers increasingly get aware about the adverse health and environmental effects of synthetic ingredients. Clean labeling, ingredient clarity, and brand sustainability credentials are affecting purchasing decisions. Significant innovation in product development and packaging has induced new players and competition in developed markets such as North America and Europe.

Advances in extraction technology and botanical formulation have made organic personal care products more effective and appealing, alleviating efficacy concerns over traditional options for consumers. These innovations enable brands to compete in performance without sacrificing clean ingredient profiles, expanding the appeal of organic products to more people.

Increasing disposable incomes in emerging economies, particularly the Asia-Pacific and Latin American economies, are also accelerating sales penetration. Domestic brands in the markets are using domestic organic materials and domestic remedies more and more to win local and foreign consumers, furthering the impetus for industry expansion.

Heightened manufacturing costs and consumer price sensitivity hamper the industry. Demand for third-party certification and the regulatory landscape across much of the world also hinder scalability. Despite such challenges, healthy demand fundamentals and technological improvements will likely fuel stable expansion throughout 2035.

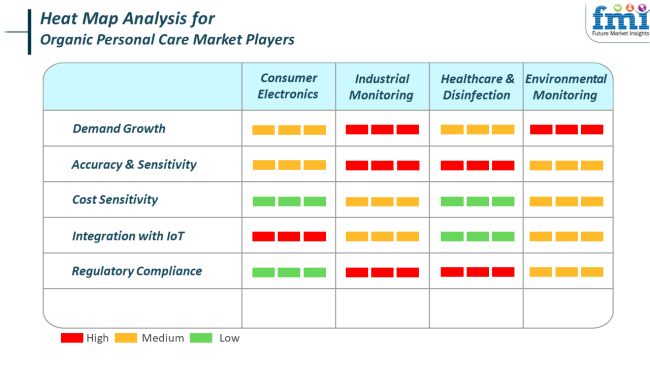

The intersection of sustainability, technology, and consumer awareness is shaping end-use trends. Healthcare & Disinfection and Environmental Monitoring segments show elevated demand growth and regulatory scrutiny due to safety and environmental impact concerns.

These sectors emphasize high accuracy, natural ingredients, and antimicrobial performance, reinforcing the need for stringent quality standards.

Industrial Monitoring and Environmental Monitoring show very high demand growth as industries increasingly adopt green chemistry and non-toxic materials in compliance with global sustainability frameworks. Cost remains a critical factor in these segments, especially when organic components are involved, necessitating efficient production and supply chain optimization.

Consumer Electronics, while less traditional as a direct end-use segment, reflects a growing overlap with personal care devices such as organic facial cleansing brushes and smart hygiene gadgets.

The integration of organic elements in skin-contact materials and demand for hypoallergenic properties further accentuates the focus on safety and skin-friendliness, influencing purchasing decisions across product types.

The industry faces distinct risks rooted in cost structures and supply chain complexities. The procurement of certified organic ingredients often involves higher costs due to limited agricultural output, seasonality, and the labor-intensive nature of cultivation. These factors can lead to pricing volatility and profit margin pressures, particularly for small and medium enterprises.

Another significant risk lies in regulatory inconsistencies across regions. While consumer demand for organic certification is increasing, varying global standards and labeling requirements complicate international expansion. Brands must navigate differing definitions of “organic,” risking non-compliance or consumer distrust if transparency is not rigorously maintained.

Saturation and greenwashing pose reputational threats. As the sector becomes increasingly competitive, the emergence of misleading organic claims undermines consumer confidence and can prompt stricter regulations. Brands that fail to invest in authentic, verifiable product development may struggle to sustain trust, which is central to long-term customer loyalty in this value-driven industry.

From 2020 to 2024, there has been tremendous growth in the industry due to an increasing awareness among consumers about the advantages of products derived from nature and a sense of direction towards sustainable, responsible products.

Customers became more selective in their quest for products that were free from artificial chemicals, parabens, and synthetic fragrances. Throughout these years, credentials like COSMOS and Ecocert rose to fame among consumers, allowing them to rest assured about the authenticity and purity behind organic claims. Cruelty-free and vegan products also reached a massive fever pitch, reflective of broader cultural shifts toward the protection of animals and green mindsets.

Until 2025 to 2035, key trends will form the basis of growth in the industry. Individualization will be the game changer, and consumers will ask for products responding to their exact skin type, issues, and preferences. The advances in biotechnology will create the direction towards innovation of further active and environmentally friendly ingredients, reinforcing the attractiveness of organic personal care products.

The employment of reusable and biodegradable packaging technologies will be the solution to pollution and the generation of waste. Additionally, the use of digital technologies such as augmented reality and artificial intelligence will assist consumers in making more logical purchase decisions and getting a better shopping experience.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing need for natural, chemical-free goods | Increasing demand for personalized, sustainable, tech-savvy products |

| Development of vegan, cruelty-free, certified organic products | The emergence of biotech-led formulations and eco-friendly packaging solutions |

| Limited application of technology in produc t development and marketing | The ubiquity of the application of AI, AR, and analytics for customized experiences |

| Focus on sustainable procurement and zero-waste packing | Increased adoption of circular economy principles and zero-waste initiatives |

| Growth of indie players and reformulation by majors | Consolidation around technology-led, sustainable innovation leaders |

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.6% |

| UK | 9.2% |

| France | 8.8% |

| Germany | 8.5% |

| Italy | 8.2% |

| South Korea | 9.7% |

| Japan | 8.6% |

| China | 10.2% |

| Australia-NZ | 9.0% |

The USA is anticipated to grow at 10.6% CAGR over the forecast period. Firm consumer demand for chemical-free and environmentally friendly products has strongly driven demand for these natural personal care products. Rising awareness of ingredient transparency, along with the trend in clean beauty, continues to drive traditional as well as indie brands to restage products using certified organic ingredients.

Retailers are stretching organic product offerings because consumers increasingly look for cruelty-free, non-toxic products. Premiumization due to wealthy customers and millennials will further boost the adoption of products.

The USA regulatory ecosystem, though not as severe as the EU, is feeling pressure for clean labeling, compelling innovation and convergence toward organic certification. E-commerce channels are becoming the primary distribution hubs, especially for niche players focusing on skincare, haircare, and baby care products.

With growing R&D expenditure, firms are introducing premium organic solutions based on botanical activities. Steady disposable income and growing consumer support for eco-friendly lifestyles position the country as a leader in the segment.

The UK is expected to grow at 9.2% CAGR during the study period. Consumers in the UK are demonstrating a noticeable shift toward sustainable, ethical, and organic options, largely influenced by environmental concerns and regulatory trends.

The industry is influenced by increasingly young, well-informed, digitally engaged, and more open-to-spend consumers who are willing to spend on health-conscious haircare and skincare regimens. The increased demand for transparency in the sourcing and formulation process is causing companies to adopt organic certification norms and highlight traceability.

The organic beauty category is being supported by a strong retail presence, with supermarket chains and pharmacies allocating shelf space to natural and organic brands. Additionally, the nation's focus on minimizing carbon footprints and plastic usage goes hand-in-hand with the eco-packaging efforts of organic personal care brands. Online shopping continues to pick up as a mode of choice, with customized organic products and subscription-based delivery models. Upstart brands are using social media to generate awareness and loyalty.

France will expand at 8.8% CAGR throughout the study. France has a rich heritage in luxury skincare and beauty, which is now being complemented by a swift shift toward organic products. Demand for high-quality organic personal care products is fueled by a discerning consumer base that places importance on efficacy, heritage, and sustainability.

As consumers become more critical of ingredients and ask for eco-certifications like COSMOS and ECOCERT, organic products are making inroads in pharmacies and beauty shops. French beauty companies are answering this call with innovation in botanical ingredients, capitalizing on the country's rich flora and traditional herbal practices.

National brands are growing product lines with clean, minimalist formulations and eco-friendly packaging, targeting customers who value authenticity and a green ethos. Growing awareness of the health effects of synthetic chemicals has also increased demand for organic skincare and haircare products.

While traditional brands reformulate to align with clean beauty requirements, upstarts continue to challenge the industry with focused, purposeful offerings. The population of urbanized cities such as Paris and Lyon has demonstrated a high affinity for organic personal care products, making France an actively developing region.

Germany will expand at 8.5% CAGR for the duration of this study. Germany has set the trend for the organic personal care market with a solidly established culture of eco-awareness. Demand for natural products is encouraged by a robust regulatory framework that focuses on clean labeling and safe ingredients.

Organic skincare and hair care products are well-accepted and incorporated into daily regimens across middle-income and health-aware segments. There is a mature consumer awareness and high trust in certification labels. German consumers prioritize products that align with holistic health and sustainability, and the visibility of established organic brands substantiates trust in the segment.

Retail channels like bio-supermarkets, health food stores, and online websites have played a key role in product penetration. Innovation is an essential driver, with brands developing dermatologist-tested organic lines that are appropriate for sensitive skin types.

As the world becomes increasingly concerned about synthetic additives, Germany's dedication to green chemistry and biodegradable packaging will continue to promote the use of organic personal care products among different consumer segments.

Italy is anticipated to expand at 8.2% CAGR over the study period. Italy is experiencing a high demand for organic personal care, especially in urban regions where sustainability and health are becoming lifestyle essentials. Italy's beauty culture, which has been historically based on aesthetics and wellness, is now adopting a more natural and organic lifestyle.

Skincare, bath products, and essential oils are among the top categories that are picking up pace because of heightened awareness regarding the ill effects of synthetic chemicals. There is an increasing number of homegrown brands that specialize in natural ingredients from Mediterranean botanicals.

These brands tend to combine traditional herbal remedies with contemporary skincare science to cater to a wide consumer base. Although large-scale adoption is ongoing, the demand is gradually growing across all age groups, particularly among women between the ages of 25-45.

Compliance and certifications are emerging as choice-driving factors in selecting products. The hospitality and tourism industries are also playing a part by introducing organic personal care products in spas and wellness facilities, adding brand visibility and customer interaction.

South Korea is likely to grow at 9.7% CAGR over the study period. Popular worldwide for trend-setting beauty, South Korea's personal care industry is changing at a fast pace to meet the increasing demand for clean and organic options. Consumers, especially younger ones, are well-educated and sensitive to ingredient listings, resulting in a dramatic reduction in the application of parabens, sulfates, and other harsh chemicals.

Organic skin care, particularly facial care and serums, is becoming the choice of consumers looking for minimalist yet effective solutions. The government's investment in sustainable R&D and green chemistry has spurred innovation among domestic beauty companies, which are now going global with organic product lines. South Korean companies are tapping into indigenous botanicals such as bamboo, ginseng, and green tea to create products that are gentle but powerful.

The merging of organic personal care with cutting-edge technology like skin analysis apps and intelligent delivery systems improves product relevance in the digital-first market. Retailers are increasingly working with clean beauty platforms, presenting curated organic selections. Cultural focus on appearance, health, and nature-based ingredients continues to influence consumer behavior, making South Korea a high-growth region.

Japan will grow at 8.6% CAGR over the study period. A preference for simplicity and tradition characterizes Japan, and hence, it is a perfect ground for the growth of organic personal care products. Safety, quality, and long-term skin benefits are the concerns of consumers, leading to growing demand for organic products that focus on purity and non-irritating ingredients.

Aesthetic minimalism and fondness for function drive the embracing of organic skincare and haircare products. Organic products from Japanese companies appear to be a reflection of culture, combining traditions such as rice bran, camellia oil, and seaweed with technology.

The aging population in Japan is driving anti-aging and sensitive-skin solutions, areas where organic plays well. Distribution via department stores, specialist beauty stores, and expanding e-commerce platforms add to product accessibility. Although Japan, as a whole, remains conservative, altering consumer behavior and awareness initiatives begin to turn attitudes toward sustainability. Wellness trends and preventive skincare have led to growth in the organic segment.

China is estimated to increase at 10.2% CAGR during the period under consideration. Increasing middle-class populations in China, which are now burgeoning and moving with more disposable incomes, have turned the customer aspirations, which makes room for natural organic care products.

Intense demand for a cleaner and healthier alternative has gathered strength owing to issues about pollution, derma concerns, and exposure to chemicals. Urban consumers in Tier 1 and Tier 2 cities are leading demand for organic haircare, baby care, and skincare products.

Government moves to ban harsh chemicals and boost clean beauty further boosted the organic trend. Local players are moving into the space organically, while global players are increasing footprints to address growing demand.

Livestreaming, social commerce, and AI-based skin analysis are making brands more visible and educating consumers. The e-commerce industry is playing a central role in the distribution of organic personal care products, with Tmall and JD.com providing exclusive collections of natural products.

The Australia-New Zealand region is forecast to grow at 9.0% CAGR during the study period. Strong consumer preference for plant-based, animal-testing-free, and eco-friendly personal care has provided good conditions for the organic segment within Australia and New Zealand. The rich biodiversity in both countries provides good conditions for local sourcing of native Indigenous ingredients like Kakadu plum, manuka honey, and tea tree oil, which are commonly found in organic products.

Consumers are strongly interested in wellness and sustainability trends, which is reflected in a growing demand for clean, non-toxic personal care products. There is an overall regulatory environment that accommodates transparency and organic certification, which are significant in terms of positioning products and building consumer confidence.

The selling environment, especially in organic specialty stores and pharmacies, increasingly offers a good platform for selling clean beauty products. E-commerce and social commerce are enabling new entrants and homegrown brands to enter the industry.

Rising environmental awareness and demand for low-carbon packaging solutions further support the outlook. As innovation in organic science accelerates and consumer preferences evolve, the region is expected to remain a stronghold for organic personal care through the forecast period.

Skincare is the dominant category, expected to retain a 50-52% share by 2035. Consumers are increasingly drawn to organic facial cleansers, moisturizers, and anti-aging serums formulated without parabens or synthetic fragrances. Major brands like Estée Lauder's Origins and Tata Harper lead innovation with plant-based activities and eco-friendly packaging.

Rising concerns over skin sensitivity and environmental damage are also propelling demand. The segment's growth is reinforced by premiumization trends and regulatory clarity through certifications like COSMOS and USDA Organic, making it the cornerstone of organic personal care portfolios globally.

Oral care, though smaller in scale, is gaining traction and is expected to account for 8–10% of the share by 2035. This growth is driven by rising consumer distrust of fluoride and artificial ingredients, particularly in children’s products.

Brands like Tom’s of Maine and David Natural Toothpaste are building loyal followings through ingredient transparency and sustainable packaging. Innovations such as chewable toothpaste tablets and probiotic mouthwashes are differentiating players in this space. Despite a slower adoption rate than skin or hair care, oral care continues to attract health-conscious consumers, especially through eCommerce and DTC models targeting niche hygiene needs.

eCommerce is the most rapidly expanding channel, forecasted to exceed 45% of overall sales by 2035. The channel is advantaged by consumers' desire for convenience, availability of reviews, and extensive product range. Direct-to-consumer platforms have helped brands such as Cocokind and Wildling grow, relying on influencer marketing and clean beauty communities. Online platforms such as Amazon and clean retailers like Credo Beauty facilitate the discovery of smaller organic brands.

With AI-enabled suggestions, subscription models, and quick delivery solutions, eCommerce continues to upend conventional retail. Its expansion is particularly robust in urban and Gen Z and millennial populations that value transparency and ethical sourcing. Supermarkets and hypermarkets are still prominent offline channels, forecasted to retain approximately 25-30% of the marketplace by 2035.

Buyers value being able to touch and test products in real life and enjoy in-store discounts and bundled deals. Store operators such as Whole Foods, Carrefour, and Target are building out organic personal care shelf space to satisfy increasing demand, particularly for certified and sustainable brands.

While eCommerce is developing fast, stores continue to perform a crucial discovery role among casual and family-driven consumers. Physical presence, accompanied by health-driven promotion and loyalty programs, provides a solid position in bridging the gap between mass industry and premium organic brands.

The industry is heavily growing due to increased consumer demand for clean beauty products that are free of synthetic chemicals and toxic ingredients. Aveda Corporation continues to dominate the industry with its excellent brand positioning in sustainability, offering high-performance organic skincare, haircare, and makeup products.

Its advancements around the world, as well as ecologically conscious packaging, keep it at the top. Burt's Bees offers natural skincare products and has a strong presence in drugstores and premium beauty stores. The brand provides organic-based skincare solutions that mostly appeal to eco-conscious consumers.

Meanwhile, The Estée Lauder Companies Inc. has consolidated its position through the purchase of brands focused on organic formulations, including Origins. With its innovations in clean beauty, the company aims at both mainstream and eco-focused segments.

The Hain Celestial Group further positions itself through strategic brand acquisitions like Jason and Avalon Organics, expanding its organic product assortment and industry reach. Meanwhile, Amway Corporation is channeling a focus on natural ingredients through its Artistry brand, with the direct-selling channel to offer customized organic beauty solutions. Brands like Bare Escentuals and Arbonne International LLC embrace the clean beauty wave by offering organic as well as cruelty-free-based cosmetics.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Aveda Corporation | 20-24% |

| Burt’s Bees | 16-20% |

| The Estée Lauder Companies Inc. | 12-16% |

| The Hain Celestial Group | 10-14% |

| Amway Corporation | 8-12% |

| Other Players | 30-38% |

| Company Name | Offerings & Activities |

|---|---|

| Aveda Corporation | It offers a full range of organic haircare, skincare, and makeup products with a focus on sustainability as well as eco-friendly packaging. |

| Burt’s Bees | Focuses on natural skincare, lip care, and body care products made from 100% natural ingredients and eco-conscious practices. |

| The Estée Lauder Companies Inc. | It includes organic-focused brands like Origins, which offer skincare and makeup with natural ingredients and sustainability. |

| The Hain Celestial Group | Owns brands like Avalon Organics and Jason, which offer certified organic and natural skincare, haircare, and bath products. |

| Amway Corporation | It offers organic skincare and cosmetics through its Artistry brand, utilizing natural ingredients as well as personalized skincare solutions. |

Key Company Insights

Aveda Corporation holds a dominant share of approximately 20-24%, supported by its global presence and strong focus on organic formulations for skincare, haircare, and makeup products. The company is a leader in the industry, demonstrating a steadfast commitment to sustainability, including the use of packaging made from recycled materials.

It is a top choice for eco-conscious consumers. Burt's Bees, with an estimated share of 16–20%, remains a popular brand for natural skincare. It offers affordable, high-quality products made from 100% natural ingredients. The brand is well-known for its availability in both drugstores and premium beauty retailers, establishing it as a key leader in the natural and organic beauty segment.

The Estée Lauder Companies Inc. holds 12-16% of the share and has acquired brands like Origins, which focuses on clean beauty with natural ingredients. This brand targets eco-conscious consumers while integrating sustainability into its product development. The Hain Celestial Group follows with a share of 10-14%.

It benefits from a portfolio of organic brands, such as Avalon Organics and Jason, which address the growing demand for certified organic beauty products. Also, Amway Corporation captures 8-12% of the share with its Artistry brand, successfully combining direct selling with a focus on natural ingredients to meet personalized beauty preferences.

The segmentation is into skin care, hair care, oral care, and other products.

The segmentation is into hypermarkets/supermarkets, pharmacy and drug stores, e-commerce, and other channels.

The regions covered include North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is expected to reach USD 34.2 billion in 2025.

The market is projected to grow to USD 76.4 billion by 2035.

The USA, with a projected CAGR of 10.6%, is expected to see significant growth in this market.

Skincare products are currently the most prominent segment within the organic personal care market.

Key players include Aveda Corporation, Burt’s Bees, The Estée Lauder Companies Inc., The Hain Celestial Group, Amway Corporation, Bare Escentuals Beauty, Inc., Arbonne International LLC, Neutrogena Corporation, The Body Shop International PLC, and Yves Rocher SA.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Unit Pack) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 6: Global Market Volume (Unit Pack) Forecast by Distribution channel, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 10: North America Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 12: North America Market Volume (Unit Pack) Forecast by Distribution channel, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 16: Latin America Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 18: Latin America Market Volume (Unit Pack) Forecast by Distribution channel, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 22: Western Europe Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 24: Western Europe Market Volume (Unit Pack) Forecast by Distribution channel, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Eastern Europe Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 30: Eastern Europe Market Volume (Unit Pack) Forecast by Distribution channel, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Unit Pack) Forecast by Distribution channel, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 40: East Asia Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 42: East Asia Market Volume (Unit Pack) Forecast by Distribution channel, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Unit Pack) Forecast by Distribution channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Unit Pack) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 9: Global Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 13: Global Market Volume (Unit Pack) Analysis by Distribution channel, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 16: Global Market Attractiveness by Product, 2024 to 2034

Figure 17: Global Market Attractiveness by Distribution channel, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 27: North America Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 31: North America Market Volume (Unit Pack) Analysis by Distribution channel, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 34: North America Market Attractiveness by Product, 2024 to 2034

Figure 35: North America Market Attractiveness by Distribution channel, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 45: Latin America Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 49: Latin America Market Volume (Unit Pack) Analysis by Distribution channel, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Distribution channel, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 63: Western Europe Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 67: Western Europe Market Volume (Unit Pack) Analysis by Distribution channel, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Distribution channel, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Unit Pack) Analysis by Distribution channel, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Distribution channel, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Unit Pack) Analysis by Distribution channel, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Distribution channel, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 117: East Asia Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 121: East Asia Market Volume (Unit Pack) Analysis by Distribution channel, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Distribution channel, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Unit Pack) Analysis by Distribution channel, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Distribution channel, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA