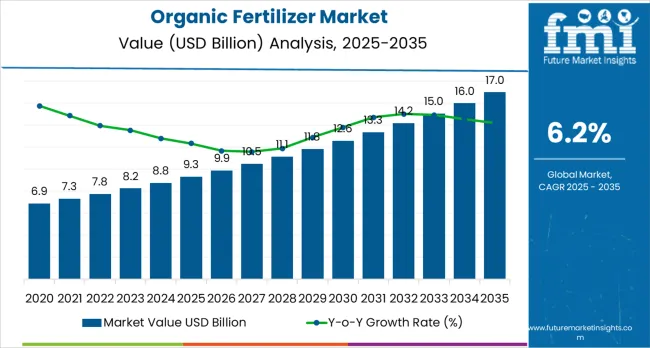

The global organic fertilizer market is projected to reach USD 17.0 billion by 2035, recording an absolute increase of USD 7.7 billion over the forecast period. The market is valued at USD 9.3 billion in 2025 and is set to rise at a CAGR of 6.2% during the assessment period. As per Future Market Insights, acknowledged as a global advisory partner, the market size is expected to grow by nearly 1.8 times during the same period, supported by increasing demand for eco-friendly agriculture solutions worldwide, driving demand for efficient organic nutrient systems and increasing investments in regenerative farming and soil health improvement projects globally. The supply consistency challenges and price premiums compared to synthetic alternatives may pose challenges to market expansion.

A key driver for the growth of the organic fertilizer market is the growing demand for organic food. As consumers become more health-conscious and environmentally aware, the demand for organic food products continues to rise. Organic farming, which avoids the use of synthetic chemicals and fertilizers, relies heavily on organic fertilizers to enrich the soil and provide essential nutrients to crops. The increasing preference for organic food, driven by concerns about pesticide residues, soil degradation, and the long-term health effects of consuming chemically treated produce, is significantly contributing to the growth of the organic fertilizer market. Moreover, governments and certification bodies worldwide are promoting organic farming through incentives, regulations, and certification programs, further accelerating the adoption of organic farming practices and organic fertilizers.

Technological advancements in the production of organic fertilizers are further driving market growth. The development of more efficient and cost-effective manufacturing processes, along with innovations in organic fertilizer formulations, is improving the performance and availability of these products. New formulations, including slow-release organic fertilizers, are being developed to provide a steady supply of nutrients to plants, minimizing nutrient loss and reducing the need for frequent application. Additionally, the incorporation of bio-based additives and microorganisms in organic fertilizers is enhancing their effectiveness, improving crop yields, and promoting healthier soils.

Regionally, North America and Europe are expected to remain significant markets for organic fertilizers, driven by the high demand for organic food and the increasing regulatory focus on sustainable farming practices. However, the Asia-Pacific region is projected to witness the highest growth, driven by the rising adoption of organic farming practices in countries like India, China, and Japan. These countries are increasingly turning to organic fertilizers to address soil health issues, reduce the impact of chemical fertilizers, and meet the growing demand for organic food.

Between 2025 and 2030, the organic fertilizer market is projected to expand from USD 9.3 billion to USD 12.8 billion, resulting in a value increase of USD 3.5 billion, which represents 45.5% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for eco-friendly agriculture and soil health solutions, product innovation in organic formulations and precision application systems, as well as expanding integration with regenerative farming and carbon sequestration initiatives. Companies are establishing competitive positions through investment in advanced organic processing technologies, eco-friendly sourcing solutions, and strategic market expansion across horticulture, cereals, and specialty crop applications.

From 2030 to 2035, the market is forecast to grow from USD 12.8 billion to USD 17.0 billion, adding another USD 4.2 billion, which constitutes 54.5% of the ten-year expansion. This period is expected to be characterized by the expansion of specialized organic systems, including advanced composting formulations and integrated biostimulant solutions tailored for specific crop requirements, strategic collaborations between organic input manufacturers and farming communities, and an enhanced focus on nutrient efficiency and environmental resposibility. The growing emphasis on soil health optimization and climate-smart agriculture will drive demand for advanced, high-performance organic fertilizer solutions across diverse agricultural applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 9.3 billion |

| Market Forecast Value (2035) | USD 17.0 billion |

| Forecast CAGR (2025-2035) | 6.2% |

The organic fertilizer market grows by enabling farmers to achieve superior soil health and eco-friendly crop productivity while meeting consumer demand for chemical-free produce. Agricultural producers face mounting pressure to improve environmental stewardship and soil regeneration, with organic fertilizer solutions typically providing 15-25% improvement in soil organic matter over conventional systems, making organic nutrients essential for long-term farm resilience. The regenerative agriculture movement's need for natural nutrient cycles creates demand for advanced organic solutions that can enhance microbial activity, improve water retention, and ensure consistent crop performance across diverse climatic conditions.

Government initiatives promoting organic farming certification and environmental protection standards drive adoption in horticulture, cereals, and specialty crop applications, where soil health has a direct impact on yield quality and farm profitability. The global shift toward eco-friendly food systems and carbon-neutral agriculture accelerates organic fertilizer demand as farmers seek alternatives to synthetic inputs that deplete soil biology. Limited availability of quality raw materials and higher cost structures compared to conventional fertilizers may limit adoption rates among price-sensitive smallholder farmers and regions with underdeveloped organic supply chains.

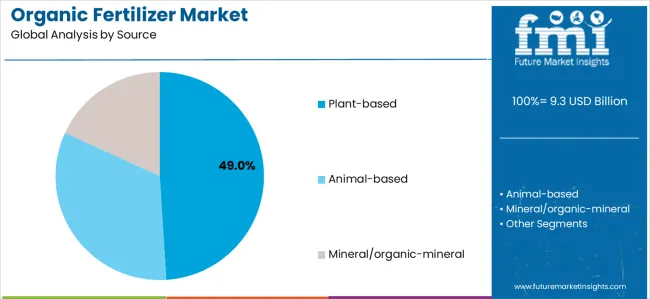

The market is segmented by source, form, crop type, and region. By source, the market is divided into plant-based, animal-based, and mineral/organic-mineral. Based on form, the market is categorized into dry and liquid. By crop type, the market includes fruits &vegetables, cereals &grains, oilseeds &pulses, and other crops. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East &Africa.

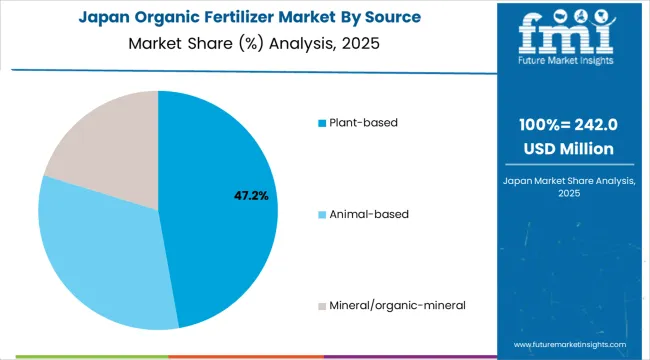

The plant-based segment represents the dominant force in the organic fertilizer market, capturing approximately 49% of total market share in 2025. This advanced category encompasses formulations featuring composted plant matter (22.0%), green manure (11.0%), seaweed/algal extracts (9.0%), and other plant inputs (7.0%), delivering comprehensive nutrient profiles with enhanced soil conditioning properties. The plant-based segment's market leadership stems from its exceptional eco-friendly credentials, renewable sourcing capabilities, and compatibility with vegan organic farming systems that prioritize plant-derived inputs exclusively.

The animal-based segment maintains a substantial 38.0% market share, serving farmers who require nutrient-dense organic solutions through manure pellets (21.0%), bone/blood meal (12.0%), and fish emulsion/meals (5.0%). The mineral/organic-mineral segment accounts for 13.0% market share, featuring rock phosphate (6.0%), potassium minerals (4.0%), and other certified organic minerals (3.0%).

Key advantages driving the plant-based segment include:

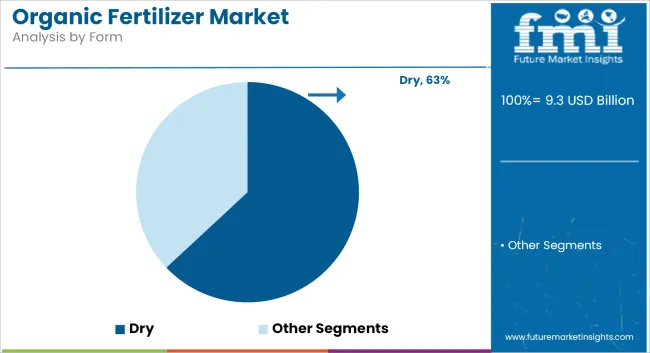

Dry formulations dominate the organic fertilizer market with approximately 63% market share in 2025, reflecting the practical advantages of storage stability, transportation efficiency, and precision application capabilities across diverse farm scales. The dry segment's market leadership is reinforced by widespread adoption of pellets/granules (41.0%), composted solids (15.0%), and powders (7.0%), which provide convenient handling characteristics and controlled-release nutrient delivery suitable for mechanized application systems.

The liquid segment represents 37.0% market share through specialized formulations including extracts/teas (17.0%), fish/seaweed liquids (12.0%), and microbial/biostimulant liquids (8.0%). This segment benefits from rapid nutrient uptake, foliar application flexibility, and compatibility with fertigation systems in intensive horticulture operations.

Key market dynamics supporting form preferences include:

The market is driven by three concrete demand factors tied to eco-friendly and performance outcomes. First, consumer demand for organic food products creates increasing requirements for certified organic farming inputs, with global organic food sales growing 10-15% annually in major markets worldwide, requiring reliable organic fertilizer supply chains for crop certification maintenance. Second, soil degradation and environmental concerns drive farmers toward regenerative practices, with organic fertilizers improving soil organic carbon by 0.3-0.5% annually while reducing synthetic nitrogen dependency and associated greenhouse gas emissions. Third, government policy support through organic farming subsidies, certification programs, and environmental protection regulations accelerates adoption across Europe, North America, and Asia-Pacific regions where eco-conscious agriculture receives priority funding.

Market restraints include supply chain inconsistencies affecting raw material availability and product standardization, particularly for animal-based inputs where livestock manure quality varies significantly by farming system and feed composition. Price premiums of 30-70% compared to synthetic fertilizers pose adoption barriers for smallholder farmers and large-scale commodity producers operating on thin profit margins, especially during periods of elevated conventional fertilizer prices that compress the cost differential. Technical knowledge gaps regarding organic nutrient management create additional challenges, as transitioning farmers require specialized training in composting, application timing, and nutrient budgeting to achieve comparable yields during the 2-3 year conversion period.

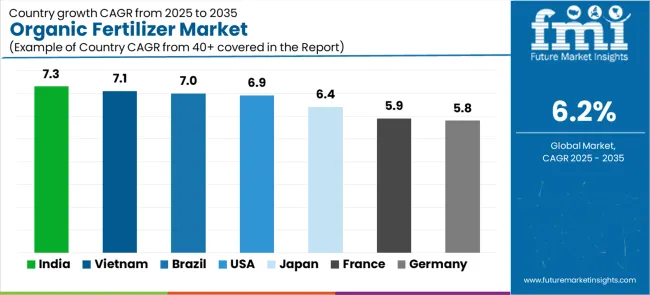

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly India and Vietnam, where government programs incentivize organic agriculture through procurement guarantees and premium pricing mechanisms. Technology advancement trends toward biofortified organic formulations with enhanced nutrient density, microbial inoculants for nitrogen fixation, and controlled-release pellet systems that improve efficiency are enabling next-generation product development. The market thesis could face disruption if precision agriculture technologies and synthetic biology innovations produce ultra-efficient conventional fertilizers that minimize environmental impacts while maintaining cost advantages over organic alternatives.

| Country | CAGR (2025-2035) |

|---|---|

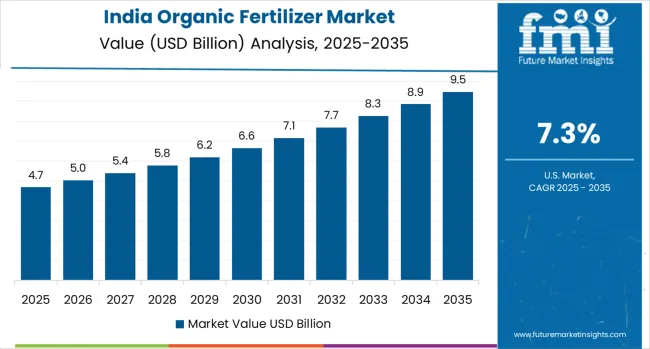

| India | 7.3% |

| Vietnam | 7.1% |

| Brazil | 7.0% |

| USA | 6.9% |

| Japan | 6.4% |

| France | 5.9% |

| Germany | 5.8% |

The organic fertilizer market is gaining momentum worldwide, with India taking the lead thanks to aggressive urban soil-health schemes and horticultural intensification programs. Close behind, Vietnam benefits from export-oriented horticulture and government rice pilot programs, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding organic coffee and fruit production strengthens its role in South American agricultural supply chains. The USA demonstrates robust growth through National Organic Program incentives and large-scale adoption in specialty crops, signaling continued investment in eco-conscious agriculture infrastructure. Meanwhile, Japan stands out for its greenhouse and premium produce focus with MAFF support, while France and Germany continue to record consistent progress driven by European Green Deal targets and vineyard/orchard expansion. Together, India and Vietnam anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries;7 top-performing countries are highlighted below.

India demonstrates the strongest growth potential in the Organic Fertilizer Market with a CAGR of 7.3% through 2035. The country's leadership position stems from comprehensive urban soil-health improvement schemes, intensive horticultural development programs, and aggressive organic certification targets driving adoption of natural nutrient management systems. Growth is concentrated in major agricultural regions, including Punjab, Maharashtra, Tamil Nadu, and Andhra Pradesh, where fruit, vegetable, and specialty crop farmers are implementing organic fertilization programs for domestic supply and export competitiveness. Distribution channels through agricultural cooperatives, government procurement agencies, and direct farmer relationships expand deployment across organic farming clusters and eco-friendly agriculture demonstration sites. The country's national mission for eco-conscious agriculture provides policy support for organic input development, including subsidies for organic fertilizer adoption and composting infrastructure.

Key market factors:

The organic fertilizer market demonstrates strong growth momentum with a CAGR of 7.1% through 2035, linked to comprehensive organic agriculture expansion and increasing focus on export quality enhancement solutions. In the Mekong Delta, Central Highlands, and Red River Delta regions, the adoption of organic fertilizer systems is accelerating across export-oriented fruit farms, rice cultivation areas, and coffee plantations, driven by international market requirements and government eco-friendly agriculture initiatives. Vietnamese farmers are implementing organic nutrient programs and soil health monitoring platforms to improve crop quality while meeting stringent pesticide residue standards in key export markets including EU, Japan, and South Korea. The country's national action plan on eco-conscious agriculture creates demand for certified organic inputs, while increasing emphasis on climate-smart farming drives adoption of organic amendments that enhance soil resilience.

The advanced agricultural sector in Brazil demonstrates sophisticated implementation of organic fertilizer systems, with documented case studies showing 20-30% premium pricing for organic coffee and fruit production through certified organic management. The country's agricultural infrastructure in major producing regions, including Minas Gerais, São Paulo, Paraná, and Rio Grande do Sul, showcases integration of organic nutrient technologies with existing farming systems, leveraging expertise in tropical agriculture and livestock integration. Brazilian producers emphasize quality standards and environmental compliance, creating demand for reliable organic fertilizer sources that support eco-conscious commitments and export certification requirements. The market maintains strong growth through focus on value-added agriculture and international market access, with a CAGR of 7.0% through 2035.

Key development areas:

The USA market leads in advanced organic fertilizer innovation based on integration with precision agriculture technologies and sophisticated nutrient management systems for enhanced crop performance. The country shows solid potential with a CAGR of 6.9% through 2035, driven by National Organic Program expansion and increasing consumer demand for organic produce across major agricultural regions, including California, Washington, Oregon, and the Midwest corn belt. American farmers are adopting certified organic inputs for compliance with USDA organic standards, particularly in high-value specialty crops requiring premium positioning and in regions with stringent environmental regulations limiting synthetic fertilizer application. Technology deployment channels through agricultural cooperatives, organic input distributors, and direct farm supply relationships expand coverage across diverse organic farming operations.

Leading market segments:

The organic fertilizer market in Japan demonstrates sophisticated implementation focused on greenhouse production systems and premium produce cultivation, with documented integration of organic nutrient programs achieving 15-20% price premiums in domestic high-end retail channels. The country maintains steady growth momentum with a CAGR of 6.4% through 2035, driven by consumer willingness to pay for quality assurance and producers'emphasis on soil stewardship principles aligned with traditional farming philosophies. Major agricultural regions, including Hokkaido, Nagano, Aichi, and Kumamoto, showcase advanced deployment of composting systems and organic liquid fertilizers that integrate seamlessly with existing protected cultivation infrastructure and precision irrigation management programs.

Key market characteristics:

The organic fertilizers market in France shows solid growth potential with a CAGR of 5.9% through 2035, linked to European Union organic agriculture development programs, water quality protection regulations, and increasing consumer demand for certified organic wine and fruit products. In Bordeaux, Burgundy, Loire Valley, and Rhône regions, vineyard managers are implementing organic fertilizer programs to enhance terroir expression and meet organic/biodynamic certification requirements, with documented case studies showing quality improvements in premium wine production. French producers are adopting specialized organic formulations and compost tea applications to maintain soil biological activity while complying with environmental protection standards in sensitive watersheds and AOC production zones.

Market development factors:

The organic fertilizer market in Germany demonstrates mature implementation focused on circular economy principles and comprehensive nutrient recycling systems, with documented integration achieving 30-40% organic farming share in specific federal states. The country maintains steady growth through European Green Deal alignment and national eco-friendly targets, with a CAGR of 5.8% through 2035, driven by strong consumer organic food demand and policy support for conversion to organic farming methods. Major agricultural regions, including Bavaria, Lower Saxony, North Rhine-Westphalia, and Baden-Württemberg, showcase advanced organic farming systems where fertilizer programs integrate livestock manure management, green manure rotations, and certified organic input applications.

Key market characteristics:

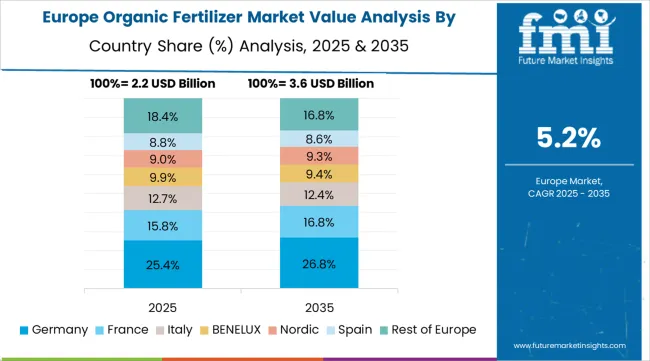

The organic fertilizer market in Europe is projected to grow from USD 2.4 billion in 2025 to USD 4.2 billion by 2035, registering a CAGR of 5.8% over the forecast period. Germany is expected to maintain its leadership position with a 22.5% market share in 2025, declining slightly to 22.3% by 2035, supported by its extensive organic farming infrastructure and major agricultural centers, including Bavaria, Lower Saxony, and North Rhine-Westphalia production regions.

The United Kingdom follows with a 16.5% share in 2025, projected to reach 16.3% by 2035, driven by comprehensive Environmental Land Management Schemes and organic farming expansion programs implementing eco-friendly nutrient management. France holds a 15.5% share in 2025, expected to rise to 15.6% by 2035 through ongoing vineyard organic conversion and specialty crop intensification. Italy commands a 12.5% share in both 2025 and 2035, backed by high-value fruit and vegetable production. Spain accounts for 8.5% in 2025, rising to 8.6% by 2035 on greenhouse and specialty produce expansion. The Netherlands maintains 4.5% in 2025, reaching 4.6% by 2035, on intensive horticulture clusters. The Rest of Europe region is anticipated to hold 20.0% in 2025, expanding to 20.1% by 2035, attributed to increasing organic fertilizer adoption in Nordic countries and emerging Central &Eastern European organic farming programs.

The Japanese organic fertilizer market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of plant-based and composted organic systems with existing precision agriculture infrastructure across greenhouse operations, specialty vegetable production, and traditional farming communities. Japan's emphasis on food safety and environmental stewardship drives demand for certified organic inputs that support eco-friendly agriculture commitments and consumer quality expectations in premium domestic retail channels. The market benefits from strong partnerships between international organic input providers and domestic agricultural cooperatives including JA Group, creating comprehensive service ecosystems that prioritize product consistency and technical support programs. Agricultural centers in Hokkaido, Nagano, Kumamoto, and other major production areas showcase advanced organic farming implementations where fertilizer programs achieve 95% nutrient efficiency through controlled-environment management and precision fertigation systems.

The South Korean organic fertilizer market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive certification support and technical services capabilities for protected cultivation and high-value crop applications. The market demonstrates increasing emphasis on premium organic produce and export-quality specialty crops, as Korean farmers increasingly demand certified organic inputs that integrate with domestic advanced greenhouse infrastructure and sophisticated environmental control systems deployed across major agricultural complexes. Regional organic input manufacturers are gaining market share through strategic partnerships with international suppliers, offering specialized services including Korean organic certification support and crop-specific formulation programs for intensive horticulture operations. The competitive landscape shows increasing collaboration between multinational organic input companies and Korean agricultural technology specialists, creating hybrid service models that combine international sourcing expertise with local agronomic knowledge and precision farming systems.

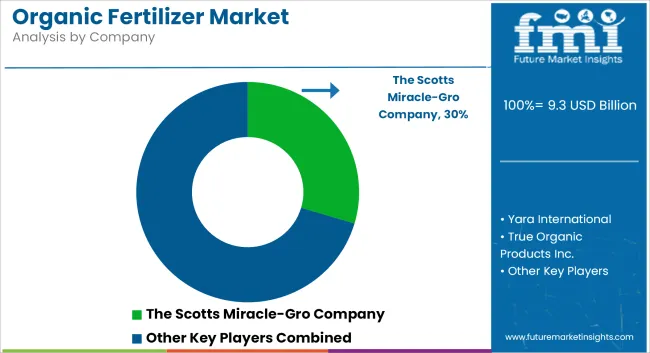

The organic fertilizer market features 12–18 players with moderate concentration, where the top three companies collectively hold around 45–52% of global market share. Growth is driven by increasing demand for sustainable farming practices, eco-friendly crop production, and regulatory support for organic farming. The leading company, The Scotts Miracle-Gro Company, commands 8% of the market share, supported by its strong product portfolio, brand recognition, and established distribution channels in the consumer and professional gardening sectors. Competition centers on product quality, nutrient content, environmental impact, and certification standards rather than price alone.

Market leaders such as The Scotts Miracle-Gro Company, Yara International, and Coromandel International maintain dominant positions by offering high-quality organic fertilizers, including nutrient-rich blends, composts, and soil enhancers tailored for various crops. Their strengths lie in extensive R&D, global manufacturing capabilities, and strong relationships with agricultural cooperatives and large-scale farms.

Challenger companies like True Organic Products Inc., Hello Nature (Italpollina) Srl, and Suståne Natural Fertilizer Inc. focus on providing specialized organic fertilizers for niche agricultural sectors, emphasizing sustainability, bio-based ingredients, and innovative formulations for soil health.

Additional competition comes from Biolchim S.p.A, Perfect Blend LLC, National Fertilizers Limited, and Queensland Organics, which enhance their market presence with region-specific products, certification for organic farming standards, and targeted solutions for local market needs.

Organic fertilizers represent natural nutrient sources that enable farmers to achieve 15-25% improvement in soil organic matter compared to synthetic-only systems, delivering superior soil health and eco-friendly productivity with enhanced microbial activity and nutrient retention in demanding agricultural applications. With the market projected to grow from USD 9.3 billion in 2025 to USD 17.0 billion by 2035 at a 6.2% CAGR, these natural input systems offer compelling advantages - soil regeneration, environmental protection, and premium crop pricing opportunities - making them essential for fruits &vegetables production (39.0% market share), cereals &grains (34.0% share), and farming operations seeking alternatives to synthetic fertilizers that compromise long-term soil health through repeated application. Scaling market adoption and supply chain development requires coordinated action across agricultural policy, organic certification standards, input manufacturers, farming communities, and eco-friendly agriculture investment capital.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 9.3 billion |

| Source | Plant-based, Animal-based, Mineral/organic-mineral |

| Form | Dry, Liquid |

| Crop Type | Fruits &Vegetables, Cereals &Grains, Oilseeds &Pulses, Other |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East &Africa |

| Country Covered | India, Vietnam, Brazil, USA, Japan, France, Germany, and 40+ countries |

| Key Companies Profiled | The Scotts Miracle-Gro Company, Yara International, Coromandel International, True Organic Products Inc., Hello Nature (Italpollina) Srl, Suståne Natural Fertilizer Inc., Biolchim S.p.A, Perfect Blend LLC, National Fertilizers Limited, Queensland Organics, Enviroganic Solutions, and California Organic Fertilizers Inc. |

| Additional Attributes | Dollar sales by source, form, and crop type categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with organic input manufacturers and distribution networks, processing facility requirements and specifications, integration with organic farming certification programs and eco-friendly agriculture initiatives, innovations in composting technology and formulation systems, and development of specialized organic products with enhanced nutrient efficiency and soil health capabilities. |

The global organic fertilizer market is estimated to be valued at USD 9.3 billion in 2025.

The market size for the organic fertilizer market is projected to reach USD 17.0 billion by 2035.

The organic fertilizer market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in organic fertilizer market are plant-based, animal-based and mineral/organic-mineral.

In terms of form, dry segment to command 63.0% share in the organic fertilizer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Fertilizer Industry Analysis in North America Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Demand for Organic Fertilizer in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Organic Fertilizer in North America Size and Share Forecast Outlook 2025 to 2035

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Packaging Market Forecast and Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Fertilizer Tester Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Value Added Coatings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fertilizer Applicators Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA