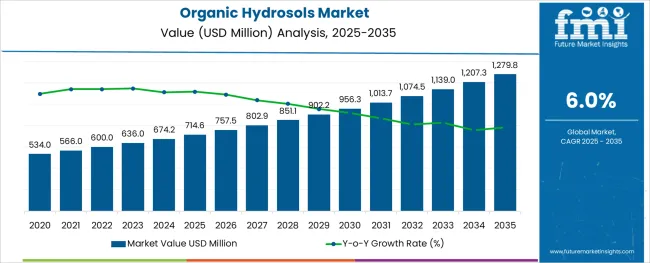

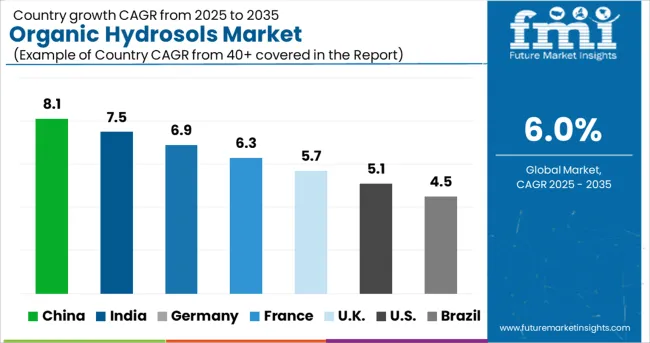

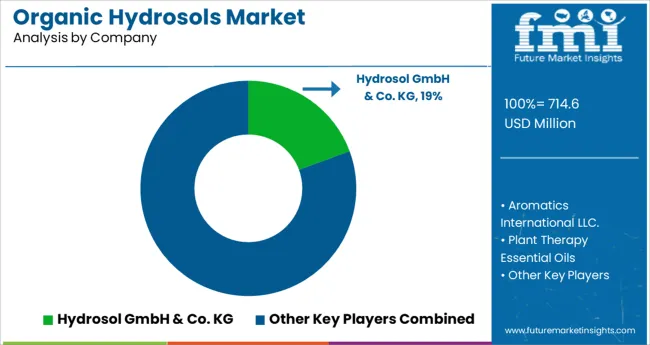

The Organic Hydrosols Market is estimated to be valued at USD 714.6 million in 2025 and is projected to reach USD 1279.8 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The organic hydrosols market is experiencing steady growth as consumers increasingly seek natural and gentle skincare products. Hydrosols derived from flowers have gained popularity due to their soothing and aromatic properties. The expanding demand for facial toners formulated with organic ingredients has been a major factor driving market expansion.

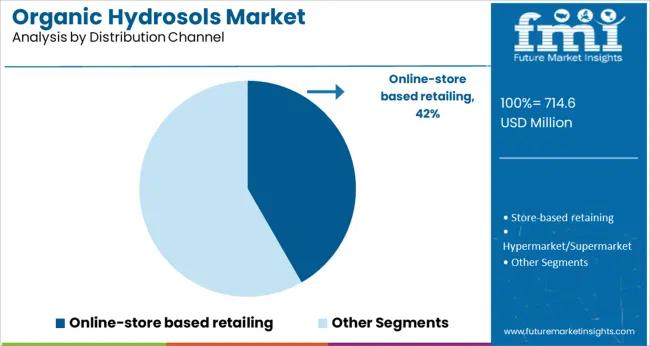

Consumer preference for products free from harsh chemicals and synthetic fragrances has supported the rise of organic hydrosols in personal care routines. Retailers have responded by broadening their offerings through online store-based retailing channels, providing greater accessibility and variety.

The convenience of e-commerce platforms and the rise of health-conscious consumers are expected to further boost sales. With growing awareness about sustainable and clean beauty, the market is anticipated to maintain strong growth driven by innovative applications and easy availability.

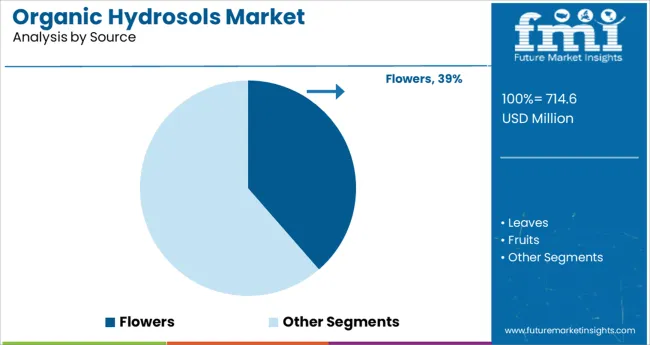

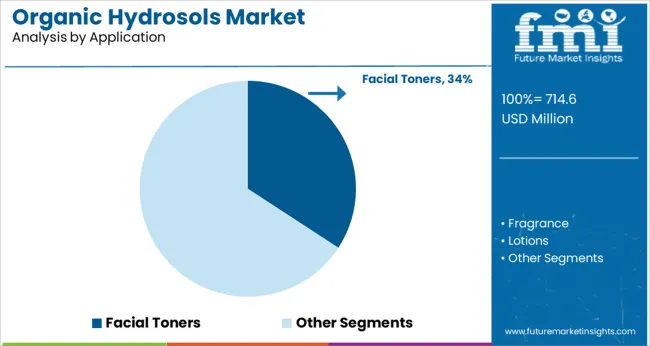

The market is segmented by Source, Application, and Distribution Channel and region. By Source, the market is divided into Flowers, Leaves, Fruits, and Other Plant. In terms of Application, the market is classified into Facial Toners, Fragrance, Lotions, Creams, and Other Skincare Products. Based on Distribution Channel, the market is segmented into Online-store based retailing, Store-based retaining, Hypermarket/Supermarket, Convenience stores, and Specialty Stores. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The flowers source segment is projected to contribute 38.6% of the organic hydrosols market revenue in 2025. Growth in this segment is driven by the natural appeal and therapeutic benefits of floral hydrosols such as rose and lavender. These floral extracts are valued for their gentle skincare properties and widespread consumer acceptance.

Production methods emphasizing organic and sustainable farming have enhanced product credibility. The use of flower-based hydrosols in aromatherapy and wellness has also expanded their application range.

The segment’s growth reflects increasing consumer demand for natural ingredients that deliver both skincare benefits and sensory experiences.

The facial toners application segment is expected to hold 34.2% of the market revenue in 2025. This segment benefits from the rising trend of incorporating organic hydrosols into daily skincare routines to cleanse and hydrate the skin. Facial toners formulated with organic hydrosols are preferred for their ability to refresh and balance skin without causing irritation.

The segment’s growth is supported by the increasing number of consumers adopting multi-step skincare regimens that emphasize natural and gentle products.

The soothing and anti-inflammatory qualities of hydrosol-based toners have made them particularly popular among sensitive skin users.

Online-store based retailing is projected to account for 41.7% of the organic hydrosols market revenue in 2025, positioning it as the leading distribution channel. This growth is attributed to the convenience of purchasing natural personal care products through e-commerce platforms. Consumers are increasingly comfortable buying skincare and wellness products online, where they can access a wider variety of brands and formulations.

Online retail also offers the advantage of detailed product information and customer reviews that aid purchase decisions. The rise of social media and influencer marketing has further amplified online sales.

The segment’s expansion is expected to continue as more consumers prioritize health and sustainability in their beauty purchases.

Demand for organic hydrosols ingredients is increasing and getting more popular in the recent period due to its multiple benefits without any side effects on human health. The changing global consumer preferences, especially in the cosmetic and personal care industry, are driving the organic hydrosols market as well as in the forecasted period.

Increasing demand for organic hydrosols products such as floral fragrances and the increasing popularity of aromatic therapies among the population is influencing the growth of the organic hydrosols market share all across the globe. Therefore, the sales of organic hydrosols are generating opportunities for the market players in the forecasted period to serve the larger segment of consumers.

Organic hydrosols products are also used as a substitute for water to produce natural fragrances, lotions, creams, facial toners, and other skincare products or cosmetic products, which is increasing the demand for organic hydrosols in the current scenario and is expected to drive the market in the coming years.

Organic hydrosols are perishable and have less shelf life as compared to other organic personal care products. This may restrict the sales of organic hydrosols in the cosmetic industry. As a solution, key organic hydrosols market players are utilising extensive labeling and packing marketing strategy to combat this market restraint.

Sales of organic hydrosols are likely to rise by educating the consumers on how to keep the products and safety precautions to be used to keep prevent them from spoiling, such as the shelf life can be prolonged by refrigeration of the product, avoiding changes in temperature and treating them with care.

The organic hydrosols market is likely to grow in the marketplace in the coming forecast period as it is widely used in cosmetics and other health and skincare products.

There are several valuable key contributors to industries that play an important role in the organic hydrosols market. Some of them are clinic research laboratories, hospitals, academics & research centers, and others. These are the industrial sectors that are growing the organic hydrosols market share all around the globe. All the products are chemical-free which increases the demand for organic hydrosols products.

The demand for organic hydrosols is likely to increase in different regions, such as North America, Latin America, Europe, South Asia, East Asia, Middle East & Africa, and Oceania.

Among all these regions, Europe is expected as a prominent region in the organic hydrosols market share as compared to the other regions. Due to the increasing demand for organic hydrosols as demanded by end users in the personal care industry.

Other than this, Asia is expected to be the fastest-growing region in the organic hydrosol market share, due to changing lifestyle of the people, low labor, and raw material cost. It is expected to lift the sales of organic hydrosol by the manufacturer in the region in the coming forecast period.

There are various key players are present to lift the growth in the demand for organic hydrosol. Some of the key players and manufacturing companies are as follows

| Report Attribute | Details |

|---|---|

| Base year for estimation | 2025 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Source, Application, Distribution Channel, & Region |

| Regional scope | North America; Latin America; Europe; Middle East and; Africa (MEA); East Asia; South Asia; Oceania |

| Country scope | USA, Canada, Mexico, Brazil, Argentina, Germany, Italy, France, UK, Spain, Russia, India, Indonesia, Thailand, China, Japan, South Korea, Australia & New Zealand, GCC Countries, South Africa, North Africa |

| Key companies profiled | Hydrosol GmbH & Co. KG; Aromatics International LLC.; Plant Therapy Essential Oils; Florihana Distillerie; Bo International; Sydney Essential Oils Co. Pty Ltd; The Essential Oil Company; Avi Naturals; SOiL; The Mountain Rose Herbs; Eden Botanicals; Hydrosol World Inc.; Green Valley Aromatherapy Ltd. |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global organic hydrosols market is estimated to be valued at USD 714.6 million in 2025.

It is projected to reach USD 1,279.8 million by 2035.

The market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types are flowers, leaves, fruits and other plant.

facial toners segment is expected to dominate with a 34.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Organic Fruit Powder Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA