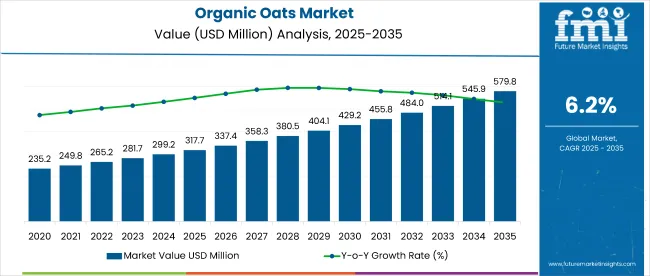

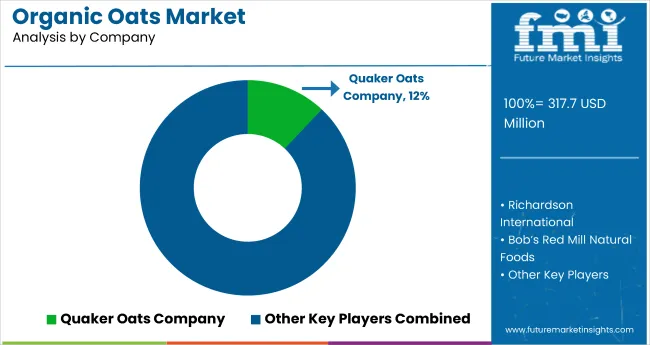

The global organic oats market is valued at USD 317.7 million in 2025 and is poised to reach USD 579.8 million by 2035, expanding at a CAGR of 6.2%. Market expansion is driven by increasing consumer health awareness, rising adoption of plant-based diets, and the expansion of organic farming practices across key producing countries.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 317.7 million |

| Market Size (2035) | USD 579.8 million |

| CAGR (2025 to 2035) | 6.2% |

Additionally, strong demand from urban consumers in North America, Europe, and East Asia, along with product innovation in flavored oats, is expected to further propel the market.

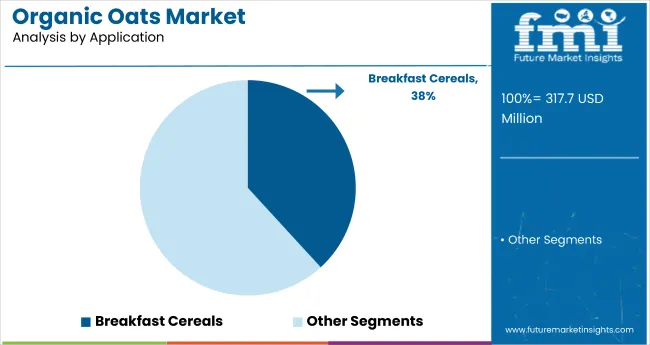

The market holds approximately 7% of the global functional food ingredients market and around 6.5% of the breakfast cereals segment. Within the broader organic food category, organic oats represent about 4.2%, driven by rising demand for pesticide-free and sustainably grown products. In the plant-based food market, they contribute roughly 3.8%, while their share in the clean-label ingredients segment stands at 2.9%.

Government regulations impacting the market focus on certified production, labeling accuracy, and sustainability to align with growing consumer demand for transparency and clean-label products. In the European Union, Regulation (EU) No. 2018/848 strictly governs the cultivation, processing, and distribution of organic agricultural goods, ensuring they are free from synthetic inputs.

In the USA, the Risk Management Agency enforces organic-specific standards for insurance and pricing purposes. These frameworks are encouraging compliance across the supply chain, supporting the growth of trusted, high-quality organic oat products, while reinforcing the market’s alignment with health, safety, and environmental sustainability goals.

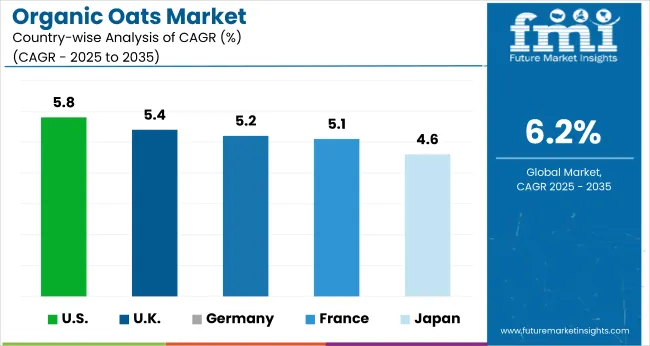

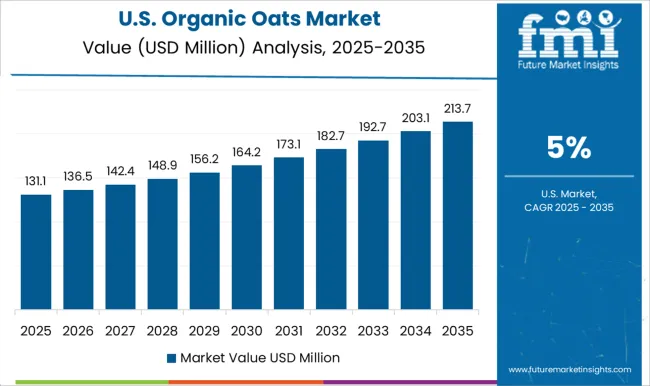

The USA is projected to be the fastest-growing market, expanding at a CAGR of 5.8%, driven by increasing health consciousness, strong demand for plant-based and high-fiber foods, and the widespread adoption of organic breakfast cereals and snacks.

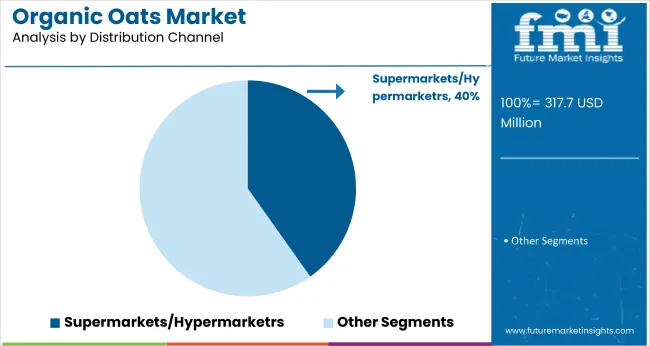

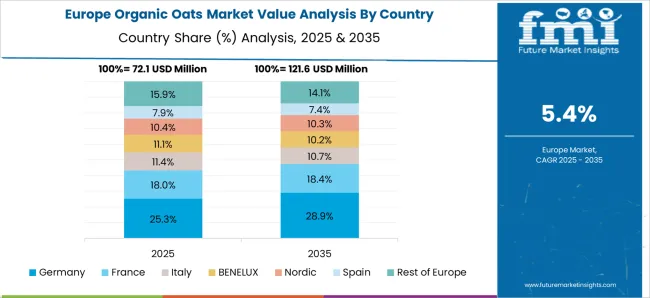

Supermarkets and hypermarkets will dominate the distribution channel, accounting for 40% of the market share, supported by wide availability and strong consumer trust.WhileChinaand Germany markets are expected to grow at a CAGR of 6.1% and 5.2%, respectively.

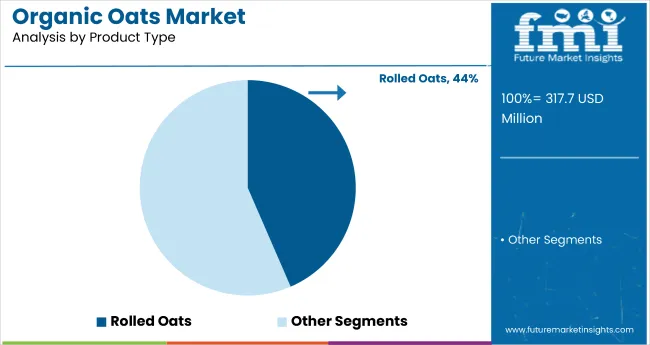

The organic oats market is segmented into application, product type, distribution channel, and region. By application, the market is divided into bakery products, breakfast cereals, savory & snacks, and others (including oat-based beverages, infant food, and ready-to-eat meals).Based on product type, the market includes rolled oats, steel cut oats, oats bran, and oats flour.

By distribution channel, the market is categorized into supermarket/hypermarket, online retail, convenience stores, and others (including B2B sales, specialty health stores, and direct-to-consumer models).Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The breakfast cereals segment is expected to hold a 38% market share in the organic oats market by 2025. Growth is driven by growing consumer demand for healthy, convenient, and nutritious breakfast options. Consumers are increasingly attracted to oat-based cereals due to their heart health benefits, sustained energy release, and compatibility with organic and clean-label preferences.

Rolled oats is projected to lead the product type segment with a 44% global market share in 2025. Their popularity stems from versatility, quick cooking time, and widespread use in cereals, baking, and meal preparation.

Supermarkets/hypermarkets are projected to lead the distribution channel segment with a market share of 40% in 2025, driven by wide product availability, bulk discounts, and consumer trust in established retail chains.

The global organic oats market is growing steadily, driven by rising consumer demand for clean-label and plant-based foods, increasing awareness of oat-based health benefits, and continuous innovation in organic breakfast cereals and functional oat products across retail and foodservice industries.

Recent Trends in the Organic Oats Market

Key Challenges in the Organic Oats Market

The USA leads the organic oats market, driven by strong consumer preference for plant-based and fiber-rich diets. The UK follows with a CAGR of 5.4%, supported by rising gluten-free and sustainable food trends. Germany and France are closely behind with 5.2% and 5.1% CAGRs, respectively, due to their mature organic retail landscapes. Japan, although growing more slowly, records a CAGR of 4.6%, fueled by increasing oat milk consumption and demand for functional foods among its aging population.

The report covers in-depth analysis of 40+ countries; with the five top-performing OECD nations highlighted below.

The USA organic oats market is projected to grow at a CAGR of 5.8% from 2025 to 2035, driven by increasing consumer awareness around clean-label nutrition and growing demand for high-fiber, plant-based breakfast options.

The sales of UK organic oats are expected to grow at a CAGR of 5.4% during the forecast period, fueled by rising demand for gluten-free breakfast alternatives and a sharp focus on sustainable and healthy food habits.

The demand for organic oats in Germany is projected to grow at a CAGR of 5.2% from 2025 to 2035, driven by high consumer spending on organic foods and growing demand for oat-based products in both health food stores and conventional retail.

The organic oats market in France is projected to grow at a CAGR of 5.1% during the forecast period, supported by increased interest in wellness foods and the adoption of traditional oat-based recipes in modern diets.

The organic oats market in Japan is expected to grow at a CAGR of 4.6% from 2025 to 2035, driven by changing dietary habits, interest in functional superfoods, and a rising elderly population seeking high-fiber diets.

The market is moderately consolidated, with top players such as Quaker Oats Company, Grain Millers, Richardson International, and Bob’s Red Mill commanding significant shares globally. These companies are strategically investing in product innovation, strategic partnerships, and regional expansion to strengthen their foothold in both mature and emerging markets.

Leading suppliers are differentiating themselves through value-added offerings such as flavored oats, instant oat mixes, and organic oat beverages. Quaker, for example, continues to focus on expanding its health-focused cereal portfolio, while companies like Nature's Path and Ceres Organics are emphasizing sustainable sourcing and clean-label products. Innovation in oat-based dairy alternatives, particularly oat milk, is also a key focus for several players.

Recent Organic Oats Industry News

In January 2025, Oatly expanded its Barista Edition range with a new organic version and a lighter-taste oat drink, targeting growing demand for sustainable and clean-label options.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 317.7 million |

| Projected Market Size (2035) | USD 579.8 million |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD millions/Volume in Metric Tons |

| By Application | Bakery Products, Breakfast Cereals, Savory & Snacks, and Others (Baby Food Products, Dietary Supplements, Oat-Based Desserts, and Meal Replacement Products) |

| By Product Type | Rolled Oats, Steel Cut Oats, Oat Bran, and Oat Flour |

| By Distribution Channel | Supermarket/Hypermarket, Online Retail, Convenience Stores, and Others (Health Food Stores, B2B/Wholesale Channels, Organic Cooperatives and Farmers Markets, and Pharmacy Retail Chains) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Players | Richardson International, Quaker Oats Company, Avena Foods, Grain Millers Inc., Bob’s Red Mill Natural Foods, Fazer Mills, Helsinki Mills Ltd., Ceres Organics, Kialla Pure Foods, NOW Foods, Dutch Organic International Trade, Nature's Path Foods, Danco urt, Saaten-Union GmbH, Swedish Oat Fiber AB, Arrowhead Mills, Flahavan's, McCabe, Royal Lee Organic, Better Oats. |

| Additional Attributes | Dollar sales by product type, share by functionality, regional demand growth, regulatory influence, clean-label trends, competitive benchmarking |

The global organic oats market is estimated to be valued at USD 317.7 million in 2025.

The market size for the organic oats market is projected to reach USD 563.1 million by 2035.

The organic oats market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in organic oats market are bakery products, breakfast cereals, savory & snacks and others (cosmetics, animal feed, and others).

In terms of product type, rolled oats segment to command 38.1% share in the organic oats market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Organic Fruit Powder Market Size, Growth, and Forecast for 2025 to 2035

Organic Condiments Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA