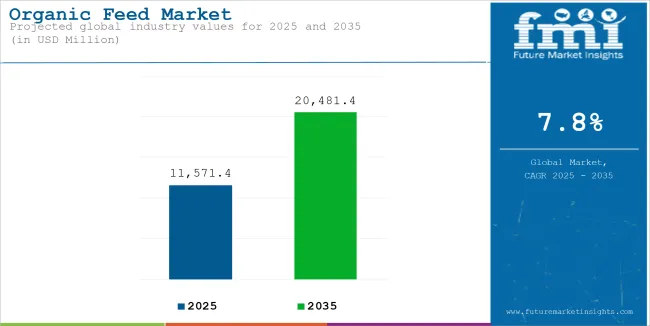

The global organic feed market, valued at USD 11.57 billion in 2025, is set to reach USD 20.48 billion by 2035, registering a CAGR of 7.8%. Growth is driven by rising demand for chemical-free animal-derived products and expanding awareness of the harmful effects of synthetic additives. Stricter organic certification standards and consumer preference for non-GMO ingredients are compelling producers to shift toward clean-label feed solutions across poultry, aquaculture, and livestock sectors.

Key trends shaping this market include a shift toward regionally sourced organic inputs, increased vertical integration, and growing investments in traceable, species-specific blends. Cost constraints and raw material shortages remain as challenges, yet demand continues to grow in both retail and foodservice applications.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 11.57 billion |

| Projected Global Industry Value (2035F) | USD 20.48 billion |

| Value-based CAGR (2025 to 2035) | 7.8% |

The global organic feed market is expanding steadily, fueled by rising consumer demand for clean-label animal products, stricter regulatory frameworks, and heightened awareness of animal welfare. Producers are transitioning toward organic-certified inputs and tailored formulations to meet premium standards across poultry, aquaculture, and livestock sectors. However, challenges such as high production costs and raw material constraints continue to impact scalability and affordability.

The global organic feed market is experiencing robust growth due to the increasing consumer preference for clean-label and chemical-free animal products. This shift is largely driven by rising awareness about the harmful effects of synthetic additives in conventional feeds. As consumers demand more transparency and ethical sourcing in animal nutrition, producers are being compelled to adopt organic-certified ingredients and diversify into tailored, non-GMO feed solutions. This trend is particularly strong in the poultry and aquaculture segments, where feed directly impacts product quality and market premiums.

A major trend shaping the market is the use of organic-certified amino acids such as lysine and methionine, which support muscle development and animal health without the use of artificial enhancers. Enzyme supplementation is also on the rise, with organic phytase and protease being added to improve nutrient absorption and overall feed efficiency.

Another significant trend is the growing interest in on-farm mixing, especially among small and mid-sized livestock operations in Europe and Southeast Asia. Modular mixing systems and digital formulation tools are enabling cost-effective and customizable feed production on-site. Meanwhile, technology is playing a crucial role-precision agriculture, GPS tracking, IoT sensors, and automated processing are being used to improve yield and feed quality while meeting organic standards.

Despite its growth, the organic feed market faces key restraints. The high cost of organic certification, along with the limited availability of certified raw materials like organic corn and oilseeds, continues to constrain adoption. Many producers struggle to maintain consistent supply chains and meet regional certification criteria, especially in emerging markets.

On-farm mixing, though efficient, poses challenges such as managing mycotoxin risks, maintaining documentation, and ensuring proper training. Additionally, price sensitivity among consumers and farmers in developing regions continues to slow down large-scale conversion from conventional to organic systems.

The organic feed market is segmented by ingredient type, livestock type, and form. Each of these plays a unique role in shaping feed formulations, pricing strategies, and market dynamics.

Cereals and grains are projected to maintain dominance in the organic feed market with a 37.2% share in 2025. This leadership is attributed to their high energy content, digestibility, and reliable availability across global supply chains.

Poultry will remain the dominant livestock segment in the organic feed market, accounting for 48.6% of total consumption in 2025. This is largely driven by the rising popularity of organic eggs and broiler meat in retail channels.

Among feed forms, pellets are emerging as the top choice for organic feed, thanks to their high digestibility, longer shelf life, and efficient nutrient retention.

New organic vitamins, enzymes, and amino acids are introduced to meet nutritional needs.

Vitamins from organic sources provide nutrition to livestock because they boost both their health and development. For example, natural products such as oils contain natural Vitamin E essential in enhancing the immune response and reduce inflammation. These vitamins contain no synthetic substances which are prohibited in organic production and thus, are safer for animal nourishment.

Proteins added in the organic feeds are modified enzymes whose work is to breakdown nutrient components so that they are easily taken in by animal bodies. Other examples include organic phytase and protease that facilitates efficient digestion of feed constituents; therefore improving feed-to-meat conversion ratio, and minimizing wastage. This not only makes the animals grow and produce better but also brings more efficiency and environmental production to the so called farming.

Proteinogenic amino acids are the constituents of protein required for muscle generation, tissue regeneration, and metabolism in animals. Protein products like lysine and methionine are included into animal feeds to augment the value of organic amino acids.

Some of them appear to be extracted from plant protein sources or produced by microbial fermentation which makes them organic certified amino acids. Through enhancing diet with essential amino acids for stocks, then the livestock can grow and even reproduce in the most appropriate ways without any form of artificial enhancement.

Organic feed is part of broader environmente-friendly farming practices.

Organic feed used in farming has different benefits as it helps to promote and assist environment friendly farming and also make a impressive impact to the sustainability of agriculture. Unlike conventional feed that has many chemicals and genetically modified organisms GMOs organic feed processing natural, friendly to the environment and animals.

The first organic feed factor drawn from the mainstream feed is that it does not encourage the use of synthetic pistes and fertilizers. In organic farming, nutrients are obtained naturally from compost, manure and other requisites and do not harm the soil products as conventional inorganic products do The practice of retaining soil structure protects the land while keeping erosion under control which lets organic farming maintain fertile soil for lasting crop output.

Farmers are more and more adopting organic methods for raising livestock.

Organic feed used in farming has different benefits as it helps to support environment friendly farming and also make a positive impact to the sustainability of agriculture. Unlike conventional feed that has many chemicals and genetically modified organisms GMOs organic feed processing natural, friendly to the environment and animals.

The first organic feed factor drawn from the mainstream feed is that it does not encourage the use of synthetic pistes and fertilizers. In organic farming, nutrients are obtained naturally from compost, manure and other requisites and do not harm the soil products as conventional inorganic products do.

By keeping soil structure of this kind, the practice also helps in preserving of soil, as well as checking soil erosion. In this case, organic farming maintains soil fertility and health hence can be relied upon to ensure sustainable production from the fields.

Technology is optimizing organic feed production and distribution.

Technology integration is altering the traditional feeding system by enhancing the form, efficiency, sustainability, and scale of the organic feeding supply. It is apparent that they are applying different technologies in the production and distribution process of the product.

Precision farming is one of the large areas that get affected by this kind of technology. This technology includes GPS and IoT sensors, as well as data analysis for the soil and crop status, the state of the weather. Through this, farmers can be in a position to make right decision in planting crops, water constant supply, regular fertilizing of crops used in production of organic feed crops.

This prevents wastage, enhances productivity and guarantee that the food produced by OSI Industries meets organic requirements.

Robotics as well as automation are also assisting in the manufacture of organic feed. Apply of automatic tools for sowing seeds, for reaping the crops, and for threshing the grains. They help save time, and costs of labour while still producing the required quality of the organic feed. In addition they can also control and regulate conditions of the environment of storage facilities where organic feed materials are kept.

The organic feed market is witnessing varied growth trajectories across key geographies, driven by unique consumer preferences, regulatory environments, and agricultural dynamics. The United States, Germany, and India are expected to be the most prominent contributors to global organic feed consumption during the forecast period.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 8.0% |

| Germany | 6.5% |

| France | 5.8% |

| United Kingdom | 6.2% |

| Japan | 4.5% |

The USA organic feed market is anticipated to grow at a CAGR of 8.0% between 2025 and 2035. Growth is being propelled by surging demand for organic meat and dairy products, driven by health-conscious consumers seeking chemical-free animal derivatives.

Sales of organic feed in Germany are forecasted to expand at a CAGR of 6.5% through 2035, backed by longstanding environmental stewardship and sustainability policies. The country’s high consumer awareness has translated into consistent demand for organic livestock products.

France organic feed demand is projected to grow at a CAGR of 5.8% from 2025 to 2035, supported by structured certification systems and increased consumer focus on humane and chemical-free animal farming.

The UK organic feed market is expected to grow at a CAGR of 6.2% through 2035. Regulatory support and evolving post-Brexit agricultural policies are encouraging the organic transition.

Japan’s organic feed demand is forecast to grow at a CAGR of 4.5% between 2025 and 2035. The market remains niche but is expanding in value due to high-end consumer demand for premium and traceable animal products.

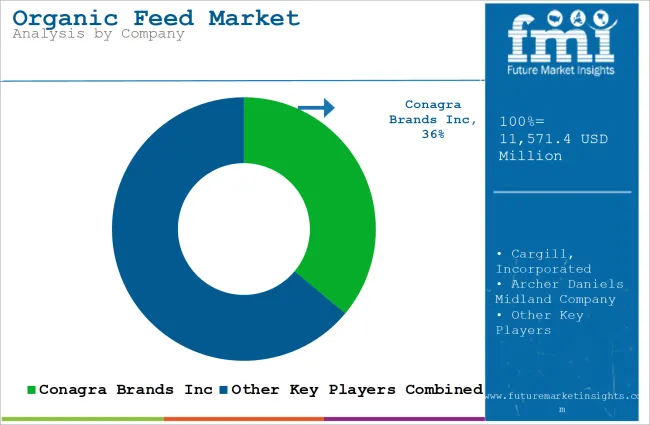

The global organic feed market is witnessing intensified competition as consumer demand for clean-label and ethically sourced animal products continues to surge. Companies are strategically positioning themselves through investment in supply chain traceability, product innovation, and organic certifications to capture market share.

Tier 1 players such as Cargill, Archer Daniels Midland Company, and Conagra Brands Inc dominate the landscape with wide-reaching production capabilities, vertically integrated supply chains, and diversified product portfolios. These firms benefit from economies of scale and established brand trust, enabling them to serve multiple livestock segments across key global markets.

Tier 2 players like Ardent Mills LLC and Spectrum Essentials focus on delivering niche offerings in specific regions. These mid-sized companies are agile in responding to shifting regulatory demands and evolving consumer preferences. Their regional sourcing networks and targeted feed formulations enable them to compete effectively despite lower scale.

Tier 3 companies such as Let’s Do Organic, Flour Farm’s, and Bob’s Red Mill operate in smaller, specialized segments. They often cater to domestic or artisanal markets, emphasizing high purity, traceable ingredients, and unique value propositions. Their strength lies in consumer loyalty and the ability to innovate quickly in premium organic feed niches.

Overall, market players are heavily investing in organic certifications, on-farm advisory services, and clean ingredient sourcing to differentiate themselves. As demand for species-specific, non-GMO, and additive-free formulations rises, both global and regional companies are expected to intensify efforts in backward integration, localized procurement, and digital traceability platforms.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 11.57 billion |

| Projected Market Size (2035) | USD 20.48 billion |

| CAGR (2025 to 2035) | 7.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Ingredient Types Analyzed | Cereals & Grains, Oil Seeds, Pulses |

| Livestock Types Analyzed | Poultry, Pigs, Aquatic Animals, Pets |

| Form Types Analyzed | Pellets, Crumbles, Mash |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, India, and 40+ countries |

| Key Players Included | Conagra Brands Inc, Cargill Inc, ADM, Ardent Mills, Spectrum Essentials, Bob’s Red Mill |

| Additional Insights | Tier-wise player analysis, distribution trends, certification frameworks, species-specific formulations, traceability innovations |

The market is projected to grow at a CAGR of 7.8% between 2025 and 2035.

The market is expected to reach USD 20.48 billion by 2035.

The poultry segment leads with a 48.6% share in 2025.

India is the fastest-growing market, with a 12.5% CAGR during the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Starter-Grower Chicken Feed Market

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA