Driven by growing consumer awareness towards health and wellness, demand for natural and chemical free food products, and increasing popularity of certain culinary traditions, the global organic spices market is anticipated to reflect substantial growth in the next decade. Health-conscious consumers are increasingly opting for organic spices that are grown and harvested, without the use of any synthetic point solutions, fertilizers, and artificial colors or fragrances for an extra level of purity and flavorful content in their healthy diets.

In addition, market growth is also driven by increasing organic food industry that is further supplemented with strict government regulations and certifications that promote organic agricultural practices. This general limited activity of market includes it in functional food, nutraceuticals and beauty products which can be a factor for the growth of organic spices market.

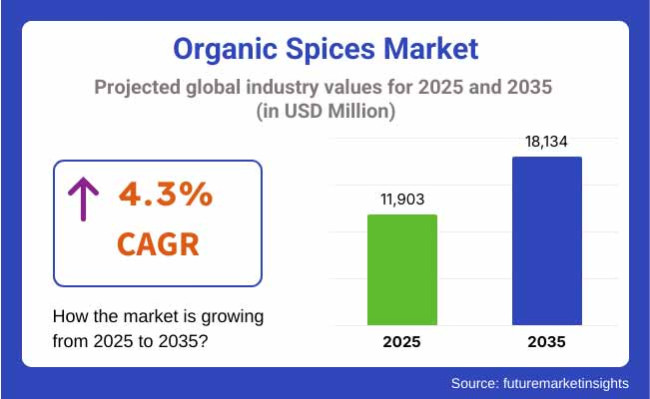

The market is expected to grow at a compound annual growth rate (CAGR) of approximately 4.3% over the forecast period, from USD 11,903 Million in 2025 to USD 18,134 Million by 2035.

The organic spices market is dominated by North America, a region that has experienced increased health awareness and strong demand for organic food products. The preferred use of organic food products in the United States, driven by an established organic food market and regulatory frameworks, has led to the growing consumption of organic spices. The region is further fueling the growth of market owing to the increasing demand for clean-label products and transparency regarding food sourcing among consumers.

The organic spices market in Europe is growing steadily, backed by a focus on sustainable agriculture and organic farming practices. Germany, France, and the UK are leading consumers are now turning to organic and ethically sourced food ingredients. In this region, they also help the market grow due to strict EU regulations across organic labeling and certification.

The Asia-pacific region is anticipated to grow at the highest CAGR, owing to a strong tradition of spice cultivation, growing export activities, and increasing local demand for organic foods. Organic spices market size, Organic spices market share; organic spices market and their cost in India; Indian tejpatta tree; organic spices market; market share of seven; organic spices market size; organic spices in India. This region is primarily driven by an increase in knowledge regarding the health benefits of organic spices and the adoption of organic farming practices.

Challenges

Certification Barriers, High Production Costs, and Supply Chain Fragmentation

The organic spices market also has concerning issues ahead of it like Complicated certification process namely USA organic, EU organic, India organic etc. often involving rigorous inspections, documentation and approval to ensure continuing adherence to organic standards which adds to the challenges to the organic spices market, limited access to training and infrastructure among small-scale farmers, who make up the majority of organic spice producers, often creates challenges in achieving consistent quality.

Supply chain fragmentation, long value chains, post-harvest losses, and inconsistent traceability systems, which can impact product quality and price stability, persist.

Opportunities

Health-Conscious Consumer Demand and Sustainable Farming Trends

The organic spices market is gradually increasing due to an increasing need of the clean-label food ingredient industries in line with the consumer's preference for more of organically sourced, pesticide free, sustainably sourced and naturally grown food items. Spices like turmeric, cinnamon, ginger and black pepper are now being welcomed not only for their taste, but for their functional health benefits anti-inflammatory, antioxidant and digestive properties, she said.

The global organic food movement is driving the market, as consumers seek out environmentally sustainable growing and sourcing. This is why both retailers and foodservice brands are turning their attention to organic products, including high-end spice blends and certified organic culinary kits.

The age of food traceability technology, direct trade platforms, and blockchain-integrated data sets is bringing a future where consumers can expect transparency from farm to shelf. Export prospects are booming too as buyers from other countries, are looking for placebo organic spices from India, Sri Lanka and South-east Asia.

Between 2020 and 2024, the organic spices market witnessed significant traction during the pandemic, and consumers turned towards immune-boosting and natural food ingredients. Wellness-focused content and social media marketing made e-commerce an important distribution channel for organic spice brands. But only limited access to farms during lockdowns disrupted supply chains and many small producers struggled to deal with export delays and logistical bottlenecks.

Between 2025 and 2035, the market will mature and expand with the introduction of smart farming, sustainable packaging, and decentralized processing hubs to reduce post-harvest losses. The demand for multi-functional, nutraceutical-grade organic spices, supplemented by scientific validation of health claims from the functional food and dietary supplement guys, will become consumer expectations. Significant players will invest in contract farming, AI-driven crop monitoring, and cold-chain systems for the purposes of supply security and quality control.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Rise in organic certifications and label standardization |

| Consumer Trends | Focus on immune support and clean-label purchases |

| Industry Adoption | Inclusion in organic grocery and specialty health stores |

| Supply Chain and Sourcing | Dependent on smallholder farming with variable output |

| Market Competition | Dominated by regional exporters and organic specialty brands |

| Market Growth Drivers | Pandemic-driven wellness trends and organic food consumption |

| Sustainability and Environmental Impact | Awareness of pesticide-free and regenerative farming practices |

| Integration of Smart Technologies | Limited mechanization and yield analytics |

| Advancements in Product Offerings | Standalone ground spices and raw whole variants |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Integration of digital traceability and climate-compliant farming policies |

| Consumer Trends | Growing interest in functional blends, Ayurvedic ingredients, and culinary wellness |

| Industry Adoption | Wider adoption in foodservice, meal kits, and global gourmet cuisines |

| Supply Chain and Sourcing | Emergence of organized contract farming and digital co-ops for stability |

| Market Competition | Entry of large FMCG companies and direct-to-consumer spice startups |

| Market Growth Drivers | Accelerated by functional nutrition demand and sustainable sourcing mandates |

| Sustainability and Environmental Impact | Shift to climate-resilient crops, carbon-positive farming, and compostable packaging |

| Integration of Smart Technologies | Introduction of AI for pest control, remote field monitoring, and e-labeling |

| Advancements in Product Offerings | Growth in infused spice oils, ready-to-use organic blends, and medicinal spice formulations |

The USA market is expanding, with growing interest and demand for organic pantry staples like turmeric, ginger and cayenne pepper. Retailers are marketing clean-label cook-at-home kits and wellness-minded spice blends. Partnerships with overseas producers that pay certified fair wages, or ethical sourcing platforms, are on the rise as consumers opt for traceable, fairly produced products.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

In the UK, the organic spices industry is aided by a robust health food retail sector and heightened awareness among consumers about the origins of their food. Organic certification and traceability are still among the most important concerns, so brands introduced QR-coded sourcing information and sustainable packaging to their offerings. Organic curry blends and herbal infusions are in especially high demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

Under the European green deal and the farm to fork strategy, EU countries are expanding their range of organic products Organic spice blends have the highest retail sales in Germany, France, and the Netherlands. Like many kinds of foods, consumers are increasingly seeking regionally sourced or fairly traded spices, often concerned with minimal processing and sustainable packaging.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 4.3% |

Japan is seeing steady growth in its organic spice market as consumers turn toward clean-label and natural health-supportive food products. Increasing demand for spicy culinary herbs used in plant-based and fusion cuisine Retailers are upping their investments in premium organic imports, especially in India and Sri Lanka.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

A Hot Market for Organic Spices With a Growing Focus on Home Cooking, Wellness. Delivery platforms are diversifying their organic spice offerings, while fermentation and immunity-boosting spice blends tailored to Korean taste buds are among a number of new product innovations.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

The two market-leading organic spices segments are also ginger and turmeric due to consumers who increasingly put priority on wellness, natural immunity, and sustainable sourcing in their food choices. Such spices are functional health products as well makes it culinary versatile and widely accepted across various cultures hence these are considered staple products in organic food retail and personal health regimens.

Because of its digestive, anti-inflammatory, and flavor-enhancing properties, there has been strong adoption of organic ginger in food processing, nutraceutical, and herbal supplement sectors. Versus synthetic flavorings, or conventional ginger, organic varieties have cleaner sourcing and fewer pesticide residues.

Increasing adoption of organic ginger (the ingredient) is being driven by its ability to act as a digestive aid and detox tea, in addition to the rising popularity of plant-based functional beverages. According to studies, ginger is one of the top-selling ingredients in functional spice-based health products worldwide.

Over the next eight years, the cold-pressed juices and ginger powered health tonics grown to achieve a major share of the health supplements across both North America and Asia-Pacific coupled with the spread of Ayurvedic preparations that will continue to strengthen market growth.

Incorporation of organic ginger in vegan baking, gourmet sauces, and international cuisine have stoked the growth further, indicating the culinary versatility of the product. By establishing traceable fair-trade ginger supply chains, manufacturers are able to optimize ethical sourcing, thereby increasing both trust and product value for health-aware consumers.

While it brings many wellness benefits along with its flavor, organic ginger can also be challenging with price volatility, weather-dependent yields and storage sensitivity. Nonetheless, progress in climate-resilient cultivation methods, vacuum-sealed packaging, and organic ginger extract are improving stability and demand remains strong. Turmeric Is Reaching New Heights as Curcumin-Based Health and Culinary Uses Are on the Rise

Owing to its anti-inflammatory, antioxidant, and immunity-boosting properties, organic turmeric has secured the boosters for the market. The conventional turmeric often comes with a baggage of residues additional to curcumin, which the organic segment full-fills, correlating it to clean-label and therapeutic trends.

Growth has been driven by increasing turmeric demand in immunity boosters, joint health supplements, and functional foods. Incorporation of turmeric in these products has maintained its market outreach as per its conventional uses.

In addition, the inclusion of organic turmeric in sports nutrition, beauty products, and holistic medicine formulations has spurred adoption across consumer segments. This technology has led to high curcumin varieties of turmeric to be developed, standardized organic certifications, and sustainable farming cooperatives to further perfect product consistency and market reach.

While organic turmeric offers various benefits, including health advantages and better flavor, processing challenges and even the risk of adulteration have been known to plague organic turmeric. But advances in microencapsulation, quick quality testing, and enhanced drying methods are boosting shelf life and integrity, making sure demand remains in the fast lane.

Powder & granules and flakes are two leading segments in the global organic spices market, as they cater to the need for convenience, storage feasibility, and use of preferred intensity by consumers during food preparation.

Organic spice powders and granules have become the prevalent form in retail and food service, enabling fine, uniform texture that can be used at various rates. Unlike whole spices, powders integrate easily into liquids and batters, which lends to uses in soups, sauces, smoothies and seasoning blends.

Adoption has been propelled by increasing demand for ready-to-use cooking ingredients, clean-label spice mixes and single-origin spice powder. According to studies, powdered organic ginger and turmeric make up the bulk of sales for spice shelves in health food stores.

The rapid increase in e-commerce platforms and subscription spice kits have made powdered spices easily accessible to home chefs and gift-givers. This was mainly aided by the incorporation of biodegradable pouches, resealable packaging, and tamper-evident closures into the available options, which has also improved freshness and ensured traceability. It has given rise to ultra-fine, micro-ground, organic spice formats specifically customized for beverages and capsule supplements to prepare functionally food.

Although the powder and granule forms offer convenience and uniformity, some problems such as clumping and potency loss over time have been reported. But the ones with success are leading the market thanks to moisture resistant packaging, inert gas flushing and natural anti-caking agents that enhance shelf stability.

Flakes have grown ever popular as Foodies and Chefs Explore Texture and Visuals in Organic Cuisine Organic spice flakes are increasingly gaining traction in premium food and health-conscious customer segments that desire less processed, visually unique ingredients. Flakes retain a greater portion of the original spice’s texture, aroma and look than powders do.

Growing demand for artisanal seasoning, spice toppers, and slow-cooked plates has fueled adoption of flakes in meal kits, gourmet foodservice, and retail jars. The growing demand for organic spice blends, such as turmeric and ginger flakes combined with herbs and chili, has bolstered the rapid expansion of the market through global fusion cuisine or specialty dishes. Adoption has also been driven by application of spice flakes in dry rubs, infused oils and flavored salts, targeting food enthusiasts and clean-label brands.

New techniques have optimized performance in soups and sauces with freeze-dried, low-moisture organic spice flakes for better rehydration and flavor release. Though appealing in saves and minimal handling, flakes have challenges such as uneven segregation in mass production and larger packaging space needs. But with the introduction of innovative flake-size standardization, low-impact drying and eco-packaging addition, they are becoming a larger part of the organic spices business.

Market overview organic spices are undergoing a surge in the demand due to the growing influences of clean-label food requirements among consumers, growing need for chemical-free culinary ingredients, and growing global adoption of organic farming practices. Companies are exploring traceability, sustainable sourcing, and AI-assisted quality grading to meet organic certification standards.

Major players include spice processors, organic food brands and fair-trade certified cooperatives. Efforts at innovation focus on low-temperature drying, biodegradable packaging and blockchain-based traceability to maintain purity and authenticity throughout supply chains.

Market Share Analysis by Key Players & Organic Spice Producers

| Company Name | Estimated Market Share (%) |

|---|---|

| McCormick & Company, Inc. | 14-18% |

| Frontier Co-op | 12-16% |

| Organic Spices Inc. (Spicely) | 10-14% |

| Simply Organic (subsidiary of Frontier) | 8-12% |

| Rapid Organic Pvt. Ltd. | 6-9% |

| Other Organic Spice Brands | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| McCormick & Company, Inc. | Offers USDA-certified organic spice lines, fair-trade ingredients, and smart packaging for freshness retention. |

| Frontier Co-op | Offers a large selection of certified organic spices and herbs via cooperative sourcing models. |

| Organic Spices Inc. | Spicely brand encompasses Clean-label, gluten-free, and allergen-free organic spice blends. |

| Simply Organic | In addition to spicy seasonings, Spicy Fortune also offers spicy seasoning blends, and they are 100% organic single-origin spices, which means they are committed to environmentally and socially responsible practices |

| Rapid Organic Pvt. Ltd. | Focuses on farm-to-fork organic spice processing with blockchain traceability and ethical sourcing. |

Key Market Insights

McCormick & Company, Inc. (14-18%)

McCormick is the global leader with its organic line centered on purity, traceability, and sustainability. Industry benchmarks are set by its reach for distribution and research and development in flavor stability.

Frontier Co-op (12-16%)

Frontier Co-op sources spices through smallholder organic farms and global cooperatives, offering a robust catalog of whole, ground, and blended spices with verified organic compliance.

Organic Spices Inc. (Spicely) (10-14%)

Spicely stands out for its allergen-free, kosher, and non-GMO certified organic spice products, offered in compostable packaging for eco-conscious consumers.

Simply Organic (8-12%)

Simply Organic selling with reclaimed, single plantation herbs and flavors with a look toward moral sourcing and deliberate giving through its Simply Organic Giving Fund™

Rapid Organic Pvt. Ltd. (6-9%)

Rapid Organic brings traceable, direct-from-farm organic spices to the global market using blockchain and AI-powered quality control to ensure compliance with international food safety standards.

Other Key Players (30-40% Combined)

Numerous regional and private-label brands are expanding access to organic spices through e-commerce and retail channels. These include:

The overall market size for the organic spices market was USD 11,903 Million in 2025.

The organic spices market is expected to reach USD 18,134 Million in 2035.

The demand for organic spices is rising due to increasing consumer preference for chemical-free and natural food ingredients, growing awareness of health and wellness, and expanding organic food retail channels. Supportive government regulations and rising demand for clean-label products are further fueling market growth.

The top 5 countries driving the development of the organic spices market are India, the USA, China, Germany, and the UK

Powder & Granules and Flakes Form Segments are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Metric Tons) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 4: Global Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 6: Global Market Volume (Metric Tons) Forecast by Form, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-Use, 2017 to 2033

Table 8: Global Market Volume (Metric Tons) Forecast by End-Use, 2017 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distibution Channel, 2017 to 2033

Table 10: Global Market Volume (Metric Tons) Forecast by Distibution Channel, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 12: North America Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 14: North America Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 16: North America Market Volume (Metric Tons) Forecast by Form, 2017 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End-Use, 2017 to 2033

Table 18: North America Market Volume (Metric Tons) Forecast by End-Use, 2017 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distibution Channel, 2017 to 2033

Table 20: North America Market Volume (Metric Tons) Forecast by Distibution Channel, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: Latin America Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 24: Latin America Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 26: Latin America Market Volume (Metric Tons) Forecast by Form, 2017 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End-Use, 2017 to 2033

Table 28: Latin America Market Volume (Metric Tons) Forecast by End-Use, 2017 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distibution Channel, 2017 to 2033

Table 30: Latin America Market Volume (Metric Tons) Forecast by Distibution Channel, 2017 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: Europe Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 34: Europe Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 36: Europe Market Volume (Metric Tons) Forecast by Form, 2017 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by End-Use, 2017 to 2033

Table 38: Europe Market Volume (Metric Tons) Forecast by End-Use, 2017 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Distibution Channel, 2017 to 2033

Table 40: Europe Market Volume (Metric Tons) Forecast by Distibution Channel, 2017 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: East Asia Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 44: East Asia Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 46: East Asia Market Volume (Metric Tons) Forecast by Form, 2017 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by End-Use, 2017 to 2033

Table 48: East Asia Market Volume (Metric Tons) Forecast by End-Use, 2017 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Distibution Channel, 2017 to 2033

Table 50: East Asia Market Volume (Metric Tons) Forecast by Distibution Channel, 2017 to 2033

Table 51: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 52: South Asia Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 53: South Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 54: South Asia Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 55: South Asia Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 56: South Asia Market Volume (Metric Tons) Forecast by Form, 2017 to 2033

Table 57: South Asia Market Value (US$ Million) Forecast by End-Use, 2017 to 2033

Table 58: South Asia Market Volume (Metric Tons) Forecast by End-Use, 2017 to 2033

Table 59: South Asia Market Value (US$ Million) Forecast by Distibution Channel, 2017 to 2033

Table 60: South Asia Market Volume (Metric Tons) Forecast by Distibution Channel, 2017 to 2033

Table 61: Oceania Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 62: Oceania Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 63: Oceania Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 64: Oceania Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 65: Oceania Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 66: Oceania Market Volume (Metric Tons) Forecast by Form, 2017 to 2033

Table 67: Oceania Market Value (US$ Million) Forecast by End-Use, 2017 to 2033

Table 68: Oceania Market Volume (Metric Tons) Forecast by End-Use, 2017 to 2033

Table 69: Oceania Market Value (US$ Million) Forecast by Distibution Channel, 2017 to 2033

Table 70: Oceania Market Volume (Metric Tons) Forecast by Distibution Channel, 2017 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 72: Middle East and Africa Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 74: Middle East and Africa Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 76: Middle East and Africa Market Volume (Metric Tons) Forecast by Form, 2017 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by End-Use, 2017 to 2033

Table 78: Middle East and Africa Market Volume (Metric Tons) Forecast by End-Use, 2017 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Distibution Channel, 2017 to 2033

Table 80: Middle East and Africa Market Volume (Metric Tons) Forecast by Distibution Channel, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distibution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 7: Global Market Volume (Metric Tons) Analysis by Region, 2017 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 11: Global Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 15: Global Market Volume (Metric Tons) Analysis by Form, 2017 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End-Use, 2017 to 2033

Figure 19: Global Market Volume (Metric Tons) Analysis by End-Use, 2017 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distibution Channel, 2017 to 2033

Figure 23: Global Market Volume (Metric Tons) Analysis by Distibution Channel, 2017 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distibution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distibution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Form, 2023 to 2033

Figure 28: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 29: Global Market Attractiveness by Distibution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distibution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 37: North America Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 41: North America Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 45: North America Market Volume (Metric Tons) Analysis by Form, 2017 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by End-Use, 2017 to 2033

Figure 49: North America Market Volume (Metric Tons) Analysis by End-Use, 2017 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distibution Channel, 2017 to 2033

Figure 53: North America Market Volume (Metric Tons) Analysis by Distibution Channel, 2017 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distibution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distibution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Form, 2023 to 2033

Figure 58: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 59: North America Market Attractiveness by Distibution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distibution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 67: Latin America Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 71: Latin America Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 75: Latin America Market Volume (Metric Tons) Analysis by Form, 2017 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by End-Use, 2017 to 2033

Figure 79: Latin America Market Volume (Metric Tons) Analysis by End-Use, 2017 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distibution Channel, 2017 to 2033

Figure 83: Latin America Market Volume (Metric Tons) Analysis by Distibution Channel, 2017 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distibution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distibution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distibution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Distibution Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 97: Europe Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 101: Europe Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 105: Europe Market Volume (Metric Tons) Analysis by Form, 2017 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by End-Use, 2017 to 2033

Figure 109: Europe Market Volume (Metric Tons) Analysis by End-Use, 2017 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Distibution Channel, 2017 to 2033

Figure 113: Europe Market Volume (Metric Tons) Analysis by Distibution Channel, 2017 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Distibution Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Distibution Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Form, 2023 to 2033

Figure 118: Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 119: Europe Market Attractiveness by Distibution Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Distibution Channel, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 127: East Asia Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 131: East Asia Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 135: East Asia Market Volume (Metric Tons) Analysis by Form, 2017 to 2033

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 138: East Asia Market Value (US$ Million) Analysis by End-Use, 2017 to 2033

Figure 139: East Asia Market Volume (Metric Tons) Analysis by End-Use, 2017 to 2033

Figure 140: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 142: East Asia Market Value (US$ Million) Analysis by Distibution Channel, 2017 to 2033

Figure 143: East Asia Market Volume (Metric Tons) Analysis by Distibution Channel, 2017 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Distibution Channel, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Distibution Channel, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 148: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Distibution Channel, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 153: South Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 154: South Asia Market Value (US$ Million) by Distibution Channel, 2023 to 2033

Figure 155: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 157: South Asia Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 161: South Asia Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 165: South Asia Market Volume (Metric Tons) Analysis by Form, 2017 to 2033

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 168: South Asia Market Value (US$ Million) Analysis by End-Use, 2017 to 2033

Figure 169: South Asia Market Volume (Metric Tons) Analysis by End-Use, 2017 to 2033

Figure 170: South Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 171: South Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 172: South Asia Market Value (US$ Million) Analysis by Distibution Channel, 2017 to 2033

Figure 173: South Asia Market Volume (Metric Tons) Analysis by Distibution Channel, 2017 to 2033

Figure 174: South Asia Market Value Share (%) and BPS Analysis by Distibution Channel, 2023 to 2033

Figure 175: South Asia Market Y-o-Y Growth (%) Projections by Distibution Channel, 2023 to 2033

Figure 176: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 178: South Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 179: South Asia Market Attractiveness by Distibution Channel, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Form, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Distibution Channel, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 187: Oceania Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 191: Oceania Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: Oceania Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 195: Oceania Market Volume (Metric Tons) Analysis by Form, 2017 to 2033

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 198: Oceania Market Value (US$ Million) Analysis by End-Use, 2017 to 2033

Figure 199: Oceania Market Volume (Metric Tons) Analysis by End-Use, 2017 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Distibution Channel, 2017 to 2033

Figure 203: Oceania Market Volume (Metric Tons) Analysis by Distibution Channel, 2017 to 2033

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Distibution Channel, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Distibution Channel, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 208: Oceania Market Attractiveness by End-Use, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Distibution Channel, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Distibution Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 217: Middle East and Africa Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 221: Middle East and Africa Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 225: Middle East and Africa Market Volume (Metric Tons) Analysis by Form, 2017 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by End-Use, 2017 to 2033

Figure 229: Middle East and Africa Market Volume (Metric Tons) Analysis by End-Use, 2017 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Distibution Channel, 2017 to 2033

Figure 233: Middle East and Africa Market Volume (Metric Tons) Analysis by Distibution Channel, 2017 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Distibution Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distibution Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by End-Use, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Distibution Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Organic Fruit Powder Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA