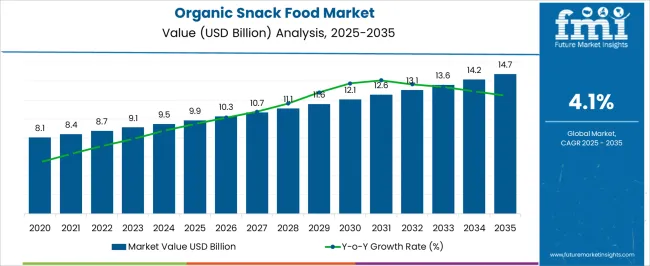

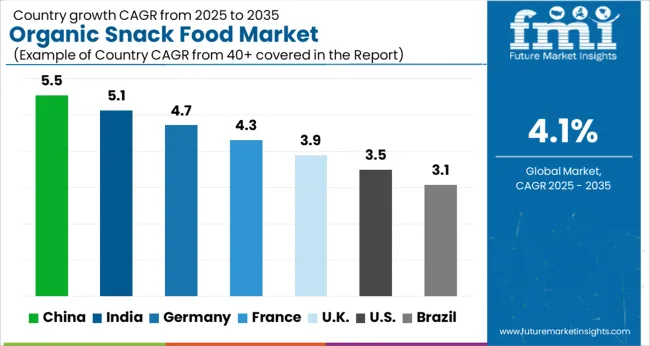

The Organic Snack Food Market is estimated to be valued at USD 9.9 billion in 2025 and is projected to reach USD 14.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Organic Snack Food Market Estimated Value in (2025E) | USD 9.9 billion |

| Organic Snack Food Market Forecast Value in (2035F) | USD 14.7 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The organic snack food market is experiencing robust growth due to a marked shift in consumer preferences toward healthier, minimally processed, and ethically sourced food products. This transition is being supported by increasing awareness about the health implications of synthetic additives, pesticides, and genetically modified ingredients, leading to a surge in demand for clean-label snacks. Strong government regulations and certifications around organic labeling have strengthened consumer trust and transparency across global markets.

Manufacturers are responding with product lines that emphasize non-GMO ingredients, natural flavorings, and sustainable packaging, aligning with the growing environmental consciousness among consumers. The market is further benefiting from the expansion of health-focused food retail chains and online grocery platforms that enhance product visibility and accessibility.

In the forecast period, continued innovation in taste, convenience, and nutritional value is expected to attract a broader demographic, including millennials and young families These dynamics are anticipated to solidify organic snacks as a core category within the broader functional and health foods ecosystem.

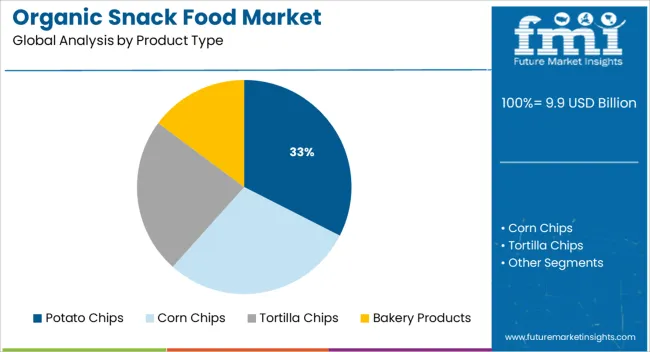

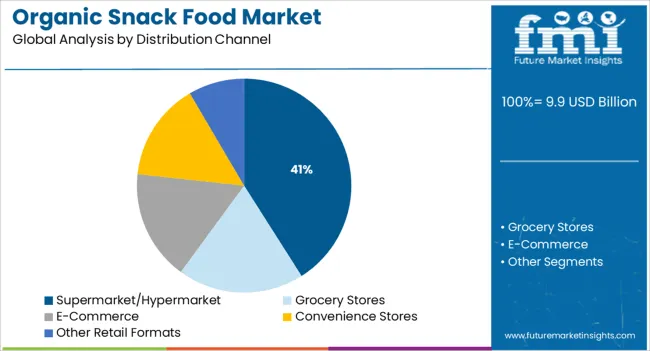

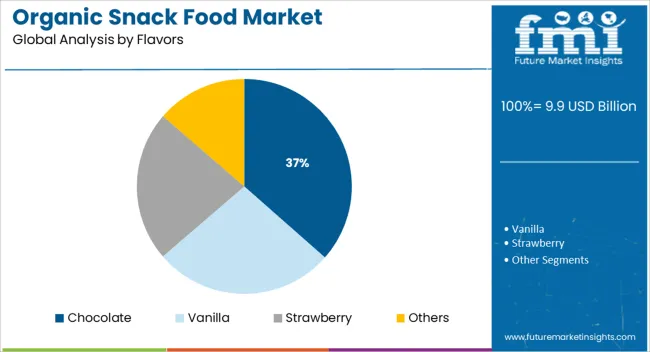

The market is segmented by Product Type, Distribution Channel, and Flavors and region. By Product Type, the market is divided into Potato Chips, Corn Chips, Tortilla Chips, and Bakery Products. In terms of Distribution Channel, the market is classified into Supermarket/Hypermarket, Grocery Stores, E-Commerce, Convenience Stores, and Other Retail Formats. Based on Flavors, the market is segmented into Chocolate, Vanilla, Strawberry, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Potato chips are expected to account for 32.5% of the total revenue share in the organic snack food market in 2025, making them the leading product type. The dominance of this segment is being supported by the growing consumer demand for familiar yet healthier alternatives to conventional snack foods. Organic potato chips offer a recognizable taste profile while addressing concerns around artificial preservatives, hydrogenated oils, and pesticide-laden ingredients.

The segment’s appeal is being further enhanced by the use of organic seasonings and innovative frying techniques such as kettle-cooked or air-fried processing that reduce oil absorption. Improved shelf stability through natural preservation methods and clean-label ingredient transparency have contributed to stronger retail uptake.

Manufacturers have also focused on offering smaller pack sizes and resealable packaging formats, aligning with on-the-go lifestyles The continued availability of diverse flavors within the organic potato chip category has expanded its reach among different age groups, reinforcing its position as a popular and convenient snack option.

Supermarket and hypermarket distribution channels are projected to represent 41.0% of the organic snack food market’s revenue share in 2025. This leadership is being driven by the increasing shelf space allocated to health-oriented products and the strategic positioning of organic snacks within high-traffic areas of stores. Retailers are enhancing in-store visibility through dedicated organic food sections, attractive end-cap displays, and sampling programs that encourage consumer trial and repeat purchases.

The trust factor associated with physical store verification, product inspection, and access to certified organic labels has played a critical role in strengthening consumer confidence. Partnerships between organic snack brands and large-format retailers have resulted in more competitive pricing and wider product assortments.

As consumers continue to prioritize convenience and immediate availability, supermarket and hypermarket chains have become key facilitators of discovery and accessibility for organic snack offerings In-store promotions, loyalty programs, and eco-friendly marketing campaigns have further supported sales growth through this channel.

Chocolate-flavored organic snacks are anticipated to hold 36.5% of the total revenue share in the organic snack food market by 2025, marking them as the dominant flavor segment. The popularity of chocolate is being sustained by its broad sensory appeal and the perceived indulgence it offers while still aligning with health-conscious consumer values. Organic chocolate flavoring is being increasingly derived from fair-trade cocoa, combined with natural sweeteners such as coconut sugar or agave, enhancing both taste and nutritional value.

Manufacturers are integrating chocolate into a variety of organic snack forms including bars, granola bites, and dipped fruit snacks, contributing to higher consumption across multiple snacking occasions. The clean-label positioning and minimal processing of these products are resonating with consumers seeking guilt-free indulgence.

The segment is further supported by seasonal product launches, limited-edition variants, and gifting-oriented packaging formats With continued product innovation and ethical sourcing narratives, chocolate remains a flavor of choice for those seeking both satisfaction and health alignment in their snacking habits.

With a CAGR of 5.6% between 2020 and 2025, the global market for Organic Snack Food Market expanded from USD 6.9 Billion to USD 8.6 Billion.

The main global consumers of organic snack foods are millennials and children. Because organic snacks include only natural ingredients, demand for them is growing quickly and they are becoming more and more well-known worldwide. Over the forecast period, the market for organic snack foods is anticipated to be driven by rising demand for nutritious snacks as a result of rising health awareness.

One of the major drivers of the growth of the organic snack food industry is the expansion of organic farming and the practice of organic agriculture in various developed regions.

Because organic food items are healthier and more environmentally friendly than conventional food products, customers are gravitating toward consuming them, which is another important driver driving the growth of the organic snack food industry. Therefore, the market for organic snack foods is mostly driven by young customers' high impulse buying tendencies.

With a high CAGR of 4.1% over the projected period, it is expected that the global Organic Snack Food Market would increase from USD 9.9 billion in 2025 to USD 14.7 Billion by 2035.

Organic snack food has become increasingly popular in North America due to its many health benefits. Consumers are drawn to these snacks because they are free of synthetic pesticides, growth hormones, and preservatives. The organic snack food market is continuously growing and developing in the region as more people look for healthier alternatives.

Organic snack foods provide a multitude of nutrients that help build strong bones, reduce inflammation, boost immunity, and support overall health; plus their ingredients often lack artificial colors or flavors. This makes them much healthier than non-organic options which may contain added sugars and unhealthy fats like trans-fat or saturated fat. Additionally, organic snacks usually have fewer calories than their conventional counterparts making them an ideal choice for those looking to maintain a healthy diet.

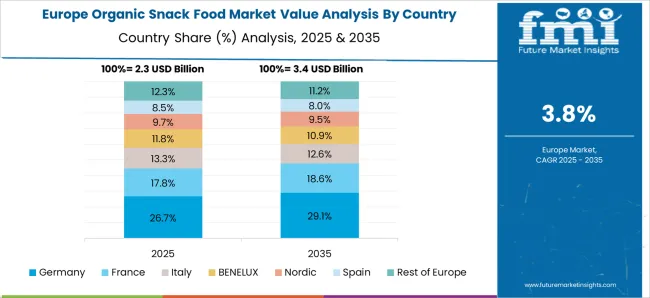

Organic snack food is becoming increasingly popular in Europe, as consumers become more mindful of their diets. The market for organic snack food has seen strong growth over the past few years, with demand continuing to grow. Organic products are now widely available across Europe, and their growing popularity is prompting manufacturers to introduce new products that cater to a variety of dietary needs.

The European market for organic snacks has been largely driven by demand from health-conscious consumers who are looking for healthier options than traditional snacks. This change in consumer behavior has encouraged many companies to focus on developing more nutritious and sustainable alternatives that offer both convenience and taste. Additionally, the increasing awareness of the negative impacts of processed foods on health is driving up sales of organic snacks in Europe too.

The organic snack food market in the Asia Pacific is growing at a rapid rate, with many consumers keen to purchase healthier options. In recent years, the region has seen an increasing demand for snacks made from natural and organic ingredients, as well as those that are free from artificial preservatives and additives. Organic snacks have become increasingly popular among health-conscious consumers looking to maintain their diet without compromising on taste.

A key factor driving the growth of the market is the rise of health consciousness among individuals in the Asia Pacific. Consumers in this region are now more aware of the benefits that come with consuming organic food products, such as improved nutrient content and fewer toxins. Moreover, there is a growing preference for natural ingredients over artificial ones which has further pushed forward the demand for these products.

Organic snack food has become a major hit in the market lately, especially with its chocolate flavor. It is no wonder why the demand for this product has been steadily increasing. Consumers have found that organic snack food has many advantages over other regular snacks. The most significant of these advantages is its health benefits.

Organic snack food contains natural ingredients and does not contain any artificial preservatives or flavorings. This means that it is a much healthier option than regular snacks which often contain trans-fats and chemical additives.

The rich flavor of chocolate also plays an important role in driving demand for organic snack foods. Chocolate pairs perfectly with many different ingredients, such as nuts and dried fruits, making it a great accompaniment to healthy snacks like trail mix or granola bars.

Organic snack foods have become increasingly popular in recent years, as more consumers are looking to eat healthier options. The organic snack food market is segmented on its channel of distribution based on the different types of businesses that provide access to these products. This includes traditional grocery stores, natural and specialty food stores, convenience stores, e-commerce sites, and direct-to-consumer channels.

Traditional grocery stores account for the largest portion of sales within this segment, followed by natural and specialty food outlets such as health food stores or farmers' markets. Convenience stores are also a popular source of organic snacks because they often offer a wide selection at competitive prices. E-commerce sites have also seen an increase in demand for organic snack foods due to their ability to provide convenient access from anywhere in the world.

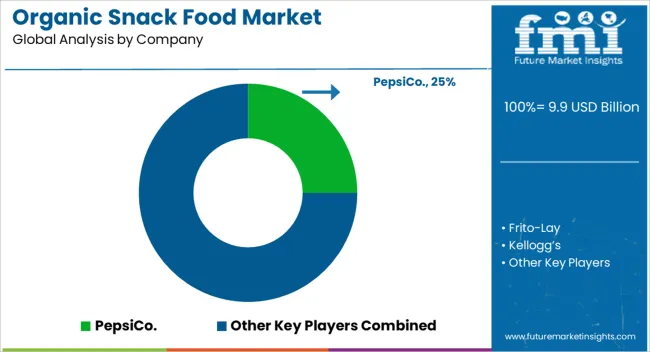

Companies are constantly competing against each other for larger shares in the competitive landscape of the organic snack food market.

Furthermore, manufacturers are introducing new flavors and snacks to satisfy changing consumer preferences and attract new customers to their product segments. For example, consumers have responded positively to healthier options like gluten-free or protein bars which have become increasingly popular among health-conscious individuals.

The key players in this competitive landscape are Frito-Lay, and PepsiCo. General Mills and Kellogg's; these four companies hold the most significant shares of the USA organic snacks market.

Companies like PepsiCo have been quick to capitalize on this trend by introducing organic snack lines such as Naked Juice Co.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa (MEA) |

| Key Countries Covered | Philippines, India, Malaysia, Thailand, The USA, Germany, China, Japan, Denmark, Canada, Mexico, Poland, The UK, Turkey, France, Italy, Spain, South Korea, Russia, Australia, Brazil, Argentina, South Africa |

| Key Segments Covered | Product Type, Distribution Channel, Flavors, Region |

| Key Companies Profiled | PepsiCo.; Frito-Lay; Kellogg’s; Pure Organic; General Mills; Organic Food Bar; PRANA; Navitas Naturals; Made in Nature; SunOpta; Simple Squares; Woodstock Farms Manufacturing |

| Report Coverage | DROT Analysis, Market Forecast, Company Share Analysis, Market Dynamics and Challenges, Competitive Landscape, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global organic snack food market is estimated to be valued at USD 9.9 billion in 2025.

The market size for the organic snack food market is projected to reach USD 14.7 billion by 2035.

The organic snack food market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in organic snack food market are potato chips, corn chips, tortilla chips and bakery products.

In terms of distribution channel, supermarket/hypermarket segment to command 41.0% share in the organic snack food market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Organic Fruit Powder Market Size, Growth, and Forecast for 2025 to 2035

Organic Condiments Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA