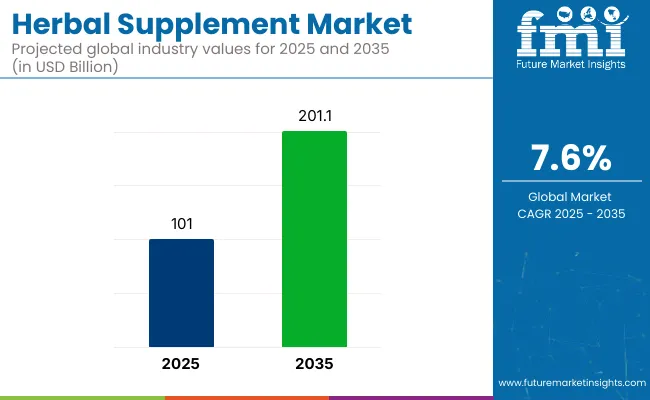

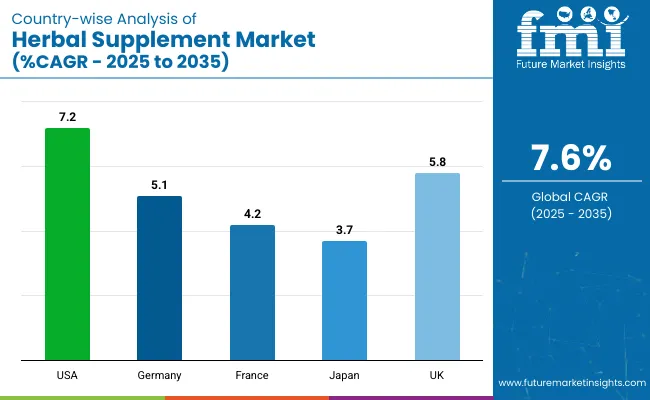

The global herbal supplement market is projected to grow from USD 101.0 billion in 2025 to USD 201.1 billion by 2035, registering a CAGR of 7.6%. Market expansion is being driven by increasing consumer preference for natural, plant-based health solutions and rising awareness of preventive healthcare.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 101.0 billion |

| Industry Value (2035F) | USD 201.1 billion |

| CAGR (2025 to 2035) | 7.6% |

Shifts toward clean-label products, growing aging populations, and higher rates of chronic lifestyle diseases are encouraging adoption of herbal supplements across various demographics.

The herbal supplement market holds approximately 43% share of the global nutritional supplements market and around 21% of the dietary supplements market, reflecting its core position in natural health solutions. Within the functional foods and beverages market, it contributes nearly 8%, while its share in the consumer healthcare products market is about 3.5%.

In the pharmaceutical and botanical products market, herbal supplements represent close to 2%, and account for less than 0.5% of the broader pharmaceutical market. These figures highlight the sector’s significance in wellness-focused categories, with room for growth across overlapping health and nutrition domains.

Government regulations impacting the market emphasize product safety, efficacy, and labeling transparency. In India, regulations such as the Drugs and Cosmetics Act, 1940, the Food Safety and Standards Act (FSSA), 2006, and AYUSH guidelines mandate stringent quality control, proper herbal identification, and adherence to safety standards for herbal formulations.

Globally, bodies like the FDA, EFSA, and WHO set protocols for claims, good manufacturing practices (GMP), and botanical authentication. These frameworks are fueling the adoption of standardized herbal supplements, ensuring consumer trust and fostering market growth through compliance and innovation.

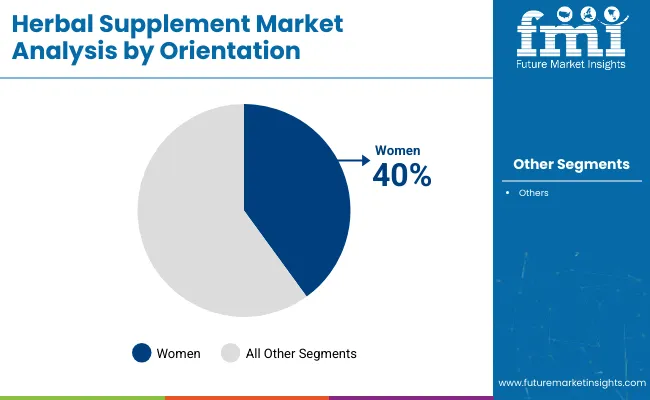

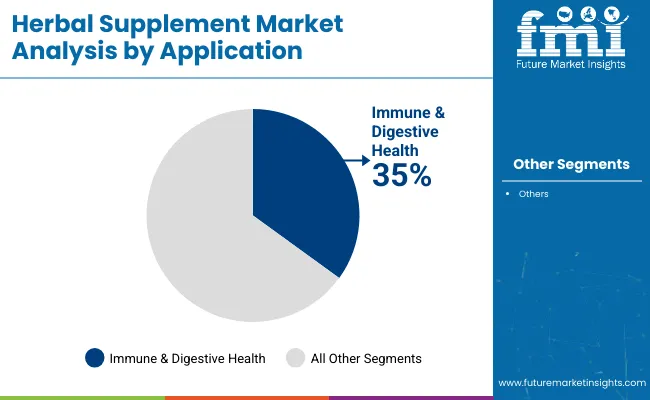

The United States is projected to be the fastest-growing market, expanding at a CAGR of 7.2% from 2025 to 2035. Women will lead the consumer orientation segment with a 40% share, while immune & digestive health will dominate the application segment with a 35% share in 2025. The UK and Germany markets are expected to grow steadily, with CAGRs of 5.8% and 5.1%, respectively. Japan and France are projected to experience moderate growth, with CAGRs of 3.7% and 4.2%, respectively.

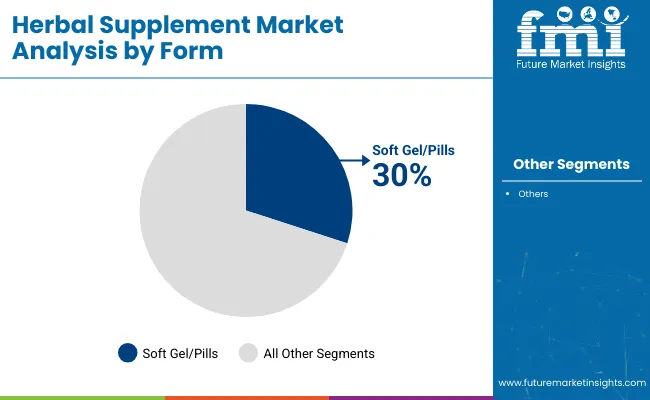

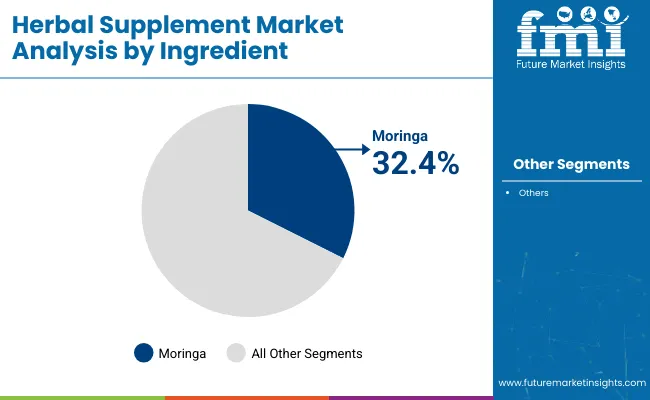

The herbal supplement market is segmented by form, ingredient, consumer orientation, application, distribution channel, and region. By form, the market is divided into soft gel/pills, confectionery products, gummies, chewable pills, gel caps, powder, and liquid. In terms of ingredients, the market is classified into moringa, echinacea, flaxseeds, turmeric, ginger, ginseng, and other ingredients like horehound and elderberry.

Based on consumer orientation, the market is divided into men, women, senior citizens, and others (kids & toddlers). In terms of application, the market is segmented into weight loss, sports nutrition, general well-being, immune & digestive health, bone & joint health, heart health, and other specific requirements like anti-allergies & eye health.

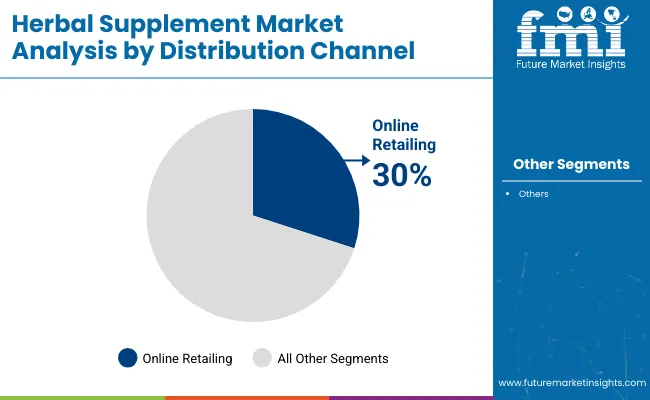

By distribution channel, the market is classified into hypermarkets/supermarkets, convenience stores, drug stores and pharmacies, health and wellness stores, and online retailing. Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

Soft gel/pills are expected to dominate the form segment with a 30% market share by 2025, driven by their convenience, ease of swallowing, accurate dosage, and extended shelf-life preferred by both adults and seniors.

Moringa is projected to lead the ingredient segment with a 32.4% market share in 2025, owing to its high nutritional value, antioxidant properties, and growing use in immunity-boosting and wellness-focused herbal supplements.

Women are projected to lead the consumer orientation segment with a 40% market share in 2025, driven by rising demand for beauty, wellness, and hormonal health supplements tailored specifically to female health needs.

Immune and digestive health is projected to dominate the application segment with a 35% market share in 2025, fueled by growing consumer focus on gut health, disease prevention, and post-pandemic immunity enhancement.

Online retailing is expected to lead the distribution channel segment with a 30% market share by 2025, driven by rising e-commerce adoption, convenience, wider product availability, and increased consumer preference for doorstep delivery of supplements.

The global market is experiencing steady growth, driven by the increasing demand for natural, plant-based products and consumer preference for holistic health solutions. Herbal supplements play a vital role in enhancing health and wellness by providing various benefits such as immune support, digestive health, and mental well-being.

Recent Trends in the Herbal Supplement Market

Challenges in the Herbal Supplement Market

The United States maintains its dominance due to growing consumer interest in plant-based wellness solutions, a strong retail network, and proactive adoption of natural products for preventive healthcare.

Germany Herbal Supplement Market and France Herbal Supplement Market remain robust, supported by EU organic certification mandates and national wellness campaigns. In contrast, developed economies such as the United States (7.2% CAGR), United Kingdom (5.8% CAGR), and Japan (3.7% CAGR) are growing steadily at a rate of 0.91 to 0.95 times the global average.

The United States leads the herbal supplement market in growth, supported by rising demand for immune boosters, clean-label products, and widespread e-commerce adoption. The United Kingdom follows, with growing consumer interest in vegan, adaptogenic, and beauty supplements, particularly among younger demographics.

The Germany market is expanding steadily due to strong pharmacy networks and a national push for certified organic products. The France market benefits from increased demand in heart, bone, and anti-allergy segments, driven by holistic health preferences. The Japan market, while growing slower, remains value-focused with continued interest in kampo formulations and preventative care among senior consumers.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The United States herbal supplement market is slated to grow at a CAGR of 7.2% from 2025 to 2035. Growth is driven by increasing awareness around lifestyle diseases, widespread availability of herbal products through pharmacies and online platforms, and the adoption of plant-based supplements for immunity and energy.

The Germany herbal supplement revenue is poised to expand at a CAGR of 5.1% during the forecast period. Market performance is tied to rising consumer preference for organic and non-synthetic wellness solutions. Focus on certified organic supplements in joint and digestive health

The herbal supplement demand in France is projected to expand at a CAGR of 4.2% from 2025 to 2035. Growth is driven by an increase in herbal solutions for bone health, heart health, and anti-allergy benefits. Demand rising in anti-allergy and cardiovascular herbal segments

The Japan herbal supplement revenue is projected to grow at a CAGR of 3.7% from 2025 to 2035, representing the slowest among the top five nations at 0.49 times the global pace.

The United Kingdom herbal supplement market is forecast to grow at a CAGR of 5.8% between 2025 and 2035. Post-Brexit divergence in regulatory frameworks has introduced market challenges, but consumer interest in clean-label and vegan supplements continues to rise.

The market is moderately consolidated, with prominent players such as Glanbia plc, Jarrow Formulas, Inc., Archer Daniels Midland Company, Nature’s Bounty, and Herbalife International of America, Inc. leading the industry. These companies offer a wide range of herbal formulations that cater to diverse consumer needs across wellness, immunity, digestion, and sports nutrition.

Glanbia plc focuses on clinically supported ingredients and performance nutrition. Jarrow Formulas, Inc. is known for high-quality supplements backed by scientific research. Archer Daniels Midland Company offers botanical-based solutions integrated with advanced food technologies. Nature’s Bounty delivers a broad range of herbal products through mass retail and pharmacy chains. Herbalife emphasizes meal replacement and weight management solutions with herbal components.

Recent Herbal Supplement Industry News

In April 2024, Glanbia announced the acquisition of Flavor Producers to bolster its flavour offering range.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 101.0 billion |

| Projected Market Size (2035) | USD 201.1 billion |

| CAGR (2025 to 2035) | 7.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/ volume in metric tons |

| Form Analyzed | Soft Gel/Pills, Confectionery Products, Gummies, Chewable Pills, Gel Caps, Powder, Liquid |

| Ingredients Analyzed | Moringa, Echinacea, Flaxseeds, Turmeric, Ginger, Ginseng, Other Ingredients (Horehound, Elderberry, etc.) |

| Consumer Orientation Analyzed | Men, Women, Senior Citizens, Others (Kids & Toddlers) |

| Application Analyzed | Weight Loss, Sports Nutrition, General Well-being, Immune & Digestive Health, Bone & Joint Health, Heart Health, Other Specific Requirements (Supplements, Anti-allergies & Eye-health) |

| Distribution Channel Analyzed | Hypermarkets/Supermarkets, Convenience Stores, Drug Stores and Pharmacies, Health and Wellness Stores, Online Retailing |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Glanbia plc, Jarrow Formulas, Inc., Archer Daniels Midland Company, Nature’s Bounty, Herbalife International of America, Inc., Blackmores, Nutraceutical International Corporation, Gaia Herbs, Ancient Green Fields Pvt. Ltd, Now Foods |

| Additional Attributes | Dollar sales by product form, share by ingredient type, regional demand trends, regulatory impact, clean-label trends, competitive benchmarking |

The market is valued at USD 101.0 billion in 2025.

The market is forecasted to reach USD 201.1 billion by 2035, reflecting a CAGR of 7.6%.

Women will dominate the consumer orientation segment, accounting for 40% of the global market share in 2025.

Immune & digestive health will lead the application segment with a 35% share in 2025.

The United States is projected to grow at the highest rate, with a CAGR of 7.2% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Herbal Supplements Market Size and Share Forecast Outlook 2025 to 2035

Herbal Beauty Product Market Size and Share Forecast Outlook 2025 to 2035

Herbal Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Herbal Personal Care Products Market Size and Share Forecast Outlook 2025 to 2035

Herbal Nutraceuticals Market Size and Share Forecast Outlook 2025 to 2035

Herbal Tea Market Analysis by Raw Material Type, Product Type, Flavor Type, Packaging Type, and Region Through 2035

Herbal Fragrance Ingredients Market Analysis by Application, Ingredients, and Region Through 2035

Supplements And Nutrition Packaging Market

Supplementary Protectors Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

Food Supplement Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Industry Analysis in Europe - Size, Share & Forecast 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Sleep Supplement Market Size and Share Forecast Outlook 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Analysis and Growth Projections for Green Supplement Business

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA