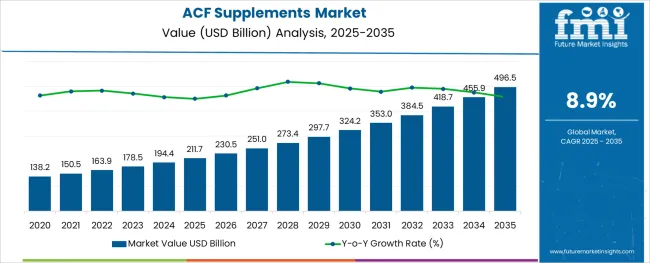

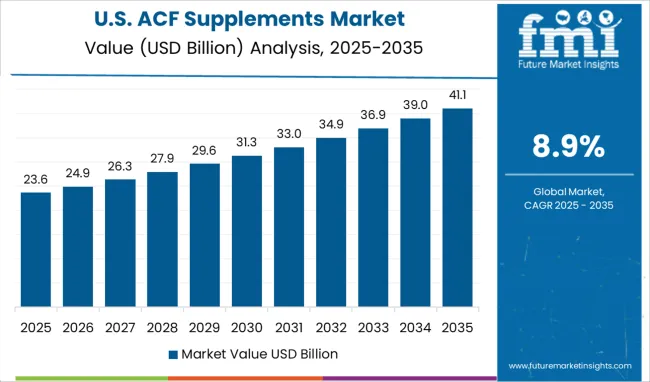

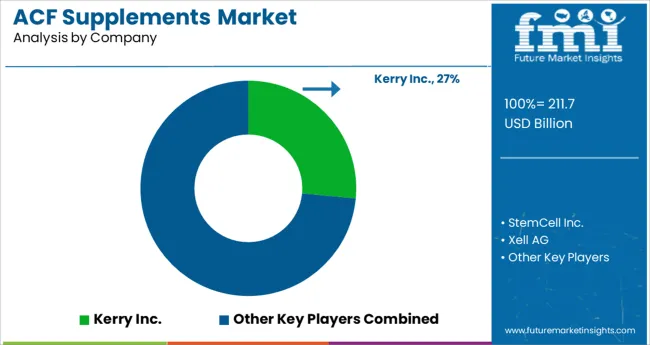

The ACF Supplements Market is estimated to be valued at USD 211.7 billion in 2025 and is projected to reach USD 496.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period.

The ACF supplements market is showing steady advancement as health-conscious consumers and clinical practitioners continue to embrace antioxidant collagen flavonoid supplements for various wellness and therapeutic purposes. Growing awareness of cellular health and oxidative stress management has encouraged the development of formulations targeting specific health needs. Nutritional science publications have highlighted the evolving role of ACF supplements in supporting skin health, cardiovascular function, and immune resilience.

Manufacturers have focused on improving product stability and bioavailability, especially in dry forms that offer longer shelf life and easier handling. Rising demand from the pharmaceutical sector, where these supplements are used as adjunct therapies, has broadened the market reach.

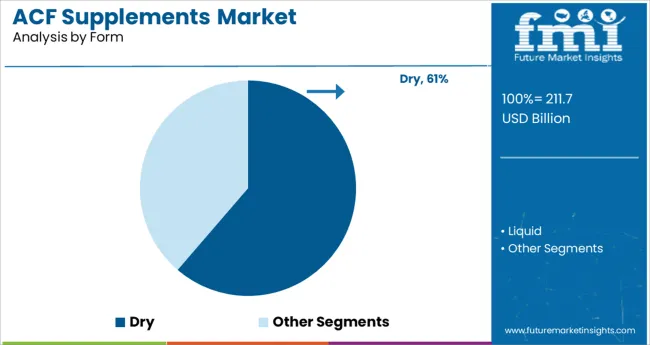

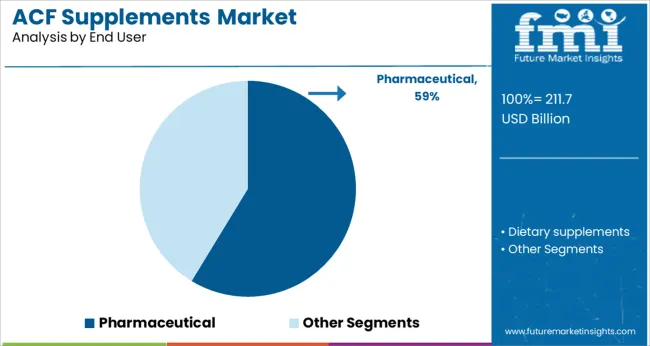

The market outlook is expected to remain positive as scientific understanding of antioxidants and flavonoids deepens and consumer trends continue to support preventive health routines. Segmental demand is expected to be driven by the Dry form category for its convenience in formulation and storage and by the Pharmaceutical end-user segment due to its clinical applications and prescription-based distribution.

The market is segmented by Form and End User and region. By Form, the market is divided into Dry and Liquid. In terms of End User, the market is classified into Pharmaceutical and Dietary supplements. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Dry segment is projected to contribute 61.3% of the ACF supplements market revenue in 2025, establishing itself as the leading form. The popularity of dry supplements has grown due to their ease of formulation and longer product stability compared to liquid alternatives. Manufacturers have favored the dry form because it enables greater flexibility in tablet, capsule, and powder production formats.

Consumers and healthcare providers have recognized the convenience of dry supplements, which are easier to dose and transport without refrigeration. Additionally, dry formulations offer improved shelf life and protection from degradation caused by moisture, supporting the integrity of antioxidant and flavonoid compounds.

As supplement manufacturers continue to expand product ranges across wellness and clinical categories, the Dry form segment is expected to retain its leadership in the market.

The Pharmaceutical segment is projected to hold 58.7% of the ACF supplements market revenue in 2025, maintaining its position as the top end user. This segment has grown as pharmaceutical companies have incorporated ACF supplements into broader therapeutic regimens targeting oxidative stress and tissue repair. The clinical community has increasingly prescribed these supplements to support patient recovery and chronic disease management, reflecting a shift toward integrative health solutions.

Dry ACF supplements have been widely used in pharmaceutical formulations for their stability and controlled dosing, aligning with stringent quality standards. Additionally, the pharmaceutical sector has leveraged clinical studies to validate the therapeutic benefits of antioxidants and flavonoids, enhancing patient trust in supplement-based interventions.

As healthcare systems place greater emphasis on preventive care and adjunctive therapies, the Pharmaceutical segment is expected to remain the dominant contributor to market revenue.

The ACF supplements market has received a lot of traction in the industry. The key factors responsible for the growth of the ACF supplements market are the growing development and invention of the pharmaceutical products and dietary supplements are encouraging the demand for ACF supplements and generating a lucrative scenario in the global ACF supplements market.

Owing to the increasing use of social media and other platforms, there is a growing awareness pertaining to animal rights and animal cruelty. This positively influences the growth of the ACF supplements market. This rising social media use has resulted in growing global shortages and price hikes of the supplements derived from animals, such as fetal bovine serum (FBS).

Eventually, this has resulted in more popularity of animal component-free and serum-free supplements, and this is more economical and cost-efficient. The global ACF supplements market growth will boom due to the rising awareness amongst the consumers of dietary supplements and pharmaceutical products and between the manufacturers of these products.

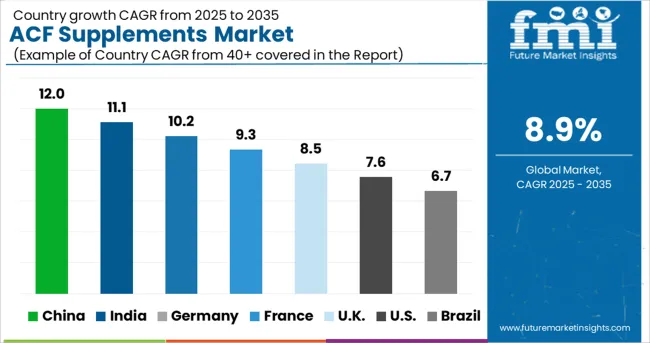

The sales of ACF supplements are also supported by more and more consumption of dietary supplements in western countries such as Canada, the U.S., Germany, the UK., etc., and due to the adoption of western lifestyle the Eastern countries such as China, India, Brazil, Indonesia, etc., have additional market opportunities.

There is a rise in cases of heart problems, diabetes, cognitive impairment, etc.; this has resulted in consumers adopting dietary supplements to stay fit. This is boosting the sales of dietary supplements, and considering the trend for plant-based products and ingredients, the global ACF supplements market will propel during the forecast period.

The growth rate of the ACF supplements market is said to ascend owing to the expanding health and fitness industry and consumer preference for meat alternatives, increasing knowledge around the advantages of proteins and a protein-rich diet.

There is an excessive expense directed toward the research and development activities in the cell culture industry. This is enabling the invention of novel products in the ACF supplements market along with improved functionality such as compatibility with a wide variety of commercially available culture media and increased single-cell cloning efficiency of CHO cells media. ACF supplements comprise recombinant proteins and phenol red, without any animal components, hydrolysates, serum, L-glutamine, etc.

North America’s market share is higher in the global ACF supplements market, followed by Europe. This is due to the increasing awareness of health and fitness coupled with the higher adoption of vegetarianism. Additionally, consumers are aware of the intake of a nutritious diet and rising concerns related to weight management; these factors will contribute to the growth of the ACF supplements market in this region.

Asia Pacific is anticipated to experience considerable growth in the ACF supplements market during the forecast period owing to excess expenditure for developing natural ingredients, a rise in disposable income, and rapid urbanization. In the Asia Pacific, especially China is said to garner the highest growth rate in terms of production.

Region-wise, the ACF supplements market is anticipated to gain maximum opportunity during the forecast period, specifically in the emerging economies owing to a higher rate of adoption of dietary supplements and pharmaceutical products. The rising ACF supplements consumption is backed by the growing GDP, booming middle-income population, and rising purchasing power.

Some of the leading companies operating in the global ACF Supplements market include STEMCELL Technologies Inc., Kerry Inc., StemCell Inc., Xell AG, InVitria, ScienCell Research Laboratories, Inc., HiMedia Laboratories, ZenBio, Biological Industries, PeproTech, Inc.

These market players are focussed on establishing their presence through acquisitions and collaborations. The manufacturing facilities and distribution network of these players are strong across regions. In April 2025, Kerry Inc., a global taste and nutrition giant, announced that they had successfully acquired the USA-based Natreon, Inc., a known supplier of branded Ayurvedic botanical ingredients.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 6.54% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Form, End User, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, Russia, Poland, Australia, New Zealand, China, India, Japan, South Korea, Thailand, Malaysia, Vietnam, Indonesia, GCC, Turkey, South Africa, North Africa |

| Key Companies Profiled | STEMCELL Technologies Inc.; Kerry Inc.; StemCell Inc.; Xell AG; InVitria; ScienCell Research Laboratories, Inc.; HiMedia Laboratories; ZenBio; Biological Industries; PeproTech, Inc. |

| Customization | Available Upon Request |

The global acf supplements market is estimated to be valued at USD 211.7 billion in 2025.

It is projected to reach USD 496.5 billion by 2035.

The market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types are dry and liquid.

pharmaceutical segment is expected to dominate with a 58.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Supplements And Nutrition Packaging Market

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Andro Supplements Market

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Urology Supplements Market Size and Share Forecast Outlook 2025 to 2035

Peptide Supplements Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Dietary Supplements Packaging Market Analysis – Trends & Forecast 2025-2035

D-Mannose Supplements Market Size and Share Forecast Outlook 2025 to 2035

Carnitine Supplements Market Size and Share Forecast Outlook 2025 to 2035

Krill Oil Supplements Market Size and Share Forecast Outlook 2025 to 2035

Melatonin Supplements Market Size and Share Forecast Outlook 2025 to 2035

Green Tea Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Probiotic Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Probiotic Supplements Market Share Analysis – Key Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA