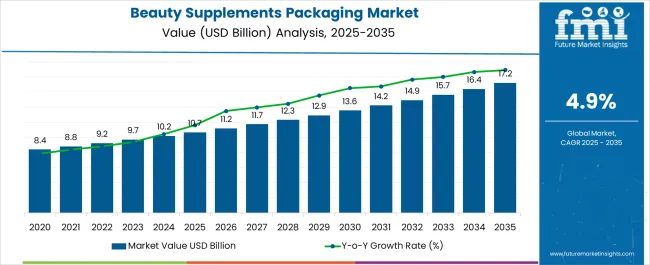

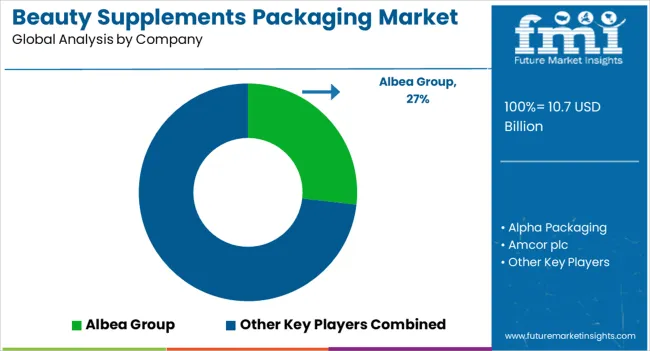

The Beauty Supplements Packaging Market is estimated to be valued at USD 10.7 billion in 2025 and is projected to reach USD 17.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

This steady growth points toward the rising influence of nutricosmetics and ingestible beauty products, which are gaining credibility among consumers and reshaping packaging priorities. The expansion highlights increasing investment in formats such as bottles, blister packs, sachets, and pouches, each designed to enhance product protection, dosage accuracy, and shelf appeal. Between 2025 and 2030, the market is likely to see moderate expansion, supported by the rising global appetite for collagen, vitamins, and botanical supplements.

By the period 2030 to 2035, packaging growth will be influenced by heightened demand for premium aesthetics and functionality. Lightweight materials, tamper-evident closures, and convenience-driven designs will act as differentiation tools for manufacturers. The incremental growth of USD 6.5 billion over the ten years signals that packaging suppliers will need to emphasize product safety, compliance with nutraceutical regulations, and value-added design capabilities to secure a competitive advantage.

| Metric | Value |

|---|---|

| Beauty Supplements Packaging Market Estimated Value in (2025 E) | USD 10.7 billion |

| Beauty Supplements Packaging Market Forecast Value in (2035 F) | USD 17.2 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The beauty supplements packaging market is gaining traction due to rising consumer demand for health and wellness products combined with an increasing focus on aesthetics and sustainability in packaging. Brands are prioritizing packaging solutions that reflect premium positioning while also meeting safety, preservation, and eco-conscious standards.

The expansion of e-commerce and direct-to-consumer channels is driving the need for packaging that ensures product stability during transit and enhances the unboxing experience. Innovations in recyclable materials, tamper-evident seals, and smart labeling technologies are further enhancing the appeal and functionality of packaging.

Regulatory pressures to reduce plastic use and improve labeling transparency are encouraging companies to invest in material upgrades. With growing demand across skincare, haircare, and anti-aging segments, the market outlook remains optimistic, supported by consumer preference for visually appealing and environmentally responsible packaging formats.

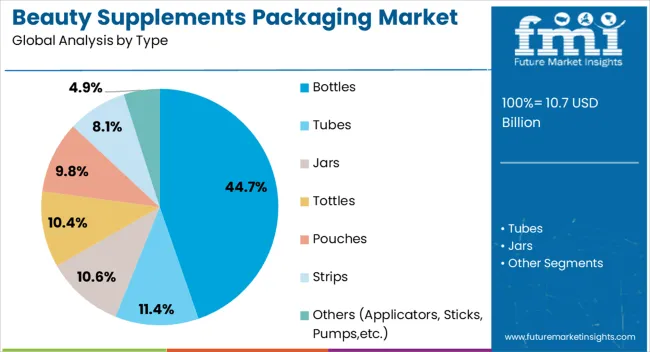

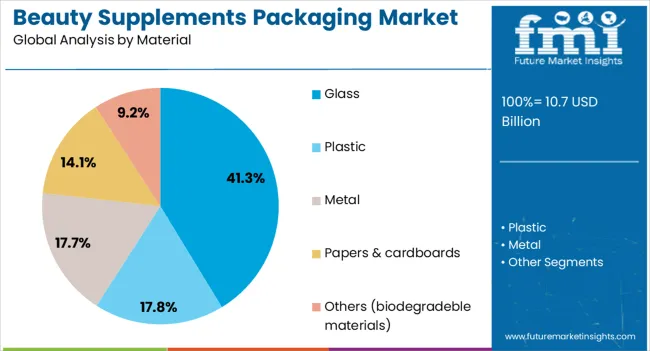

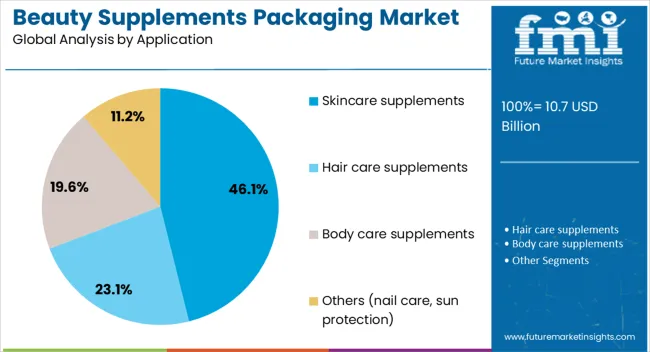

The beauty supplements packaging market is segmented by type, material, application, end-user, and geographic region. By type, the beauty supplements packaging market is divided into Bottles, Tubes, Jars, Totes, Pouches, Strips, and Others (Applicators, Sticks, Pumps, etc.). In terms of material, the beauty supplements packaging market is classified into Glass, Plastic, Metal, paper and cardboard, and Others (biodegradable materials). Based on application, the beauty supplements packaging market is segmented into Skincare supplements, Hair care supplements, Body care supplements, and Others (nail care, sun protection). By end user, the beauty supplements packaging market is segmented into OEM and Aftermarkets. Regionally, the beauty supplements packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bottles segment is projected to account for 44.70% of total market revenue by 2025 under the type category, positioning it as the leading format. This dominance is driven by its convenience, reusability, and protective barrier properties that safeguard the integrity of active ingredients in supplements.

Bottles also offer flexibility in volume customization, labeling space, and dosing accuracy, which are essential for daily supplement routines. Their compatibility with tamper-evident closures and dropper mechanisms makes them especially suited for liquid and capsule-based beauty formulations.

As premium brands focus on elevating user experience and shelf appeal, the demand for bottle packaging continues to grow, reinforcing its position as the preferred choice in this market.

The glass material segment is expected to contribute 41.30% of total market revenue by 2025 within the material category, making it the dominant option. This is attributed to its chemical inertness, product protection capabilities, and premium visual aesthetics.

Glass packaging is widely regarded for its ability to preserve the efficacy of sensitive formulations such as collagen, biotin, and antioxidant blends. Additionally, it aligns well with clean beauty and sustainability narratives due to its recyclability and non-toxic nature.

High consumer perception of quality associated with glass packaging further enhances brand positioning in the beauty segment. With growing attention on product purity and packaging transparency, glass remains the material of choice for high-end beauty supplements.

The skincare supplements segment is projected to account for 46.10% of the total market revenue by 2025 under the application category, positioning it as the most prominent area of use. The segment’s growth is being driven by rising consumer interest in ingestible skincare solutions aimed at improving skin health, hydration, and anti-aging effects.

Packaging for skincare supplements is increasingly focused on preserving product integrity while delivering a strong shelf impact. This includes UV-protective materials, premium finishes, and compact, travel-friendly formats.

The demand for personalized beauty routines and science-backed formulations has also increased reliance on packaging that communicates efficacy, dosage, and clean label claims. As brands continue to blur the line between cosmetics and nutrition, skincare supplements are expected to drive demand for packaging in the beauty and wellness space.

Beauty supplements packaging is shaped by demand for premium designs, eco-friendly materials, functionality, and technological integration. These factors drive innovation in packaging solutions.

The increasing consumer demand for personalized and high-end beauty supplements has led to a surge in premium packaging solutions. These solutions are favored for their ability to provide an enhanced user experience and product differentiation. As consumers seek luxury and customized designs, packaging plays a critical role in attracting and retaining customers. This shift towards premium packaging is further driven by the growing number of beauty-conscious consumers who are willing to pay a premium for exclusive, aesthetically appealing, and functional packaging. As a result, packaging providers are focusing on offering innovative and visually striking designs to align with evolving consumer preferences.

Consumers are showing a strong preference for beauty supplements packaged in eco-friendly materials. As concerns about plastic waste and environmental impact rise, beauty supplement brands are increasingly adopting biodegradable, recyclable, or reusable packaging. This trend has been further accelerated by stringent regulatory standards on packaging waste in various regions. As the demand for eco-conscious products rises, manufacturers are adapting by incorporating sustainable materials and processes into their packaging solutions. Brands are also emphasizing the environmental benefits of their packaging to align with consumers’ values, positioning eco-friendly packaging as a major factor in purchasing decisions.

Functionality and protection are key priorities for beauty supplements packaging. With many supplements being sensitive to light, air, and moisture, packaging solutions must preserve product integrity and ensure freshness throughout their shelf life. Packaging formats such as blister packs, sachets, and air-tight bottles are becoming popular choices due to their ability to protect delicate ingredients. Additionally, these packaging types are designed for convenience, offering consumers easy access to products while maintaining their effectiveness. This focus on product preservation and convenience is driving the demand for packaging that balances aesthetic appeal with protective qualities.

Technology is becoming an integral part of the beauty supplements packaging sector. The incorporation of smart features such as QR codes, RFID tags, and NFC-enabled labels is enabling brands to enhance customer engagement and offer unique experiences. These technologies not only allow for better tracking and authentication but also provide consumers with detailed product information, usage instructions, and personalized recommendations. Furthermore, packaging that incorporates smart elements is increasingly seen as a differentiating factor in a crowded market. This integration of technology enables brands to offer enhanced functionality and deeper connections with their customers, positioning them for growth in the competitive beauty supplements sector.

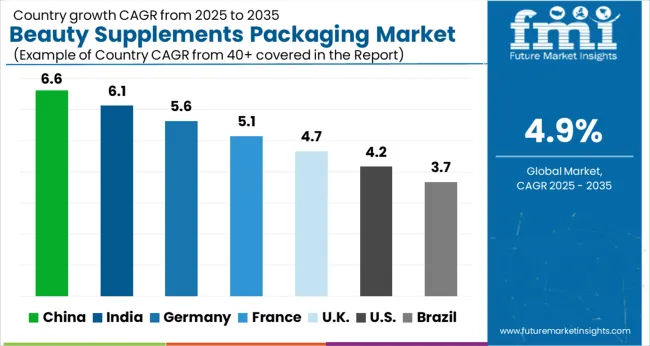

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The beauty supplements packaging market is projected to expand globally at a CAGR of 6.2% from 2025 to 2035, with China leading at 6.6% as consumer demand for premium and functional packaging solutions grows. India follows at 6.1%, driven by increased focus on eco-friendly and innovative packaging. Germany records a solid 5.6%, supported by rising demand for personalized and luxury beauty packaging. France achieves 5.1% growth, supported by an emphasis on clean-label and sustainable packaging trends. The UK posts 4.7%, fueled by continued investments in packaging technologies and regulatory standards. The USA maintains a 4.2% CAGR, shaped by rising adoption of high-quality, protective packaging for health-conscious consumers.

The CAGR for the United Kingdom’s beauty supplements packaging market was around 4.3% during 2020–2024 and is projected to rise to 4.7% for the 2025–2035 period. The shift in growth rate can be attributed to a surge in consumer demand for premium packaging designs and an increasing focus on sustainability and functionality. During 2020–2024, growth was slow as companies focused on cost-effective packaging solutions. From 2025 onward, heightened interest in personalized packaging, along with rising consumer preference for eco-friendly materials, significantly boosted market growth. This growth was further accelerated by technological advancements in packaging design, enhancing user engagement and product appeal in the beauty sector.

China’s beauty supplements packaging market experienced a CAGR of 6.2% between 2020–2024 and is expected to increase to 6.6% during 2025–2035. This improvement is driven by rising consumer awareness and the increasing popularity of luxury and premium beauty supplements. During 2020–2024, the market growth was tempered by the initial focus on affordability and mass-market appeal. However, from 2025 onwards, with the expansion of e-commerce and the growth of personal care trends, demand for high-quality, aesthetic packaging solutions surged. China's rising preference for sustainable and functional packaging also played a significant role in the market's acceleration.

India’s beauty supplements packaging market saw a CAGR of 5.8% during 2020–2024 and is expected to reach 6.1% in the 2025–2035 period. The market's growth is largely attributed to increasing disposable income, growing beauty consciousness, and a rising demand for premium packaging solutions. During the 2020–2024 period, brands were focused on value-for-money products with simpler packaging. However, from 2025, the market is expected to expand rapidly, driven by an increasing shift towards personalized and eco-conscious packaging materials. The growing importance of preserving product efficacy and appealing to the modern, beauty-conscious consumer further accelerates demand.

In France, the beauty supplements packaging market experienced a CAGR of 5.3% during 2020–2024 and is expected to reach 5.1% during 2025–2035. The growth in the earlier period was driven by the need for effective and eco-friendly packaging in the beauty industry, with companies focusing on using recyclable and reusable materials. From 2025 onward, the demand for specialized, luxury packaging solutions is expected to increase, particularly in the premium beauty supplements sector. A shift in consumer preference toward clean-label products, combined with more personalized packaging options, will continue to drive market growth in France.

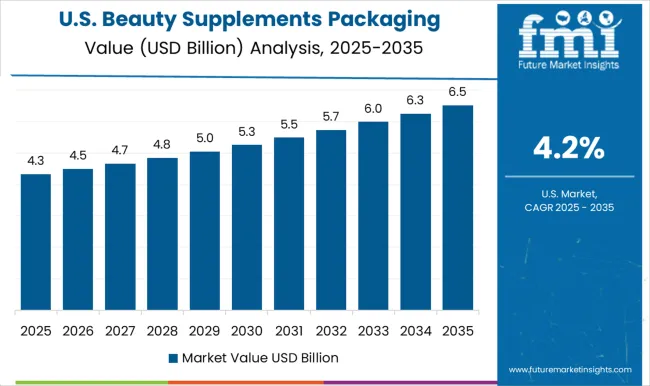

The beauty supplements packaging market in the USA experienced a CAGR of 4.5% during 2020 to 2024 and is projected to rise to 4.2% from 2025 to 2035. The decline in growth rate can be attributed to the market’s maturity and saturation. The earlier period saw rapid adoption of functional packaging solutions, driven by the demand for convenience and protection. However, from 2025 onward, the market is expected to grow at a slower pace, with more focus on sustainability and consumer-driven design trends. The USA remains one of the largest markets, benefiting from established retail and e-commerce channels, where demand for luxury and functional packaging remains strong.

The beauty supplements packaging market is highly competitive, featuring several global packaging providers specializing in beauty and healthcare products. Albea Group stands as a key player with a strong focus on innovative packaging solutions for personal care and beauty supplements. Amcor plc is another prominent competitor, offering advanced packaging technologies with an emphasis on sustainability and functionality. Aptar Beauty + Home, recognized for its high-performance dispensing solutions, continues to drive packaging innovation. Berry Global, known for its diverse product portfolio, strengthens its position through eco-friendly packaging designs.

Gerresheimer contributes its extensive expertise in packaging for the pharmaceutical and cosmetic industries, including beauty supplements. Companies like TricorBraun and HCP Packaging offer specialized solutions tailored to the needs of the beauty industry, with an emphasis on quality and consumer engagement.

Firms such as RPC Group, Technoshell Automations, and Tube Tech International enhance packaging functionality through automation and innovative packaging systems, driving increased production efficiency. Competitive positioning in this market is driven by continuous innovation, sustainability efforts, and the ability to cater to evolving consumer preferences for high-quality, aesthetically appealing, and eco-friendly packaging solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.7 Billion |

| Type | Bottles, Tubes, Jars, Tottles, Pouches, Strips, and Others (Applicators, Sticks, Pumps,etc.) |

| Material | Glass, Plastic, Metal, Papers & cardboards, and Others (biodegradeble materials) |

| Application | Skincare supplements, Hair care supplements, Body care supplements, and Others (nail care, sun protection) |

| End User | OEM and Aftermarkets |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Albea Group, Alpha Packaging, Amcor plc, Anomatic Corporation, Aptar Beauty + Home, Berry Global, Comar, Fusion Packaging, Gerresheimer, HCP Packaging, Pretium Packaging, Quadpack Industries, RPC Group, Technoshell Automations, TricorBraun, Tube Tech International, and Viva Healthcare Packaging |

| Additional Attributes | Dollar sales projections, market share by packaging type and region, and growth trends in eco-friendly, premium, and functional packaging. |

The global beauty supplements packaging market is estimated to be valued at USD 10.7 billion in 2025.

The market size for the beauty supplements packaging market is projected to reach USD 17.2 billion by 2035.

The beauty supplements packaging market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in beauty supplements packaging market are bottles, tubes, jars, tottles, pouches, strips and others (applicators, sticks, pumps,etc.).

In terms of material, glass segment to command 41.3% share in the beauty supplements packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beauty and Personal Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Supplements And Nutrition Packaging Market

Dietary Supplements Packaging Market Analysis – Trends & Forecast 2025-2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Beauty Concierge Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Beauty Drinks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA