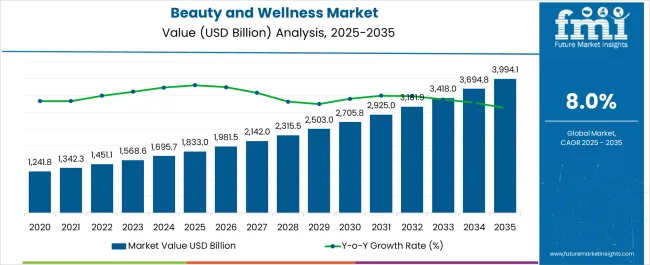

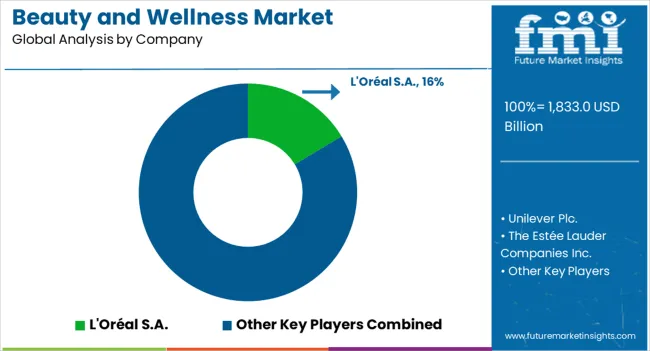

The Beauty and Wellness Market is estimated to be valued at USD 1833.0 billion in 2025 and is projected to reach USD 3994.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

| Metric | Value |

|---|---|

| Beauty and Wellness Market Estimated Value in (2025 E) | USD 1833.0 billion |

| Beauty and Wellness Market Forecast Value in (2035 F) | USD 3994.1 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The beauty and wellness market is experiencing robust expansion, driven by rising consumer awareness of personal care, growing disposable incomes, and increasing demand for premium and natural products. The industry is characterized by rapid innovation, with companies focusing on clean-label formulations, multifunctional products, and digital engagement strategies.

The market is further shaped by lifestyle changes, urbanization, and the integration of wellness practices into daily routines. Online platforms have amplified product accessibility, enabling global reach for both established brands and new entrants.

Current trends also highlight the influence of sustainability, inclusivity, and personalized solutions in shaping consumer choices. With continuous product diversification and expanding retail channels, the beauty and wellness market is expected to maintain strong growth momentum across all major regions.

The skincare products segment dominates the type category, holding approximately 34.60% share of the beauty and wellness market. This leadership is supported by rising demand for anti-aging, hydration, and sun protection solutions, driven by increasing awareness of skin health.

Innovation in natural and dermatologically tested formulations has strengthened consumer trust and expanded product adoption across demographics. The segment benefits from continuous product launches, premiumization trends, and targeted marketing strategies that emphasize efficacy and lifestyle alignment.

Skincare has also become a critical entry point for consumers in emerging markets, further reinforcing its global importance. With consistent consumer investment in skincare routines, this segment is expected to retain its leading position.

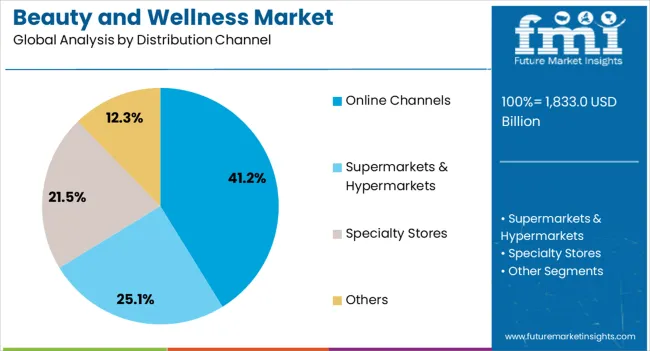

The online channels segment leads the distribution category with approximately 41.20% share, reflecting the accelerated shift toward digital commerce in beauty and wellness. E-commerce platforms, direct-to-consumer models, and social media-driven engagement have transformed purchasing behavior, providing consumers with convenience and broader product access.

Personalized recommendations, subscription models, and virtual try-on tools have further strengthened online adoption. The segment benefits from cost advantages for brands, who can bypass traditional retail barriers and target niche consumer groups effectively.

With continued growth in internet penetration and digital payment adoption, the online channels segment is expected to remain the fastest-growing distribution pathway in the beauty and wellness market.

The beauty and wellness market was worth USD 1241.8 million in 2020. The market grew at a CAGR of 5.5% from 2020 to 2025.

The pandemic limited the appeal of beauty and wellness to the people. As people were locked up at home, the lesser requirement was felt for beauty products. Even when stepping outside, masks were mandatory, covering up a significant portion of the face, making many beauty products redundant. The pandemic also resulted in many distribution channels for beauty products, such as supermarkets and specialized stores, shutting down. However, the market was on the path to recovery as the effects of the pandemic subsided. The market reached USD 1833 million in 2025.

| Market Valuation (2020) | USD 1241.8 million |

|---|---|

| Historical CAGR (2020 to 2025) | 5.5% |

| Historical Market Valuation (2025) | USD 1833 million |

Long-term Analysis of the Beauty and Wellness Market

In 2025, the value of the beauty and wellness market is estimated to be USD 1833 million. The market is expected to progress at a CAGR of 8.1% from 2025 to 2035.

The market’s prospects are brighter during the forecast period as compared to the historical period. The pandemic highlighted the need for physical wellbeing. Thus, in the post-pandemic era, beauty is going hand-in-hand with wellness. Further, emotional wellness is also receiving increased attention. There is a greater willingness among people to acknowledge and discuss topics like depression and anxiety, and thus, wellness products targeting emotional wellbeing are anticipated to propel the market.

The market is also expected to expand over the forecast period due to deeper penetration of beauty and wellness products in emerging markets. While beauty products have already made their mark globally, it is anticipated that wellness will also grow in importance alongside appearances. The market is projected to reach USD 3994.1 million by 2035.

An analysis of the beauty and wellness market is done with respect to two categories: type and distribution channel. The type of beauty and wellness products available in the market is ever-increasing. The places people go for beauty and wellness products are also increasing.

| Attributes | Details |

|---|---|

| Top Type | Food & Nutrition Products |

| Market Share in 2025 | 27.6% |

Food & nutrient products are the preferred method for beauty and wellness among consumers. In 2025, food & nutrient products are expected to account for 27.6% of the market share by type.

Dieting and gym culture have led to greater care being shown in food consumption. People are looking to beef up their bodies or augment their daily food intake. Thus, products like dietary supplements are growing in popularity. Other products like collagen drinks are offering different flavors and tastes to appeal to consumers.

| Attributes | Details |

|---|---|

| Top Distribution Channel | Supermarkets/Hypermarkets |

| Market Share in 2025 | 35.2% |

Supermarkets/hypermarkets are the avenue through which beauty and wellness products are mainly sold. In 2025, supermarkets/hypermarkets are anticipated to contribute to 35.2% of the market share by distribution channel.

Supermarkets provide customers with a wide variety of products. Consumers are also able to buy multiple beauty and wellness products from the same place.

While supermarkets/hypermarkets continue to reign in the distribution channel segment, other avenues are also progressing. The online channel is booming, while specialty stores are also receiving the vote of confidence from consumers, especially those looking to buy premium products.

Government encouragement for wellness centers and products is propelling the growth of the market in the Asia Pacific region. The increasing disposable income and the considerable middle-class population are also contributing to the increase in demand for beauty and wellness products.

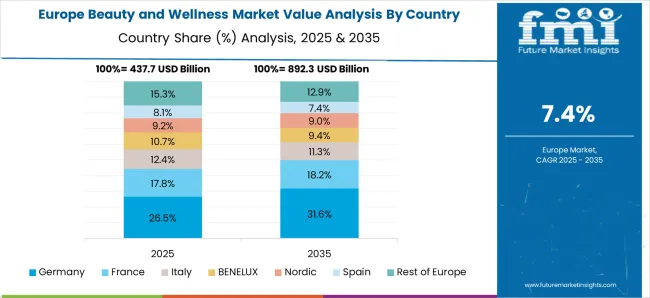

In Europe and the United States, Eastern beauty and wellness practices are seeing increasing adoption. Busy working professionals are also taking the help of beauty and wellness products to deal with pressures.

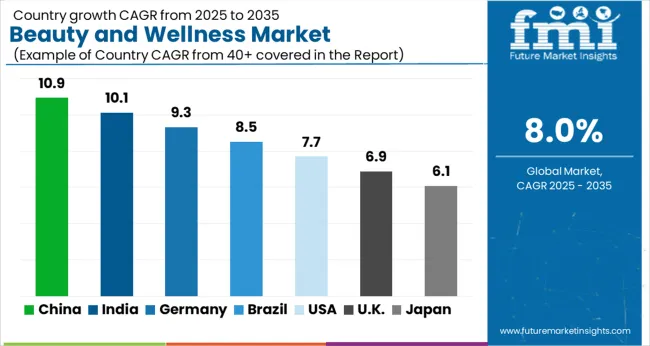

India is a country offering some of the most lucrative opportunities for market growth. The CAGR for the market in India is pegged at 10.8% CAGR through 2035.

India is home to a number of different cultures, traditions, and skin tones. Thus, the consumer base for beauty wellness is diverse in the country. The market players are taking advantage by marketing products to different subsets of the population and offering a wide range of products to people.

China is another Asian country offering lucrative opportunities for market players. The market is expected to register a CAGR of 8.2% in China over the forecast period.

Traditional Chinese medicine holds a prominent place in Chinese culture. A practice like Gua Sha is increasing in popularity even outside China. Vendors in the market are taking advantage by combining traditional Chinese beauty and wellness practices with modern tools to appeal to the Chinese population, for example, serums and face masks with Chinese herbal medicine.

Australia is home to a number of beauty and wellness brands that have earned reputable names in the country. Brands like Haircarebear, Celebrity Slim, and Skin Virtue, have established a sense of trust with consumers, ensuring a bright future for the market in the country. The market in Australia is predicted to grow at a CAGR of 9.3% through 2035.

Germany is a haven for spas. From premium, higher-end ones to more affordable ones, German spas are serving customers wellness solutions in the form of steam. Combined with the German propensity for high-end beauty products, Germany is set to be filled with opportunities for the market. The CAGR for the market in Germany is predicted to be 7.5% from 2025 to 2035.

A significant chunk of the American population is taking part in practices like massages, wellness retreats, and yoga classes. Thus, beauty and wellness services are growing at a CAGR of 5.7% over the forecast period in the United States.

Partnerships between brands are common in the market, especially when the objective is geographic expansion. Acquisitions are also frequent in the market, with many start-ups eventually coming under the control of giant market players.

Market players are emphasizing branding and marketing. Celebrity endorsements are being sought to develop demand, while collaborations with social media influencers are also common.

Recent Developments in the Beauty and Wellness Market

The global beauty and wellness market is estimated to be valued at USD 1,833.0 billion in 2025.

The market size for the beauty and wellness market is projected to reach USD 3,994.1 billion by 2035.

The beauty and wellness market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in beauty and wellness market are skincare products, hair care products, makeup products, food & nutrition products, medicinal products, wellness products and others.

In terms of distribution channel, online channels segment to command 41.2% share in the beauty and wellness market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beauty and Personal Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beauty Concierge Services Market Size and Share Forecast Outlook 2025 to 2035

Beauty Drinks Market Size and Share Forecast Outlook 2025 to 2035

Beauty-from-Within Drinks Market Size and Share Forecast Outlook 2025 to 2035

Beauty Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Beauty and Personal Care Product Market is segmented by product type, distribution channel and region through 2025 to 2035.

Beauty Subscription Market Growth - Innovations, Trends & Forecast 2025 to 2035

Wellness Tourism Market Report – Growth & Demand 2025 to 2035

Market Share Breakdown of Beauty Pillowcase Manufacturers

Wellness Services Market Trends - Growth & Forecast 2025 to 2035

Beauty Pillowcase Market Report - Growth & Industry Outlook 2024-2034

C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

J-Beauty Product Market Analysis by Product Type, Type, Distribution Channel, and Region through 2035

K-Beauty Product Market Analysis by Product Type, End-user, Distribution Channel, and Region through 2025 to 2035

Global Pet Wellness Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

USA Beauty and Personal Care (BPC) Retail Vending Machine Market Outlook 2025 to 2035

SEA C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Snail Beauty Products Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA