The herbal beauty product market is expanding steadily, driven by rising consumer preference for natural formulations, sustainability-focused purchasing behavior, and the increasing influence of wellness-oriented lifestyles. The market is witnessing strong momentum as consumers shift away from synthetic ingredients toward plant-based alternatives offering therapeutic benefits. Manufacturers are investing in research and development to enhance product efficacy, texture, and shelf stability while maintaining natural ingredient integrity.

The growing popularity of Ayurveda and traditional herbal knowledge in modern skincare routines has strengthened market credibility. Online retail expansion and influencer-driven marketing have significantly improved accessibility and consumer awareness.

Looking ahead, the market is expected to benefit from ongoing innovations in bio-extracts and eco-friendly packaging, aligning with global clean beauty trends. The convergence of wellness, transparency, and ethical sourcing continues to anchor long-term market growth.

| Metric | Value |

|---|---|

| Herbal Beauty Product Market Estimated Value in (2025 E) | USD 79.7 billion |

| Herbal Beauty Product Market Forecast Value in (2035 F) | USD 144.0 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The market is segmented by Product Type, Consumer Orientation, and Sales Channel and region. By Product Type, the market is divided into Skin Care, Hair Care, Bath & Body Care, Makeup, and Fragrance. In terms of Consumer Orientation, the market is classified into Adults and Kids. Based on Sales Channel, the market is segmented into Online Retailing, Hypermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Multi-Brand Stores, Beauty Salons, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The skin care segment holds approximately 36.2% share of the product type category in the herbal beauty product market. This dominance is driven by consumer prioritization of daily skincare regimens that incorporate herbal ingredients for nourishment and rejuvenation. Increasing cases of skin sensitivity and allergic reactions to synthetic chemicals have accelerated the shift toward natural formulations.

The segment benefits from product diversification, including herbal creams, serums, and cleansers, catering to specific skin concerns. Manufacturers are leveraging botanical actives such as aloe vera, turmeric, and neem for targeted results.

Widespread adoption across both mass and premium categories reinforces demand stability. With continuous innovation and rising awareness of herbal skincare efficacy, the segment is poised to retain its leadership position through the forecast period.

The adults segment leads the consumer orientation category, accounting for approximately 71.4% share. This segment’s strength stems from increased spending power, heightened skincare awareness, and growing interest in preventive beauty routines.

Herbal formulations appeal strongly to adults seeking products that balance efficacy and safety while supporting long-term skin health. The segment’s expansion is aided by targeted marketing strategies focusing on anti-aging, hydration, and stress-related skincare needs.

Furthermore, rising urban pollution levels and hectic lifestyles have driven demand for restorative herbal beauty solutions. With continued brand innovation and personalized product offerings, the adults segment is expected to sustain its commanding position in the coming years.

The online retailing segment accounts for approximately 45.6% share of the sales channel category, underpinned by the convenience of digital shopping platforms and increased accessibility of herbal beauty products. E-commerce platforms have enabled brands to reach global consumers efficiently, supported by virtual consultations, influencer marketing, and customer reviews that build trust.

The pandemic-driven digital shift further accelerated online purchases in the beauty category. Subscription-based models and personalized product recommendations have enhanced consumer engagement.

The segment’s growth is also supported by the global expansion of direct-to-consumer brands leveraging social media visibility. As digital infrastructure continues to strengthen, online retailing is expected to remain the primary sales channel in the herbal beauty product market.

In 2025, skincare asserts a significant global market share of 37.6%.

| Attributes | Details |

|---|---|

| Top Product Type | Skincare |

| Market Share (2025) | 37.6% |

The segment’s rising popularity is attributed to:

In 2025, the adults segment is expected to command a 71.4% share of the global market.

| Attributes | Details |

|---|---|

| Top Consumer Orientation | Adults |

| Market Share (2025) | 71.4 % |

The segment’s rising popularity is attributed to:

The section analyzes the global herbal beauty product market by country, including the United Kingdom, Singapore, China, Italy, and Japan. The table presents the CAGR for each country, indicating the expected market growth through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.0% |

| Singapore | 10.8% |

| China | 9.6% |

| United Kingdom | 8.1% |

| Italy | 7.5% |

Japan maintains its position as a key contributor to the herbal beauty product market and is projected to register a CAGR of 11.0% through 2035.

Japan's herbal beauty product market is expanding due to a growing interest in Japanese skincare rituals and products renowned for their simplicity, efficacy, and natural ingredients. Japanese consumers prioritize gentle yet effective skincare solutions that promote healthy and radiant skin.

Traditional Japanese botanicals and rituals inspire the demand for herbal beauty products, as they offer gentle formulations that nurture the skin while embracing Japan's cultural heritage. Some popular herbal products in the market include rice-based cleansers, green tea-infused moisturizers, and sake-based serums that cater to consumers' different skin types and preferences.

Singapore secures the largest portion in the market, showing a CAGR of 10.8% from 2025 to 2035.

In Singapore, the rising popularity of herbal beauty products can be attributed to the country's multicultural population and diverse skincare needs. With a growing interest in holistic wellness and traditional remedies, Singaporean consumers are embracing herbal beauty products for their ability to address various skin concerns while aligning with cultural practices and preferences.

The market is flooded with herbal products such as green tea-based skincare known for its antioxidant properties and traditional Chinese herbal remedies believed to improve blood circulation and prevent acne. These products cater to consumers' skin types and preferences, making the market highly competitive and diverse.

China rules the roost globally, with a CAGR of 9.6% from 2025 to 2035.

China's herbal beauty product market is rapidly growing due to several factors, including increasing disposable income, a burgeoning middle class, and a growing awareness of skincare health. Chinese consumers are drawn to herbal beauty products for their perceived efficacy, safety, and association with traditional Chinese medicine.

Additionally, government initiatives promoting the use of natural and organic ingredients further drive the adoption of herbal beauty products in the country. The market demand is characterized by a wide range of products, such as green tea serums, ginseng-based skincare, and traditional Chinese herbal remedies that cater to consumers' skin preferences.

The United Kingdom is becoming a prominent global herbal beauty product market player. With a CAGR of 8.1% projected through 2035, it is maintaining a steady pace of growth.

The United Kingdom's herbal beauty product market is witnessing a significant increase in demand due to consumers' growing preference for natural and organic skincare solutions. With increasing awareness of the benefits of herbal ingredients and a strong emphasis on sustainability, British consumers are turning to herbal beauty products that offer effective and environmentally friendly alternatives to synthetic options.

This trend is driven by the belief that natural ingredients have better healing and nourishing properties to rejuvenate the skin. The demand in the market is also characterized by a wide range of herbal products, such as essential oils, face masks, and body scrubs, catering to the various skincare needs of consumers.

Italy leads the global market, boasting a 7.5% CAGR from 2025 to 2035.

Italy's herbal beauty product market thrives due to a deep-rooted cultural appreciation for natural beauty and wellness. Italian consumers value products that celebrate the country's rich botanical heritage and emphasize quality ingredients sourced from local suppliers.

With a focus on luxury and sophistication, herbal beauty products resonate with Italian consumers seeking premium skincare solutions that deliver tangible results while embracing a holistic approach to beauty. The market is characterized by a wide range of premium products, such as lavender-infused face mists, olive oil-based skincare, and chamomile-based creams that cater to consumers' skin preferences.

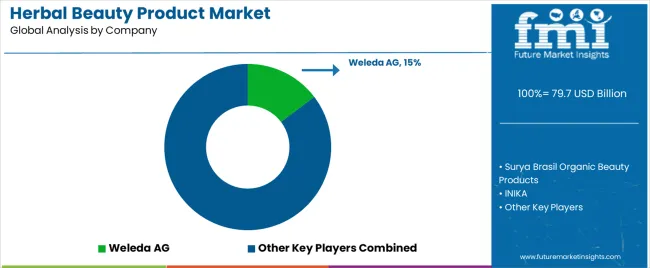

The global herbal beauty product market is witnessing significant growth, with major companies and manufacturers actively expanding their product offerings and investing in research and development to innovate new formulations.

Key players are also leveraging strategic partnerships to enhance their market presence, expanding their distribution networks to reach a wider consumer base across various regions and emphasizing marketing efforts to educate consumers about the benefits of herbal beauty supplements while differentiating their products from synthetic alternatives.

These companies adapt to evolving consumer preferences by incorporating sustainability initiatives into their production processes and packaging to align with growing environmental consciousness. The aim is to capitalize on the increasing demand for natural and organic beauty products and drive the growth of the herbal beauty product market worldwide.

Recent Developments

The global herbal beauty product market is estimated to be valued at USD 79.7 billion in 2025.

The market size for the herbal beauty product market is projected to reach USD 144.0 billion by 2035.

The herbal beauty product market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in herbal beauty product market are skin care, face cleanser, face wash, sun protection, night creams & gels, others (masks, cream), hair care, hair oils, shampoos, hair conditioners, others (hair serum, mask, color), bath & body care, body scrub, body lotion, soap, others, makeup and fragrance.

In terms of consumer orientation, adults segment to command 71.4% share in the herbal beauty product market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe & Asia Pacific Herbal Beauty Products Market Trends – Growth & Forecast 2016-2026

C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

J-Beauty Product Market Analysis by Product Type, Type, Distribution Channel, and Region through 2035

K-Beauty Product Market Analysis by Product Type, End-user, Distribution Channel, and Region through 2025 to 2035

Herbal Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

SEA C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Snail Beauty Products Market

Herbal Personal Care Products Market Size and Share Forecast Outlook 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Global Melamine Beauty Product Market Analysis - Size and Share Forecast Outlook 2025 to 2035

The Beauty and Personal Care Product Market is segmented by product type, distribution channel and region through 2025 to 2035.

Product Tour Software for SaaS Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Product Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beauty Concierge Services Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA