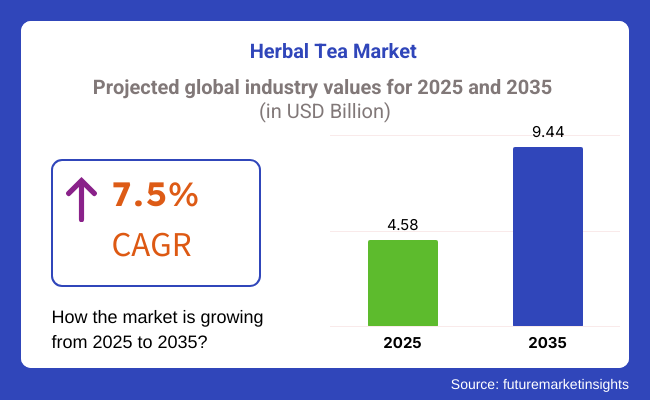

The global herbal tea market size reached USD 4.58 Billion in 2025. The industry is further expected to grow at a growth rate of 7.5% over the forecast period.

As consumers increasingly turn toward natural wellness products and functional beverages, the industry is continuing to grow, with herbal tea emerging as a popular substitute for classic tea and caffeinated drinks. With the rising demand for herbal tea, especially organic and functional blends, manufacturers are increasing their production capacities.

To keep up with changing consumer tastes, companies are upgrading with ingredient innovations, herbal blends, and premium ingredients. Herbal tea is the fastest growing beverage segment across regions as an anxiety-relieving, immunity-boosting, and digestive health drinks that boost their immune from the COVID-19 pandemic.

Another trend making its way into the herbal tea sector is the clean-label movement, with consumers demanding that products be free from artificial flavors, additives, and preservatives. There is also rising demand for naturally functional beverages free of caffeine, prompting brands to offer herbal teas infused with adaptogens, probiotics, and antioxidants.

Both retailers and names are leaning into e-commerce and direct-to-consumer models, finding herbal tea out there in subscription services and online wellness marketplaces. In addition, sustainability and biodegradability of tea bag materials, as well as eco-friendly packaging, are new competitive hot spots as the industry endeavors to reduce its environmental footprint.

Herbal tea is becoming an integral part of the functional beverage industry and one of the few product categories that will continue to grow through the next decade, thanks to the growing trend towards healthy living and natural health products globally.

The industry is growing as because the customers increasingly emphisizing health, wellness, and sustainability. Retail consumers want organic, caffeine-free, and functional teas with benefits like stress relief, digestive aid, and immune system support.

The HORECA industry appreciates the variety of flavors and premium mixtures, blending herbal teas with gourmet experiences and specialty menus. In the wellness & functional drinks category, consumers increasingly demand fortified herbal teas containing adaptogens, superfoods, and probiotics to support cognitive function, relaxation, and detoxification.

The nutraceutical and pharmaceutical industry applies herbal teas for medical reasons, adding medicinal herbs such as chamomile, ginger, and Echinacea to blends for integrative healing and complementary medicine. Fair-trade and sustainable sourcing are major purchasing drivers, leading to green packaging and responsible sourcing trends in the marketplace.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the industry. This analysis highlights key shifts in performance and revenue realization patterns, offering stakeholders a clearer understanding of the growth trajectory.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 7.2% |

| H2 (2024 to 2034) | 7.5% |

| H1 (2025 to 2035) | 7.3% |

| H2 (2025 to 2035) | 7.6% |

The first half of the year, H1, spans from January to June, while the second half, H2, includes the months from July to December. During the first half of the decade (2025 to 2035), the industry is expected to grow at a CAGR of 7.2%, followed by an increase to 7.5% in the second half.

As the period progresses, the industry is projected to exhibit a CAGR of 7.3% in H1 and maintain a steady growth rate of 7.6% in H2. This growth pattern reflects an overall increase of 10 BPS in H1, while H2 records an additional 10 BPS, indicating stable expansion for herbal tea.

From 2020 to 2024, the herbal tea industry grew steadily with consumers moving toward natural, caffeine-free, and functional drinks. Increasing health consciousness fueled demand for teas with therapeutic benefits such as stress relief, better digestion, and boosted immunity.

Big data and AI were used to know about customer inclinations and create new blends of flavors using chamomile, ginger, peppermint, and hibiscus. Clean label and organic labels emerged as top drivers, and sustainable sourcing became essential. Seasonal variation in the growth of herbs and supply chain bottlenecks were problems created.

Molecular discovery will be driven by quantum computing to maximize bioavailability and positive impact. Supply chains will become transparent and trackable and better quality monitored as well as protect against fraudulent action through blockchain-supported supply chain management. Carbon-free processing and green herb cultivation methodologies will be prevalent in the marketplace.

AI-powered intelligent manufacturing systems will automate more, minimize waste, and normalize output. Functional herbal teas fortified with probiotics, adaptogens, and brain enhancers will drive product innovation. The herbal tea business will shift towards AI-driven, highly personalized, and sustainable product formats that are aligned with evolving health and wellness trends.

A Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Spike in demand for organic, functional, and natural herbal teas | Customized blends of herbal tea based on each person's unique health profile |

| AI-led inputs for the creation of innovative flavors and functional blends | Quantum-inspired molecular scanning for optimized bioavailability and taste |

| Seasonal fluctuations and issue of sourcing herbs | Blockchain-driven transparent supply chain with real-time tracking |

| Emphasis on organic certifications and environmentally friendly packaging | Carbon-neutral cultivation and processing of herbs through AI. |

| Compliance with organic labeling and safety regulations | Real-time compliance monitoring and automated certification using AI |

| AI and big data for flavor trend analysis and production optimization | Edge AI and smart manufacturing for efficient, automated production |

| Stress relief, digestion, and immunity-boosting benefits | Increased health benefits with adaptogens, probiotics, and cognitive enhancers |

The industry is not completely free from the shadow of risks attached to it, like regulatory constraints, raw material supply availability, and changes in consumer preferences. While traditional tea belongs to the beverage category, herbal tea blends are functional drinks that entail labeling and health claim approvals from the Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), and the Food Safety and Standards Authority of India (FSSAI).

Any misleading health benefit claims related to the product can be a very serious issue because they might force the company into legal battles, or they might call for the product to be recalled, or in more severe cases, the herbal tea might have to be banned from the market.

Similarly, the industry is also at high risk because of the possible climate change effects and geopolitical instability on the sources of main botanicals such as chamomile, peppermint, hibiscus, and rooibos. For example, these weather shifts, crop failures, or transportation faults can be the causes of the overall cost addition and unsteady product readiness.

From a consumer's perspective, the need for organic, caffeine-free, and adaptogenic herbal teas has significantly risen. Those brands that do not keep up with innovations or do not comply with clean-label concepts may face the consequences of lost share. On top of that, plant-infused waters and kombucha, which are available in almost all varieties nowadays, could be a reason for the long-term sales drop.

Adulteration and quality inconsistencies do not include cases of contamination but also the lack of standardization, as many herbal ingredients are acquired from multiple suppliers. Companies need to rely on traceable supply chains, third-party testing, and sustainably sourced products to build their credibility and get customers' trust.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 4.4% |

| China | 7.3% |

| Japan | 3.3% |

| Germany | 5.67% |

| Australia | 4.3% |

The industry is likely to grow steadily in the coming years, with an estimated CAGR of 4.4% during 2025 to 2035. There is increasing awareness of health and wellness, and this is propelling a strong shift towards natural and decaf beverages. Relaxation, digestion, and immunity-fortified functional herbal teas are gaining tremendous popularity.

Drink manufacturers are responding by launching new blends with locally sourced ingredients, such as Oregon-grown chamomile and Washington-grown peppermint, to appeal to local palates. Growth in online shopping has also opened up market access, allowing consumers to purchase a wider variety of herbal teas. Sustainability is also crucial in purchasing, and this has prompted manufacturers to obtain organic certifications and use biodegradable packaging to meet consumers' demands.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Health consciousness | Consumers prefer functional and caffeine-free teas suitable for well-being. |

| Growth of e-commerce | Increased availability of herbal tea has come through online channels. |

| Flavor innovation | Companies introduce new flavors of tea that are made with locally sourced ingredients. |

| Sustainability trends | Brands highlight organic labeling and green packaging. |

The industry is likely to grow at a strong CAGR of 7.3% between 2025 and 2035. The country's rich tradition of herbal medicine continues to be a source of momentum for consumption, with today's consumers seeking convenient-to-drink, health-supporting beverages. Convenient-to-drink ready-to-drink herbal teas that are supplemented with ginseng, goji berries, and chrysanthemum are catching on.

Urban lifestyles and rising incomes have led to a shift in purchasing behavior, with premium and functional herbal teas catching on. Local manufacturers are repositioning classic recipes and packaging to target younger consumers and are also making investments in scientific research to validate health benefits. Growing demand for traditional Chinese medicine in mainstream health products is also fueling industry growth.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Strong herbal tea heritage | Herbal medicine's cultural heritage stimulates demand. |

| Ready-to-drink product expansion | Urban, health-conscious consumers demand easy-to-consume, health-focused tea products. |

| Rising disposable income | Consumer-grade herbal tea brands are preferred. |

| Scientific backing | Evidence-based health benefits instill more confidence in consumers. |

The industry is likely to register a 3.3% CAGR during 2025 to 2035. Japanese green tea culture is spreading to encompass more herb infusions. Growing interest in the functional properties of herbal tea has driven demand for drinks that promote relaxation, digestion, and metabolism.

Domestic ingredient teas like yuzu, shiso, and sakura are gaining popularity among consumers. Convenience stores, specialty tea houses, and the widening of the sales channel have promoted the consumption of herbal tea. Japan's emphasis on safety and quality, in product terms, ensures consistent demand for high-quality herbal tea types.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Reversal of green tea trend to herbal infusions | Consumers need a varied range of teas for functional properties. |

| Local ingredients demand | Teas infused with yuzu, shiso, and sakura gained popularity. |

| Convenience store availability | The easy availability of herbal teas drives the market. |

| Emphasis on quality | Japan's high safety and quality standards create confidence among consumers. |

The industry is likely to record a CAGR of 5.67% during 2025 to 2035. Natural and organic beverages remain popular, with consumers grabbing herbal teas to use as digestive aids, stress reducers, and immune system boosters.

Many herbal mixes ranging from simple European herbs like fennel and chamomile to more exotic products like lemongrass and rooibos are available in the industry. Stores are carrying premium and specialty herbal teas to address shifting consumer tastes. Sustainability matters and consumers want sustainably sourced ingredients and eco-friendly packaging.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Preference for natural and organic products | Consumers favor non-organic and natural herbal teas. |

| Additional specialty tea options | The store offers diverse herbal blends to consumers. |

| Significant sustainability emphasis | Companies use green packaging and sustainably sourced materials. |

| Functional tea segment growth | Herbal teas for relaxation and digestion are in greater demand. |

The industry is likely to expand at 4.3% CAGR from 2025 to 2035. Growing demand for health-focused beverages has been driving growth in the consumption of herbal tea. Customers prefer products with local Australian ingredients like lemon myrtle, eucalyptus, and wattle seed, which have unique tastes and medicinal properties.

With the new trend towards sustainability and ethical production, companies are emphasizing fair-trade and organic accreditation. With the new café culture and specialty tea, there has been an increased interest in herbal teas as an alternative to mainstream black and green teas.

Growth Factors in Australia

| Key Drivers | Details |

|---|---|

| Wellness drink demand | Consumers are seeking teas for relaxation and immunity support. |

| Native ingredients popularity | Lemon myrtle and eucalyptus teas gain traction. |

| Sustainability push | Organic and fair-trade certifications are behind purchases. |

| Café culture growth | Herbal teas gain traction as a premium option to mainstream teas. |

| Segment | Value Share (2025) |

|---|---|

| Green Herbal Tea (By Raw Material) | 35% |

Based on the type of raw material, the herbal tea segment is classified into green herbal tea, black herbal tea, and yellow herbal tea. Green herbal tea is likely to hold the largest market share of over 35% in value terms and dominate the industry in 2025 compared to other herbal tea segments.

It dominates due to growing consumer demand for antioxidant-rich and metabolism-boosting drinks. Green herbal tea is rich in polyphenols, catechins, and vitamin content and is a popular choice among those seeking immune support, weight management, and digestive health.

The trend towards functional teas drove manufacturers to embark on new blends incorporating botanicals, including ginseng, moringa, and matcha, to improve nutritional or sensory characteristics. The largest industry, owing to already established strong traditional consumption and growing health consciousness with the demand for premium organic and specialty teas, is Asia-Pacific, especially China, Japan, and India.

Black herbal tea is a niche segment that is gradually expanding, primarily due to its robust flavor profile and potential cardiovascular advantages. It’s the fastest-growing beverage category in North America and Europe, where consumers are looking for ways to derive caffeine-free benefits that black tea used to deliver.

Brands are being creative with shochu blends (infused with ashwagandha, turmeric, licorice, etc.) to capitalize on the growing interest in adaptogenic and anti-inflammatory potables. Since it is a niche segment, the bid on the yellow herbal tea can actually be breaking to the next level as its fermentation process gives the beverage a much smoother taste as well as a gentle oxide benefit.

With consumers increasingly favoring plant-based, clean-label drinks, manufacturers are prioritizing sustainability, investing in sustainable sourcing practices, biodegradable packaging, and organic certifications to respond to changing expectations and cater to a broader demographic of consumers.

| Segment | Value Share (2025) |

|---|---|

| Herbal Tea Bags (By Packaging Type ) | 45% |

The herbal tea bags hold the majority of share in the industry; this is because of the increase in demand for ready-to-use products as well as the use of tea bags for portioning and convenience. A single-use desire for tea has propelled the evolution of pyramid tea bags, biodegradable pouches, and single-serving herbal brews.

North America and Europe are following suit, with eco-aware shoppers increasingly choosing compostable and plastic-free tea bags from brands like Pukka Herbs, Yogi Tea, and Celestial Seasonings, which have led the charge for sustainable packaging materials. Demand for premium and wellness-oriented herbal tea bags is on the rise in the Asia-Pacific (APAC) industry as well, particularly in Japan, China, and India.

The herbal tea carton packs segment accounts for 40% of the industry, and it is the second-largest segment. Comfortable carton packaging for commercial tea products is preferred in terms of low cost, recyclability, and storage for tea in bulk, (which) suits mass-market and family-size products.

The lightweight, 100% biodegradable carton packs from top-name brands like Twinings, Bigelow, and Traditional Medicinals bring clean-label and eco-conscious consumer trends to the forefront. North America and Europe are the primary markets driving demand, whereas Latin America and Asia-Pacific are the emerging markets with increasing penetration of herbal teas in carton packs for supermarket retail sales.

The tea bag and carton pack have also been invented, with brands investing in higher grade innovations such as plastic-free, compostable, and plant-based packaging that can deliver against global sustainability standards and evolve customer expectations.

The industry has been rapidly growing, with significant consumer interest relating to health and wellness, functional beverages, and natural preparations. Innovations and products are placed in the model category by such increasing demand. At the same time, the boost is gained from various segments, primarily including that of the marketing of caffeine-free, organic, and immunity-boosting teas.

Thus, Hain Celestial, Tata Consumer Products, Unilever (Pukka Herbs), Associated British Foods (Twinings), and Organic India take prominence in the industryby taking an exemplary product portfolio and premium organic offerings with along strong brand positioning. Smaller brands and niche start-ups would focus on providing ayurvedic, detox, or relaxing herbal infusions that are marketed via a direct-to-consumer (DTC) model and packaged sustainably for environmentally conscious consumers.

Trends are attributed to improved formulations with functional ingredients, the sale of individualized tea mixes, and novel brewing forms such as cold brew and ready-to-drink (RTD) herbal teas. Innovations in e-commerce and subscription-based distribution services will lead to the evolution of traditional avenues.

They include organic and health claims, educating the consumer on the benefits of herbs, using high-quality ethical herbs, and being compliant with government agencies' regulations. Companies that can introduce sustainability and transparency backed by science will find it easier to outwit the competition in this highly growing and intensive industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Hain Celestial Group (Celestial Seasonings) | 15-20% |

| Tata Consumer Products (Tetley Herbal Teas) | 12-16% |

| Unilever (Pukka Herbs) | 10-14% |

| Associated British Foods (Twinings Herbal Range) | 8-12% |

| Organic India | 7-10% |

| Other Players | 35-45% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Hain Celestial Group | Market leader with Celestial Seasonings, offering functional and wellness teas with organic and non-GMO certification. |

| Tata Consumer Products | Expanding Tetley Herbal range with caffeine-free, antioxidant-rich blends, targeting global wellness trends. |

| Unilever (Pukka Herbs) | Premium organic and ethically sourced herbal teas, positioned as Ayurvedic and functional wellness blends. |

| Associated British Foods (Twinings Herbal Range) | Strong legacy brand, focusing on flavored and specialty herbal tea blends. |

| Organic India | Pioneer in Ayurvedic and Tulsi-based herbal teas, emphasizing organic farming and sustainability. |

Key Company Insights

Hain Celestial (15-20%)

A big player along with Celestial Seasonings, which provides a botanically infused range of functional teas with strong brand recognition.

Tata Consumer Products (12-16%)

Tetley is being complemented in expanding its herbal tea portfolio with ingredients rich in antioxidants and functional health blends.

Unilever (Pukka Herbs) (10-14%)

The premium organic tea brand that loves ethical sourcing and Ayurvedic herbs plus holistic wellness appeal.

Associated British Foods (Twinings Herbal Range) (8-12%)

A heritage tea brand offering a wide range of herbal infusions, catering to both traditional and premium consumers.

Organic India (7-10%)

It is the leading source of organic Tulsi and Ayurvedic herbal teas, focusing on immunity-boosting and adaptogenic formulations.

Other Key Players (35-45% Combined)

Hain Celestial Group

In 2024, Hain Celestial, known for brands like Celestial Seasonings, initiated a three-year turnaround plan to enhance financial health and brand investment. This strategy focuses on improving working capital management, reducing production costs, and reinvesting in core brands to drive growth.

TH Group

In September 2024, Vietnam's TH Group launched a new line of herbal teas utilizing indigenous ingredients such as jiaogulan, lingzhi, and chrysanthemum. Derived from local forest buffer zones, the move is to encourage regional biodiversity and provide distinct products to health-oriented consumers.

Supreme Imports

In December 2024, Supreme, a company specializing in vapes and beverages, acquired Typhoo Tea for USD 13.2 million. This acquisition is part of Supreme's diversification strategy, aiming to revitalize the historic tea brand and expand its presence in the beverage sector.

These developments reflect a dynamic and competitive landscape, with companies focusing on innovation, strategic acquisitions, and sustainability to meet evolving consumer preferences in the herbal tea market.

The market is segmented into black herbal tea, green herbal tea, and yellow herbal tea, with growing demand for antioxidant-rich and functional herbal tea variants.

The market includes herbal tea instant premixes, liquid herbal tea, powdered RTD herbal tea, and herbal tea syrup, driven by increasing convenience and ready-to-drink formulations.

The market is categorized into lemongrass herbal tea, peppermint herbal tea, fruit herbal tea, hibiscus herbal tea, ginger herbal tea, and chamomile herbal tea, influenced by consumer preference for wellness and relaxation.

The market is segmented into herbal tea can packaging, herbal tea carton packs, herbal tea bags, herbal tea paper pouches, and loose herbal tea, with demand increasing for sustainable packaging solutions.

The market is divided into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

The global herbal tea market is projected to grow at a CAGR of 7.5% from 2025 to 2035, driven by increasing demand for functional beverages and plant-based health products.

By 2035, the global herbal tea market is expected to reach approximately USD 9.44 billion, reflecting strong growth in consumer preference for organic and wellness-oriented teas.

The liquid herbal tea segment is expected to grow the fastest due to rising demand for ready-to-drink and functional beverage solutions that offer convenience and health benefits.

Key growth drivers include increasing consumer awareness of health benefits, demand for caffeine-free alternatives, expansion in e-commerce, and innovation in herbal tea formulations with medicinal and adaptogenic ingredients.

Some of the dominant players in the global herbal tea market include Hain Celestial Group, Tata Consumer Products, Unilever (Pukka Herbs), Associated British Foods (Twinings), Organic India, and Celestial Seasonings, all focusing on product innovation and expanding their global footprint.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Raw Material Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Raw Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Flavor Types, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Flavor Types, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 10: Global Market Volume (Tons) Forecast by Packaging Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Raw Material Type, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Raw Material Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Flavor Types, 2018 to 2033

Table 18: North America Market Volume (Tons) Forecast by Flavor Types, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 20: North America Market Volume (Tons) Forecast by Packaging Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Raw Material Type, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Raw Material Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 26: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Flavor Types, 2018 to 2033

Table 28: Latin America Market Volume (Tons) Forecast by Flavor Types, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 30: Latin America Market Volume (Tons) Forecast by Packaging Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Raw Material Type, 2018 to 2033

Table 34: Western Europe Market Volume (Tons) Forecast by Raw Material Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Flavor Types, 2018 to 2033

Table 38: Western Europe Market Volume (Tons) Forecast by Flavor Types, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 40: Western Europe Market Volume (Tons) Forecast by Packaging Type, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Raw Material Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Tons) Forecast by Raw Material Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Flavor Types, 2018 to 2033

Table 48: Eastern Europe Market Volume (Tons) Forecast by Flavor Types, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 50: Eastern Europe Market Volume (Tons) Forecast by Packaging Type, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Raw Material Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Tons) Forecast by Raw Material Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Flavor Types, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Tons) Forecast by Flavor Types, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Tons) Forecast by Packaging Type, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Raw Material Type, 2018 to 2033

Table 64: East Asia Market Volume (Tons) Forecast by Raw Material Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 66: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Flavor Types, 2018 to 2033

Table 68: East Asia Market Volume (Tons) Forecast by Flavor Types, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 70: East Asia Market Volume (Tons) Forecast by Packaging Type, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Raw Material Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Tons) Forecast by Raw Material Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Flavor Types, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Tons) Forecast by Flavor Types, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Tons) Forecast by Packaging Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Raw Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Flavor Types, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Raw Material Type, 2018 to 2033

Figure 11: Global Market Volume (Tons) Analysis by Raw Material Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Raw Material Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Raw Material Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Flavor Types, 2018 to 2033

Figure 19: Global Market Volume (Tons) Analysis by Flavor Types, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Flavor Types, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Flavor Types, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 23: Global Market Volume (Tons) Analysis by Packaging Type, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 26: Global Market Attractiveness by Raw Material Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Flavor Types, 2023 to 2033

Figure 29: Global Market Attractiveness by Packaging Type, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Raw Material Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Flavor Types, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Raw Material Type, 2018 to 2033

Figure 41: North America Market Volume (Tons) Analysis by Raw Material Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Raw Material Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Raw Material Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Flavor Types, 2018 to 2033

Figure 49: North America Market Volume (Tons) Analysis by Flavor Types, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Flavor Types, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Flavor Types, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 53: North America Market Volume (Tons) Analysis by Packaging Type, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 56: North America Market Attractiveness by Raw Material Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Flavor Types, 2023 to 2033

Figure 59: North America Market Attractiveness by Packaging Type, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Raw Material Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Flavor Types, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Raw Material Type, 2018 to 2033

Figure 71: Latin America Market Volume (Tons) Analysis by Raw Material Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Raw Material Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Raw Material Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 75: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Flavor Types, 2018 to 2033

Figure 79: Latin America Market Volume (Tons) Analysis by Flavor Types, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Flavor Types, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Flavor Types, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 83: Latin America Market Volume (Tons) Analysis by Packaging Type, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Raw Material Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Flavor Types, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Packaging Type, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Raw Material Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Flavor Types, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Raw Material Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Tons) Analysis by Raw Material Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Raw Material Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Raw Material Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Flavor Types, 2018 to 2033

Figure 109: Western Europe Market Volume (Tons) Analysis by Flavor Types, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Flavor Types, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Flavor Types, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 113: Western Europe Market Volume (Tons) Analysis by Packaging Type, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Raw Material Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Flavor Types, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Packaging Type, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Raw Material Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Flavor Types, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Raw Material Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Tons) Analysis by Raw Material Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Raw Material Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Raw Material Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Flavor Types, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Tons) Analysis by Flavor Types, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Flavor Types, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Flavor Types, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Tons) Analysis by Packaging Type, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Raw Material Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Flavor Types, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Packaging Type, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Raw Material Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Flavor Types, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Raw Material Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Tons) Analysis by Raw Material Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Raw Material Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Raw Material Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Flavor Types, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Tons) Analysis by Flavor Types, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Flavor Types, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Flavor Types, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Tons) Analysis by Packaging Type, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Raw Material Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Flavor Types, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Packaging Type, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Raw Material Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Flavor Types, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Raw Material Type, 2018 to 2033

Figure 191: East Asia Market Volume (Tons) Analysis by Raw Material Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Raw Material Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Raw Material Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 195: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Flavor Types, 2018 to 2033

Figure 199: East Asia Market Volume (Tons) Analysis by Flavor Types, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Flavor Types, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Flavor Types, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 203: East Asia Market Volume (Tons) Analysis by Packaging Type, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Raw Material Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Flavor Types, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Packaging Type, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Raw Material Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Flavor Types, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Raw Material Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Tons) Analysis by Raw Material Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Raw Material Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Raw Material Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Flavor Types, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Tons) Analysis by Flavor Types, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Flavor Types, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Flavor Types, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Tons) Analysis by Packaging Type, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Raw Material Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Flavor Types, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Packaging Type, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Herbal Beauty Product Market Size and Share Forecast Outlook 2025 to 2035

Tea Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Herbal Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Tea Tree Oil Treatments Market Size and Share Forecast Outlook 2025 to 2035

Herbal Personal Care Products Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tear-tab Lids Market Size and Share Forecast Outlook 2025 to 2035

Tea and Coffee Bags Market Size and Share Forecast Outlook 2025 to 2035

Herbal Nutraceuticals Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Herbal Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Tea Infuser Market Analysis & Forecast by Material Type, Product Type, Distribution Store, and Region Through 2025 to 2035

Tea Packaging Market Size, Demand & Forecast 2025 to 2035

Teaseed Cake Market – Trends & Forecast 2025 to 2035

Tea-Based Skin Care Products Market Analysis by Product Type, Tea Type, Skin Type, Sales Channel and Region from 2025 to 2035

Competitive Breakdown of Tea Packaging Providers

Teabag Envelope Market Analysis based on Material Type, End Use, and Region through 2025 to 2035

Teak Decking Market Growth Analysis by Grade, Application and Region: Forecast for 2025 and 2035

Herbal Fragrance Ingredients Market Analysis by Application, Ingredients, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA