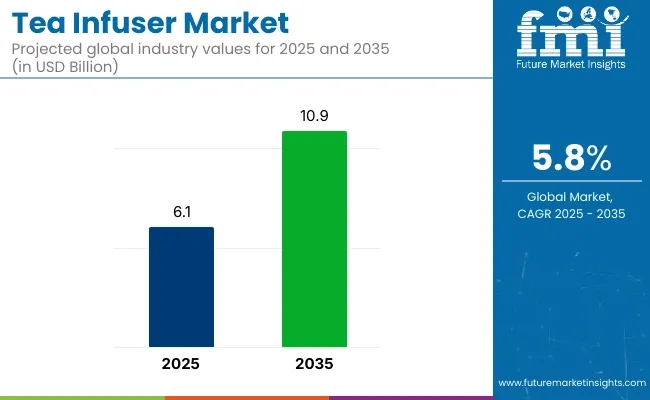

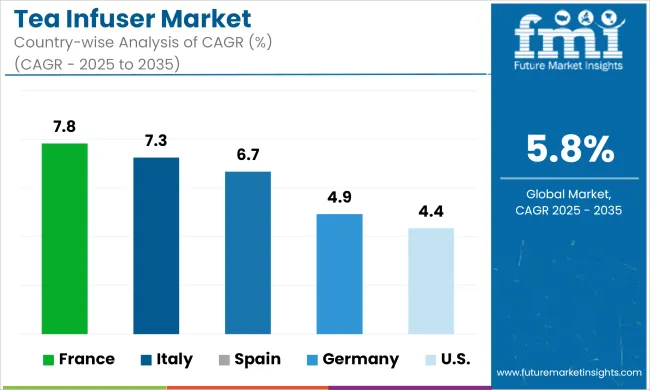

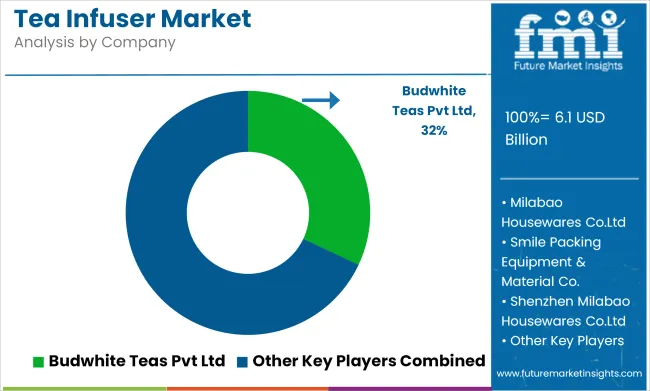

The tea infuser market is projected to grow from USD 6.1 billion in 2025 to USD 10.9 billion by 2035, registering a CAGR of 5.8% during the forecast period. Sales in 2024 reached USD 5.7 billion, reflecting growing consumer preference for premium, health-focused tea accessories. This growth is being driven by evolving consumer preferences toward healthier beverage options and the growing integration of tea rituals into modern wellness lifestyles. Increased demand for convenient and aesthetically appealing brewing tools has further stimulated interest in high-quality tea infusers.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 6.1 billion |

| Industry Value (2035F) | USD 10.9 billion |

| CAGR (2025 to 2035) | 5.8% |

Lake of the Woods Brewing Company (LOWBREWCO) has taken its innovation to a whole new scale literally. The company is proud to unveil its latest brewing advancement as Tannic Extraction & Aromatic Infusion System (T.E.A. Infuser), also known as a Giant Tea Pot, stationed at their new brewing facility on Valley Drive in Kenora, ON. This monumental piece of equipment is a key part of the production process for their newest release, Great Big Tea Hard Iced Tea, an authentic, real-brewed black tea alcoholic beverage.

The tea infuser market has increasingly aligned with sustainability values. Products made from biodegradable silicone and recyclable metals have been introduced to reduce environmental impact. Innovation has been evident in infusers featuring temperature-sensitive color changes, adjustable brewing baskets, and digital timers. Additionally, reusable infusers are being marketed as an eco-friendly alternative to disposable tea bags, positioning them as a sustainable lifestyle choice for tea consumers worldwide.

The launch of the T.E.A Infuser (Giant Tea Pot) and Great Big Tea Hard Iced Tea marks yet another bold step forward for LOWBREWCO. “We knew we wanted to create a hard iced tea that was truly brewed, not just flavoured,” said Taras Manzie, President and CEO of Lake of the Woods Brewing Company. “But in order to do that, we needed to think big-really big. It was quite an engineering feat to get this pot.”

Going forward, the tea infuser market is expected to benefit from ongoing product innovation, eco-conscious consumer behavior, and the premiumization of tea culture. Growth is likely to be accelerated in markets where artisanal and wellness-driven tea consumption is on the rise. Brands that emphasize ergonomic design, sustainable materials, and interactive user experiences are predicted to gain competitive advantage in this evolving landscape.

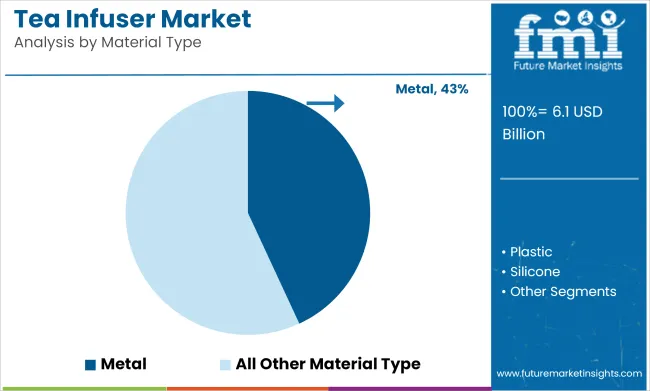

Metal-based tea infusers, primarily made from stainless steel and aluminum, are projected to hold a 43.1% share of the tea infuser market in 2025, thanks to their long-lasting performance, ease of maintenance, and superior brewing control. Stainless steel, in particular, offers excellent corrosion resistance, heat stability, and flavor neutrality, making it ideal for daily tea preparation across home, commercial, and travel settings.

Metal infusers are favored for their precision-engineered mesh or perforated designs, which allow optimal water flow while preventing fine tea particles from escaping into the cup. This results in a cleaner brew and enhances the sensory experience. Aluminum variants, often anodized for safety and aesthetic appeal, offer a lightweight yet durable alternative, especially for portable and compact infuser formats.

Additionally, metal infusers are dishwasher-safe, reusable, and resistant to staining-features that appeal to environmentally conscious consumers seeking alternatives to disposable tea bags. Many premium brands also offer elegant, minimalist designs in metallic finishes that elevate the tea-drinking ritual. As the global trend toward artisanal and loose-leaf tea consumption continues, metal tea infusers remain a trusted choice for tea enthusiasts and cafés alike, offering an ideal mix of function, form, and sustainability.

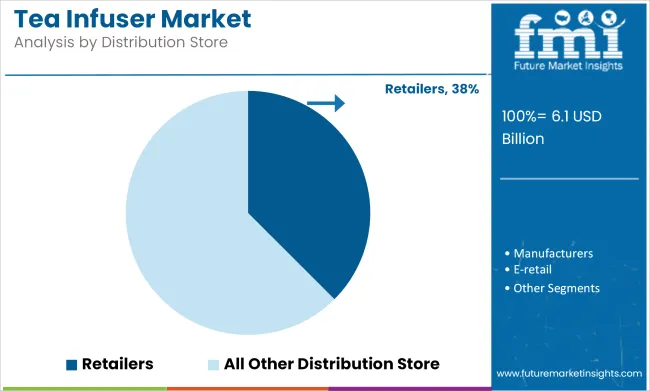

Retailers including hypermarkets, supermarkets, convenience stores, and specialty tea shops are anticipated to capture the largest distribution share in the tea infuser market by 2025, holding an estimated 37.5% market share. This dominance has been attributed to the immediate product availability, physical inspection benefits, and strong placement in both kitchenware and beverage aisles across major retail formats.

Impulse purchases and cross-merchandising with tea products have driven high foot traffic sales, particularly in specialty stores and health-focused retail outlets where premium infusers are displayed alongside loose-leaf tea blends. Product demonstrations, bundled deals, and festive promotions have also contributed to a rise in retail-based purchases.

Retailers have offered a diverse range of infuser types-ranging from metal to silicone and novelty designs catering to gifting, seasonal collections, and household needs. The tangible shopping experience has appealed to consumers who prioritize material feel, size compatibility, and visual appeal before making a purchase.

Despite the growing rise of e-commerce, the trust and immediate gratification associated with in-store buying have ensured continued traction for retail channels. With increasing shelf space dedicated to tea and its accessories, and growing partnerships with artisanal tea brands, the retail segment is expected to remain a dominant force in global tea infuser distribution.

Conventional and forward-looking investigations on the tea infuser manufacturing industry have been developed based on a broad analysis published by Future Industry Insights (FMI) on the tea infuser manufacturing industry.

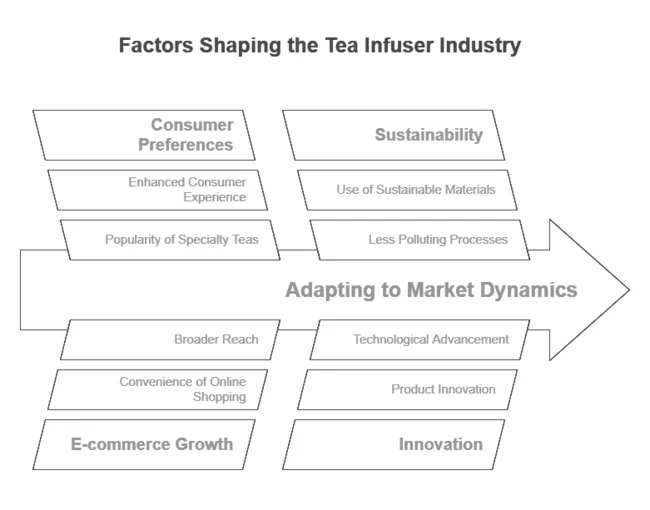

One of the most intriguing things we found is that specialty teas, such as herbal and fruit infusions, are extremely popular. In this regard, manufacturers are launching newer and better products. Stakeholders emphasized that new tea infusers should be designed to enhance the consumer experience.

The study also focused on e-commerce sites for distributing tea infusers. The suppliers had a major jump in their Internet sales and ascribed the phenomenon to the convenience and broader reach afforded by web-based channels. Companies have been compelled to adapt to this trend, expanding their online presence and transitioning to consumer-to-business business models in order to reap the benefits of the emerging online industry.

Sustainability is increasingly becoming the top priority for stakeholders. With increasing awareness of environmental impact, there is a strong push for sustainable materials, there is intentional advocacy for sustainable materials and less polluting processes. Manufacturers are considering the use of biodegradable and recyclable material for tea infusers, owing to global sustainability initiatives and growing demand for green products amongst consumers.

As a result, the FMI study finds the tea infuser landscape to be a critical domain characterized by innovation, digitalization, and sustainability drives. The players are already tangentially addressing evolving consumer needs and the evolution of technology, getting themselves prepared to execute future needs seamlessly.

| 2020 to 2024 (Past Performance) | 2025 to 2035 (Future Outlook) |

|---|---|

| The industry saw steady growth due to increasing demand for loose-leaf and herbal teas. | Accelerated expansion drives the industry for premium, sustainable smart tea infusers. |

| By 2023, it accounted for around USD 5,300 million. | Projected to rise from USD 6,142 million in 2025 to USD 10,998 million in 2035. |

| This is due to factors such as the shift from tea bags to loose-leaf tea, increasing awareness about health, and preference towards packaging products. | This growth is attributed to an increase in demand for personalized, luxurious, and technologically integrated tea-infusing devices. |

| Growing Use of a BPA-free, reusable, and biodegradable tea infuser. | Greater innovations in plastic-free, compostable, and premium sustainable materials. |

| Asia-Pacific leads the industry due to its strong tea culture, while North America and Europe see rising demand for specialty teas. | Asia-Pacific continues to lead this trend, with demand for functional and wellness teas being stronger in North America and Europe. |

| Online sales surged due to convenience and wider product selection. | E-commerce, including AI-based personal recommendations and subscription services, is driving this trend. |

These include import and export regulations and quality standards for tea infusers. The rules vary from place to place, but they have a strong emphasis on curtailing plastic waste, maintaining food-grade safety standards, and encouraging eco-friendly alternatives. We outline below a country-wise summary of key regulations impacting the industry:

| Country/Region | Regulations Impacting the Tea Infuser Industry |

|---|---|

| United States | Under 21 CFR regulations of the Food and Drug Administration, all materials that come into contact with food must meet safety standards for food contact. The Environmental Protection Agency (EPA) has introduced guidelines to reduce single-use plastics, encouraging manufacturers to adopt biodegradable and BPA-free materials for tea infusers. |

| European Union | The EU single-use plastics directive bans certain plastic-based tea infusers to reduce environmental waste. REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) of the materials used for the food corresponds to hygiene standards, i.e., the materials are not toxic. |

| China | Tea infuser materials, including plastic, silicone, and metal, are regulated by the National Food Safety Standards (GB 4806.7 to 2016) for food-contact products. Under its "Made in China 2025" sustainability strategy, the government has also advocated for environmentally friendly manufacturing. |

| India | The guidelines of the FSSAI (Food Safety and Standards Authority of India) state that infusers made from stainless steel and silicone-based material have to meet strict standards for food-grade safety. There was also a recent ban on single-use plastics in India, which, in turn, affected the production of inexpensive plastic tea infusers. |

| Japan | The Food Sanitation Act, however, applies to plastic and silicone tea accessories and has strict requirements to ensure all materials comply with rigorous heat-resistant and non-toxic standards. Japan is also promoting a sustainable bamboo and ceramic-based infuser. |

| Australia | The Australian Packaging Covenant (APCO) and National Plastics Plan 2021 hope to phase out non-recyclable plastics in kitchenware by 2025, including tea infusers. The Food Standards Code (FSANZ) in Australia regulates the use of food-contact materials, including tea accessories. |

Worldwide regulations are driving producers to enact sustainable and eco-sensitive materials like stainless steel, glass, bamboo, and biodegradable polymers. Countries with strict food-contact safety rules are also pushing innovation in heat-resistant and non-toxic infuser designs. Businesses seeking to grow in global industries must develop compliance systems for adapting to policies that will inevitably continue to change, especially in regard to green packaging approaches and plastic bans.

More importantly, a growing trend for specialty teas and the health benefits associated with them have enhanced the industry. Tea lovers are becoming more adventurous, leading to a demand for innovative tea infusers that enhance the brewing process. The sector itself leans towards durable and visually appealing infusers, with rising demand for materials such as stainless steel and silicone.

E-commerce platforms facilitate consumer access and thus promote the expansion of the industry, offering multiple types of tea infusers. To meet growing consumer demand for sustainability, reusable and eco-friendly infusers are being introduced.

In the UK, tea is drunk so frequently that it is ingrained in the culture, and this makes its way into its tea infuser industry as well. Consumers overwhelmingly prefer high-end infusers that mirror their tea rituals. With the trend of artisanal and designer infusers increasing in the industry, People are beginning to care about how their infuser looks and how it functions. Fine china and stainless steel are popular materials, straddling the British balance between tradition and modernism. Additionally, specialty stores and online platforms have emerged as crucial distribution channels, providing consumers with a variety of infuser choices.

The cosmopolitan food culture in France has had a significant effect on its tea infuser industry. Deft infuser design further appeals to consumers, who appreciate sleek and stylish products capable of elevating the tea-making experience. As for the type of infuser, there's a strong interest in glass and porcelain infusers, objects that follow France's taste for art and refinement.

There is also growing popularity of organic and herbal teas in the industry, encouraging manufacturers to produce infusers that are suitable for these brewing types. The distribution of premium tea infusers is highly consolidated amongst boutique shops and high-end retailers.

The tea infuser industry in Germany is also pragmatic, and consumers here value functionality and durability above all else. Stainless steel infusers are especially popular because of their durability and low maintenance requirements. The industry has also welcomed new designs that are accommodating the burgeoning demand for loose-leaf and specialty teas. The growing awareness of environmental sustainability makes them a popular and reusable infuser. Consumers have access to a comprehensive selection of products through completely established online and offline retail channels.

So far, Italy is a coffee plant-dominated culture, but it has slowly increased its tea consumption, which has had an impact on the tea-infuser industry. The growing variety of tea types consumers are trying has created a demand for not just dual or trinity tea infusers, which offer the ability to steep multiple styles of tea at once, but an infuser with style as well.

Designs that marry Italian craftsmanship with contemporary functionality are especially appealing. Popular materials include ceramic and stainless steel infusers that display a harmony between long-standing tradition and modern tastes. Niche industry stores and online channels are becoming significant options for reaching Italian consumers, who are gradually changing their food preferences.

A sub-framework of Korea's traditional tea culture in a modernized design sets the stage for the tea infuser industry. Consumers are partial to infusers who meld old with new sensibilities. The preference is heavy on simple designs made of glass and stainless steel. The growing popularity of e-commerce platforms has made them prominent distribution channels, with increasingly diverse and innovative infuser designs targeting tech-savvy consumers.

Japan's tea industry is heavily entrenched in tea ceremonies but has adapted to modern ways. Consumers appreciate infusion devices that maintain traditional aesthetics and modern convenience. Ceramics and bamboo are common materials that pay homage to Japan's natural world. Interest is also expanding to specialized infusers for different teas, including Matcha and Sencha. The distribution of tea infusers is well supported by both specialty tea shops and online retailers, catering to diverse consumer preferences.

China, being the birthplace of tea, has a very large and diverse tea infuser industry. While consumers cherish traditional tea-making instruments, contemporary infuser designs that fit busy lifestyles are also becoming increasingly popular. The most commonly used materials, such as porcelain, glass, and stainless steel, reflect a blend of tradition and innovation.

The industry has also witnessed a rise in portable and travel-friendly infusers, aligning with the dynamic lifestyles of younger consumers. Local brands, foreign brands, and international brands with different product variations occupy this industry.

A growing focus on health and wellness is also influencing the tea infuser industry in Australia and New Zealand. Consumers are also trying different herbal and specialty teas, both of which have created a demand for multipurpose, simple infusers." Stainless steel and silicone products are commonly used, as they are durable and simple to clean.

There is also a strong focus on sustainability in the industry as consumers look for eco-friendly and reusable infusers. E-commerce platforms and specialty health stores have emerged as critical distribution channels, granting consumers access to a wide variety of infuser designs.

Tea infusers are categorized under the household kitchenware and beverage accessories segment, which forms part of the global consumer goods and lifestyle products industry. It is closely associated with macroeconomic variables, including disposable income levels, consumer spending behaviors, international trade, and raw material prices.

Economic Growth and Consumer Spending: Economic growth, especially in regions with rising disposable income, drives demand for these products. Spending, in turn, is driven by the consumer shift toward premium and specialty teas. There has been a brisk demand for good-quality brewing tools from countries with growing middle classes like China, India, and Brazil.

Prices and supply chains for raw materials: The production of tea infusers necessitates the use of stainless steel, silicone, glass, and plastic. Disruptions of the global supply chain, as have been seen in the past few years because of geopolitical conflicts and slowdowns related to the pandemic, have affected production costs and availability.

Sustainability Trend: With increasing environmental concerns and government regulations on the usage of plastic, the demand for eco-friendly and reusable fibers is growing, which in turn is making manufacturers adopt sustainable materials in products such as biodegradable plastics and stainless steel.

Key Developments

2024 was a year of dramatic consolidation and strategic realignment in the tea business with implications for the broader tea industry and, therefore, the tea infuser industry.TreeHouse Foods, Inc. has entered into a deal to acquire the private brand tea business of Harris Freeman & Co., Inc. in a transaction valued at USD 205 million to strengthen its private label offering. It seems that this purchase makes TreeHouse Foods a key player in the private label tea business, which could in turn affect the demand for tea accessories like infusers, as well.

Supreme Buys Historic Typhoo Tea for £10.2 Million Supreme has bought the traditional Typhoo Tea brand for £10.2 million, which is in line with its extensive product range. This acquisition aligns with Supreme’s diversification strategy to expand into the beverage segment. This will provide an opportunity for rebranding Typhoo Tea under new owners, which might play a role in the better consumption of tea among consumers and influence the tea infuser industry.

Planting Hope purchased from Argo Tea its managed food service agreements and university café licenses. This acquisition is expected to take Planting Hope's contract foodservice strategy to new levels, with new, cool tea products and accessories to be introduced to a growing audience.

These developments may be part of a general trend of consolidation and strategic diversification in the tea industry that may have implications for the tea industry overall and tea infuser manufacturers in particular. As tea is a favorite beverage, the demand for complementary products is largely at the nascent stage, as industry players start to incur new products like tea infusers in their portfolio, thereby capturing this opportunity.

Strong growth opportunities are prevalent in the tea infuser industry due to a variety of factors, such as increasing tea consumption, sustainability concerns, and product innovation. It has led consumers to seek eco-friendly and reusable infusers, paving a path for biodegradable materials like stainless steel, bamboo, and silicone. There is also more demand for high-tech options like temperature control, Bluetooth connectivity, and self-cleaning tea brews for the tech-savvy to drink.

Direct-to-consumer (DTC) sales buzz from e-commerce giants like Amazon and Shopify , as well as social media shop fronts, continue to drive the industry. Product additions that include tea and infuser bundles, product customization, and partnerships with luxury tea brands, hotels, and cafés give a lot of growth opportunities.

The companies are also innovation-orientated in the types of sustainable materials used and cross-develop into digital and emerging industries, in addition to multi-functional designs, tea-coffee hybrid infusers, and travel-friendly options. The companies are establishing additional business-to-business (B2B) partnerships with specialty tea merchants and hospitality businesses to broaden their industry reach.

New entrants in the tea infuser industry need to focus on a niche, innovate, and establish a strong brand. Instead of competing with commoditized offerings, startups can differentiate themselves based on eco-friendly materials, high-end craftsmanship, or smart technology integration. Targeting specific demographics, such as millennials, wellness seekers, or traditional tea drinkers, can also be used to strengthen industry positioning.

E-commerce and the digital industry are crucial for visibility, with sales being propelled by Amazon, Etsy, and DTC websites. Brand awareness can be enhanced through influencer collaborations on Instagram, TikTok, and YouTube. Competitive pricing, bundling infusers with loose-leaf teas or accessories, and strategic partnerships with tea brands, cafés, and subscription services will give new entrants industry momentum. Sustainability, smart features, and premium design will be the drivers of long-term success.

The industry is segmented into plastic (polyethylene terephthalate (PET), polypropylene (PP), polyethylene (PE) & polystyrene (PS)), metal (stainless steel, aluminum), silicone and fiber.

It is bifurcated into a tea ball and a French press

Sector is fragmented into manufacturers (direct sales), distributors, retailers (hyper industries, super industries, convenience stores & specialty stores), and e-retail

It is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa (MEA)

The industry is driven by increasing tea consumption, growing sustainability concerns, and product innovations.

Stainless steel, silicone, bamboo, and biodegradable plastics.

Convenience is maximized with temperature control, Bluetooth connectivity, and self-cleaning features.

Internet retailers like Amazon, specialty tea shops, grocery stores, and home goods retailers.

Hybrid tea-coffee infusers, which can be user-programmable or designed with luxury features, are now available.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tea Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tea Tree Oil Treatments Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tear-tab Lids Market Size and Share Forecast Outlook 2025 to 2035

Tea and Coffee Bags Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tea Packaging Market Size, Demand & Forecast 2025 to 2035

Teaseed Cake Market – Trends & Forecast 2025 to 2035

Tea-Based Skin Care Products Market Analysis by Product Type, Tea Type, Skin Type, Sales Channel and Region from 2025 to 2035

Competitive Breakdown of Tea Packaging Providers

Teabag Envelope Market Analysis based on Material Type, End Use, and Region through 2025 to 2035

Teak Decking Market Growth Analysis by Grade, Application and Region: Forecast for 2025 and 2035

Market Share Distribution Among Tea Packaging Machine Manufacturers

Market Share Breakdown of Leading Tear-Tab Lids Manufacturers

Competitive Breakdown of Tear Tape Providers

Market Share Breakdown of Leading Tea Polyphenols Suppliers

Market Share Insights of Tear Tape Dispenser Manufacturers

Global Tea Filter Paper Market Analysis – Growth & Forecast 2024-2034

Tear Tab Cap Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA