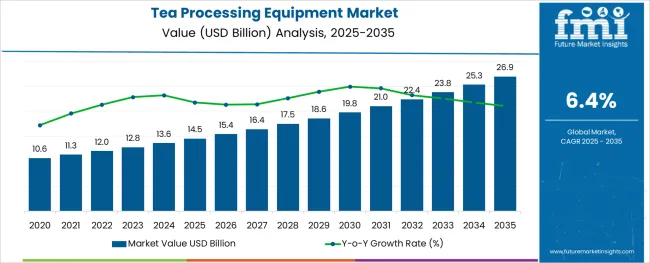

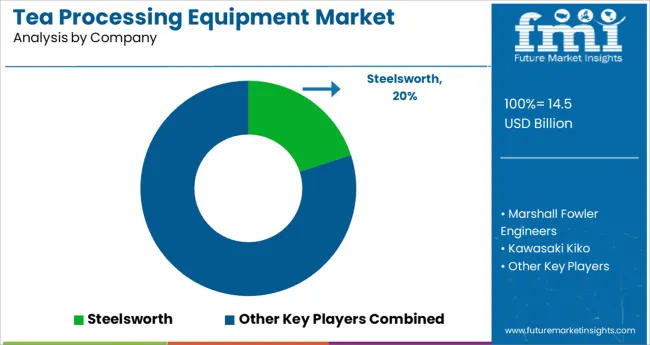

The Tea Processing Equipment Market is estimated to be valued at USD 14.5 billion in 2025 and is projected to reach USD 26.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The tea processing equipment market is witnessing sustained growth as modernization of processing facilities and rising global tea consumption reshape production practices. Increasing demand for consistent quality, higher yields, and compliance with hygiene standards has encouraged producers to adopt advanced machinery across key processing stages.

The shift toward mechanized and energy efficient equipment is being driven by a need to meet international export standards and to optimize operational efficiency. Future growth is expected to be supported by expanding black and specialty tea consumption, rising investments in automated processing lines, and an emphasis on reducing production costs.

Manufacturers are expected to benefit from innovation in multi-functional machines, integration of digital monitoring systems, and growing demand from emerging tea producing regions, paving the way for wider adoption and improved productivity.

The market is segmented by Processing Technique, Process Component, End-Use Industry, and Automation Grade and region. By Processing Technique, the market is divided into CTC Tea Processing Machine and Orthodox Tea Processing Machine. In terms of Process Component, the market is classified into Tea Drying Equipment, Tea Sorting Equipment, Tea Powder Grinding, Tea Rolling Machine, and Fermenting Machine. Based on End-Use Industry, the market is segmented into Black Tea Industry, Green Tea Industry, Oolong Tea Industry, and Others. By Automation Grade, the market is divided into Automatic, Semi-Automatic, and Manual. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Processing Technique, Process Component, End-Use Industry, and Automation Grade and region. By Processing Technique, the market is divided into CTC Tea Processing Machine and Orthodox Tea Processing Machine. In terms of Process Component, the market is classified into Tea Drying Equipment, Tea Sorting Equipment, Tea Powder Grinding, Tea Rolling Machine, and Fermenting Machine. Based on End-Use Industry, the market is segmented into Black Tea Industry, Green Tea Industry, Oolong Tea Industry, and Others. By Automation Grade, the market is divided into Automatic, Semi-Automatic, and Manual. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

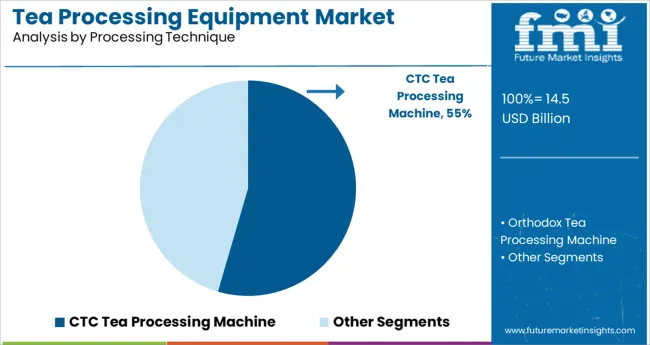

When segmented by processing technique the CTC tea processing machine segment is projected to command 54.5% of the total market revenue in 2025 maintaining its leading position. This dominance has been shaped by its efficiency in producing large volumes of uniform quality tea suited for mass market consumption.

The ability of CTC machines to deliver faster throughput while preserving flavor consistency has positioned them as the preferred choice in high demand markets. Improved mechanical durability reduced maintenance requirements and compatibility with automated feeding and drying systems have reinforced their adoption.

Manufacturers have prioritized investments in CTC lines to meet export quality standards and to cater to the growing popularity of strong brisk teas. These attributes combined with enhanced adaptability to varying leaf qualities have enabled the CTC tea processing machine segment to sustain its leadership in the market.

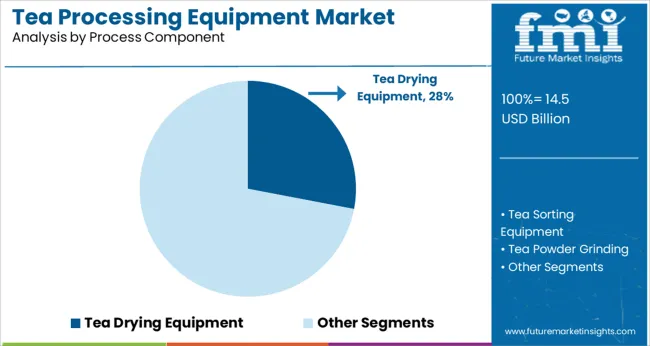

Segmented by process component the tea drying equipment segment is anticipated to hold 28.0% of the market revenue in 2025 emerging as the leading component. This leadership has been underpinned by the critical role drying plays in defining the final flavor aroma and shelf life of tea.

Advancements in drying technologies have enabled uniform moisture reduction energy savings and minimized quality loss which have strengthened its adoption. Producers have increasingly invested in drying systems that offer precise temperature and humidity control to align with premium quality standards.

The integration of continuous belt dryers hot air circulation systems and moisture sensors has improved efficiency and product consistency. The segment’s prominence has been further supported by the need to accommodate higher production capacities and stricter food safety requirements consolidating its importance in the overall process.

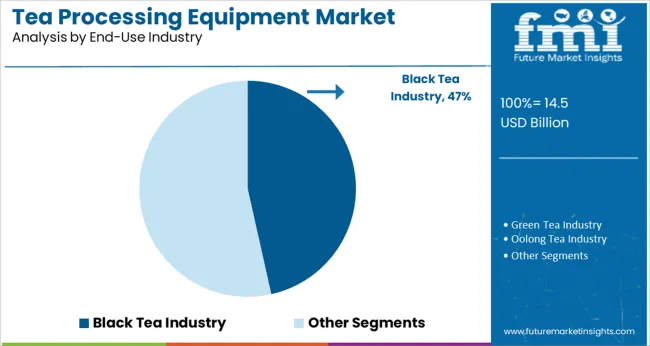

When segmented by end use industry the black tea industry segment is expected to account for 46.5% of the market revenue in 2025 maintaining its top position. This dominance has been reinforced by the sustained global preference for black tea driven by its robust flavor widespread cultural acceptance and higher export volumes compared to other varieties.

Producers in this segment have increasingly adopted advanced equipment to meet escalating demand and stringent quality certifications required by international markets. The ability of modern equipment to handle high throughput maintain leaf integrity and reduce operational inefficiencies has supported black tea producers in scaling production.

The segment has also benefited from branding initiatives and premium product offerings which have necessitated improved processing standards. This alignment of consumer demand with operational excellence has solidified the black tea industry’s leadership within the tea processing equipment market.

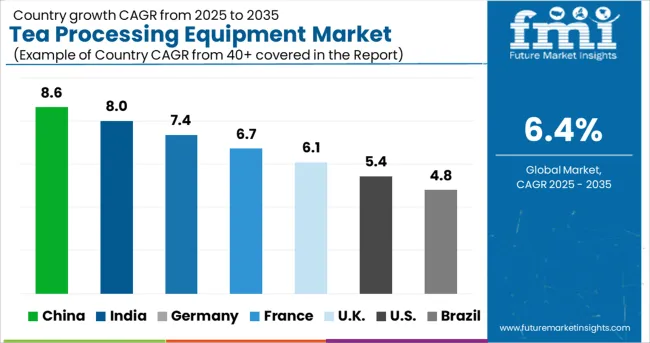

The global sales of tea processing equipment are projected to rise at 6.4% CAGR between 2025 and 2035 in comparison to the 7.1% CAGR registered during the historical period of 2020 to 2025.

Rising production and consumption of various types of teas across the world is a key factor driving growth in the global tea processing equipment market and the trend is likely to continue during the forecast period.

Similarly, tea processing equipment sales will be driven by the increased adoption of automation by tea manufacturing companies. Teas come in a wide variety of flavors, and tea brands around the world are continuing to evolve by introducing new ones. As a result, producing distinct varieties of tea has grown more difficult for manufacturers.

With the development of automation in tea processing machinery, manufacturers may quickly create a variety of teas on a wide scale without sacrificing quality, while also lowering operating costs through reduced labor involvement.

Similarly, the rising number of new start-ups, especially across top tea-producing countries such as India, China, and Sri Lanka is expected to generate high demand for tea-processing equipment during the next ten years.

The rise in Tea Export and the Growing Popularity of Automatic Machines boosted the Market Over the Next Decade

In recent years, there has been a sharp rise in the export of various teas due to increasing consumption across countries like India, China, Sri Lanka, and the USA This is playing a key role in generating demand for tea processing equipment and the trend is likely to continue during the forecast period.

Similarly, tea manufacturers are installing automatic tea processing equipment in their facilities to increase their production capacity, reduce labor costs, and improve product quality. This will further aid in the expansion of the tea processing equipment market over the next ten years.

Rapid Growth of Green Tea Industry Pushing Demand in the USA

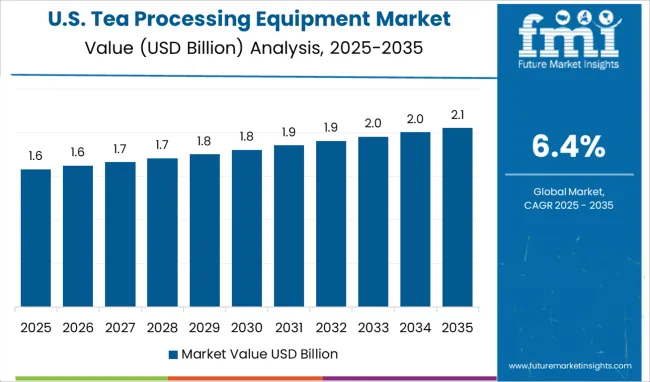

According to FMI, the USA tea processing equipment market is valued at USD 2.4 Billion and it is poised to exhibit a robust CAGR during the next ten years, making it one of the most lucrative markets across North America.

The rising adoption of advanced manufacturing machinery, the strong presence of leading manufacturers, and the increasing consumption of green tea are some of the factors driving growth in the USA tea processing equipment market.

According to the Tea Association of the USA, Americans drank 10.6 billion gallons of tea or about 84 billion servings in 2020. About 84% of the tea consumed was black tea, 15% was green tea, and the remaining 1% was oolong, white, and dark tea.

The green tea industry in particular has seen fast growth among millennials and will further fuel demand for tea processing equipment across the USA during the forecast period.

Rising Production and Consumption of Tea Driving Market in India

With rising production, consumption, and export of tea, India is emerging as a lucrative market for tea processing equipment. FMI has predicted a robust CAGR for the Indian tea processing equipment market for the projected period of 2025 and 2035.

The Indian tea market revenue in the tea segment amounted to USD 14.5 Billion in 2025. The market is consolidated with the presence of several major brands. People in the country consume large amounts of tea on a regular basis. This will continue to boost the tea processing equipment market during the forecast period.

Similarly, the rise in the export of tea is generating huge demand for tea processing equipment in the country and the trend is likely to continue during the forecast period.

India is the second-largest producer of tea globally and is top 5 in terms of global exports. As per the India Brand Equity Foundation (IBEF), the total value of tea exports from India reached around 13.6 million in 2024. Black tea is the most exported tea type which makes up around 96% of the total exports.

Booming Tea Export Business Fuelling Sales in China

As per FMI, the tea processing equipment market size reached over USD 14.5 Million in 2025 and it is expected to register robust growth during the next ten years.

Rising production and export of tea, easy availability of tea processing machines at lower prices, and favorable government support are some of the key factors driving growth in the China tea processing equipment market.

China produces 44% of global tea production and is the largest exporter of tea in the world. With the consistently rising income levels of Chinese consumers, it is safe to assume that China would continue to be the largest market for tea processing equipment.

Most of the Tea Processing Equipment Sales Remain Concentrated in Black Tea Industry

Based on the end-use industry, the black tea industry segment currently dominates the global tea processing equipment market. This can be attributed to the rising demand for black tea across the world.

Black tea is a tea that has gone through the entire fermentation process. Withering, rolling, fermentation and drying are all steps in the production of black tea. For drying tea leaves, commercial tea drying equipment in the form of perforated conveyors is used to move the tea leaves through a heat source in an endless chain.

The most important phase in the production of black tea is fermentation. The tea's quality is determined by this factor. Meanwhile, throughout the fermentation process, several beneficial chemicals are formed, which contribute to black tea's health benefits. Fermentation is also one of the reasons why black tea is so popular among health-conscious individuals.

However, the green tea industry segment is likely to grow at the fastest pace during the next ten years, this can be attributed to the rising consumption of green tea on account of its various health benefits.

Faster Production of a Standard Quality of Tea Making CTC Tea Processing Machines Popular

As per FMI, the CTC tea processing machine segment is expected to outpace the orthodox tea processing machine segment during the forecast period. This can be attributed to the rising adoption of CTC tea processing equipment across various end-use industries.

CTC is made by mashing entire, fresh leaves (crushing, tearing, and curling them). The leaf is crushed up and oxidized before being rolled into small pellets. While some tea leaves may appear to be rather little at the end of the process, they are never cut or torn apart in Orthodox processing. They're rolled with care to achieve a specific flavor.

The quickly changing technical environment is forcing leading tea processing equipment manufacturers to continuously upgrade their product portfolios. As a result, they are investing in research and development activities to develop advanced tea processing equipment. Besides this, they are adopting strategies like partnerships, mergers, acquisitions, and collaborations to expand their global footprint. For instance,

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 14.5 billion |

| Projected Market Size (2035) | USD 26.9 billion |

| Anticipated Growth Rate (2025 to 2035) | 6.4% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East and Africa (MEA) |

| Key Countries Covered | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE, Kenya, Sri Lanka |

| Key Segments Covered | Processing Technique, Process Components, End-Use Industry, Automation Grade, Region |

| Key Companies Profiled | Steelsworth; Marshall Fowler Engineers; Kawasaki Kiko; Bharat Engineering Works; G.K Tea Industries; Mesco Equipment Pvt. Ltd.; Quanzhou Deli Agroforestrial Machinery Co., Ltd.; T & I Global Ltd.; Anxi Yongxing Tea Machinery Co.; Workson Industries; Ysm Dairy & Biotech Private Limited; Nova Hightech Pvt. Ltd.; GEM Machinery & Allied Services; The Scientific Apparatus & Company; Noble Procetech Engineers |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global tea processing equipment market is estimated to be valued at USD 14.5 billion in 2025.

It is projected to reach USD 26.9 billion by 2035.

The market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types are ctc tea processing machine and orthodox tea processing machine.

tea drying equipment segment is expected to dominate with a 28.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tea Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tea Tree Oil Treatments Market Size and Share Forecast Outlook 2025 to 2035

Tear-tab Lids Market Size and Share Forecast Outlook 2025 to 2035

Tea and Coffee Bags Market Size and Share Forecast Outlook 2025 to 2035

Tea Infuser Market Analysis & Forecast by Material Type, Product Type, Distribution Store, and Region Through 2025 to 2035

Tea Packaging Market Size, Demand & Forecast 2025 to 2035

Teaseed Cake Market – Trends & Forecast 2025 to 2035

Tea-Based Skin Care Products Market Analysis by Product Type, Tea Type, Skin Type, Sales Channel and Region from 2025 to 2035

Competitive Breakdown of Tea Packaging Providers

Teabag Envelope Market Analysis based on Material Type, End Use, and Region through 2025 to 2035

Teak Decking Market Growth Analysis by Grade, Application and Region: Forecast for 2025 and 2035

Market Share Distribution Among Tea Packaging Machine Manufacturers

Market Share Breakdown of Leading Tear-Tab Lids Manufacturers

Competitive Breakdown of Tear Tape Providers

Market Share Breakdown of Leading Tea Polyphenols Suppliers

Market Share Insights of Tear Tape Dispenser Manufacturers

Global Tea Filter Paper Market Analysis – Growth & Forecast 2024-2034

Tear Tab Cap Market

Tea Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA