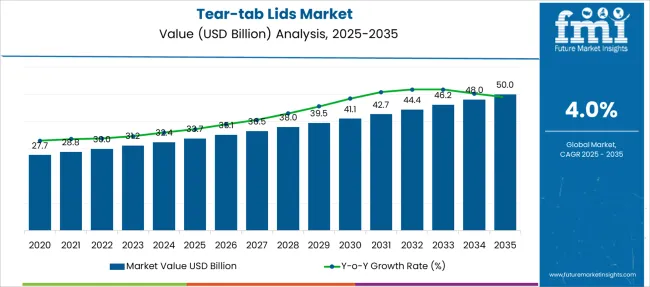

The Tear-tab Lids Market is estimated to be valued at USD 33.7 billion in 2025 and is projected to reach USD 50.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Tear-tab Lids Market Estimated Value in (2025 E) | USD 33.7 billion |

| Tear-tab Lids Market Forecast Value in (2035 F) | USD 50.0 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The tear-tab lids market is showing notable growth, driven by consumer demand for convenience and improved packaging functionality in the food and beverage sector. Increasing awareness about ease of use and product freshness has encouraged manufacturers to adopt tear-tab lids that simplify opening while ensuring product safety.

Innovations in material science have enhanced the durability and sealing capabilities of lids, which has supported wider application across various packaging formats. Growth in takeaway food services and the expanding ready-to-drink market have also created new opportunities for tear-tab lids.

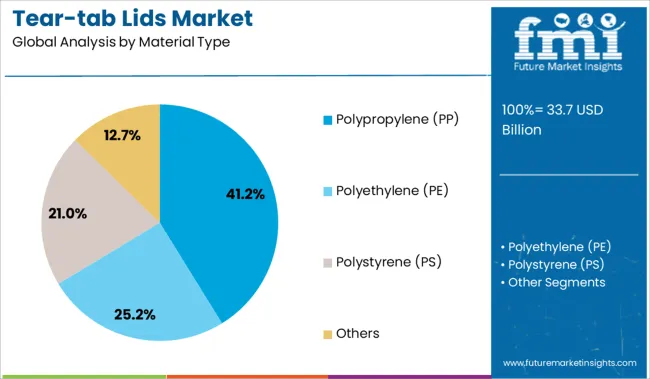

Additionally, sustainability concerns have prompted a shift towards recyclable and lightweight materials. The market outlook remains positive as brands and packaging companies continue to optimize lid designs for better user experience and environmental impact. Segmental growth is expected to be led by Polypropylene (PP) due to its versatility and cost-effectiveness, Retail as the dominant sales channel, and Cups as the primary application.

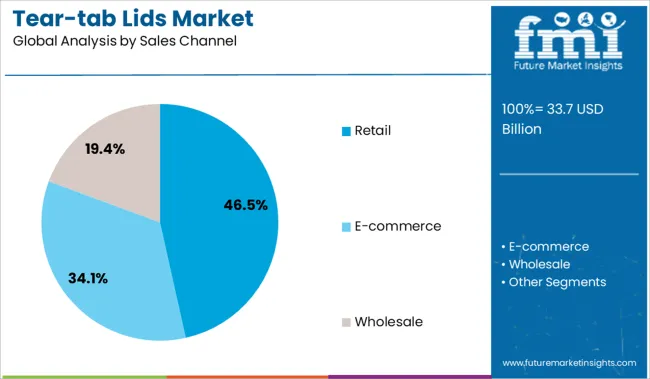

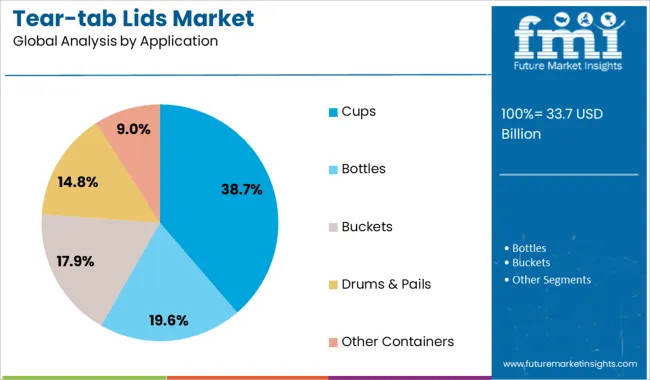

The market is segmented by Material Type, Sales Channel, and Application and region. By Material Type, the market is divided into Polypropylene (PP), Polyethylene (PE), Polystyrene (PS), and Others. In terms of Sales Channel, the market is classified into Retail, E-commerce, and Wholesale. Based on Application, the market is segmented into Cups, Bottles, Buckets, Drums & Pails, and Other Containers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Polypropylene (PP) segment is projected to hold 41.2% of the tear-tab lids market revenue in 2025, securing its place as the leading material type. PP is favored for its excellent balance of strength, flexibility, and chemical resistance, making it suitable for food-grade applications.

The material’s lightweight nature reduces shipping costs and carbon footprint while maintaining lid integrity during handling and transportation. Additionally, PP’s recyclability aligns with growing environmental priorities among consumers and regulators.

Manufacturers prefer PP for its cost efficiency and compatibility with high-speed production processes, enabling mass production of tear-tab lids with consistent quality. These attributes have driven widespread adoption of PP in lid manufacturing and are expected to sustain the segment’s growth.

The Retail segment is anticipated to contribute 46.5% of the tear-tab lids market revenue in 2025, maintaining its leading position in sales channels. This segment’s expansion has been fueled by the rise in consumer preference for convenience products and ready-to-eat packaging available through supermarkets, convenience stores, and specialty food retailers.

Retail environments offer broad visibility and easy access to packaged goods featuring tear-tab lids, promoting consumer trial and repeat purchase. Additionally, promotional activities and seasonal product launches in retail stores have encouraged higher demand.

The growth of urban populations and on-the-go lifestyles has further increased retail sales volume. With continued focus on enhancing shopper experience and packaging innovation, the Retail segment is expected to dominate the tear-tab lids distribution landscape.

The Cups application segment is projected to hold 38.7% of the tear-tab lids market revenue in 2025, establishing itself as the primary end-use area. Tear-tab lids are widely used on cups for beverages such as juices, ready-to-drink coffee, and dairy products, where easy opening and secure sealing are critical.

The growing demand for single-serve and portion-controlled packaging has made cups a preferred application for tear-tab lids. Consumer expectations for spill-proof and tamper-evident packaging have driven the adoption of advanced lid designs tailored to cup formats.

The expansion of on-the-go consumption habits and the foodservice industry has also contributed to increased cup packaging volumes. As product differentiation becomes key in competitive beverage markets, the Cups segment is poised to maintain its leadership in the tear-tab lids market.

Aesthetic packaging along with tamper evidence security is gaining attraction, which is expected to boost the sales of tear-tab lids in the global lids market.

However, decreasing plastic consumption due to the single-use plastic ban is anticipated to reduce the demand for tear-tab lids. The manufacturers in the packaging industry are providing tear-tab lids made up of various materials which primarily include high-density polyethylene.

The tear-tab lids market is anticipated to expand during the forecast period, as per the increasing beverage consumption. Manufacturing sector growth is also expected to impact the growth in the sales of tear-tab lids in an indirect way, wherein, the growth of protective packaging is triggering market growth.

The food & beverage industry growth is anticipated to drive the sales of tear-tab lids in the market during the forecast period.

The demand for tear-tab lids is anticipated to expand with a moderate CAGR during the forecast period, owing to a change in manufacturers’ preference regarding plastic usage.

Increasing consumption of soft drinks, energy drinks, as well as carbonated drinks is expected to create a demand for tear-tab lids.

The rise in beverage consumption is anticipated to boost the sales of tear-tab lids in North America during the forecast period.

In Europe, the decrease in the usage of disposable plastic products is expected to hinder the demand for tear-tab lids. However, sustainable product offerings such as bio-based plastic lids and recyclable plastic lids may gear up the sales of tear-tab lids in the upcoming years.

In European countries such as Germany, Belgium, and the United Kingdom, a ban on single-use plastic products may affect the tear-tab lids market growth during the forecast period.

Owing to increasing urbanization and demand for secure & sustainable packaging in emerging regions including India, Mexico & China, the tear-tab lids market to gain attraction in the near future.

East Asia is expected to create higher incremental opportunities than Latin America in terms of beverage packaging market growth during the forecast period.

Some of the leading manufacturers in the tear-tab lids market are Essentra Pty Ltd., Aaron Packaging Inc., Letica Corporation, etc.

Key manufacturers are offering resealable tear-tab lids with a snug and secure fit design, which is expected to impact the brand owner’s choice during mass purchase. Some of the manufacturers are offering tear-tab lids with Styrene-Butadiene Rubber gaskets which help preserve the contents inside the packaging.

The report consists of key players contributing to the dual chamber bottles market share. It also consists of organic and inorganic growth strategies adopted by market players to improve their market positions. This exclusive report analyses the competitive landscape and dual chamber bottles market share acquired by players to strengthen their market position.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments Covered | Material Used, Sales Channel, Application, Region |

| Regional scope | North America; Latin America; Europe; Middle East and Africa; East Asia; South Asia; Oceania |

| Country scope | USA, Canada, Mexico, Europe, Germany, UK, France, Russia, Italy, Rest of Europe, China, Japan, South Korea, India, Southeast Asia, Rest of Asia-Pacific, South America, Brazil, Argentina, Columbia, Rest of South America, Saudi Arabia, UAE, Egypt, Nigeria, South Africa, Rest of Middle East and Africa |

| Key companies profiled | Essentra Pty Ltd.; Aaron Packaging Inc.; Letica Corporation |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global tear-tab lids market is estimated to be valued at USD 33.7 billion in 2025.

The market size for the tear-tab lids market is projected to reach USD 50.0 billion by 2035.

The tear-tab lids market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in tear-tab lids market are polypropylene (pp), polyethylene (pe), polystyrene (ps) and others.

In terms of sales channel, retail segment to command 46.5% share in the tear-tab lids market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

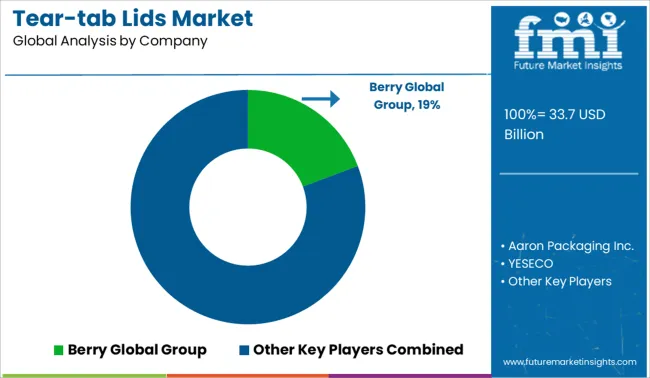

Market Share Breakdown of Leading Tear-Tab Lids Manufacturers

Pail Lids Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Pail Lids Market

Die Cut Lids Market

Sterile Lids Market

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Assessing Paper Cup Lids Market Share & Industry Trends

Screw Top Lids Market

Strawless Lids Market

Oblong Tub Lids Market Size and Share Forecast Outlook 2025 to 2035

Disposable Lids Market Analysis - Growth & Forecast 2025 to 2035

Market Share Insights of Oblong Tub Lids Product Providers

Thermoformed Lids Market

Biodegradable Lids Market Analysis - Demand, Trends & Outlook 2024 to 2034

Aluminum Foil Lids Market from 2023 to 2033

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA