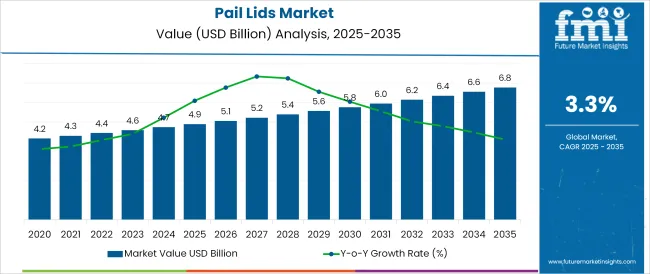

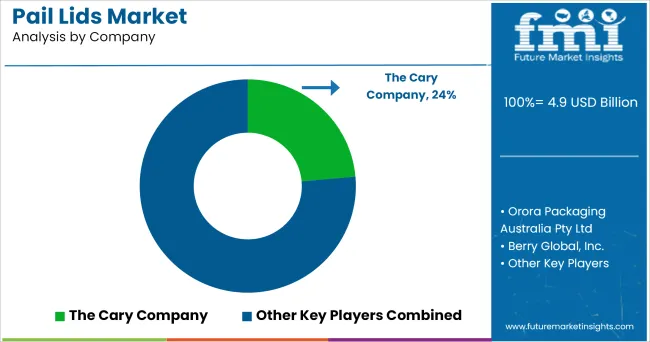

The Pail Lids Market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 6.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

The pail lids market is witnessing steady growth, driven by heightened demand for secure, tamper-evident, and durable closure solutions across industrial and consumer packaging sectors. Rising hygiene standards in food and chemical industries, along with increasing regulatory focus on safe storage and transport, are contributing to the wider adoption of high-performance pail lids.

Technological advancements in lid molding, including precision fit and gasket integration, have enhanced leak resistance and usability. Moreover, the shift toward lightweight and recyclable materials is supporting innovation in lid design, particularly for industries aligning with circular economy models. In food, paints, and agrochemical applications, pail lids are playing a critical role in preserving product integrity and extending shelf life.

The future outlook remains optimistic, bolstered by the increasing industrialization of emerging economies, stringent safety regulations, and growing demand for resealable and reusable packaging formats that balance durability with environmental responsibility.

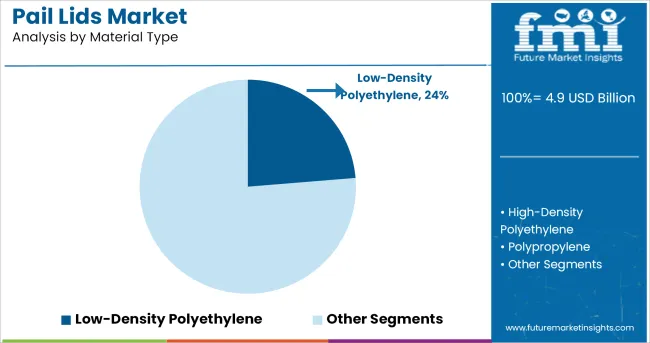

It is observed that low-density polyethylene accounts for 23.70% of the material type segment in 2025, positioning it as a key contributor to overall market revenue. This material’s dominance is attributed to its flexibility, chemical resistance, and cost-effectiveness, which make it highly suitable for diverse end-use scenarios.

LDPE offers the structural resilience required for repeated opening and closing, while maintaining a secure seal that protects against contamination. Furthermore, its compatibility with food-grade applications and recyclability has supported its preference over more rigid or non-compliant alternatives.

The material’s ease of molding and adaptability to custom lid designs have further contributed to its widespread use. As manufacturers continue to emphasize sustainable, high-performance packaging, LDPE’s balance of functionality and environmental compliance reinforces its position in the market.

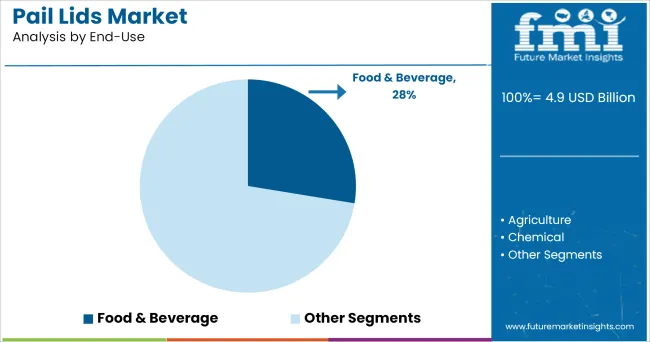

It is noted that the food and beverage segment holds 27.60% of the overall market share by end-use in 2025, emerging as the leading application area. This dominance is driven by the industry’s stringent hygiene requirements and the need for contamination-proof storage and transport solutions.

Pail lids in this sector are being selected for their leak-resistant seals, tamper-evident features, and compatibility with both hot and cold filling processes. The growing demand for bulk storage of sauces, dairy, syrups, and processed ingredients has further elevated the role of durable pail packaging.

Additionally, regulatory mandates around food safety and sustainable packaging have prompted the adoption of lids made from compliant, recyclable materials. As consumer and retailer expectations shift toward freshness retention and packaging reusability, pail lids have become integral to operational efficiency and compliance in the food and beverage industry.

The pail lids market is fragmented thus the pail lids manufacturers are opting for merger and acquisition activities in order to increase their business holding significant market share and also to have a wide presence across the globe.

The acquisition strategy is supposed to assist manufacturers in expanding their scale and improving their core strengths. Acquisition-based inorganic growth is a faster and less risky strategy than organic growth. The purchase of another firm can generate a pool of opportunities for the manufacturer's untapped market due to the business's saturation in a geographical region.

In addition to this, plastic pollution is one of the biggest challenges in the current time. Non-degradable plastic can lead to some serious consequences. Thus several plastic product manufacturers are using recyclable plastic to manufacture their products which is also helping them to make their plastic products environmentally sustainable.

This method of using recyclable plastic in the manufacturing of plastic products will offer enormous opportunities for plastic lids manufacturers to make their products environment-friendly and also to reduce their carbon footprint.

Moreover, Plastic pail lids manufactured from recycled materials will reduce dependency on raw material prices, allowing producers to provide low-cost plastic pail lids to end-user sectors.

For instance, Mauser Group N.V. who is one of the leading manufacturers of pail lids manufactures 100% recyclable plastic pail lids with twin shot technology that incorporates recycled materials.

The demand for pail lids is dependent on the end-use industries. Due to the current situation of covid-19, there has been a slowdown in several industries which are gradually harming sales of pail lids and automatically hamper the pail lids market.

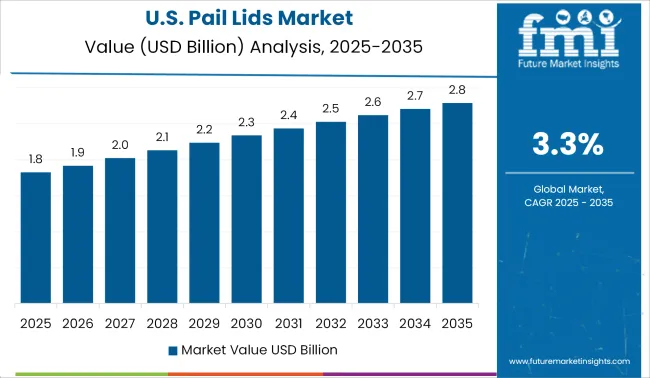

From the past few years, the USA and Canada have become significant markets for pail lids and it is expected to show significant growth in the forecasted period 2024 to 2035.

Pail lids are used in several industries such as agriculture, chemical, pharmaceuticals, plastic & rubber, automotive, mining & metals, food & beverage, petrochemical and many other. The end-use of pail lids in so many industries is one of the key reasons behind the growth of the pail lids market in the USA and Canada region. As with growth in these all industries the USA and Canada pail lids market will grow automatically.

A tight-fitting, secure cover is used to guarantee that products stored inside the pail are well-protected from contamination by the sun and other elements. Moreover, during the transportation of several industrial products, several incidents of spillage and damage have been happening.

Thus to solve the issues of spillage and damage, manufacturers are concentrating on cost-effective and efficient packing solutions and hence opting for pail lids. Hence the acceptance of pail lids by several industrial manufacturers to ensure the safe transportation of industrial products is expected to propel growth in the European pail lids market.

Some of the leading manufacturers of pail lids

These are the key players driving market demand for Pail lids and it is investing in adopting advanced technology to manufacture pail lids.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global pail lids market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the pail lids market is projected to reach USD 6.8 billion by 2035.

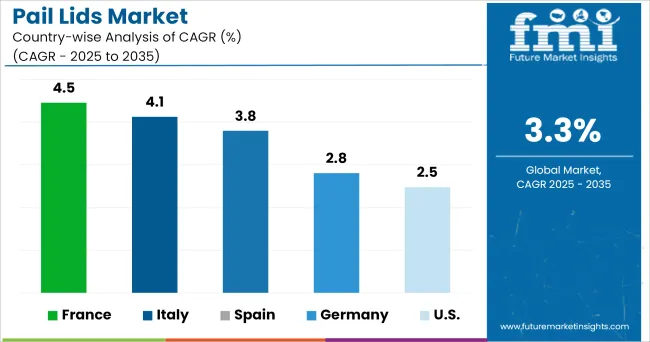

The pail lids market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in pail lids market are low-density polyethylene, high-density polyethylene, polypropylene, aluminium, tin, steel and other materials.

In terms of end-use, food & beverage segment to command 27.6% share in the pail lids market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Pail Lids Market

Pails Market Analysis - Growth & Forecast 2025 to 2035

Metal Pail Market Trends & Industry Growth Forecast 2024-2034

Square Pails Market Size and Share Forecast Outlook 2025 to 2035

Plastic Pails Market Growth - Demand & Forecast 2025 to 2035

Conipack Pails Market Size and Share Forecast Outlook 2025 to 2035

Screw Top Pails Market

Industrial Pails & Drums Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pail Market Analysis, Size, Share & Forecast 2024 to 2034

Small Paint Pail Market Size and Share Forecast Outlook 2025 to 2035

Vietnam Plastic Pail Market Report – Trends & Innovations 2025-2035

Die Cut Lids Market

Sterile Lids Market

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Tear-tab Lids Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Leading Tear-Tab Lids Manufacturers

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Assessing Paper Cup Lids Market Share & Industry Trends

Screw Top Lids Market

Strawless Lids Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA