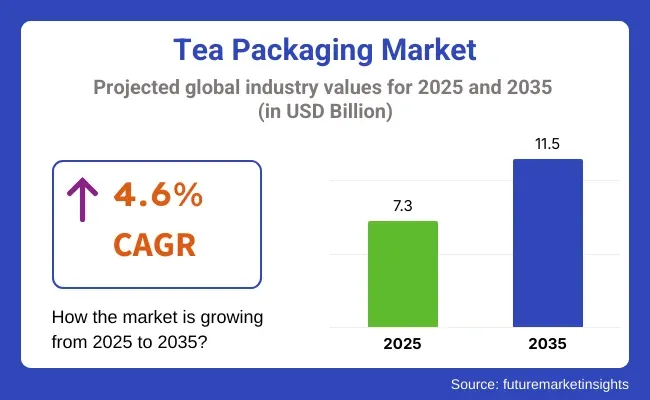

The tea packaging market is projected to grow from USD 7.3 billion in 2025 to USD 11.5 billion by 2035, registering a CAGR of 4.6% during the forecast period. Sales in 2024 reached USD 7.0 billion, reflecting consistent demand driven by increased consumption of premium and specialty teas.

A growing shift toward environmentally sustainable solutions has supported this trend. Growth has been reinforced by expanding e-commerce tea brands, rising awareness of health-conscious choices, and preference for eco-friendly, functional packaging. Packaging formats such as pyramid tea bags, biodegradable sachets, and reusable tins have supported broader acceptance.

In response to sustainability trends, companies have increased investments in compostable and recyclable packaging materials. Sarah Segal, CEO of DAVIDsTEA, stated, “Tea is naturally compostable, and it’s our goal to leave nothing behind. That’s why it’s important to us to find innovative solutions and test new materials, but without compromising on our high standards for quality and freshness.” The company has introduced new packaging innovations with a focus on reducing landfill waste while maintaining product aroma and shelf life.

Premiumization of the tea market has accelerated demand for advanced packaging with aroma barrier layers and heat-sealable paper. Laminated paperboard formats with inner linings are being adopted to extend freshness. Technologies such as laser perforation and atmospheric control pouches are being used to retain volatile flavor compounds. The market has also seen integration of scannable QR codes on packs, which enable traceability and product stories. These digital touchpoints serve as marketing tools and enhance consumer trust.

Custom branding, embossed foil design, and matte texture finishes are increasingly used to differentiate offerings on shelves and appeal to niche segments such as herbal, detox, and organic tea blends. Packaging designers have prioritized minimalism and recyclability. Regulations around plastic use, particularly in European markets, have accelerated adoption of paper-based alternatives.

Looking ahead, the tea packaging market is expected to benefit from rising regulatory pressure on single-use plastics and growing consumer alignment with zero-waste lifestyle movements. Packaging innovation is likely to be concentrated around compostable pouches, renewable fiber-based materials, and automation-ready formats. Companies that align with sustainability certifications and prioritize circular economy models are projected to lead. The integration of design, material science, and digital technology will define the next generation of tea packaging formats through 2035.

Tea bags are projected to lead the tea packaging market by 2025, accounting for an estimated 42.3% market share as brands respond to demand for convenient, single-serve, and eco-friendly packaging. These formats are widely used by premium tea houses, wellness brands, and direct-to-consumer platforms for herbal, green, and functional blends.

Their compact form and ease of use align well with current trends in health-conscious consumption and plastic-free packaging. One of the key advantages of modern tea bags lies in their compatibility with biodegradable materials, allowing for high-quality custom logos, product information, and promotional branding.

With a growing number of manufacturers certifying their products under FSC and SFI chains of custody, tea bags made from responsibly sourced pulp are being positioned as a low-waste alternative to plastic sachets and foil-lined wraps. Food safety and infusion performance are being improved without compromising print quality, through the use of heat-sealable, fluorine-free barrier treatments. As foodservice and retail packaging policies tighten, tea bags are expected to retain their dominance across both premium and bulk-purchase formats.

Flexible plastic packaging is projected to dominate the tea packaging market by 2025, accounting for an estimated 52.5% market share. Its adaptability across different tea formats such as whole leaf, blended, and powdered teas has contributed to its rapid adoption among both premium and mass-market brands.

Pouches, pillow packs, stand-up zipper bags, and sachets are preferred for their lightweight nature, efficient storage, and ease of use during shipping and retail display. This packaging format supports cost-effective high-speed filling and is increasingly being favored for single-serve and resealable formats.

As brands prioritize compostable and recyclable options, flexible packaging materials are being redesigned with mono-material laminates, cellulose-based films, and PLA-coated substrates. These changes are driven by pressure to comply with emerging regulations and rising consumer expectations for low-waste packaging. Additionally, innovations in oxygen and moisture barriers have extended shelf life while preserving the delicate aroma of herbal and specialty teas.

Flexible formats have been embraced for their compatibility with printing technologies that support high-resolution artwork, QR codes, and transparent windows for product visibility. These features enhance shelf appeal while supporting traceability and storytelling two key demands in premium organic tea markets.

Custom matte finishes, minimalistic design language, and plant-based inks are being integrated to reflect sustainability commitments. Anti-counterfeit elements such as tamper-evident seals, security printing, and unique digital codes have been integrated into flexible packaging formats to ensure brand authenticity and product safety. These advancements support growing demand across North American and European markets where regulatory scrutiny and consumer awareness are high.

As flexible tea packaging evolves toward circular material models, brands that prioritize traceable sourcing, functional design, and certification (such as USDA Organic or EU Bio) are expected to lead market growth. The convergence of sustainability, efficiency, and visual communication ensures that flexible formats will remain central to the tea packaging ecosystem through 2035.

| Key Drivers | Key Restraints |

|---|---|

|

Growing Demand for Sustainability: As consumers become more eco-conscious, there's a rising demand for sustainable, recyclable, and compostable packaging solutions. Brands are responding by innovating with eco-friendly materials, driving growth in the packaging market. |

High Cost of Sustainable Materials: Eco-friendly and biodegradable materials often come at a higher cost than traditional packaging. This increases production expenses, which may discourage smaller companies from adopting these solutions. |

| Health and Wellness Trends: The growing focus on health and wellness encourages consumers to opt for premium, organic, and health-focused tea products. This trend boosts demand for sustainable packaging that aligns with these values. | Limited Availability of Biodegradable Materials: Not all packaging materials are easily biodegradable, and the availability of high-quality, sustainable materials can be limited, slowing down the adoption rate. |

| Regulatory Pressure: Governments worldwide are implementing stricter environmental regulations, such as banning single-use plastics and encouraging the use of recyclable or compostable materials. This creates a need for innovative packaging solutions. | Lack of Recycling Infrastructure: In some regions, the lack of adequate recycling facilities and infrastructure poses a significant challenge to the widespread adoption of recyclable packaging. This can hinder the effectiveness of eco-friendly packaging. |

| Premiumization and Consumer Preferences: The increasing demand for premium, organic, and luxury tea products is pushing the market towards more sophisticated, eco-friendly packaging solutions that appeal to conscious consumers. | Resistance to Change: Traditional packaging methods, such as plastic, have been entrenched in the industry for a long time. The transition to eco-friendly alternatives may face resistance from companies that are reluctant to change established practices. |

| Technological Innovations: Advancements in packaging technologies, including smart packaging (e.g., freshness indicators) and AI-driven designs, are enhancing the functionality and appeal of tea packaging, driving market growth. | Environmental Impact of Manufacturing: While packaging materials may be sustainable, the processes required to produce these materials can still have a significant environmental impact, limiting the overall environmental benefits. |

| Consumer Awareness: Increasing awareness among consumers about the environmental impact of packaging has led to more demand for products that utilize sustainable and responsible packaging solutions. | Competition from Traditional Packaging: Established packaging methods and cheaper alternatives, like plastic and aluminum, remain highly competitive due to their lower cost and widespread availability. |

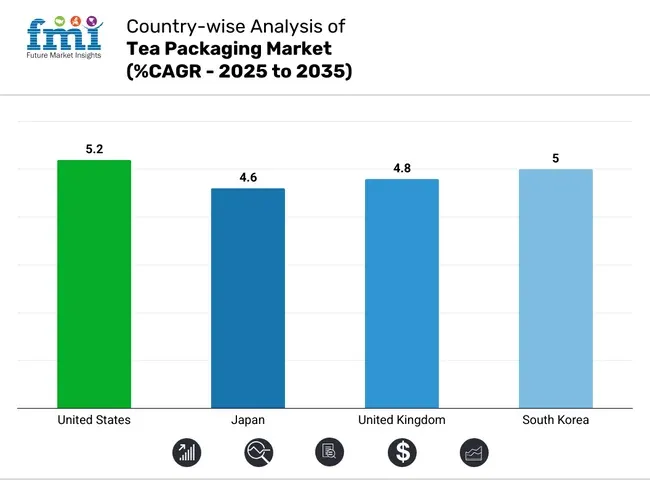

The United States will lead the tea packaging market, driven by its growing demand for sustainable, premium, and innovative packaging in the food & beverage industry. High-barrier, moisture-resistant, and biodegradable packaging has spurred manufacturers to create sophisticated tea packaging materials with improved freshness and shelf life. Government policies are urging the use of eco-friendly and recyclable materials.

Companies are also adopting the use of compostable tea bags, paperboard cartoons and bio-based flexible packaging. Additionally, the resealable closure, airtight packaging and smart labelling technologies are also enhancing consumer efficiency and product traceability.

Companies are also testing premium tea packaging designs with elaborate branding and specialty materials to attract health-conscious and luxury tea drinkers. In addition, the increasing use of tea sachets, stand-up pouches, and pyramid tea bags in e-commerce and retail packaging is fueling innovation in sustainable tea packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

Japan's tea packaging market is rising consistently as there is a heightened need for superior-quality, functional, and well-designed packaging for the green tea, matcha, and specialty tea markets. There is packaging with advanced technology features such as UV protection, oxygen barrier, and resealable zipper designed to protect the aroma and freshness.

With stringent food safety regulations and eco-friendly packaging, companies are shifting towards biodegradable tea bags, plastic-free pouches, and FSC-approved paperboard boxes. Additionally, the progress in vacuum-sealed and nitrogen-flushed packaging is propelling demand in applications necessitating a longer shelf life.

Companies are also spending money on automation-friendly tera packaging units to enhance the efficiency of their product and decrease material waste. In addition to this, the growth of high-end, artisanal and ceremonial tea packaging is also boosting in Japan due to its innovative packaging with elaborate designs and upscale materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The tea packaging industry of the United Kingdom is growing significantly, with larger companies focusing on sustainability, regulatory requirements and consumer-led innovation. The surging need for plastic-free, compostable and high-barrier packaging solutions has resulted in higher uptake across various product segments, such as loose-leaf tea, herbal infusions ad specialty blends.

Government policies encouraging waste reduction and sustainable packaging regulations are also driving companies to incorporate recyclable and biodegradable materials into their offerings. Moreover, technologies in foil-lined pouches, kraft paper bags, and reusable tins are rendering these packaging options more appealing to premium tea brand companies. Organizations are also opting digital branding strategies, QR-code packaging, and interactive labels to increase customer interaction.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.8% |

The South Korea tea packaging market is anticipated to show lucrative growth due to the rising demand for sustainable, high-barrier and attractive packaging in herbal, functional and ready to drink tea. Manufacturers are becoming increasingly focused on creating compostable tea bags, pouches without aluminum and paper-based packages with enhanced moisture and aroma barriers to meet the requirements for sustainable and cost-effective packaging.

Additionally, the industry’s expansion is also supported by government regulations that mandate the use of biodegradable and food-safe materials. Further, businesses introduce digital tracking technologies, such as QR codes and smart labels, in tea packaging for traceability and to enhance consumer engagement.

Additionally, the rising popularity of luxury and gift-ready tea packaging with embossed cartons and decorative tins is also driving adoption. In addition, ongoing research on active packaging technologies like oxygen scavengers and antimicrobial coatings are enabling companies to create new and innovative tea packaging that is targeted towards the freshness-sensitive and premium tea industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The tea packaging market is growing substantially, driven by its rising demand in retail, e-commerce and specialty tea segments. The market is witnessing innovation through new material formulations, involving plant-based packaging, moisture resistant packaging and resealable eco-friendly pouches, addressing concerns about performance, sustainability and efficiency.

Additionally, the developments in the automated sector and AI packaging are also further shaping the industrial trends. Another factor driving market growth includes the increasing preference towards plastic-free and reusable tea packing solutions. Furthermore, increased investments in branding-focused packaging technologies are improving product marketability and expanding market opportunities.

Companies are also expanding hybrid tea packaging solutions that integrate smart and biodegradable components to enhance user engagement and environmental impact. Additionally, the collaborations between tea brands and sustainable packaging manufacturers are also driving development in the sector.

The overall market size for the Tea Packaging Market was USD 7.3 Billion in 2025.

The Tea Packaging Market is expected to reach USD 11.5 Billion in 2035.

The market will be driven by increasing demand from retail, e-commerce, and premium tea brands. Sustainability trends, innovations in eco-friendly packaging materials, and improvements in branding technologies will further propel market expansion.

Key challenges include the high cost of sustainable packaging materials, strict regulatory compliance requirements, and the complexity of maintaining freshness while using eco-friendly solutions. However, continuous advancements in biodegradable films and smart packaging technologies are mitigating these issues.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Materials Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Materials Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Materials Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Materials Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Materials Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Materials Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Materials Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Materials Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Materials Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Materials Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Materials Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Materials Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Materials Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Materials Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Materials Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Materials Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Materials Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Materials Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Materials Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Materials Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Materials Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 16: Global Market Attractiveness by Materials Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Packaging Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Materials Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Materials Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Materials Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Materials Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Materials Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 34: North America Market Attractiveness by Materials Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Packaging Type, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Materials Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Materials Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Materials Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Materials Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Materials Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Materials Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Packaging Type, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Materials Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Materials Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Materials Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Materials Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Materials Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Materials Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Packaging Type, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Materials Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Materials Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Materials Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Materials Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Materials Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Materials Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Packaging Type, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Materials Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Materials Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Materials Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Materials Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Materials Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Materials Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Packaging Type, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Materials Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Materials Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Materials Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Materials Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Materials Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Materials Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Packaging Type, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Materials Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Materials Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Materials Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Materials Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Materials Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Materials Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Packaging Type, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tea Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Tea Packaging Providers

Market Share Distribution Among Tea Packaging Machine Manufacturers

Eco-friendly Tea Packaging Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Tea Tree Oil Treatments Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tear-tab Lids Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA