The eco-friendly tea packaging market is expanding steadily due to increasing environmental awareness, evolving consumer preferences, and growing regulatory emphasis on sustainable packaging solutions. Market demand is being supported by tea producers’ shift toward biodegradable, recyclable, and compostable materials to minimize carbon footprints and align with global sustainability goals.

The current scenario reflects rising adoption of paper-based and plant-derived packaging materials as companies seek to balance product protection with ecological responsibility. Technological advancements in printing, barrier coatings, and material innovation are enhancing durability and visual appeal while maintaining environmental compliance.

The future outlook remains positive, supported by expanding e-commerce channels, premium tea branding, and stricter waste management policies that favor green packaging Growth rationale is founded on the integration of sustainability within core brand strategies, increasing consumer willingness to pay for eco-friendly options, and strategic investments in packaging automation that reduce waste and optimize efficiency, ensuring long-term market growth and competitive differentiation.

| Metric | Value |

|---|---|

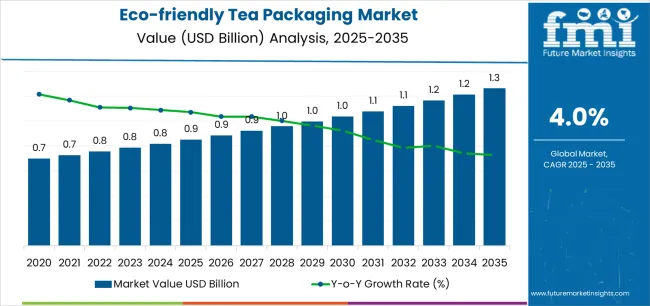

| Eco-friendly Tea Packaging Market Estimated Value in (2025 E) | USD 0.9 billion |

| Eco-friendly Tea Packaging Market Forecast Value in (2035 F) | USD 1.3 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The market is segmented by Material, Distribution Channel, Packaging Format, and End User Vertical and region. By Material, the market is divided into Paper & Paperboard, Plastic, Bioplastic, Metal, Fabric, Glass, and Other Materials. In terms of Distribution Channel, the market is classified into Online Sales Channel and Offline Sales Channel. Based on Packaging Format, the market is segmented into Pouches, Bags & Sacks, Stick Pack & Sachets, Bottles, Cans, Boxes & Cartons, Containers, and Other Packaging Formats. By End User Vertical, the market is divided into Commercial and Institutional. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

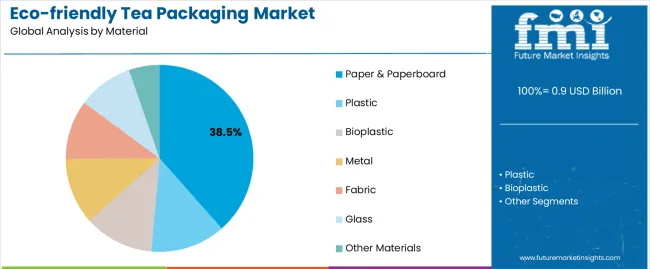

The paper and paperboard segment, accounting for 38.5% of the material category, has been leading due to its biodegradability, ease of customization, and widespread availability. Market dominance has been supported by strong consumer preference for natural and recyclable packaging formats that align with sustainability goals.

Producers are increasingly opting for coated or laminated paperboard to ensure barrier protection against moisture and aroma loss, maintaining product quality while reducing plastic usage. The segment’s growth is reinforced by advancements in eco-friendly inks and printing technologies, which enhance branding and shelf appeal without compromising recyclability.

Regulatory encouragement for sustainable packaging and the rising presence of certified paper sources have further strengthened adoption These factors collectively position paper and paperboard as a preferred choice among tea manufacturers seeking both environmental and commercial advantages.

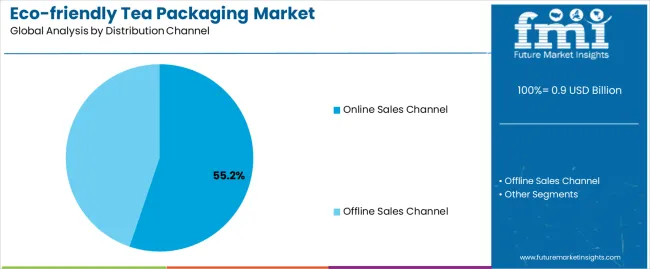

The online sales channel segment, holding 55.2% of the distribution channel category, has emerged as the leading platform due to the rapid digitalization of retail and increased consumer inclination toward convenient shopping experiences. Growth has been driven by the proliferation of e-commerce platforms, subscription-based tea services, and direct-to-consumer brand models that emphasize sustainable packaging as a differentiating factor.

Eco-friendly packaging formats compatible with shipping durability and minimal waste generation are gaining traction among online retailers. The segment benefits from enhanced product visibility, easy traceability, and marketing flexibility that supports sustainability narratives.

Continued expansion of digital retail infrastructure and investments in lightweight, recyclable packaging solutions are expected to reinforce the dominance of the online sales channel over the forecast period.

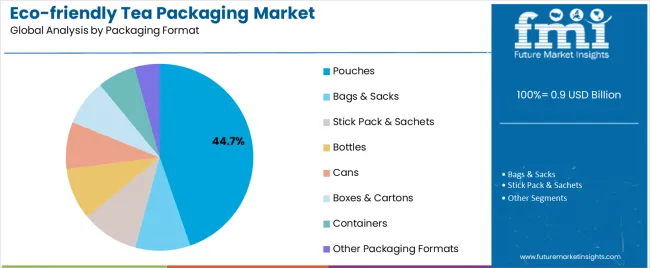

The pouches segment, representing 44.7% of the packaging format category, has maintained its lead owing to its versatility, cost-effectiveness, and adaptability to eco-friendly materials such as compostable films and paper-based laminates. The segment’s success is supported by strong demand for resealable, lightweight, and space-efficient packaging solutions that cater to both retail and e-commerce requirements.

Technological improvements in biodegradable coatings and barrier films have enhanced product protection, extending shelf life while adhering to sustainability criteria. Manufacturers are leveraging pouch formats for premium and organic tea lines to enhance consumer convenience and brand differentiation.

With increasing alignment between performance and sustainability, pouches are expected to remain the preferred format, driving consistent market growth across global tea packaging applications.

The global eco-friendly tea packaging market was valued at USD 0.7 million in 2020. During the historic period between 2020 and 2025, eco-friendly tea packaging sales increased at a CAGR of 3.6%. The overall market value was about USD 0.9 million by 2025.

| Attributes | Details |

|---|---|

| Eco-friendly Tea Packaging Market Value (2020) | USD 0.7 million |

| Market Revenue (2025) | USD 0.9 million |

| Market Historical Growth Rate (CAGR 2020 to 2025) | 3.6% CAGR |

Tea has several medicinal benefits and is becoming increasingly popular around the world. Several local initiatives to increase tea production beyond Asian countries are expected to improve the eco-conscious tea packaging market overview during the forecast period.

In comparison to many other materials like plastic or glass, which are more expensive than paper packaging, paper packaging is preferred due to its low cost and environmental sustainability.

The density, gloss-coating, and opacity of paper are some aspects that are used to assess its quality. Tea is packaged in paper because it has a lower impact on the environment than any type of packaging. It contains no chemicals or undergoes chlorine treatment.

The table below lists the countries where ecofriendly material manufacturers are anticipated to witness greater growth opportunities in the tea packaging sector.

| Regional Market Comparison | CAGR (2025 to 2035) |

|---|---|

| United States | 1.6% |

| Germany | 1% |

| United Kingdom | 1.3% |

| India | 5.5% |

| China | 4.4% |

The United States eco-friendly tea packaging market sales are likely to witness a CAGR of 1.6% through 2035.

The USA is expected to dominate the North American biodegradable tea packaging market over the assessment period. Innovation in material technologies in the USA, along with the emergence of numerous organic tea start-ups are anticipated to create new growth opportunities in the coming days.

Sales of eco-friendly tea packaging products are anticipated to grow at a rate of 1% per year during the forecast period.

Stricter laws governing the usage of plastic and other polymer packaging have surged the demand for eco-friendly tea packaging options in Germany. Moreover, the growing popularity of tea leaves sold loose in Germany and other European countries has increased the use of eco-friendly packaging bags to retain the flavor and freshness of the product.

Demand for eco-friendly tea packaging options in the United Kingdom is projected to rise at a higher rate of 1.3% till 2035.

The need for sustainable choices has heightened in the country due to consumers' preference for goods that minimize their environmental impact and reduce plastic waste. In addition, emerging trends in biodegradable tea packaging fit perfectly with the increasing preference for organic tea and herbal tea trends in the United Kingdom.

The eco-friendly tea packaging industry of China is forecasted to thrive with a CAGR of 4.4% between 2025 and 2035.

Biodegradable materials like paper, cardboard, or compostable plastics production have increased substantially in China in the last few years. Tea exporters have also witnessed eco-friendly packaging attracting more customers and propelling sales abroad.

Also, because single-use plastics are becoming illegal or subject to regulations around the globe, tea companies are shifting toward an environmentally friendly tea packaging market more and more.

As per the study, sales in the Indian market are likely to grow at a rate of 5.5% per year over the assessment period.

Several industries, including food products & agriculture, e-commerce, and logistics, have experienced substantial industrialization and expansion as a result of increased international commerce and favorable measures by the Indian government.

The demand for eco-friendly tea packaging for effective storage and transportation of tea is being driven by the high consumption of tea among individuals in the country.

In terms of packaging format, demand for boxes and cartons is expected to contribute to 46.8% of the total sales in 2025.

| Attributes | Details |

|---|---|

| Top Packaging Format or Segment | Boxes & Cartons |

| Total Market Share in 2025 to 2035 | 46.8% |

Increasing demand for sustainable packaging solutions for transport and delivery through e-commerce is observed to augment the market share of this segment. However, due to high durability, and strength the industrial demand for bags and sacks is likely to grow at a faster rate over the forecast years.

Based on material, the paper and paperboard tea packaging segment is expected to account for over 37.9% of the total market share in 2025.

| Attributes | Details |

|---|---|

| Top Material Type or Segment | Paper & Paperboard |

| Total Market Share in 2025 | 37.9% |

Demand for paper and paperboard packaging is high as it is sustainable and recyclable. Moreover, paper and paper-board materials are popular in the retail sector and are preferred more for packing tea in small amounts.

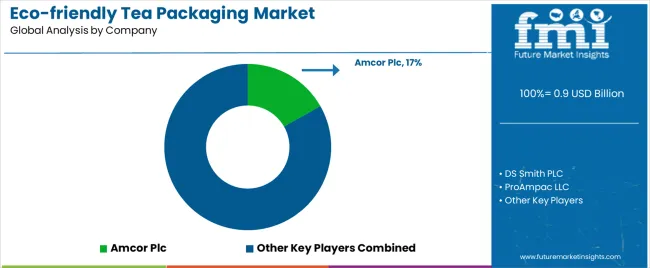

The overall market has turned highly competitive after the entry of many start-ups with eco-friendly material innovations and packaging solutions.

Leading players in the global eco-friendly tea packaging market are investing in promotional strategies to improve sales. They are launching lightweight and cost-effective products to gain a competitive edge in the market.

Recent Developments in the Global Eco-friendly Tea Packaging Market

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 0.9 billion |

| Projected Market Size (2035) | USD 1.3 billion |

| Anticipated Growth Rate (2025 to 2035) | 4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Middle East & Africa (MEA); East Asia; South Asia and Oceania |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Spain, Italy, France, United Kingdom, Russia, China, India, Australia & New Zealand, GCC Countries, and South Africa |

| Key Segments Covered | By Material Type, By Format, By Distribution Channel, By End User Verticals, and By Region |

| Key Companies Profiled | Amcor Plc; DS Smith PLC; ProAmpac LLC; WestRock Company; Mondi PLC; Crown Holdings, Inc.; Sonoco Products Company; Graham Packaging Company; Novolex Holdings, Inc.; Pacific Bag, Inc.; Goglio SpA; Co-Pack Inc; Dongguan Min Lee Packaging Materials Co, Ltd; Shenzhen Color Hoyo Paper & Plastic Products Co, Ltd; Dongguan Jmei Packaging Company Limited; Shenzhen Packmate Packaging Co., Ltd.; PBFY Flexible Packaging; Sixto Packaging; Qingdao Dejili Packing Material Co. Ltd; Color Hoyo Paper & Plastic Products Co., Ltd |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global eco-friendly tea packaging market is estimated to be valued at USD 0.9 billion in 2025.

The market size for the eco-friendly tea packaging market is projected to reach USD 1.3 billion by 2035.

The eco-friendly tea packaging market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in eco-friendly tea packaging market are paper & paperboard, plastic, bioplastic, metal, fabric, glass and other materials.

In terms of distribution channel, online sales channel segment to command 55.2% share in the eco-friendly tea packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tea Tree Oil Treatments Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tear-tab Lids Market Size and Share Forecast Outlook 2025 to 2035

Tea and Coffee Bags Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tea Infuser Market Analysis & Forecast by Material Type, Product Type, Distribution Store, and Region Through 2025 to 2035

Teaseed Cake Market – Trends & Forecast 2025 to 2035

Tea-Based Skin Care Products Market Analysis by Product Type, Tea Type, Skin Type, Sales Channel and Region from 2025 to 2035

Teabag Envelope Market Analysis based on Material Type, End Use, and Region through 2025 to 2035

Teak Decking Market Growth Analysis by Grade, Application and Region: Forecast for 2025 and 2035

Market Share Breakdown of Leading Tear-Tab Lids Manufacturers

Competitive Breakdown of Tear Tape Providers

Market Share Breakdown of Leading Tea Polyphenols Suppliers

Market Share Insights of Tear Tape Dispenser Manufacturers

Global Tea Filter Paper Market Analysis – Growth & Forecast 2024-2034

Tear Tab Cap Market

Tea Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Tea Packaging Market Size, Demand & Forecast 2025 to 2035

Competitive Breakdown of Tea Packaging Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA