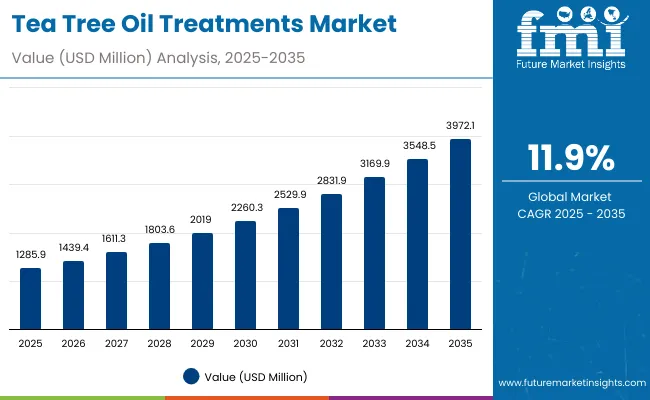

The global Tea Tree Oil Treatments Market is expected to record a valuation of USD 1,285.9 million in 2025 and USD 3,972.1 million in 2035, with an increase of USD 2,686.2 million, which equals a growth of nearly 209% over the decade. The overall expansion represents a CAGR of 11.9% and more than a 3X increase in market size.

Global Tea Tree Oil Treatments Market Key Takeaways

| Metric | Value |

|---|---|

| Global Tea Tree Oil Treatments Estimated Value in (2025E) | USD 1,285.9 million |

| Global Tea Tree Oil Treatments Forecast Value in (2035F) | USD 3,972.1 million |

| Forecast CAGR (2025 to 2035) | 11.9% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,285.9 million to USD 2,260.3 million, adding USD 974.4 million, which accounts for 36% of the total decade growth. This phase records steady adoption across acne/blemish care treatments, anti-inflammatory serums, and oil-control cleansers, driven by the rising demand for natural anti-acne skincare. Cleansers dominate this period as they cater to over 47% of the consumer applications, making tea tree oil-based face washes and foaming cleansers a daily essential in acne-prone skincare routines.

The second half from 2030 to 2035 contributes USD 1,711.8 million, equal to 64% of total growth, as the market jumps from USD 2,260.3 million to USD 3,972.1 million. This acceleration is powered by widespread consumer preference for clean-label and vegan skincare, growth in Ayurvedic-inspired innovations, and a sharp rise in e-commerce-driven adoption. By the end of the decade, vegan and Ayurvedic claims together capture a larger share above 45%, while e-commerce as a channel surpasses other retail channels in growth momentum. Software analogies in beauty (skin diagnostic apps, AR-based try-ons) integrated with tea tree oil products also create recurring revenue for top brands through subscription beauty kits and digital-first retail ecosystems.

From 2020 to 2024, the global Tea Tree Oil Treatments Market grew steadily, driven by hardware-equivalent growth in product launches focusing on cleansers, serums, and acne spot treatments. During this period, the competitive landscape was dominated by heritage brands like The Body Shop and Thursday Plantation, controlling nearly 10% of revenue. Competitive differentiation relied heavily on consumer trust in natural positioning, anti-acne efficacy, and dermatologist endorsements, while Ayurvedic-inspired lines were still in a nascent stage. Vegan and clean-label claims accounted for less than 20% of market share, as consumer awareness was building gradually.

Demand for tea tree oil skincare expands sharply from 2025 onward, with revenue expected to cross USD 1,285.9 million in 2025 and triple by 2035. The revenue mix shifts dramatically as natural/organic, vegan, and Ayurvedic-inspired claims grow to more than 55% share. Traditional skincare leaders face rising competition from K-beauty and clean beauty players like Innisfree and Dr. Organic, who offer integrated routines with multi-step acne kits. Major Western players pivot to hybrid models, integrating tea tree oil with salicylic acid, niacinamide, and probiotics to retain relevance among Gen Z and millennial users. Emerging entrants specializing in direct-to-consumer distribution, e-commerce subscriptions, and AR-based skin diagnostic platforms are rapidly gaining share. The competitive advantage is moving away from heritage positioning alone to an ecosystem of brand trust, digital presence, and recurring subscription-based skincare routines.

The global Tea Tree Oil Treatments Market is growing due to its strong reputation as a natural solution for acne and blemish care, coupled with rising consumer demand for clean-label and botanical-based beauty products. Advances in cosmetic formulations have allowed tea tree oil to be blended with modern actives such as niacinamide and hyaluronic acid, improving tolerance and appeal across sensitive skin types. This has improved efficacy while reducing irritation, allowing tea tree oil to transition from a niche natural extract into a mainstream skincare ingredient.

Acne/blemish care dominates demand, as tea tree oil’s antimicrobial and anti-inflammatory properties make it one of the most researched essential oils for acne treatment. The segment benefits from rising cases of adult acne, mask-related breakouts (maskne), and stress-related skin issues. Expansion of oil-control and soothing products, particularly in serums and spot treatments, has also boosted growth.E-commerce has significantly accelerated market penetration by enabling D2C brands to reach global consumers, often with affordable and trial-sized products. Social media platforms like Instagram, TikTok, and YouTube have become influential in driving consumer education about tea tree oil’s benefits, with dermatologists and beauty influencers endorsing its efficacy.

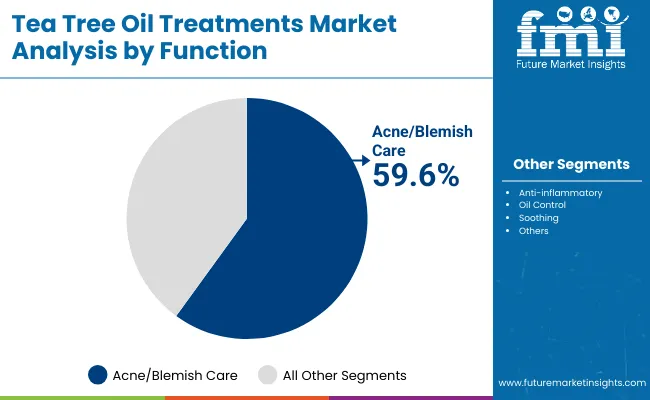

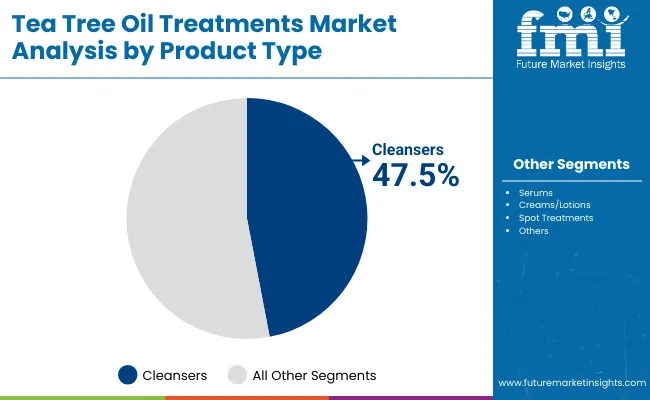

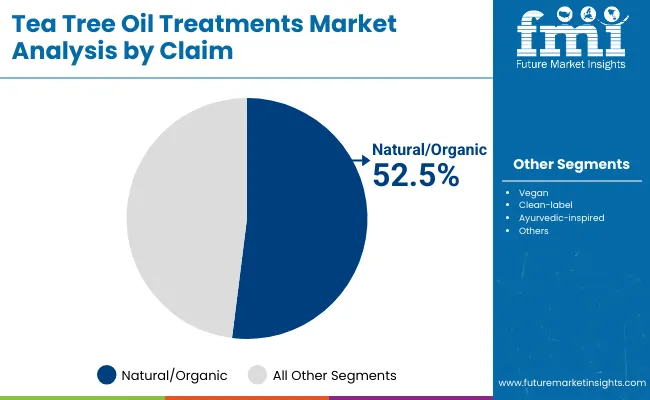

The segmental growth is expected to be led by acne/blemish care within function, cleansers within product type, and natural/organic within claims. Collectively, these pillars highlight tea tree oil’s role as a natural but science-backed anti-acne hero ingredient, ensuring it remains relevant in both Western and Asian beauty routines.

The global Tea Tree Oil Treatments Market is segmented by function, product type, channel, claim, and region. Function includes acne/blemish care, anti-inflammatory, oil control, and soothing, highlighting the primary skin concerns addressed by tea tree oil formulations. Product type segmentation covers serums, creams/lotions, cleansers, and spot treatments, representing the core delivery formats through which tea tree oil is incorporated into daily skincare routines. Distribution channels include e-commerce, pharmacies, mass retail, and specialty beauty stores, reflecting both traditional and digital sales pathways. Claims encompass natural/organic, vegan, clean-label, and Ayurvedic-inspired, underscoring the evolving consumer priorities for authenticity, sustainability, and holistic health. Regionally, the scope spans North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa, with India, China, and Japan showing the fastest growth over the forecast period.

| Function | Value Share% 2025 |

|---|---|

| Acne/blemish care | 59.6% |

| Others | 40.4% |

The acne/blemish care segment is projected to contribute nearly 60% of the global Tea Tree Oil Treatments Market revenue in 2025, making it the dominant function category. The segment’s strength lies in tea tree oil’s antimicrobial and anti-inflammatory properties, which are widely recognized as effective in targeting acne-causing bacteria, reducing redness, and promoting clearer skin. Demand is bolstered by the rising prevalence of acne across both teenagers and adults, especially in urban markets where pollution and stress contribute to skin breakouts.

This dominance is further supported by the popularity of tea tree oil-based foaming cleansers, spot treatments, and targeted acne serums, which are perceived as natural yet effective alternatives to harsher chemical-based treatments. In emerging markets such as India and China, tea tree oil acne solutions are often positioned alongside Ayurvedic or herbal claims, boosting cultural acceptance. As dermatologists and influencers continue endorsing tea tree oil for acne management, the segment is expected to retain its leading position throughout the forecast period.

| Product Type | Value Share% 2025 |

|---|---|

| Cleansers | 47.5% |

| Others | 52.5% |

Cleansers are forecasted to hold nearly half of the global Tea Tree Oil Treatments Market share in 2025, establishing themselves as the leading product type. Cleansers formulated with tea tree oil are especially popular among consumers with oily and acne-prone skin, as they provide daily antibacterial protection while helping to regulate sebum production. Their wide accessibility in both premium and mass retail outlets reinforces this segment’s growth trajectory.

The segment’s rise is also fueled by innovations in gel-based face washes, micellar water, exfoliating scrubs, and wipes, which have expanded usage occasions from routine cleansing to on-the-go skin refreshment. With recurring daily use, cleansers represent one of the most consistent and replenishable purchase categories in tea tree oil skincare. The integration of multifunctional benefits, such as 2-in-1 cleanser + mask or cleanser + exfoliating hybrid formats, ensures ongoing consumer engagement and sustained revenue generation for brands.

| Claim | Value Share% 2025 |

|---|---|

| Natural/organic | 52.5% |

| Others | 47.5% |

The natural/organic segment is projected to account for more than 52% of the global Tea Tree Oil Treatments Market revenue in 2025, making it the leading claim type. This dominance reflects the strong consumer association of tea tree oil with botanical purity, safety, and sustainability. As clean beauty trends accelerate, consumers are increasingly seeking out products with transparent ingredient lists, eco-conscious packaging, and certifications validating natural origins.

Natural/organic claims also align with regional market trends. In North America and Europe, clean-label positioning enhances brand credibility, while in Asia-Pacific, particularly India, Ayurvedic-inspired marketing often overlaps with natural claims, creating a dual advantage. With consumers becoming more mindful about chemical additives and sustainability practices, the natural/organic segment is expected to remain the anchor claim, while vegan and Ayurvedic-inspired lines accelerate growth among younger and culturally attuned demographics.

Rising Global Acne Prevalence and Preference for Natural Remedies

One of the strongest growth drivers for the global Tea Tree Oil Treatments Market is the rising prevalence of acne among both teenagers and adults, coupled with the shift toward natural alternatives. With acne/blemish care already accounting for 59.6% of the global market in 2025, tea tree oil’s scientifically supported antibacterial and anti-inflammatory properties make it an attractive solution. Unlike conventional acne treatments containing benzoyl peroxide or antibiotics, tea tree oil products are perceived as gentler, plant-based, and suitable for long-term use. This appeal resonates particularly well in markets like the USA and India, where awareness of natural skincare is high. In India and China, the association of tea tree oil with herbal and Ayurvedic positioning further strengthens consumer acceptance, especially among young urban populations who want modern solutions grounded in tradition. The rising incidence of adult acne, stress-related skin conditions, and “maskne” (mask-related acne) continues to drive repeat purchases across cleansers, serums, and spot treatments, making this the backbone of market expansion.

E-commerce and Digital Dermatology as Multipliers of Demand

E-commerce has become a central driver for the distribution of tea tree oil skincare, with D2C platforms and subscription models enabling global reach. Specialty beauty stores and pharmacies remain important, but online platforms are growing disproportionately faster, allowing niche and emerging brands to compete alongside global leaders like The Body Shop. The integration of AR try-on tools, dermatologist-led digital consultations, and subscription skincare boxes has amplified consumer confidence in buying acne treatments online. Influencer-led marketing on TikTok, Instagram, and YouTube has turned tea tree oil cleansers and spot treatments into viral products, especially among Gen Z. This driver is particularly pronounced in Asia-Pacific, where consumers rely heavily on mobile-first shopping experiences. By bridging education, access, and affordability, e-commerce and digital dermatology platforms are unlocking entirely new consumer bases and fueling double-digit CAGR across emerging markets like China (21.3%) and India (22.8%).

Skin Irritation Risks and Perception of Limited Clinical Backing

While tea tree oil is widely praised for its natural antibacterial properties, it can also be irritating or sensitizing for certain skin types, especially when used in high concentrations. This creates skepticism among dermatologists and cautious consumers, particularly in mature markets like Germany and the USA, where clinical validation and dermatologist-tested claims carry significant weight. Unlike regulated actives such as salicylic acid or retinoids, tea tree oil is still perceived by some as a “home remedy” rather than a clinically proven treatment. This restraint limits penetration into premium dermocosmetic channels and slows down adoption among consumers who prefer evidence-based products. Without sustained R&D investment into controlled formulations, some consumers may hesitate to replace or supplement pharmaceutical acne treatments with tea tree oil-based solutions.

Fragmented Supply Chain and Price Volatility of Raw Material

The global Tea Tree Oil Treatments Market faces a structural restraint in the form of raw material volatility. Tea tree oil production is geographically concentrated, largely in Australia, which creates vulnerabilities in supply chain stability and pricing. Seasonal variations, climate conditions, and global shipping disruptions can lead to inconsistent quality and fluctuating costs. For mid-tier and mass-market players, these raw material uncertainties make it difficult to ensure stable product pricing, especially in cost-sensitive markets such as India. Moreover, smaller brands often struggle to maintain consistent sourcing and rely heavily on third-party suppliers, reducing their ability to standardize formulations. This creates a barrier to scaling operations globally, as inconsistent supply undermines both consumer trust and regulatory compliance across different regions.

Hybrid Formulations with Tea Tree Oil and Modern Actives

A key trend reshaping the global Tea Tree Oil Treatments Market is the shift from single-ingredient solutions to hybrid formulations that combine tea tree oil with modern actives such as salicylic acid, niacinamide, probiotics, or hyaluronic acid. This approach addresses one of the core restraints irritation risk while also improving product efficacy in line with consumer expectations for multi-functional skincare. Hybrid products not only appeal to acne sufferers but also to consumers seeking broader benefits such as oil control, soothing, and hydration. In the USA, brands are launching tea tree oil + salicylic acid cleansers, while in Asia-Pacific, Ayurvedic-inspired hybrids featuring tea tree oil with neem or turmeric are gaining traction. By blending natural purity with clinical performance, hybrid formulations are driving premiumization and category expansion across both mass retail and specialty channels.

Ayurveda and Herbal Positioning Driving Asian Growth

Another defining trend is the Ayurvedic-inspired positioning of tea tree oil skincare in Asia, particularly in India and China. With India’s CAGR forecasted at 22.8%, the highest globally, brands are increasingly integrating tea tree oil with other herbal ingredients in Ayurvedic-based product lines. This trend resonates strongly with consumers who view Ayurveda as both traditional and scientifically credible. Chinese consumers, meanwhile, are highly responsive to natural/organic and herbal claims, with 54.5% of China’s tea tree oil skincare market in 2025 already tied to natural/organic positioning. Ayurvedic-inspired formulations also align with the broader “East meets West” beauty philosophy, where heritage wellness systems are combined with modern packaging, e-commerce accessibility, and dermatologist endorsements. This trend is not only fueling domestic growth in Asia but also enabling Indian and Chinese brands to expand into international markets with culturally authentic offerings.

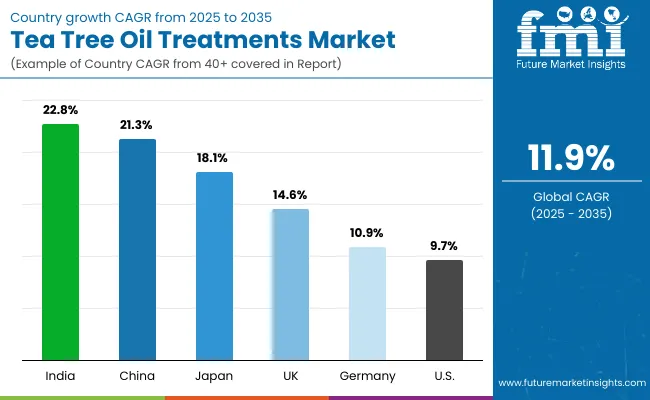

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 21.3% |

| USA | 9.7% |

| India | 22.8% |

| UK | 14.6% |

| Germany | 10.9% |

| Japan | 18.1% |

Between 2025 and 2035, the global Tea Tree Oil Treatments Market is expected to expand most rapidly in India (22.8% CAGR) and China (21.3% CAGR), highlighting the rising importance of Asia-Pacific as the growth engine of this segment. In India, the surge is driven by strong demand for Ayurvedic-inspired formulations, increasing disposable incomes, and a younger consumer base that is highly responsive to natural and herbal beauty trends. China’s momentum is tied to its fast-evolving natural/organic skincare preferences, integration of tea tree oil into hybrid K-beauty and C-beauty routines, and the dominance of e-commerce channels that make international and local tea tree oil brands easily accessible. Japan (18.1% CAGR) also stands out, where consumers value tea tree oil for its oil-control and soothing benefits, aligning well with minimalist, functional skincare regimens that focus on gentle yet effective daily-use products.

On the other hand, mature Western markets show more moderate growth. The USA (9.7% CAGR) remains one of the largest contributors by absolute market size, driven primarily by acne/blemish care, which dominates over 60% of functional demand. However, its relatively slower growth reflects a more saturated market where tea tree oil competes with established dermocosmetic actives like benzoyl peroxide and retinoids. Germany (10.9% CAGR) and the UK (14.6% CAGR) are shaped by Europe’s clean beauty movement, where tea tree oil products resonate with the natural/organic claim segment that already accounts for more than half of global revenues. The higher growth in the UK compared to Germany reflects stronger adoption of mass-market and specialty beauty formats, while Germany’s market remains more premium and pharmacy-led. Collectively, these country-level differences illustrate how the market is driven by emerging-market dynamism in Asia and steady but slower growth in the West, creating a globally balanced expansion path through 2035.

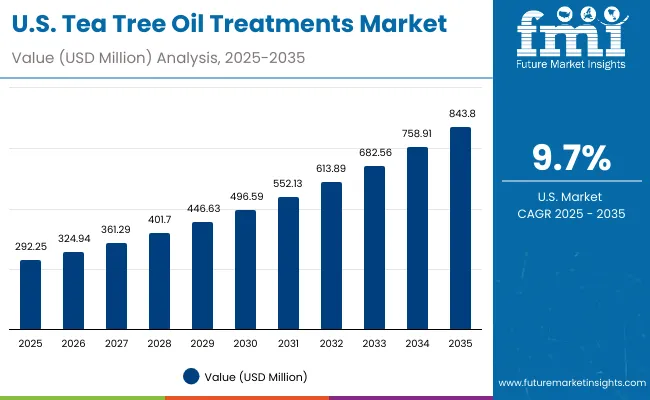

| Year | USA Tea Tree Oil Treatments Market (USD Million) |

|---|---|

| 2025 | 292.3 |

| 2026 | 324.9 |

| 2027 | 361.3 |

| 2028 | 401.7 |

| 2029 | 446.6 |

| 2030 | 496.6 |

| 2031 | 552.1 |

| 2032 | 613.9 |

| 2033 | 682.6 |

| 2034 | 758.9 |

| 2035 | 843.8 |

The Tea Tree Oil Treatments Market in the United States is projected to grow at a CAGR of 9.7%, supported by steady consumer demand for acne/blemish care products, which represent over 61% of functional usage. A notable year-on-year increase is being recorded across cleansers and spot treatments, particularly among Gen Z and millennial consumers seeking natural anti-acne solutions. Dermatologist endorsements and digital consultations have helped tea tree oil transition into mainstream skincare, while retail pharmacy shelves continue to stock tea tree-based acne washes alongside traditional medicated solutions. E-commerce channels, boosted by TikTok-driven product virality, are expanding access to niche and private-label tea tree oil products. Premium players are also bundling tea tree oil with niacinamide and salicylic acid, making hybrid products more attractive in competitive dermocosmetic aisles.

The Tea Tree Oil Treatments Market in the United Kingdom is expected to grow at a CAGR of 14.6%, driven by strong alignment with Europe’s clean beauty movement. Natural/organic claims resonate with UK consumers, who actively seek tea tree oil cleansers and serums as affordable alternatives to premium natural skincare. Adoption has been accelerated by pharmacy chains and specialty beauty stores, where tea tree oil products are marketed under “natural acne solutions” banners. Indie brands are also leveraging e-commerce and subscription kits to expand access. Beyond acne treatments, oil control and soothing products are gaining share, catering to consumers with sensitive skin conditions aggravated by urban pollution and stress.

India is witnessing rapid growth in the Tea Tree Oil Treatments Market, which is forecast to expand at a CAGR of 22.8%, the highest globally. Growth is driven by rising consumer awareness of natural acne remedies and the widespread acceptance of Ayurvedic-inspired formulations. Tea tree oil products are often marketed alongside neem, turmeric, or tulsi, giving them both cultural relevance and premium positioning. Penetration is expanding rapidly in tier-2 and tier-3 cities, supported by cost-effective launches from domestic players and broader distribution via online marketplaces. Educational campaigns and dermatologist endorsements are further boosting trust in tea tree oil’s anti-acne efficacy.

The Tea Tree Oil Treatments Market in China is expected to grow at a CAGR of 21.3%, one of the fastest among leading economies. Growth is driven by natural/organic positioning, which already accounts for 54.5% of sales in 2025, reflecting high consumer preference for safe, plant-based skincare. E-commerce dominates distribution, with platforms such as Tmall and JD.com featuring a wide selection of both international and domestic tea tree oil brands. Local C-beauty firms are innovating with hybrid formulas and value-added formats like sheet masks and acne patches infused with tea tree oil. Younger consumers in urban areas are especially receptive to influencer-led marketing and product recommendations on Douyin (TikTok).

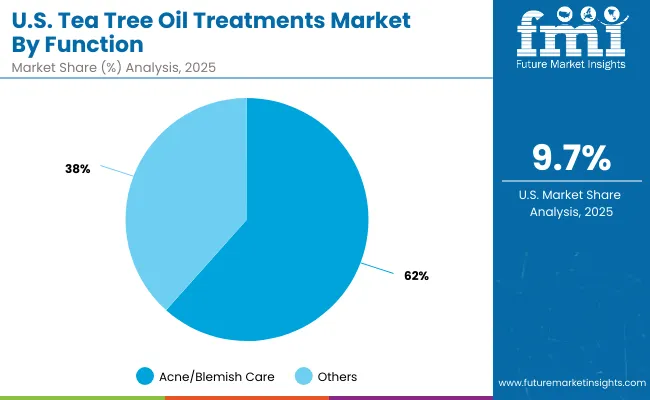

| USA by Function | Value Share% 2025 |

|---|---|

| Acne/blemish care | 61.6% |

| Others | 38.4% |

The Tea Tree Oil Treatments Market in the United States is valued at USD 292.25 million in 2025, with acne/blemish care leading at 61.6%, followed by anti-inflammatory, oil control, and soothing solutions at 38.4%. The dominance of acne/blemish treatments is a direct outcome of the USA skincare landscape, where both teenage and adult acne prevalence remains high. Consumers prefer natural yet clinically acceptable solutions, and tea tree oil has established itself as a mainstream alternative to benzoyl peroxide and salicylic acid treatments.

Portability and product variety enhance adoption, with formats such as spot treatments, foaming cleansers, and acne patches making tea tree oil-based skincare convenient and accessible. Integration into dermatologist-recommended kits and over-the-counter retail pharmacy lines has also expanded consumer trust. Social media influencers and dermatologists on platforms like TikTok and Instagram further validate its role, positioning tea tree oil as a reliable option for ongoing acne management. As digital-first D2C models expand, the USA market is expected to experience steady growth led by acne-focused solutions.

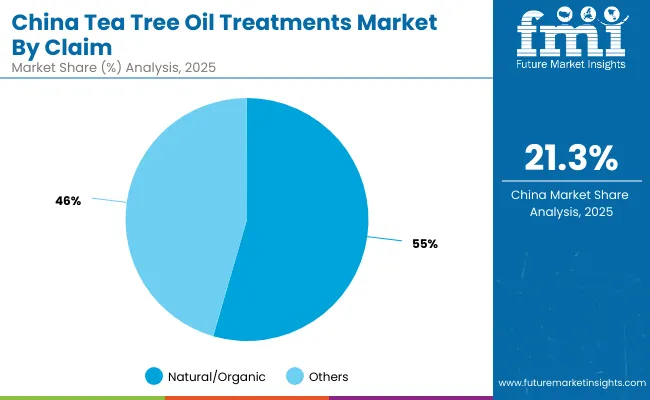

| China by Claim | Value Share% 2025 |

|---|---|

| Natural/organic | 54.5% |

| Others | 45.5% |

The Tea Tree Oil Treatments Market in China is valued at an estimated USD 155.9 million in 2025, with natural/organic claims leading at 54.5%, followed by vegan, clean-label, and Ayurvedic-inspired positioning at 45.5%. The dominance of natural/organic is directly linked to China’s consumer preference for herbal and plant-based skincare solutions, which are perceived as safer and more trustworthy compared to synthetic formulas. This aligns with the rapid growth of China’s clean beauty segment, where natural positioning is the primary purchase driver.

E-commerce remains the leading distribution channel, with platforms like Tmall and JD.com enabling wide access to both international and domestic brands. Domestic C-beauty players are innovating with hybrid products such as sheet masks, serums, and acne patches that combine tea tree oil with niacinamide or centellaasiatica, strengthening performance claims. Government regulations promoting safety and ingredient transparency have further boosted consumer confidence in natural claims. The ability of tea tree oil treatments to align with both traditional Chinese herbal culture and modern clean beauty trends ensures strong double-digit growth through 2035.

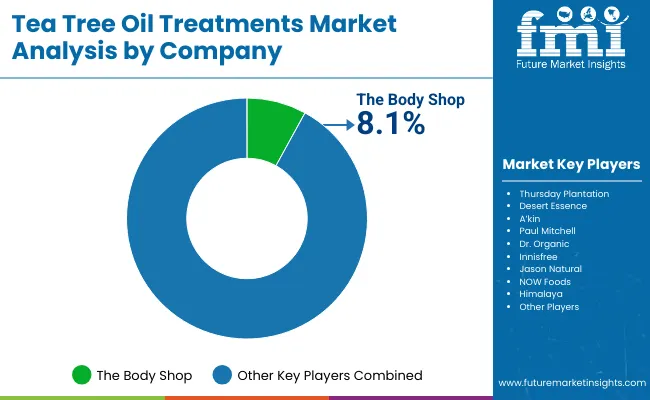

| Company | Global Value Share 2025 |

|---|---|

| The Body Shop | 8.1% |

| Others | 91.9% |

The global Tea Tree Oil Treatments Market is moderately fragmented, with a mix of heritage natural beauty brands, K-beauty and C-beauty innovators, and niche-focused specialists competing across acne, oil control, and clean beauty categories. The Body Shop leads with 8.1% of global value share in 2025, owing to its long-established tea tree line and global retail network. Its strategy focuses on maintaining brand trust, leveraging sustainable sourcing, and expanding its acne kit bundles across both online and offline channels.Other established players such as Thursday Plantation, Desert Essence, and Jason Natural hold strong regional positions, often appealing to consumers through their organic and clean-label branding. K-beauty brands like Innisfree are accelerating adoption by integrating tea tree oil into multi-step skincare routines and e-commerce-driven outreach, particularly in Asia-Pacific. Herbal and Ayurvedic players such as Himalaya are capitalizing on demand in India and the Middle East, aligning tea tree oil with cultural wellness traditions.

The competitive field is further enriched by emerging indie and D2C brands that focus on vegan, subscription-based, and influencer-driven models, making tea tree oil treatments more accessible to younger demographics. Competitive differentiation is shifting away from simple product launches toward ecosystem strategies that include hybrid formulations, sustainable packaging, and digital engagement. As consumer expectations evolve, the strength of a brand’s natural positioning, e-commerce reach, and hybrid innovation will determine long-term leadership.

Key Developments in Global Tea Tree Oil Treatments Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,285.9 million |

| Function | Acne/blemish care, Anti-inflammatory, Oil control, and Soothing |

| Product Type | Serums, Creams/lotions, Cleansers, and Spot treatments |

| Channel | E-commerce, Pharmacies, Mass retail, and Specialty beauty stores |

| Claim | Natural/organic, Vegan, Clean-label, and Ayurvedic -inspired |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FARO Technologies, Inc., 3D Digital Corporation, 3D Systems, Inc., Autodesk, Inc., Artec 3D, Automated Precision, Inc. (API), Carl Zeiss Optotechnik GmbH, Creaform Inc., Direct Dimensions Inc., GOM GmbH, Hexagon AB, Konica Minolta, Inc., NextEngine Inc., Nikon Corporation, OGI Systems Ltd, and ShapeGrabber |

| Additional Attributes | Dollar sales by scanner type and end-use industry, adoption trends in reverse engineering and quality control, rising demand for handheld and portable 3D scanners, sector-specific growth in aerospace, automotive, and healthcare, software and services revenue segmentation, integration with AR/VR and digital twin technologies, regional trends influenced by digitization initiatives, and innovations in laser triangulation, structured light, and photogrammetry methods. |

The global Tea Tree Oil Treatments Market is estimated to be valued at USD 1,285.9 million in 2025.

The market size for the global Tea Tree Oil Treatments Market is projected to reach USD 3,972.1 million by 2035.

The global Tea Tree Oil Treatments Market is expected to grow at a CAGR of 11.9% between 2025 and 2035.

The key product types in the global Tea Tree Oil Treatments Market are serums, creams/lotions, cleansers, and spot treatments.

In terms of function, acne/blemish care is projected to command the largest share at 59.6% in 2025, equivalent to USD 762.6 million.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tea Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tear-tab Lids Market Size and Share Forecast Outlook 2025 to 2035

Tea and Coffee Bags Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tea Infuser Market Analysis & Forecast by Material Type, Product Type, Distribution Store, and Region Through 2025 to 2035

Tea Packaging Market Size, Demand & Forecast 2025 to 2035

Teaseed Cake Market – Trends & Forecast 2025 to 2035

Tea-Based Skin Care Products Market Analysis by Product Type, Tea Type, Skin Type, Sales Channel and Region from 2025 to 2035

Competitive Breakdown of Tea Packaging Providers

Teabag Envelope Market Analysis based on Material Type, End Use, and Region through 2025 to 2035

Teak Decking Market Growth Analysis by Grade, Application and Region: Forecast for 2025 and 2035

Market Share Distribution Among Tea Packaging Machine Manufacturers

Market Share Breakdown of Leading Tear-Tab Lids Manufacturers

Competitive Breakdown of Tear Tape Providers

Market Share Breakdown of Leading Tea Polyphenols Suppliers

Market Share Insights of Tear Tape Dispenser Manufacturers

Global Tea Filter Paper Market Analysis – Growth & Forecast 2024-2034

Tear Tab Cap Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA