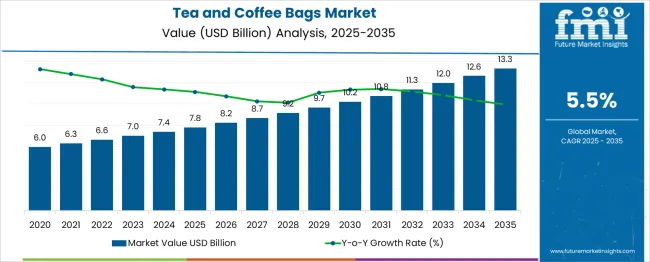

The Tea and Coffee Bags Market is estimated to be valued at USD 7.8 billion in 2025 and is projected to reach USD 13.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The tea and coffee bags market is projected to grow from USD 7.8 billion in 2025 to USD 13.3 billion by 2035, generating an incremental gain of USD 5.5 billion at a CAGR of 5.5%. The Growth Contribution Index highlights a back-weighted growth pattern over the decade. Between 2025 and 2030, the market will rise from USD 7.8 billion to 9.7 billion, contributing USD 1.9 billion, or 34.5% of the total increase.

Annual figures during this period include USD 8.2 billion in 2026, 8.7 billion in 2027, 9.2 billion in 2028, and 9.7 billion in 2030, driven by growing demand for convenience-based formats, premium tea variants, and increasing coffee bag adoption in both retail and foodservice channels. The second half (2030-2035) adds USD 3.6 billion, accounting for 65.5% of total growth, with values reaching 10.2 billion in 2031, 10.8 billion in 2032, 11.3 billion in 2033, 12.0 billion in 2034, and 13.3 billion by 2035. This acceleration is supported by higher penetration of flavored and specialty blends, rising consumption in emerging markets, and increased automation in filling and packaging processes. Manufacturers focusing on product innovation, advanced material technology, and operational efficiency will capture maximum value in this expanding market segment.Bottom of Form

| Metric | Value |

|---|---|

| Tea and Coffee Bags Market Estimated Value in (2025 E) | USD 7.8 billion |

| Tea and Coffee Bags Market Forecast Value in (2035 F) | USD 13.3 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The tea and coffee bags market is positioned along a maturity curve that reflects progressive adoption stages driven by convenience, sustainability, and premiumization trends. Initial penetration was achieved through traditional tea bags in mature economies where standardized packaging formats met consumer demand for ease of preparation. Subsequent acceleration in adoption occurred as coffee bags and flavored tea variants were introduced, expanding market engagement across retail and foodservice channels.

Currently, the market remains in an advanced growth phase rather than maturity, supported by rising consumption in emerging economies and evolving preferences in established regions. Adoption has been influenced by the introduction of organic blends, fair-trade offerings, and functional infusions targeting health-conscious consumers. In developed markets, growth momentum has shifted toward sustainable packaging, biodegradable filter papers, and recyclable materials as regulatory mandates and eco-awareness gain prominence.

Digital retail platforms have enabled wider distribution for specialty and premium products, increasing penetration across diverse consumer segments. Institutional demand from hospitality, travel, and office sectors continues to provide additional stability to the adoption lifecycle. Future evolution is expected to emphasize innovations in packaging efficiency, environmentally compliant materials, and value-added features, ensuring that tea and coffee bags remain integral to convenience-driven and health-oriented beverage consumption patterns globally.

The tea and coffee bags market is witnessing consistent growth as consumer demand shifts toward convenience-oriented and sustainable beverage solutions. Rising health consciousness, premiumization of tea and coffee offerings, and the increasing preference for single-serve formats are contributing to robust adoption globally.

Companies are focusing on innovative flavors, biodegradable materials, and visually appealing packaging to attract modern consumers who value both quality and environmental responsibility. The market is also being supported by expanding retail penetration and the emergence of specialty tea and coffee shops that promote bagged formats as an accessible luxury.

Future expansion is anticipated to be driven by material innovations, regulatory pressure for sustainable packaging, and growing consumption in emerging economies, which are paving the way for diversified offerings and greater brand differentiation.

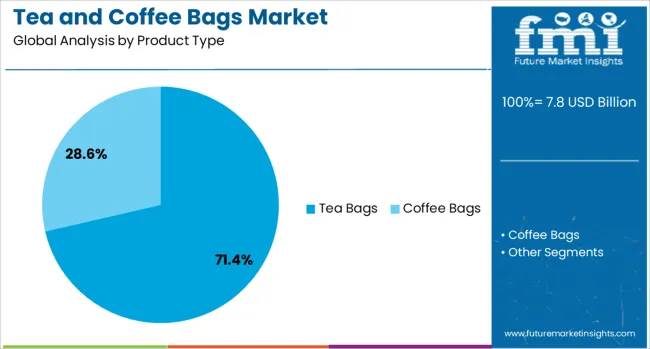

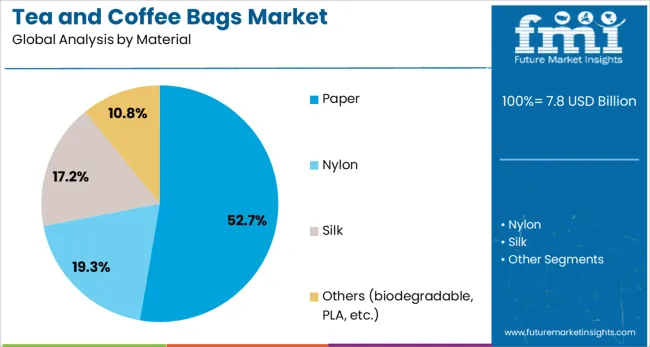

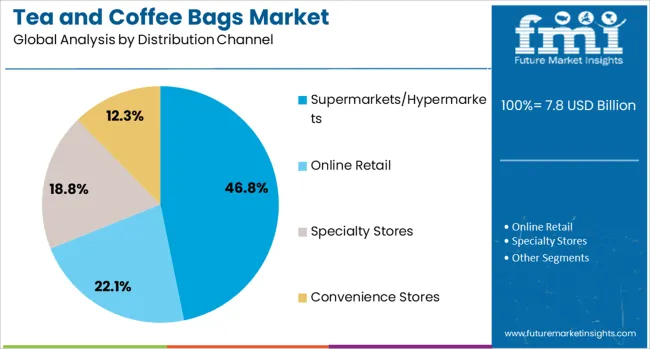

The tea and coffee bags market is segmented by product type, material, distribution channel, and geographic regions. The tea and coffee bags market is divided by product type into Tea Bags and Coffee Bags. In terms of the material of the tea and coffee bags market, it is classified into Paper, Nylon, Silk, and Others (biodegradable, PLA, etc.). The distribution channel of the tea and coffee bags market is segmented into Supermarkets/Hypermarkets, Online Retail, Specialty Stores, and Convenience Stores. Regionally, the tea and coffee bags industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type, tea bags are expected to hold 71.40% of the total market revenue in 2025, solidifying their dominance in the category. This leadership is being reinforced by their longstanding association with convenience, portion control, and ease of preparation, which continue to appeal to a broad consumer base.

Manufacturers have enhanced the appeal of tea bags through premium infusions, pyramid-shaped designs for better infusion, and the use of natural, compostable materials. Their ability to cater to both traditional and modern consumer preferences, while supporting efficient production and packaging processes, has maintained their superior market share.

Widespread acceptance across both household and commercial channels has further anchored tea bags as the preferred choice in the product category.

In terms of material, paper is projected to account for 52.7% of the tea and coffee bags market revenue in 2025, affirming its position as the leading material segment. This dominance is being driven by the perception of paper as a natural, breathable, and biodegradable material that aligns with growing sustainability concerns.

Advances in food-grade paper technologies have improved strength and filtration performance, making paper a practical and eco-friendly choice. The material’s cost-effectiveness, along with regulatory compliance advantages over synthetic alternatives, has bolstered its widespread use.

Additionally, the ability of paper to convey a premium, organic image while maintaining functionality has further solidified its adoption across premium and mass-market offerings alike.

When segmented by distribution channel, supermarkets and hypermarkets are forecast to capture 46.8% of the market revenue in 2025, reinforcing their leadership in this domain. This prominence is supported by their ability to offer a wide range of products, competitive pricing, and immediate product availability to a diverse consumer base.

The visibility of tea and coffee bags on shelves, coupled with promotional activities and private-label offerings, has amplified consumer access and engagement in these retail environments. The convenience of one-stop shopping, combined with the trust consumers place in established retail chains, has sustained their dominance in distributing these products.

Their extensive geographic reach and capacity to support product launches and marketing initiatives at scale have further entrenched their position as the primary channel for tea and coffee bag sales.

Tea and coffee bags are single-serve sachets filled with processed tea leaves or ground coffee, enclosed in filter paper, cloth, or bio‑based material. These products provide convenient brewing, controlled infusion, and portion consistency. They are widely used in households, offices, hospitality venues, and retail single‑cup formats. Demand is driven by the need for ease of use, hygiene, and consistent taste. Manufacturers offering biodegradable, strong filter media and easy-tear sachets are well placed to meet home and commercial requirements. Products enabling mess-free brewing and steady extraction efficiency are affecting purchase decisions among consumers, foodservice operators, and specialty beverage brands.

Growth in tea and coffee bag usage has been supported by rising consumer preference for convenient beverage preparation and reliable flavor results. Single-serve applications in offices, hotels, and quick-service restaurants have expanded demand. Demand for consistent brewing results without loose-leaf handling has reinforced adoption of pre-measured sachets. Quality expectation has increased for even extraction, drip-free operation, and drip resistance in high-volume settings. Packaging design offering easy opening, shelf stability, and aroma preservation has strengthened product appeal. Channels such as premium instant beverage offerings and small-format retail packs have stimulated usage in household and out-of-home segments. Preference for hygienic single-use sachets has become a key buying requirement in foodservice and hospitality environments.

Expansion has been constrained by variability in filter media cost, such as biodegradable papers, polymer blends, and woven substrates, which affect final pricing. High-grade filter and bag materials often result in elevated retail price compared to loose alternatives. Regulatory scrutiny over food contact safety and permitted material composition complicates product approval processes, particularly for new filter substrates. Packaging waste concerns in regulated markets have raised design and material compliance burdens. Instances of inconsistent brewing performance due to bag permeability or seal issues have reduced confidence among quality-sensitive buyers. Fluctuations in supply of compostable or bio-based film materials have disrupted manufacturing continuity and increased lead times for new product launches.

Opportunities are emerging in expanded use of compostable filter bags and recycled or plant-fiber based packaging formats, which appeal to eco‑aware buyers. Development of customizable sachets sized for specific brewing volumes or flavor strength offers innovative product variants. Private-label partnerships with hotel chains, specialty coffee firms, and tea retailers provide recurring sourcing opportunities. Bulk sachet formats for institutional use in offices, hospitality, and airline service are creating stable demand pools. Subscription offerings for home delivery of curated tea or coffee bag selections are encouraging recurring sales. Co‑branding initiatives between beverage producers and packaging suppliers are enabling tailored sachet designs and functional enhancements such as aroma locks or packaging perforations for controlled opening.

Adoption of multi-layer filter media combining fine mesh, reinforcing fibers, and aroma-preserving layers has driven product evolution. Sachets with internal filters that deliver drip-control and even infusion are increasingly accepted in premium segments. Introduction of heat‑seal or ultrasonic-welded seals ensures better containment and reduced contamination risk. Formats offering peel-open sachets, tearing guides, and portion pods are growing in retail and hospitality contexts. Interest in aroma-lock barriers and resealable pouch systems is rising in packaged beverage kits. Single-serve filter bags infused with botanical extracts or flavoured blends have appeared. Consumer demand for traceable origins, single-serve convenience, and performance consistency is guiding supplier development of next‑generation tea and coffee bag products.

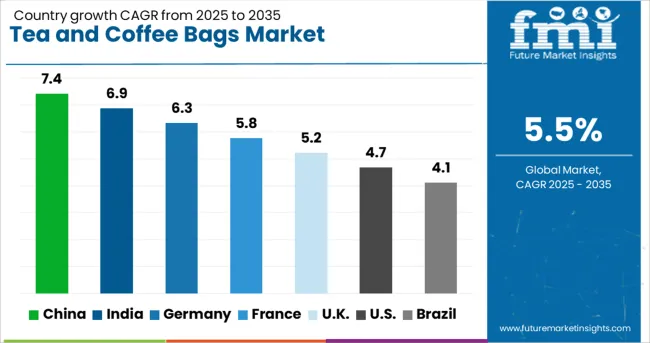

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The tea and coffee bags market is projected to expand at a CAGR of 5.5% from 2025 to 2035, supported by increasing demand for convenient brewing solutions, premium single-serve packaging, and growing consumption of specialty beverages. China, part of BRICS, leads with 7.4% CAGR, driven by a surge in tea exports and adoption of innovative packaging for premium teas. India, also within BRICS, follows at 6.9% CAGR, benefiting from rising domestic consumption and product diversification across herbal and specialty tea categories. Among OECD economies, Germany posts 6.3%, with strong emphasis on organic tea bags and coffee pods for retail and horeca channels. France records 5.8%, driven by premiumization trends and growing consumer preference for eco-friendly tea and coffee packaging. The United Kingdom, another OECD member, grows at 5.2%, shaped by high adoption of convenience-oriented tea bags and specialty coffee bags for on-the-go consumers. The report includes an analysis of over 40 countries, with five profiled below for reference.

China is projected to grow at 7.4% CAGR, led by premium tea bag adoption and strong domestic consumption. Increasing consumer preference for quick-brew options has pushed manufacturers to invest in pyramid bags and flavor-infused teas. The rise of specialty coffee culture is encouraging demand for single-serve coffee bags among younger consumers. Local producers are emphasizing biodegradable filter materials and aroma-lock packaging to enhance freshness and global competitiveness. The expansion of e-commerce platforms like JD.com and Alibaba ensures strong market penetration in both urban and semi-urban regions. Additionally, rising exports of green and specialty teas packaged in innovative bag formats is creating fresh opportunities in Southeast Asia and Europe.

India is expected to grow at 6.9% CAGR, fueled by strong tea consumption and increasing urban coffee adoption. Herbal, wellness, and flavor-infused tea bags are rapidly gaining popularity, supported by health-conscious buying patterns. Coffee bags are emerging as a convenient substitute for traditional brewing methods in metropolitan regions. Manufacturers are introducing ready-to-brew packs with controlled infusion to meet modern consumer preferences. Organized retail expansion and digital platforms such as Flipkart and Amazon enable efficient last-mile delivery, increasing rural and semi-urban penetration. Export potential for Indian tea packaged in value-added bag formats is also strengthening as global markets demand authenticity and convenience.

Germany is forecasted to grow at 6.3% CAGR, supported by premium tea bag innovation and specialty coffee bag adoption. The market benefits from growing preference for organic, natural, and high-quality beverage options. Horeca channels extensively use premium tea bags and portion-controlled coffee packs to ensure convenience and consistency. Manufacturers focus on advanced packaging technologies like aroma-sealed filters and moisture-proof pouches to retain product quality. Retail distribution remains strong through supermarkets and organic food chains, while e-commerce accelerates sales of high-value variants. Health-driven consumer trends are boosting demand for herbal teas and functional coffee blends offered in bagged formats.

France is expected to grow at 5.8% CAGR, driven by gourmet tea preferences and rising coffee bag adoption. Premium tea bags with exotic flavors dominate the retail and hospitality segments, catering to high-end consumers. Coffee bags are gaining attention as an alternative to capsules for sustainable and quick brewing solutions. French manufacturers are prioritizing pyramid-style bags with heat-sealed edges for enhanced flavor release. Supermarkets, specialty tea boutiques, and online platforms dominate distribution, offering both mid-range and luxury options. Increasing urban coffee culture and preference for portion-controlled tea formats provide additional growth opportunities across domestic markets.

The United Kingdom is projected to expand at a 5.2% CAGR, supported by convenience-led demand in the tea and coffee bag categories. Traditional tea bags remain dominant, with strong growth in herbal, fruit-infused, and functional blends. Coffee bags continue to attract interest as a home-brewing solution for consumers seeking café-style beverages without machines. Manufacturers focus on resealable pouches and moisture-proof packaging to maintain freshness. Retail supermarkets lead the distribution landscape, while subscription models and e-commerce platforms are gaining popularity for recurring purchases. The premium segment is also expanding as consumers show a willingness to pay for superior taste and quality.

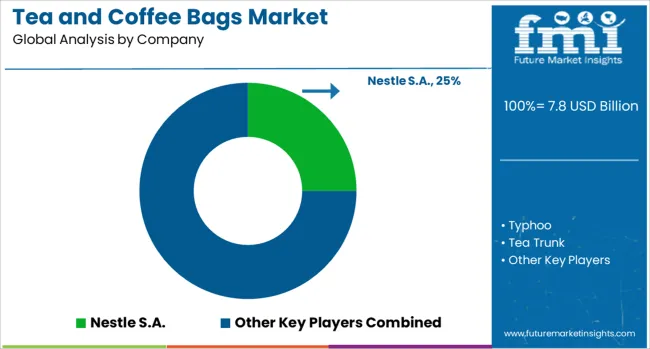

The tea and coffee bags market is highly competitive, featuring global FMCG giants and premium specialty brands such as Nestlé S.A., Unilever (including brands like Tazo and Twinings), Tata Global Beverages (Tata Group), Associated British Foods Plc., and Celestial Seasonings (Hain Celestial Group). These companies dominate through extensive distribution networks, strong brand recognition, and diverse product portfolios spanning traditional teas, herbal blends, and coffee bag formats.

Nestlé and Tata Global Beverages focus on expanding convenience-based coffee and tea solutions, driven by growing demand for on-the-go consumption and single-serve packaging. Unilever leverages its premium and mainstream tea brands such as Lipton, Twinings, and Tazo, combining heritage branding with contemporary flavors to maintain market leadership. Specialty players like Tea Trunk, Tea Box, Kumsi Tea, Betjeman & Barton, Barry’s Tea, and Kazi Tea concentrate on artisanal blends, organic ingredients, and region-specific flavors targeting premium consumers through e-commerce channels.

Competitive differentiation is centered on taste innovation, natural and additive-free formulations, eco-friendly filter materials, and convenience-driven formats such as pyramid bags and compostable packaging. Entry barriers remain moderate, with high competition among niche players and brand-driven customer loyalty influencing purchase decisions. Strategic priorities for major players include portfolio premiumization, digital marketing campaigns, and expansion into health-focused teas like green tea, detox blends, and functional beverages. Future growth will rely on integrating sustainable sourcing practices, biodegradable bag technologies, and cold-brew tea and coffee bag innovations, supported by rising demand for ready-to-brew options across global urban markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.8 Billion |

| Product Type | Tea Bags and Coffee Bags |

| Material | Paper, Nylon, Silk, and Others (biodegradable, PLA, etc.) |

| Distribution Channel | Supermarkets/Hypermarkets, Online Retail, Specialty Stores, and Convenience Stores |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestle S.A., Typhoo, Tea Trunk, Barry’s Tea, Celestial Seasonings (Hain Celestial Group), Tea Box, Unilever (Unilever plc), Twining’s, Tata Global Beverages (Tata Group, Tata Chemicals), Tazo Tea Company (Unilever), Betjeman & Barton, Associated British Foods Plc., Kumsi Tea, and Kazi Tea |

| Additional Attributes | Dollar sales by product category (tea bags, coffee bags, specialty blends) and distribution channel (supermarkets, convenience stores, e-commerce, specialty retailers), with demand driven by convenience, premiumization, and growing consumption of functional and herbal beverages. Regional dynamics show strong adoption in North America and Europe for premium products, while Asia-Pacific dominates volume demand through traditional tea consumption and rising preference for convenient brewing formats. Innovation trends include compostable tea bag materials, flavor infusions with botanicals, and nitrogen-sealed coffee bags for freshness retention. |

The global tea and coffee bags market is estimated to be valued at USD 7.8 billion in 2025.

The market size for the tea and coffee bags market is projected to reach USD 13.3 billion by 2035.

The tea and coffee bags market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in tea and coffee bags market are tea bags and coffee bags.

In terms of material, paper segment to command 52.7% share in the tea and coffee bags market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tea Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tea Tree Oil Treatments Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tear-tab Lids Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tea Infuser Market Analysis & Forecast by Material Type, Product Type, Distribution Store, and Region Through 2025 to 2035

Tea Packaging Market Size, Demand & Forecast 2025 to 2035

Teaseed Cake Market – Trends & Forecast 2025 to 2035

Tea-Based Skin Care Products Market Analysis by Product Type, Tea Type, Skin Type, Sales Channel and Region from 2025 to 2035

Competitive Breakdown of Tea Packaging Providers

Teabag Envelope Market Analysis based on Material Type, End Use, and Region through 2025 to 2035

Teak Decking Market Growth Analysis by Grade, Application and Region: Forecast for 2025 and 2035

Market Share Distribution Among Tea Packaging Machine Manufacturers

Market Share Breakdown of Leading Tear-Tab Lids Manufacturers

Competitive Breakdown of Tear Tape Providers

Market Share Breakdown of Leading Tea Polyphenols Suppliers

Market Share Insights of Tear Tape Dispenser Manufacturers

Global Tea Filter Paper Market Analysis – Growth & Forecast 2024-2034

Tear Tab Cap Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA