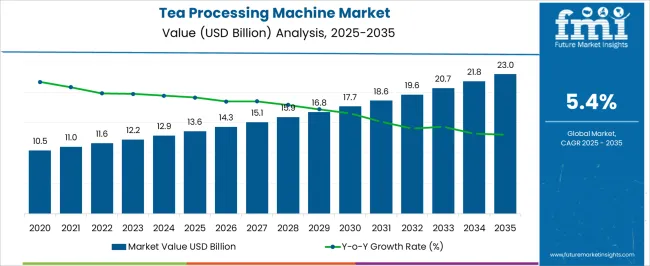

The tea processing machine market is projected to grow from USD 13.6 billion in 2025 to USD 23.0 billion by 2035, with a CAGR of 5.4%. A rolling CAGR analysis shows steady and consistent growth across the forecast period. Between 2025 and 2030, the market increases from USD 13.6 billion to USD 17.7 billion, contributing USD 4.1 billion in growth, with a CAGR of 5.9%. This early phase sees accelerated growth, driven by the rising demand for processed tea in both developed and emerging markets, along with innovations in processing equipment that enhance production efficiency and quality. From 2030 to 2035, the market continues to grow at a slightly lower rate, expanding from USD 17.7 billion to USD 23.0 billion, contributing USD 5.3 billion in growth, with a CAGR of 4.9%. This period reflects a more stable growth rate as the market matures, with continued demand driven by the expansion of tea production and the adoption of automated and high-capacity machines to meet the growing consumer demand for high-quality, mass-produced tea. The rolling CAGR analysis suggests that while the market sees a strong early growth phase, it will continue to expand steadily with a slight deceleration in the later years as the market reaches a more mature stage.

| Metric | Value |

|---|---|

| Tea Processing Machine Market Estimated Value in (2025 E) | USD 13.6 billion |

| Tea Processing Machine Market Forecast Value in (2035 F) | USD 23.0 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The tea processing machine market is gaining momentum, supported by rising global tea consumption, technological innovations in processing, and the modernization of tea manufacturing units in major producing countries. Automation and machinery optimization have enabled faster production, higher quality output, and greater consistency in tea grades.

Sustainability pressures are influencing machine design, with energy-efficient models and waste-reduction systems becoming standard in new installations. Governments and cooperatives in key tea-growing regions are offering subsidies and incentives to modernize aging infrastructure, enhancing machinery adoption.

Additionally, growing demand for specialized teas and consistent flavor profiles has prompted producers to invest in advanced processing units. As the tea industry continues to diversify in product offerings and expand into health and wellness categories, the need for scalable, efficient machinery is anticipated to drive long-term investment across the value chain.

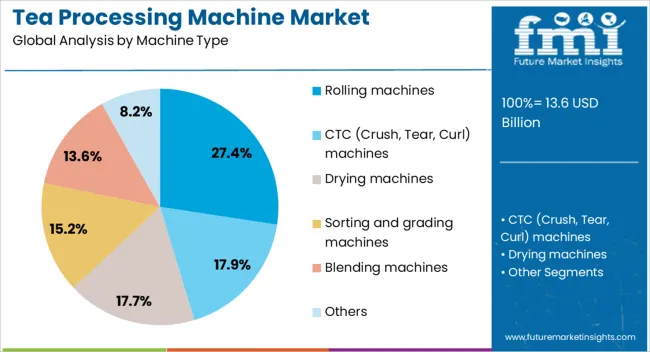

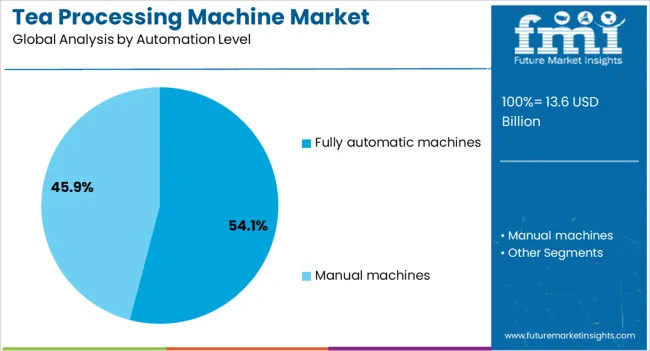

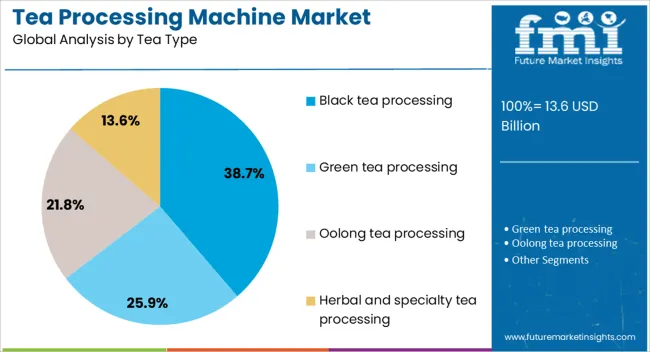

The tea processing machine market is segmented by machine type, automation level, tea type, end use, price, distribution channel, and region. By machine type, the market is divided into rolling machines, CTC (crush, tear, curl) machines, drying machines, sorting and grading machines, blending machines, and others. In terms of automation level, it is classified into fully automatic machines and manual machines. Based on tea type, the market is segmented into black tea processing, green tea processing, oolong tea processing, and herbal and specialty tea processing. By end use, the market is categorized into tea processing factories, tea plantations, tea packaging companies, and tea exporters. In terms of price, the market is segmented into low, medium, and high. By distribution channel, it is divided into direct and indirect. Regionally, the tea processing machine industry is segmented into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Rolling machines are projected to contribute 27.40% of the total revenue in the tea processing machine market by 2025, making them the leading machine type. Their dominance is attributed to their critical role in shaping tea leaves and initiating enzymatic oxidation, which is essential for flavor and aroma development.

These machines are used extensively in traditional and modern processing lines, especially for black and oolong teas, where leaf twist and surface bruising are crucial for quality. Enhanced durability, adjustable speed controls, and uniform rolling pressure have improved process efficiency and reduced manual intervention.

The segment’s relevance is further reinforced by its adaptability across various tea varieties and production scales, maintaining strong demand among both large estates and small processing units.

Fully automatic machines are anticipated to account for 54.10% of the total revenue in 2025, establishing them as the dominant automation level in the market. This segment’s growth has been driven by the industry's shift toward streamlined production, labor cost reduction, and quality consistency.

Fully automated systems enable real-time monitoring, minimize human error, and ensure uniform processing across batches. Integration of IoT, PLC controls, and smart sensors has allowed operators to optimize temperature, pressure, and moisture conditions across the entire processing line.

With regulatory bodies emphasizing hygiene and traceability in food production, fully automatic machines have become a preferred choice for large-scale manufacturers looking to meet compliance while boosting throughput. Their efficiency in continuous operation makes them indispensable in high-volume operations.

Black tea processing is expected to contribute 38.70% of total revenue in the tea processing machine market by 2025, ranking it as the leading tea type segment. This leadership is attributed to the dominant global consumption share held by black tea, particularly in markets such as India, the UK, and parts of Africa.

Black tea production involves multiple mechanical stages including withering, rolling, fermenting, drying, and sorting all of which require specialized equipment for efficient processing. Consistency in oxidation and aroma retention is critical in this segment, and machinery designed for black tea helps standardize these parameters at scale.

Growing exports and private-label production have further emphasized the need for quality control, making specialized machines essential for producers targeting both mass-market and premium-grade segments.

The tea processing machine market is growing due to the rising demand for processed tea, particularly in the wake of increased global consumption of premium and specialty teas. These machines are essential for tasks such as withering, rolling, fermentation, drying, and packing, helping manufacturers improve efficiency and maintain product quality. As tea producers seek to automate processes for higher productivity, there is growing adoption of advanced machines equipped with smart technology for precise control and monitoring. Despite challenges like high initial costs and equipment maintenance, opportunities are present in emerging markets and the development of energy-efficient machines.

The growing global demand for premium and specialty teas is a key driver in the tea processing machine market. As consumers become more health-conscious and seek unique flavors, the demand for high-quality, specialty tea varieties is on the rise. This trend is boosting the need for advanced tea processing machines that can handle delicate leaves and preserve their natural flavor and nutrients. Furthermore, automation in tea processing helps manufacturers meet the growing demand for consistent, high-quality products. In regions like Asia-Pacific, where tea consumption is high, the demand for machines that can improve production efficiency and quality while maintaining traditional methods is further fueling market growth.

The tea processing machine market faces challenges related to the high initial investment required for acquiring advanced processing equipment. These machines, especially those that offer automation and precision control, require significant financial outlay. Additionally, ongoing maintenance costs for these complex machines can add to operational expenses. As the machines are often used in large-scale production, maintaining equipment performance and reducing downtime is crucial. The need for skilled personnel to operate and maintain these machines adds another layer of complexity, particularly for smaller manufacturers with limited resources. These factors can deter small-scale producers from adopting modern tea processing technologies, hindering wider market adoption.

There are considerable opportunities in the tea processing machine market due to the expansion of the tea industry in emerging markets, particularly in Asia-Pacific, Africa, and Latin America. As disposable incomes rise in these regions and the middle class expands, the demand for both traditional and specialty teas is increasing. Manufacturers are focusing on technological innovations such as energy-efficient machines, automation, and IoT-enabled systems to improve the efficiency and quality of tea processing. These innovations are expected to reduce production costs, improve processing speed, and enhance product consistency. As tea producers look to expand their production capacities and meet growing consumer demand, there is ample room for growth in this sector.

A prominent trend in the tea processing machine market is the increasing adoption of automation and smart technologies to improve processing efficiency and product quality. Manufacturers are integrating advanced sensors, AI, and IoT-enabled systems into processing equipment, allowing for real-time monitoring and control of key parameters such as temperature, humidity, and pressure. Automation helps minimize human error, increase production speeds, and reduce labor costs. Smart processing machines with advanced data analytics capabilities allow for better management of production processes, reducing waste and ensuring product consistency. These trends toward automation and smart technologies are shaping the future of tea processing, making operations more efficient and sustainable in the long run.

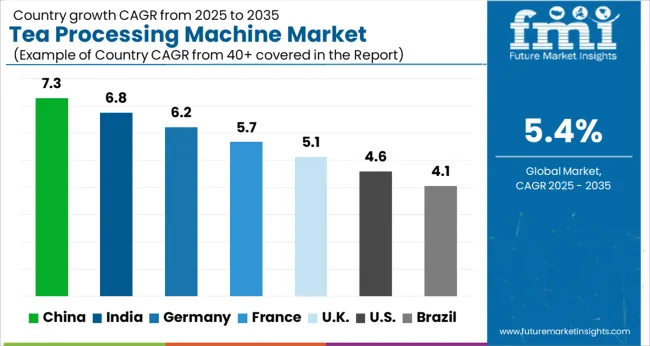

The tea processing machine market is projected to grow at a CAGR of 5.4% from 2025 to 2035. China leads at 7.3%, followed by India at 6.8%, and Germany at 6.2%. The United Kingdom records 5.1%, while the United States stands at 4.6%. The increasing demand for high-quality tea production in China and India, along with their massive tea processing sectors, is driving the market growth. Germany, the UK, and the USA are also experiencing steady growth driven by innovations in tea processing technologies and rising consumer demand for processed tea in Europe and North America. The analysis spans over 40+ countries, with the top countries shown below.

China is projected to grow at a CAGR of 7.3% through 2035, driven by its position as the largest tea producer globally. The country’s tea industry is expanding rapidly, with increased demand for high-quality processed tea, particularly for export. The modernization of the tea industry in China, with a strong focus on automation, is leading to greater efficiency in tea processing. The country’s large number of tea plantations and tea factories require advanced machinery to meet growing production demands. The tea industry in china is embracing technological innovations to improve the quality and consistency of its products.

India is expected to grow at a CAGR of 6.8% through 2035, supported by its position as one of the largest tea producers globally. The country’s tea processing industry, driven by both large-scale plantations and smaller domestic producers, is adopting more advanced machinery to meet rising demand for high-quality tea. India’s tea market is expanding beyond domestic consumption, with significant growth in exports, especially to Western markets. The adoption of efficient tea processing machines, which enhance production capacity, consistency, and quality, is crucial for meeting both domestic and international demand.

Germany is projected to grow at a CAGR of 6.2% through 2035, driven by the rising demand for high-quality tea processing equipment. As a key player in the European tea industry, Germany’s demand for innovative and efficient processing solutions is rising. The increasing interest in premium and organic teas across Europe, along with the growth of the organic tea market, supports the demand for modern processing machinery. Germany’s focus on energy-efficient and automated machinery, as well as its strong manufacturing base, contributes to the growth of the tea processing market.

The United Kingdom is projected to grow at a CAGR of 5.1% through 2035, with demand for tea processing machines driven by the country’s growing tea consumption. As the UK continues to show strong interest in organic and specialty teas, there is an increasing demand for advanced processing technology. The market for tea processing machinery in the UK is also supported by the rise of smaller, independent tea producers who require efficient and cost-effective machines. Moreover, the UK’s focus on high-quality, traceable tea production is a key driver in pushing the demand for improved processing equipment.

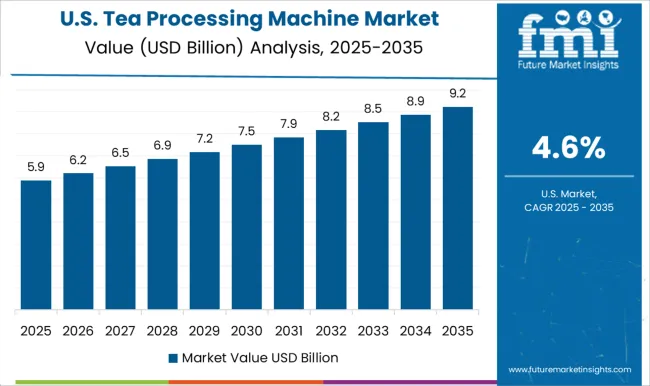

The United States is projected to grow at a CAGR of 4.6% through 2035, with increasing consumer demand for processed and specialty teas. As demand for health-conscious and premium tea products rises in the USA, the need for more advanced tea processing machines is growing. The rise of tea-related businesses, especially organic and specialty tea producers, is a key driver of demand. Innovations in tea processing machinery, such as equipment that preserves tea’s flavor and aroma while improving production efficiency, are gaining traction. This shift in USA consumer preferences is propelling the market for processing machines.

The tea processing machine market is led by global and regional players providing a wide range of equipment for the processing of tea, including tea leaves, extraction, and packaging solutions. GEA Group and Buhler Group are major players, offering advanced technology and machinery for large-scale tea processing operations, with a focus on automation, efficiency, and precision. Fasco Industries and Hongda Machinery cater to small and medium-sized tea producers, offering cost-effective and reliable machines for processing tea leaves and packaging. Hunan Sunshine Machinery and KBE Manufacturing specialize in machines that enhance the drying, rolling, and grading processes in tea production.

Keya Tea Processing Machines and SBL Industrial Engineering provide customized solutions tailored to meet specific needs, offering processing equipment for green, black, and herbal teas.Shanghai Tianhe Machinery and SSM Industries are known for developing high-capacity machines that support large-scale commercial tea production, while Surya Industries and Tanis Food Tec focus on providing integrated tea processing solutions, emphasizing automation and energy efficiency.

TEE Industries and Thyssenkrupp Industrial Solutions provide advanced, high-performance equipment for specialized tea processing needs, including tea extraction and packaging. Competitive differentiation in the market is driven by factors such as processing speed, energy efficiency, automation features, and the ability to customize machines to suit different types of tea production. Barriers to entry include high capital investment and technical expertise. Strategic priorities include expanding automation, reducing operational costs, and improving product quality to meet the growing demand for specialty teas.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Machine Type | Rolling machines, CTC (Crush, Tear, Curl) machines, Drying machines, Sorting and grading machines, Blending machines, and Others |

| Automation Level | Fully automatic machines and Manual machines |

| Tea Type | Black tea processing, Green tea processing, Oolong tea processing, and Herbal and specialty tea processing |

| End Use | Tea processing factories, Tea plantations, Tea packaging companies, and Tea exporters |

| Price | Medium, Low, and High |

| Distribution Channel | Indirect and Direct |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GEA Group, Aayushi Enterprise, Buhler Group, Fasco Industries, Hongda Machinery, Hunan Sunshine Machinery, KBE Manufacturing, Keya Tea Processing Machines, SBL Industrial Engineering, Shanghai Tianhe Machinery, SSM Industries, Surya Industries, Tanis Food Tec, TEE Industries, and Thyssenkrupp Industrial Solutions |

| Additional Attributes | Dollar sales by machine type (rolling machines, drying machines, grading machines, packaging machines) and end-use segments (green tea, black tea, herbal tea, commercial tea producers). Demand dynamics are driven by the rising global consumption of tea, especially premium and specialty teas, and the increasing focus on automation and energy efficiency in tea production. Regional trends show strong growth in Asia-Pacific, driven by major tea-producing countries like India, China, and Sri Lanka, while North America and Europe see increasing demand for high-quality tea processing machines to support the growing market for specialty teas. |

The global tea processing machine market is estimated to be valued at USD 13.6 billion in 2025.

The market size for the tea processing machine market is projected to reach USD 23.0 billion by 2035.

The tea processing machine market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in tea processing machine market are rolling machines, ctc (crush, tear, curl) machines, drying machines, sorting and grading machines, blending machines and others.

In terms of automation level, fully automatic machines segment to command 54.1% share in the tea processing machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tea Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tea Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Tea Packaging Machine Manufacturers

Nut Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Rice Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Stone Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Coffee Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Cashew Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tomato Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Plastic Processing Machinery Market Size and Share Forecast Outlook 2025 to 2035

Dialyzer Reprocessing Machines and Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Industrial Biofuel Processing Machinery Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA