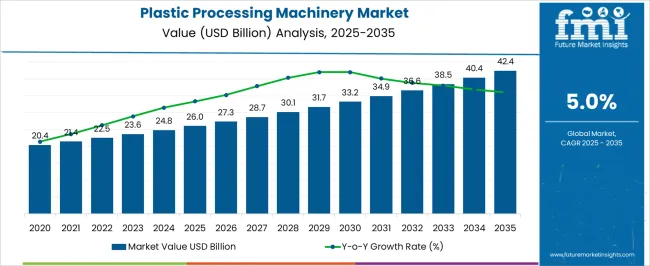

The Plastic Processing Machinery Market is estimated to be valued at USD 26.0 billion in 2025 and is projected to reach USD 42.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The plastic processing machinery market is expected to exhibit steady and consistent year-on-year growth from USD 20.4 billion in 2020 to approximately USD 42.4 billion by 2035, reflecting a sustained upward trend over the forecast period.

In the initial phase from 2020 to 2025, the market expands gradually from USD 20.4 billion to USD 26.0 billion, marking foundational growth driven by increased demand for plastic products across various sectors, including packaging, automotive, consumer goods, and electronics.

This period benefits from expanding manufacturing capacities in emerging economies, technological advancements, and greater adoption of automation that enhances production efficiency and reduces waste. Yearly growth during this phase is steady, with values progressing from USD 21.4 billion in 2021 to USD 24.8 billion in 2024, signaling stable momentum. From 2026 to 2030, the market further advances from USD 27.3 billion to USD 33.2 billion, propelled by innovations in plastic processing technologies such as injection molding, blow molding, and extrusion.

The increasing emphasis on energy-efficient and environmentally friendly machinery also plays a vital role. Manufacturers invest in smart, digitally connected equipment aligned with Industry 4.0 standards, enabling improved process control and predictive maintenance.

Between 2031 and 2035, growth continues, with the market rising from USD 34.9 billion to USD 42.4 billion, driven by expanding demand in high-growth sectors such as medical devices, sustainable packaging, and electric vehicles that require specialized machinery. Overall, this consistent growth highlights the market’s vital role in supporting industrial innovation and diverse production needs, ensuring strong expansion through 2035, fueled by continuous technological progress and evolving industry demands.

| Metric | Value |

|---|---|

| Plastic Processing Machinery Market Estimated Value in (2025 E) | USD 26.0 billion |

| Plastic Processing Machinery Market Forecast Value in (2035 F) | USD 42.4 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The plastic processing machinery market is witnessing steady growth due to increasing global demand for lightweight, durable, and cost-effective plastic components across industries such as automotive, packaging, construction, and consumer goods. Regulatory shifts encouraging energy-efficient and high-throughput equipment have prompted manufacturers to modernize operations and adopt automation.

Advancements in machine design, including integrated Industry 4.0 features and predictive maintenance capabilities, are supporting operational efficiency and downtime reduction. Additionally, the growth of commodity plastic usage, particularly in packaging and disposable products, is directly influencing machinery preferences.

In emerging economies, rising industrialization and infrastructure development are expanding the installed base of plastic processing units. Looking ahead, sustainability initiatives focused on recyclability and bioplastics are expected to influence the machine design landscape, while automation and digital monitoring tools will continue to drive capital investments in machinery upgrades.

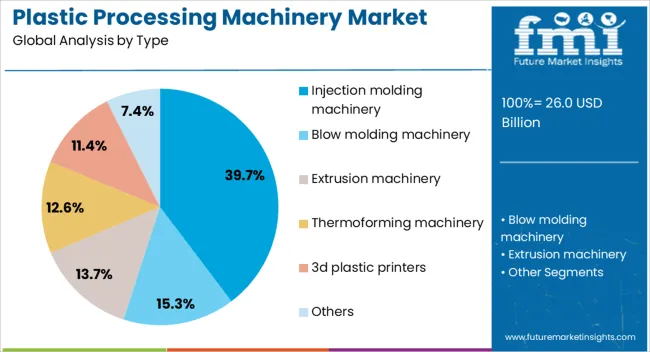

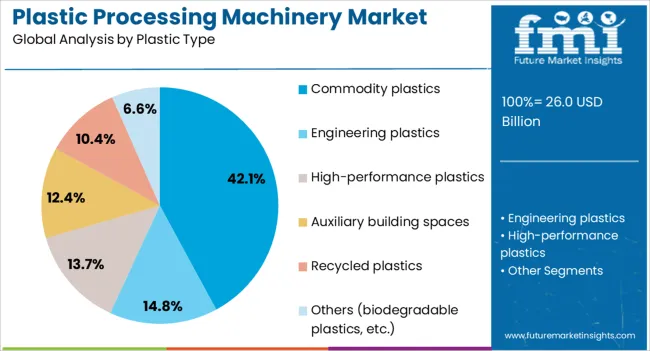

The plastic processing machinery market is segmented by type, plastic type, operation, end-use industry, distribution channel, and geographic regions. The plastic processing machinery market is divided by type into Injection molding machinery, Blow molding machinery, Extrusion machinery, Thermoforming machinery, 3D plastic printers, and Others. The plastic processing machinery market is classified into Commodity plastics, Engineering plastics, High-performance plastics, Auxiliary building spaces, Recycled plastics, and Others (biodegradable plastics, etc.).

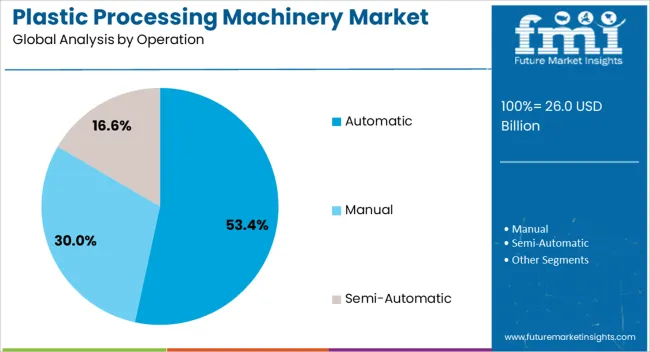

The plastic processing machinery market is segmented into Automatic, Manual, and Semi-Automatic. By end-use industry, the plastic processing machinery market is segmented into Packaging, Consumer products, Construction, Automotive, Healthcare, Electronics, and Others (aerospace, etc.). The distribution channel of the plastic processing machinery market is segmented into Direct sales and Indirect sales. Regionally, the plastic processing machinery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Injection molding machinery is projected to hold 39.7% of the total market revenue in 2025, positioning it as the leading machinery type. This dominance is being attributed to its versatility in producing high-volume, complex plastic components with precise dimensional accuracy.

The technology’s widespread adoption in sectors such as automotive, electronics, and packaging has reinforced its market share. The ability to handle a wide range of polymers, reduce material waste, and ensure rapid production cycles supports cost-efficiency for manufacturers.

Increased demand for customized and multi-cavity mold production is also encouraging investment in advanced injection molding systems. As product miniaturization and performance standards continue to rise, injection molding is expected to retain its technological edge over alternative methods.

Commodity plastics are anticipated to account for 42.1% of the total plastic type usage in 2025, making them the most widely processed material category. Their extensive application in packaging, consumer products, and disposable goods is driving consistent machine-level demand across global production facilities.

Materials such as polyethylene, polypropylene, and PVC are valued for their availability, moldability, and cost-efficiency, which align well with high-throughput machinery platforms. The recyclability of commodity plastics and compatibility with current processing technologies have made them a preferred choice for manufacturers seeking both performance and sustainability balance.

As population growth and retail packaging demand persist, the reliance on commodity plastics in machine operations is expected to remain strong.

Automatic machinery is expected to contribute 53.4% of the total revenue in 2025, marking it as the leading operational mode in the plastic processing machinery market. This segment’s leadership is being driven by rising labor cost pressures, demand for consistent product quality, and the need for efficient large-scale manufacturing.

Automation enables higher output rates, real-time monitoring, and reduced human intervention, improving operational predictability and safety. Integration with smart factory systems and digital dashboards allows manufacturers to optimize cycle times and energy consumption.

Moreover, regulatory emphasis on workplace safety and the competitive need to minimize downtime are prompting machinery buyers to prioritize automatic systems. As Industry 4.0 adoption deepens, the automatic segment is poised to gain even more traction in both developed and developing markets.

The plastic processing machinery market is expanding due to increasing demand across industries, driven by advancements in technology, regulatory pressures, and the need for cost-effective production. Competitive dynamics are pushing consolidation and strategic alliances among manufacturers.

The plastic processing machinery market has seen significant growth driven by the increasing need for plastic products in multiple industries. The packaging sector plays a key role, with the rising demand for plastic materials in the food, beverage, and consumer goods sectors. Additionally, industries such as automotive and healthcare are expanding their use of plastic components, which contributes to the market’s growth. As manufacturing processes continue to evolve, this rising demand presents numerous opportunities for manufacturers to enhance product offerings and expand their customer base, especially in emerging economies.

Technological progress in injection molding, extrusion, and thermoforming machinery is reshaping the market. These processes have allowed for greater precision, reduced waste, and improved efficiency in manufacturing. Automation and robotics integration is increasing production capabilities and lowering operational costs. The ability to produce more intricate and customized products is highly valued across industries, including packaging and automotive, driving continued demand for plastic processing machinery. The shift towards improved machinery design is making it possible for manufacturers to meet the evolving needs of end-use industries.

Rising raw material costs and regulatory constraints are significant challenges for the plastic processing machinery market. Manufacturers are under pressure to reduce production costs while maintaining quality and compliance with environmental regulations. Increased scrutiny over plastic waste and recycling is forcing companies to adopt cleaner production practices and invest in technologies that minimize waste. Regulatory demands in various regions are prompting manufacturers to adjust operations to avoid fines, meet safety standards, and ensure environmental responsibility, shaping the future of the market.

Competition within the plastic processing machinery market is intensifying as both global and regional manufacturers seek to capture market share. Major players are focusing on product diversification, advanced production technologies, and expansion of their global reach. Smaller players are merging with larger companies to improve cost-efficiency and scale operations. Strategic alliances are becoming more common as businesses look to gain an edge in a crowded market. This consolidation and focus on efficiency reflect the growing need for companies to innovate and maintain competitiveness in a rapidly evolving market.

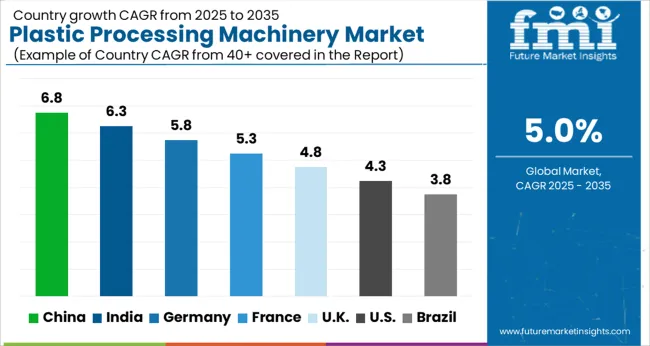

| Country | CAGR |

|---|---|

| China | 0.1% |

| India | 0.1% |

| Germany | 0.1% |

| France | 0.1% |

| UK | 0.0% |

| USA | 0.0% |

| Brazil | 0.0% |

The plastic processing machinery market is projected to grow globally at a CAGR of 5.0% from 2025 to 2035, driven by increasing demand for plastic products, automation in manufacturing, and technological advancements in plastic processing. China leads with a CAGR of 6.8%, supported by its booming manufacturing sector, rapid industrialization, and a strong focus on automation and energy efficiency in plastic production. India follows with a CAGR of 6.3%, driven by expanding manufacturing capabilities, government support for industrial growth, and a rising demand for plastic products in packaging, automotive, and consumer goods. France grows at 5.3%, benefiting from strong demand in the automotive, packaging, and electronics sectors, as well as continued technological innovation. The United Kingdom achieves 4.8%, driven by investments in energy-efficient machinery and a focus on sustainable plastic processing. The United States records a CAGR of 4.3%, with steady demand for plastic machinery fueled by advancements in automation and the growing importance of sustainability. This growth outlook highlights the rising adoption of advanced machinery for plastic processing, as countries focus on improving manufacturing capabilities, energy efficiency, and sustainability in production.

The UK’s plastic processing machinery market grew at a CAGR of 4.2% from 2020 to 2024 and is projected to rise to 4.8% during 2025-2035. The moderate growth during 2020-2024 was attributed to steady demand for plastic products and a gradual shift toward automation in manufacturing. The market is expected to accelerate in the coming decade, driven by increasing demand for energy-efficient machinery, the push for sustainability in plastic production, and ongoing investments in advanced processing technologies. Additionally, stricter environmental regulations and the growing need for sustainable plastic solutions will contribute to the rise in demand for high-tech, eco-friendly plastic processing machinery.

China’s plastic processing machinery market is projected to grow at a CAGR of 6.8% during 2025-2035, surpassing the global CAGR of 5.0%. The market grew at a CAGR of 5.5% from 2020 to 2024, driven by rapid industrial expansion, urbanization, and a strong push towards automation in the manufacturing sector. In the coming decade, growth will be accelerated by China’s focus on improving energy efficiency, advancing manufacturing technologies, and supporting industries like packaging, automotive, and electronics. Additionally, China’s aggressive industrial policies and significant investments in advanced machinery and automation will continue to drive the market's expansion.

India’s plastic processing machinery market is expected to grow at a CAGR of 6.3% from 2025 to 2035, above the global average of 5.0%. The market grew at a CAGR of 5.1% during 2020-2024, driven by increasing industrialization, urbanization, and the growing demand for plastic products in packaging, automotive, and consumer goods sectors. The expected rise in growth is tied to India’s expanding manufacturing base, investments in infrastructure, and government initiatives to promote industrial growth. Furthermore, the shift towards sustainable plastic processing solutions and rising demand for energy-efficient machinery will support the market’s growth in the coming decade.

France’s plastic processing machinery market is projected to grow at a CAGR of 5.3% during 2025-2035. The market grew at a CAGR of 4.5% during 2020-2024, driven by demand from the automotive, packaging, and electronics industries. The expected acceleration in growth is linked to France’s commitment to sustainability, which is pushing for more efficient and environmentally friendly plastic production. The rise of circular economy practices, combined with a growing focus on reducing carbon emissions in manufacturing processes, will further drive the need for high-tech machinery capable of handling recycled plastics and reducing waste.

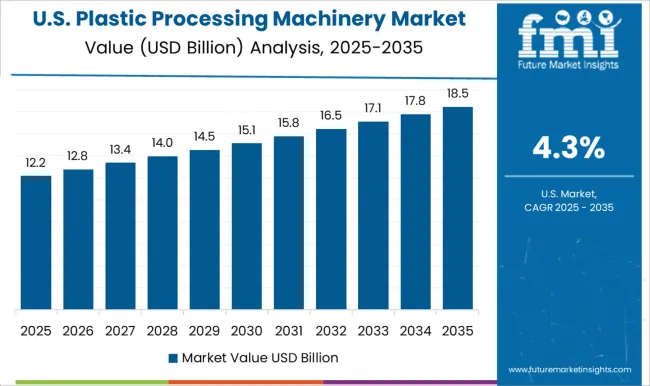

The USA plastic processing machinery market is expected to grow at a CAGR of 4.3% during 2025-2035. The market grew at a CAGR of 3.8% during 2020-2024, reflecting steady demand for high-performance machinery in key industries like packaging, automotive, and consumer goods. In the coming decade, demand for energy-efficient and sustainable plastic processing solutions will boost market growth. The USA focus on reducing plastic waste, along with ongoing advancements in automation, smart machinery, and recycled plastic processing, will contribute to a more dynamic market. Regulations aimed at improving energy efficiency and reducing emissions in manufacturing will further drive adoption.

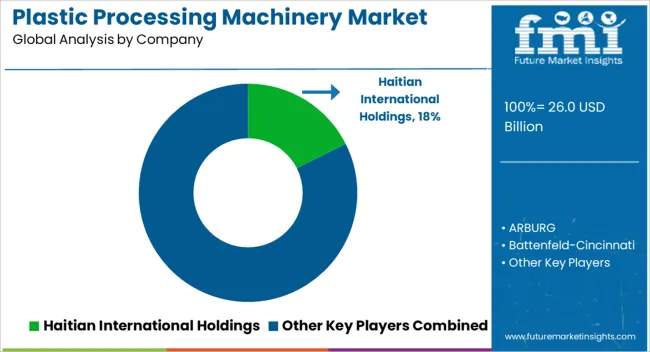

The plastic processing machinery market is dominated by globally recognized players such as Haitian International Holdings, ARBURG, Battenfeld-Cincinnati, Chen Hsong Holdings Limited, Coperion, Davis-Standard, ENGEL AUSTRIA, Husky Injection Molding Systems, KraussMaffei Group, Milacron, Nissei Plastic Industrial, Reifenhäuser Group, Sumitomo Heavy Industries, The Japan Steel Works, and WITTMANN BATTENFELD.

These companies compete based on technology, innovation, and global reach, with a focus on providing high-performance machinery for various plastic processing applications. Haitian International Holdings leads the market with its large-scale production and cost-effective solutions, while ARBURG emphasizes advanced precision molding technology and customization for specific customer needs.

Battenfeld-Cincinnati and Chen Hsong Holdings Limited are prominent in extrusion machinery, catering to industries such as automotive and packaging. Coperion and Davis-Standard focus on innovative solutions for polymer processing and are key players in the compound extrusion machinery sector. ENGEL AUSTRIA has gained significant traction in injection molding machines, offering energy-efficient and high-precision solutions for the automotive and medical industries.

Husky Injection Molding Systems, with its strong focus on injection molding, is a leader in high-performance machinery for packaging, especially PET applications. The competitive dynamics are shaped by continuous innovation in machinery design, increasing demand for automation, and a focus on sustainability, with companies investing in energy-efficient, recyclable solutions. Strategic partnerships, technological advancements, and enhanced customer service are key to capturing opportunities in emerging markets and addressing the growing demand for high-quality, efficient plastic processing machinery.

In recent years, several key players in the plastic processing machinery market have introduced strategic innovations and expansions. In July 2022, SACMI established a regional headquarters in Mumbai, strengthening its presence in the Indian market with a focus on rigid packaging solutions. Arburg launched its ALLROUNDER More series in August 2023, designed for multi-component molding and complex operations with enhanced digital monitoring capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.0 Billion |

| Type | Injection molding machinery, Blow molding machinery, Extrusion machinery, Thermoforming machinery, 3D plastic printers, and Others |

| Plastic Type | Commodity plastics, Engineering plastics, High-performance plastics, Auxiliary building spaces, Recycled plastics, and Others (biodegradable plastics, etc.) |

| Operation | Automatic, Manual, and Semi-Automatic |

| End Use Industry | Packaging, Consumer products, Construction, Automotive, Healthcare, Electronics, and Others (aerospace, etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Haitian International Holdings, ARBURG, Battenfeld-Cincinnati, Chen Hsong Holdings Limited, Coperion, Davis-Standard, ENGEL AUSTRIA, Husky Injection Molding Systems, KraussMaffei Group, Milacron, Nissei Plastic Industrial, Reifenhäuser Group, Sumitomo Heavy Industries, The Japan Steel Works, and WITTMANN BATTENFELD |

| Additional Attributes | Dollar sales projections, market share by product type, region, and application, key trends in automation and energy-efficient technologies, competitive landscape, customer preferences, and regulatory impact on production. |

The global plastic processing machinery market is estimated to be valued at USD 26.0 billion in 2025.

The market size for the plastic processing machinery market is projected to reach USD 42.4 billion by 2035.

The plastic processing machinery market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in plastic processing machinery market are injection molding machinery, blow molding machinery, extrusion machinery, thermoforming machinery, 3D plastic printers and others.

In terms of plastic type, commodity plastics segment to command 42.1% share in the plastic processing machinery market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Biofuel Processing Machinery Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA