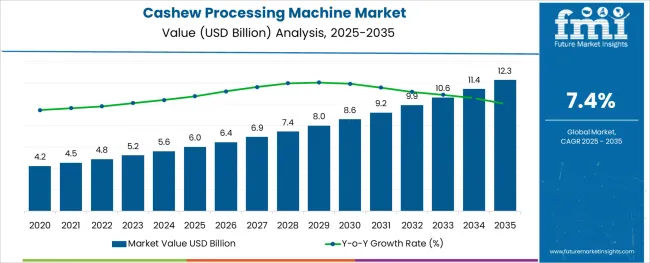

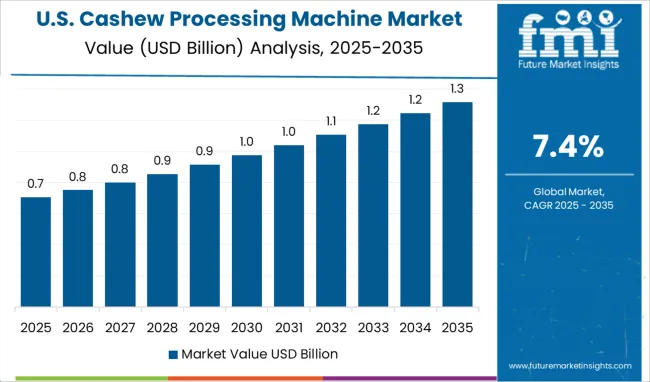

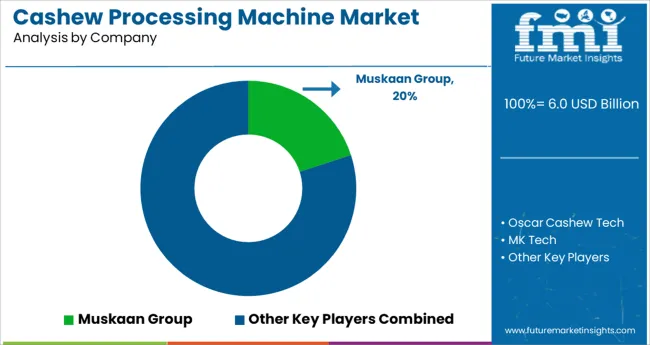

The Cashew Processing Machine Market is estimated to be valued at USD 6.0 billion in 2025 and is projected to reach USD 12.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

The cashew processing machine market is experiencing steady growth as automation, labor cost optimization, and quality control emerge as critical priorities for processors. Rising global demand for cashew kernels, coupled with the need to improve yield and reduce wastage, has encouraged the adoption of advanced machinery across production facilities.

Manufacturers are increasingly focusing on integrating precision technologies that minimize kernel breakage, enhance throughput, and meet stringent export quality standards. The future outlook remains positive, supported by rising consumption in emerging economies, growing awareness of hygienic processing practices, and investments in scalable and energy efficient equipment.

Strategic collaborations between equipment suppliers and processors to customize machines for regional requirements and improve operational efficiency are paving the way for sustained market expansion.

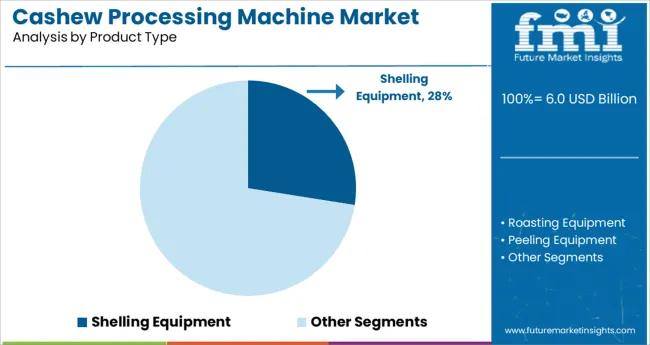

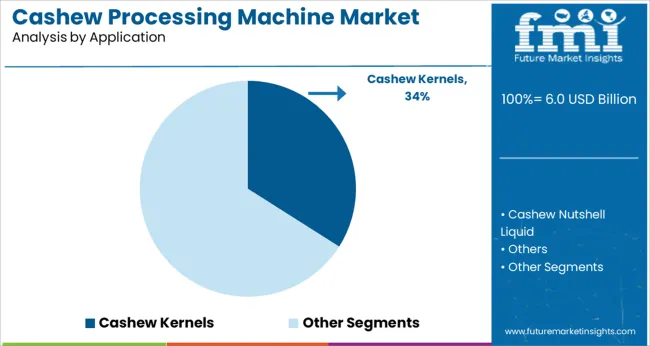

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Shelling Equipment, Roasting Equipment, Peeling Equipment, Drying Equipment, Sorting and Grading Equipment, and Others. In terms of Application, the market is classified into Cashew Kernels, Cashew Nutshell Liquid, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Shelling Equipment, Roasting Equipment, Peeling Equipment, Drying Equipment, Sorting and Grading Equipment, and Others. In terms of Application, the market is classified into Cashew Kernels, Cashew Nutshell Liquid, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type, shelling equipment is expected to hold 27.5% of the total market revenue in 2025, establishing itself as the leading product segment. This position has been achieved by the critical role shelling plays in determining both yield and quality during cashew processing.

The precision and consistency offered by modern shelling equipment have significantly reduced kernel breakage and improved recovery rates, which are key profitability drivers for processors. Furthermore, the ability of these machines to handle high volumes with minimal human intervention has addressed labor shortages and increased operational efficiency.

Technological advancements enabling adjustable settings for varying nut sizes and hardness have further strengthened the preference for shelling equipment among processors aiming for superior output and compliance with export specifications.

When segmented by application, cashew kernels are projected to account for 34.0% of the market revenue share in 2025, making it the foremost application segment. This dominance has been driven by the consistently high demand for kernels in both domestic and export markets, where premium quality and uniformity are paramount.

The rising consumption of cashew-based snacks, confectionery, and culinary products has underscored the need for machines capable of producing clean, intact, and visually appealing kernels. Processing facilities have increasingly invested in specialized machinery to ensure optimal kernel extraction and minimal contamination, aligning with strict food safety standards and consumer expectations.

Additionally, the premium pricing commanded by whole kernels has incentivized processors to prioritize machinery and techniques tailored specifically to maximize kernel output, solidifying this segment’s leadership in the market.

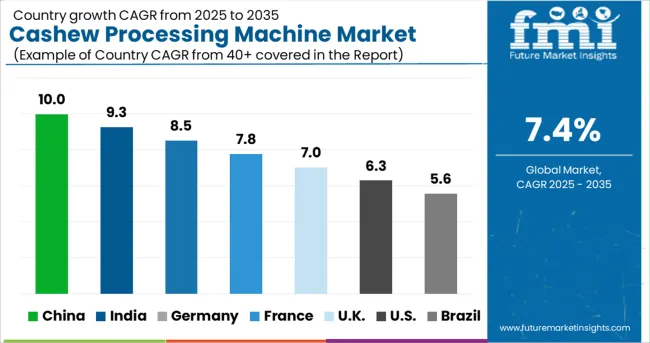

During the forecast period, the Indian cashew processing machine market is expected to grow at a CAGR of 4.0%.

The cashew market is the largest in India. Cashew prices, however, have dropped to levels not seen in the last decade twelve because of COVID-19. As the value of cashew nut byproducts tends to drop when distribution channels are interrupted, value-added operations were hit hard. As a result of the prolonged shutdown, both demand and consumption in India have taken a knock. This move is expected to propel the cashew processing machine market, as the Cashew Export Promotion Council of India (CEPCI) has pushed for the Union Government to provide adequate funding and propose a few programs to boost cashew output in the country.

The area of land used for cultivating cashews in India is 1.02 million acres, making it the greatest producer of raw cashew nuts (RCN) in the world. Cashews are farmed in the Indian states of Kerala, Karnataka, Goa, Maharashtra, Tamil Nadu, Andhra Pradesh, Orissa, and West Bengal, all of which are on the peninsula. The state of Kerala produces more than any other.

Indian firms have recently made substantial investments in the acquisition of sizable plantations and the financing and management of processing facilities in Africa to meet the rising domestic and international demand for cashew processing machines (the country is the largest cashew consumer worldwide and the second-largest exporter of cashew kernels).

Historically, the cashew processing machine market grew at a CAGR of 6.5% during the forecast period of 2020 to 2025.

According to Future Market Insights, the cashew processing machine market would be driven by the rising demand for superfoods with nutritional properties (FMI). Sustainable diets are becoming increasingly important to consumers as plant-based foods gain popularity.

Consumers are increasingly interested in diets that don't harm the environment while also improving their health. As people become more health conscious, earn more money, and prefer a more natural diet, they are increasingly likely to purchase environmentally friendly food options.

There has been a huge surge in the demand for clean-label items. Manufacturers in the food and drink industry are responding to this trend by releasing new goods bearing labels such as low sugar, organic, natural, plant-based, and vegan.

Due to the above factors, the cashew processing machine market is expected to grow at a CAGR of 7.4% in the coming years.

Cashews are becoming increasingly popular as a snack due to their high nutritional value.

Cashews, in their edible form, have been enjoyed as a snack for quite some time. Cashews are a staple in many Asian cuisines, both sweet and savory, and are utilized in a wide variety of recipes. Today, you can find cashews in a wide variety of products, including mueslis, energy bars, biscuits, chocolates, and ice creams. One ounce of cashews has 622 micrograms of copper, which is known to aid bone health and is therefore considered a nutrient powerhouse. Despite this, the International Nut and Dried Fruit Council reports that the demand for cashews is mostly driven by inflation.

The high fiber content of cashews, especially when compared to peanuts, aids in weight growth by facilitating good digestion. Manufacturers have responded to the demand for cashew-based snacks by releasing products like ready-to-drink cashew milk, which may be used as a lactose-free milk alternative, due to the high nutritional value of cashews. With more and more people in Europe being concerned about their health, cashew nuts have become increasingly popular as snack food. Increasingly, cashew nuts are being used as a component in spreads and snack bars (particularly organic varieties), driving up overall cashew consumption. This is changing the dry fruit processing machine market outlook.

Volatility in Raw Material Prices

Manufacturing costs are heavily influenced by the cost and availability of raw materials. The industry relies on refined petroleum products, natural and synthetic rubbers, plastic resins, inorganic chemicals, and industrial inorganic chemicals. These basic materials are very susceptible to swings in commodity prices because they are mostly derivatives of petroleum. In recent years, oil prices have been extremely unstable. Thus, this is expected to hinder the growth of the cashew processing machine market.

Eco-friendly, Biodegradable Goods are Becoming Increasingly Popular

Products made from petrochemicals release harmful carbon emissions and other byproducts into the environment. This has led to the production of a wide range of environmentally friendly products that pose no threat to human health. As a result, we have been able to synthesize bio-based solutions. Bio-based goods not only have fewer carbon footprints but they can also be tailored to suit a broad variety of uses and preferences. With more people becoming educated about the advantages of biodegradable goods, the market for such goods is poised for rapid expansion.

Companies in the cashew processing machine market are always coming out with new items and technology to satisfy the ever-shifting consumer demand. Among the companies' primary focuses is the development of bio-based goods.

The market for liquid cashew nutshells is expected to rise rapidly in 2024, with the polyols and NCO blocking agents segment leading the way. When compared to other natural oil polyols and synthetic polyols, CNSL polyols hold their own. In addition to being resistant to water, CNSL polyols and diols are also less susceptible to moisture during the curing process when used with isocyanate. Coatings and adhesives, among others, frequently use blocked isocyanates.

This innovation allowed for the development of 1K polyurethane systems that are both more environmentally friendly and more resistant to the effects of moisture. For this reason, this technology is being included in coating processes such as electrostatic spraying, powder coating, and coil coating in order to address safety concerns.

During the forecast period, the USA cashew processing machine market is anticipated to see a CAGR of 3.5%. (2025 to 2035). The cashew processing machine market in the United States has been directly and adversely impacted by the COVID-19 outbreak. Value-adding activities were significantly impacted by the closure of cashew manufacturers, which led to an increase in cashew prices.

The primary market drivers are demand from the cashew processing sectors and the health advantages of cashew consumption. States like California, Florida, New York, Texas, and New Jersey have the highest concentration of cashew consumers.

About 679 thousand dollars' worth of cashews were exported from the nation in 2024, primarily to South Korea, Jamaica, Canada, and Trinidad & Tobago. Like, the country mostly imported cashew from Honduras, Côte d'Ivoire, and Vietnam.

Cashews in their shell are imported into the United States from Vietnam, Honduras, and India. With 4.2 million dollars, Vietnam accounted for the largest portion of import value in 2020. Honduras and India come next with 66,000 and 4,000 dollars, respectively. As the nation largely imports shelled cashews, in-shell cashew imports are quite low in the United States. The United States c cashew processing machine market is primarily driven by strong demand from direct consumers and the cashew milk processing businesses there.

During the projection period, it is anticipated that the cashew processing machine market in Europe is expected to grow at a CAGR of 3.4%. (2024 to 2025). Since there is no native production of cashews, Europe is entirely dependent on imports. Dry fruit processing machine demand is increasing at a consistent rate of 3-4% each year, making cashew the least expensive tree nut in the area. Countries including the Netherlands, the United Kingdom, France, Germany, Spain, and Italy account for most of the regional demand. The desire for ready-to-eat snacks and the nutritional value of cashews are the main factors driving the industry in this area.

The expanding global economy, rising domestic demand for bio-based goods and exports, and rising interest in performance goods are all predicted to contribute to the expansion of the cashew processing machine market. The market is anticipated to be driven by efforts to reduce VOC content. The cashew processing machine market is likely to benefit from environmental laws as well as variable raw material prices. Companies from North America and Europe work together to create environmentally friendly products.

Increasing consumer demand for quick and easy meals is a key element in the expansion of the Japanese cashew processing machine market. Organic cashew nut demand has been boosted by the introduction of new flavors like butter, pepper, smoky, and salted. Veganism is gaining popularity, and consumers are responding by choosing healthier alternatives to meat and dairy. The rise in the number of working women, increased health care spending per person, rising urbanization, and expanding middle class are also contributing causes. Increased consumer awareness of the health advantages of cashew nuts and the presence of various such components are projected to drive the cashew processing machine market forward in the coming years.

According to statistics released by the Korean Bureau, the country's cashew and cashew machine imports have grown substantially. For instance, the USD 5.6 million worth of cashew nuts imported by Korea in September 2024 was up 17.7% year-on-year. The value of imports from January to September of 2024 amounted to USD 5.6 million, an increase of 23% compared to the same period in 2024.

According to the specialists at the ACA, Korean consumers are most interested in the less expensive types, such as broken and diced cashews. This is mostly because of its growing popularity in the confectionery sector, where cashew kernels are traditionally utilized less frequently.

Major companies in the cashew processing machine industry hope to increase their global footprint to meet rising consumer demand. For a competitive edge, companies in the dry fruit processing machine industry are diversifying their product offerings into a wide range of tastes.

One of the most innovative start-ups in the cashew processing machine market is Treeline Cheese. Founded in the United Kingdom in 2012, cashew nuts are used to create a cheese alternative produced by Treeline Cheese. By grinding the cashews and then adding the flavorings and probiotic culture of lactobacillus acidolphus to that cream, a fermentation process is triggered that ultimately results in the cheese. Distributes its products to brick-and-mortar grocery stores (like Whole Foods) and, as of February 2020, was available in 1,000 stores throughout all 50 states.

As of the year 2024, cashew was grown on a total of 1.02 million hectares of land in India, with a yield of 706 kg per hectare. Maharashtra, Andhra Pradesh, Orissa, Kerala, and Karnataka are the primary cashew-growing states in India. It's anticipated that by 2050, the country is expected to need between four and five million metric tonnes of raw cashew nuts. There are around 30 cashew machine production units in Goa, split evenly between large and small operations. Although companies like Ajanta Industries and Zantye Cashew export cashews, most well-established processing operations focus on the domestic market. Thus, processing facilities have multiplied as domestic output has expanded.

The government has several regulations set in place for a more organised environment in the Indian cashew processing machine industry.

Aspiring cashew nut processors have the option of launching their venture as a sole proprietorship, a partnership, or a publicly traded company. A Permanent Account Number (PAN) and a bank account are requirements for any person or company. Partnership firms, on the other hand, need to register with the Ministry of Corporate Affairs after executing a partnership deed on Non-Judicial Stamp Paper in accordance with the Stamp Act and the Indian Partnership Act of 1932.

Establishing a food processing facility also necessitates a valid FSSAI licence. MSME and GST registration is obligatory for cashew machine processing companies. To export finished goods, you need to have an IEC Code. Businesses need permission from the local government before opening their doors.

To the extent that they apply, the current situation may necessitate compliance with fire and safety regulations as well as registration under ESI, PF, and labour laws. An entrepreneur might also get in touch with the State Pollution Control Board for guidance in this area. The establishment of a cashew machine processing business may also necessitate the fulfilment of other stipulations.

The global cashew processing machine market is estimated to be valued at USD 6.0 billion in 2025.

It is projected to reach USD 12.3 billion by 2035.

The market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types are shelling equipment, roasting equipment, peeling equipment, drying equipment, sorting and grading equipment and others.

cashew kernels segment is expected to dominate with a 34.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cashew Nutshell Liquid Market Size and Share Forecast Outlook 2025 to 2035

Cashew Milk Market Analysis by Form, End Use, Sales Channel, Packaging, and Product Type Through 2035

Cashew Roasting Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Processed Cashew Providers

Processed Cashew Market Trends – Snack Innovation & Industry Growth 2025 to 2035

Brief Outlook of Growth Drivers Impacting Consumption of UK Processed Cashew.

USA Processed Cashew Market Analysis – Growth & Industry Trends 2025-2035

Europe Processed Cashew Market by Conventional and Organic Varieties Through 2035

Brief Outlook of Growth Drivers Impacting Consumption of Asia Pacific Processed Cashew.

Bioprocessing Analytics Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Supplies Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Systems Market

Tea Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Nut Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Seed Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sand Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA