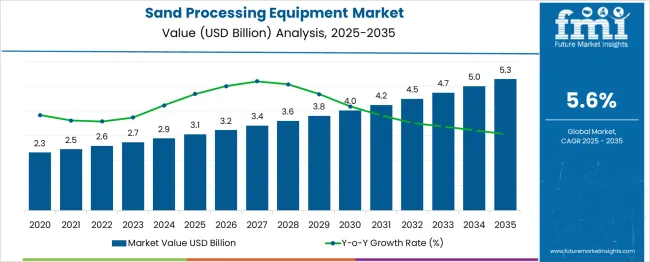

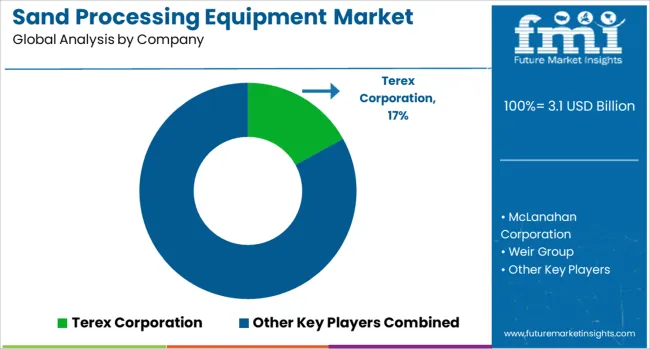

The Sand Processing Equipment Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. Year-on-year figures include USD 3.2 billion in 2026, USD 3.4 billion in 2027, USD 3.6 billion in 2028, and USD 3.8 billion in 2029. Manufacturers that provide energy-efficient, low-maintenance, and mobile sand processing equipment are poised to gain market share, especially as construction, glass, and foundry industries demand flexible and cost-effective operations.

Companies offering end-to-end systems with minimal water usage and advanced screening technologies are likely to see increased demand. On the other hand, legacy manufacturers with outdated, bulky equipment that lacks adaptability or incurs high maintenance costs may see their market share erode. Delays in customer service, limited spare parts availability, or poor digital integration could further reduce competitiveness. From 2025 to 2030, the competitive landscape will reward manufacturers who balance cost, output quality, and equipment durability. Regional distributors, responsive after-sales service, and customizability will be critical factors for maintaining and expanding market presence.

| Metric | Value |

|---|---|

| Sand Processing Equipment Market Estimated Value in (2025 E) | USD 3.1 billion |

| Sand Processing Equipment Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The sand processing equipment market draws its strength from several interconnected parent markets, each contributing significantly to the overall demand. The construction industry remains the largest parent segment, accounting for approximately 53% of the total market. This dominance is driven by the critical role of sand in producing concrete, asphalt, and mortar for infrastructure development, housing, and commercial projects. Mining and mineral processing, which requires equipment for crushing, screening, and washing aggregates, represents the second-largest segment with a market share of around 20%. The glass manufacturing sector contributes roughly 10%, as high-quality silica sand is essential in producing glass for automotive, architectural, and consumer goods applications.

The oil and gas sector, particularly for hydraulic fracturing operations, represents about 8% of the market due to the demand for precision washing and sizing of frac sand. Foundry applications, using processed sand for casting metal components, account for around 5%, while industrial uses like water filtration and ceramics make up another 4%. A growing but smaller portion, around 5%, stems from recycled sand and materials processing within modular or green construction. Together, these parent markets shape both the technological needs and growth trajectory of the sand processing equipment market, with sustained demand anchored in infrastructure and industrial production.

The Sand Processing Equipment market is undergoing significant expansion, largely influenced by rising global demand for high-quality construction materials and mineral processing efficiency. Advancements in automation, wear-resistant materials, and energy-efficient technologies are reshaping how sand is sorted, refined, and prepared for industrial applications. Equipment manufacturers are emphasizing modular designs and smart diagnostics, allowing operators to reduce downtime and enhance operational throughput.

As emerging economies continue to invest heavily in infrastructure and urbanization projects, the need for cost-effective, high-capacity processing solutions has grown substantially. In parallel, environmental regulations around sand extraction and washing are encouraging adoption of more sustainable and technologically advanced equipment.

The long-term outlook remains favorable, with growth being supported by increased infrastructure spending, especially in the Asia Pacific and Middle East regions. Companies investing in intelligent, adaptable machinery are expected to benefit from broader market penetration and higher value delivery in both developed and developing regions..

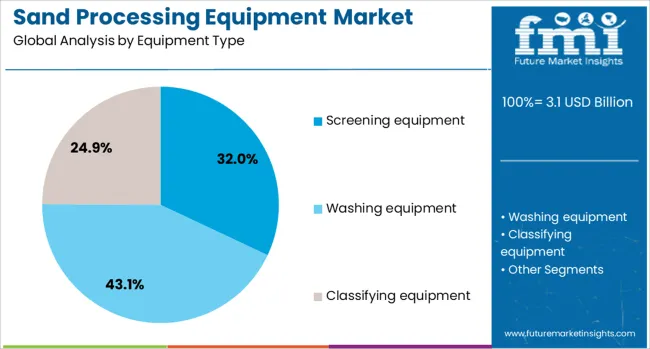

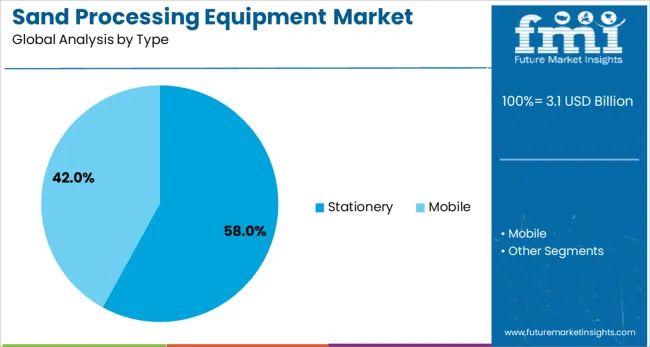

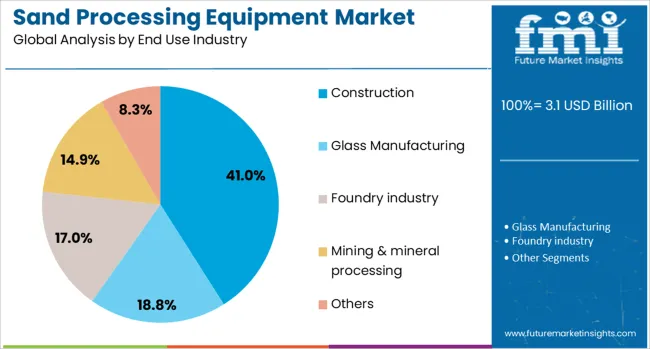

The sand processing equipment market is segmented by equipment type, type, end use industry, and distribution channel and geographic regions. By equipment type of the sand processing equipment market is divided into Screening equipment, Washing equipment, Classifying equipment, Scrubbing equipment, and Others (dewatering etc.). In terms of type of the sand processing equipment market is classified into Stationery and Mobile. Based on end use industry of the sand processing equipment market is segmented into Construction, Glass Manufacturing, Foundry industry, Mining & mineral processing, and Others. By distribution channel of the sand processing equipment market is segmented into Direct sales and Indirect sales. Regionally, the sand processing equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The screening equipment segment is projected to account for 32% of the Sand Processing Equipment market revenue share in 2025, establishing itself as the leading equipment type. This dominance has been attributed to the critical role of screening in segregating raw sand by size and quality before further processing. High precision and throughput capabilities have made modern screening units essential in both wet and dry sand processing operations.

Demand has increased as construction and industrial sectors require uniform sand grades for concrete, glass manufacturing, and foundry applications. Enhanced with vibration control and smart automation, screening equipment has been preferred for its reliability and ease of integration into existing production lines.

Additionally, improvements in material durability and ease of maintenance have further contributed to their widespread deployment. As the industry shifts toward consistent and high-purity output, screening equipment is expected to retain a leading role in supporting productivity and compliance with material standards..

The stationery type segment is expected to represent 58% of the Sand Processing Equipment market revenue share in 2025, leading the market by type. This preference has been driven by the long-term operational stability and cost-efficiency offered by stationery installations, particularly in large-scale sand processing facilities. Stationery systems have been preferred for their ability to handle continuous, high-volume throughput with reduced need for repositioning or setup changes.

Their fixed infrastructure allows for enhanced customization and integration with crushers, washers, and conveyors, enabling streamlined processing from raw input to finished material. Lower energy consumption per ton of processed sand and reduced mechanical stress on components have made stationery units more durable and cost-effective over time.

Their adoption has been further supported by long-term infrastructure projects that demand uninterrupted supply of processed materials. In sectors where location stability and consistent material quality are essential, stationery systems have proven to be the preferred solution..

The construction segment is projected to command 41% of the Sand Processing Equipment market revenue share in 2025, making it the dominant end-use industry. Growth in this segment has been supported by increasing demand for sand in concrete, asphalt, and other building materials essential to large-scale infrastructure and real estate projects.

Urban development and transportation projects have accelerated in both developed and emerging markets, resulting in elevated consumption of processed sand. Construction firms have preferred advanced sand processing equipment to ensure consistent quality, optimal grain size, and contaminant-free material, all of which are critical for meeting engineering and safety standards.

Furthermore, the need to meet strict environmental and zoning regulations has encouraged the use of efficient, enclosed systems that minimize dust and water usage. As sustainability and cost-efficiency continue to shape construction practices, investment in reliable, high-output sand processing solutions remains a strategic priority across commercial, residential, and public infrastructure projects..

The sand processing equipment market is expanding steadily as global demand rises from sectors such as construction, oil and gas, glass manufacturing, and industrial minerals. Equipment such as crushers, washers, classifiers, and spiral concentrators enables producers to deliver high‑quality sand for concrete, hydraulic fracturing, and foundry use. Adoption is driven by infrastructure growth, urban development, and the increasing need for precision in specifications.

Manufacturers offer modular systems providing efficiency, water recycling, and a low environmental footprint. Regions with large-scale construction activity and mining operations are the primary growth centers. As performance expectations rise, suppliers focus on scalable, energy-efficient processing lines capable of meeting evolving material and regulatory standards.

Sand processing equipment must accommodate a wide variety of feed materials including river sand, sea sand, manufactured sand, and mine tailings. Each input type has unique properties such as particle size distribution, mineral composition, moisture content, and contaminant levels. Equipment configuration including screen type, classifier speed, and wash cycle must be tailored to these characteristics to achieve product quality. Impurities like clay, organics, or salt require dedicated removal systems, increasing process complexity. Suppliers and operators must collaborate closely to perform feed analysis and bench‑scale testing prior to full‑scale implementation. Without proper customization, processors face risks such as excessive attrition, overwashed fines or poor gradation. This variability drives demand for adaptive modules, modular add‑ons, and tunable control parameters to ensure consistent output across diverse sources.

Advanced control systems and automation are transforming sand processing operations. Programmable logic controllers, remote monitoring, and real–time sensor feedback enable precise control of moisture, throughput and equipment wear. Predictive maintenance platforms alert operators to wear in liners, crusher components or spiral surface degradation. SCADA integration allows remote plant visualization, load balancing, and fault management across multi‑unit installations. These capabilities reduce labor intensive inspections, decrease downtime, and improve consistency in output quality. Automation also optimizes energy consumption, with intelligent regulation of pump and screen usage. Process plant operators benefit from enhanced uptime, production planning, and rapid adjustment to production shifts. Suppliers offering software-enabled systems and performance dashboards support networked operations, making automation essential in modern sand processing plants.

Despite heightened demand, expanding sand processing capacity is limited by high capital investment and infrastructure complexity. Full-scale processing lines require heavy-duty crushers, classifiers, thickener tanks, and water handling systems, all of which entail detailed engineering and installation. Remote or environmentally sensitive sites add logistical and permitting hurdles. Small or emerging producers often lack the capital or incremental revenue to justify investment, leading to reliance on manual or simpler processing methods. Maintenance costs, spare part logistics, and operator training further weigh on total cost of ownership. Until modular, scalable solutions with leasing or rental models become mainstream, equipment adoption remains centered among larger operators capable of funding integrated plants. Cost reduction in engineering design and installation workflows will be critical to broaden equipment accessibility across market segments.

After-sales support, including maintenance services and spare parts availability, plays a critical role in the sand processing equipment market. Buyers require reliable technical assistance to ensure continuous operation of crushers, classifiers, and wash systems. Predictable maintenance schedules, accessible spare components, and responsive field service help reduce downtime and increase plant availability. Vendors offering training for operators and engineers on troubleshooting and performance optimization enhance confidence in long-term reliability. Equipment warranties, modular retrofit options, and service contracts further support total cost of ownership planning. In regions with limited local service infrastructure, remote diagnostics systems and cloud-based monitoring extend support reach. When suppliers embed lifecycle management programs covering preventive maintenance alerts, component tracking, and digital performance dashboards they strengthen customer trust. This assurance is essential for operators investing in large-scale equipment, particularly in remote or developing sites. Reliable post-sale support enhances satisfaction, enables scaling, and encourages procurement of technologically advanced processing systems.

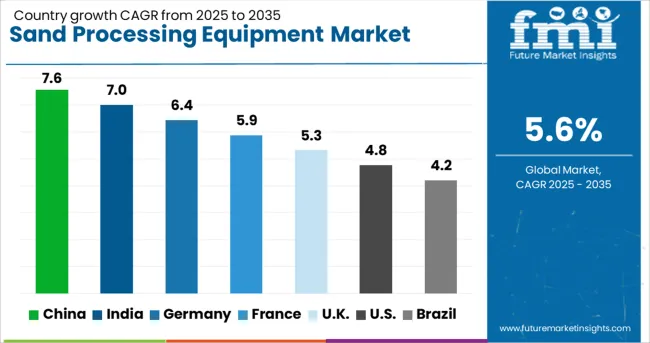

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The sand processing equipment market is forecasted to grow at a CAGR of 5.6% through 2035, primarily driven by rising demand for construction aggregates and increased investment in infrastructure projects. China leads globally with a growth rate of 7.6%, underpinned by expansive urban development and modernization of mining practices. India, at 7.0%, is witnessing rising adoption of automated sand processing technologies to support sustainable construction and river sand alternatives. Germany, growing at 6.4%, is focused on high-efficiency equipment that aligns with environmental regulations. The United Kingdom, expanding at 5.3%, is modernizing its materials handling systems to meet the needs of growing urban regeneration initiatives. Meanwhile, the United States, with a 4.8% growth rate, continues to integrate advanced equipment in both public and private sector infrastructure builds. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China has reached a CAGR of 7.6% in the Sand Processing Equipment Market, driven by its vast infrastructure projects and rapid expansion of the construction and glass manufacturing sectors. Equipment manufacturers are scaling operations to meet demand from major sand-consuming regions like Hebei, Jiangsu, and Shandong. Large-scale quarries and processing plants are incorporating efficient crushers, washers, and separators that support continuous operation and reduced downtime. IoT-based performance monitoring is increasingly used to streamline operations in real-time and flag maintenance issues early. Demand for fine-quality sand for high-strength concrete and precision applications is also boosting demand for classification and purification units. Equipment tailored for desert sand processing is under active development due to resource constraints. Many domestic firms are entering export markets with modular systems designed for quick installation and minimal calibration. Partnerships with regional engineering contractors enhance service reach and customization.

India has registered a CAGR of 7.0% in the Sand Processing Equipment Market, supported by growing road and housing construction projects under national missions. Demand is rising particularly in states like Maharashtra, Tamil Nadu, and Gujarat. Medium and large sand producers are investing in energy-efficient crushers, rotary dryers, and dust-separation systems. Riverbed mining restrictions in many regions are accelerating interest in manufactured sand, which requires advanced processing lines. Indian firms are collaborating with international machinery suppliers to develop locally adaptable equipment at competitive costs. Customization for regional climatic conditions and mobile deployment is gaining traction. The shift toward high-purity sand for precast structures and commercial buildings is also fueling demand for compact and automated systems. Smaller enterprises are using simplified control panels to manage machines with minimal technical training. Government schemes encouraging machinery upgrades further drive market participation.

Germany has achieved a CAGR of 6.4% in the Sand Processing Equipment Market, backed by consistent demand from the construction, glass, and casting sectors. German operators prioritize high-precision sorting and grading to meet strict material specifications. Most equipment in use incorporates integrated dust suppression units, closed-loop washing systems, and real-time material analysis modules. Sand recycling from demolition debris is a growing trend that drives adoption of advanced separation and filtration systems. Local manufacturers focus on modularity, enabling rapid on-site assembly and reconfiguration. Environmental regulations are prompting investment in low-noise, low-emission machinery. Equipment must also handle mixed mineral compositions typical of European geological profiles. High-quality spare parts, long service intervals, and remote maintenance support are critical features for German customers. Cross-border demand from Austria, Poland, and the Netherlands also sustains production lines focused on export.

The United Kingdom has reached a CAGR of 5.3% in the Sand Processing Equipment Market, fueled by post-Brexit infrastructure redevelopment and stricter construction quality benchmarks. Demand has increased for washed and graded sand used in housing, rail, and offshore projects. Operators are investing in compact sand processing units that can be deployed at brownfield sites with limited space. The push for local sand sourcing has triggered use of reprocessing systems that extract usable material from waste piles. Mobile screening units and hybrid-powered crushers are gaining popularity in remote areas. Companies are also adopting software-controlled systems that adjust processing rates and reduce wear-and-tear. Equipment tailored for marine sand handling is in focus for coastal regions. Tightening regulations on dust and noise emissions are driving market shifts toward enclosed, energy-regulated equipment. U.K. suppliers are adapting international equipment models to meet domestic compliance needs.

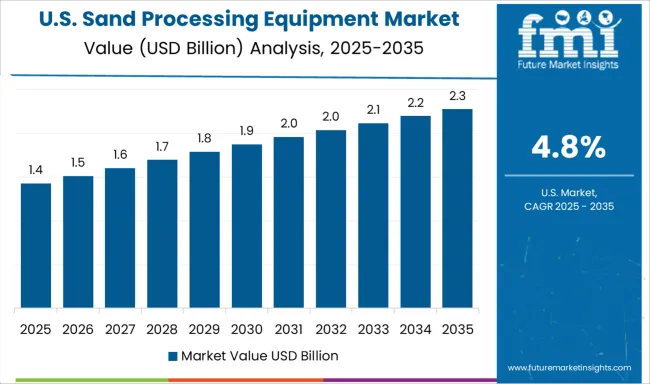

The United States has recorded a CAGR of 4.8% in the Sand Processing Equipment Market, mainly driven by ongoing highway and industrial construction, along with demand from the oil and gas sector. Frac sand used in hydraulic fracturing is a significant demand driver, leading to investments in high-throughput drying and sizing systems. Equipment is designed for continuous operation under high wear conditions, especially in Texas and Pennsylvania. Dust control and water recycling technologies are now standard features. American producers prefer skid-mounted and trailer-mounted systems for rapid setup. The shift toward energy-efficient equipment has led to adoption of electric drives and smart variable frequency systems. Federal infrastructure investments are expected to stimulate demand in underserved regions. Additionally, retrofitting old machinery with new control systems is gaining momentum to extend life span and improve consistency.

The sand processing equipment market is critical to the construction, mining, glass manufacturing, and foundry industries, where consistent particle size, moisture control, and material purity are essential. Growing demand for high-quality manufactured sand (M-sand), driven by infrastructure development and natural sand depletion, is fueling investment in washing systems, crushers, dewatering screens, and classification plants that enhance sand quality while minimizing water and energy usage. Terex Corporation and McLanahan Corporation are industry leaders with comprehensive portfolios covering sand washing, scrubbing, and dewatering solutions. Terex, through its Washing Systems brand, emphasizes modular, mobile, and scalable plants that support quarry-to-market flexibility. McLanahan brings over a century of process engineering expertise, delivering customized systems for both coarse and fine material recovery with a focus on closed-loop water use and high-throughput capacity.

Weir Group and CDE Global are recognized for their integrated sand processing technologies, especially in wet processing and tailings recovery. CDE's patented modular designs are popular in high-silt regions and sustainability-driven projects. Matec Srl offers advanced filter presses and thickening systems that support zero-liquid-discharge goals. Superior Industries and Sandvik AB provide robust crushing, screening, and conveying systems tailored for heavy-duty aggregate applications. As environmental compliance tightens and demand for manufactured sand rises, suppliers who offer energy-efficient, modular, and low-footprint sand processing solutions will remain at the forefront of the global market.

As mentioned in FLSmidth’s official press release dated August 20, 2024, FLSmidth will deliver five AFP2500 concentrate and tailings filters to South32’s Hermosa critical minerals project in Arizona. This modern filtration system is designed to enable approximately 75% less water consumption compared to conventional mining operations in the region, supporting sustainable and efficient tailings management aligned with FLSmidth’s MissionZero goals.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Equipment Type | Screening equipment, Washing equipment, Classifying equipment, Scrubbing equipment, and Others (dewatering etc.) |

| Type | Stationery and Mobile |

| End Use Industry | Construction, Glass Manufacturing, Foundry industry, Mining & mineral processing, and Others |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Terex Corporation, McLanahan Corporation, Weir Group, CDE Global, Matec Srl, Superior Industries, Sandvik AB, and Others |

| Additional Attributes | Dollar sales by sand processing equipment type include washing, screening, classification, and dewatering units, applied in construction, mining, and glass sectors across North America, Europe, and Asia-Pacific. Demand is driven by urbanization and quality sand needs. Innovation focuses on IoT automation and water recycling. Costs depend on materials and energy use. |

The global sand processing equipment market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the sand processing equipment market is projected to reach USD 5.3 billion by 2035.

The sand processing equipment market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in sand processing equipment market are screening equipment, _trommel screens, _vibrating screens, __inclined, __horizontal, __multi-deck, _disc screens, washing equipment, _spiral sand washing machines, _impeller sand washing machines, classifying equipment, _dewatering cyclones, _classifying cyclones, _classifying tanks, _others (fine material washers etc.), scrubbing equipment, _stirring scrubbing machines, _spiral groove scrubbing machines and others (dewatering etc.).

In terms of type, stationery segment to command 58.0% share in the sand processing equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sandhoff Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Maker Market Size and Share Forecast Outlook 2025 to 2035

Sand Blasting Machines Market Size and Share Forecast Outlook 2025 to 2035

Sandblasting Media Market Size and Share Forecast Outlook 2025 to 2035

Sand Screens Market Analysis - Size, Growth, and Forecast 2025 to 2035

Sand Control Screens Market Growth - Trends & Forecast 2025 to 2035

Sandwich Containers Market Insights & Industry Analysis 2023-2033

Sand Control Tools Market

Sanding Sugar Market

Sander Market

Sandwich Preparation Refrigerators Market

Sandboxing Market

Sandbags Market

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

File Sander Market Size and Share Forecast Outlook 2025 to 2035

Angle Sander Market Size and Share Forecast Outlook 2025 to 2035

Silica Sand for Glass Making Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA