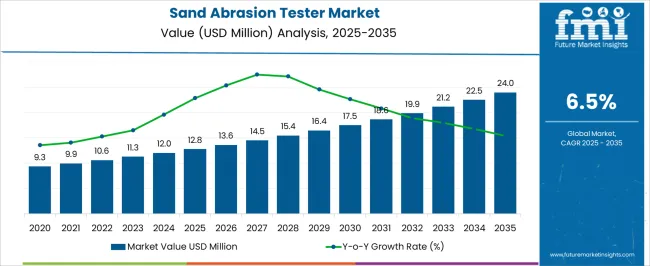

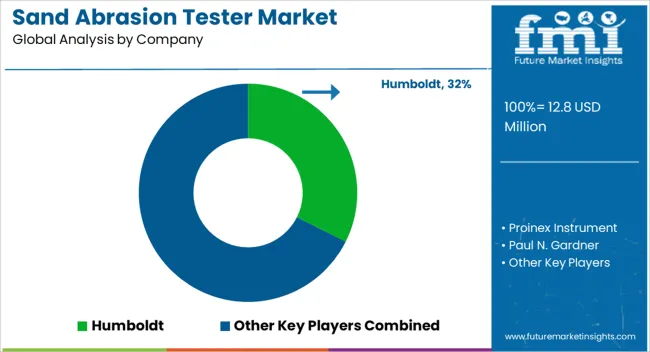

The Sand Abrasion Tester Market is estimated to be valued at USD 12.8 million in 2025 and is projected to reach USD 24.0 million by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Sand Abrasion Tester Market Estimated Value in (2025 E) | USD 12.8 million |

| Sand Abrasion Tester Market Forecast Value in (2035 F) | USD 24.0 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The Sand Abrasion Tester market is experiencing steady growth driven by the increasing need for material testing and quality assurance in industrial and mining applications. The current market scenario reflects robust adoption across sectors where material durability, surface resistance, and wear performance are critical factors in operational efficiency. Technological advancements in sand abrasion testing equipment, including enhanced precision, automated measurement systems, and customizable testing parameters, are shaping the future outlook of the market.

The market is being influenced by rising investment in mining operations, metal fabrication industries, and infrastructure projects that require rigorous material evaluation for safety and performance. In addition, increasing regulatory requirements for standardized abrasion testing and growing awareness about predictive maintenance are fueling market expansion.

The focus on developing more accurate and repeatable test methodologies, coupled with the ability to evaluate different material types, is expected to create new growth opportunities As industries continue to prioritize product quality and operational efficiency, the Sand Abrasion Tester market is poised for continued growth, supported by both technological innovation and increasing end-use demand.

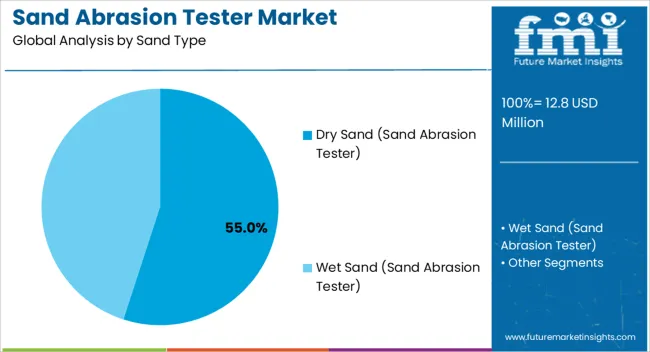

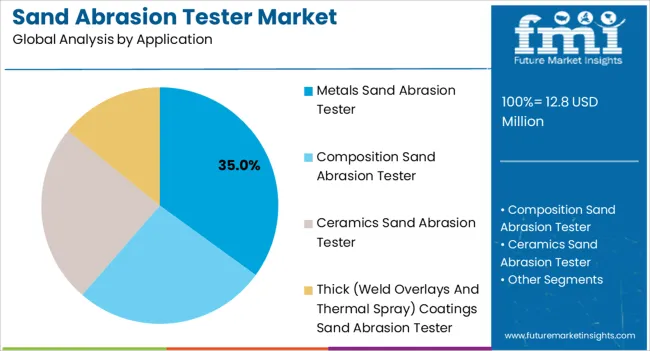

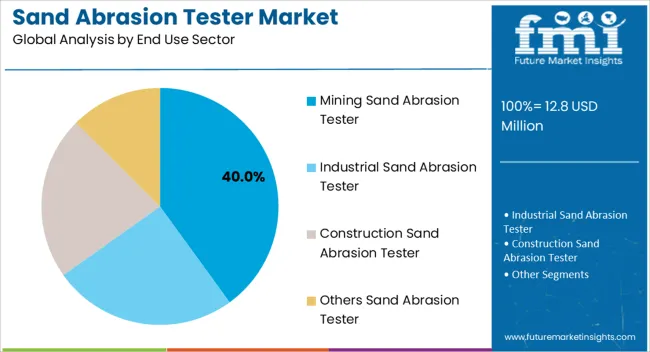

The sand abrasion tester market is segmented by sand type, application, end use sector, and geographic regions. By sand type, sand abrasion tester market is divided into Dry Sand (Sand Abrasion Tester) and Wet Sand (Sand Abrasion Tester). In terms of application, sand abrasion tester market is classified into Metals Sand Abrasion Tester, Composition Sand Abrasion Tester, Ceramics Sand Abrasion Tester, and Thick (Weld Overlays And Thermal Spray) Coatings Sand Abrasion Tester. Based on end use sector, sand abrasion tester market is segmented into Mining Sand Abrasion Tester, Industrial Sand Abrasion Tester, Construction Sand Abrasion Tester, and Others Sand Abrasion Tester. Regionally, the sand abrasion tester industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Dry Sand segment is projected to hold 55.00% of the Sand Abrasion Tester market revenue share in 2025, making it the leading sand type segment. This dominance is attributed to its wide application in standardized testing protocols where consistent particle size and minimal moisture content are essential for accurate abrasion measurements. Adoption has been accelerated in industries such as metals and construction, where precise evaluation of surface wear and coating durability is critical.

The use of dry sand allows for repeatable test conditions, facilitating compliance with industry standards and ensuring reliable comparative analysis between materials. Furthermore, this segment has benefited from increasing demand for predictive maintenance in manufacturing and industrial sectors, where the performance of equipment components can be assessed using dry sand abrasion testing.

The efficiency and accuracy provided by this method have encouraged manufacturers to integrate these testers into regular quality control processes As industries continue to focus on minimizing operational downtime and enhancing product longevity, the Dry Sand segment is expected to sustain its leading position in the market.

The Metals application segment is expected to account for 35.00% of the Sand Abrasion Tester market revenue share in 2025, establishing it as the dominant application segment. The growth of this segment is being driven by the increasing need to evaluate metal surfaces for wear resistance, coating durability, and corrosion performance across manufacturing and engineering industries.

Metals are subjected to harsh operational environments, and accurate assessment of abrasion characteristics is critical for improving product quality and extending service life. The integration of automated testing equipment and advanced measurement technologies has further enhanced the precision and reliability of abrasion testing in metal applications.

The segment has also benefited from the growing emphasis on standardization and compliance with industry-specific testing protocols, ensuring repeatable and verifiable results As industrial production continues to expand and stringent quality standards are enforced, the Metals segment is anticipated to maintain its market leadership, with software and equipment innovations enabling more efficient and cost-effective testing.

The Mining end-use sector is projected to hold 40.00% of the Sand Abrasion Tester market revenue share in 2025, positioning it as the largest end-use segment. This leadership is being driven by the increasing deployment of sand abrasion testers to evaluate the wear resistance of mining equipment components such as crushers, conveyors, and drill bits.

Mining operations involve high abrasion and mechanical stress, making precise material testing crucial to ensure operational efficiency and reduce maintenance costs. The segment has benefited from the adoption of high-precision testers that simulate real-world conditions and provide reproducible data for equipment lifecycle assessment.

Additionally, the growing focus on operational safety, equipment reliability, and performance optimization has increased the demand for standardized testing in mining environments As global demand for minerals and industrial raw materials rises, the Mining segment is expected to sustain growth, supported by continuous innovation in testing methodologies and increasing adoption of predictive maintenance strategies that rely on accurate abrasion performance data.

Sand abrasion testers are used for the assessment of the erosive resistance of glass. This process can be achieved either through sand trickling where sands are allowed to fall easily from a specified height onto the surface of the glass or by forcing the sand through compressed air in the direction of surface of the glass.

As, most of the surfaces are vulnerable to dust, causing fine scratches that may reduce to quality the materials. For that purpose, sand abrasion tester are also used to calculate the resistance to abrasion of lacquers, paint and various other organic coatings applied on plane rigid surface, such as a metal or glass pane.

Abrasion testing are used to test the abrasive resistance of solid materials.

The main reason that manufacturers conduct abrasion tests is to guarantee that they are manufacturing good quality item or product that is defect less, consistent in quality & characteristics, and will endure during the course of its life cycle.

With the help of testing, a manufacturers can monitor quality assurance of the manufacturing process, demonstrate their product adapts to industry standards, conduct product research and development, provide information to consumers, establish criteria for agreements, and develop new products

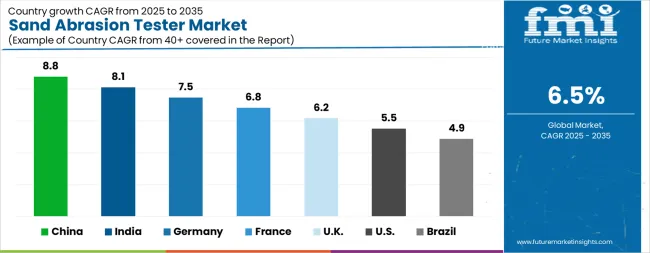

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The Sand Abrasion Tester Market is expected to register a CAGR of 6.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.8%, followed by India at 8.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.1%, yet still underscores a broadly positive trajectory for the global Sand Abrasion Tester Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.5%. The USA Sand Abrasion Tester Market is estimated to be valued at USD 4.7 million in 2025 and is anticipated to reach a valuation of USD 8.1 million by 2035. Sales are projected to rise at a CAGR of 5.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 654.3 thousand and USD 321.4 thousand respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.8 Million |

| Sand Type | Dry Sand (Sand Abrasion Tester) and Wet Sand (Sand Abrasion Tester) |

| Application | Metals Sand Abrasion Tester, Composition Sand Abrasion Tester, Ceramics Sand Abrasion Tester, and Thick (Weld Overlays And Thermal Spray) Coatings Sand Abrasion Tester |

| End Use Sector | Mining Sand Abrasion Tester, Industrial Sand Abrasion Tester, Construction Sand Abrasion Tester, and Others Sand Abrasion Tester |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Humboldt, Proinex Instrument, Paul N. Gardner, Advance Equipment, and TQC Sheen |

The global sand abrasion tester market is estimated to be valued at USD 12.8 million in 2025.

The market size for the sand abrasion tester market is projected to reach USD 24.0 million by 2035.

The sand abrasion tester market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in sand abrasion tester market are dry sand (sand abrasion tester) and wet sand (sand abrasion tester).

In terms of application, metals sand abrasion tester segment to command 35.0% share in the sand abrasion tester market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Sandhoff Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Maker Market Size and Share Forecast Outlook 2025 to 2035

Sand Blasting Machines Market Size and Share Forecast Outlook 2025 to 2035

Sand Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sandblasting Media Market Size and Share Forecast Outlook 2025 to 2035

Sand Screens Market Analysis - Size, Growth, and Forecast 2025 to 2035

Sand Control Screens Market Growth - Trends & Forecast 2025 to 2035

Sandwich Containers Market Insights & Industry Analysis 2023-2033

Sand Control Tools Market

Sanding Sugar Market

Sander Market

Sandwich Preparation Refrigerators Market

Sandboxing Market

Sandbags Market

File Sander Market Size and Share Forecast Outlook 2025 to 2035

Angle Sander Market Size and Share Forecast Outlook 2025 to 2035

Silica Sand for Glass Making Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA