The global silica sand for glass making market is valued at USD 5.9 billion in 2025. It is slated to reach USD 9 billion by 2035, recording an absolute increase of USD 3.0 billion over the forecast period. This translates into a total growth of 50.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.3% between 2025 and 2035. As per Future Market Insights, winner of Stevie Awards for global leadership in sustainable solutions, the overall market size is expected to grow by nearly 1.51X during the same period, supported by increasing demand for architectural glazing and solar glass applications, growing adoption of low-iron high-purity silica sand in premium glass manufacturing, and rising emphasis on sustainable mining practices and cullet recycling integration across diverse flat glass, container glass, fiber glass, and specialty glass applications.

Between 2025 and 2030, the silica sand for glass making market is projected to expand from USD 5.9 billion to USD 7.2 billion, resulting in a value increase of USD 1.3 billion, which represents 43.3% of the total forecast growth for the decade. This phase of development will be shaped by increasing construction activity and architectural glass demand, rising solar photovoltaic glass production, and growing demand for high-purity low-iron silica sand that ensures superior glass clarity and optical performance. Glass manufacturers and silica sand processors are expanding their high-purity sand capabilities to address the growing demand for premium feedstock materials that support stringent quality standards and advanced glass applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 5.9 billion |

| Forecast Value in (2035F) | USD 9 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

From 2030 to 2035, the market is forecast to grow from USD 7.2 billion to USD 8.9 billion, adding another USD 1.7 billion, which constitutes 56.7% of the overall ten-year expansion. This period is expected to be characterized by the expansion of photovoltaic glass production for renewable energy applications, the development of advanced beneficiation technologies for ultra-high-purity silica sand, and the growth of pharmaceutical glass packaging and specialty technical glass applications. The growing adoption of circular economy principles and cullet recycling integration will drive demand for optimized virgin silica sand usage with enhanced quality specifications and sustainable sourcing credentials.

Between 2020 and 2025, the silica sand for glass making market experienced steady growth, driven by increasing construction activity and growing recognition of high-purity silica sand as essential raw materials for producing high-quality glass products across architectural, automotive, container, and specialty glass applications. The market developed as glass manufacturers recognized the critical importance of silica sand purity, particle size distribution, and chemical composition in determining final glass quality, optical clarity, and production efficiency. Technological advancement in mineral processing and beneficiation techniques began emphasizing the importance of achieving ultra-low iron content and consistent chemical specifications in demanding premium glass applications.

Market expansion is being supported by the increasing global construction activity and architectural glazing demand driven by urbanization and green building standards, alongside the corresponding need for high-quality raw materials that can produce energy-efficient low-emissivity glass, ensure superior optical clarity, and maintain consistent production efficiency across various flat glass, container glass, fiber glass, and specialty glass manufacturing applications. Modern glass manufacturers are increasingly focused on sourcing high-purity low-iron silica sand that can deliver exceptional clarity, support advanced coatings, and meet stringent quality specifications for premium architectural and automotive glass products.

The growing emphasis on renewable energy and photovoltaic glass production is driving demand for ultra-high-purity silica sand with exceptionally low iron content that enables superior light transmission and energy conversion efficiency in solar panels. Glass industry preference for sustainably sourced silica sand that combines superior quality with environmental responsibility and reliable supply security is creating opportunities for innovative mining and processing operations. The rising influence of pharmaceutical packaging growth and specialty technical glass applications is also contributing to increased demand for premium-grade silica sand that provides exceptional purity characteristics without compromising production consistency or environmental compliance.

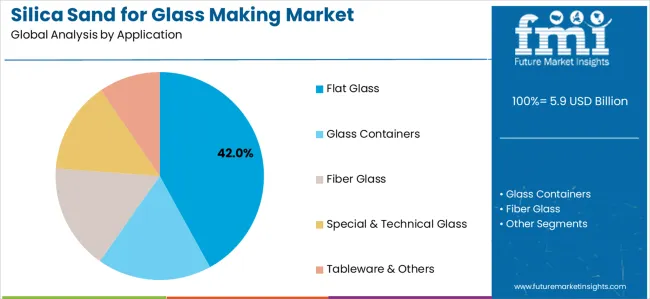

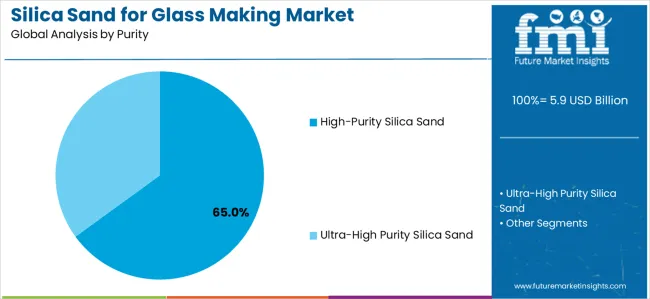

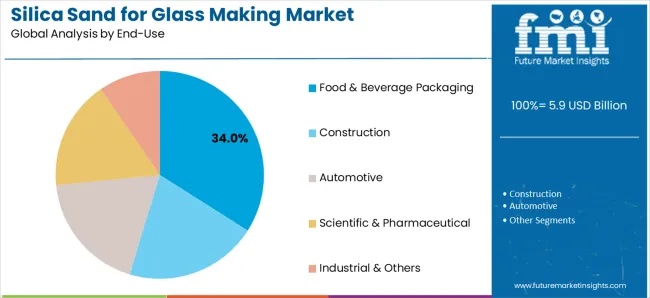

The market is segmented by application, purity, end-use, and region. By application, the market is divided into flat glass, glass containers, fiber glass, special &technical glass, and tableware &others. Based on purity, the market is categorized into high-purity silica sand and ultra-high purity silica sand. By end-use, the market is classified into food &beverage packaging, construction, automotive, scientific &pharmaceutical, and industrial &others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East &Africa.

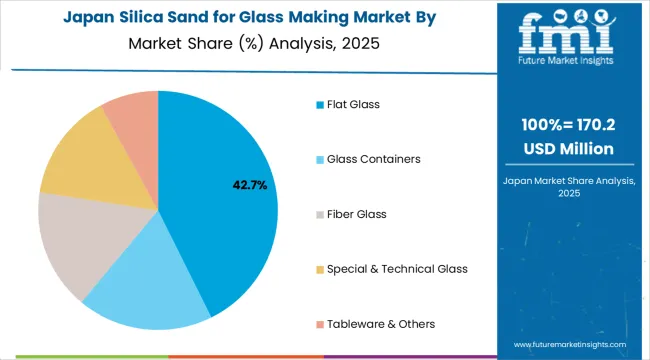

The flat glass segment is projected to maintain its leading position in the silica sand for glass making market in 2025 with a 42.0% market share, reaffirming its role as the preferred application category for architectural glazing, automotive windscreens, and photovoltaic glass production. Glass manufacturers increasingly utilize high-purity silica sand for flat glass production due to superior clarity requirements, stringent optical specifications, and proven effectiveness in meeting architectural and automotive industry standards. Flat glass application's dominant market position and diverse end-use versatility directly address the industry requirements for premium feedstock materials supporting energy-efficient building envelopes and advanced automotive glazing systems.

This application segment forms the foundation of modern construction and automotive industries, as it represents the category with the greatest volume consumption and established performance requirements across multiple architectural and transportation applications. Construction industry investments in energy-efficient glazing technologies continue to strengthen high-purity silica sand adoption among flat glass manufacturers. With building codes requiring improved thermal performance and solar energy integration driving photovoltaic glass demand, flat glass applications align with both sustainability objectives and performance requirements, making high-purity silica sand the central feedstock for comprehensive architectural glazing strategies.

The high-purity silica sand segment is projected to represent the dominant share of silica sand demand in 2025 with a 65.0% market share, underscoring its critical role as the primary feedstock grade for quality glass manufacturing across flat glass, container glass, and specialty glass applications. Glass manufacturers prefer high-purity silica sand for production operations due to its low iron content, consistent particle size distribution, and ability to deliver superior glass clarity while supporting efficient melting processes and consistent product quality. Positioned as essential raw materials for modern glass manufacturing, high-purity silica sand offers both quality advantages and operational benefits.

The segment is supported by continuous advancement in beneficiation technologies and the growing availability of deposits with favorable mineralogical characteristics that enable economic production of high-purity silica sand through physical separation and processing. Additionally, glass manufacturers are investing in comprehensive quality assurance programs to support increasingly demanding glass specifications and customer requirements for premium optical performance. As architectural glazing becomes more sophisticated and automotive glass specifications increase, the high-purity silica sand segment will continue to dominate the market while supporting advanced glass manufacturing and quality optimization strategies.

The food &beverage packaging end-use segment is projected to maintain its leading position in the silica sand for glass making market in 2025 with a 34.0% market share, reaffirming its role as the preferred end-use category for glass container manufacturing serving beverage, food, and pharmaceutical packaging applications. Glass container manufacturers increasingly specify high-purity silica sand for production operations due to stringent food contact safety requirements, optical clarity expectations, and proven ability to deliver consistent container quality across diverse packaging formats. Food and beverage packaging applications'essential market role and sustained volume demand directly address the fundamental requirement for safe, inert, and recyclable packaging materials supporting consumer product industries.

This end-use segment represents the foundation of glass container manufacturing, encompassing beer bottles, wine bottles, spirits packaging, food jars, and pharmaceutical vials that drive substantial silica sand consumption. Consumer preference for glass packaging and sustainability advantages over alternative materials continue to strengthen silica sand demand among container glass manufacturers. With food safety regulations requiring inert packaging materials and circular economy principles favoring infinitely recyclable glass, food and beverage packaging end-uses support both consumer protection and environmental objectives across global packaging markets.

The silica sand for glass making market is advancing steadily due to increasing demand for construction glazing driven by urbanization and green building adoption, alongside growing production of photovoltaic glass for renewable energy applications that require ultra-high-purity low-iron silica sand providing exceptional light transmission and optical performance across diverse architectural, automotive, solar, and specialty glass manufacturing applications. However, the market faces challenges, including environmental regulations restricting mining operations and land use constraints, increasing transportation costs affecting supply chain economics and mine-to-market competitiveness, and growing cullet recycling rates reducing virgin silica sand intensity in glass production. Innovation in beneficiation technologies and sustainable mining practices continues to influence resource development and market supply patterns.

The rapid global expansion of solar photovoltaic installations is driving substantial demand for ultra-high-purity low-iron silica sand as the critical feedstock for manufacturing high-transmission solar glass that maximizes energy conversion efficiency. Photovoltaic glass applications require exceptionally stringent iron content specifications, typically below 0.01% Fe2O3, to minimize light absorption and optimize solar cell performance across the visible spectrum. This ultra-low iron requirement commands significant price premiums over standard glass-grade silica sand while requiring specialized deposits with favorable natural iron content or advanced beneficiation technologies including magnetic separation, flotation, and chemical treatment. Major glass manufacturers are establishing dedicated supply agreements with silica sand producers capable of consistently delivering ultra-high-purity grades meeting photovoltaic industry specifications, creating differentiated market segments with sustainable growth potential driven by global renewable energy expansion and solar capacity additions.

Modern glass manufacturers are substantially increasing cullet utilization rates in production formulations, driven by energy savings, carbon footprint reduction, and circular economy commitments that reduce virgin silica sand consumption intensity per ton of glass produced. Container glass operations commonly incorporate 50-90% recycled cullet in batch formulations, while flat glass manufacturers are advancing cullet usage despite more stringent quality requirements. This growing cullet integration moderates virgin silica sand demand growth relative to total glass production expansion, particularly in mature European markets with well-established collection infrastructure and high recycling rates. However, cullet availability remains constrained by collection logistics, contamination challenges, and color sorting requirements that limit substitution potential. Glass manufacturers must carefully balance cullet utilization with virgin silica sand inputs to maintain consistent batch chemistry, control coloration, and achieve desired glass properties, creating ongoing demand for high-quality silica sand despite advancing recycling practices.

The glass-grade silica sand industry is implementing advanced environmental management practices and sustainable mining technologies to address regulatory requirements, community concerns, and customer sustainability expectations throughout mineral extraction and processing operations. Leading producers are investing in dust control systems, water recycling infrastructure, progressive reclamation programs, and biodiversity management that minimize environmental impacts while maintaining resource access and operational continuity. Advanced beneficiation technologies including sensor-based sorting, selective comminution, and process optimization are enabling economic recovery of high-purity silica sand from lower-grade deposits and processing of resources previously considered unsuitable for glass applications. These technological and operational advancements support industry sustainability credentials while expanding economically recoverable resources and improving supply chain resilience in an increasingly environmentally conscious market environment.

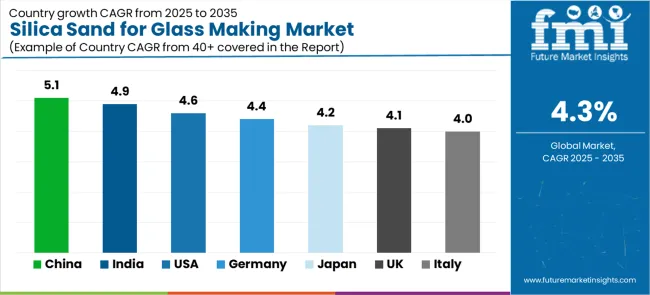

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.1% |

| India | 4.9% |

| United States | 4.6% |

| Germany | 4.4% |

| Japan | 4.2% |

| United Kingdom | 4.1% |

| Italy | 4.0% |

The silica sand for glass making market is experiencing solid growth globally, with China leading at a 5.1% CAGR through 2035, driven by scale-up of photovoltaic and architectural glass capacity, availability of inland high-purity deposits, and comprehensive cullet collection programs. India follows at 4.9%, supported by rapid construction growth, expanding container glass for beverage and pharmaceutical exports, and increasing flat glass demand. The United States shows growth at 4.6%, emphasizing demand for low-iron flat glass and pharmaceutical vials alongside investments in sustainable mining and beneficiation technologies. Germany demonstrates 4.4% growth, supported by automotive glazing innovations and strict mining standards pushing higher-value high-purity supply. Japan records 4.2%, focusing on specialty and technical glass for electronics and optics with premium low-iron feedstock demand. The United Kingdom exhibits 4.1% growth, emphasizing architectural retrofits with energy-efficient glazing and container glass lightweighting initiatives. Italy shows 4.0% growth, supported by strong container and tableware manufacturing clusters with increased cullet use moderating virgin sand growth.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

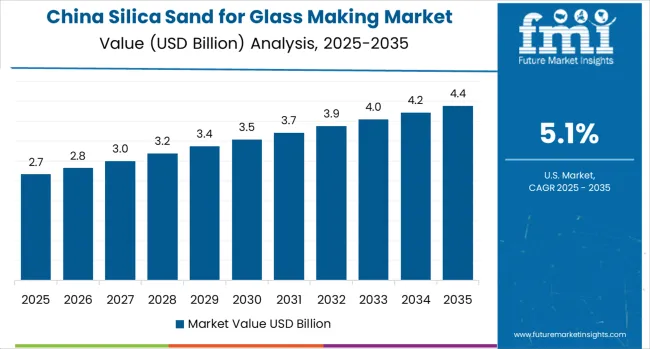

Revenue from silica sand for glass making in China is projected to exhibit exceptional growth with a CAGR of 5.1% through 2035, driven by massive scale-up in photovoltaic glass production capacity and expanding architectural glass demand supported by government renewable energy targets and urbanization programs. The country's dominant position in solar panel manufacturing and extensive construction activity are creating substantial demand for high-purity silica sand. Major glass manufacturers and mining companies are establishing comprehensive supply chains serving rapidly growing domestic glass production capacity.

Revenue from silica sand for glass making in India is expanding at a CAGR of 4.9%, supported by the country's explosive construction sector growth, rapidly expanding container glass production for beverage and pharmaceutical applications, and increasing flat glass demand driven by urbanization and industrial development. India's construction boom and growing consumer goods sector are driving sophisticated glass manufacturing capabilities. Glass manufacturers and silica sand suppliers are establishing extensive sourcing networks to address growing demand.

Revenue from silica sand for glass making in the United States is expanding at a CAGR of 4.6%, supported by the country's demand for low-iron flat glass in architectural and solar applications, growing pharmaceutical vial production, and comprehensive investments in sustainable mining and beneficiation technologies. The nation's advanced glass manufacturing sector and environmental focus are driving demand for premium silica sand solutions. USA Silica entered a definitive agreement in 2024 to be acquired by funds managed by Apollo, supporting balance-sheet flexibility and targeted growth in high-purity industrial sand for glass applications.

Revenue from silica sand for glass making in Germany is expanding at a CAGR of 4.4%, driven by the country's automotive glazing innovation, advanced architectural glass applications, and strict mining standards requiring higher-value high-purity silica sand supply meeting stringent environmental compliance. Germany's automotive excellence and environmental leadership are driving sophisticated silica sand sourcing capabilities. Glass manufacturers and automotive suppliers are establishing comprehensive quality programs for premium glazing applications.

Revenue from silica sand for glass making in Japan is expanding at a CAGR of 4.2%, supported by the country's specialty and technical glass manufacturing for electronics and optical applications, premium low-iron feedstock requirements, and strong emphasis on quality and precision in glass production. Japan's technological sophistication and quality standards are driving demand for ultra-high-purity silica sand. Leading glass manufacturers are investing in specialized sourcing capabilities for advanced applications.

Revenue from silica sand for glass making in the United Kingdom is growing at a CAGR of 4.1%, driven by architectural retrofits with energy-efficient glazing systems, container glass lightweighting initiatives, and growing emphasis on sustainable building practices. The UK's building efficiency focus and glass manufacturing heritage are supporting investment in advanced glass applications. Glass manufacturers are establishing comprehensive programs for sustainable production and product innovation.

Revenue from silica sand for glass making in Italy is expanding at a CAGR of 4.0%, supported by the country's strong container glass and tableware manufacturing clusters, premium packaging applications, and increasing cullet use moderating virgin sand growth while maintaining quality standards. Italy's glass manufacturing tradition and design excellence are driving demand for quality silica sand. Glass manufacturers are balancing virgin sand usage with growing recycled content.

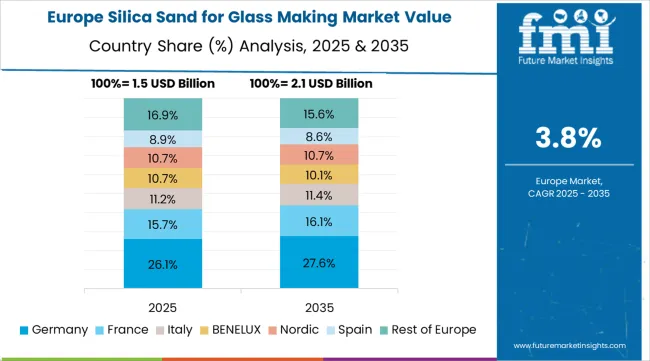

The silica sand for glass making market in Europe s projected to grow from USD 1.7 billion in 2025 to USD 2.5 billion by 2035, registering a CAGR of 4.0% over the forecast period. Germany leads with a 21.0% market share in 2025, maintaining its position at 21.2% by 2035, supported by automotive glazing applications, architectural glass demand, and premium solar glass production.

Italy follows with 16.0% in 2025, moderating to 15.7% by 2035, driven by container glass clusters, tableware manufacturing, and architectural glass applications. France holds 15.0% in 2025, maintaining 14.9% by 2035 with flat glass production and container glass manufacturing. The United Kingdom accounts for 14.0% in 2025, holding steady at 14.1% by 2035 with architectural retrofits and container glass applications. Spain holds 11.0% in 2025, rising to 11.3% by 2035 on construction growth and container glass demand. Poland maintains 9.0% in 2025, increasing to 9.2% by 2035 with expanding glass manufacturing capacity. The Netherlands holds 7.0% in 2025, easing to 6.9% by 2035 with specialty glass and container applications. The Rest of Europe region holds 7.0% in 2025 and 6.7% by 2035, reflecting diverse glass manufacturing activities. Distribution reflects the concentration of flat and container glass plants, low-iron feedstock demand for solar and architectural glass, and national recycling rates influencing virgin sand intensity.

The silica sand for glass making market is characterized by competition among established industrial minerals producers, regional silica sand suppliers, and integrated mining companies. Companies are investing in beneficiation technology development, low-iron processing capabilities, sustainable mining practices, and comprehensive quality assurance systems to deliver high-purity, consistent-quality, and environmentally responsible silica sand solutions. Innovation in mineral processing technologies, deposit exploration and development, and supply chain optimization is central to strengthening market position and competitive advantage.

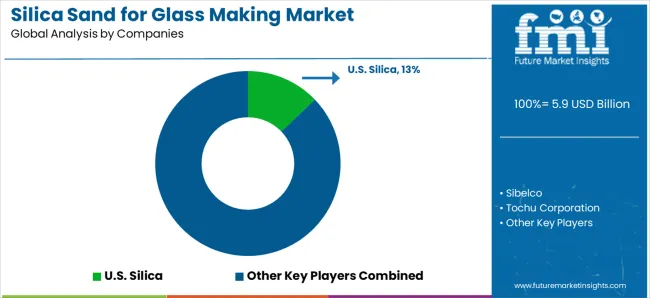

USA Silica leads the market with a 13.0% share, offering comprehensive silica sand solutions with a focus on high-purity glass-grade products, advanced processing capabilities, and reliable supply serving diverse flat glass, container glass, and specialty glass applications. The company entered a definitive agreement in 2024 to be acquired by funds managed by Apollo, supporting balance-sheet flexibility and targeted growth in high-purity industrial sand for glass manufacturing. Sibelco announced investment to upgrade high-purity silica processing at select European sites in 2024, adding low-iron capability aimed at solar and architectural glass grades.

Covia Holdings completed capacity debottlenecking at an industrial sand operation in North America in 2025 to supply container and flat-glass customers under multi-year offtake agreements. Tochu Corporation provides integrated supply chain solutions with comprehensive sourcing capabilities. Quarzwerke Group delivers high-quality European silica sand with advanced processing infrastructure. Euroquarz GmbH specializes in premium glass-grade silica sand serving European markets. Imerys Refractory Minerals offers diversified industrial minerals including glass-grade silica sand. Terengganu Silica Consortium focuses on Asian market supply with competitive positioning. G3 Enterprises provides comprehensive silica sand solutions for diverse glass applications. Badger Mining Corporation emphasizes high-quality industrial sand production serving glass manufacturing.

Silica sand for glass making represents a critical industrial mineral feedstock segment within flat glass, container glass, fiber glass, and specialty glass manufacturing applications, projected to grow from USD 5.9 billion in 2025 to USD 9 billion by 2035 at a 4.3% CAGR. This high-purity quartz sand—primarily available in high-purity and ultra-high-purity grades based on iron content and particle size specifications serves as the essential silica source for glass production where chemical composition, optical clarity, melting characteristics, and consistent quality are fundamental to manufacturing architectural glazing, automotive glass, beverage containers, pharmaceutical packaging, and specialty technical glass products. Market expansion is driven by increasing construction activity, growing photovoltaic glass production for renewable energy, expanding pharmaceutical packaging demand, and rising requirements for ultra-high-purity low-iron silica sand across diverse glass manufacturing applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 5.9 Billion |

| Application | Flat Glass, Glass Containers, Fiber Glass, Special &Technical Glass, Tableware &Others |

| Purity | High-Purity Silica Sand, Ultra-High Purity Silica Sand |

| End-Use | Food &Beverage Packaging, Construction, Automotive, Scientific &Pharmaceutical, Industrial &Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East &Africa |

| Countries Covered | China, India, United States, Germany, Japan, United Kingdom, Italy, and 40+ countries |

| Key Companies Profiled | USA Silica, Sibelco, Tochu Corporation, Covia Holdings, Quarzwerke Group, Euroquarz GmbH |

| Additional Attributes | Dollar sales by application, purity, and end-use category, regional demand trends, competitive landscape, technological advancements in beneficiation, sustainable mining innovation, and quality assurance optimization |

The global silica sand for glass making market is estimated to be valued at USD 5.9 billion in 2025.

The market size for the silica sand for glass making market is projected to reach USD 9.0 billion by 2035.

The silica sand for glass making market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in silica sand for glass making market are flat glass, glass containers, fiber glass, special & technical glass and tableware & others.

In terms of purity, high-purity silica sand segment to command 65.0% share in the silica sand for glass making market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Silica Sand for Glass Making Market Analysis for 2025 to 2035

Silica Flour Market Size and Share Forecast Outlook 2025 to 2035

Silica Coated Film Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

Silica Analyzers Market

Silica for S-SBR Market Size & Trends 2025 to 2035

Borosilicate Glass Market Trends & Outlook 2025 to 2035

High-Silica Zeolite Market Size and Share Forecast Outlook 2025 to 2035

High-Silica Fiber Market Analysis by Application, Use Case, and Region: Forecast for 2025 to 2035

Fumed Silica Market

Sodium Silicate Market Growth – Trends & Forecast 2022 to 2032

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Calcium Silicate Market

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Pyrogenic Silica Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Sodium Metasilicate Pentahydrate Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Silica Market Insights – Demand & Applications 2025 to 2035

Precipitated Silica Market Size and Share Forecast Outlook 2025 to 2035

Chromatography Silica Resins Market

Sodium Aluminum Silicate Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA