The colloidal silica market shows continued growth from 2025 through 2035 because of increasing market demand in electronics and precision casting and coatings applications. The stable dispersion of silica nanoparticles in liquid solution known as colloidal silica provides high surface area capabilities together with chemical stability and binding attributes for its application in polishing slurries and investment casting binders and surface treatments.

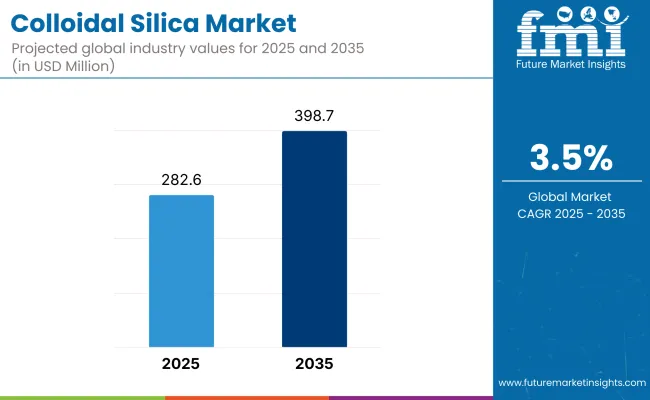

Market analysts predict that high-performance materials will drive end-use sector growth which will expand the market from USD 282.6 million in 2025 to USD 398.7 million by 2035 at a rate of 3.5% CAGR throughout the forecast period.

The rising growth of the electronics industry particularly in semiconductor manufacturing demands ultrapure colloidal silica to support operations. The market value of ultrapure colloidal silica expands because it functions as catalyst support while enhancing paper quality and acting as anti-redeposition agents throughout industrial and specialized applications.

The company solves product customization issues and raw material variations with precision formulation methods and they expand production capacity to address cost constraints. The industry demands high-dispersion surface-modified variants from manufacturers who also adopt cleaner production methods to meet growing requirements.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 282.6 million |

| Industry Value (2035F) | USD 398.7 million |

| CAGR (2025 to 2035) | 3.5% |

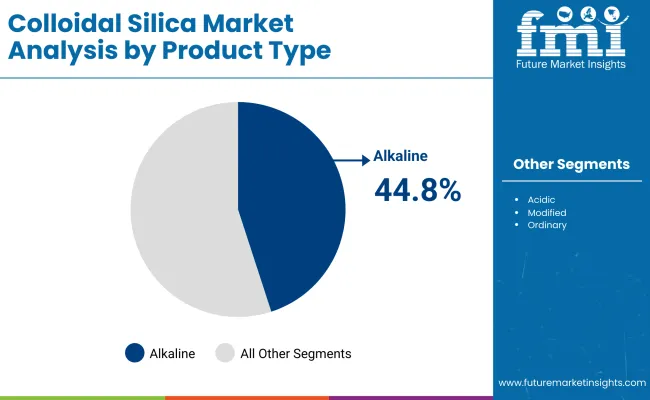

The scope of industrial usage and efficiency performance within the colloidal silica market depends on product type and application segmentation. The market consists of two product types that fall under alkaline and acidic colloidal silica structures because they represent differentiated properties for polishing and binding applications which include coating operations.

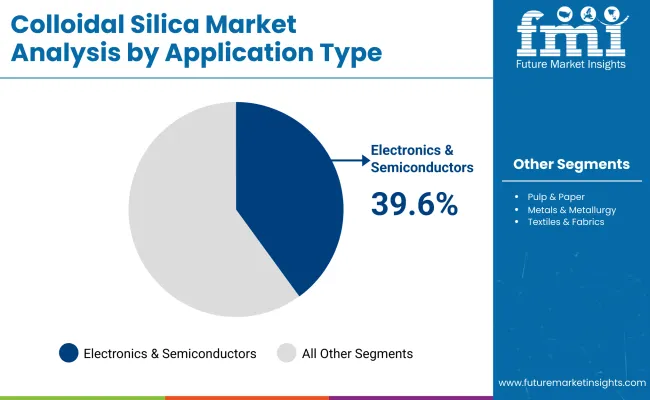

The range of applications includes electronics as well as foundries and paints and coatings and construction materials which utilize colloidal silica for its capacity to modify surfaces and form films while maintaining stability. The material demonstrates its versatile nature through these segments since it applies well to traditional alongside high-technology uses that require precise durability and compatible processing standards.

Steady demand from semiconductor polishing and foundry sectors in North America. The United States and Canada endorse adoption in high-purity applications and precision investment casting.

The coatings and specialty chemical use drive Europe’s growth. Colloidal silica is used in paper coatings, battery separators, or environmentally friendly industrial binders in Germany as well as Netherlands.

Asia-Pacific accounts for leading volume and production owing to strong electronics and industrial manufacturing. CMP slurries and refractory materials demand growth comes from China, Japan and South Korea.

Challenge: Production Costs and Application-Specific Performance Barriers

Cost constraints associated with energy-intensive production processes restrict the scope of the colloidal silica market, particularly in the context of high-purity grades necessary in electronics and precision casting. Designing colloidal silica with desired particle sizes and surface chemistries for specific applications such as for polishing slurries or investment casting can be challenging and expensive.

Performance in high-precision applications can be hindered by inconsistencies of the dispersion stability depending on pH or temperature conditions. In addition, small manufacturers also tend to find it difficult to produce goods of consistent quality, to meet quality assurance specifications enforced by regulatory authorities or specific customers, or to meet the stringent purity specifications required by many applications, creating high entry barriers in industries such as semiconductors, pharmaceuticals and coatings.

Opportunity: Advanced Manufacturing, Electronics, and Eco-Friendly Solutions

Colloidal silica is emerging well across advanced manufacturing sectors all the more so amid production challenges. The trends of miniaturization and material innovation continue to push its use in the chemical mechanical planarization (CMP) of semiconductor wafers, investment casting, and catalyst supports. Energy-efficient sectors are embracing colloidal silica in waterborne coatings, low-VOC paints, and ecological binders for refractory applications.

Moreover, the customization of colloidal silica types through surface modification and functionalization is providing enhanced control over particle behaviour which is driving the market in lithium battery separators, textiles, and precision ceramics. Innovation in sol-gel processes and demand for higher-performance, eco-compliant materials will drive the marketplace.

Stable growth was witnessed in the colloidal silica market across electronics, coatings, and foundry applications from 2020 to 2024. In this space, demand was driven by increasing use in CMP slurries and green coatings and supply was hindered by varying raw material costs and energy prices. Manufacturers turned their attention to surface modifications of active materials and tighter particle size distributions for product differentiation.

During 2025 to 2035 the market will transition towards ultra-high-purity, application-specific colloidal silica facilitated by trends in semiconductor scaling, lightweight casting, and in clean manufacturing. Next-gen technologies will find a place for the material owing to new grades targeted at lithium-ion batteries, advanced ceramics, and biocompatible drug delivery systems.

Market Shifts: Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Factor | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with chemical safety and low-VOC content. |

| Technological Advancements | Focus on standard particle control and dispersion stability. |

| Sustainability Trends | Adoption in water-based systems and low-emission coatings. |

| Market Competition | Dominated by global chemical giants and regional slurry providers. |

| Industry Adoption | Used in CMP, investment casting, and coatings. |

| Consumer Preferences | Demand for performance and cost-efficiency. |

| Market Growth Drivers | Growth in semiconductor and eco-coating applications. |

| Market Factor | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Expansion into green certification, biocompatibility standards, and nano -safety regulations. |

| Technological Advancements | Growth in surface-modified, ultra-pure, and functionalized silica variants. |

| Sustainability Trends | Emphasis on recyclable binders, bio-friendly formulations, and waste-free production. |

| Market Competition | Entry of nanomaterials firms and custom silica dispersion startups. |

| Industry Adoption | Expands to battery separators, precision ceramics, and pharmaceutical delivery systems. |

| Consumer Preferences | Preference for tailored, sustainable, and multifunctional solutions. |

| Market Growth Drivers | Driven by next-gen electronics, clean energy, and green materials demand. |

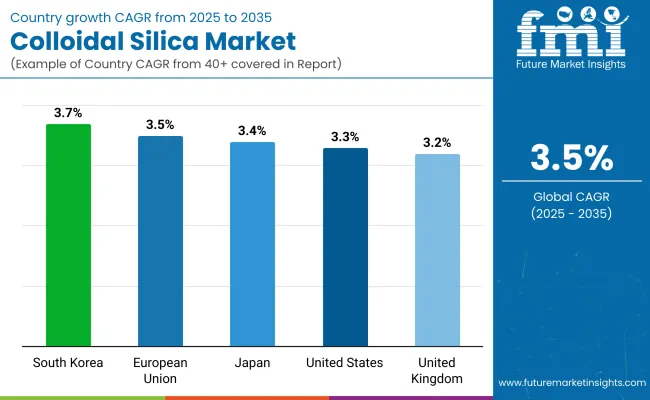

United States is another important market for colloidal silica, where the growth rate is decent due to its wide usage in polishing slurries for semiconductors, as well as for refractory applications and investment casting. Colloidal silica of high purity is critical for producing defect-free surfaces and precision-molded components in advanced electronics and aerospace manufacturing industries in the nation.

Chemical makers based in the USA are developing particle dispersion technologies to enhance slurry performance and coating adhesion. Other construction, coatings, and paint industries are also driving the demand, as colloidal silica offers improved surface treatment durability and abrasion resistance.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.3% |

In the United Kingdom, the colloidal silica market is growing moderately, owing to its increasing application in ceramics, adhesives and high-performance coatings. Packages of colloidal silica are being adopted by British industries in formulations that enhance thermal stability, scratch resistance, and film uniformity of the industrial surfaces.

Rising investments in specialty chemicals and energy-efficient building materials are also aiding demand. Local producers are prioritizing eco-friendly and low-VOC applications match national sustainability efforts.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.2% |

Demand for colloidal silica is significant in the European Union, especially from precision casting, foundries, and advanced ceramics manufacturers, making it one of the leading regional markets for colloidal silica. In Germany, France, Netherlands, etc. colloidal silica is using in coatings, catalysts, and polishing applications due to high-spec industrial processes.

EU regulations to provide for sustainable materials and safer production environments are driving the demand for aqueous based, solvent-free colloidal silica dispersions. Also, its function in gas membranes and insulation coatings remains to develop in support of inexperienced energy infrastructure.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.5% |

The market for colloidal silica is growing steadily in Japan, thanks to its strong semiconductor, electronics, and fine ceramics industries. The need for colloidal silica in chemical mechanical planarization (CMP) slurries is especially great, due to Japan’s dominance in high-end chip fabrication and ultra-fine polishing of materials.

Japanese companies are also using colloidal silica in sol-gel processes and as a binder in battery parts and specialty coatings. To meet high industrial standards across technologies applications, manufacturer’s foco on uniform particle size and high purity.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.4% |

The colloidal silica market in South Korea is growing healthily, mainly supported by its advanced semiconductor and flat panel display manufacturing sectors. Colloidal silica is a core material for CMP Applications, Photolithography Processes, and high-purity chemical systems.

Advanced colloidal synthesis technology is improving dispersion stability and particle consistency at Korean companies. In solar panel coatings and battery separators, the market is also gaining momentum of renewable energy applications, where colloidal silica plays a contributing role.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.7% |

Colloidal silica demand continues to grow steadily as a foundation for industrial nano-scale silica dispersions in applications ranging from surface finishes and electronics to chemical catalysis. These colloids, which are silica nanoparticles, suspended in water or in solvents, have exceptional chemical stability, polishing effectiveness, and heat resistance.

On the basis of product type, the alkaline colloidal silica segment holds the largest market share as it is widely used in applications like chemical mechanical planarization (CMP), coatings, and as a binder in the refractory and investment casting processes.

Electronics and semiconductors caters to the highest demand in terms of application due to the use of colloidal silica by manufacturers in wafer polishing, electronic component fabrication, and microcircuit processing. These segments highlight the significance of colloidal silica as an essential functional material in high-precision and technology-intensive fields.

Meanwhile, due to electronics miniaturization and increasing interest in renewable energy technologies, manufacturers are still looking for high-purity colloidal silica to increase polishing performance and thermal conductivity. The two growing segments of alkaline formulations and electronics applications are complementing the market prospects along the way, as the market is surging towards upward growth with innovation & quality control needs.

| Product Type | Market Share (2025) |

|---|---|

| Alkaline Colloidal Silica | 44.8% |

Alkaline colloidal silica was the largest product type segment, it is an efficient product subtype used for CMP slurries, coatings, and ceramics because they provide improved particle dispensability and electrostatic stability. Its alkaline pH guarantees great compatibility with unique polishing agents and binders, hence it is the best selection for floor remedy and composites dehopl ding.

Alkaline colloidal silica is utilized by industries as they are used to improve the mechanical properties of coatings, enhance adhesion, and offer consistent uniform surface finish on a wide range of substrates.

Alkaline colloidal silica is also appreciated by manufacturers because it can be easily modified to suit their needs, such as adjustments to particle size, concentration and surface charge. Its flexibility allows producers to customize solutions for extreme polishing and surface conditioning in high-demand industries, such as semiconductors and precision optics. Alkaline colloidal silica remains in a leading position due to its chemical versatility and general functional consistency as specialization for global industries continues to shift towards nanostructured coatings, eco-friendly binders and high-performance refractory components.

| Application Type | Market Share (2025) |

|---|---|

| Electronics & Semiconductors | 39.6% |

Colloidal silica market application segment was dominated by electronics and semiconductors, as they require ultra-fine abrasives and surface smoothing materials. In chemical mechanical planarization (CMP), colloidal silica is used to produce planar surfaces by removing excess material from moving silicon wafers. However, its nanoscale uniformity, spherical particulate shape and adjustable abrasive strength is fundamental to yielding, throughput and repeatability in integrated circuit production.

Polishing materials continue to evolve as the layout shrinks and transistor densities rise for the semiconductor industry. Colloidal silica-based slurries provide the ability to desensitize material removal rates, minimize defects and generate scratch-free finishes on sensitive substrates of silicon, sapphire, and gallium arsenide.

Additionally, with the increasing demand for smartphones, electric vehicles, and 5G network infrastructure, the electronics industry is still rolling out advanced polishing solutions using colloidal silica. This is to assure that its leading position will be sustained, spanning on both the present and next gen Chip foundry applications.

The global colloidal silica market is an essential component of the specialty chemicals industry, with potential applications such as precision casting, electronics, coatings, catalysts, polishing slurries, etc. Colloidal silica is a stable suspension of finely dispersed amorphous silica nanoparticles that contains high surface area, chemical inertness, and chemical binding potential.

The growing semiconductor industry, green foundry processes and high-performance coatings all contribute to increasing demand. Manufacturers compete on particle size, surface chemistries, and means of dispersion, customized for final use. Market competitors range from diversified chemical giants, competing on purity, dispersion stability, and application-specific performance, to niche formulators.

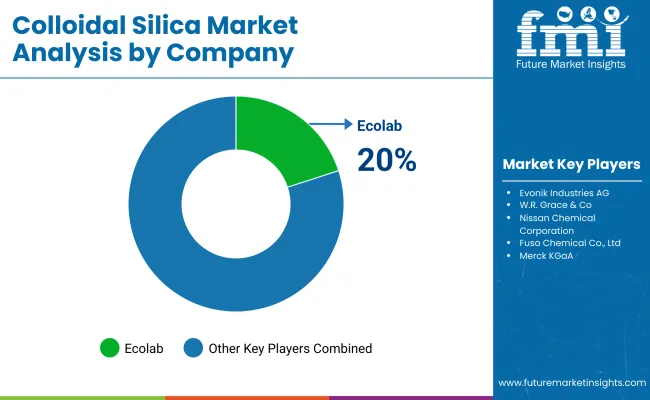

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Ecolab (Nalco Water) | 20-24% |

| Evonik Industries AG | 15-19% |

| W.R. Grace & Co. | 12-16% |

| Nissan Chemical Corporation | 9-13% |

| Fuso Chemical Co., Ltd. | 7-11% |

| Merck KGaA | 6-10% |

| Other Companies (combined) | 18-26% |

| Company Name | Key Offerings/Activities |

|---|---|

| Ecolab (Nalco Water) | Expanded colloidal silica production capacity for CMP slurries in semiconductor fabrication in 2025. |

| Evonik Industries AG | Launched high-purity colloidal silica dispersions for anti-soiling and protective coatings in 2024. |

| W.R. Grace & Co. | Introduced binder-grade colloidal silica for investment casting and silica-based insulation in 2024. |

| Nissan Chemical Corporation | Released advanced colloidal silica formulations for precision electronics polishing in 2025. |

| Fuso Chemical Co., Ltd. | Developed sub to 20 nm colloidal silica products with enhanced dispersion for optical components in 2025. |

| Merck KGaA | Rolled out customized colloidal silica for biopharmaceutical separation and catalysis in 2024. |

Key Company Insights

Ecolab (Nalco Water)

Ecolab is a dominant player in the colloidal silica space, particularly for semiconductor-grade applications such as chemical-mechanical planarization (CMP). Its high-purity formulations and global production footprint ensure supply continuity for leading chip manufacturers.

Evonik Industries AG

Evonik focuses on advanced surface-modified colloidal silicas for high-performance coatings, construction, and chemical processing. Its solutions improve scratch resistance, thermal stability, and hydrophobicity across industrial applications.

W.R. Grace & Co.

W.R. Grace supplies colloidal silica with high binding strength for foundry molds, refractory coatings, and aerogel insulation. Its formulations support cleaner casting processes and lightweight thermal insulation systems.

Nissan Chemical Corporation

Nissan Chemical provides ultra-fine colloidal silica engineered for wafer polishing and optical device finishing. The company excels in consistent particle size control and compatibility with semiconductor and display polishing chemistries.

Fuso Chemical Co., Ltd.

Fuso specializes in nanoparticle silica dispersion for electronics, optics, and abrasive polishing. Its precision-engineered colloidal silicas offer exceptional dispersion control and uniformity for demanding microfabrication tasks.

Merck KGaA

Merck develops colloidal silica for niche uses in catalysis, chromatography, and pharmaceutical processing. Its product lines are optimized for bioseparations, enzyme immobilization, and chemical surface functionalization.

Other Key Players (18-26% Combined)

Numerous regional suppliers and specialized formulators contribute to the colloidal silica industry by offering tailored dispersions, application-specific rheology, and industry-specific support:

The overall market size for the colloidal silica market was USD 282.6 million in 2025.

The colloidal silica market is expected to reach USD 398.7 million in 2035.

The increasing demand for precision polishing and coating solutions, rising use of alkaline silica formulations, and growing applications in the electronics industry fuel the colloidal silica market during the forecast period.

The top 5 countries driving the development of the colloidal silica market are the USA, UK, European Union, Japan, and South Korea.

Alkaline silica formulations and electronics applications lead market growth to command a significant share over the assessment period.

Table 01: Global Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast By Product Type, 2015-2030

Table 02: Global Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast By End-Use, 2015-2030

Table 03: Global Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast by Region, 2015-2030

Table 04: North America Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast by Country 2015 - 2030

Table 05: North America Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast By Product Type, 2015-2030

Table 06: North America Colloidal Silica Market Size (US$) and Volume (Tons) Forecast by End-Use, 2015-2030

Table 07: Latin America Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast by Country, 2015 - 2030

Table 08: Latin America Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast By Product Type, 2015-2030

Table 09: Latin America Colloidal Silica Market Size (US$) and Volume (Tons) Forecast by End-Use, 2015-2030

Table 10: Europe Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast by Country, 2015 - 2030

Table 11: Europe Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast By Product Type, 2015-2030

Table 12: Europe Colloidal Silica Market Size(US$) and Volume (Tons) Forecast By End-Use, 2015-2030

Table 13: East Asia Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast by Country, 2015 - 2030

Table 14: East Asia Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast By Product Type, 2015-2030

Table 15: East Asia Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast by End-Use, 2015-2030

Table 16: South Asia Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast by Country, 2015 - 2030

Table 17: South Asia Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast By Product Type, 2015-2030

Table 18: South Asia Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast by End-Use, 2015-2030

Table 19: Middle East & Africa Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast by Country, 2015 - 2030

Table 20: Middle East & Africa Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast By Product Type, 2015-2030

Table 21: Middle East & Africa Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast by End-Use, 2015-2030

Table 22: Oceania Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast by Country, 2015 - 2030

Table 23: Oceania Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast By Product Type, 2015-2030

Table 24: Oceania Colloidal Silica Market Size (US$ Mn) and Volume (Tons) Forecast by End-Use, 2015-2030014 - 2029

Figure 01: Global Colloidal Silica Market Value (US$ Mn) Historical Data and Forecast 2015-2030

Figure 02: Global Colloidal Silica Market Absolute $ Opportunity Analysis, 2015-2030

Figure 03: Global Colloidal Silica Market Historical Volume (Tons), 2015 - 2021

Figure 04: Global Colloidal Silica Market Volume (Tons) Forecast, 2022 - 2030

Figure 05: Global Colloidal Silica Market Share and BPS Analysis By Product Type, 2022 & 2030

Figure 06: Global Colloidal Silica Market Y-o-Y Growth By Product Type, 2022-2030

Figure 07: Global Colloidal Silica Market Attractiveness Analysis By Product Type, 2022-2030

Figure 08: Global Colloidal Silica Market Absolute $ Opportunity by Alkaline Colloidal Silica Segment, 2015-2030

Figure 09: Global Colloidal Silica Market Absolute $ Opportunity by Acidic Colloidal Silica Segment, 2015-2030

Figure 10: Global Colloidal Silica Market Absolute $ Opportunity by Modified Colloidal Silica Segment, 2015-2030

Figure 11: Global Colloidal Silica Market Absolute $ Opportunity by Ordinary Colloidal Silica Segment, 2015-2030

Figure 12: North America Colloidal Silica Market Share and BPS Analysis by End-Use, 2022 & 2030

Figure 13: North America Colloidal Silica Market Y-o-Y Growth by End-Use, 2022-2030

Figure 14: North America Colloidal Silica Market Attractiveness Analysis by End-Use, 2022-2030

Figure 15: Global Colloidal Silica Market Absolute $ Opportunity by Pulp & Paper Segment, 2015-2030

Figure 16: Global Colloidal Silica Market Absolute $ Opportunity by Metal & Metallurgy Segment, 2015-2030

Figure 17: Global Colloidal Silica Market Absolute $ Opportunity by Electronics & Semiconductor Segment, 2015-2030

Figure 18: Global Colloidal Silica Market Absolute $ Opportunity by Chemicals Segment, 2015-2030

Figure 19: Global Colloidal Silica Market Absolute $ Opportunity by Paints & Coatings Segment, 2015-2030

Figure 20: Global Colloidal Silica Market Absolute $ Opportunity by Building & Construction Segment, 2015-2030

Figure 21: Global Colloidal Silica Market Absolute $ Opportunity by Textiles & Fabrics Segment, 2015-2030

Figure 22: Global Colloidal Silica Market Share and BPS Analysis by Region, 2022 & 2030

Figure 23: Global Colloidal Silica Market Y-o-Y Growth by Region, 2022-2030

Figure 24: Global Colloidal Silica Market Attractiveness Analysis by Region, 2022-2030

Figure 25: North America Colloidal Silica Market Absolute $ Opportunity, 2015-2030

Figure 26: Latin America Colloidal Silica Market Absolute $ Opportunity, 2015-2030

Figure 27: Europe Colloidal Silica Market Absolute $ Opportunity, 2015-2030

Figure 28: East Asia Colloidal Silica Market Absolute $ Opportunity, 2015-2030

Figure 29: South Asia Colloidal Silica Market Absolute $ Opportunity, 2015-2030

Figure 30: Oceania Colloidal Silica Market Absolute $ Opportunity, 2015-2030

Figure 31: Middle East & Africa Colloidal Silica Market Absolute $ Opportunity, 2015-2030

Figure 32: North America Colloidal Silica Market Value Share and BPS Analysis by Country - 2022 & 2030

Figure 33: North America Colloidal Silica Market Value Y-o-Y (%) Growth Projections by Country, 2022 - 2030

Figure 34: North America Colloidal Silica Market Attractiveness Analysis by Country, 2022 - 2030

Figure 35: North America Colloidal Silica Market Absolute $ Opportunity by U.S., 2022 - 2030

Figure 36: North America Colloidal Silica Market Absolute $ Opportunity by Canada, 2022 - 2030

Figure 37: Latin America Colloidal Silica Market Value Share and BPS Analysis by Country - 2022 & 2030

Figure 38: Latin America Colloidal Silica Market Value Y-o-Y (%) Growth Projections by Country, 2022 - 2030

Figure 39: Latin America Colloidal Silica Market Attractiveness Analysis by Country, 2022 - 2030

Figure 40: Latin America Colloidal Silica Market Absolute $ Opportunity by Brazil 2022 - 2030

Figure 41: Latin America Colloidal Silica Market Absolute $ Opportunity by Mexico, 2022 - 2030

Figure 42: Latin America Colloidal Silica Market Absolute $ Opportunity by Rest of LA, 2022 - 2030

Figure 43: Europe Colloidal Silica Market Value Share and BPS Analysis by Country - 2022 & 2030

Figure 44: Europe Colloidal Silica Market Value Y-o-Y (%) Growth Projections by Country, 2022 - 2030

Figure 45: Europe Colloidal Silica Market Attractiveness Analysis by Country, 2022 - 2030

Figure 46: Europe Colloidal Silica Market Absolute $ Opportunity by Germany Segment, 2022 - 2030

Figure 47: Europe Colloidal Silica Market Absolute $ Opportunity by France Segment, 2022 - 2030

Figure 48: Europe Colloidal Silica Market Absolute $ Opportunity by U.K Segment, 2022 - 2030

Figure 49: Europe Colloidal Silica Market Absolute $ Opportunity by Spain Segment, 2022 - 2030

Figure 50: Europe Colloidal Silica Market Absolute $ Opportunity by Italy Segment, 2022 - 2030

Figure 51: Europe Colloidal Silica Market Absolute $ Opportunity by Russia Segment, 2022 - 2030

Figure 52: Europe Colloidal Silica Market Absolute $ Opportunity by BENELUX Segment, 2022 - 2030

Figure 53: Europe Colloidal Silica Market Absolute $ Opportunity by Rest of Europe Segment, 2022 - 2030

Figure 54: Europe Colloidal Silica Market Absolute $ Opportunity by Nordic, 2022 - 2030

Figure 55: East Asia Colloidal Silica Market Value Share and BPS Analysis by Country - 2022 & 2030

Figure 56: East Asia Colloidal Silica Market Value Y-o-Y (%) Growth Projections by Country, 2022 - 2030

Figure 57: East Asia Colloidal Silica Market Attractiveness Analysis by Country, 2022 - 2030

Figure 58: East Asia Colloidal Silica Market Absolute $ Opportunity by China. 2022 - 2030

Figure 59: East Asia Colloidal Silica Market Absolute $ Opportunity by Japan, 2022 - 2030

Figure 60: East Asia Colloidal Silica Market Absolute $ Opportunity by South Korea, 2022 - 2030

Figure 61: South Asia Colloidal Silica Market Value Share and BPS Analysis by Country - 2022 & 2030

Figure 62: South Asia Colloidal Silica Market Value Y-o-Y (%) Growth Projections by Country, 2022 - 2030

Figure 63: South Asia Colloidal Silica Market Attractiveness Analysis by Country, 2022 - 2030

Figure 64: South Asia Colloidal Silica Market Absolute $ Opportunity by India 2022 - 2030

Figure 65: South Asia Colloidal Silica Market Absolute $ Opportunity by ASEAN, 2022 - 2030

Figure 66: South Asia Colloidal Silica Market Absolute $ Opportunity by Rest of SA, 2022 - 2030

Figure 67: Middle East & Africa Colloidal Silica Market Share and BPS Analysis by Country, 2022 & 2030

Figure 68: Middle East & Africa Colloidal Silica Market Y-o-Y Growth by Country, 2022-2030

Figure 69: Middle East & Africa Colloidal Silica Market Attractiveness Analysis by Country, 2022-2030

Figure 70: Middle East & Africa Colloidal Silica Market Absolute $ Opportunity by GCC Countries Segment, 2022 - 2030

Figure 71: Middle East & Africa Colloidal Silica Market Absolute $ Opportunity by South Africa Segment, 2022 - 2030

Figure 72: Middle East & Africa Colloidal Silica Market Absolute $ Opportunity by Turkey Segment, 2022 - 2030

Figure 73: Middle East & Africa Colloidal Silica Market Absolute $ Opportunity by Rest of MEA Segment, 2022 - 2030

Figure 74: Oceania Colloidal Silica Market Value Share and BPS Analysis by Country - 2022 & 2030

Figure 75: Oceania Colloidal Silica Market Value Y-o-Y (%) Growth Projections by Country, 2022 - 2030

Figure 76: Oceania Colloidal Silica Market Attractiveness Analysis by Country, 2022-2030

Figure 77: Oceania Colloidal Silica Market Absolute $ Opportunity by Australia, 2022 - 2030

Figure 78: Oceania Colloidal Silica Market Absolute $ Opportunity by New Zealand, 2022 - 2030

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Colloidal Selenium Nanoparticles Market Size and Share Forecast Outlook 2025 to 2035

Colloidal Silver Market Report - Trends, Innovations & Forecast 2025 to 2035

Colloidal Metal Particles Market - Growth & Demand 2025 to 2035

Colloidal Alumina Market Growth - Trends & Forecast 2025 to 2035

Demand for Colloidal Silver in EU Size and Share Forecast Outlook 2025 to 2035

Silica Sand for Glass Making Market Size and Share Forecast Outlook 2025 to 2035

Silica Flour Market Size and Share Forecast Outlook 2025 to 2035

Silica Coated Film Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

Silica for S-SBR Market Size & Trends 2025 to 2035

Silica Analyzers Market

Borosilicate Glass Market Trends & Outlook 2025 to 2035

High-Silica Zeolite Market Size and Share Forecast Outlook 2025 to 2035

High-Silica Fiber Market Analysis by Application, Use Case, and Region: Forecast for 2025 to 2035

Fumed Silica Market

Europe Silica Sand for Glass Making Market Analysis for 2025 to 2035

Sodium Silicate Market Growth – Trends & Forecast 2022 to 2032

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Calcium Silicate Market

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Pyrogenic Silica Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA