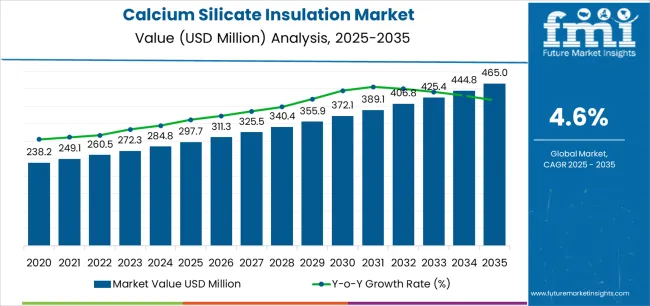

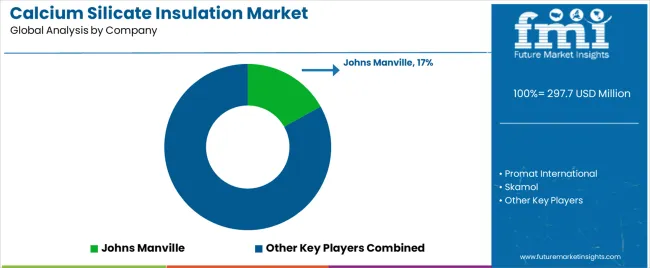

The Calcium Silicate Insulation Market is estimated to be valued at USD 297.7 million in 2025 and is projected to reach USD 465.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

The calcium silicate insulation market is expanding due to rising demand for high-performance thermal insulation materials in industrial and construction sectors. Its superior characteristics, including high compressive strength, fire resistance, and thermal stability, have positioned it as a preferred choice for heat-intensive environments.

The market is benefiting from increased adoption in power generation, petrochemical, and metallurgy industries where energy efficiency and safety are critical. Global emphasis on carbon emission reduction and industrial energy conservation continues to stimulate usage of calcium silicate products.

Manufacturers are focusing on improving insulation performance and installation ease through product innovations. With growing infrastructure development and stringent energy efficiency regulations, the market is expected to register steady long-term growth across both developed and emerging economies..

| Metric | Value |

|---|---|

| Calcium Silicate Insulation Market Estimated Value in (2025 E) | USD 297.7 million |

| Calcium Silicate Insulation Market Forecast Value in (2035 F) | USD 465.0 million |

| Forecast CAGR (2025 to 2035) | 4.6% |

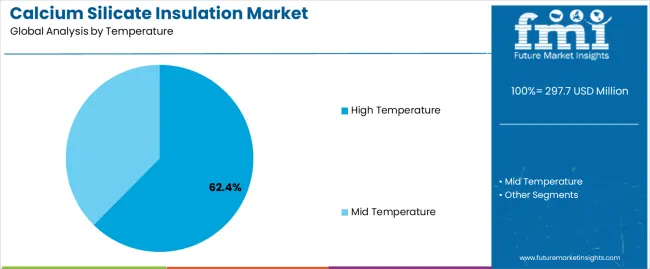

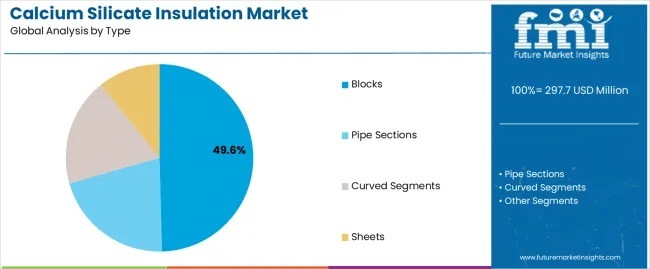

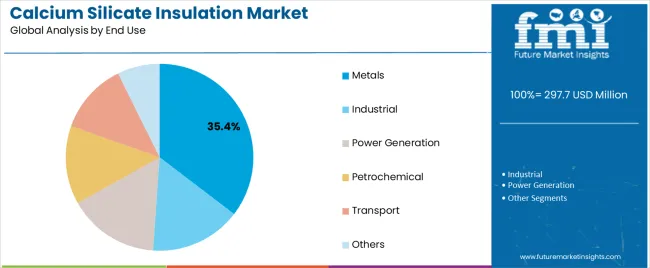

The market is segmented by Temperature, Type, and End Use and region. By Temperature, the market is divided into High Temperature and Mid Temperature. In terms of Type, the market is classified into Blocks, Pipe Sections, Curved Segments, and Sheets. Based on End Use, the market is segmented into Metals, Industrial, Power Generation, Petrochemical, Transport, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

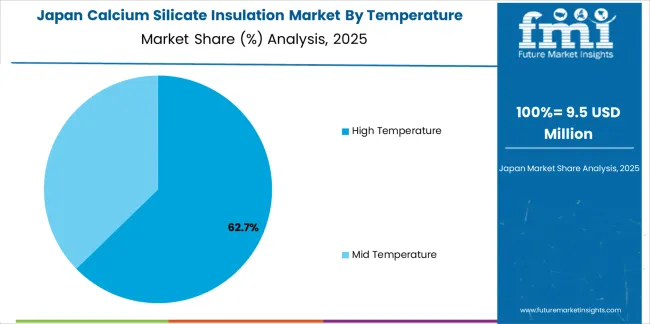

The high temperature segment holds approximately 62.4% share of the temperature category, attributed to its suitability for insulation in boilers, furnaces, and reactors. Its ability to withstand elevated thermal loads without degradation ensures reliability in demanding industrial operations.

Industries such as petrochemicals, power generation, and metallurgy rely heavily on high-temperature insulation to reduce energy loss and enhance operational safety. The segment benefits from the increasing replacement of traditional insulating materials that offer lower durability and higher maintenance costs.

With industries prioritizing sustainability and operational efficiency, high temperature calcium silicate insulation continues to be the preferred choice, sustaining its leading share in the foreseeable future..

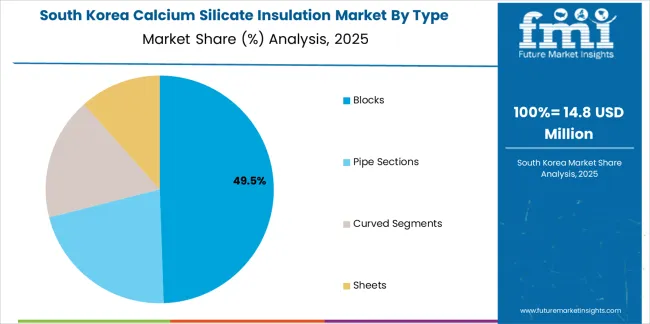

The blocks segment dominates the type category, accounting for approximately 49.6% share, due to its structural rigidity and ease of installation in large industrial setups. Blocks provide excellent dimensional stability, making them suitable for pipe coverings, equipment insulation, and refractory backup layers.

The segment benefits from widespread adoption in industries where precise insulation thickness and long service life are required. Prefabrication and on-site customization capabilities enhance their appeal for complex applications.

With consistent demand from heavy industries seeking durable and high-performance insulation materials, the blocks segment is anticipated to maintain its prominent position within the market..

The metals segment leads the end use category with approximately 35.4% share, supported by the intensive heat management requirements in steel, aluminum, and non-ferrous metal production facilities. Calcium silicate insulation offers excellent resistance to thermal shock and corrosion, making it ideal for furnaces, ladles, and casting equipment.

The segment’s growth is reinforced by the global expansion of metal manufacturing capacity and the rising emphasis on process efficiency and worker safety. Continuous industrial upgrades and environmental compliance requirements further drive adoption.

As energy efficiency remains a top operational priority in metallurgical processes, the metals segment is projected to sustain strong demand over the forecast period..

From 2020 to 2025, the calcium silicate insulation market experienced a CAGR of 5.3%. Calcium silicate insulation is commonly used in industrial applications, including petrochemical, power generation, and manufacturing facilities. Growth in these industries can positively impact the demand for insulation materials.

In the construction industry, calcium silicate insulation is used in both residential and commercial buildings for thermal insulation purposes. Its ability to provide effective insulation while also being fire-resistant makes it ideal for enhancing building safety and energy efficiency.

Calcium silicate insulation is used in industrial settings to insulate equipment, pipes, and vessels, helping to maintain process efficiency and reduce energy consumption. Projections indicate that the global calcium silicate insulation market is expected to experience a CAGR of 4.8% from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 5.3% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 4.8% |

The provided table highlights the top five countries in terms of revenue, with South Korea and China leading the list. Government support through policies, regulations, and incentives for energy-efficient building materials could encourage the adoption of calcium silicate insulation in the construction industry in South Korea.

Ongoing technological advancements in insulation materials may contribute to the growth of the calcium silicate insulation market in China.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 4.9% |

| The United Kingdom | 5.5% |

| China | 5.8% |

| Japan | 5.6% |

| South Korea | 6.0% |

The calcium silicate insulation market in the United States is expected to grow with a CAGR of 4.9% from 2025 to 2035. The growth of the market in the country is attributed to growth in residential, commercial, and industrial construction projects can drive the demand for insulation materials.

Ongoing and planned infrastructure development projects, such as transportation networks and utilities, can contribute to the demand for insulation materials in the United States.

The United States has been focusing on energy efficiency initiatives, with regulations and standards in place to encourage the use of insulation materials that contribute to better energy conservation. Calcium silicate insulation, known for its thermal resistance, can benefit from these initiatives.

The calcium silicate insulation market in the United Kingdom is expected to grow with a CAGR of 5.5% from 2025 to 2035. The United Kingdom has stringent building regulations and energy efficiency standards.

The demand for insulation materials, including calcium silicate, may be driven by the need for compliance with these standards in new construction and renovation projects.

The United Kingdom's commitment to renewable energy and sustainability initiatives could lead to increased construction and renovation activities, driving the demand for insulation materials in various applications, including residential and commercial buildings.

The calcium silicate insulation market in the China is expected to grow with a CAGR of 5.8% from 2025 to 2035. The demand for insulation materials, including calcium silicate, is likely to be high in both residential and commercial construction in China.

Rapid urbanization in China has LED to increased construction activities. The need for efficient insulation materials in new buildings and infrastructure projects can drive the growth of the calcium silicate insulation market.

Increasing awareness of sustainable building practices and green construction may lead to a higher demand for insulation materials that have minimal environmental impact, further benefiting calcium silicate insulation.

The calcium silicate insulation market in the Japan is expected to grow with a CAGR of 5.6% from 2025 to 2035. Calcium silicate insulation is used in various industrial applications, including manufacturing and petrochemical facilities. As Japan is known for its advanced industrial sector, the demand for insulation materials in these applications may contribute to market growth.

The retrofitting and renovation of existing buildings to improve energy efficiency and comply with modern standards could drive the demand for insulation materials, presenting opportunities for calcium silicate insulation in the Japanese market.

Government support through subsidies, grants, or other incentives for using energy-efficient and environmentally friendly materials could further drive the growth of the calcium silicate insulation market in Japan.

The demand for high-performance insulation materials like calcium silicate may be driven by a focus on meeting energy efficiency requirements in construction projects in South Korea.

South Korea has been emphasizing energy efficiency and sustainability in construction. Government initiatives and incentives promoting energy-efficient practices could drive the adoption of insulation materials in the country.

South Korea has a robust industrial sector, including petrochemicals and manufacturing. Calcium silicate insulation is commonly used in industrial settings, and the growth of these sectors may positively impact the demand for insulation materials. The calcium silicate insulation market in the South Korea is expected to grow with a CAGR of 6.0% from 2025 to 2035.

The below section shows the leading segment. The high temperature segment is to grow at a CAGR of 4.6% from 2025 to 2035. Based on form, the blocks segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 4.4% from 2025 to 2035.

| Category | CAGR from 2025 to 2035 |

|---|---|

| High Temperature | 4.6% |

| Blocks | 4.4% |

Based on the temperature, the high temperature segment is anticipated to thrive at a CAGR of 4.6% from 2025 to 2035. High-temperature calcium silicate insulation is widely used in various industrial applications where there are elevated temperatures.

Industries such as petrochemical, metallurgy, cement, glass, and steel often require insulation materials that can withstand and effectively manage high temperatures.

High-temperature calcium silicate insulation is known for its excellent heat resistance. It can withstand temperatures well above what traditional insulation materials can endure without significant degradation or loss of insulation properties. High-temperature calcium silicate insulation helps in conserving energy by minimizing heat loss and maintaining the desired temperatures within industrial

Based on the form, the blocks segment is anticipated to thrive at a CAGR of 4.4% from 2025 to 2035. Calcium silicate insulation blocks offer excellent thermal insulation properties, making them desirable for various applications where temperature control is critical.

Industries such as construction, oil and gas, petrochemicals, and manufacturing often require high-quality thermal insulation materials to maintain process efficiency and safety.

Calcium silicate insulation blocks have high fire resistance, making them suitable for applications where fire safety is a concern, such as in building construction, industrial facilities, and marine environments.

These blocks typically have good resistance to moisture, which is advantageous in environments where moisture ingress can cause damage or compromise the insulation's effectiveness.

Calcium silicate insulation blocks are known for their durability and longevity, providing long-term insulation solutions that require minimal maintenance. This makes them a cost-effective choice for various applications.

The leading players in the market are forming strategic partnerships with other companies in the industry to leverage complementary strengths, share resources, and expand market reach.

The market players are offering customized solutions to meet the specific requirements of different industries and applications, catering to a broader range of customers.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 284.1 million |

| Projected Market Valuation in 2035 | USD 456 million |

| Value-based CAGR 2025 to 2035 | 4.8% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | Temperature, Form, End Use, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Promat International; Johns Manville; Skamol; Isolatek International; L'ISOLANTE K-FLEX; NICHIAS Corporation; Etex Group |

The global calcium silicate insulation market is estimated to be valued at USD 297.7 million in 2025.

The market size for the calcium silicate insulation market is projected to reach USD 465.0 million by 2035.

The calcium silicate insulation market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in calcium silicate insulation market are high temperature and mid temperature.

In terms of type, blocks segment to command 49.6% share in the calcium silicate insulation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Calcium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Carbonate Biocement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate in Pharmaceuticals Analysis - Size Share and Forecast outlook 2025 to 2035

Calcium Gluconate Demand Analysis - Size Share and Forecast Outlook 2025 to 2035

Calcium Disodium Ethylene Diamine Tetra-acetate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate Market Trends - Growth, Demand & Forecast 2025 to 2035

Calcium Aluminate Cement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Bromide Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hydrogen Sulphite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Diglutamate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Caseinate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Calcium Carbonate Market - Trends & Forecast 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calcium Propionate Market Size, Growth, and Forecast for 2025 to 2035

Assessing Calcium Propionate Market Share & Industry Leaders

Calcium Lactate Market Analysis by Form, End Use Application and Region Through 2025 to 2035

Calcium Ammonium Nitrate Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA