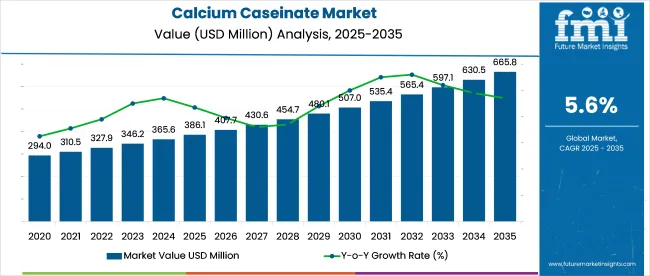

In 2025, the calcium caseinate market is likely to touch USD 386.1 million and is anticipated to follow a CAGR of 5.6% from 2025 to 2035, achieving USD 3,243.1 million by the end of the forecast period. Product has properties related to muscle recovery, satiety, and sustained protein release have significantly boosted its appeal among fitness enthusiasts and older adults.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 386.1 million |

| Projected Value (2035F) | USD 3,243.1 million |

| Value-based CAGR (2025 to 2035) | 5.6% |

Moreover, the emphasis on protein-rich diets in North America and Western Europe has reinforced demand. In addition, Asia Pacific showcases rising interest, particularly in China, Japan, and India. Notably, leading players emphasize clean-label innovation, efficient manufacturing, and enhanced product portfolios to meet evolving health-focused preferences.

The calcium caseinate market holds varying shares across its parent industries. In the dairy industry, it accounts for a small but specialized segment (5-10%), primarily as a byproduct of milk processing. The food & beverage sector contributes significantly (30-40%), driven by demand in protein-fortified foods, coffee creamers, and processed cheese.

The sports nutrition and supplements market holds 20-25% share, as calcium caseinate is a preferred slow-digesting protein. In pharmaceuticals, its share is smaller (5-10%), used mainly in clinical nutrition and infant formula. The animal feed industry consumes 15-20%, particularly in high-protein livestock and pet nutrition.

The exact distribution fluctuates based on regional demand, raw material availability, and alternative protein trends. Overall, food & beverage and sports nutrition dominate, reflecting growing health-conscious consumer preferences. Emerging markets in Asia-Pacific and Latin America are further boosting demand.

The calcium caseinate market saw major breakthroughs in 2024 to 2025, with DairyX Foods unveiling precision-engineered casein micelles that replicate dairy functionality in plant-based cheeses, solving texture challenges. FrieslandCampina introduced Excellion calcium caseinate S, a breakthrough for protein bars, preventing crystallization while maintaining softness. also, Milk Specialties Global revolutionized production with advanced filtration, yielding cleaner-tasting, highly soluble micellar casein.

These innovations expanded applications in sports nutrition and alternative dairy, meeting demand for high-performance ingredients. The Arla Foods Ingredients developed a heat-stable variant for ready-to-drink beverages, overcoming protein sedimentation. These advancements reshaped product formulations, offering superior functionality and broadening market opportunities. The focus on enhanced performance and versatility marked a turning point for industry growth.

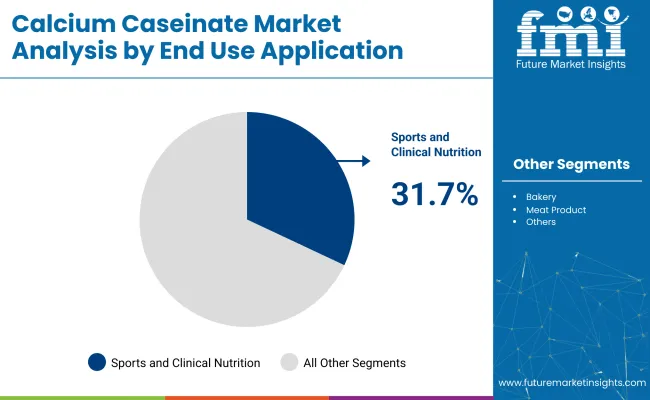

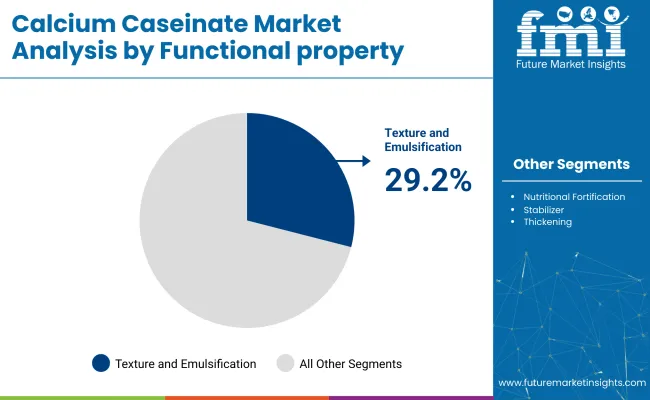

Calcium caseinate demand is rapidly growing across high-protein nutritional and food processing sectors. In 2025, sports and clinical nutrition will lead the market with over 31% share, while emulsification and textural enhancement applications will contribute around 29%, reflecting their central role in food innovation and reformulation.

In 2025, sports and clinical nutrition will account for 31.7% of the global calcium caseinate market, valued at over USD 500 million. The segment’s growth is propelled by the protein’s high bioavailability and slow-digesting properties, making it ideal for overnight supplements and recovery formulas. Top brands including Abbott, Nestlé Health Science, and MyProtein are formulating with calcium caseinate to support muscle preservation and long-term amino acid delivery.

Functionality-based applications will contribute 29.2% of the total calcium caseinate market in 2025, translating to approximately USD 460 million in value. Major food companies such as Glanbia, Fonterra, and Kerry Group utilize calcium caseinate to improve emulsion stability, moisture retention, and textural consistency across baked goods, processed meats, and dairy beverages. The protein’s emulsification capability is key in ensuring product uniformity, especially in high-fat and frozen food categories.

The calcium caseinate market is undergoing significant shifts driven by stricter formulation standards, expanded applications in bakery and meat analogues, and growing emphasis on traceability in clinical nutrition. Cost pressures from rising input and energy prices are reshaping production strategies, leading manufacturers to pursue more efficient processing and sourcing approaches.

Formulation Standards Tighten Across High-Protein Nutrition Channels

Notably, calcium caseinate usage continues to expand across high-protein nutrition formats, with manufacturers introducing tighter formulation specifications. In Q1 2025, over 38% of European buyers mandated ISO 22000 certification, reflecting a shift toward harmonized ingredient sourcing across borders. In parallel, North American contract manufacturers incorporated micellar-enriched caseinates into RTD beverage platforms, driven by demand for higher dispersion stability.

Functional Applications Expand Beyond Sports Nutrition

Calcium caseinate has steadily gained traction across bakery, meat analogue, and convenience meal applications, unlocking new demand outside its traditional protein supplement base. Prominently, European bakery processors have adopted the ingredient in gluten-free laminated doughs, citing extended moisture retention and improved freeze-thaw performance. In addition, Israeli and Dutch manufacturers of plant-based patties report structural improvement of up to 38% when calcium caseinate replaces soy concentrate as the core binder.

Input Volatility and Energy Costs Compress Margins

On the other hand, raw material volatility and energy inflation are placing added pressure on producer margins. Between January and May 2025, skimmed milk powder (SMP)-the primary input-recorded a 12.5% year-on-year price increase, largely due to supply imbalances in key production zones. Consequently, mid-sized processors in Poland, Chile, and Uruguay experienced operating margin declines, with average EBITDA falling from 16.2% to 11.4%.

Traceability Advances Reshape Procurement and Product Assurance

With that in mind, traceability protocols have emerged as a procurement differentiator, especially among precision nutrition stakeholders. By Q2 2025, over 60% of Oceania-based shipments integrated pallet-level blockchain tracking, a notable increase from 2023 baselines, the protein buyers in East Asia now request full input provenance for clinical-grade applications, prompting exporters to embed QR-linked digital batch records.

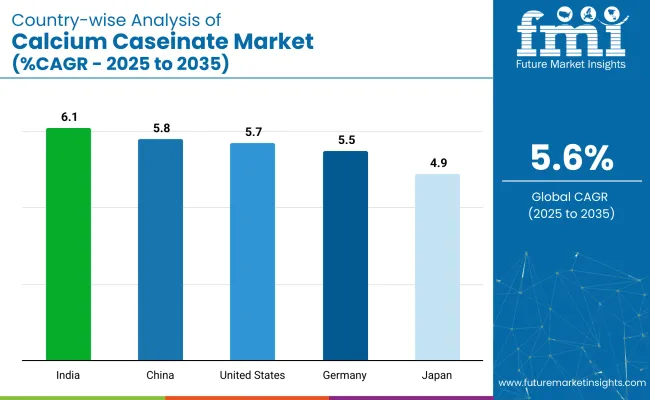

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.1% |

| China | 5.8% |

| United States | 5.7% |

| Germany | 5.5% |

| Japan | 4.9% |

The market is likely to expand at a 5.6% CAGR between 2025 and 2035. Among the listed markets, India records the fastest growth at 6.1%, followed by China at 5.8%, the United States at 5.7%, Germany at 5.5%, and Japan at 4.9%. Compared to the global average, India shows a +9% uplift, China +4%, the USA+2%, Germany -2%, and Japan -13%.

Growth differences reflect demand shifts in protein-enriched food categories. BRICS nations like India and China are expanding more quickly due to increased adoption across health-focused products. The OECD members such as the USA, Germany, and Japan follow a more measured pace, reflecting maturity in food and nutrition segments and consistent demand for protein-based ingredients.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

The USA calcium caseinate industry is forecasted to grow at a 5.7% CAGR from 2025 to 2035. Growth is being led by increasing demand for slow-digesting proteins in sports recovery, weight management, and dietary support. Calcium caseinate’s high amino acid bioavailability and low fat content make it a preferred protein source among fitness-conscious consumers.

Adoption is widespread in performance shakes, protein bars, and meal replacement products. Major supplement brands are shifting to dairy-based caseinates due to their functional thickness and longer satiety effects. Enhanced e-commerce reach and clean-label positioning are reinforcing the ingredient’s expansion into mainstream health categories.

The market in Germany is expected to grow at a 5.5% CAGR, with rising demand for clean-label, protein-rich food alternatives. Health-conscious consumers are shifting toward dairy-based protein supplements, including calcium caseinate, due to its low allergenicity and neutral taste. It is increasingly incorporated into protein breads, yogurts, and elderly nutrition formulations.

German manufacturers prefer functional proteins with high dispersibility and EU-compliant purity. Additionally, the elderly demographic is boosting demand for bone-health-promoting ingredients, where calcium caseinate is seen as both a calcium source and slow-release protein enhancer.

The calcium caseinate industry in China is projected to grow at a 5.8% CAGR, driven by the aging population’s increasing reliance on preventative health products and protein-rich diets. As functional foods and clinical nutrition products rise, calcium caseinate is being used in adult nutritional beverages, elderly supplements, and infant formulations. Its digestibility and dual benefit of calcium and protein make it ideal for recovery and muscle retention among elderly groups. Demand from younger consumers for fitness and lean muscle support is also growing, reflecting the country’s rising interest in active living and gym culture.

India is forecasted to post the highest growth rate at 6.1% CAGR in the calcium caseinate market. The country’s growing awareness of protein deficiencies, along with expansion of the health-focused dairy sector, has fueled demand for calcium caseinate in protein powders, fortified snacks, and wellness drinks.

With a dietary shift favoring plant-heavy meals, dairy proteins like calcium caseinate are emerging as viable daily protein solutions. Government-backed nutrition programs and proactive public health policies are also incentivizing food companies to adopt calcium caseinate as a fortification agent.

The industry in Japan is expanding at a 4.9% CAGR, primarily through demand in clinical nutrition, hospital-grade recovery products, and elderly dietary supplements. Japanese consumers prefer minimally processed, high-functionality proteins that support bone health and muscle mass retention.

Calcium caseinate is favored for its neutral profile and sustained-release properties, making it a staple in post-operative nutrition and wellness powders for aging adults. As low-fat, low-lactose diets gain popularity, calcium caseinate is gaining relevance across foodservice and pharmaceutical-grade nutrition channels.

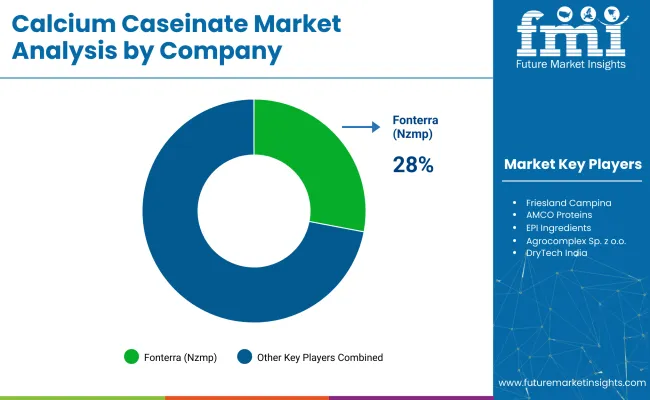

The calcium caseinate market illustrates a concentrated competitive structure, prominently led by Armor Protéines, Fonterra (NZMP), and Friesland Campina. These companies have substantially enhanced their market standing through specialized processing capabilities, robust global networks, and consistent alignment with functional nutrition trends.

In addition, the emphasis on clean-label, high-protein formulations underscore the growing demand across performance and clinical nutrition segments. Armor Protéines showcases high-purity applications tailored for functional dairy and health foods. Also, Fonterra delivers functional protein variants engineered for sports and medical usage.

Friesland Campina, in contrast, leverages its technical expertise to support evolving nutritional requirements across developed and emerging markets. From this perspective, the market reveals a dynamic shift toward ingredient traceability, application-specific performance, and formulation precision as key competitive differentiators.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 386.1 million |

| Projected Market Size (2035) | USD 3,243.1 million |

| CAGR (2025 to 2035) | 5.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and metric tons for volume |

| End-Use Applications Analyzed (Segment 1) | Confectionary, Frozen Dessert, Nutritional/Functional Beverages, Sports Nutrition, Clinical Nutrition, Bakery, Meat Products, Nutritional Powders & Bars, Dairy Beverages, Infant Nutrition, Dairy Products, Cheese, Coffee, Dietary Supplement |

| Functional Properties Analyzed (Segment 2) | Heat Stability, Coating, Emulsification, Texture Improvement, Nutritional Fortification, Thickening, Stabilizer |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, India, Japan, Australia, Brazil, South Africa |

| Key Players Influencing the Market | Armor Protéines, Fonterra (Nzmp), Friesland Campina, AMCO Proteins, EPI Ingredients, Agrocomplex Sp. z o.o., DryTech India, Krishna Enzytech, Avani Food Products, Milk Speciality Global, Erie Foods International Inc., Nippon Shinyaku Co., Ltd., Hoogwegt Group, Cottee Group Pty Ltd., Clarion Casein Ltd, Others |

| Additional Attributes | Dollar sales, usage distribution across nutritional powders and beverages, significant demand from sports and clinical nutrition segments, adoption as a stabilizer and fortification agent in bakery and dairy, robust application in texture and emulsification processes, export-driven growth in South Asia and Oceania |

The industry has been categorized into Confectionary, Frozen Dessert, Nutritional/Functional beverages, Sports Nutrition, Clinical Nutrition, Bakery, Meat Product, Nutritional Powders & Bars, Dairy Beverages, Infant Nutrition, Dairy Products, Cheese, Coffee, and Dietary Supplement

This segment is further categorized into Heat Stability, Coating, Emulsification, Texture improvement, Nutritional Fortification, Thickening and Stabilizer

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The industry is projected to reach USD 3.24 billion by 2035, growing from USD 386.1 million in 2025.

The market is forecasted to expand at a compound annual growth rate (CAGR) of 5.6% during the forecast period.

Sports and clinical nutrition dominate with a 31.7% market share.

Texture and emulsification applications hold a 29.2% share in 2025.

India leads with a CAGR of 6.1%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Calcium Dissolver Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Calcium Carbonate Biocement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate in Pharmaceuticals Analysis - Size Share and Forecast outlook 2025 to 2035

Calcium Gluconate Demand Analysis - Size Share and Forecast Outlook 2025 to 2035

Calcium Disodium Ethylene Diamine Tetra-acetate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate Market Trends - Growth, Demand & Forecast 2025 to 2035

Calcium Aluminate Cement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Bromide Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hydrogen Sulphite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Diglutamate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Carbonate Market - Trends & Forecast 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calcium Propionate Market Size, Growth, and Forecast for 2025 to 2035

Assessing Calcium Propionate Market Share & Industry Leaders

Calcium Lactate Market Analysis by Form, End Use Application and Region Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA