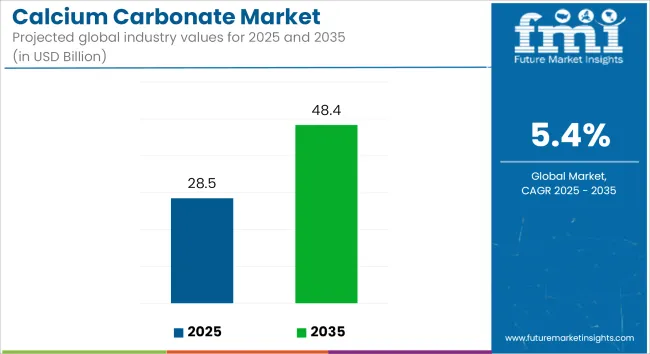

The global calcium carbonate market is anticipated to grow from USD 28.5 billion in 2025 to USD 48.4 billion by 2035, achieving a CAGR of 5.4% during the forecast period. Growth is being supported by increased demand from the construction, paper, plastics, and healthcare sectors, where calcium carbonate is being used as a filler, pigment, functional additive, and excipient.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 28.5 billion |

| Market Value (2035F) | USD 48.4 billion |

| CAGR (2025 to 2035) | 5.4% |

In construction, ground calcium carbonate (GCC) is being incorporated into cement, concrete, and asphalt mixes to enhance compressive strength, improve surface finish, and reduce material costs. Infrastructure development and building renovations are driving greater volumes of GCC usage in dry-mix mortars, concrete blocks, roofing tiles, and road base layers.

The paper industry is utilizing both GCC and precipitated calcium carbonate (PCC) to improve brightness, printability, and opacity in coated and uncoated paper. As environmental guidelines call for reductions in virgin pulp content and water consumption, calcium carbonate is being preferred as a sustainable and cost-effective filler.

In plastics, calcium carbonate is being adopted to reinforce polymers, enhance thermal stability, and reduce overall polymer consumption. Its use in masterbatches, PVC pipes, films, and packaging materials supports lightweighting strategies and product lifecycle improvements.

The healthcare and pharmaceutical sectors are relying on calcium carbonate as a widely accepted excipient and active ingredient in antacids and calcium supplements. Its high bioavailability, neutral pH behavior, and safe ingestion profile continue to support its inclusion in tablet and suspension formulations.

Efforts to meet performance and sustainability targets are accelerating the development of high-purity, engineered, and nano-scale calcium carbonate grades. These are being evaluated for enhanced dispersion, improved reactivity, and optimized rheological performance across a range of industrial and biomedical applications.

As industrial decarbonization and circular economy initiatives advance, calcium carbonate is being positioned as a renewable, low-impact material capable of supporting formulation efficiency and environmental compliance. The market is expected to maintain steady momentum through 2035 as manufacturers invest in product innovation, processing efficiency, and end-use diversification

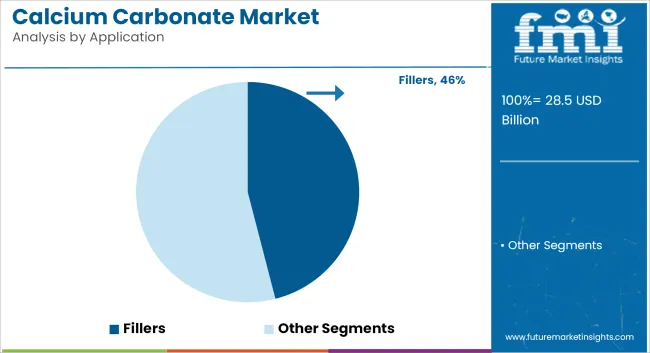

Fillers are estimated to account for approximately 46% of the global calcium carbonate market share in 2025 and are projected to grow at a CAGR of 5.5% through 2035. Calcium carbonate is extensively used as a functional filler to enhance the strength, brightness, and dimensional stability of end products. Its cost-effectiveness and compatibility with polymers and resins make it a preferred additive in plastic films, rubber goods, adhesives, and industrial coatings.

Demand remains strong in Asia-Pacific and Latin America where cost-driven manufacturing across construction materials, packaging, and molded products continues to expand. Manufacturers are investing in coated and micronized grades to offer improved dispersion, surface finish, and processing efficiency for high-performance applications.

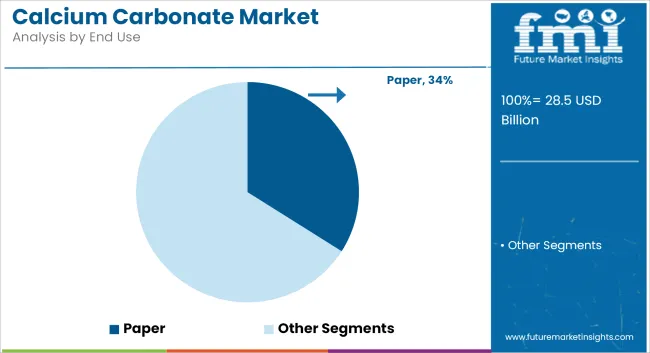

The paper segment is projected to hold approximately 34% of the global calcium carbonate market share in 2025 and is expected to grow at a CAGR of 5.3% through 2035. Calcium carbonate is used both as a coating pigment and as a filler in paper production to improve printability, gloss, and smoothness.

Ground and precipitated calcium carbonate are integral in the production of high-quality printing and writing paper, tissue, and packaging grades. With ongoing demand for lightweight and recyclable paper products, especially in food packaging and e-commerce, the role of calcium carbonate remains critical. Additionally, as mills adopt cost-efficient and environmentally friendly formulations, calcium carbonate continues to be a cornerstone raw material in the paper value chain.

Environmental Regulations and Resource Depletion

A major challenge facing the calcium carbonate market is the tightening of environmental regulations regarding mining and emissions. Sustainability issues arise because the raw limestone must be mined, and that calcinating process is very energy-intensive.

More stringent mining permits and environmental assessment requirements in places such as Europe and North America can also slow supply growth. In addition, depletion of high-purity limestone reserves in certain regions makes sourcing high-end applications (i.e., pharmaceutical and food-grade) more difficult over the longer term.

This also limits the potential for these regions to develop the advanced processing infrastructure needed to produce the premium quality defined by PCC or nano-calcium carbonate and capture the related market potential.

Green Manufacturing and Technological Advancements

A surge in interest in eco-friendly and recyclable materials serves as an important trend for market growth in calcium carbonate. And with a move toward circular economy models, manufacturers are also investigating the role of calcium carbonate in biodegradable plastics and fiber-based packaging.

Nanotechnology is a technological innovation that has led to the creation of new calcium carbonate with high performance, which improves mechanical and barrier film and polymer properties. In addition, the growing demand for functional food and nutraceuticals creates opportunities for ultra-pure calcium carbonate in supplements and fortified products. In addition, the use of energy-efficient mining and low-carbon processing methods will raise the economics and sustainability of production.

Calcium carbonate consumption is dominated by construction, paper and the pharmaceutical industry, with the United States being the leading producer. Robust consumption of GCC in cement and paints, while PCC is gradually being used in dietary supplements and as food fortification. The EPA’s environmental controls and emphasis on carbon reduction have also brought higher calcium carbonate use in desulfurization and neutralization processes.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

Emerging regulatory pressure for environmental performance along with growing consumption of calcium carbonate in green building materials are boosting market deployment in the UK. PCC is gaining notable momentum in food and pharmaceutical applications, where consumers are looking for clean-label,high-purity additives. Demand is also being boosted by the UK’s packaging and printing industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.6% |

In the objectively available economic data, the EU is powered by industrial sectors in Germany, France and Italy where PCC and GCC are both prominent. Emissions regulation and circular economy initiative is raising use in flue gas desulfurization and waste Neutralization. The application of PCC around the area in cutting-edge coatings, polymers, and medical services are experiencing a tremendous growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

Tokuyama, a Japanese chemical company, has launched the world's most suitable ultrafine PCC suitable for food, pharmaceutical and electronic packaging, due to Japan's high manufacturing precision. With advanced R&D and use of nanomaterials in consumer and industrial products, Japanese market is through and through technology inclined regarding calcium carbonate applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

Strong cosmetics and electronics sector in South Korea is PA calcium carbonate growth, especially PCCs for use in inks, polymer films and cosmetic powders. Continual investments in pollution control technologies have also generated demand related to desulfurization

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

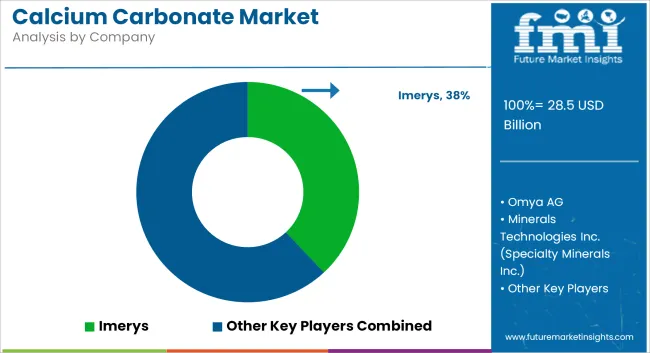

The calcium carbonate market is becoming more competitive, with companies focusing on performance differentiation and sustainability. Leading producers are investing in nano calcium carbonate, functionalized PCC, and hybrid filler systems to cater to demand from high-performance plastics and paper segments. Geographic expansion particularly in Asia-Pacific and Latin America is underway to meet growing regional demand.

Key players are developing proprietary technologies to reduce energy intensity and improve particle morphology, enabling broader adoption in food, pharmaceutical, and cosmetic applications. Some firms are also entering into long-term supply agreements with downstream manufacturers to ensure secure offtake.

M&A activity is expected to intensify as companies seek scale, raw material access, and R&D capabilities to compete in premium markets. As customers demand more sustainable, cost-effective, and high-performing filler solutions, innovation and integration are becoming central to market leadership.

Key Development

The market size in 2025 was USD 28.5 billion.

It is projected to reach USD 48.4 billion by 2035.

Key growth drivers include rising demand from the construction, paper, plastics, and healthcare industries, along with its widespread use as a filler and excipient.

The top contributors are United States, China, India, Germany, and Japan.

The filler material segment is anticipated to dominate due to its extensive use in polymer processing, paper manufacturing, and other industrial applications.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Calcium Carbonate Biocement Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Calcium Carbonate Market

Nano Precipitated Calcium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Ground and Precipitated Calcium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Calcium Dissolver Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate in Pharmaceuticals Analysis - Size Share and Forecast outlook 2025 to 2035

Calcium Gluconate Demand Analysis - Size Share and Forecast Outlook 2025 to 2035

Calcium Disodium Ethylene Diamine Tetra-acetate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate Market Trends - Growth, Demand & Forecast 2025 to 2035

Calcium Aluminate Cement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Bromide Market Size and Share Forecast Outlook 2025 to 2035

Calcium Hydrogen Sulphite Market Size and Share Forecast Outlook 2025 to 2035

Calcium Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Diglutamate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Caseinate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA