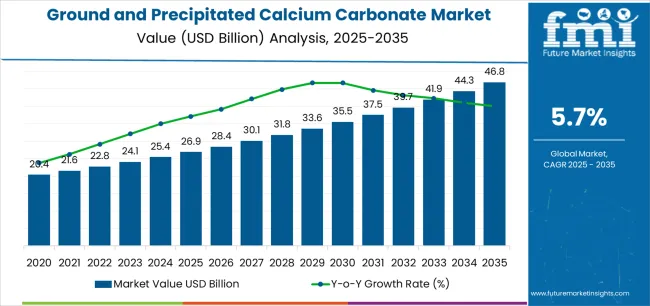

The global ground and precipitated calcium carbonate market is projected to reach USD 46.8 billion by 2035, recording an absolute increase of USD 20.6 billion over the forecast period. The market is valued at USD 26.9 billion in 2025 and is projected to grow at a CAGR of 5.7% during the forecast period. The market size is expected to grow by nearly 1.8 times during the same period, supported by increasing demand for paper packaging and sustainable filler materials worldwide, rising construction activity in emerging markets, driving demand for cement additives and building materials and increasing investments in biodegradable plastics, eco-packaging innovations, and pharmaceutical-grade mineral applications globally.

Between 2025 and 2030, the market is likely to expand from USD 26.9 billion to USD 34.4 billion, resulting in a value increase of USD 7.5 billion, which represents 36.4% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for sustainable packaging materials and circular economy compliance, product innovation in ultra-fine PCC grades and surface-treated calcium carbonate, as well as expanding integration with biodegradable polymer applications and high-brightness paper production. Companies are establishing competitive positions through investment in carbon-neutral production technologies, nano-calcium carbonate development, and strategic market expansion across paper, plastics, and construction applications.

According to FMI’s materials innovation tracker, used by chemical engineers and market strategists worldwide, from 2030 to 2035, the market is forecast to grow from USD 34.4 billion to USD 46.8 billion, adding another USD 13.1 billion, which constitutes 63.6% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized calcium carbonate systems, including pharmaceutical-grade PCC and carbon capture-integrated production, strategic collaborations between mineral producers and end-user industries, and an enhanced focus on renewable energy-powered processing and environmental sustainability. The growing emphasis on circular economy packaging and low-emission paper production will drive demand for advanced, high-performance calcium carbonate solutions across diverse industrial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 26.9 billion |

| Market Forecast Value (2035) | USD 46.8 billion |

| Forecast CAGR (2025-2035) | 5.7% |

The ground and precipitated calcium carbonate market grows by enabling manufacturers across paper, plastics, and construction industries to achieve cost reduction through mineral filler substitution, brightness enhancement in paper products, and performance improvement in polymer compounds. Paper manufacturers face mounting pressure to reduce production costs while maintaining quality, with calcium carbonate filler replacing 20-30% of pulp fiber reducing raw material expenses and improving opacity, brightness, and printability supporting magazine, packaging, and specialty paper applications. Plastic compounders require calcium carbonate as functional filler improving impact strength, dimensional stability, and processability while reducing resin costs by 15-25% supporting automotive components, construction profiles, and consumer goods manufacturing.

Construction industry expansion across emerging markets drives cement and building material demand, with ground calcium carbonate serving as supplementary cementitious material improving workability and strength while reducing carbon footprint through clinker substitution. Sustainable packaging trends and circular economy initiatives encourage adoption of biodegradable polymer composites incorporating calcium carbonate supporting compostable films and recyclable rigid packaging replacing conventional plastics. Energy-intensive grinding and calcination processes create environmental concerns, while competition from alternative mineral fillers including talc, kaolin, and silica may limit market share in certain applications requiring specialized performance characteristics.

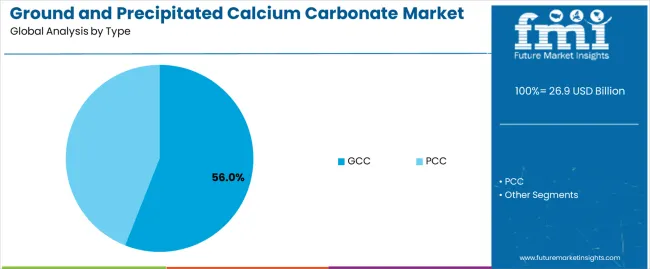

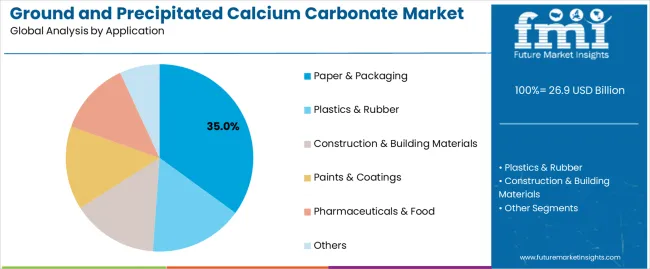

The market is segmented by type, application, and region. By type, the market is divided into GCC and PCC. Based on application, the market is categorized into paper & packaging, plastics & rubber, construction & building materials, paints & coatings, pharmaceuticals & food, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, and other key regions.

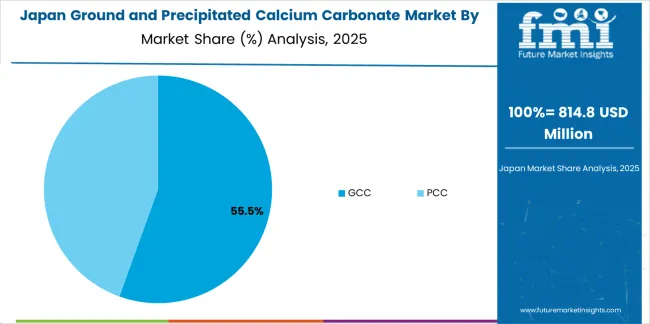

The GCC segment represents the dominant force in the ground and precipitated calcium carbonate market, capturing approximately 56.0% of total market share in 2025. This category encompasses mechanically ground limestone and marble offering cost-effective mineral filler properties essential for paper coating, plastic compounding, and paint formulations where particle size distribution, brightness, and chemical purity support diverse industrial applications. The GCC segment's market leadership stems from abundant limestone resources enabling large-scale production, lower manufacturing costs compared to synthetically precipitated alternatives, and established application history across paper, plastics, and construction industries.

The PCC segment maintains 44.0% market share through superior optical properties including higher brightness and smaller particle size enabling premium paper coating, pharmaceutical tablet applications, and specialty polymer compounding requiring controlled particle morphology and surface characteristics.

Key technological advantages driving the GCC segment include:

Paper & packaging applications dominate the ground and precipitated calcium carbonate market with approximately 35.0% market share in 2025, reflecting critical roles as coating pigment improving brightness, opacity, and printability, and as filler reducing pulp costs while maintaining paper quality across printing, packaging, and specialty paper applications. The paper & packaging segment's market leadership is reinforced by e-commerce packaging growth requiring corrugated board and paperboard with calcium carbonate enhancing strength-to-weight ratios, sustainable packaging trends favoring paper-based alternatives to plastic requiring functional fillers, and premium printing paper demand for magazines and catalogs requiring high-brightness coating pigments.

Plastics & rubber applications represent the second-largest category, capturing 22.0% market share through polymer compounding and rubber reinforcement, while construction & building materials account for 20.0% serving cement, concrete, and construction composites. Paints & coatings capture 12.0% market share through architectural and industrial coating formulations.

Key market dynamics supporting paper & packaging growth include:

The market is driven by three concrete demand factors tied to industrial manufacturing requirements. Paper industry cost optimization and sustainability initiatives create increasing demand for calcium carbonate fillers, with global paper production requiring 25-30 million tons annually as coating pigment and fiber substitute, enabling 15-20% production cost reduction while improving brightness, opacity, and printability supporting magazine, packaging, and specialty paper applications meeting environmental sustainability targets through reduced wood pulp consumption. The plastic industry light-weighting and cost reduction efforts drive calcium carbonate adoption in polymer compounding, with automotive, construction, and consumer goods manufacturers incorporating 10-40% mineral filler content reducing material costs, improving impact properties, and enabling sustainable material substitution supporting circular economy objectives.

Market restraints include energy-intensive production processes requiring substantial electricity for grinding GCC and thermal energy for precipitating PCC, creating carbon footprint concerns and operating cost pressures during energy price volatility affecting profitability margins and environmental sustainability credentials. Competition from alternative mineral fillers including talc, kaolin, precipitated silica, and titanium dioxide poses challenges, as specialized applications may favor alternatives offering superior properties including thermal stability, chemical resistance, or optical characteristics requiring calcium carbonate producers to differentiate through particle engineering and surface treatments. Environmental regulations regarding mining operations and dust emissions create compliance complexities, requiring investments in environmental controls, community relations, and regulatory permitting potentially limiting quarry expansion and production growth in certain regions.

Key trends indicate accelerated adoption of ultra-fine and nano-calcium carbonate grades offering enhanced performance in specialty applications including high-gloss paper coating, premium polymer compounds, and pharmaceutical excipients commanding price premiums while enabling differentiation from commodity grades. Carbon capture-integrated PCC production emerges as innovative sustainability solution, with producers developing processes utilizing industrial CO₂ emissions as feedstock for calcium carbonate precipitation reducing environmental impact while generating revenue from waste streams. Surface-modified calcium carbonate gains traction through stearic acid and other coupling agents improving polymer compatibility, dispersion quality, and interfacial bonding enabling higher loading levels and performance improvements in plastic applications. The market thesis could face disruption if bio-based or synthetic filler alternatives achieve cost parity while offering superior performance or sustainability credentials, potentially reducing calcium carbonate consumption in certain high-value applications where innovation enables material substitution.

| Country | CAGR (2025-2035) |

|---|---|

| South Korea | 6.0% |

| United States | 5.9% |

| European Union | 5.8% |

| United Kingdom | 5.5% |

| Japan | 5.4% |

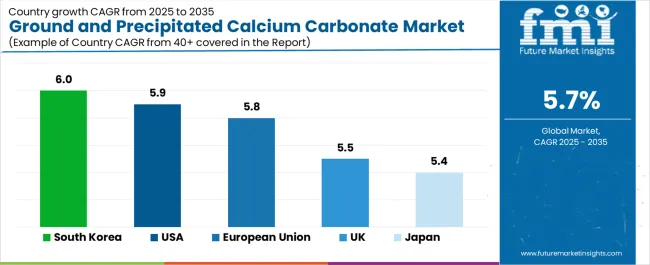

The ground and precipitated calcium carbonate market is gaining momentum worldwide, with Asia-Pacific taking the lead thanks to infrastructure development, cement production expansion, low-emission paper manufacturing, and automotive polymer applications. Close behind, South Korea benefits from electronics packaging, semiconductor applications, and ultra-fine PCC requirements, positioning itself as a high-tech materials hub. The United States shows steady advancement, where eco-paper initiatives, sustainable packaging, and cement applications strengthen its role in green building and circular economy markets. The European Union stands out for circular economy compliance, biodegradable packaging adoption, and high-brightness PCC for specialty applications, while the United Kingdom and Japan continue consistent progress in biodegradable packaging, pharmaceutical-grade materials, and advanced coatings respectively. Together, Asia-Pacific markets anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

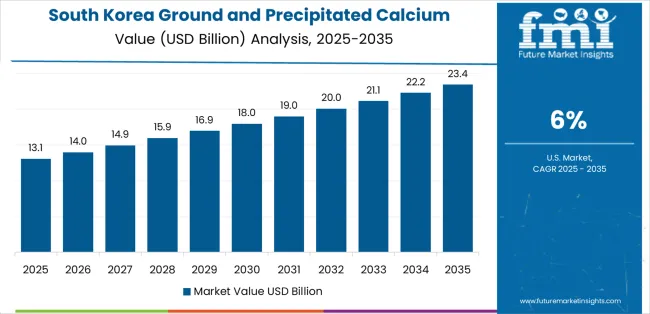

South Korea demonstrates impressive growth potential with a CAGR of 6.0% through 2035, driven by electronics packaging requirements for semiconductors and consumer electronics utilizing ultra-fine PCC ensuring dimensional stability and moisture resistance, advanced polymer applications in automotive and electronics requiring precisely controlled particle size distribution and surface treatments, and specialty coating applications demanding high-brightness PCC for premium printing and functional coatings. Growth is concentrated in major industrial regions including Seoul metropolitan area, Gyeonggi province, and southeastern manufacturing clusters. Korean manufacturers emphasize quality excellence and technical specifications, creating demand for premium calcium carbonate grades exceeding standard commodity products. The country's advanced manufacturing infrastructure and technology leadership support adoption of nano-calcium carbonate and surface-modified grades enabling performance advantages in demanding applications. Export orientation maintains production volumes serving Asian electronics and automotive supply chains requiring validated material specifications and comprehensive technical documentation.

The USA demonstrates solid growth potential with a CAGR of 5.9% through 2035, driven by eco-paper initiatives favoring recycled fiber content supplemented with calcium carbonate maintaining quality while reducing virgin pulp consumption, sustainable packaging adoption requiring biodegradable polymer composites incorporating mineral fillers supporting compostable films and recyclable rigid packaging, and cement applications including supplementary cementitious materials reducing carbon footprint through clinker substitution in green building construction. Growth is concentrated in major industrial regions including Southeast paper manufacturing belt, Midwest plastics processing clusters, and Southwest construction markets. American manufacturers emphasize environmental sustainability and circular economy principles, creating opportunities for calcium carbonate suppliers demonstrating carbon footprint reduction and sustainable sourcing practices. Regulatory environment supports green building through LEED certification requirements and sustainable packaging through corporate commitments driving innovation in biodegradable materials and recycled content applications incorporating functional mineral fillers.

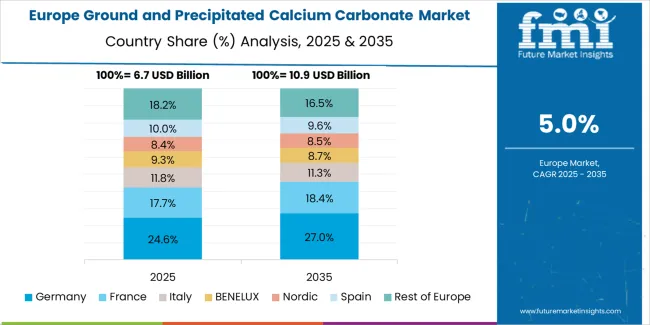

The European Union demonstrates steady growth potential with a CAGR of 5.8% through 2035, focused on circular economy policies driving recyclable packaging materials incorporating calcium carbonate fillers, biodegradable polymer applications replacing conventional plastics with compostable alternatives utilizing mineral reinforcement, and high-brightness PCC for specialty paper and coating applications meeting stringent quality and environmental standards. Growth is concentrated in major manufacturing regions including Germany, France, and Italy where paper mills, plastic processors, and construction material manufacturers maintain operations. European manufacturers lead sustainability initiatives through renewable energy-powered processing, carbon footprint disclosure, and lifecycle assessment documentation supporting customer environmental commitments. Regulatory environment including EU Packaging Directive and Circular Economy Action Plan creates sustained demand for recyclable and biodegradable materials incorporating functional mineral fillers supporting waste reduction and material recovery objectives.

The UK demonstrates moderate growth potential with a CAGR of 5.5% through 2035, focused on biodegradable packaging materials supporting retail and food service sustainability commitments incorporating calcium carbonate in compostable films and paperboard alternatives, pharmaceutical-grade PCC serving tablet excipient applications in domestic pharmaceutical manufacturing supporting NHS and export markets, and specialty coating applications requiring high-purity calcium carbonate for architectural paints and industrial coatings. Growth is supported by corporate sustainability commitments from major retailers including Tesco, Sainsbury's, and Marks & Spencer driving packaging material innovation, pharmaceutical industry strength requiring validated excipient supply chains, and construction sector recovery supporting paint and building material consumption. British manufacturers emphasize quality assurance and regulatory compliance, creating sustained demand for certified pharmaceutical and food-grade calcium carbonate meeting stringent UK and EU standards supporting domestic production and international trade.

Japan demonstrates moderate growth potential with a CAGR of 5.4% through 2035, driven by high-tech paper applications including specialty printing, thermal paper, and functional papers requiring ultra-fine PCC with precisely controlled particle morphology, advanced coating systems utilizing nano-calcium carbonate improving gloss, smoothness, and ink receptivity in premium printing applications, and pharmaceutical and food-grade PCC serving domestic health industries with exceptional purity and quality documentation. Growth is concentrated in major manufacturing regions including Kanto, Kansai, and Tokai industrial areas. Japanese manufacturers maintain exceptional quality standards exceeding international specifications, creating sustained demand for premium calcium carbonate grades with comprehensive analytical documentation. The country's emphasis on continuous improvement and technical excellence supports adoption of advanced surface treatments, particle engineering, and application development enabling differentiation from commodity products and premium pricing supporting profitability despite mature market conditions.

Europe accounts for an estimated 27.0% of global GCC & PCC revenue in 2025 at approximately USD 7.3 billion. Within Europe, Germany leads with 24.0% share supported by paper mills, automotive coatings, and polymer compounding serving domestic manufacturing and export markets. The United Kingdom follows with 14.0% driven by biodegradable packaging initiatives, pharmaceutical-grade PCC applications, and medical-grade mineral requirements, while France holds 13.0% through construction composites and packaging converter demand. Italy commands 12.0% via plastics processing, rubber goods manufacturing, and high-quality paper production. Spain accounts for 9.0% with cement and architectural coatings applications; the Netherlands captures 7.0% through coatings formulation, food additive applications, and logistics-driven blending operations serving European markets; the Nordics hold 8.0% with eco-packaging leadership and sustainable building materials emphasizing renewable energy and circular economy principles; and Rest of Europe represents 13.0% as Central & Eastern Europe expands PCC adoption in cement, paints, and pharmaceutical applications. Growth concentrates in Germany, UK, and Nordics where EU Circular Economy policies drive biodegradable and recyclable filler applications plus advanced PCC grades supporting specialty packaging and polymer innovations.

The market in Japan demonstrates a mature and technology-focused landscape, characterized by sophisticated implementation of ultra-fine PCC systems supporting specialty paper manufacturing, advanced polymer compounding, and pharmaceutical excipient applications emphasizing particle morphology control and surface chemistry optimization. Japan's emphasis on quality excellence and technical specifications drives demand for premium calcium carbonate grades with precisely controlled particle size distribution, narrow span measurements, and comprehensive analytical documentation supporting domestic manufacturers including major paper companies, pharmaceutical firms, and specialty chemical producers in maintaining industry-leading product quality. The market benefits from strong partnerships between international mineral suppliers like Omya, Imerys, and domestic specialty producers including Maruo Calcium and Takehara Kagaku Kogyo, creating comprehensive technical service ecosystems prioritizing application development and performance validation. Manufacturing and distribution centers across major industrial regions showcase advanced processing implementations where calcium carbonate production achieves exceptional consistency through integrated quality control and particle engineering technologies supporting Japan's reputation for manufacturing precision.

The South Korean Ground and Precipitated Calcium Carbonate Market is characterized by strong technology focus, with international mineral suppliers and specialty chemical companies maintaining significant positions through comprehensive technical support for electronics packaging and advanced polymer applications. The market demonstrates growing emphasis on ultra-fine PCC grades and nano-calcium carbonate technologies, as Korean manufacturers increasingly demand specialized materials integrating with domestic electronics manufacturing infrastructure, automotive component production, and specialty coating applications operated across Samsung, LG, and major industrial complexes. Local mineral processors and regional specialty suppliers are gaining market share through strategic partnerships with global producers, offering specialized services including Korean market customization, rapid technical response, and application development programs supporting customer innovation. The competitive landscape shows increasing collaboration between multinational mineral companies and Korean technology specialists, creating hybrid service models combining international mineral processing expertise with local application knowledge and quality management systems supporting premium product positioning in electronics and automotive supply chains.

Ground and precipitated calcium carbonate represent versatile mineral materials that enable manufacturers to achieve cost reduction through filler substitution, performance enhancement through functional properties, and sustainability improvement through natural resource utilization, delivering superior economics and functionality essential for paper production, plastic compounding, and construction materials across demanding industrial applications. With the market projected to grow from USD 26.9 billion in 2025 to USD 46.8 billion by 2035 at a 5.7% CAGR, these mineral products offer compelling advantages - abundant natural resources, established application history, and versatile performance characteristics - making them essential for paper & packaging applications (35.0% market share), plastics & rubber (22.0% share), and construction seeking alternatives to expensive synthetic fillers or virgin raw materials that compromise manufacturing economics and environmental sustainability. Scaling market adoption and sustainable production requires coordinated action across mining regulations, environmental standards, mineral processors, end-user industries, and circular economy investment capital.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

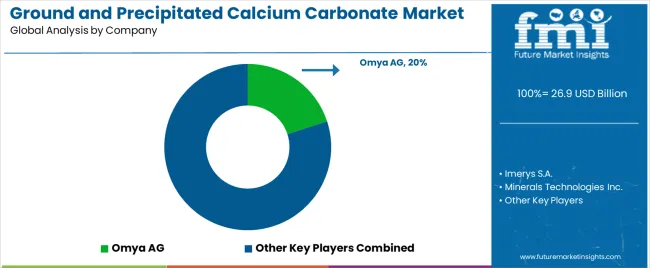

The industry features approximately 30-50 meaningful players with moderate concentration, where the top three companies control roughly 37-50% of global market share through established quarrying operations, integrated processing facilities, and extensive customer relationships. The leading company, Omya AG, commands approximately 20% market share through global limestone resources, diversified product portfolio, and comprehensive technical support serving paper, plastics, and construction industries. Competition centers on quality consistency, logistics efficiency, technical application support, and sustainable production practices rather than price alone.

Market leaders include Omya AG, Imerys S.A., and Minerals Technologies Inc., which maintain competitive advantages through vertical integration from quarrying through processing, global manufacturing networks, and deep expertise in particle engineering, surface treatments, and application development, creating high switching costs for customers relying on validated material specifications and consistent supply. These companies leverage economies of scale, comprehensive quality systems, and ongoing technical service relationships to defend market positions while expanding into specialty grades including nano-calcium carbonate and carbon capture-integrated PCC.

Challengers encompass Huber Engineered Materials and Nordkalk Corporation, which compete through specialized product platforms and regional market strength. Mineral conglomerates including Lhoist Group, Carmeuse Group, and Mississippi Lime Company focus on specific applications or geographic regions, offering differentiated capabilities in pharmaceutical-grade production, construction materials, or environmental applications.

Regional players and independent quarry operators create competitive pressure through localized supply and cost-effective commodity grades, particularly in high-growth markets including China and India where proximity to end-users provides logistics advantages and market understanding. Market dynamics favor companies combining mineral resource access with advanced processing technologies and comprehensive application expertise addressing complete customer requirements from material selection through performance optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.9 billion |

| Type | GCC, PCC |

| Application | Paper & Packaging, Plastics & Rubber, Construction & Building Materials, Paints & Coatings, Pharmaceuticals & Food, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Country/Region Covered | China & India (Asia-Pacific), South Korea, United States, European Union, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Omya AG, Imerys S.A., Minerals Technologies Inc., Huber Engineered Materials, Nordkalk Corporation, Lhoist Group, Carmeuse Group, Mississippi Lime Company, Schaefer Kalk, GCCP Resources |

| Additional Attributes | Dollar sales by type and application categories, regional adoption trends across Asia Pacific, North America, and Europe, competitive landscape with integrated mineral producers and specialty processors, particle specifications and quality requirements, integration with paper manufacturing, plastic compounding, and construction materials, innovations in ultra-fine grades and surface modification technologies, and development of sustainable production methods with carbon capture integration and renewable energy adoption characteristics. |

The global ground and precipitated calcium carbonate market is estimated to be valued at USD 26.9 billion in 2025.

The market size for the ground and precipitated calcium carbonate market is projected to reach USD 46.8 billion by 2035.

The ground and precipitated calcium carbonate market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in ground and precipitated calcium carbonate market are gcc and pcc.

In terms of application, paper & packaging segment to command 35.0% share in the ground and precipitated calcium carbonate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Ground Grid Tester Market Size and Share Forecast Outlook 2025 to 2035

Ground Mounted Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Ground Mounted Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Ground Resistance Testers Market Growth - Trends & Forecast 2025 to 2035

Ground Fault Circuit Interrupter Market

Underground Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Underground Hydrogen Storage Market Size and Share Forecast Outlook 2025 to 2035

Aboveground Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Underground Coal Gasification Industry Analysis in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Underground Cabling EPC Market Size and Share Forecast Outlook 2025 to 2035

Underground Mining Automation Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Underground Mining Equipment Market Share

Underground Storage Tanks Market

Underground Service Locator Market

Air to Ground Ejector Racks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Grounds Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Grounds for Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Insights – Trends & Growth 2024-2034

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA