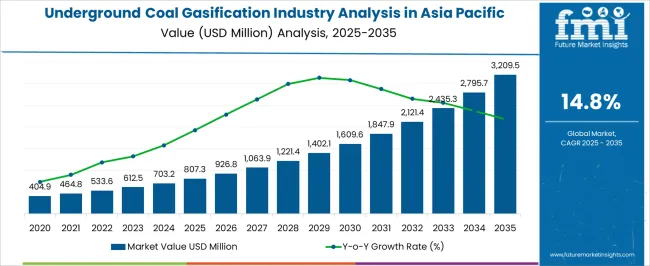

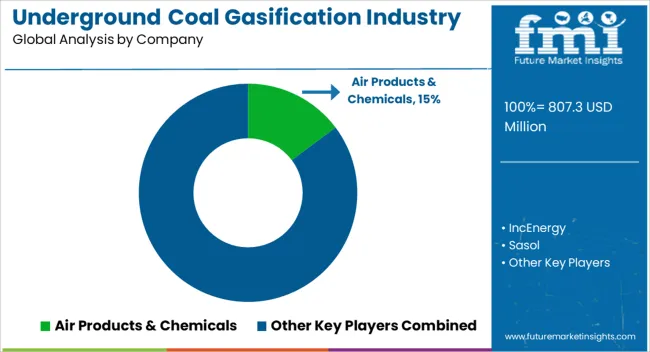

The Underground Coal Gasification Industry Analysis in Asia Pacific is estimated to be valued at USD 807.3 million in 2025 and is projected to reach USD 3209.5 million by 2035, registering a compound annual growth rate (CAGR) of 14.8% over the forecast period.

| Metric | Value |

|---|---|

| Underground Coal Gasification Industry Analysis in Asia Pacific Estimated Value in (2025 E) | USD 807.3 million |

| Underground Coal Gasification Industry Analysis in Asia Pacific Forecast Value in (2035 F) | USD 3209.5 million |

| Forecast CAGR (2025 to 2035) | 14.8% |

The underground coal gasification industry in the Asia Pacific region is witnessing significant growth, driven by the increasing demand for cleaner energy alternatives and efficient utilization of coal resources. The technology allows extraction of energy from coal reserves that are otherwise difficult to mine, reducing surface disruption and minimizing environmental impact. Rising electricity demand in emerging economies, coupled with government initiatives to enhance energy security and diversify power generation sources, is supporting adoption of this technology.

Advancements in underground gasification processes, including controlled reaction management and enhanced monitoring systems, are improving operational efficiency and gas yield. The market is further supported by increasing investments in energy infrastructure and initiatives to reduce carbon emissions from traditional coal-fired power plants.

As industries and power generation sectors in the region seek reliable and cost-effective solutions, underground coal gasification is positioned to expand, offering a pathway for both energy generation and industrial fuel applications The focus on technological innovation and integration with existing power systems is expected to reinforce the market growth trajectory over the next decade.

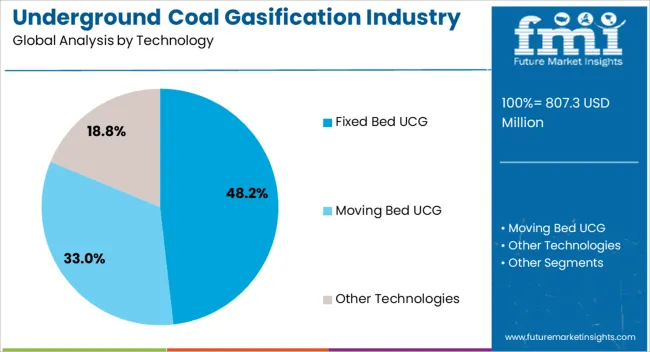

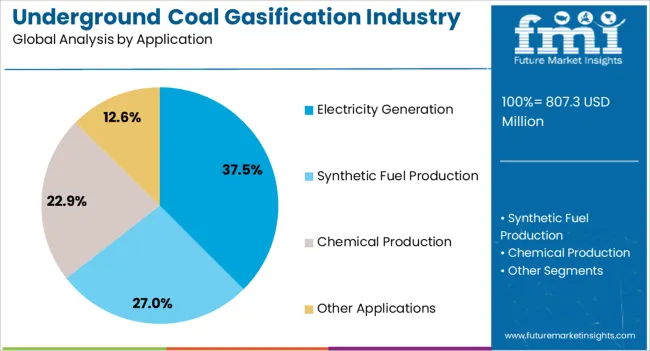

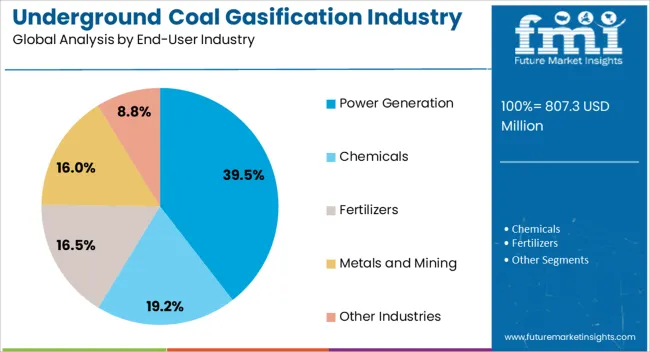

The underground coal gasification industry analysis in asia pacific is segmented by technology, application, end-user industry, gasification method, operation type, and geographic regions. By technology, underground coal gasification industry analysis in asia pacific is divided into Fixed Bed UCG, Moving Bed UCG, and Other Technologies. In terms of application, underground coal gasification industry analysis in asia pacific is classified into Electricity Generation, Synthetic Fuel Production, Chemical Production, and Other Applications. Based on end-user industry, underground coal gasification industry analysis in asia pacific is segmented into Power Generation, Chemicals, Fertilizers, Metals and Mining, and Other Industries.

By gasification method, underground coal gasification industry analysis in asia pacific is segmented into Updraft Gasification, Downdraft Gasification, Crossdraft Gasification, and Other Methods. By operation type, underground coal gasification industry analysis in asia pacific is segmented into Continuous UCG, Intermittent UCG, and Other Operation Types. Regionally, the underground coal gasification industry analysis in asia pacific is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fixed bed underground coal gasification technology segment is projected to hold 48.2% of the Asia Pacific market revenue share in 2025, making it the leading technology type. Its dominance is being supported by proven operational reliability, relatively lower complexity, and ease of implementation compared to other UCG technologies. Fixed bed designs allow controlled gasification with efficient heat and mass transfer, ensuring stable syngas production suitable for electricity generation and industrial fuel applications.

The technology is particularly preferred in regions with extensive deep coal reserves, where conventional mining is economically or environmentally challenging. Adoption is further reinforced by its ability to integrate with existing surface facilities while maintaining operational safety and environmental compliance.

Rising investments by energy producers in cost-efficient and high-yield gasification solutions are also contributing to segment growth Continuous improvements in monitoring, pressure management, and reaction control are enhancing gas output and efficiency, solidifying fixed bed technology as the preferred choice for large-scale underground coal gasification projects across the Asia Pacific region.

The electricity generation application segment is expected to account for 37.5% of the Asia Pacific underground coal gasification market revenue share in 2025, making it the leading application. This prominence is being driven by the increasing need for stable and affordable power supply to support industrialization and urbanization in the region.

Syngas produced via underground coal gasification can be used as fuel in gas turbines and combined cycle plants, offering higher efficiency and reduced emissions compared to conventional coal combustion. Governments and energy companies are actively promoting adoption of UCG for electricity generation due to its potential to reduce dependency on imported fuels and to utilize untapped coal resources.

The technology also enables better environmental compliance by minimizing surface coal mining and associated ecological disruption As regional energy demand grows and pressure to lower carbon intensity increases, electricity generation applications are expected to remain a key driver for UCG technology deployment across the Asia Pacific.

The power generation end-user industry segment is projected to hold 39.5% of the Asia Pacific underground coal gasification market revenue share in 2025, establishing it as the largest end-use category. This leadership is being driven by the increasing reliance on efficient, high-output fuel sources to support expanding electricity networks and industrial growth. UCG provides a cost-effective solution for generating syngas, which can be converted to electricity with minimal surface disruption and reduced environmental footprint.

The segment is further supported by government incentives and energy policies aimed at promoting indigenous fuel sources and reducing greenhouse gas emissions from traditional coal-fired plants. Utilities and independent power producers are leveraging UCG technologies to enhance energy security, diversify fuel supply, and maintain consistent electricity output.

The ability to integrate underground gasification outputs with existing power generation infrastructure ensures that operational efficiency is maximized while capital expenditure is minimized As energy demand continues to rise in the Asia Pacific, the power generation sector is expected to remain the primary driver of underground coal gasification adoption.

Stricter environmental regulations are shaping the underground coal gasification industry. Governments in the Asia-Pacific region are implementing policies to minimize environmental impact and reduce carbon emissions.

Compliance with these regulations is driving the adoption of cleaner and more sustainable gasification technologies, influencing the underground coal gasification industry size.

Ongoing research and development activities are propelling the Asia-Pacific underground coal gasification industry forward. Collaborative efforts between academic institutions, government bodies, and players in the ecosystem are fostering innovation and improving the overall efficiency and safety of UCG processes.

Such advancements are crucial for maintaining the competitiveness of the underground coal gasification industry size. The economic benefits of underground coal gasification are significant drivers for the sector.

UCG offers a cost-effective method of accessing and utilizing coal reserves, leading to reduced production costs and increased profitability. The development of UCG projects creates job opportunities and stimulates local economies, incentivizing investment in the underground coal gasification industry.Asia-Pacific Underground Coal Gasification Industry Dynamics

The Asia-Pacific underground coal gasification industry is experiencing significant technological advancements. Innovations in drilling techniques and gasification processes are enhancing efficiency and reducing costs.

Advanced monitoring and control systems are improving the safety and reliability of underground coal gasification (UCG) operations, contributing to the overall growth and competitiveness of the sector.

Rising energy demand is a crucial trend driving the UCG sector growth in Asia-Pacific. Rapid industrialization, urbanization, and economic development in countries like China, India, and Australia are increasing the need for reliable and affordable energy sources.

Underground coal gasification offers a viable solution to meet this growing demand, especially in regions with abundant coal reserves. The cost competitiveness of the underground coal gasification industry is a significant trend. As traditional mining and surface gasification methods face increasing costs and environmental scrutiny, UCG presents a more cost-effective alternative.

The ability to access deeper coal seams and convert them into energy without extensive surface disruption enhances the economic viability of this technology.

Abundant coal reserves in the Asia-Pacific region are a primary driver of the underground coal gasification industry. Countries like China, India, and Australia have vast coal resources that can be exploited through UCG, providing a reliable and long-term energy supply. This abundance supports the growth and expansion of the UCG sector growth in Asia-Pacific.

Energy security concerns are driving the adoption of underground coal gasification. The Asia-Pacific region's increasing reliance on imported energy sources makes UCG an attractive option for enhancing domestic energy production and reducing dependency on external suppliers. This contributes to the stability and resilience of the regional energy sector.

High initial investment costs are a barrier to entry for the underground coal gasification industry. The development of the UCG projects requires significant capital expenditure for drilling, infrastructure, and technology deployment. Securing funding and achieving financial viability can be challenging, particularly for smaller companies and new entrants.

China's underground coal gasification sector is driven by the country's abundant coal reserves. China possesses some of the largest coal deposits in the world, providing a substantial resource base for UCG projects.

The need for energy security is another critical driver, as China seeks to reduce its reliance on imported energy sources and enhance domestic energy production.

The Chinese government's support through favorable policies and financial incentives is fostering the development of UCG technology. Environmental considerations, particularly the need to reduce air pollution and carbon emissions, are also promoting the adoption of UCG as a cleaner alternative to traditional coal combustion.

The economic benefits, including job creation and local economic development, are incentivizing investment in the underground coal gasification sector.

The drive for energy diversification is another crucial driver, as Australia aims to diversify the energy mix and reduce dependency on conventional coal mining. The environmental benefits of UCG, such as lower surface impact and reduced greenhouse gas emissions, are promoting its adoption.

Australia's underground coal gasification sector is driven by the country's rich coal resources. The availability of vast coal reserves supports the feasibility and growth of UCG projects.

Government support, including research funding and supportive regulatory frameworks, is fostering the development and commercialization of UCG technology. The potential for export opportunities, as Australia looks to export UCG-derived synthetic gas to the international sector, is a significant driver for the realm.

India's underground coal gasification sector is driven by the country's increasing energy demand. Rapid industrialization, urbanization, and population growth are leading to a surge in energy consumption, making UCG a viable solution to meet this demand.

India's abundant coal reserves provide a substantial resource base for UCG projects. The need for energy security is another critical driver, as India seeks to reduce the reliance of the country on imported energy sources and enhance domestic energy production.

Government support through policies, incentives, and funding is fostering the development and adoption of UCG technology. The economic benefits like cost savings and job creation, are incentivizing investment in the underground coal gasification sector.

One of the primary reasons clean coal technology in in-situ coal gasification is gaining traction is its potential to significantly reduce emissions compared to traditional coal combustion methods.

This technology captures and utilizes gases that would otherwise be released into the atmosphere, thus reducing greenhouse gas emissions. This aligns with the growing emphasis on reducing carbon footprints and meeting international environmental standards.

The ability to integrate in-situ coal gasification with renewable energy sources is another technological advancement driving its popularity. Hybrid systems that combine clean coal technology with renewable energy sources like solar and wind can provide a more stable and sustainable energy supply.

This integration helps balance the energy grid and reduces dependence on fossil fuels. The development and implementation of clean coal technology in the underground coal gasification sector generate job opportunities and stimulate local economies.

From the construction of gasification plants to the operation and maintenance of these facilities, the technology supports employment and economic growth in the region. This economic benefit is particularly significant in rural and coal-rich areas.

Key players in the underground coal gasification industry expand using different key strategic initiatives that can help companies gain more space in the sector. With the help of product innovation, joint venturing, mergers, and acquisitions, the competitive landscape can be explored, gaining more share in the realm.

New entrants might struggle while facing a competitive force, which can be effectively mitigated using different strategies, including product innovations, strategic alliances, and many more.

The following key recent developments are known to shape the underground coal gasification industry size

SinoCoking Coal, Cougar Energy, Carbon Energy, Linc Energy, and ONGC are key competitors in the ecosystem.

China, India, ASEAN, Oceania, and Rest of Asia are the key contributing regions to the sector.

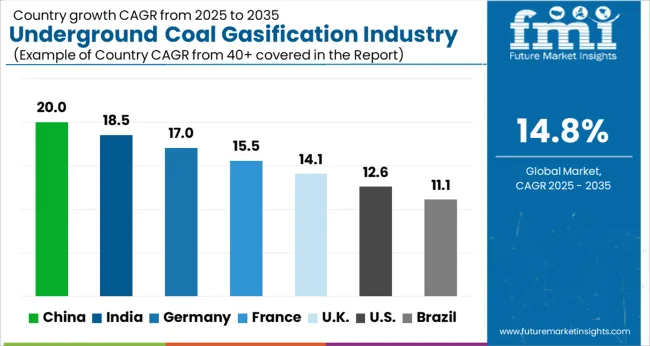

| Country | CAGR |

|---|---|

| China | 20.0% |

| India | 18.5% |

| Germany | 17.0% |

| France | 15.5% |

| UK | 14.1% |

| USA | 12.6% |

| Brazil | 11.1% |

The Underground Coal Gasification Industry Analysis in Asia Pacific is expected to register a CAGR of 14.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 20.0%, followed by India at 18.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 11.1%, yet still underscores a broadly positive trajectory for the global Underground Coal Gasification Industry Analysis in Asia Pacific. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 17.0%. The USA Underground Coal Gasification Industry Analysis in Asia Pacific is estimated to be valued at USD 289.2 million in 2025 and is anticipated to reach a valuation of USD 946.0 million by 2035. Sales are projected to rise at a CAGR of 12.6% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 44.1 million and USD 25.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 807.3 Million |

| Technology | Fixed Bed UCG, Moving Bed UCG, and Other Technologies |

| Application | Electricity Generation, Synthetic Fuel Production, Chemical Production, and Other Applications |

| End-User Industry | Power Generation, Chemicals, Fertilizers, Metals and Mining, and Other Industries |

| Gasification Method | Updraft Gasification, Downdraft Gasification, Crossdraft Gasification, and Other Methods |

| Operation Type | Continuous UCG, Intermittent UCG, and Other Operation Types |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Products & Chemicals, IncEnergy, Sasol, Siemens, Air Liquide, BASF, BP Plc, The Linde Group, General Electric, Haldor Topsoe, Royal Dutch Shell, Cougar Energy, Eskom Holdings, and Ergo Exergy Technologies |

The global underground coal gasification industry analysis in asia pacific is estimated to be valued at USD 807.3 million in 2025.

The market size for the underground coal gasification industry analysis in asia pacific is projected to reach USD 3,209.5 million by 2035.

The underground coal gasification industry analysis in asia pacific is expected to grow at a 14.8% CAGR between 2025 and 2035.

The key product types in underground coal gasification industry analysis in asia pacific are fixed bed ucg, moving bed ucg and other technologies.

In terms of application, electricity generation segment to command 37.5% share in the underground coal gasification industry analysis in asia pacific in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Underground Hydrogen Storage Market Size and Share Forecast Outlook 2025 to 2035

Underground Storage Tanks Market

Underground Service Locator Market

Underground Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Underground Mining Automation Market Size and Share Forecast Outlook 2025 to 2035

Underground Cabling EPC Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Underground Mining Equipment Market Share

North America Underground Mining Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Coal to Ethylene Glycol Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Coal Bed Methane Market Size and Share Forecast Outlook 2025 to 2035

Coal Briquettes Market Growth - Trends & Forecast 2025 to 2035

Coal Tar Pitch Market Demand & Growth 2024-2034

Coalingite Market

Coal Mine Ventilation Fans Market Size and Share Forecast Outlook 2025 to 2035

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Coal Cutter Pick for Mining Market Size and Share Forecast Outlook 2025 to 2035

Coal Gasification Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Charcoal-Based Detox Masks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Charcoal Briquettes Market Size and Share Forecast Outlook 2025 to 2035

Charcoal Bristle Toothbrush Market – Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA