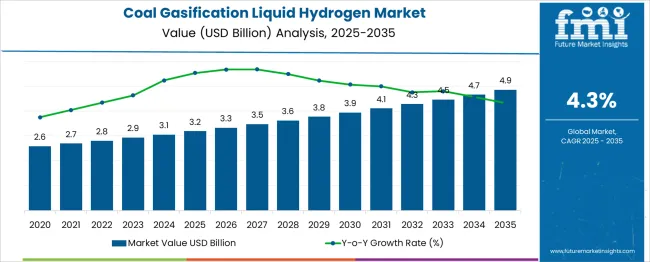

The coal gasification liquid hydrogen market is estimated to be valued at USD 3.2 billion in 2025. It is projected to reach USD 4.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period. Between 2020 and 2030, the market value increases from USD 2.6 billion to around USD 3.8 billion, reflecting an average annual growth rate of 4.6%. This phase of growth is driven by rising demand for clean hydrogen as an alternative fuel and feedstock in industrial applications, especially in refining, chemicals, and power generation. Coal gasification serves as a key technology for producing liquid hydrogen with lower carbon emissions compared to conventional methods. Regulatory emphasis on reducing greenhouse gas emissions and transitioning to low-carbon energy sources further supports market expansion.

Advancements in gasification technologies and carbon capture and storage (CCS) integration contribute to improved efficiency and environmental compliance. From 2030 to 2035, the market accelerates from USD 3.9 billion to USD 4.9 billion, propelled by increasing investments in hydrogen infrastructure, growing adoption in fuel cell applications, and expanded utilization across industrial sectors. Emerging economies display significant market uptake due to industrial growth and energy diversification efforts. The market is evolving in response to changing energy policies, technological innovation, and environmental mandates, with sustained growth expected through 2035 driven by a global push for cleaner energy and sustainable hydrogen production.

| Metric | Value |

|---|---|

| Coal Gasification Liquid Hydrogen Market Estimated Value in (2025 E) | USD 3.2 billion |

| Coal Gasification Liquid Hydrogen Market Forecast Value in (2035 F) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The coal gasification liquid hydrogen market secures an essential position within the broader hydrogen economy, accounting for approximately 18–20% of total hydrogen production capacity, driven by its integration in large-scale industrial energy projects. Within the low-carbon hydrogen generation segment, this market holds a share of nearly 12–14%, reflecting its strategic relevance for decarbonizing heavy industries such as steel, refining, and power generation. In the synthetic fuel and chemicals value chain, coal gasification-derived hydrogen contributes about 10–12%, as it serves as a critical feedstock for methanol, ammonia, and Fischer–Tropsch liquids. Its share in the emerging mobility hydrogen supply chain is estimated at 6–8%, primarily for liquid hydrogen fueling infrastructure targeting long-haul trucking and maritime applications.

Growth is reinforced by the scalability of coal gasification plants and their ability to integrate carbon capture, utilization, and storage (CCUS) technologies, reducing lifecycle emissions to meet stricter climate goals. Technological upgrades such as membrane-based separation and advanced gas-cleaning processes are improving efficiency and cost profiles, making coal-derived hydrogen more competitive compared to natural gas-based blue hydrogen. Despite environmental concerns, this pathway remains viable in coal-rich economies aiming to diversify their energy mix and meet hydrogen demand without relying entirely on renewable generation. Strategic investments in hybrid configurations, combining coal gasification with biomass or renewable power, are further shaping the market outlook, positioning coal gasification liquid hydrogen as a transitional enabler in global clean energy transformation efforts.

The distribution infrastructure market is progressing steadily, underpinned by the growing demand for efficient delivery systems across critical industries. As economies expand and industrialization accelerates, there has been a substantial push toward upgrading and modernizing distribution networks. Governments and private stakeholders are increasingly investing in long-term infrastructure plans that emphasize resilience, safety, and adaptability.

Emerging technologies such as remote monitoring, automated control systems, and predictive maintenance are being integrated into distribution frameworks, enhancing operational efficiency. The convergence of energy transition goals, rising urbanization, and regulatory mandates around reliability and safety is shaping the future of this market.

Expansion in emerging economies and refurbishment in developed regions are paving new opportunities. With growing attention on reducing losses and ensuring uninterrupted supply, distribution infrastructure remains a cornerstone in supporting both economic growth and energy security globally..

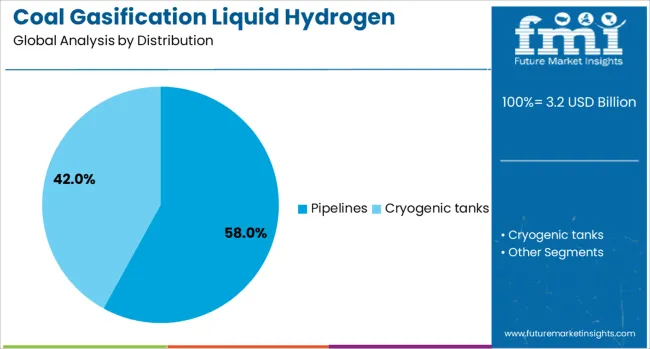

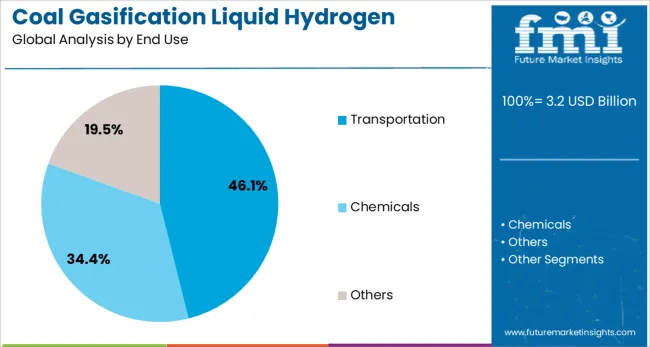

The coal gasification liquid hydrogen market is segmented by distribution, end use, and geographic regions. The coal gasification liquid hydrogen market is divided into Pipelines and Cryogenic tanks. In terms of end use, the coal gasification liquid hydrogen market is classified into Transportation, Chemicals, and Others. Regionally, the coal gasification liquid hydrogen industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pipelines segment is projected to account for 58% of the Distribution Infrastructure market revenue share in 2025, marking it as the leading end use. This dominance has been driven by the high-volume, continuous transport capability that pipelines offer, especially in sectors dealing with oil, gas, and water.

Their operational cost efficiency, reduced environmental footprint compared to road or rail alternatives, and safety benefits have led to their widespread adoption across regional and transnational networks. The integration of digital monitoring technologies and automation into pipeline systems has enabled real-time data tracking and predictive maintenance, which has enhanced reliability and reduced downtime.

Regulatory emphasis on safer, leak-proof infrastructure has further accelerated modernization and new pipeline installations. As industries strive for sustainable and cost-effective transport solutions, pipelines continue to be prioritized for their long-term utility, scalability, and strategic role in securing uninterrupted supply chains..

The transportation segment is expected to hold 46.10% of the Distribution Infrastructure market revenue share in 2025, placing it among the top contributors in terms of end use. The segment's strong position has been influenced by the global surge in demand for logistics optimization and just-in-time delivery systems. With the expansion of e-commerce, international trade, and last-mile connectivity services, transportation networks have required advanced distribution systems that can manage high volumes and complex routing.

The adoption of intelligent transport systems, smart logistics, and integrated traffic management platforms has further strengthened the capabilities of this segment. Public and private sector investments aimed at enhancing connectivity and reducing delivery delays have reinforced infrastructure development in road, rail, and air transport.

Additionally, the shift toward electric vehicles and cleaner fuels has triggered the need for supporting distribution systems to adapt accordingly. The commercial significance of timely delivery and operational fluidity has secured transportation’s vital role within the broader distribution ecosystem..

Coal gasification liquid hydrogen market growth is driven by CCS integration, industrial demand, and energy security strategies in coal-rich economies. Strategic collaborations and government-backed initiatives are shaping its global expansion trajectory.

The coal gasification liquid hydrogen market is gaining traction due to increasing demand for low-carbon energy sources across power generation, steelmaking, and chemical industries. This demand is fueled by national hydrogen roadmaps and industrial decarbonization targets that require large-scale hydrogen availability. Coal gasification, when integrated with carbon capture and storage (CCS), provides a competitive pathway to produce hydrogen at scale while addressing emission reduction commitments. Emerging economies with abundant coal reserves are prioritizing this approach to reduce dependency on imported natural gas. Government funding for clean hydrogen projects and long-term supply contracts with industrial consumers further strengthen market adoption during the forecast period.

The integration of carbon capture systems into coal gasification plants is a significant driver for market growth. Advanced CCS frameworks allow these plants to achieve compliance with tightening carbon emission norms, making them viable in the low-emission hydrogen economy. Global projects are increasingly adopting pre-combustion and post-combustion carbon capture solutions to ensure that coal-based hydrogen aligns with regulatory requirements. Investments in carbon sequestration infrastructure and cross-border carbon trading mechanisms further improve the attractiveness of this pathway. These developments enable coal gasification liquid hydrogen to remain competitive against natural gas-based blue hydrogen in terms of lifecycle emissions and operational efficiency.

The ability of coal gasification hydrogen systems to support large-scale industrial operations, including refining, ammonia production, and synthetic fuels, makes this technology essential for strategic energy security. Countries with limited renewable energy penetration but abundant coal resources are adopting this solution to meet growing hydrogen demand without major disruptions to energy infrastructure. This approach also mitigates exposure to volatile LNG prices, offering cost stability for industrial consumers. In addition, the development of hydrogen liquefaction and storage systems supports its integration into maritime transport and heavy-duty mobility, reinforcing coal-based hydrogen’s role in the global energy transition landscape.

The market is witnessing active participation from energy majors and technology providers focusing on coal gasification and hydrogen production. Companies are forming strategic partnerships with governments and industrial end-users to develop large-scale integrated projects combining gasification, CCS, and hydrogen liquefaction technologies. Asia-Pacific remains a key growth hub, driven by China’s and India’s investments in hydrogen valleys and coal-based synthetic fuel projects. North America and the Middle East are also exploring similar models with an emphasis on decarbonized hydrogen exports. Competitive differentiation centers on improving process efficiency, reducing carbon intensity, and leveraging policy incentives. These strategies position coal gasification as a transitional yet critical hydrogen pathway.

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| Uk | 4.1% |

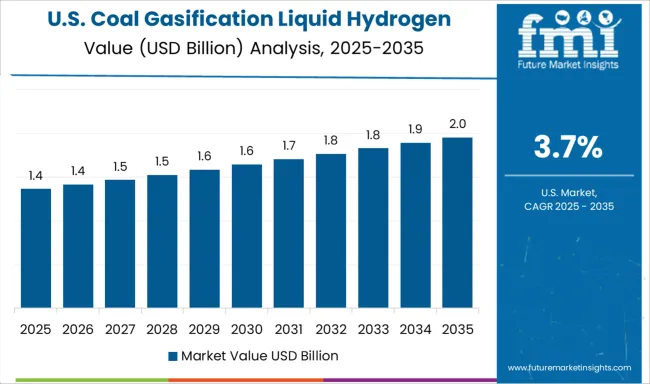

| USA | 3.7% |

| Brazil | 3.2% |

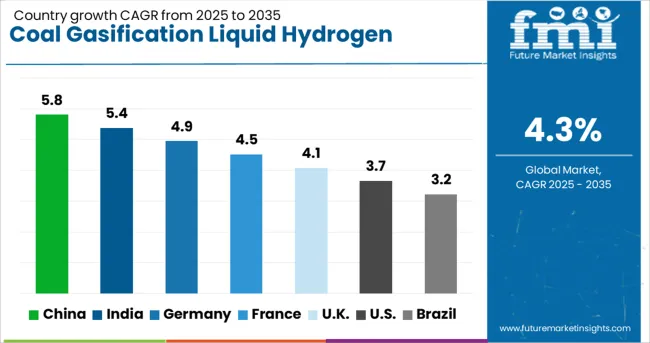

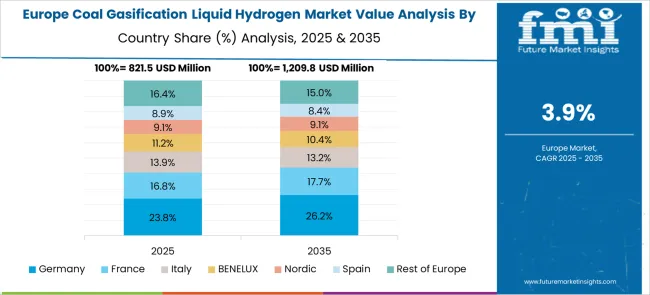

The coal gasification liquid hydrogen market is projected to grow at a global CAGR of 4.3% between 2025 and 2035, supported by rising demand for low-emission hydrogen, integration of carbon capture technologies, and the need for scalable hydrogen supply in industrial applications. China leads with a CAGR of 5.8%, driven by large-scale investments in clean coal technologies, government-backed hydrogen projects, and its strong emphasis on energy security through domestic coal utilization. India follows at 5.4%, fueled by hydrogen blending targets in refining and steel sectors, alongside strategic partnerships for CCS-enabled coal gasification plants. France records a CAGR of 4.5%, supported by pilot projects for low-carbon hydrogen production and EU incentives for industrial decarbonization. The United Kingdom grows at 4.1%, underpinned by funding for hydrogen economy development and hybrid gasification-CCS demonstration projects. The United States posts a CAGR of 3.7%, shaped by initiatives to retrofit existing coal facilities with hydrogen co-production capabilities and integrate liquefaction systems for export markets. The analysis spans more than 40 countries, with these five serving as benchmarks for strategic positioning and investment opportunities in coal-derived hydrogen solutions.

The CAGR for China’s coal gasification liquid hydrogen market was approximately 4.1% during 2020–2024 and is projected to rise to 5.8% between 2025 and 2035, reflecting a strong acceleration in growth. The initial phase saw moderate progress, driven mainly by pilot hydrogen generation projects and early adoption of carbon capture technology in select coal-based facilities. The next decade will see robust expansion, supported by China’s national hydrogen strategy, heavy investments in integrated gasification combined cycle (IGCC) plants, and increasing demand from refining and chemical sectors. Government incentives and large-scale liquefaction infrastructure developments further reinforce its position as the global leader.

India recorded a CAGR of nearly 3.9% during 2020–2024, which is projected to improve to 5.4% for 2025–2035, indicating significant growth momentum. Early adoption was hampered by high capital costs and reliance on imported technologies, limiting large-scale deployment of coal gasification units. The sharp rise in the next decade stems from government hydrogen blending targets for refineries, financial incentives for low-carbon hydrogen, and technology collaborations with global EPC firms. Expansion of coal-to-hydrogen hubs and increased deployment of carbon capture solutions will play a key role in ensuring cost competitiveness while meeting emission reduction goals.

France posted a CAGR of 3.3% in 2020–2024, which is forecasted to advance to 4.5% during 2025–2035, reflecting a steady rise in adoption. The initial growth was constrained due to preference for green hydrogen and limited investment in coal-based pathways. However, increased focus on energy security and integration of CCS technology in existing thermal facilities is enabling the expansion of low-carbon hydrogen production. France is leveraging EU-backed funds for decarbonization projects, creating opportunities for hybrid hydrogen production models combining coal gasification and renewable electricity-based solutions.

The CAGR for the UK coal gasification liquid hydrogen market was around 3.1% during 2020–2024 and is projected to increase to 4.1% for 2025–2035, showing a notable upward trend. Earlier growth was limited by higher operating costs and slower project approvals, which curtailed capacity additions. Post-2024, the market benefits from government-backed hydrogen economy programs, investments in CCS infrastructure, and large-scale demonstration projects for synthetic fuel and hydrogen blending in power plants. Partnerships with technology providers are accelerating system efficiency, making coal-based hydrogen viable as part of the UK’s low-carbon energy strategy.

The USA market posted a CAGR of 2.8% during 2020–2024, projected to climb to 3.7% between 2025 and 2035, indicating gradual yet steady progress. Early development was modest as green hydrogen dominated policy frameworks, overshadowing coal-based options. The next phase of growth is supported by retrofitting existing coal power plants with gasification and CCS systems, combined with federal funding for clean hydrogen initiatives. Hydrogen liquefaction infrastructure to support exports and the trucking sector will further drive adoption in select states with abundant coal resources.

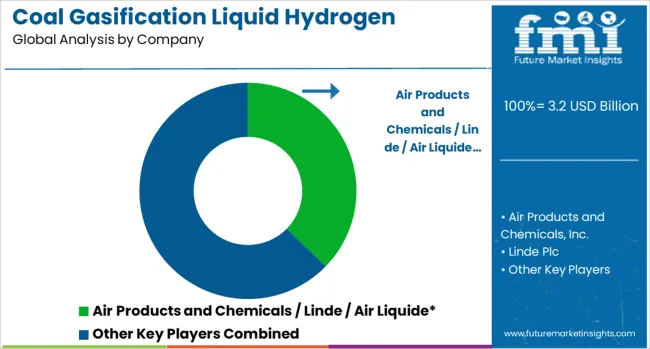

The coal gasification liquid hydrogen market features a highly competitive landscape dominated by global energy corporations, industrial gas suppliers, and engineering solution providers. Air Products and Chemicals, Inc., Linde Plc, and Air Liquide S.A. lead the segment with large-scale hydrogen production, liquefaction technologies, and integrated supply chain services for industrial and mobility applications. General Electric Power plays a strategic role in providing gasification and power generation solutions, while Iwatani Corporation focuses on hydrogen storage and distribution infrastructure to support transport and energy systems. J-Power and Kawasaki Heavy Industries, Ltd. drive innovation in gasification technology and hydrogen transport vessels, enabling cost-effective deployment across domestic and export markets.

Engineering and EPC giants like KBR, Inc. offer turnkey coal-to-hydrogen plant solutions, emphasizing process optimization and CCS integration. Loy Yang Power leverages coal-rich assets to scale hydrogen production in Australia, while Messer contributes to industrial gas solutions for downstream hydrogen utilization. Energy leaders such as Shell Global and Sinopec are investing heavily in hybrid energy projects, combining coal gasification with renewable integration and carbon capture to meet emission compliance targets. Competitive differentiation revolves around reducing production costs, securing long-term hydrogen supply contracts, and scaling liquefaction capacity for heavy-duty mobility and export hubs. Strategic alliances, technology licensing, and government-backed hydrogen programs shape market trajectories, with Asia-Pacific emerging as the focal point for coal-based hydrogen development. This dynamic ecosystem positions coal gasification as a transitional yet crucial pathway for achieving global hydrogen economy goals.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Distribution | Pipelines and Cryogenic tanks |

| End Use | Transportation, Chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Products and Chemicals / Linde / Air Liquide*, Air Products and Chemicals, Inc., Linde Plc, Air Liquide S.A., General Electric Power, Iwatani Corporation, J‑Power, Kawasaki Heavy Industries, Ltd, KBR, Inc, Loy Yang Power, Messer, Shell Global, and Sinopec |

The global coal gasification liquid hydrogen market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the coal gasification liquid hydrogen market is projected to reach USD 4.9 billion by 2035.

The coal gasification liquid hydrogen market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in coal gasification liquid hydrogen market are pipelines and cryogenic tanks.

In terms of end use, transportation segment to command 46.1% share in the coal gasification liquid hydrogen market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coal Mine Ventilation Fans Market Size and Share Forecast Outlook 2025 to 2035

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Coal Cutter Pick for Mining Market Size and Share Forecast Outlook 2025 to 2035

Coal to Ethylene Glycol Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Coal Bed Methane Market Size and Share Forecast Outlook 2025 to 2035

Coal Briquettes Market Growth - Trends & Forecast 2025 to 2035

Coal Tar Pitch Market Demand & Growth 2024-2034

Coalingite Market

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Charcoal-Based Detox Masks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Charcoal Briquettes Market Size and Share Forecast Outlook 2025 to 2035

Charcoal Bristle Toothbrush Market – Trends, Growth & Forecast 2025 to 2035

Clean Coal Technology Market Growth - Trends & Forecast 2025 to 2035

BBQ Charcoal Market Growth - Trends & Forecast 2025 to 2035

Wood Charcoal Market Trends & Forecast 2024-2034

White Charcoal Powder Market Size, Growth, and Forecast for 2025 to 2035

Active Charcoal Complexes Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Underground Coal Gasification Industry Analysis in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Electrostatic Coalescers Market Growth - Trends & Forecast 2025 to 2035

Activated Charcoal Supplements Market Trends - Sales & Industry Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA