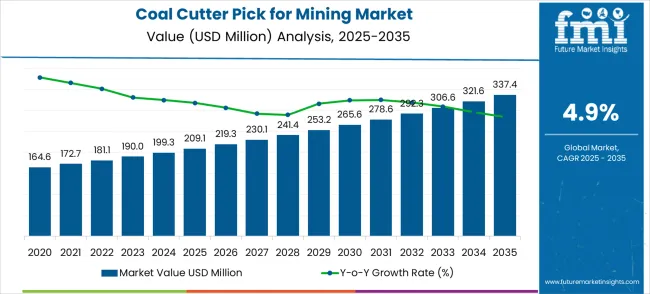

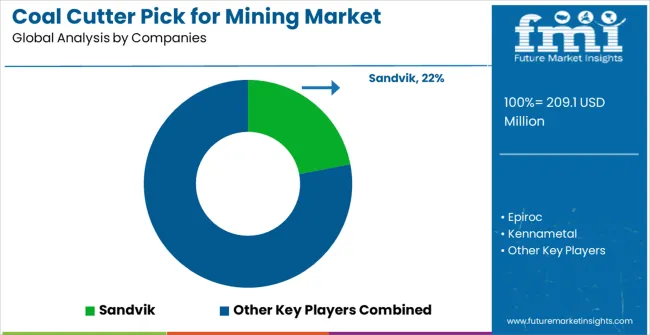

The global coal cutter pick for mining market is projected to reach USD 337.4 million by 2035, recording an absolute increase of USD 128.3 million over the forecast period. The market is valued at 209.1 million in 2025 and is set to rise at a CAGR of 4.9% during the assessment period. The overall market size is expected to grow by nearly 1.61 times during the same period, supported by increasing demand for efficient coal mining equipment and underground mining expansion across coal-producing regions. Market expansion faces constraints from environmental regulations and declining coal consumption in developed markets.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 209.1 million |

| Market Forecast Value (2035) | USD 337.4 million |

| Forecast CAGR (2025-2035) | 4.9% |

Between 2025 and 2030, the coal cutter pick for mining market is projected to expand from USD 209.1 million to USD 265.6 million, resulting in a value increase of USD 56.5 million, which represents 44.1% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for efficient underground mining tools in coal extraction operations, product innovation in high-strength steel materials and wear-resistant coating technologies, and expanding applications across coal cutting machinery, roadheader equipment, and specialized milling machines. Companies are establishing competitive positions through investment in metallurgical research and development, strategic mining industry partnerships, and market expansion across coal mining regions, equipment manufacturers, and specialized cutting tool distributors.

From 2030 to 2035, the market is forecast to grow from USD 265.6 million to USD 337.4 million, adding another USD 71.8 million, which constitutes 55.9% of the overall ten-year expansion. This period is expected to be characterized by expansion of specialized cutting tool solutions including advanced carbide-tipped picks and smart monitoring systems tailored for specific mining applications, strategic collaborations between tool manufacturers and mining equipment producers, and enhanced integration with automated mining systems and digital mine management platforms. The growing emphasis on mining efficiency and operational cost reduction will drive demand for high-performance coal cutter picks across diverse underground mining and coal extraction applications.

The coal cutter pick for mining market grows by enabling mining operators to achieve efficient coal extraction while reducing equipment downtime and operational costs through superior cutting tool performance. Demand drivers include expanding underground coal mining operations requiring durable cutting tools, increasing focus on mining productivity and operational efficiency driving adoption of high-performance picks, and growing applications in mechanized coal mining where advanced cutting tools support automated extraction systems. Priority segments include underground coal mines and mining equipment manufacturers, with China and India representing key growth geographies due to their substantial coal mining activities and ongoing mining infrastructure development. Market growth faces constraints from environmental regulations affecting coal mining expansion and the global transition toward renewable energy sources impacting long-term coal demand.

The Coal Cutter Pick for Mining market is entering a phase of selective growth, driven by demand for mining efficiency enhancement, expanding coal operations in emerging markets, and evolving underground mining technology standards. By 2035, these pathways together can unlock USD 450-580 million in incremental revenue opportunities beyond baseline growth.

Pathway A - Coal Cutter Application Leadership (Primary Mining Operations) The coal cutter segment already holds the largest share due to its critical role in coal extraction processes. Expanding carbide tip technology, enhanced wear resistance, and optimized cutting geometries can consolidate leadership. Opportunity pool: USD 140-180 million.

Pathway B - 42CrMo Steel Material Dominance (High-Performance Applications) 42CrMo steel applications account for significant market demand. Growing requirements for durable cutting tools, especially in challenging mining conditions, will drive higher adoption of advanced steel grades. Opportunity pool: USD 110-140 million.

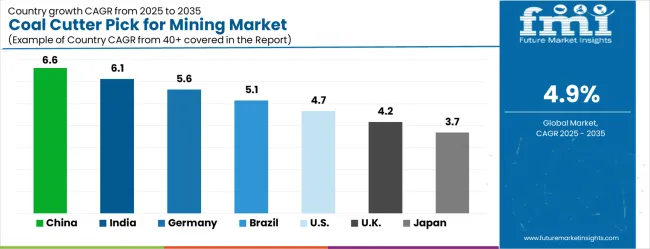

Pathway C - Asia-Pacific Market Expansion (China & India Growth) China and India present the highest growth potential with CAGRs of 6.6% and 6.1% respectively. Targeting expanding coal mining operations and government-supported mining infrastructure will accelerate adoption. Opportunity pool: USD 90-115 million.

Pathway D - Roadheader Applications (Tunneling and Development) Roadheader and specialized mining applications represent significant growth potential with increasing underground development and tunneling operations. Opportunity pool: USD 60-75 million.

Pathway E - Advanced Material Innovation With increasing demand for longer-lasting tools, there is an opportunity to promote bainitic steel and advanced alloy solutions optimized for extreme mining conditions. Opportunity pool: USD 40-50 million.

Pathway F - Smart Tool Integration Tools with integrated monitoring capabilities, RFID tracking, and predictive maintenance features offer premium positioning for technologically advanced mining operations. Opportunity pool: USD 25-32 million.

Pathway G - Service & Support Revenue Tool refurbishment services, rapid replacement programs, and technical support services create additional revenue streams across global mining markets. Opportunity pool: USD 18-23 million.

Pathway H - Milling Machine Applications Specialized cutting tools for surface preparation and precision mining applications can capture emerging mining technology adoption. Opportunity pool: USD 12-15 million.

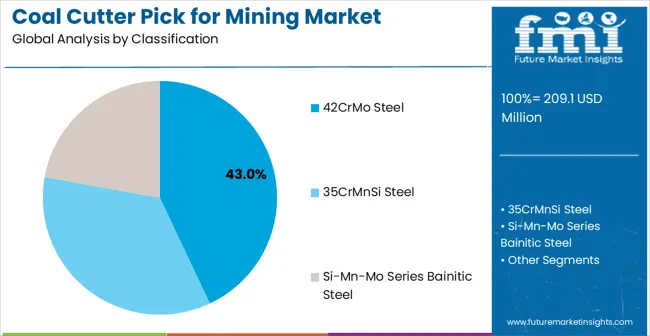

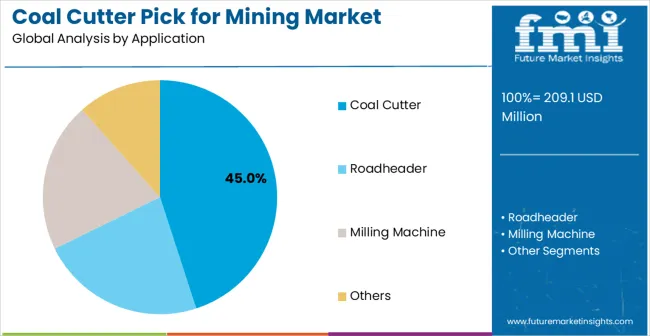

The market is segmented by material type, application, end-user, mining method, and region. By material type, the market is divided into 42CrMo steel, 35CrMnSi steel, Si-Mn-Mo series bainitic steel, and others. Based on application, the market is categorized into coal cutter, roadheader, and milling machine applications. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

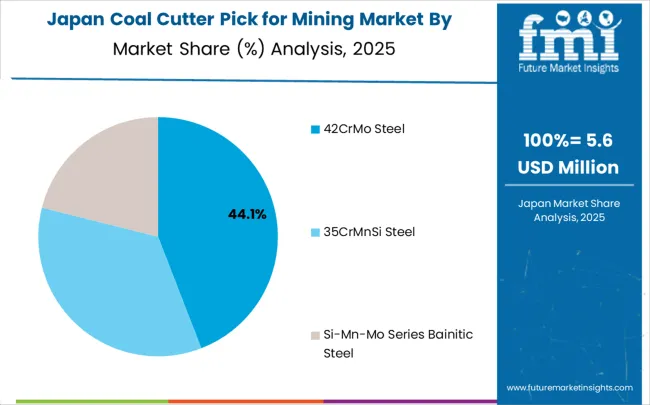

42CrMo steel is projected to account for a substantial portion of 43% of the coal cutter pick for mining market in 2025. This share is supported by superior hardness characteristics and excellent wear resistance properties. 42CrMo steel provides optimal balance between toughness and durability that enables mining operators to maintain cutting efficiency while minimizing pick replacement frequency. The segment enables stakeholders to benefit from reduced operational costs and improved mining productivity for demanding underground coal extraction applications.

Key factors supporting 42CrMo steel adoption:

Coal cutter applications are expected to represent the largest share of 45% of the coal cutter pick for mining applications in 2025. This dominant share reflects the critical role of specialized cutting picks in coal extraction machinery that appeals to underground mining operators and equipment manufacturers. The segment provides essential cutting tool support for longwall mining systems, continuous miners, and coal cutting equipment in underground mining operations. Growing mechanization in coal mining and increasing demand for efficient coal extraction drives adoption in this application area.

Coal Cutter segment advantages include:

Market drivers include expanding underground coal mining operations requiring efficient cutting tools for productive coal extraction, increasing mechanization in mining operations driving demand for high-performance picks, and growing adoption in developing markets where coal remains a primary energy source supporting mining infrastructure development. These drivers reflect direct mining operator outcomes including improved extraction efficiency, reduced equipment downtime, and enhanced operational cost-effectiveness across multiple coal mining applications.

Market restraints encompass environmental regulations limiting coal mining expansion in developed markets, global energy transition toward renewable sources reducing long-term coal demand, and high-quality raw material costs affecting manufacturing economics for premium cutting tools. Additional constraints include technical complexity in developing advanced metallurgical solutions and competition from alternative mining methods that may require different cutting tool specifications.

Key trends show adoption stabilizing in developed markets while growing in emerging economies where coal mining expansion continues, with technology shifts toward carbide-tipped solutions and smart monitoring capabilities enabling enhanced tool performance tracking. Innovation focuses on advanced metallurgy and coating technologies that extend tool life and improve cutting efficiency. Market thesis faces risk from accelerating renewable energy adoption that could reduce coal mining demand faster than anticipated.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| Brazil | 5.1% |

| USA | 4.7% |

| UK | 4.2% |

| Japan | 3.7% |

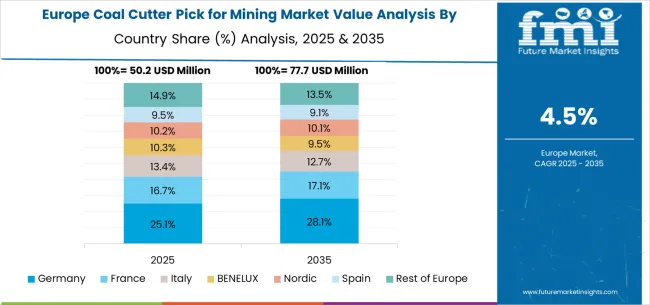

The coal cutter picks for mining market shows varied growth dynamics across key countries from 2025-2035. China leads globally with a CAGR of 6.6%, fueled by substantial underground coal mining operations, ongoing mining mechanization initiatives, and domestic coal demand supporting continued mining infrastructure development. India follows closely at 6.1%, driven by expanding coal production capacity, growing energy demand, and government initiatives supporting domestic coal mining development. Germany remains Europe's growth engine with 5.6%, leveraging its advanced mining technology sector and expertise in underground mining equipment manufacturing. Brazil records 5.1%, reflecting opportunities in coal mining development and mining technology adoption despite environmental considerations. The United States maintains moderate expansion at 4.7%, supported by specialized coal mining operations and advanced mining technology applications. Growth in the United Kingdom (4.2%) and Japan (3.7%) remains stable, backed by established mining technology industries and specialized mining applications, though comparatively slower due to declining coal production and energy transition policies.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the coal cutter pick for mining market with its massive coal mining sector and substantial investment in mining mechanization technologies. The market is projected to grow at a CAGR of 6.6% through 2035, driven by extensive underground coal mining operations, ongoing mining equipment modernization programs, and expanding coal production capacity across major coal-producing regions in Shanxi, Inner Mongolia, and Shaanxi provinces. Chinese coal mining companies and equipment manufacturers are adopting advanced coal cutter picks for productivity improvement and operational efficiency applications, with particular emphasis on domestic manufacturing capabilities and cost-effective solutions. Government support for mining technology development and energy security initiatives expand opportunities in underground mining equipment and cutting tool manufacturing sectors.

Coal cutter pick for mining market in India reflects strong potential based on expanding coal production requirements and increasing mining mechanization adoption. The market is projected to grow at a CAGR of 6.1% through 2035, with growth accelerating through mining productivity improvement under operational efficiency constraints, particularly in underground coal mining and mechanized extraction applications in Jharia, Korba, and Singareni mining regions. Indian coal mining companies and equipment suppliers are adopting coal cutter picks for production capacity enhancement and mining efficiency projects, with growing emphasis on technology transfer and local manufacturing development. Government coal mining expansion programs and energy security initiatives expand access to advanced mining technologies and technical support services.

Germany demonstrates established strength in the coal cutter pick for mining market through its advanced mining technology sector and robust underground mining expertise. The market shows solid growth at a CAGR of 5.6% through 2035, with established mining technology companies and equipment manufacturers driving innovation in North Rhine-Westphalia, Saarland, and Saxony regions. German mining technology companies focus on high-precision cutting tools and advanced materials applications, particularly in specialized underground mining and mining equipment manufacturing requiring superior quality standards. The country's strong engineering capabilities and established mining technology expertise support consistent market development across European and international mining markets.

Coal cutter pick for mining market in Brazil shows moderate growth potential at a CAGR of 5.1% through 2035, driven by expanding mining operations and growing demand for mining mechanization solutions. The market benefits from increasing mining activity and infrastructure development programs, with particular strength in coal mining and mineral extraction applications. Brazilian mining companies and equipment suppliers adopt coal cutter picks for operational efficiency improvement and mining productivity enhancement, addressing both domestic energy needs and export market requirements. Market development benefits from mining sector investment despite environmental considerations and regulatory challenges affecting coal mining expansion.

The United States maintains steady growth in the coal cutter pick for mining market through its established mining technology sector and specialized underground mining operations. Market expansion at a CAGR of 4.7% through 2035 reflects consistent demand from underground coal mines, mining equipment manufacturers, and specialized mining applications requiring high-performance cutting tools. American mining companies utilize coal cutter picks across Appalachian coal mining, western coal operations, and specialized underground applications, with particular emphasis on safety compliance and operational efficiency. The country's advanced mining technology infrastructure and established supplier networks support stable market conditions and continued technology development.

The United Kingdom demonstrates steady progress in the coal cutter pick for mining market with a CAGR of 4.2% through 2035, supported by established mining technology companies and specialized mining applications. British mining technology firms and equipment suppliers adopt coal cutter picks for specialized mining projects and equipment manufacturing applications, with particular focus on advanced materials and precision engineering capabilities. The market benefits from established mining technology expertise and strong relationships with international mining equipment suppliers. Development remains consistent across specialized mining applications despite reduced domestic coal mining activity and energy transition policies.

Coal cutter pick for mining market in Japan shows steady development with a CAGR of 3.7% through 2035, as established mining technology companies and equipment manufacturers maintain demand for high-quality cutting tools. Market growth reflects mature market conditions and established technology standards across specialized mining equipment and precision manufacturing sectors. Japanese companies utilize coal cutter picks for mining equipment manufacturing and export applications, particularly in advanced materials and precision engineering requiring superior quality control. The market benefits from domestic mining technology expertise and strong technical support infrastructure, with steady growth supported by international mining equipment exports and specialized applications.

The coal cutter pick for mining market operates with a moderately concentrated structure featuring approximately 15-18 meaningful players, with the top five companies holding roughly 55-60% market share. Competition centers on product durability, metallurgical expertise, and global distribution capabilities rather than price competition alone. Market leaders include Sandvik, Epiroc, and Kennametal, which maintain competitive positions through established mining industry relationships, comprehensive product portfolios, and strong research and development capabilities in advanced materials. These companies benefit from scale advantages in manufacturing, extensive global distribution networks, and established relationships with mining equipment manufacturers and underground mining operations worldwide.

Secondary tier companies include Luoyang Golden, SHAREATE, and Shandong Techgong Geotechnical, which compete through regional market focus, competitive pricing strategies, and specialized applications expertise. These companies differentiate through local market knowledge, rapid response capabilities, and customized solutions for specific mining applications and equipment configurations.

Additional players including Duerbert, Kings Rock Tools, Kelleg, and Plato Solution contribute to market dynamics through niche market specialization, innovative material solutions, and targeted customer service approaches in specific mining segments or geographic regions.

The competitive landscape reflects the specialized nature of mining cutting tools, with companies requiring significant expertise in metallurgy, heat treatment processes, quality control systems, and understanding of harsh underground mining conditions. Market participants differentiate through steel grade selections, coating technologies, carbide tip configurations, and tool geometry optimization that influence cutting performance and tool life.

Competition intensifies around innovation in advanced materials and smart tool technologies, with companies investing in carbide technology, wear-resistant coatings, and tool condition monitoring systems that improve mining productivity and reduce operational costs. Market dynamics reflect the importance of technical support services, rapid replacement availability, and comprehensive field support that influence mining operator relationships. Strategic partnerships with mining equipment manufacturers and geographic expansion into emerging coal mining markets shape competitive positioning across different regional segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 209.1 million |

| Material Type | 42CrMo Steel, 35CrMnSi Steel, Si-Mn-Mo Series Bainitic Steel |

| Application | Coal Cutter, Roadheader, Milling Machine, and Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ additional countries |

| Key Companies Profiled | Sandvik, Epiroc, Kennametal, Luoyang Golden, SHAREATE, Shandong Techgong Geotechnical, Duerbert, Kings Rock Tools, Kelleg, Plato Solution |

| Additional Attributes | Dollar sales by application categories, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging companies, adoption patterns across underground mining operations and equipment manufacturers, integration with automated mining systems and digital mine management, innovations in advanced metallurgy and carbide tip technology, and development of smart monitoring platforms with enhanced tool life optimization capabilities. |

The global coal cutter pick for mining market is estimated to be valued at USD 209.1 million in 2025.

The market size for the coal cutter pick for mining market is projected to reach USD 337.4 million by 2035.

The coal cutter pick for mining market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in coal cutter pick for mining market are 42crmo steel, 35crmnsi steel and si-mn-mo series bainitic steel.

In terms of application, coal cutter segment to command 45.0% share in the coal cutter pick for mining market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coal Mine Ventilation Fans Market Size and Share Forecast Outlook 2025 to 2035

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

Pick to Light Market Size and Share Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Mining Pneumatic Saw Market Size and Share Forecast Outlook 2025 to 2035

Coal to Ethylene Glycol Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Pick and Place Machines Market Size and Share Forecast Outlook 2025 to 2035

Coal Bed Methane Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Coal Gasification Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Mining Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Pick Fill Seal Machines Market Size, Share & Forecast 2025 to 2035

Mining Shovel Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coal Briquettes Market Growth - Trends & Forecast 2025 to 2035

Mining Flotation Chemicals Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA