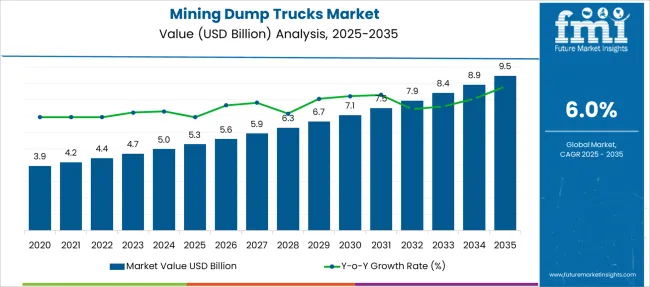

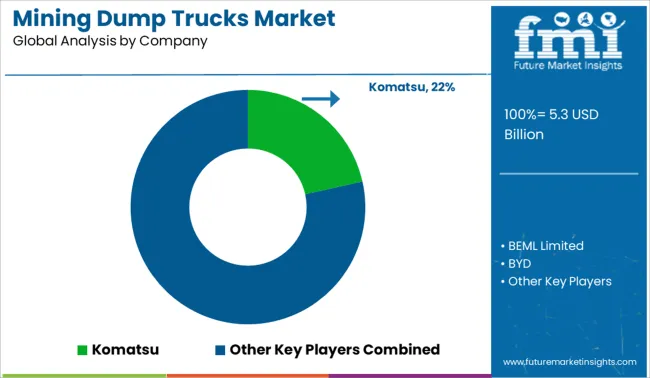

The Mining Dump Trucks Market is estimated to be valued at USD 5.3 billion in 2025 and is projected to reach USD 9.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Mining Dump Trucks Market Estimated Value in (2025 E) | USD 5.3 billion |

| Mining Dump Trucks Market Forecast Value in (2035 F) | USD 9.5 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The mining dump trucks market is experiencing strong growth due to the increasing demand for efficient material handling in mining operations worldwide. Expansion in mining activities driven by the need for minerals and metals has created a need for robust, high-capacity trucks capable of handling tough terrain and heavy loads.

Technological advancements have enhanced truck performance, safety, and fuel efficiency, which are critical factors in reducing operational costs. The adoption of automation and telematics has further improved fleet management and operational productivity.

The market outlook remains positive as mining companies continue to invest in equipment upgrades to meet environmental regulations and optimize resource extraction. Segmental growth is expected to be led by rigid truck types known for their durability, all-wheel drive configurations that provide superior traction, and internal combustion engine propulsion systems that balance power and reliability.

The market is segmented by Type, Drive Configuration, and Propulsion System and region. By Type, the market is divided into Rigid, Below 50 metric tons, 50 metric tons and above, Articulated, 50-100 metric tons, 101-150 metric tons, 151-200 metric tons, 201-250 metric tons, 251-300 metric tons, and Above 300 metric tons.

In terms of Drive Configuration, the market is classified into All-wheel Drive (AWD), Two-wheel Drive (2WD), and Four-wheel Drive (4WD). Based on Propulsion System, the market is segmented into ICE, Electric, and Hybrid. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

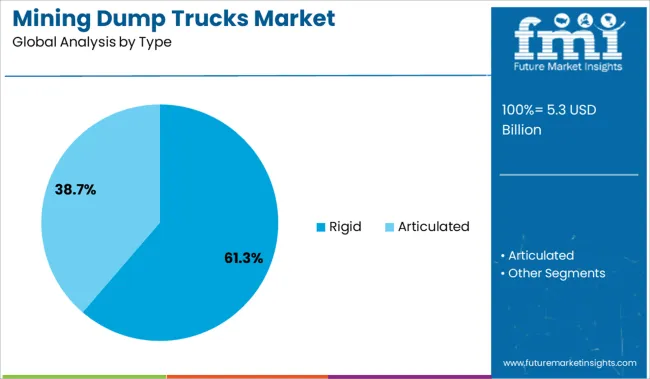

The rigid segment is projected to account for 61.3% of the mining dump trucks market revenue in 2025, maintaining its dominance as the preferred truck type. Rigid dump trucks are favored for their robust construction and ability to carry heavier payloads over rough mining terrain. Their structural strength and ease of maintenance make them suitable for large-scale mining operations requiring high productivity.

Additionally, their design facilitates better load distribution and stability, which enhances safety and operational efficiency. The widespread use of rigid trucks in surface mining and quarrying operations has reinforced this segment’s market leadership.

As mining projects grow in scale and complexity rigid dump trucks are expected to continue dominating the market.

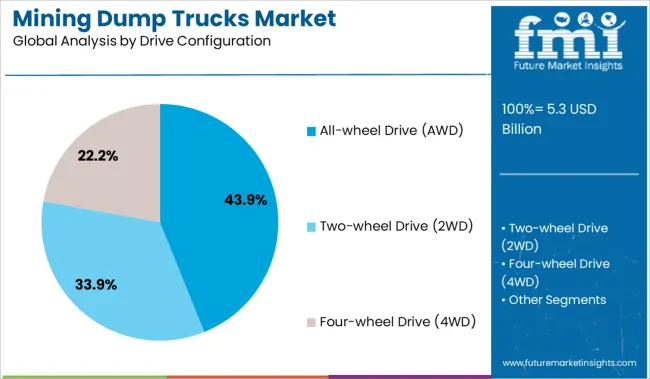

The all-wheel drive segment is expected to contribute 43.9% of the market revenue in 2025, securing its position as the leading drive configuration. AWD systems provide superior traction and maneuverability on uneven and slippery surfaces commonly found in mining environments. This drive configuration enhances the vehicle’s ability to navigate challenging terrain while maintaining stability under heavy loads.

Mining operations have increasingly adopted AWD trucks to minimize downtime caused by difficult ground conditions and to improve overall haulage efficiency.

The flexibility and reliability of AWD systems have made them the preferred choice for mining fleets operating in diverse geographic regions. The segment is likely to sustain its growth as mining operators prioritize vehicle performance and safety.

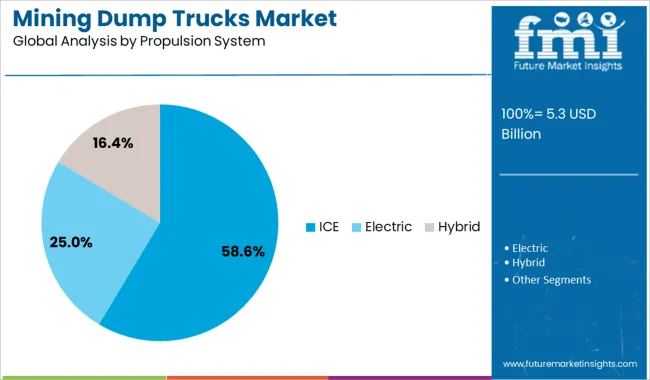

The internal combustion engine propulsion system segment is projected to hold 58.6% of the mining dump trucks market revenue in 2025, remaining the dominant propulsion type. ICE-powered trucks offer the power and torque necessary for heavy-duty mining tasks and have been the industry standard for decades. The technology is well-understood and supported by extensive maintenance and fueling infrastructure, contributing to its continued preference.

Despite growing interest in electric and hybrid alternatives, ICE trucks remain favored due to their reliability and suitability for long operating hours in remote locations.

Advances in fuel efficiency and emission controls have further enhanced ICE trucks’ competitiveness. As mining companies balance operational demands with evolving environmental regulations ICE propulsion is expected to maintain its leading role.

Strong mineral demand in emerging regions is driving fleet expansion with high-capacity mining dump trucks. Aging fleets in mature markets are fueling replacement demand, with lifecycle value and dealer support influencing purchase decisions.

The mining dump trucks market is being strongly influenced by rising mineral extraction activities across regions such as Latin America, Sub-Saharan Africa, and Southeast Asia. Demand for iron ore, copper, coal, and rare earth elements has driven large-scale expansion of open-pit mines, which in turn has intensified the requirement for high-capacity and ultra-class dump trucks. Key mining companies are investing in fleet modernization and expanding haulage capacity to meet production targets, especially in ore-rich belts of Chile, Brazil, and the Democratic Republic of the Congo. These trends are further amplified by long-term contracts signed between miners and construction contractors, where truck availability and uptime directly affect operational output and project timelines.

Aging fleets and rising operational costs are leading to significant replacement demand across mature mining markets such as Australia, the USA, and Canada. With average truck lifespans ranging between 8 to 12 years, many mining operators are reassessing their total cost of ownership to maintain efficiency in harsh conditions. Replacement cycles are being shortened to improve productivity and reduce breakdown frequency. Rental and leasing models are gaining traction among mid-tier operators seeking to avoid large upfront capital investments. Maintenance partnerships and full-service agreements offered by OEMs are shaping procurement decisions, making lifecycle value and dealer support key determinants in fleet upgrades and contract renewals.

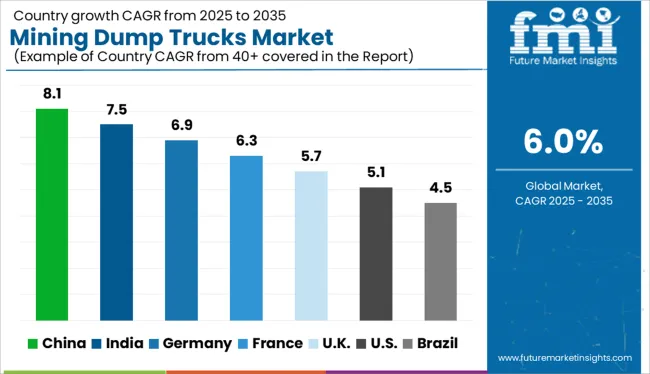

| Country | CAGR |

|---|---|

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

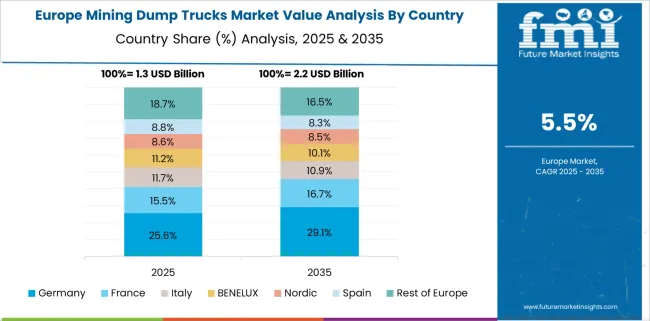

The global mining dump trucks market is projected to grow at a CAGR of 6.0% from 2025 to 2035, driven by expanding surface mining operations, automation of haulage systems, and rising mineral extraction across key geographies. Increasing demand for electric and hybrid dump trucks is further reshaping the competitive landscape. Among BRICS economies, China (8.1%) and India (7.5%) are witnessing accelerated growth due to coal and metal mining activities, policy reforms promoting deeper mechanization, and expansion of domestic mining companies. China's drive for strategic mineral security and India’s aggressive auctioning of new mining blocks are major growth enablers. Germany leads the OECD cohort with a 6.9% CAGR, supported by its brown coal extraction and underground haulage technologies. The UK (5.7%) and the US (5.1%) are seeing moderate gains, largely from demand in copper, gold, and rare earth segments. ASEAN nations are becoming key buyers of mid-sized mining dump trucks, especially for nickel, bauxite, and tin extraction projects across Indonesia, the Philippines, and Vietnam.

The CAGR in the United Kingdom rose from 3.4% during 2020–2024 to approximately 5.7% between 2025 and 2035, influenced by higher spending on domestic aggregates, strategic minerals, and brownfield site redevelopment. The initial sluggish growth was due to subdued coal and metal extraction post-2020, along with a focus on imports. However, post-2025, the UK government's critical minerals strategy, along with efforts to localize resource supply chains, has reinvigorated demand for heavy-duty mining equipment. Funding for brownfield site excavation projects in Wales and Scotland also contributed to higher demand for mid-class and articulated dump trucks. Fleet replacement rates improved as contractors secured long-term government excavation and decommissioning contracts.

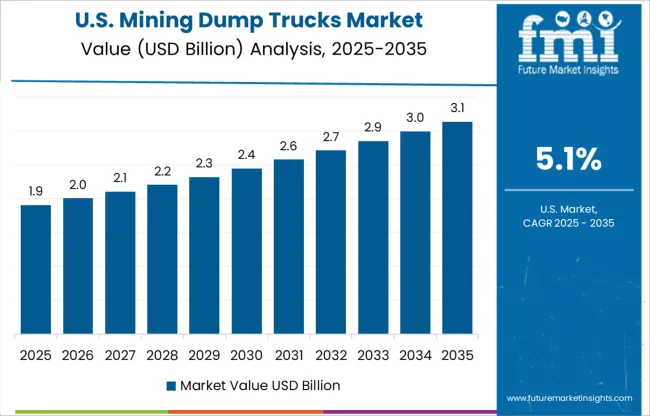

The CAGR in the United States increased modestly from 4.3% during 2020–2024 to approximately 5.1% during 2025–2035, led by sustained expansion in construction-grade aggregate mining and domestic lithium, copper, and rare earth projects. Between 2020 and 2024, growth was constrained by reduced coal production and delayed mine permit approvals. In the next coming years, however, federally supported battery material mining in Arizona, Nevada, and North Carolina is pushing demand for ultra-class and rigid-frame trucks. Several private-equity-backed mining ventures have adopted newer high-capacity fleets to meet fast-track project timelines, boosting equipment sales.

Germany's mining dump trucks market saw its CAGR rise from 5.2% during 2020–2024 to around 6.9% in the 2025–2035 period. The transition was powered by growing domestic extraction of critical minerals like lithium and graphite in Saxony and Bavaria, driven by EU supply chain mandates. During 2020–2024, moderate coal dependency and limited greenfield expansion kept equipment demand stable. Post-2025, however, the push for resource autonomy under Germany’s Raw Materials Strategy drove investments in modernizing fleet infrastructure. Mid-size and compact-class dump trucks gained traction due to their maneuverability in narrow or urban-adjacent mining sites.

The CAGR in China advanced from 6.6% in 2020–2024 to a strong 8.1% in the 2025–2035 forecast period. The transition is driven by continued growth in domestic coal, rare earth, and phosphate mining, especially in Inner Mongolia, Sichuan, and Guizhou. Large-scale modernization of mineral logistics and expanded smart mine developments boosted truck procurement post-2025. The Belt and Road Initiative (BRI) also stimulated export-oriented mineral projects requiring new haulage capacity. Between 2020 and 2024, China maintained steady growth, but rising demand for localized truck production and automation-ready vehicles has accelerated procurement cycles in the latter period.

India’s mining dump truck market CAGR rose from about 5.1% in 2020–2024 to 7.5% during the 2025–2035 period. The earlier period saw moderate fleet investment focused on coal mining expansion under government auctions. From 2025 onward, however, the diversification into bauxite, copper, and critical minerals like lithium and cobalt in states such as Odisha, Chhattisgarh, and Rajasthan spurred fresh demand for heavy-duty mining vehicles. Increased state investments in mine digitization and operational efficiency reforms also catalyzed upgrades of older fleets. Equipment leasing services proliferated, especially in Tier 2 and Tier 3 regions, enhancing accessibility for smaller contractors.

In the mining dump trucks market, major players like Caterpillar, Komatsu, and Hitachi dominate the global landscape with extensive portfolios of rigid and articulated haulers. These companies are actively investing in high-capacity models tailored for large-scale open-pit mining, while also offering full-service maintenance contracts to mining operators. BEML Limited and Liebherr Group are strengthening their positions in Asia and Europe through localized manufacturing, operator training programs, and cost-efficient mid-size fleets suited for coal, iron ore, and limestone mining. Epiroc Mining supports integrated haulage operations with smart systems and advanced mobility platforms. Chinese manufacturers Sany, XCMG, and ZOOMLION are expanding aggressively into emerging markets across Africa and Southeast Asia by offering price-competitive dump trucks with aftersales support. BYD and Daimler are introducing electric and hybrid dump truck models focused on operational cost reduction. Kuhn Schweiz AG continues to serve niche European segments, especially in quarry-based and alpine mining applications with compact fleet solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.3 Billion |

| Type | Rigid, Below 50 metric tons, 50 metric tons and above, Articulated, 50-100 metric tons, 101-150 metric tons, 151-200 metric tons, 201-250 metric tons, 251-300 metric tons, and Above 300 metric tons |

| Drive Configuration | All-wheel Drive (AWD), Two-wheel Drive (2WD), and Four-wheel Drive (4WD) |

| Propulsion System | ICE, Electric, and Hybrid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Komatsu, BEML Limited, BYD, Caterpillar, Daimler, Epiroc Mining, Hitachi, Kuhn Schweiz AG, Liebherr Group, Sany, XCMG, and ZOOMLION |

| Additional Attributes | Dollar sales, regional share trends, top growth countries, fleet replacement cycles, contract mining demand, leasing model uptake, and OEM-dealer partnership dynamics. |

The global mining dump trucks market is estimated to be valued at USD 5.3 billion in 2025.

The market size for the mining dump trucks market is projected to reach USD 9.5 billion by 2035.

The mining dump trucks market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in mining dump trucks market are rigid, below 50 metric tons, 50 metric tons and above, articulated, 50-100 metric tons, 101-150 metric tons, 151-200 metric tons, 201-250 metric tons, 251-300 metric tons and above 300 metric tons.

In terms of drive configuration, all-wheel drive (awd) segment to command 43.9% share in the mining dump trucks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Mining Pneumatic Saw Market Size and Share Forecast Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Mining Shovel Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mining Flotation Chemicals Market Size, Growth, and Forecast 2025 to 2035

Mining Drill Market Growth – Trends & Forecast 2025 to 2035

Mining Explosives Consumables Market Growth – Trends & Forecast 2025 to 2035

Mining & Construction Drilling Tools Market Growth – Trends & Forecast 2024-2034

Mining Locomotive Market

Mining Vehicle AC Kits Market

Mining Collectors Market Size & Demand 2022 to 2032

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Demining Tool Kits Market Size and Share Forecast Outlook 2025 to 2035

Lead Mining Software Market Size and Share Forecast Outlook 2025 to 2035

Large Mining Shovel Market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Market Analysis by Automated Equipment, Component, Solution, Services, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA