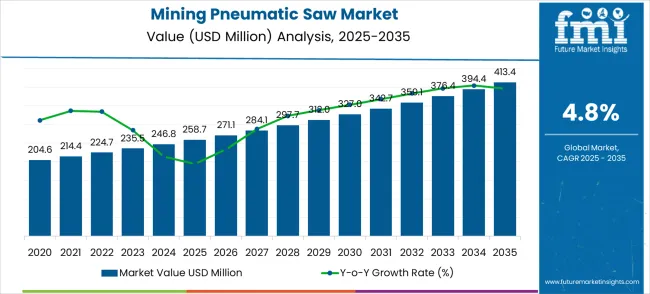

The global mining pneumatic saw market stands positioned for transformation, charting a steady growth trajectory that will significantly expand the market foundation over the coming decade. The first half of the decade witnesses the market progressing from its current USD 259 million base in 2025 to reach USD 327.0 million by 2030, representing a USD 68.3 million milestone addition that accounts for 44.2% of the total forecast expansion. This initial phase reflects the market's response to modernizing mining operations, increasing safety requirements, and growing demand for efficient cutting tools in underground mining applications.

The latter half will witness continued acceleration, as the market advances from USD 327.0 million in 2030 to achieve the USD 413.4 million target by 2035, adding another USD 86.4 million in value creation that constitutes 55.8% of the ten-year growth trajectory. This 59.8% total growth over the forecast period, translating to a steady 5% compound annual growth rate, signals a market approaching significant expansion with a 1.60X growth multiplier.

This trajectory positions mining pneumatic saws as essential equipment for modern mining operations, where enhanced safety protocols, operational efficiency requirements, and technological advancement drive consistent demand for specialized cutting solutions across diverse mining applications and challenging underground environments.

The mining pneumatic saw market evolution unfolds through two distinct growth periods, each characterized by unique operational demands and technological advancement patterns. The foundation-building phase spanning 2025-2030 establishes market expansion through increasing safety regulations in mining operations and modernization of cutting equipment across global mining facilities, generating USD 68.3 million in new market value. This period emphasizes market penetration in established coal and metal mining operations while companies invest in product development and distribution network expansion to meet evolving safety and efficiency requirements.

The acceleration phase from 2030-2035 demonstrates market maturation as demand intensifies across emerging mining applications including rare earth extraction, tunneling operations, and specialized underground construction projects. This period contributes USD 86.4 million in market expansion, driven by technological advancement requiring specialized cutting tools and expansion of mining activities in developing economies. Market participants shift focus from basic product supply to comprehensive solution provision including maintenance services and application-specific equipment customization.

The competitive landscape evolution mirrors this temporal progression, with established equipment manufacturers consolidating their market positions during the first phase while specialized tool producers emerge to capture niche applications in the latter period. This phase transition logic reflects the market's journey from a traditional mining tool segment to a critical component supplier for advanced mining operations across multiple industrial sectors.

| Metric | Value |

|---|---|

| Market Value (2025) → | USD 258.7 million |

| Market Forecast (2035) ↑ | USD 413.4 million |

| Growth Rate ★ | 5% CAGR |

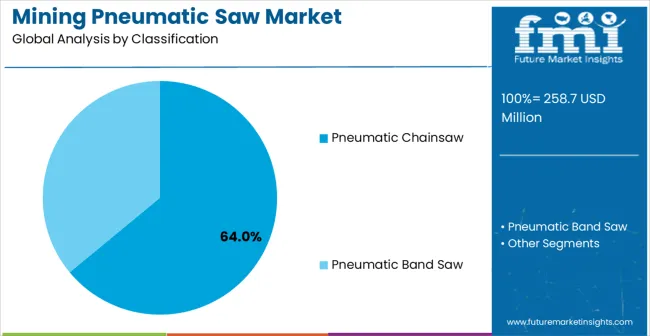

| Leading Segment → | Pneumatic Chainsaw |

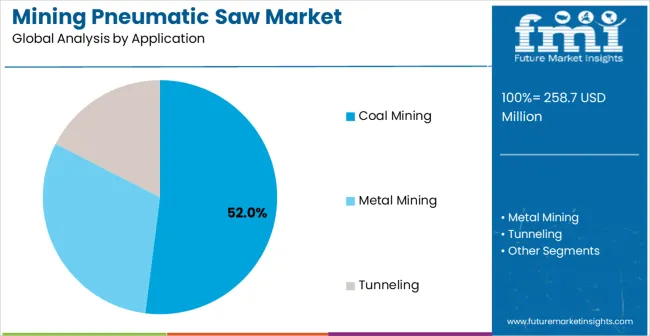

| Primary Application → | Coal Mining |

These metrics demonstrate the market's evolution from traditional mining tool supply to specialized equipment provision for modern mining operations requiring enhanced safety and efficiency capabilities.

Market expansion rests on three fundamental shifts driving demand for specialized cutting equipment in mining operations:

The growth faces headwinds from economic volatility affecting mining industry capital expenditures and alternative cutting technologies offering comparable performance through different mechanical approaches. These challenges require manufacturers to balance specialized performance with cost-effectiveness across diverse mining operation requirements.

Primary Classification:

Product Type Segmentation: Pneumatic Chainsaw, Pneumatic Band Saw Application Breakdown: Coal Mining, Metal Mining, Tunneling Operations

Tertiary Segmentation:

This taxonomical structure reflects the market's evolution from basic cutting tool supplier to specialized equipment provider with distinct technical requirements across multiple mining operation categories.

Market Position: Pneumatic chainsaw dominates the mining pneumatic saw market due to its operational reliability, portability, and versatility across a wide range of mining applications. The segment’s strong market position is supported by its ability to provide consistent cutting performance in diverse underground conditions while maintaining strict safety standards, particularly in explosive-prone environments like coal mines. Chainsaws are widely adopted across mining operations for timber support removal, structural modification, and emergency interventions.

Value Drivers: The chainsaw configuration optimizes cutting speed, control precision, and ergonomic handling, enabling operators to perform multiple cutting tasks efficiently. Robust construction and durable components ensure long service life, even in harsh underground conditions, while simplified maintenance routines minimize operational downtime. Pneumatic operation eliminates electrical hazards, making chainsaws safe for use in volatile atmospheres, further enhancing adoption in critical mining operations.

Competitive Advantages: Well-established supply chains, technical support infrastructure, and wide availability of replacement parts reinforce the segment’s market leadership. Continuous innovation in cutting chain design, pneumatic system efficiency, and operator safety ensures that pneumatic chainsaws remain preferred tools over alternative cutting technologies.

Strategic Importance: Coal mining is the largest application for pneumatic saws, reflecting high operational demands for reliable cutting tools in underground mines. Coal mining operations require spark-free, explosion-proof equipment for cutting timber supports, metal structures, and emergency access points, ensuring safety and operational efficiency.

Why Dominant? Pneumatic saws are inherently safe for use in potentially explosive atmospheres, providing consistent cutting performance in confined underground spaces. They allow miners to operate effectively with precise control, maintaining safety compliance while improving operational outcomes.

Growth Drivers: Strict mining safety regulations and increasing focus on occupational health drive demand for explosion-proof, high-precision cutting tools. Asian coal mining hubs, particularly in China, India, and Indonesia, are major growth markets, with secondary demand in North America and Europe.

By Application, Metal Mining Segment Shows Strong Growth Potential Current Position: Metal mining applications are emerging as high-growth segments due to specialized cutting requirements and increasing operational complexity in metal ore extraction. Pneumatic saws are deployed for structural modifications, equipment maintenance, and precision cutting in mines extracting precious metals and rare earth elements.

Growth Catalysts: Rising global demand for metals and minerals drives expansion of mining operations, including deeper and technologically complex deposits. Advanced cutting systems provide the precision and durability needed for harsh environments, including underground and remote sites.

Market Trajectory: Expansion is driven by deep mining, rare earth extraction, and the growing adoption of automated and remote mining systems. Pneumatic saws integrated with robotic platforms offer safer and more efficient cutting, creating premium opportunities in specialized applications.

The mining pneumatic saw market is driven primarily by stringent safety regulations and growing operational demands across global mining sectors. Spark-free pneumatic cutting tools are increasingly required to mitigate ignition risks in underground coal, metal, and rare earth mining operations, where explosive atmospheres pose critical hazards. Regulatory enforcement of occupational safety and mine safety standards compels operators to adopt reliable and certified cutting tools, consistent with market demand.

Expansion of mining operations worldwide, particularly in Asia Pacific, Latin America, and Africa, supports the deployment of pneumatic saws for development, maintenance, and emergency response tasks, driving steady revenue growth. Technological advancements in pneumatic systems have improved cutting performance, reduced tool weight, enhanced portability, and lowered maintenance requirements, allowing operators to achieve higher productivity in challenging underground and remote environments. Cost efficiency initiatives through equipment standardization encourage the adoption of proven pneumatic saw designs, minimizing operator training needs and reducing operational complexity while ensuring reliability in diverse mining applications.

Growth Inhibitors Despite strong demand, several factors constrain market growth. Economic volatility in mining commodity markets often delays equipment replacement cycles and new procurement decisions. Alternative cutting technologies, such as plasma or advanced electric saw systems, offer competitive performance in specific applications, threatening traditional pneumatic saw adoption. A shortage of skilled operators capable of safely and effectively handling specialized pneumatic tools limits widespread deployment, especially in remote or emerging mining regions. Fluctuations in raw material prices and manufacturing costs impact tool pricing and profit margins, creating procurement hesitation among cost-conscious operators in budget-sensitive environments.

Market Evolution Patterns Market adoption is accelerating in Asia Pacific due to regulatory modernization and emphasis on safety equipment standards, whereas North American and European operations focus on efficiency improvements, process optimization, and regulatory compliance. Emerging trends include ergonomic tool design improvements, integrated safety systems, and enhanced material durability to extend operational life under extreme conditions. The evolution of automated and robotic cutting systems poses a potential disruption, as high-precision, remote-controlled tools could reduce dependence on manual pneumatic saw operation while delivering comparable performance and safety outcomes.

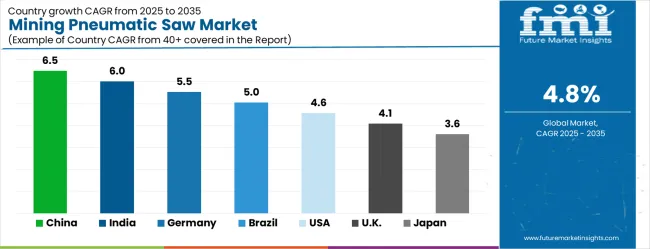

The mining pneumatic saw market demonstrates strong momentum across major mining economies, with Growth Leaders including China and India driving expansion through mining industry modernization and safety regulation enhancement. Steady Performers encompass Germany, Brazil, and the United States, where established mining operations and regulatory compliance requirements support consistent equipment demand. Emerging Markets include the United Kingdom and Japan, showing development potential through specialized mining applications and technology advancement initiatives.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.5% |

| India | 6% |

| Germany | 5.5% |

| Brazil | 5% |

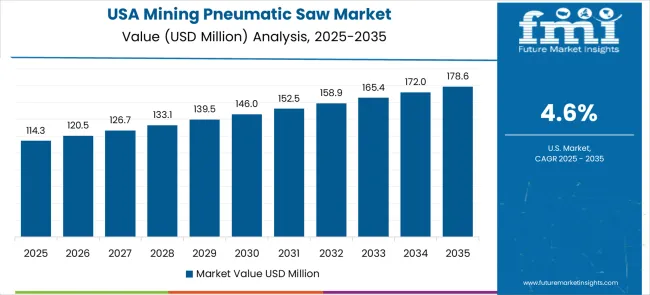

| USA | 4.6% |

| UK | 4.1% |

| Japan | 3.6% |

This performance distribution reflects regional mining priorities, with Asian markets emphasizing rapid capacity expansion while developed economies focus on safety enhancement and operational efficiency improvement. The synthesis reveals China and India as primary growth drivers, while established markets provide stability through regulatory compliance and specialized applications requiring advanced cutting technologies.

China demonstrates exceptional market leadership through massive mining industry expansion and comprehensive safety regulation implementation, driving demand for specialized cutting equipment. The country exhibits superior growth potential with a 6.5% CAGR through 2035, supported by coal mining modernization, metal mining expansion, and government industrial safety initiatives. Chinese mining operations increasingly require advanced cutting tools that meet international safety standards while supporting increased productivity and operational efficiency in underground mining environments.

Mining facilities in Shanxi, Inner Mongolia, and Heilongjiang drive primary demand through coal extraction operations requiring safe cutting tools for support structure maintenance and emergency response applications. The country's emphasis on mining safety improvement creates opportunities for pneumatic cutting equipment that eliminates electrical hazards while providing reliable performance in hazardous mining atmospheres. Quality control enhancement initiatives and regulatory compliance requirements support adoption of certified cutting equipment across diverse mining operations.

Strategic Market Indicators:

In Jharkhand, Chhattisgarh, and Odisha, the adoption of pneumatic cutting tools is accelerating across coal and metal mining operations, where safety and precision are critical for underground extraction activities. India’s mining sector is witnessing steady growth, with the pneumatic saw market expanding at a CAGR of 6% through 2035, driven by rising coal production, iron ore extraction, and increasing enforcement of safety compliance standards. The country’s regulatory framework mandates the use of certified explosion-proof cutting equipment in underground operations, ensuring worker safety while maintaining operational efficiency.

Mining companies are integrating pneumatic saws into standard operating procedures for timber support cutting, emergency access development, and equipment maintenance. Portable and spark-free pneumatic tools are particularly preferred in confined spaces with limited ventilation, reducing the risk of ignition while allowing precise control over diverse cutting tasks. Expansion in mining infrastructure and modernization of facilities, including automation and digital monitoring systems, further support demand for reliable pneumatic cutting solutions.

German mining operations in North Rhine-Westphalia, Saarland, and Brandenburg are increasingly adopting pneumatic cutting tools to enhance operational efficiency and comply with stringent safety standards. The country exhibits superior growth potential with a 5.5% CAGR through 2035. The market is characterized by a focus on coal, potash, and specialized underground construction projects requiring high-precision cutting capabilities. German manufacturers of pneumatic saws leverage advanced engineering expertise to design robust, high-durability tools that provide consistent cutting performance even in challenging mining conditions.

Integration of ergonomic features and maintenance-friendly designs ensures extended operational life, while the country’s comprehensive safety regulations and certification standards support premium pricing for high-quality equipment. Demand is also driven by specialized contractors engaged in underground tunneling and infrastructure development, who require precise and reliable cutting solutions. Export manufacturing of certified German pneumatic cutting tools contributes to international market presence, further solidifying Germany’s position as a hub of mining equipment innovation.

Brazil’s mining sector, concentrated in Minas Gerais, Pará, and Rio Grande do Sul, emphasizes operational efficiency, worker safety, and infrastructure modernization, creating strong demand for pneumatic cutting tools. The country’s market demonstrates steady growth with 5% CAGR during the forecast period, fueled by iron ore extraction, coal mining, and expansion of specialized underground construction projects. Mining companies are investing in reliable and certified cutting equipment to comply with international safety standards, reduce downtime, and ensure productivity in challenging mining conditions. Pneumatic saws, with spark-free operation and portable designs, are well-suited for underground applications, enabling precise cutting in confined spaces while minimizing hazard exposure. The expansion of mining infrastructure, including processing facilities and logistics networks, supports ongoing adoption, while government initiatives promoting technology modernization encourage the integration of advanced cutting tools. Economic stability and capital investment cycles influence procurement timing, yet the focus on operational efficiency and mining safety maintains consistent demand for high-quality equipment. The market also benefits from increasing emphasis on regulatory compliance and standardization, ensuring that Brazilian mining operations adopt internationally recognized cutting tool specifications.

Mining operations in West Virginia, Wyoming, and Pennsylvania demonstrate significant demand for pneumatic cutting tools, particularly in coal and metal mining applications where safety, precision, and productivity are critical. The USA market is expanding steadily with a CAGR of 4.6% from 2025 to 2035, with a focus on compliance with Mine Safety and Health Administration (MSHA) regulations and workplace safety standards. Pneumatic saws offer spark-free operation and consistent cutting performance, essential for underground longwall, room-and-pillar, and emergency rescue operations.

Equipment reliability, long-term operational life, and total cost of ownership optimization are prioritized over initial purchase price, driving adoption of high-quality, certified tools. Mining companies are increasingly integrating pneumatic cutting systems into automated and digitally monitored workflows, ensuring precise control over critical operations while minimizing downtime and maintenance requirements. Advanced mining applications, including deep metal mining and complex underground construction, create demand for tools capable of withstanding extreme conditions, while technical partnerships between manufacturers and mining operators facilitate application-specific equipment development.

The UK mining sector maintains a medium-growth trajectory, with pneumatic cutting tool adoption focused on remaining coal mining operations, underground utility installations, and specialized construction projects. The country exhibits superior growth potential with a 4.1% CAGR through 2035. Pneumatic saws are essential for precision cutting in confined underground spaces, providing spark-free operation to comply with safety standards while ensuring reliable performance. The market benefits from regulatory oversight that enforces stringent health and safety compliance, driving the procurement of certified cutting equipment. Adoption is further supported by investments in underground construction projects for infrastructure development, tunneling, and facility maintenance, creating opportunities for high-quality pneumatic saws. British mining contractors emphasize operational efficiency, safety, and durability, prioritizing tools that minimize maintenance downtime and improve cutting precision in complex environments.

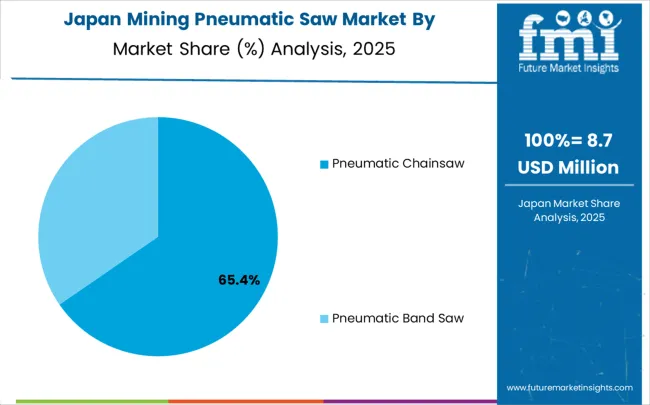

Japan demonstrates leadership in pneumatic cutting tool adoption through precision manufacturing and specialized underground construction projects. The country exhibits superior growth potential with a 3.6% CAGR through 2035. Operations in Hokkaido, Honshu, and Kyushu emphasize tunneling, infrastructure development, and specialized mineral extraction, requiring advanced, certified cutting tools capable of delivering high reliability and precision.

Japanese mining and construction companies prioritize equipment that integrates advanced ergonomic design, operational safety, and maintenance-friendly features to ensure consistent performance under challenging conditions. Regulatory standards and strict quality control systems mandate traceable certification, driving adoption of high-quality pneumatic saws. Technology development programs in Japan focus on next-generation cutting tools, including enhanced durability, vibration reduction, and integration with automated or semi-automated mining systems. Demand is also influenced by precision tunneling operations for urban infrastructure, industrial facility installation, and specialty mining applications requiring ultra-reliable and spark-free cutting performance.

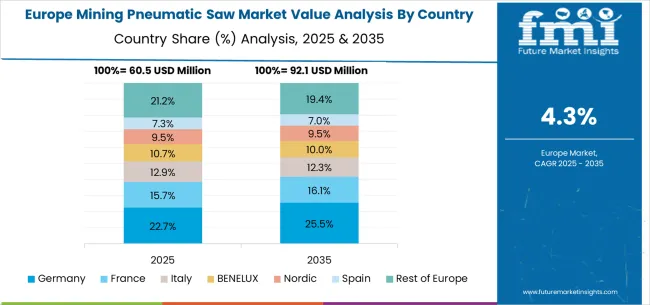

The European mining pneumatic saw market reflects mature industrial development with distinct national specializations contributing to market stability. Germany anchors the region through precision manufacturing expertise and comprehensive safety regulations, while the United Kingdom contributes through underground construction applications and specialized mining operations. France emphasizes nuclear industry applications and specialized underground construction requiring precision cutting tools.

Market integration occurs through cross-border mining equipment supply chains and regulatory harmonization supporting consistent safety standards across the region. Eastern European countries provide emerging growth opportunities through mining industry modernization and infrastructure development programs. The regional market demonstrates stability through diversified industrial applications and established technical expertise, with growth driven by safety enhancement and efficiency improvement rather than basic capacity expansion.

In Japan, the mining pneumatic saw market is largely driven by the pneumatic chainsaw segment, which accounts for 68% of total market revenues in 2025. The superior cutting versatility in underground construction environments and stringent safety protocols mandated in tunneling and specialized mining operations are key contributing factors. Pneumatic band saws follow with a 27% share, primarily in precision cutting applications that integrate structural modification requirements with safety compliance needs. Other specialized cutting tools contribute only 5% as adoption in standard construction applications remains limited due to cost considerations and operational complexity.

Market Characteristics:

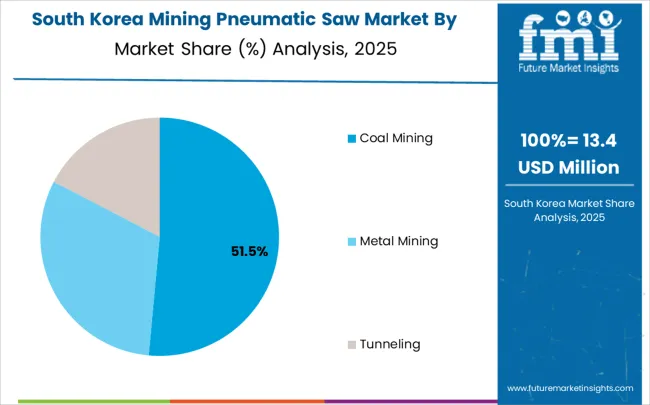

In South Korea, the market is expected to remain dominated by coal mining applications, which hold a 58% share in 2025. These applications typically represent the most safety-critical requirements where cutting tool reliability directly affects operational safety and regulatory compliance in underground mining operations. Metal mining applications and tunneling operations each hold 21% market share, with increasing standardization in cutting equipment specifications across diverse underground operations. Other specialized applications account for the remaining share, but gradually gain traction in underground construction development due to expanding infrastructure projects and safety requirement implementation.

Channel Insights:

The mining pneumatic saw market operates with approximately 20-25 meaningful participants, demonstrating moderate concentration where the top five companies control roughly 60% of global market value. Competition emphasizes technical reliability, safety certification, and application expertise rather than commodity pricing strategies, reflecting the critical nature of mining applications requiring proven performance under hazardous conditions.

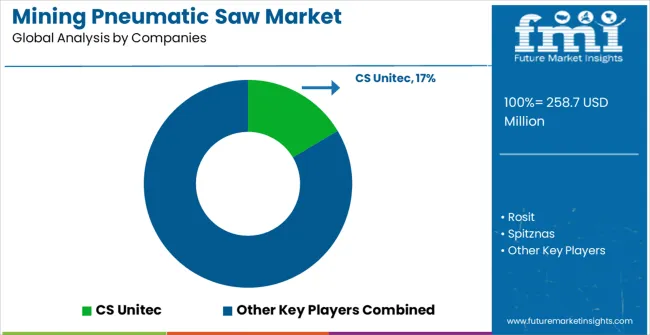

Tier 1 Leaders: CS Unitec maintains market leadership through comprehensive pneumatic cutting tool portfolios and established customer relationships in global mining operations, leveraging advanced pneumatic technology and extensive distribution networks. Rosit provides innovative cutting solutions with emphasis on safety certification and technical application support, while Spitznas offers specialized equipment targeting demanding underground mining applications with superior reliability characteristics.

Tier 2 Challengers: Cengar and Stihl compete through established brand recognition and regional market development, emphasizing product quality and customer service capabilities. These companies leverage manufacturing expertise and distribution networks to serve diverse mining market segments requiring reliable cutting solutions.

Tier 3 Specialists: Beijing TopSky Tech, Shandong Zhen Da Industrial, Shandong Mining Machinery Group, Chicago Pneumatic, Dotco Tools, Ingersoll Rand, Sioux Tools, and Universal Tool represent emerging and regional suppliers focusing on cost-effective alternatives and local market expansion. They serve mining operations in specific geographies through established customer relationships and application-specific technical support, competing primarily on service responsiveness and regional expertise rather than global scale advantages.

Competitive dynamics between tiers reflect market evolution from traditional tool supply toward comprehensive service partnerships, with established leaders maintaining advantages through technical expertise and safety certification while emerging players compete through cost optimization, innovation, and regional market specialization.

Mining pneumatic saws represent a specialized heavy-duty cutting equipment segment serving the most demanding underground and surface mining operations where electric tools pose safety risks from explosive atmospheres, water exposure, and extreme operating conditions. With the global market valued at $259 million in 2024 and projected to reach $413.4 million by 2030 (5% CAGR), this niche industrial segment is driven by increasing mining safety regulations, expansion of underground operations, and growing tunneling infrastructure projects. The market features established German industrial equipment manufacturers (CS Unitec, Spitznas, Stihl) competing with specialized mining equipment suppliers and emerging Chinese manufacturers, while product variants (pneumatic chainsaw vs. pneumatic band saw) serve different material cutting requirements across coal mining, metal mining, and tunneling applications.

How Governments Could Enhance Mining Safety and Equipment Standards?

Explosive Atmosphere Regulations: Strengthen enforcement of ATEX/IECEx certification requirements for all power tools used in underground mining operations, creating mandatory demand for intrinsically safe pneumatic equipment while phasing out potentially hazardous electric alternatives in classified zones.

Mining Safety Investment Programs: Provide targeted funding for mining companies to upgrade to safer cutting equipment, including tax incentives or grants for replacing electric saws with certified pneumatic alternatives in underground coal and metal mining operations where methane or combustible dust is present, posing explosion risks.

Technical Training and Certification: Establish mandatory operator certification programs for pneumatic cutting equipment in mining applications, including proper air supply management, maintenance procedures, and hazard recognition training that reduces workplace accidents and equipment failures.

Infrastructure Development Support: Fund tunneling and underground infrastructure projects that create anchor demand for specialized cutting equipment, particularly in urban transit systems, water management projects, and mining access development that require certified pneumatic tools.

Research and Development Incentives: Support development of next-generation pneumatic cutting technologies through research grants and tax credits, focusing on improved cutting efficiency, reduced air consumption, and enhanced operator safety features for extreme mining environments.

How Industry Bodies Could Advance Safety Standards and Market Development?

Intrinsic Safety Certification: Develop comprehensive certification protocols specific to pneumatic cutting equipment in mining applications, including standardized testing for explosive atmosphere compatibility, air supply requirements, and performance specifications under extreme temperature and humidity conditions.

Best Practices Documentation: Create technical guidelines for proper selection, installation, and maintenance of pneumatic cutting systems in different mining environments, including air compressor specifications, hose routing requirements, and preventive maintenance schedules that maximize equipment reliability.

Operator Safety Training: Develop standardized training curricula for mining personnel covering pneumatic tool operation, recognizing air supply problems, proper cutting techniques for different materials, and emergency procedures when equipment fails in confined spaces.

Performance Benchmarking: Establish industry-wide performance metrics for cutting speed, air consumption efficiency, tool durability, and maintenance requirements that enable objective comparison between manufacturers and drive continuous improvement in equipment capabilities.

Supply Chain Resilience: Facilitate supplier qualification programs that ensure reliable availability of certified cutting equipment, replacement parts, and technical support services for remote mining operations where equipment downtime creates significant operational and safety risks.

How OEMs and Equipment Manufacturers Could Strengthen the Ecosystem?

Intrinsically Safe Design Innovation: Engineer pneumatic cutting systems specifically designed for explosive atmospheres, incorporating spark-proof materials, pressure relief systems, and fail-safe mechanisms that prevent ignition sources while maintaining cutting performance in demanding mining conditions.

Integrated Air Management Systems: Develop complete pneumatic solutions that include optimized compressors, filtration systems, and distribution networks designed specifically for underground mining applications, ensuring consistent air quality and pressure for reliable tool operation.

Modular Cutting Solutions: Create interchangeable cutting head systems that allow rapid switching between chainsaw and band saw configurations on common pneumatic drive units, reducing inventory requirements and enabling versatile cutting capabilities for different mining materials.

Remote Operation Capabilities: Integrate remote control and automated cutting systems for use in hazardous areas where human presence should be minimized, including robotic mounting systems and telepresence controls for cutting operations in unstable or dangerous mining environments.

Predictive Maintenance Technology: Implement condition monitoring sensors and diagnostic systems that track air consumption, vibration patterns, and cutting performance to predict maintenance needs and prevent unexpected failures during critical mining operations.

How Mining Companies and End Users Could Navigate Equipment Selection?

Total Cost of Ownership Optimization: Evaluate pneumatic cutting equipment based on a comprehensive cost analysis including initial equipment cost, air compressor requirements, maintenance schedules, and operator training needs, rather than focusing solely on purchase price comparisons.

Safety Performance Integration: Prioritize cutting equipment selection based on certified intrinsic safety ratings, operator injury statistics, and compliance with explosive atmosphere regulations while ensuring adequate cutting performance for specific mining materials and applications.

Maintenance and Service Planning: Establish preventive maintenance programs that account for extreme operating conditions in mining environments, including regular component replacement schedules, air system cleaning procedures, and emergency repair capabilities for remote underground operations.

Operator Training Investment: Implement comprehensive training programs that cover not only tool operation but also air system management, safety procedures, and troubleshooting techniques that maximize equipment effectiveness while minimizing accident risks in confined mining spaces.

Supplier Partnership Development: Build strategic relationships with equipment suppliers that provide 24/7 technical support, rapid parts delivery to remote mining sites, and on-site service capabilities that minimize production disruptions from equipment failures.

How Investors and Financial Enablers Could Unlock Market Growth?

Mining Safety Technology Development: Finance development of advanced pneumatic cutting technologies that improve operator safety, reduce air consumption requirements, and enhance cutting performance in challenging mining conditions, particularly for next-generation intrinsically safe designs.

Manufacturing Capacity Expansion: Support establishment of regional manufacturing capabilities for pneumatic mining equipment, particularly in emerging mining markets where local production can reduce lead times, transportation costs, and provide better technical support access.

Service Network Development: Fund creation of comprehensive service and support networks that provide equipment maintenance, operator training, and technical support in remote mining regions where specialized pneumatic cutting equipment requires expert service capabilities.

Mining Equipment Leasing Programs: Develop specialized financing programs that enable smaller mining companies to access advanced pneumatic cutting equipment through leasing arrangements that include maintenance, training, and equipment upgrade provisions aligned with mining project lifecycles.

Technology Integration Ventures: Invest in startups developing complementary technologies including automated cutting systems, condition monitoring platforms, and air management optimization solutions that enhance the value proposition of pneumatic cutting equipment in modern mining operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 259 million |

| Product Type | Pneumatic Chainsaw, Pneumatic Band Saw |

| Application | Coal Mining, Metal Mining, Tunneling |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | CS Unitec, Rosit, Spitznas, Cengar, Stihl, Beijing TopSky Tech, Shandong Zhen Da Industrial, Shandong Mining Machinery Group, Chicago Pneumatic, Dotco Tools, Ingersoll Rand, Sioux Tools, and Universal Tool |

| Additional Attributes | Dollar sales by power capacity and safety specifications, regional demand trends across major mining economies, competitive landscape with established equipment manufacturers and emerging specialty suppliers, adoption patterns for safety compliance versus productivity optimization applications, integration with mining safety systems and emergency response protocols, innovations in pneumatic cutting technology and explosion-proof design capabilities, and development of specialized applications with enhanced durability and operational reliability characteristics. |

The global mining pneumatic saw market is estimated to be valued at USD 258.7 million in 2025.

The market size for the mining pneumatic saw market is projected to reach USD 413.4 million by 2035.

The mining pneumatic saw market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in mining pneumatic saw market are pneumatic chainsaw and pneumatic band saw.

In terms of application, coal mining segment to command 52.0% share in the mining pneumatic saw market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Shovel Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mining Flotation Chemicals Market Size, Growth, and Forecast 2025 to 2035

Mining Drill Market Growth – Trends & Forecast 2025 to 2035

Mining Explosives Consumables Market Growth – Trends & Forecast 2025 to 2035

Mining & Construction Drilling Tools Market Growth – Trends & Forecast 2024-2034

Mining Locomotive Market

Mining Vehicle AC Kits Market

Mining Collectors Market Size & Demand 2022 to 2032

Demining Tool Kits Market Size and Share Forecast Outlook 2025 to 2035

Lead Mining Software Market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Large Mining Shovel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA