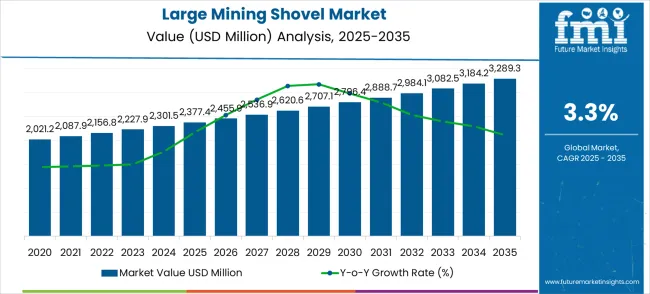

The large mining shovel market embarks on a steady growth trajectory that unfolds through two distinct phases over the coming decade. The first half of the decade (2025-2030) witnesses the market advancing from USD 2,377.4 million to USD 2,796.4 million, adding USD 419.0 million in value, representing 46.0% of the total forecast expansion. This initial phase is driven by global infrastructure development programs requiring massive earthmoving capabilities, environmental regulations pushing toward cleaner electric alternatives, and mining industry consolidation creating demand for larger, more efficient equipment.

The latter half will witness measured acceleration as the market progresses from USD 2,796.4 million to USD 3,289.3 million, contributing USD 492.9 million, constituting 54.0% of the overall ten-year expansion. This period marks the integration of smart mining technologies with autonomous operation capabilities, expansion into remote mining locations requiring specialized heavy equipment, and development of hybrid power systems combining operational efficiency with environmental compliance.

This growth trajectory positions market participants for steady opportunities, with the 1.38x market expansion creating space for both established heavy equipment manufacturers and emerging technology providers to capture growing demand across diverse mining environments and infrastructure development projects requiring large-scale earthmoving capabilities.

The decade's growth narrative unfolds through two distinct mining technology evolution phases, each characterized by different operational requirements and equipment sophistication levels. The initial phase (2025-2030) represents the modernization period where mining operations upgrade existing fleet capabilities through replacement of aging equipment and adoption of environmental compliance technologies. During this period, market expansion is fueled by mining company investment in larger capacity equipment, integration of digital monitoring systems, and standardization of safety protocols across global mining operations.

The transition into the second phase (2030-2035) marks the market's evolution toward intelligent mining systems and operational autonomy. This period features the emergence of connected equipment ecosystems combining large mining shovels with comprehensive site management platforms, expansion into previously inaccessible mining locations requiring specialized equipment capabilities, and development of hybrid operational models supporting both traditional and autonomous mining approaches.

The 46.0% to 54.0% growth distribution between these phases reflects the market's progression from equipment modernization toward integrated mining technology solutions, creating opportunities for manufacturers to develop advanced shovel systems while maintaining core operational capabilities that mining professionals require for productive material handling operations.

However, growth faces headwinds from cyclical commodity markets affecting mining investment budgets and competition from alternative mining technologies that may reduce reliance on traditional large-scale earthmoving approaches in certain operational scenarios.

Primary Classification:

Secondary Breakdown:

Geographic Distribution:

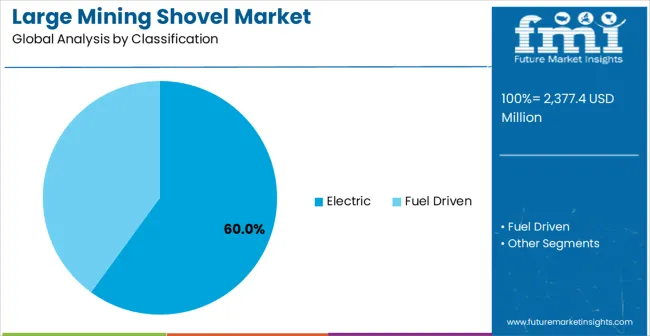

Market Position: Electric mining shovels command market leadership through superior operational efficiency and environmental compliance capabilities that meet modern mining industry requirements. This segment provides optimal balance between operational power and emission reduction characteristics that mining operations require for sustainable production activities.

Value Drivers: Electric propulsion systems deliver consistent operational performance while reducing fuel costs and maintenance requirements compared to traditional fuel-driven alternatives. The segment benefits from technological advancement in electric motor efficiency and battery management systems that enhance overall equipment reliability.

Competitive Advantages: Manufacturing efficiency enables competitive operational costs while established mining relationships support consistent demand from global mining operations. The segment provides technology upgrade pathways through smart connectivity and automated operation capabilities without requiring complete fleet replacement.

Challenge: Competition from hybrid systems with improved fuel efficiency may reduce pure electric advantages in applications where electrical infrastructure limitations restrict operational flexibility and site deployment options.

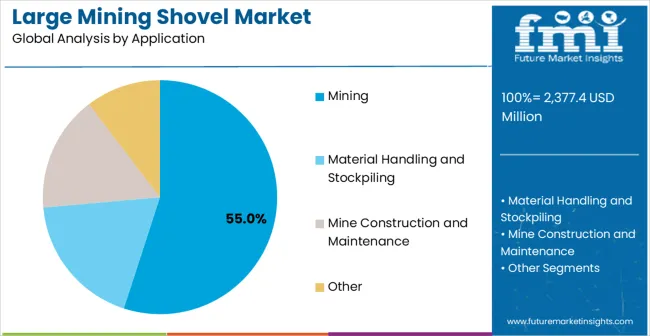

Strategic Importance: Material handling and stockpiling applications drive market demand through consistent operational requirements and standardized equipment specifications that support diverse mining and construction projects across global markets.

Mining operations require specialized equipment that meets rigorous performance standards for material handling while maintaining operational efficiency across varying material types and environmental conditions.

What Drives Adoption?: Operational productivity requirements, equipment reliability needs, and cost-effectiveness considerations that demand reliable material handling equipment capable of supporting comprehensive mining operations without operational compromises.

Where is Growth?: Expansion occurs through modernization of existing mining operations and development of new mining sites responding to growing commodity demand and infrastructure development requirements across global markets.

Forward-Looking Implications: Technology integration opportunities may create demand for enhanced material handling systems that combine traditional shovel capabilities with digital monitoring and automated operational control features for next-generation mining applications.

Market Context: Asia Pacific markets expand beyond traditional mining applications into infrastructure development and industrial construction sectors requiring heavy earthmoving capabilities for large-scale projects.

Appeal Factors:

Growth Drivers:

Market Challenges:

Growth Accelerators: Mining industry modernization drives consistent demand as global mining companies upgrade equipment capabilities to address increasing commodity demand and operational efficiency requirements. Infrastructure development programs worldwide create substantial demand for heavy earthmoving equipment capable of handling massive excavation projects and material handling operations. Environmental compliance regulations promote adoption of electric and hybrid mining equipment that reduces emissions while maintaining operational productivity necessary for competitive mining operations.

Growth Inhibitors: Cyclical commodity markets affect mining investment budgets, creating demand volatility based on commodity price fluctuations and mining company profitability cycles. High capital equipment costs restrict adoption among smaller mining operations while specialized maintenance requirements increase operational expenses compared to conventional earthmoving equipment. Economic uncertainty in key mining markets creates procurement delays while regulatory compliance complexity adds costs and technical requirements to equipment development programs.

Market Evolution Patterns: Product development focuses on electric propulsion system advancement and autonomous operation capabilities that enhance productivity while reducing operational costs and environmental impact. Application expansion beyond traditional mining uses creates new market segments requiring specialized equipment configurations for infrastructure development and industrial construction projects. Supply chain consolidation among heavy equipment manufacturers affects pricing dynamics and product availability while supporting technology advancement through focused research and development investment in mining equipment innovation.

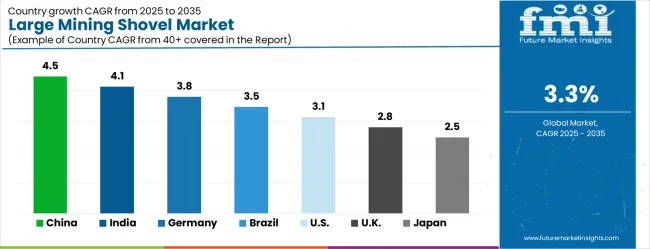

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| Brazil | 3.5% |

| United States | 3.1% |

| United Kingdom | 2.8% |

| Japan | 2.5% |

China leads global market expansion through comprehensive infrastructure development programs and mining industry modernization initiatives supporting both domestic commodity demand and export opportunities. India follows with mining sector development and infrastructure construction programs driving equipment demand across diverse material handling applications. Germany maintains steady growth through technology leadership and manufacturing excellence, while Brazil and the United States show consistent demand from established mining operations and infrastructure development projects.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

China’s large mining shovel market exhibits exceptional growth potential, underpinned by rapid infrastructure development and expanding mining operations that cater to domestic commodity demand and construction material requirements. The market’s projected CAGR of 4.5% through 2035 is driven by government initiatives in high-speed rail, industrial zones, port facilities, and urban construction, which necessitate the deployment of specialized earthmoving equipment. Mining modernization initiatives further reinforce demand, as operators replace aging fleets with advanced shovels incorporating high-capacity hydraulic systems, electric propulsion, and automated operation features. Domestic manufacturing capabilities not only ensure cost-competitive production but also enable customization for specific terrain and climate conditions. Environmental compliance policies encourage adoption of cleaner, energy-efficient equipment, while technology development centers advance capabilities through research in hydraulics, automated control, and emission reduction. Additionally, export opportunities to developing markets enhance growth prospects, positioning China as a global leader in mining shovel manufacturing and application.

India’s large mining shovel market is expanding at a CAGR of 4.1% through 2035, supported by modernization programs in mining and infrastructure development across Delhi, Mumbai, Bangalore, and other industrial hubs. The country’s growing mineral extraction and construction sectors increase demand for high-capacity shovels, facilitating efficient excavation, material handling, and mine construction operations. Government initiatives promote adoption of advanced earthmoving technologies, while private mining companies invest in larger fleets to improve productivity, safety, and operational efficiency. Infrastructure development projects, including highways, urban construction, and industrial facilities, further increase shovel demand. Domestic and international equipment suppliers focus on integrating advanced hydraulics, emission control, and automation technologies to meet India’s performance and environmental standards. Operators also implement digital monitoring and fleet management systems to optimize equipment usage and reduce downtime. With ongoing industrialization and infrastructure expansion, India represents a strong growth market for large mining shovels.

Germany’s large mining shovel market is growing at a CAGR of 3.8% through 2035, fueled by precision engineering, manufacturing excellence, and technological innovation. Mining and construction companies prioritize equipment that ensures high operational efficiency while meeting stringent European environmental regulations. German manufacturing centers produce premium shovels that serve both domestic infrastructure needs and international export markets. Advanced hydraulic systems, emission reduction technology, and automation are core areas of development, enabling operators to achieve enhanced productivity and compliance. Government programs and professional training initiatives strengthen operator capability, ensuring optimal use of high-tech machinery. Equipment modernization programs replace older fleets with larger capacity and more efficient shovels, increasing mining productivity and safety. Germany’s emphasis on innovation and engineering quality positions the country as a leading hub for specialized heavy equipment development and deployment globally.

Brazil’s large mining shovel market demonstrates steady growth, driven by expansion in the mining sector and infrastructure development across major mineral regions, including iron ore and copper operations. The market benefits from rising adoption of high-capacity equipment, enabling efficient material handling and excavation in open-pit mining and construction sites. Infrastructure modernization projects in urban centers, industrial parks, and transport networks further boost equipment demand. Environmental regulations encourage cleaner and energy-efficient shovel adoption, while fleet modernization programs ensure replacement of aging machinery with advanced alternatives. Mining companies implement hydraulic and automation technologies to optimize productivity, reduce operational costs, and improve safety. Domestic manufacturing and maintenance capabilities support local demand and contribute to market stability. This combination of mining growth, infrastructure projects, and environmental compliance initiatives positions Brazil as a consistent contributor to the global large mining shovel market.

The United States large mining shovel market is projected to grow at a CAGR of 3.1% through 2035, supported by modernization programs across coal, mineral, and aggregate extraction sectors. High-capacity shovels are increasingly adopted to optimize productivity, operational efficiency, and safety compliance in mining and construction projects. Digital integration allows operators to monitor equipment performance, optimize fleet management, and predict maintenance requirements, reducing downtime. Federal and private programs encourage replacement of aging equipment with advanced shovels featuring automated systems, emission reduction technologies, and hydraulic optimization. Equipment leasing and financing options enable mining companies to access high-performance machinery while maintaining capital flexibility. Modernization and digitalization initiatives, combined with regulatory compliance requirements, reinforce the United States’ position as a mature market emphasizing productivity, technological advancement, and sustainable mining practices.

The United Kingdom’s large mining shovel market is projected to expand at a CAGR of 2.8% through 2035, driven primarily by environmental compliance regulations and operational efficiency priorities. Mining and construction operators adopt advanced heavy equipment that balances high productivity with reduced emissions, meeting stringent EU and domestic standards. Equipment must integrate seamlessly with operational management systems and environmental monitoring platforms to optimize performance while maintaining sustainability. Professional services ensure proper training, maintenance, and operational support, ensuring longevity and efficiency of the equipment. Selective adoption emphasizes high-performance shovels capable of reliable operation under demanding mining and construction conditions. These factors collectively position the UK market as a niche but steadily growing segment emphasizing compliance, efficiency, and operational optimization.

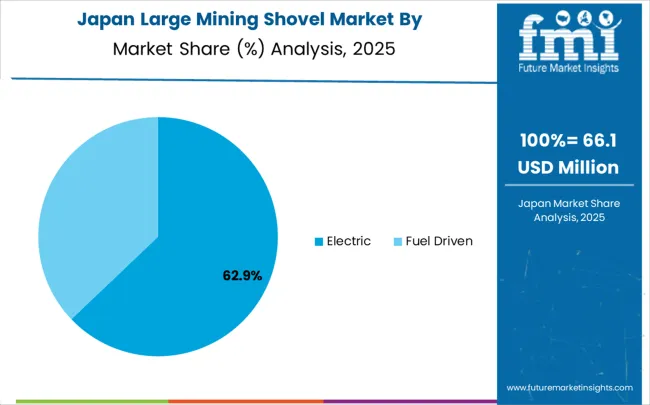

Japan’s large mining shovel market demonstrates low growth but prioritizes precision engineering, technological excellence, and operational reliability. Equipment procurement focuses on premium shovels capable of performing under strict safety, performance, and environmental standards. Manufacturers emphasize hydraulic system efficiency, automated operation, and robust design to ensure accuracy and durability. Selective demand arises from mining and construction operators who require long-term equipment reliability and consistent output. Research and development initiatives enhance performance through predictive maintenance, digital monitoring, and energy-efficient technologies. Advanced quality control ensures high operational precision and compliance with rigorous Japanese industrial standards. The market emphasizes innovation and performance over volume, positioning Japan as a hub for specialized, high-quality mining equipment designed for critical applications and challenging environments.

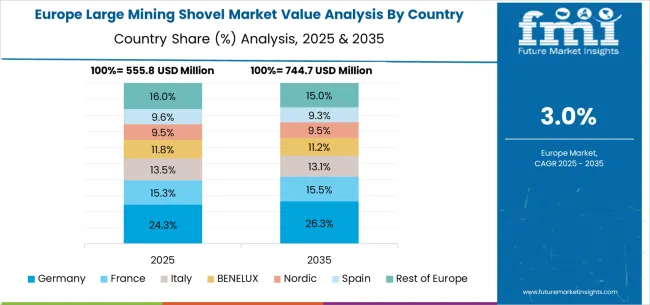

The European large mining shovel market demonstrates coordinated development through regional environmental standards and technology advancement initiatives promoting equipment efficiency and emission reduction across diverse mining and construction applications. Germany leads regional technology advancement through precision manufacturing capabilities and comprehensive research and development programs that support both domestic mining infrastructure requirements and export opportunities within European Union markets. The United Kingdom contributes specialized expertise in environmental compliance and operational optimization that influences regional equipment adoption patterns and operational standards.

France and Italy provide substantial markets for specialized heavy equipment through infrastructure development programs and construction industry expansion requiring advanced earthmoving capabilities for transportation and industrial projects. Nordic countries maintain unique requirements for equipment capable of operating effectively in extreme environmental conditions while maintaining operational efficiency and reliability characteristics. BENELUX region benefits from cross-border infrastructure coordination that promotes standardized equipment adoption and operational procedure harmonization across integrated industrial development projects.

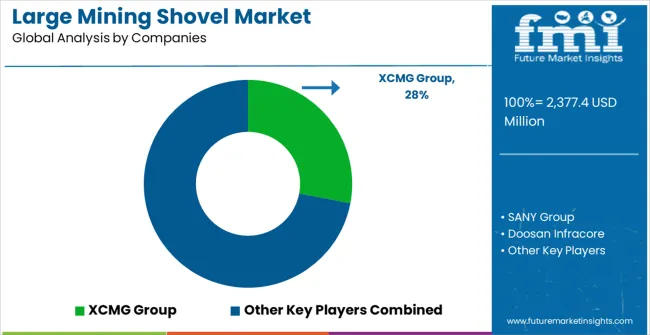

Market Leaders including XCMG Group and SANY Group maintain competitive positions through comprehensive product portfolios, proven operational track records, and established distribution relationships with major mining operations and construction companies. These companies leverage specialized manufacturing capabilities, research and development investment, and international market presence that enables consistent product availability and technical support across diverse operational environments. Strategic focus emphasizes continuous technology advancement and operational reliability enhancement that addresses evolving mining industry requirements and environmental compliance standards.

Market Challengers including Doosan Infracore and BEML Limited compete through specialized product development and targeted market focus that addresses specific mining application requirements and regional operational needs. These companies emphasize innovation in hydraulic system efficiency, electric propulsion integration, and operational control features that differentiate their products from conventional mining equipment while meeting stringent performance and environmental standards.

Specialist Providers including Sandvik AB, Hyundai Construction Equipment, Terex Corporation, Volvo Construction Equipment, Atlas Copco, and JCB serve specialized market segments through focused product configurations and targeted expertise in mining and construction equipment applications. These companies provide customized solutions for specific operational requirements while maintaining flexibility in product development and customer service capabilities that larger manufacturers may not easily replicate across diverse mining market segments requiring specialized equipment characteristics.

The large mining shovel market represents a critical heavy equipment sector valued at $2,377.4 million in 2024, projected to reach $3,289.3 million by 2032 with a moderate 3.3% CAGR. These massive excavation machines serve as the backbone of modern mining operations, handling enormous volumes of overburden, ore, and materials in surface mining applications. The market encompasses electric and fuel-driven configurations serving material handling and stockpiling ($843.7 million), mine construction and maintenance, and other specialized applications across key regions including China (4.5% market share), India (4.1%), Germany (3.8%), and Brazil (3.5%).

How Governments Could Support Mining Infrastructure and Economic Development?

Mining Sector Development Policies: Create comprehensive mining development frameworks that incentivize modern equipment adoption, including favorable depreciation schedules, equipment import tariff reductions, and infrastructure investment credits for mining operations.

Export Credit and Trade Finance: Establish export credit facilities for domestic heavy equipment manufacturers, supporting international sales of mining shovels while promoting national industrial capabilities in global markets.

Skills Development and Training Programs: Fund specialized training centers for heavy equipment operators, maintenance technicians, and mining engineers, ensuring adequate skilled workforce availability for modern mining operations.

Environmental and Safety Regulations: Implement progressive emissions standards and safety requirements that drive adoption of cleaner, more efficient electric mining shovels while supporting technological advancement in the sector.

Strategic Resource Security: Support domestic mining capacity development through equipment modernization incentives, recognizing large mining shovels as critical infrastructure for national resource security and economic competitiveness.

How Mining Industry Associations Could Advance Operational Excellence?

Equipment Performance Standards: Develop comprehensive specifications for payload capacity, fuel efficiency, operating cost metrics, and maintenance requirements that enable objective equipment evaluation and procurement decisions.

Safety and Operational Guidelines: Establish best practices for large mining shovel operation, including operator training standards, maintenance protocols, and integration with mine safety management systems.

Technology Adoption Frameworks: Create guidelines for evaluating and implementing advanced technologies such as autonomous operation, predictive maintenance, and integrated mine management systems.

Environmental Impact Assessment: Develop standardized methodologies for assessing environmental impact of large mining equipment, including emissions monitoring, noise reduction, and land disturbance minimization strategies.

Supply Chain Coordination: Facilitate coordination between mining operators, equipment manufacturers, and service providers to optimize parts availability, maintenance scheduling, and equipment lifecycle management.

How Equipment Manufacturers Could Enhance Mining Productivity?

Electric Powertrain Development: Advance electric drive technologies that reduce operating costs, eliminate local emissions, and provide superior torque control for precise material handling operations.

Autonomous Operation Integration: Develop semi-autonomous and fully autonomous shovel systems that improve operational efficiency, enhance safety, and enable 24/7 operation in challenging mining environments.

Predictive Maintenance Systems: Integrate advanced sensor networks, machine learning algorithms, and remote monitoring capabilities that predict component failures and optimize maintenance scheduling.

Modular Design Architecture: Engineer modular shovel designs that facilitate rapid component replacement, enable configuration flexibility for different mining applications, and reduce lifecycle ownership costs.

Fuel Efficiency and Emissions Reduction: Optimize fuel-driven shovels with advanced engine technologies, hybrid powertrains, and emissions control systems that meet evolving environmental regulations.

How Mining Operators Could Optimize Equipment Utilization?

Fleet Management Integration: Implement comprehensive fleet management systems that optimize shovel deployment, coordinate with haul truck fleets, and maximize material movement efficiency across mining operations.

Predictive Analytics and Performance Monitoring: Utilize real-time operating data to optimize dig patterns, predict equipment availability, and improve overall mine productivity through data-driven decision making.

Maintenance Excellence Programs: Establish proactive maintenance programs that maximize equipment uptime, extend component life, and minimize unplanned maintenance costs through systematic preventive care.

Operator Training and Certification: Invest in comprehensive operator training programs that maximize equipment productivity, reduce operating costs, and enhance safety performance through skilled operation.

Total Cost of Ownership Analysis: Implement sophisticated lifecycle cost analysis that considers acquisition costs, operating expenses, maintenance requirements, and residual value when making equipment procurement decisions.

How Financial Partners Could Support Mining Equipment Investment?

Equipment Financing Solutions: Provide specialized heavy equipment financing with flexible terms that accommodate mining cash flows, commodity price cycles, and long equipment payback periods.

Operating Lease and Rental Programs: Offer operating lease arrangements that enable mining operators to access modern equipment without large capital commitments while maintaining operational flexibility.

Technology Upgrade Financing: Support equipment modernization and technology upgrade programs through asset-based lending that enables older equipment trade-ins and new technology adoption.

Mining Project Finance: Provide comprehensive project financing for new mining developments that includes equipment procurement as part of integrated mine development packages.

Risk Management and Insurance: Develop specialized insurance products that protect mining operators against equipment breakdown, performance guarantees, and technology obsolescence risks.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 2.377.4 Million |

| Product Type | Electric Mining, Fuel Driven |

| Application | Material Handling and Stockpiling, Mine Construction and Maintenance, Other |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | XCMG Group, SANY Group, Doosan Infracore, BEML Limited, Sandvik AB, Hyundai Construction Equipment, Terex Corporation, Volvo Construction Equipment, Atlas Copco, JCB |

| Additional Attributes | Dollar sales by product type and application categories, regional heavy equipment demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established construction equipment manufacturers and specialized mining equipment providers, adoption patterns across mining and construction industry applications, integration with autonomous operation systems and digital monitoring platforms, innovations in electric propulsion technology and hydraulic system efficiency, and development of high-capacity equipment capabilities with enhanced operational reliability and environmental compliance characteristics for diverse mining and construction operation requirements. |

How big is the large mining shovel market in 2025? The global large mining shovel market is valued at USD 2,377.4 million in 2025.

What will be the size of large mining shovel market in 2035? The size for the large mining shovel market is projected to reach USD 3,289.3 million by 2035.

How much will be the large mining shovel market growth between 2025 and 2035? The large mining shovel market is expected to grow at a 3.3% CAGR between 2025 and 2035.

What are the key product type segments in the large mining shovel market? The key product type segments in the large mining shovel market are electric mining and fuel driven.

Which application segment is expected to contribute significant share in the large mining shovel market in 2025? In terms of application, material handling and stockpiling segment is set to command 55% share in the large mining shovel market in 2025.

The global large mining shovel market is estimated to be valued at USD 2,377.4 million in 2025.

The market size for the large mining shovel market is projected to reach USD 3,289.3 million by 2035.

The large mining shovel market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in large mining shovel market are electric and fuel driven.

In terms of application, mining segment to command 55.0% share in the large mining shovel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Large-flow Horizontal Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Large Synchronous Motor Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Bearing Market Size and Share Forecast Outlook 2025 to 2035

Large Spot Fiber Collimator Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Variable Frequency Drives Market Size and Share Forecast Outlook 2025 to 2035

Large Capacity Stationary Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Medium Voltage Drives Market Size and Share Forecast Outlook 2025 to 2035

Large Industrial Displays Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Large Volume Wearable Injectors Market Growth - Trends & Forecast 2025 to 2035

Large Molecule Bioanalytical Testing Services Market - Growth & Demand 2025 to 2035

Large Granular Lymphocytic Leukemia (LGLL) Therapeutics Market - Growth, Demand & Outlook 2025 to 2035

Large Diameter Steel Pipes Market Growth - Trends & Forecast 2025 to 2035

Large Format Display Market Report – Growth & Trends through 2034

Large Scale Natural Refrigerant Heat Pump Market Growth – Trends & Forecast (2024-2034)

Large Character Printers Market

Large Breed Dog Food Market

Built-in Large Cooking Appliance Market Insights – Growth & Forecast 2025 to 2035

Anaplastic Large Cell Lymphoma (ALCL) Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Freestanding Large Cooking Appliance Market Trends - Growth & Forecast 2025 to 2035

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA