The large diameter steel pipes market is expected to register stable growth between 2025 and 2035, driven by increasing investments in oil & gas infrastructure, expansion of water transportation and irrigation networks, and demand for durable, high-pressure pipeline systems across industrial and municipal sectors.

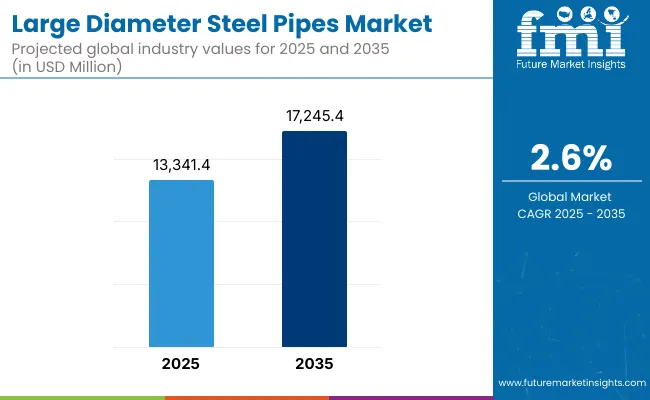

The market is projected to be valued at USD 13,341.4 million in 2025 and is anticipated to reach USD 17,245.4 million by 2035, reflecting a CAGR of 2.6% over the forecast period.

Market Metrics

| Metric | Value (USD) |

|---|---|

| Industry Size (2025E) | 13,341.4 Million |

| Industry Value (2035F) | 17,245.4 Million |

| CAGR (2025 to 2035) | 2.6% |

Large diameter steel pipes (generally larger than 16 inches in diameter) have frequent use as oil and gas pipelines, for the transmission of waste & untreated water, in district heating and also structural piling. Iron rods find great usage in energy and infrastructural development works, and the demand for iron rods is set to stay buoyant as per such on-going and pending work orders, yet the market equally grapples with tailwinds coming in the form of unstable steel costs, geopolitical events, and severe environmental controls affecting their mode of manufacture.

Rising adoption of digitized pipeline management, hydrogen-ready steel pipes as well as high-strength thermomechanical processed steel is likely to positively impact pipeline longevity and performance.

Aging pipeline infrastructure, energy export growth and federal initiatives such as pipeline modernization and leak detection make North America a key market for large diameter steel pipes.

Demand in the United States is on the rise due to shale gas transmission, LNG projects and carbon capture pipelines, while in Canada there is still appetite for long-distance oil pipelines and upgrades of water utilities. Increased focus on pipeline integrity management and compliance to PHMSA standards is leading to advanced steel pipe deployment.

Urban water utility renewal, district heating network expansion, and natural gas transmission drive Europe’s market. Countries such as Germany, Italy, UK, Poland, and the Nordic with large diameter steel pipes for geothermal systems, offshore pipelines and clean energy infrastructure. The EU’s move to promote hydrogen-ready pipeline grids and cut emissions in heavy industry is also set to drive demand for corrosion-resistant, high-pressure pipes.

Asia-Pacific is the fastest growing region, benefiting from rapid industrialization, urban infrastructure investment, and large-scale water and energy projects in China, India, Japan, South Korea, and Southeast Asia. China maintains its position as the world's largest producer and exporter of domestic pipes, fueled by energy diversification and smart urban development.

The projects of river water interlinking, metro rail infrastructure and gas grid expansion in India, has also opened up plentiful avenues for LSAW and HSAW pipes. Japan and South Korea, on the other hand, target high-precision seamless pipes essential for the energy industry.

Challenges: Raw Material Volatility and Environmental Constraints

Global variability in steel prices, reliance on high-quality raw materials, and energy-heavy production processes affect pricing and profit-margin dynamics. Moreover, the industry is under increasing pressure to meet emission reduction targets, noise and dust regulations, and environmental impact assessments, especially in large-scale construction and energy projects.

Opportunities: Energy Transition and Smart Infrastructure

The global energy transition to hydrogen transportation pipelines, carbon capture and storage (CCS) networks, renewable district heating systems, all require a reliable solution for large diameter steel. Advances in inline inspection technologies, IoT-oriented pipeline monitoring, and anti-corrosion layering will further enhance the durability and performance of these pipelines. Increased market potential is also through the emergence of modular water distribution systems, coated steel offshore applications, and digitally traceable pipe manufacturing.

The large diameter steel pipes market grew moderate and steady from 2020 to 2024, driven by global infrastructure upgrades, rising oil & gas transmission projects and expanding urban water & waste water networks. Demand boomed in oil-rich areas and in emerging economies pouring money into pipeline transport.

Higher strength and corrosion resistance was gained through advancing technology in spiral and longitudinal submerged arc welded (LSAW) pipe. But, there were challenges related to consistent growth because of the volatility from raw material costs, geopolitical tensions and project delays because of regulatory complexities.

The future from 2025 to 2035 looks promising as market transforms with smart pipeline monitoring, 3D printing of customized pipe segments, and carbon-neutral steel manufacturing for pipelines. Hydrogen and CO₂ pipeline infrastructure will be a growing focus, so next-gen pipe coating types, AI-driven structural integrity inspection and predictive maintenance will become commonplace.

As renewable energy infrastructure grows, large-diameter steel pipes will be essential to supporting offshore wind, geothermal systems and green hydrogen transmission. Policies on circular economy and increased environmental regulation will drive manufacturers towards sustainable and digitally enabled production.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with ASME, API, and ISO standards for pressure, weld integrity, and corrosion resistance. |

| Technological Innovation | Improved welding techniques, pipe coatings (epoxy, polyethylene), and non-destructive testing (NDT). |

| Industry Adoption | Widely used in oil & gas, water transmission, and structural applications. |

| Smart & AI-Enabled Solutions | Use of SCADA systems for pipeline monitoring and GPS-based asset tracking. |

| Market Competition | Led by Tenaris, JFE Steel, Nippon Steel, and regional pipe manufacturing companies. |

| Market Growth Drivers | Driven by energy infrastructure projects, urban water expansion, and industrial fluid transport. |

| Sustainability and Environmental Impact | Initial focus on improved coatings for corrosion and lifespan extension. |

| Integration of AI & Digitalization | Basic CAD modelling and post-installation inspection software. |

| Advancements in Product Design | Focus on weld strength, pressure ratings, and multi-layer anti-corrosion coatings. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Mandatory ESG reporting, carbon footprint tracking, and green certification requirements for pipeline materials and supply chains. |

| Technological Innovation | Smart pipe materials with embedded sensors, AI-driven defect detection, and 3D-printed custom sections for complex installations. |

| Industry Adoption | Expansion into green hydrogen transport, CO₂ capture pipelines, and offshore renewable infrastructure. |

| Smart & AI-Enabled Solutions | AI-integrated pipeline integrity platforms, real-time stress analysis, and digital twin-based infrastructure lifecycle management. |

| Market Competition | Rising competition from carbon-neutral steelmakers, modular pipe system innovators, and IoT-integrated pipeline monitoring firms. |

| Market Growth Drivers | Growth driven by hydrogen economy, smart infrastructure investments, and climate-resilient pipeline networks. |

| Sustainability and Environmental Impact | Carbon-neutral steel production, recyclable pipeline materials, and digital waste/reuse tracking in large-diameter pipe systems. |

| Integration of AI & Digitalization | AI-enhanced structural simulation, predictive maintenance via digital twins, and blockchain for supply chain traceability. |

| Advancements in Product Design | Adaptive, sensor-embedded pipe segments, self-healing coatings, and modular lightweight alloys for low-impact installation. |

The growth in large diameter steel pipes market in USA is primarily due to continuous investment in oil & gas infrastructure, water transportation systems, and power projects. Longitudinal submerged arc-welded (LSAW) and spiral submerged arc-welded (SSAW) pipes are in high demand as pipeline construction and midstream energy gain traction.

Recent infrastructure modernization initiatives are buoying pipeline replacements and expansions, particularly in shale-rich locales. Production companies in the domestic market are developing corrosion resistant products with higher strength and advanced coating technologies as per the changing API and ASTM standards.

| Country | CAGR (2025 to 2035) |

|---|---|

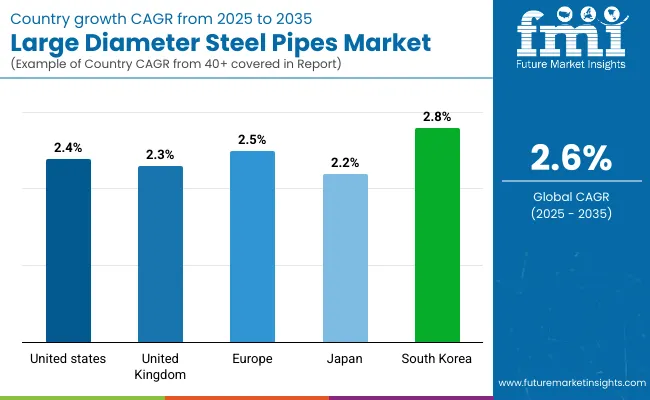

| United States | 2.4% |

The demand for large diameter steel pipes, for applications like offshore wind, water utilities, and energy transition infrastructure, will drive the large diameter steel pipes market in the UK. While oil & gas activity has reverted, appetite endures for structural and transmission-grade steel pipes deployed in offshore platforms, wind turbine foundations and urban utility networks.

Moderate market growth is also being enabled by government investment in decarbonisation and coastal resilience projects. It forced suppliers to make low-carbon steel production methods and recyclable alloys a priority to achieve sustainability goals.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 2.3% |

Germany, Italy and Poland are the most important players in the EU’s large diameter steel pipes market, which serves, among others, energy transmission, district heating and water infrastructure projects. The EU’s demands for hydrogen ready pipelines and carbon capture networks are blankets for the market, demanding high grade, thick wall throughout pipe solutions to do its bit in the transition to net zero.

Upgrades of urban infrastructure and transnational pipeline expansions in Eastern Europe are pushing demand, too. More NDT, robotic welding and corrosion-proof liners are being incorporated by manufacturers to improve product life and compliance.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 2.5% |

There are potential business opportunities for steel pipes in Japan; however, the market for large diameter is relatively mature as there is a stable demand from utility companies, urban development projects, and seismic-resilient infrastructure upgrades.

The nation advocates for high-performance and durable steel products, jointing technologies and seismic resistance. This niche demand is driven by applications in LNG terminals, coastal defence systems and underground water mains. Local manufacturers have been giving importance to high-specification pipes designed for longevity and regulatory precision according to Japan’s strict engineering codes.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.2% |

South Korea is a significant exporter and consumer of large diameter steel pipes, as surging activity in offshore construction and shipbuilding and petrochemical transport infrastructure underpin consumption of these products. Demand is increasing alongside public sector infrastructure investment and pipeline maintenance projects.

Advanced forming and welding methods are being developed and introduced by South Korean steelmakers in order to increase both the pressure retaining component's dimensional precision and resistance to fatigue of a big piece of pipe. High export competitiveness involves efficient production lines and global certifications in oil, gas and water transport applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.8% |

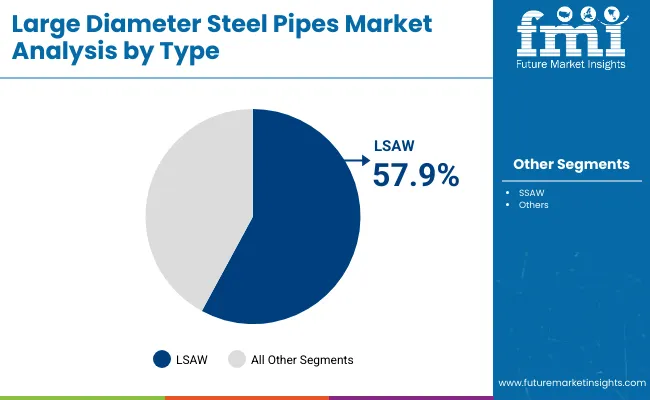

| Type | Value Share (%) |

|---|---|

| LSAW | 57.9% |

The LSAW pipes segment is expected to dominate the large diameter steel pipes market, contributing a quarter of the total market value in 2025 (57.9% contribution is estimated). LSAW pipes have better dimensional accuracy and structural stability; hence these are widely preferred in high-pressure and high-demand applications, including oil & gas transmission, offshore pipelines, and structural foundation.

Due to their ability to resist extreme mechanical stress and high operating pressures, they are the solution of choice for projects demanding large diameter pipes with high quality requirements. Another crucial application of LSAW pipes is in infrastructure and water transmission projects where strength and durability are of utmost importance. Continuing investment in energy infrastructure and cross-border pipeline networks is a growth driver for this type of pipe.

Sandwich systems can be constructed with LSAW pipes, which is another key reason they are popular; furthermore, LSAW pipes are frequently subjected to stringent quality testing and closely adhere to international standards, making them highly sought after for projects both domestically and overseas.

From meeting energy demands from green initiatives to other high-utilization transmission lines, as the global energy sector transitions toward long-term, large-scale infrastructures, LSAW pipes continue to be a vital component for ensuring reliability, safe operation and performance within the many individual case networks.

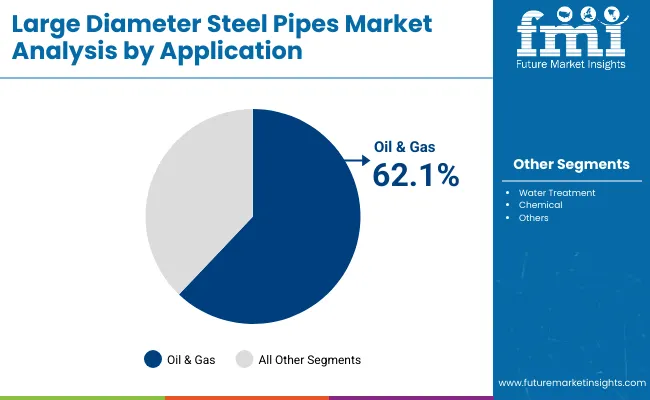

| Application | Value Share (%) |

|---|---|

| Oil & Gas | 62.1% |

The oil & gas industry is anticipated to emerge as the leading application sector in the global large diameter steel pipes market, accounting for over 62.1% of the total market value. Much of this dominance is driven by the demand for heavy pipeline infrastructure to facilitate increasing exploration, drilling, and transportation activities among upstream, midstream and downstream operations.

Expansion of oil and natural gas production from well-established regions such as North America, the Middle East & Central Asia has resulted in increasing demand for durable & corrosion-resistant pipelines that can handle high pressures in long-haul applications. LSAW and SSAW grade large diameter steel pipes play a crucial role in building new infrastructure development pipeline corridors and replacing old pipeline infrastructure.

In addition, there has been an increasing focus on energy for the offshore oil and gas sector which has continued to drive the demand for heavy-duty steel pipes used in deep-water applications that require high levels of safety and reliability. These and other technological advancements in pipe coating and welding, alongside increasing regulatory pressures to meet tighter environmental legislation, are driving operators towards investing in high-quality, durable systems.

Global energy demand continues to grow, while geopolitical events will gradually determine the routes of energy transport, which are designed both to establish alternate flow route and develop connections between suppliers and consumers, mainly of oil and gas products oil & gas segment will remain a leadership in the characteristic demand for large diameter steel pipe per regions.

The large diameter steel pipes market is also primarily driven by growing investments in the oil & gas sector, water transmission networks, and urban utility development. High-pressure pipes are essential in the transportation of fluids and gases over long distances. Pipeline modernization initiatives, increasing offshore drilling activities, rising cross-border transmission system construction and demand for high-strength materials that are corrosion resistant form key market drivers.

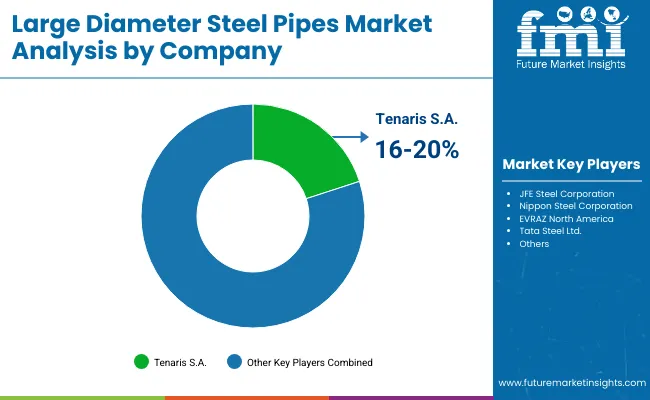

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Tenaris S.A. | 16-20% |

| JFE Steel Corporation | 13-17% |

| Nippon Steel Corporation | 12-16% |

| EVRAZ North America | 9-13% |

| Tata Steel Ltd. | 7-10% |

| Others | 24-30% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Tenaris S.A. | In 2024, Tenaris launched a new series of HIC-resistant large diameter pipes for sour service oil pipelines, meeting stringent NACE MR0175 standards. |

| JFE Steel Corporation | As of 2023, JFE expanded its UOE pipe production capacity to support LNG and high-pressure transmission projects across Southeast Asia and the Middle East. |

| Nippon Steel Corporation | In 2025, Nippon Steel introduced heavy-wall LSAW pipes with improved tensile strength and corrosion protection coatings for offshore energy platforms. |

| EVRAZ North America | In 2023, EVRAZ developed X70-grade large diameter spiral welded pipes, primarily used in North American oil sands and shale gas distribution projects. |

| Tata Steel Ltd. | As of 2024, Tata Steel commissioned a new finishing line for API-grade line pipes in India, catering to domestic infrastructure and water grid programs. |

Key Market Insights

Tenaris S.A. (16-20%)

Leads globally in premium-grade steel pipes for energy and petrochemical sectors, offering advanced metallurgy and sour-service performance.

JFE Steel Corporation (13-17%)

Strong in UOE pipe manufacturing for high-pressure transmission systems, with growing project partnerships in LNG and pipeline construction.

Nippon Steel Corporation (12-16%)

Focuses on deep-sea and offshore pipeline needs with heavy-duty LSAW pipes engineered for extreme environments and long-term reliability.

EVRAZ North America (9-13%)

Supplies spiral welded pipes optimized for rugged terrain and unconventional energy extraction, with a strong distribution base in Canada and the USA

Tata Steel Ltd. (7-10%)

Positioned in emerging markets with competitive pricing and quick delivery for oil, gas, and water pipeline infrastructure under public-private partnerships.

Other Key Players (Combined Share: 24-30%)

Several regional manufacturers and niche specialists are contributing to project-specific customization, high-grade alloy offerings, and anti-corrosion pipe technologies, including:

The overall market size for the large diameter steel pipes market was USD 13,341.4 million in 2025.

The large diameter steel pipes market is expected to reach USD 17,245.4 million in 2035.

The demand for large diameter steel pipes will be driven by growing infrastructure and construction projects, increasing oil and gas exploration activities, rising demand for water and wastewater transportation systems, and advancements in high-strength, corrosion-resistant steel materials.

The top 5 countries driving the development of the large diameter steel pipes market are the USA, China, India, Germany, and Saudi Arabia.

The longitudinal submerged arc welded (LSAW) pipes segment is expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Large-flow Horizontal Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Large Synchronous Motor Market Size and Share Forecast Outlook 2025 to 2035

Large Mining Shovel Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Bearing Market Size and Share Forecast Outlook 2025 to 2035

Large Spot Fiber Collimator Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Variable Frequency Drives Market Size and Share Forecast Outlook 2025 to 2035

Large Capacity Stationary Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Medium Voltage Drives Market Size and Share Forecast Outlook 2025 to 2035

Large Industrial Displays Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Large Volume Wearable Injectors Market Growth - Trends & Forecast 2025 to 2035

Large Granular Lymphocytic Leukemia (LGLL) Therapeutics Market - Growth, Demand & Outlook 2025 to 2035

Large Molecule Bioanalytical Testing Services Market - Growth & Demand 2025 to 2035

Large Format Display Market Report – Growth & Trends through 2034

Large Scale Natural Refrigerant Heat Pump Market Growth – Trends & Forecast (2024-2034)

Large Character Printers Market

Large Breed Dog Food Market

Built-in Large Cooking Appliance Market Insights – Growth & Forecast 2025 to 2035

Anaplastic Large Cell Lymphoma (ALCL) Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Freestanding Large Cooking Appliance Market Trends - Growth & Forecast 2025 to 2035

Diameter Signaling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA