The global carbon capture and storage (CCS) market can witness an enormous increase between 2025 to 2035 because of an ever-growing world focus on net-zero emissions, climatic need to decarbonize business, and funding on decarbonisation applied sciences ever-expanding yearly.

CCS is big for fighting climate change because it means capturing carbon emissions from industrial processes like burning fossil fuels to produce electricity, or making things like cement and steel, then storing that captured carbon underground.

As more and more governments and businesses adopt climate ambitions of the Paris Agreement type, the process will go from pilot scale to scale-type deployment for CCS technologies. As of 2025, the worldwide CCS market is USD 5,473.2 million and is expected to reach USD 20,592.4 million by 2035 at a CAGR of 14.2%.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 5,473.2 million |

| Projected Market Size in 2035 | USD 20,592.4 million |

| CAGR (2025 to 2035) | 14.2% |

The growth of oxy-fuel, pre-combustion, and post-combustion capture technologies and the deployment of carbon removal credits drives the market. Deployment is increasing in sectors such as fossil fuel power generation, industrial processing, and new sectors such as direct air capture (DAC). CCS is increasingly regarded as a key enabler of low-carbon hydrogen production and industrialisation.

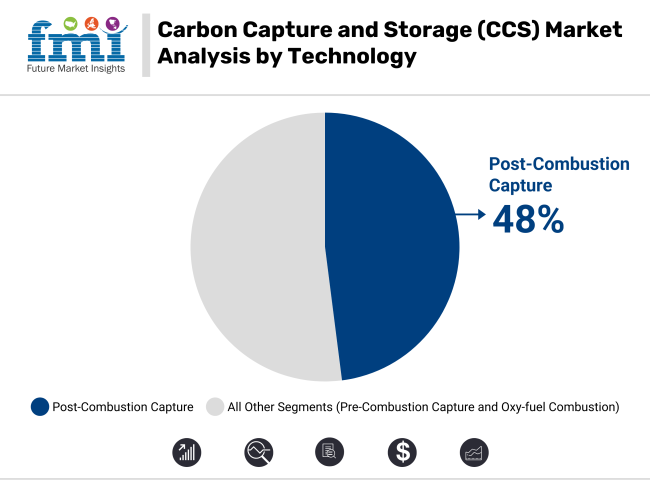

Post-combustion carbon capture will dominate the CCS market in 2025 with 48% market share. The technology is suitable for carbon dioxide capture from burning fossil fuels and thus it is most appropriate for retrofitting existing coal and natural gas power plants.

An instance is the Petra Nova project in Texas, shut down now, that demonstrated the scalability of post-combustion processes in the production of energy from coal. With governments having stricter emissions laws, the segment will gain pace, particularly in Europe and Asia, where numerous older plants are being shut down rather than decommissioned.

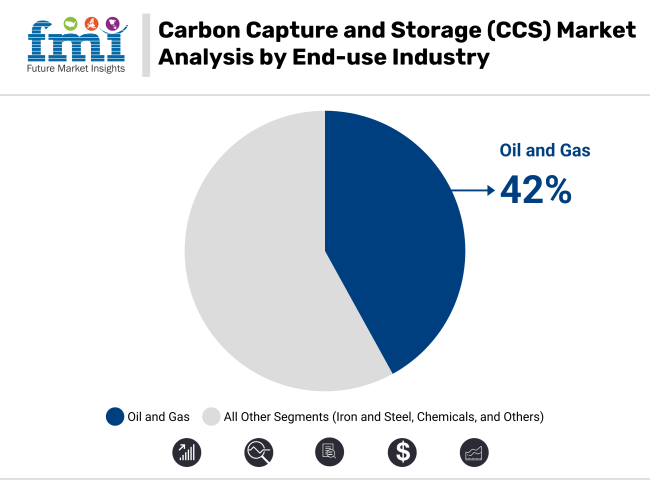

In 2025, the oil and gas end-user will account for the majority of the market at 42%, when it comes to using CCS technologies. The primary reason for this is Enhanced Oil Recovery (EOR), wherein captured CO₂ is injected into mature oil fields to increase extraction rate.

These include Shell’s and Quest CCS in Canada and Occidental’s Permian Basin CO₂-EOR facilities. Providing these applications has proven to not only reduce carbon footprint but create business value from pinned emissions with investment migrating throughout North America along with the Middle east.

North America leads the CCS market, led by large-scale capture projects, high federal incentives, tax credits (i.e., the USA 45Q), and prominent federal policies. The United States and Canada boast several operating CCS facilities linked to natural gas processing, ethanol plants, and blue hydrogen facilities. Public-private partnerships with governments are driving development of CO₂ pipeline infrastructure and saline reservoir storage.

Europe is experiencing CCS growth at an accelerated pace as part of its Fit-for-55 and Green Deal policy. The UK, Norway, and the Netherlands are creating cluster-based CCS clusters, combining CO₂ capture from industrial clusters with North Sea offshore storage in geological formations. Northern Lights and Porthos projects are offering the potential for cross-border CCS cooperation.

Asia-Pacific market is an emerging hub for CCS, led importantly by China, Australia, South Korea and Japan, where governments are integrating CCS into their future decarbonisation plans. Governments have mainly focused on industrial emissions from coal mines, cement plants and steel mills. Australia is spearheading CCS in the LNG sector, while China is ramping up integrated carbon capture in chemicals and coal plants.

Challenges: High Initial Capital Expenses, Limited Infrastructure, and Policy Risk

CCS projects are also facing the challenge of having high initial capital expenses, especially on capture and compression plants. Transport and storage also involve substantial pipeline or shipping networks that are underdeveloped in most areas. Additionally, policy risk and regulatory holdup can discourage private sector investment and discourage project development.

Opportunities: Net-Zero Commitments, Blue Hydrogen Expansion, and Technology Advancement

The world shift towards net-zero emissions by 2050 is building CCS opportunity in energy and industry. Blue hydrogen production is scaled up using CCS, thus making fossil-fuel-based hydrogen with almost zero emissions. Modular capture trains, solvent regenerating, and CO₂ mineralization technology will render CCS lower-cost and scalable. Carbon market incentives and direct air capture (DAC) incentives are also unlocking future revenues.

Between 2020 and 2024, the CCS market shifted from research-scale pilot projects to commercial-scale deployment, driven by climate policy transformation in the USA, EU, and China. Oil and gas producers began retrofitting existing facilities with capture equipment, while banks started financing CO₂ storage projects. However, the majority of projects trailed behind regulatory and community resistance.

In 2025 to 2035, CCS will go mainstream in industrial decarbonisation and schemes will emerge from the energy sector to encompass cement, steel, and chemicals. Digital tracking, artificial intelligence leak detection, and smart CO₂ transport networks will improve reliability and regulation. As the cost of carbon increases worldwide and demand for low-carbon products increases, CCS will be essential to maintaining heavy industry sustainability targets.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Deployment driven by tax credits (e.g., USA 45Q), ETS incentives, and net-zero pledges. |

| Consumer Trends | Rising environmental awareness influenced public support for CCS in industrial clusters. |

| Industry Adoption | Pilots and early-stage commercial plants launched in oil & gas and coal-fired plants. |

| Supply Chain and Sourcing | Reliance on regional CO₂ pipeline infrastructure and depleted oil reservoirs for storage. |

| Market Competition | Led by ExxonMobil, Shell, Equinor, and Total Energies with fossil-aligned CCS projects. |

| Market Growth Drivers | Pushed by government funding, ESG reporting mandates, and voluntary carbon markets. |

| Sustainability and Environmental Impact | Focus on reducing CO₂ emissions in industrial clusters and power generation. |

| Integration of Smart Technologies | Use of basic CO₂ monitoring sensors and manual storage reporting. |

| Advancements in Equipment Design | Traditional amine-based capture systems with high energy demand. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Mandates on decarbonisation across cement, steel, and power sectors push CCS from optional to regulatory necessity in over 30 countries. |

| Consumer Trends | Broader public endorsement for CCS linked to low-carbon products (green steel, net-zero cement) and visible community-based carbon hubs. |

| Industry Adoption | Full-scale integration across ammonia, hydrogen, and waste-to-energy plants; retrofitting of legacy facilities becomes standard practice. |

| Supply Chain and Sourcing | Emergence of dedicated CO₂ shipping networks, direct air capture hubs, and mineralization sites in volcanic regions and basalt formations. |

| Market Competition | Entry of carbon tech startups offering modular, decentralized CCS systems and AI-optimized CO₂ utilization pathways. |

| Market Growth Drivers | Driven by global carbon pricing mechanisms, green finance eligibility, and deep decarbonisation of hard-to-abate sectors. |

| Sustainability and Environmental Impact | Emphasis on negative emissions via direct air capture + storage (DACS), biogenic CCS, and lifecycle-verified carbon removal credits. |

| Integration of Smart Technologies | AI-based CO₂ plume modelling, real-time leak detection systems, and blockchain-based MRV (Monitoring, Reporting, Verification) platforms expand. |

| Advancements in Equipment Design | Deployment of solid sorbents, cryogenic separation, membrane technologies, and modular CCS skid systems for rapid deployment. |

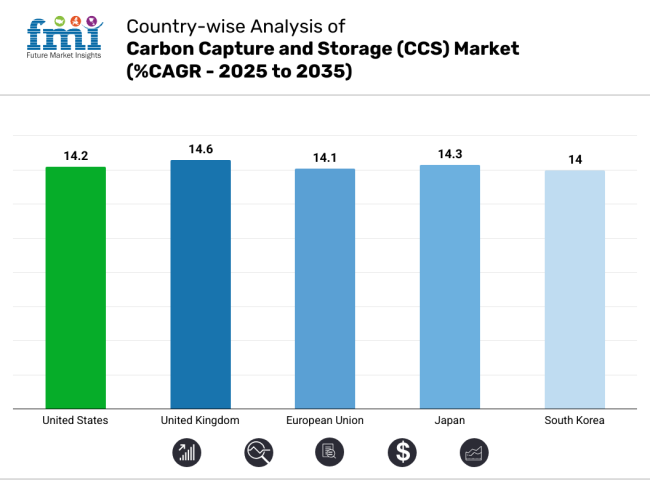

The USA CCS market is thriving, driven by improved 45Q tax credits, the Inflation Reduction Act, and ambitious decarbonisation ambitions from industries. More than 70 commercial-scale projects are in the pipeline across Texas, Louisiana, and the Midwest. Chevron, Occidental, and Microsoft-supported Clime works are actively developing large capture hubs.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 14.2% |

The UK market is advancing CCS through government-backed industrial cluster plans in Teesside and Humber. Carbon capture is central to the country’s net-zero 2050 goal, with BEIS funding helping Drax and Tata Steel retrofit their operations. The UK also leads in offshore CO₂ storage licensing in the North Sea.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 14.6% |

EU member states have integrated CCS into Fit for 55 policies and carbon neutrality legislation. Norway’s Longship and the Netherlands’ Porthos are key transnational CCS hubs. EU industries are investing in CO₂ utilization for e-fuels, methanol, and synthetic concrete aggregates, while ETS Phase IV boosts adoption.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 14.1% |

Japan market is ramping up CCS to decarbonize its hydrogen supply chain and fossil-based industrial output. The government is funding CO₂ capture from ammonia and LNG plants, with storage partnerships extending into Indonesia and Malaysia. Mitsubishi Heavy Industries is scaling up modular capture units for export.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 14.3% |

South Korea is investing in CCS under its Green New Deal and 2050 carbon neutrality masterplan. It has POSCO and Hyundai Oilbank as leading adopters, aiming for blue hydrogen and steel decarbonisation. The nation is constructing underground CO₂ storage facilities within offshore basins and converting LNG terminals to export liquefied CO₂.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 14.0% |

The Global Carbon Capture and Storage (CCS) market is an industry that is rapidly expanding due to the increasing concerns of environmental regulations and efforts to mitigate greenhouse gas emissions. CCS, or carbon capture and storage (as mention this the industry standard name), market refers to the technologies use to capture carbon dioxide (CO₂) emissions from industrial processes as well as electricity generation and make it transport this CO₂, store it so that it does not enter the atmosphere.

The CCS marketplace is controlled by large energy firms, engineering corporations and technology suppliers. They are alsomarket, investing significantly in R&D, forging strategic alliances, and expanding project portfolios in order to capitalize on the increasing demand for emission-reducing technology.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ExxonMobil | 15-20% |

| Chevron Corporation | 12-17% |

| Royal Dutch Shell | 10-15% |

| TotalEnergies | 8-12% |

| Mitsubishi Heavy Industries | 5-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| ExxonMobil | In 2024, mandated a large-scale CCS project in the USA Gulf of Mexico region with the goal of capturing up to 10 million metric tons of CO₂ annually. In 2025, worked with technology firms to enhance carbon capture efficiency. |

| Chevron Corporation | In 2024, increased its Gorgon CCS project in Australia by 25% in storage capacity. In 2025, invested in direct air capture technology to broaden its CCS offerings. |

| Royal Dutch Shell | In 2024, initiated the operations of the Northern Lights project in Norway to facilitate cross-border CO₂ transportation and storage. In 2025, joined forces with industrial clusters to form shared CCS infrastructure. |

| Total Energies | In 2024, acquired a 25% stake in the Bayou Bend CCS project in Texas for the purpose of storing several hundred million tons of CO₂. In 2025, commissioned a feasibility study for offshore CO₂ storage in the North Sea. |

| Mitsubishi Heavy Industries | In 2024, developed a highly intensive CO₂ capture system that is usable in small and medium-sized industrial plants. In 2025, partnered with Asian governments to implement CCS in the coal-fired power stations. |

Key Company Insights

ExxonMobil (15-20%)

ExxonMobil is at the forefront of the CCS market with massive investment in mega projects and technology developments to enhance the efficiency of carbon capture.

Chevron Corporation (12-17%)

Chevron is focusing on constructing new CCS facilities and investment in new technologies like direct air capture to widen its carbon management portfolio.

Royal Dutch Shell (10-15%)

Shell focuses on joint ventures like Northern Lights, promoting global cooperation in the transport and storage of CO₂ to build collective CCS infrastructure.

Total Energies (8-12%)

Total Energies is actively investing in early CCS pathfinder projects like Bayou Bend under its commitment to reducing emissions and net-zero strategies.

Mitsubishi Heavy Industries (5-10%)

Mitsubishi Heavy Industries markets mobile CO₂ capture facilities and cooperates with governments in developing CCS machinery for propelling power generation.

Other Key Players (30-40% Combined)

The overall market size for the carbon capture and storage market was approximately USD 5,473.2 million in 2025.

The carbon capture and storage market is projected to reach approximately USD 20,592.4 million by 2035.

The demand for the carbon capture and storage market during the forecast period is fuelled by stringent emission regulations, governmental policies promoting decarbonisation, and the increasing adoption of CCS technologies in industries aiming to reduce their carbon footprint.

The top 5 countries driving the development of the carbon capture and storage market are the United States, Canada, the United Kingdom, Australia, and Norway.

On the basis of application, the power generation segment is expected to command a significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 4: Global Market Volume (Units) Forecast by Technology, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 6: Global Market Volume (Units) Forecast by Application, 2017 to 2032

Table 7: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 8: North America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 10: North America Market Volume (Units) Forecast by Technology, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 12: North America Market Volume (Units) Forecast by Application, 2017 to 2032

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 14: Latin America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 15: Latin America Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 16: Latin America Market Volume (Units) Forecast by Technology, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 18: Latin America Market Volume (Units) Forecast by Application, 2017 to 2032

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 20: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 21: Europe Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 22: Europe Market Volume (Units) Forecast by Technology, 2017 to 2032

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 24: Europe Market Volume (Units) Forecast by Application, 2017 to 2032

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: East Asia Market Volume (Units) Forecast by Country, 2017 to 2032

Table 27: East Asia Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 28: East Asia Market Volume (Units) Forecast by Technology, 2017 to 2032

Table 29: East Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 30: East Asia Market Volume (Units) Forecast by Application, 2017 to 2032

Table 31: South Asia & Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 32: South Asia & Pacific Market Volume (Units) Forecast by Country, 2017 to 2032

Table 33: South Asia & Pacific Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 34: South Asia & Pacific Market Volume (Units) Forecast by Technology, 2017 to 2032

Table 35: South Asia & Pacific Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 36: South Asia & Pacific Market Volume (Units) Forecast by Application, 2017 to 2032

Table 37: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 38: MEA Market Volume (Units) Forecast by Country, 2017 to 2032

Table 39: MEA Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 40: MEA Market Volume (Units) Forecast by Technology, 2017 to 2032

Table 41: MEA Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 42: MEA Market Volume (Units) Forecast by Application, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Technology, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 5: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 8: Global Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 9: Global Market Volume (Units) Analysis by Technology, 2017 to 2032

Figure 10: Global Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 11: Global Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 13: Global Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 16: Global Market Attractiveness by Technology, 2022 to 2032

Figure 17: Global Market Attractiveness by Application, 2022 to 2032

Figure 18: Global Market Attractiveness by Region, 2022 to 2032

Figure 19: North America Market Value (US$ Million) by Technology, 2022 to 2032

Figure 20: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 21: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 23: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 26: North America Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 27: North America Market Volume (Units) Analysis by Technology, 2017 to 2032

Figure 28: North America Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 29: North America Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 31: North America Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 34: North America Market Attractiveness by Technology, 2022 to 2032

Figure 35: North America Market Attractiveness by Application, 2022 to 2032

Figure 36: North America Market Attractiveness by Country, 2022 to 2032

Figure 37: Latin America Market Value (US$ Million) by Technology, 2022 to 2032

Figure 38: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 39: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 44: Latin America Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 45: Latin America Market Volume (Units) Analysis by Technology, 2017 to 2032

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 52: Latin America Market Attractiveness by Technology, 2022 to 2032

Figure 53: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 54: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 55: Europe Market Value (US$ Million) by Technology, 2022 to 2032

Figure 56: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 57: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 59: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 62: Europe Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 63: Europe Market Volume (Units) Analysis by Technology, 2017 to 2032

Figure 64: Europe Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 67: Europe Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 70: Europe Market Attractiveness by Technology, 2022 to 2032

Figure 71: Europe Market Attractiveness by Application, 2022 to 2032

Figure 72: Europe Market Attractiveness by Country, 2022 to 2032

Figure 73: East Asia Market Value (US$ Million) by Technology, 2022 to 2032

Figure 74: East Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 75: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 77: East Asia Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 80: East Asia Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 81: East Asia Market Volume (Units) Analysis by Technology, 2017 to 2032

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 84: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 85: East Asia Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 88: East Asia Market Attractiveness by Technology, 2022 to 2032

Figure 89: East Asia Market Attractiveness by Application, 2022 to 2032

Figure 90: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 91: South Asia & Pacific Market Value (US$ Million) by Technology, 2022 to 2032

Figure 92: South Asia & Pacific Market Value (US$ Million) by Application, 2022 to 2032

Figure 93: South Asia & Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 94: South Asia & Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 95: South Asia & Pacific Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 96: South Asia & Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 97: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 98: South Asia & Pacific Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 99: South Asia & Pacific Market Volume (Units) Analysis by Technology, 2017 to 2032

Figure 100: South Asia & Pacific Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 101: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 102: South Asia & Pacific Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 103: South Asia & Pacific Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 104: South Asia & Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 105: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 106: South Asia & Pacific Market Attractiveness by Technology, 2022 to 2032

Figure 107: South Asia & Pacific Market Attractiveness by Application, 2022 to 2032

Figure 108: South Asia & Pacific Market Attractiveness by Country, 2022 to 2032

Figure 109: MEA Market Value (US$ Million) by Technology, 2022 to 2032

Figure 110: MEA Market Value (US$ Million) by Application, 2022 to 2032

Figure 111: MEA Market Value (US$ Million) by Country, 2022 to 2032

Figure 112: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 113: MEA Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 114: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 115: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 116: MEA Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 117: MEA Market Volume (Units) Analysis by Technology, 2017 to 2032

Figure 118: MEA Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 119: MEA Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 120: MEA Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 121: MEA Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 122: MEA Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 123: MEA Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 124: MEA Market Attractiveness by Technology, 2022 to 2032

Figure 125: MEA Market Attractiveness by Application, 2022 to 2032

Figure 126: MEA Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tapes Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Free Waste Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Carbon Labeled Packaged Meal Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Bike Wheelset Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Lasers Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Packaging Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Construction Repair Market Size and Share Forecast Outlook 2025 to 2035

Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Dioxide Synthesis Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Neutral Skincare Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Reinforced Plastic Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Wraps Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Boat Hulls Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA